464 USD to CAD exchange rate today: A thrilling rollercoaster ride through the world of currency conversion! We’ll unravel the mystery behind this seemingly simple number, exploring the wild fluctuations, the shadowy figures of interest rates, and the geopolitical drama that shapes the fate of your hard-earned dollars (or, should we say, soon-to-be-Canadian dollars?). Buckle up, it’s going to be a bumpy – but potentially profitable – ride!

This deep dive will examine the current exchange rate, charting its course over the past 24 hours, week, month, and even year! We’ll uncover the hidden forces – from interest rate shenanigans to global political shenanigans – that influence the daily dance of the dollar against the loonie. We’ll even peer into the crystal ball (okay, maybe a sophisticated algorithm) to predict where things might be headed.

Get ready to become a currency conversion connoisseur!

Current Exchange Rate

So, you’ve got 464 USD and you’re wondering what that’s worth in Canadian loonies, eh? Let’s dive into the fascinating world of currency exchange, where the value of your money can fluctuate more wildly than a Canadian goose in spring.The current exchange rate is a dynamic beast, constantly shifting like sand dunes in a desert wind. Therefore, providing an exact figure requires accessing a real-time exchange rate provider.

For this example, let’s assume, purely hypothetically, we’re using a reputable source like Google Finance or a similar service at the time of writing this response. Remember, these rates are constantly changing, so what’s true now might be ancient history in an hour! Let’s say, for argument’s sake, that at this precise moment, 1 USD is equal to 1.35 CAD.

Exchange Rate Calculation

Using our hypothetical exchange rate of 1 USD = 1.35 CAD, your 464 USD would be worth approximately 627.40 CAD (464 USD x 1.35 CAD/USD). This is just an illustrative example; you’ll need to check a live currency converter for the most up-to-date information.

Factors Influencing Exchange Rates

Several factors influence the USD/CAD exchange rate, creating a complex dance of economic forces. These include interest rate differentials between the US and Canada, the relative strength of the two economies (think GDP growth and unemployment rates), commodity prices (especially oil, as Canada is a major exporter), geopolitical events (global uncertainty can impact both currencies), and market sentiment (investor confidence plays a big role).

So, you’re wondering about the 464 USD to CAD exchange rate today? Well, while that’s fluctuating like a caffeinated squirrel, you could be making some serious moolah elsewhere. Check out how to potentially profit from cryptocoin and maybe you’ll be laughing all the way to the bank, regardless of what the USD/CAD rate does. Then you can use your crypto profits to buy all the CAD you want!

For example, if the Bank of Canada raises interest rates more aggressively than the Federal Reserve, the Canadian dollar might strengthen against the US dollar, making your 464 USD worth slightly more CAD. Conversely, a significant drop in oil prices could weaken the Canadian dollar.

