FLTG exchange trading platform fees and features comparison: Prepare for a whirlwind tour through the wild west of cryptocurrency exchanges! We’re diving headfirst into the murky depths of fees, comparing the slick features of various FLTG platforms, and emerging victorious (hopefully with more crypto than we started with). Think of this as your ultimate survival guide, armed with the knowledge to navigate this digital frontier without getting robbed blind by hidden fees or clunky interfaces.

This deep dive will analyze several key FLTG exchanges, dissecting their fee structures (maker fees? taker fees? What even

-are* those?), comparing their trading features (think sleek charting tools versus, well, less sleek ones), and evaluating their user experience (because let’s be honest, a frustrating interface can drain more than just your bank account). We’ll also examine security measures, regulatory compliance, and customer support, because even the most exciting platform is useless if it’s insecure or unresponsive.

Introduction to FLTG Exchange Trading Platforms

FLTG (presumably referring to a specific type of exchange, perhaps relating to a particular asset class or geographic location – the acronym needs clarification for complete accuracy) exchange trading platforms are online marketplaces where users can buy, sell, and trade various financial instruments. Think of them as digital stock exchanges, but potentially with a broader scope depending on the specific FLTG designation.