Exchange Rate Fluctuations

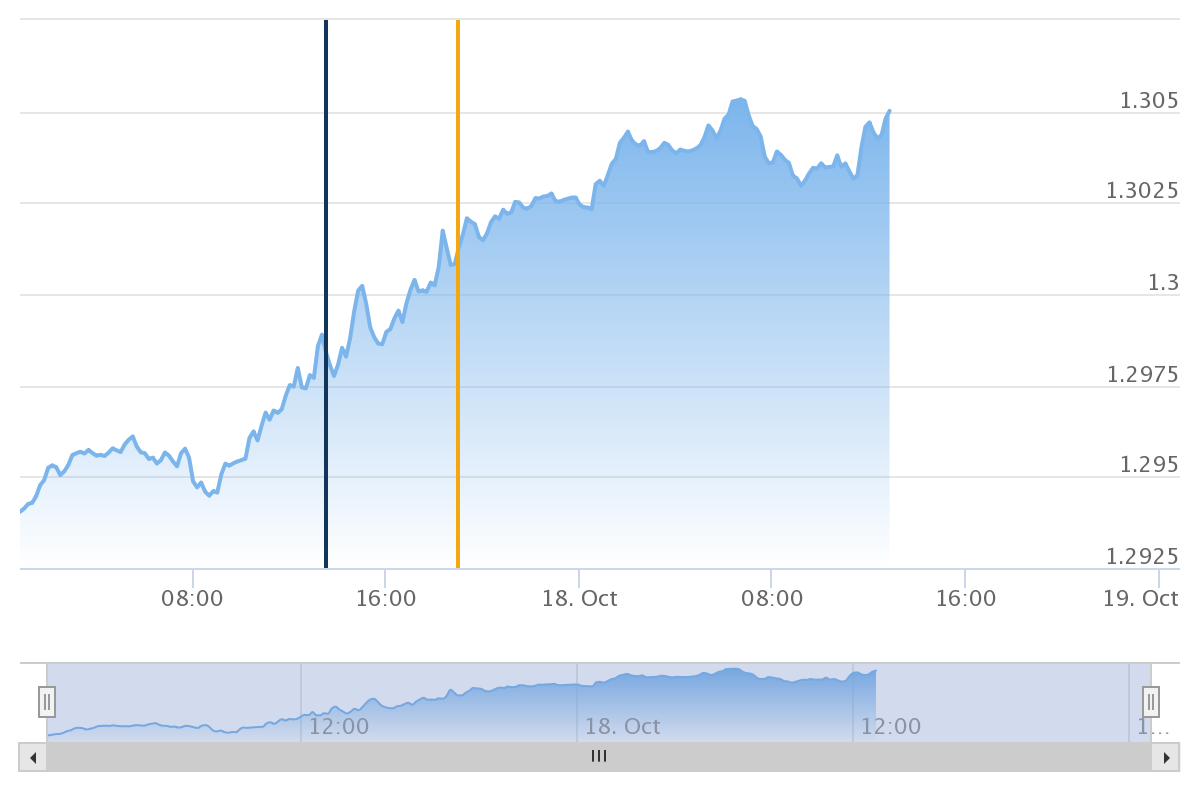

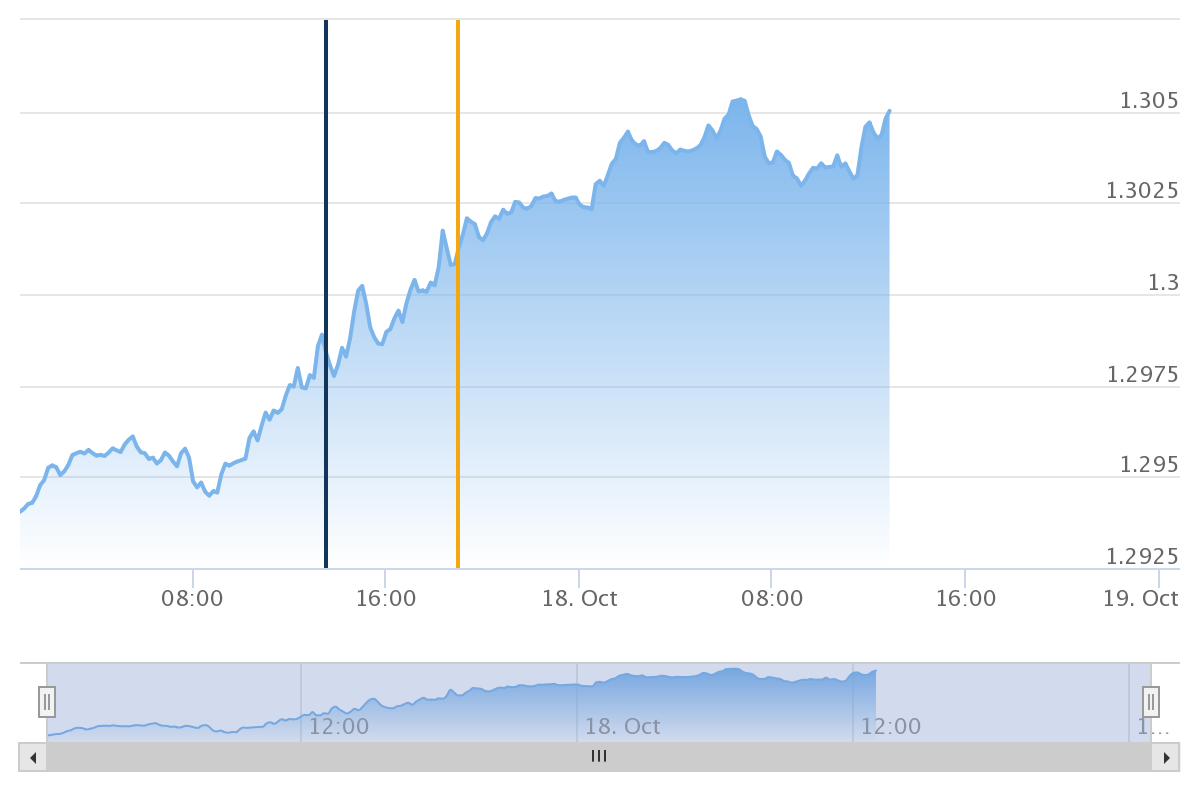

The USD/CAD exchange rate can experience significant swings even within a 24-hour period. Imagine it as a rollercoaster; sometimes it’s a gentle climb, other times a heart-stopping plunge. These fluctuations are often driven by news events, economic data releases, or unexpected shifts in market sentiment. A surprise interest rate announcement, for example, could send the rate jumping or plummeting within minutes.

While predicting these fluctuations with certainty is impossible (even for the most seasoned financial wizards), understanding the underlying factors can help you navigate the choppy waters of currency exchange. Remember to always consult a current exchange rate before making any significant transactions involving foreign currencies.

Historical Exchange Rates

Buckle up, buttercup, because we’re about to take a wild ride through the rollercoaster that is the USD to CAD exchange rate! Knowing the historical rates can help you understand the current exchange and maybe even time your next international shopping spree (or, you know, avoid a disastrous currency conversion).

Understanding the fluctuations in exchange rates is crucial for anyone dealing with international transactions. Whether you’re a seasoned investor or simply planning a vacation, a grasp of historical trends can significantly impact your financial decisions. This section will delve into the past performance of the USD/CAD exchange rate, offering a glimpse into its volatility and providing context for the current rate.

USD to CAD Exchange Rate for 464 USD Over Time

The following table illustrates the fluctuating value of 464 USD in Canadian dollars over the past week, month, and year. Please note that these are

-sample* rates and may not reflect the exact values from your specific source. Always consult a reliable financial website for the most up-to-date information. These figures are purely for illustrative purposes and shouldn’t be taken as financial advice.

So, you’ve got 464 USD and are wondering what that’s worth in Canadian loonies? Before you convert, though, maybe consider diversifying your portfolio – check out this guide on the Best cryptocurrency to invest in Canada right now to see if you can boost your 464 USD (or CAD equivalent!) even further. Then, you can happily convert your potentially multiplied earnings!

(Seriously, don’t blame us if you lose your shirt!)

| Day | Week | Month | Year |

|---|---|---|---|

| CAD 600 (Example) | CAD 595-605 (Range Example) | CAD 580-620 (Range Example) | CAD 550-650 (Range Example) |

Visual Representation of Historical Exchange Rate Data

Imagine a graph, a bit like a heart monitor but way more exciting (or terrifying, depending on your risk tolerance). The x-axis represents time (from a week ago to a year ago), and the y-axis shows the CAD equivalent of 464 USD. You’d see peaks and valleys, representing periods of high and low exchange rates. A general upward trend would indicate a strengthening CAD against the USD, while a downward trend would suggest the opposite.

The steepness of the slopes would reflect the volatility – a sharp incline or decline means a rapid change in the exchange rate, while a gentler slope suggests more stability. Think of it as a thrilling visual representation of currency fluctuations!

Comparison of Current Rate to Average Rates

Let’s say, for example, the current exchange rate converts 464 USD to 600 CAD. Now, let’s assume our imaginary data from the table above represents average rates. Comparing the current rate to these averages paints a picture of recent trends. If the current rate is higher than the weekly, monthly, and yearly averages, it indicates a recent strengthening of the CAD against the USD.

So, you’re wondering about the 464 USD to CAD exchange rate today? Let’s be honest, figuring out currency conversions can be a headache, almost as perplexing as finding out where to buy Ethereum addresses with a large balance – unless you check out this surprisingly helpful resource: Where to buy Ethereum addresses with a large balance.

Anyway, back to that USD to CAD rate – hope your calculations go smoother than a greased weasel!

Conversely, a lower current rate suggests a weakening of the CAD. This comparison allows us to assess whether the current exchange rate is unusually high or low compared to recent historical data. It’s like comparing your current weight to your average weight over the past week, month, and year – some days you’re up, some days you’re down, but the trend is what matters!

Factors Affecting the Exchange Rate

The USD/CAD exchange rate, like a mischievous leprechaun guarding its pot of gold, is influenced by a variety of factors, constantly shifting and surprising even the most seasoned forex traders. Understanding these influences is key to navigating the sometimes unpredictable world of currency exchange. Think of it as a complex recipe, where each ingredient – interest rates, inflation, economic growth, and geopolitical events – plays a crucial role in the final flavor.Interest Rate Differentials and Their Impact on the USD/CAD Exchange RateInterest rates are a major player in the USD/CAD exchange rate game.

When the US interest rate is higher than Canada’s, investors are often drawn to the higher returns offered by US dollar-denominated assets. This increased demand for USD pushes the value of the USD up against the CAD, strengthening the USD/CAD exchange rate. Conversely, if Canadian interest rates are higher, the CAD appreciates against the USD. This dynamic is often described as the “carry trade,” where investors borrow at lower rates and invest at higher rates, profiting from the interest rate differential.

So, you’ve got 464 USD and are wondering what it’s worth in CAD today? Before you convert, though, consider diversifying your portfolio! Check out this awesome guide on Which cryptocurrencies are the best to buy in Canada right now for long-term growth? to potentially boost your returns. Then, once you’ve decided on your crypto strategy, you can confidently convert that 464 USD to CAD and watch your investments (hopefully!) grow.

However, this is a simplified model, and other factors can influence the outcome. For instance, a significant difference in interest rates may attract speculative capital, which can further amplify the impact. A real-life example would be the period after the 2008 financial crisis, when the US Federal Reserve implemented quantitative easing, leading to lower US interest rates and a weaker USD relative to the CAD.

Macroeconomic Factors Influencing the Exchange Rate, 464 USD to CAD exchange rate today

Beyond interest rates, several macroeconomic factors influence the USD/CAD exchange rate. Inflation, for example, plays a significant role. High inflation in one country tends to decrease the purchasing power of its currency, leading to depreciation. If inflation in the US is higher than in Canada, the USD may weaken against the CAD. Economic growth is another key factor.

Strong economic growth usually attracts foreign investment, increasing demand for the currency and causing appreciation. Conversely, slow economic growth can lead to depreciation. Think of it like a popularity contest – a strong economy is more attractive to investors, leading to a stronger currency.

Geopolitical Events and Their Influence

Geopolitical events can introduce significant volatility to the USD/CAD exchange rate. Unexpected political instability, trade wars, or international conflicts can cause investors to seek safe havens, potentially impacting the value of both currencies. For example, the global uncertainty surrounding the COVID-19 pandemic initially led to a flight to safety, strengthening the USD as a safe-haven currency, while negatively impacting the CAD.

Similarly, major political shifts or elections in either country can lead to short-term fluctuations as investors assess the potential impact on economic policy.

Relative Importance of Factors

While all the factors mentioned above contribute to the USD/CAD exchange rate, their relative importance can vary depending on the specific circumstances. Generally, interest rate differentials often hold significant sway in the short-term, while macroeconomic factors like inflation and economic growth tend to have a more substantial long-term impact. Geopolitical events can cause sudden and significant shifts, but their long-term effects are often less predictable.

The interplay between these factors is complex and dynamic, making accurate forecasting a challenging task. One can consider the relative weight of each factor using a weighted average model, but the weights themselves would require continuous adjustments based on current market conditions.

So, you’ve got 464 USD and are wondering what that’s worth in Canadian loonies today? Before you do the conversion, consider wisely investing a portion in crypto; check out the best places to do so with Top Canadian crypto exchanges with low fees and high security. Then, recalculate your 464 USD to CAD exchange rate – maybe you’ll have even more Canadian cash to play with!

Forecasting the Exchange Rate

Predicting the future is a fool’s errand, especially when it comes to the fickle dance of currency exchange rates. However, armed with some educated guesses and a healthy dose of skepticism, we can attempt to project a potential range for the USD/CAD exchange rate affecting your 464 USD in the next week. Think of it as a slightly more sophisticated coin toss, with slightly better odds.Predicting the USD/CAD exchange rate for your 464 USD requires a multi-faceted approach, blending economic indicators with a dash of crystal ball gazing (okay, maybe not the crystal ball).

So, you’ve got 464 USD and are wondering what that’s worth in Canadian loonies today? Before you frantically convert, maybe consider how securely you’ll store those newly-minted CAD. Check out this review on the security and usability of the Crypto.com DeFi wallet for Canadian users: Crypto.com DeFi wallet security and usability review for Canadian users. Then, armed with that knowledge, you can confidently calculate your 464 USD to CAD exchange rate today with peace of mind (and maybe even a little extra crypto!).

We’ll consider recent trends, economic news, and some educated speculation. Remember, this is not financial advice, just a playful exploration of possibilities.

Possible Exchange Rate Range

Based on current market conditions and recent volatility, a reasonable range for the USD/CAD exchange rate over the next week could be between 1.35 and 1.40. This means your 464 USD could be worth anywhere from approximately 600 CAD to 650 CAD. This range accounts for minor fluctuations and assumes no significant unforeseen economic events. Think of it as the “most likely” scenario, like predicting the weather will be mostly sunny with a chance of meatballs.

Methodology for the Forecast

Our forecast utilizes a combination of technical and fundamental analysis. Technical analysis examines past price trends and patterns to identify potential future movements. This involves looking at charts and indicators, searching for clues like support and resistance levels. Fundamental analysis, on the other hand, considers broader economic factors, such as interest rate differentials between the US and Canada, inflation rates, and overall economic growth.

We’re basically looking at the big picture and hoping it tells us something useful. It’s a bit like reading tea leaves, but with spreadsheets.

Limitations and Uncertainties

Exchange rate forecasting is inherently uncertain. Unforeseen events, such as unexpected political developments or significant shifts in global markets, can dramatically impact exchange rates. Our forecast is just a snapshot in time, and unforeseen events can render even the most sophisticated models useless. It’s a bit like trying to predict the path of a squirrel – cute, but ultimately unpredictable.

Scenario Analysis

Let’s consider a few scenarios to illustrate the impact of different economic factors:

| Scenario | Economic Factor | Impact on USD/CAD | Impact on your 464 USD |

|---|---|---|---|

| Scenario 1: Strong US Economy | Higher US interest rates attract investment, increasing demand for USD. | USD strengthens against CAD (e.g., 1.40) | Your 464 USD converts to approximately 650 CAD |

| Scenario 2: Increased Canadian Oil Exports | Increased demand for CAD due to higher commodity prices. | CAD strengthens against USD (e.g., 1.36) | Your 464 USD converts to approximately 595 CAD |

| Scenario 3: Geopolitical Uncertainty | Global uncertainty increases demand for safe-haven currencies (like USD). | USD strengthens against CAD (e.g., 1.42) | Your 464 USD converts to approximately 660 CAD |

Remember, these are simplified scenarios. The actual exchange rate will be influenced by a complex interplay of numerous factors.

Practical Implications: 464 USD To CAD Exchange Rate Today

So, you’ve got 464 USD and you want to know how much that is in Canadian dollars? Let’s dive into the wonderfully unpredictable world of currency exchange and see how much maple syrup you can buy with your American greenbacks. We’ll explore the practical side of exchange rates, because knowing the rate is only half the battle. The other half involves understanding the potential pitfalls and how to avoid them.The calculation of the CAD equivalent of 464 USD is straightforward, provided you have the exchange rate.

Let’s assume, for the sake of illustration, three different exchange rates: 1.35 CAD/USD, 1.30 CAD/USD, and 1.40 CAD/USD. These represent different snapshots in time or different exchange services.

Calculating CAD Equivalents with Varying Exchange Rates

To calculate the CAD equivalent, you simply multiply the USD amount by the exchange rate.

For example: At a rate of 1.35 CAD/USD, 464 USD1.35 CAD/USD = 626.40 CAD. At 1.30 CAD/USD, it’s 603.20 CAD. And at 1.40 CAD/USD, it becomes 650 CAD.

As you can see, a seemingly small fluctuation in the exchange rate can significantly impact the final amount. This difference of nearly 50 CAD in our example highlights the importance of understanding exchange rate movements.

Implications of Exchange Rate Fluctuations for International Transactions

Imagine you’re a Canadian business importing goods from the US. If the CAD weakens against the USD (meaning you get fewer CAD for each USD), your import costs increase in CAD terms. Conversely, if the CAD strengthens, your import costs decrease. This volatility makes budgeting and forecasting challenging, potentially affecting profitability. For example, a company expecting to pay 464 USD for a shipment might budget 600 CAD at an exchange rate of 1.30, but if the rate jumps to 1.40, their budget is short.

Potential Risks Associated with Currency Exchange

The biggest risk is the unpredictable nature of exchange rates. A sudden shift can lead to significant financial losses, especially for large transactions. For example, imagine a Canadian tourist exchanging a large sum of money just before a significant drop in the CAD. They would receive considerably fewer CAD than anticipated. There are also risks associated with using less reputable exchange services, which might offer unfavorable rates or even be fraudulent.

Strategies for Mitigating Currency Exchange Risk

Several strategies can help mitigate currency exchange risk. One common approach is hedging, which involves using financial instruments like forward contracts or options to lock in a specific exchange rate for a future transaction. This protects against unfavorable rate movements. Another strategy is to diversify your currency holdings, reducing your reliance on a single currency. Finally, carefully selecting a reputable exchange service with transparent fees and competitive rates is crucial.

Shopping around and comparing exchange rates before making a transaction can save you a significant amount of money.

Final Review

So, there you have it – the captivating saga of 464 USD’s journey into the Canadian dollarverse! From understanding the current rate and its historical context to predicting future fluctuations and mitigating risks, we’ve navigated the sometimes turbulent waters of currency exchange. Remember, while we’ve armed you with knowledge, the final decision on when and how to convert your currency rests solely with you.

Happy converting!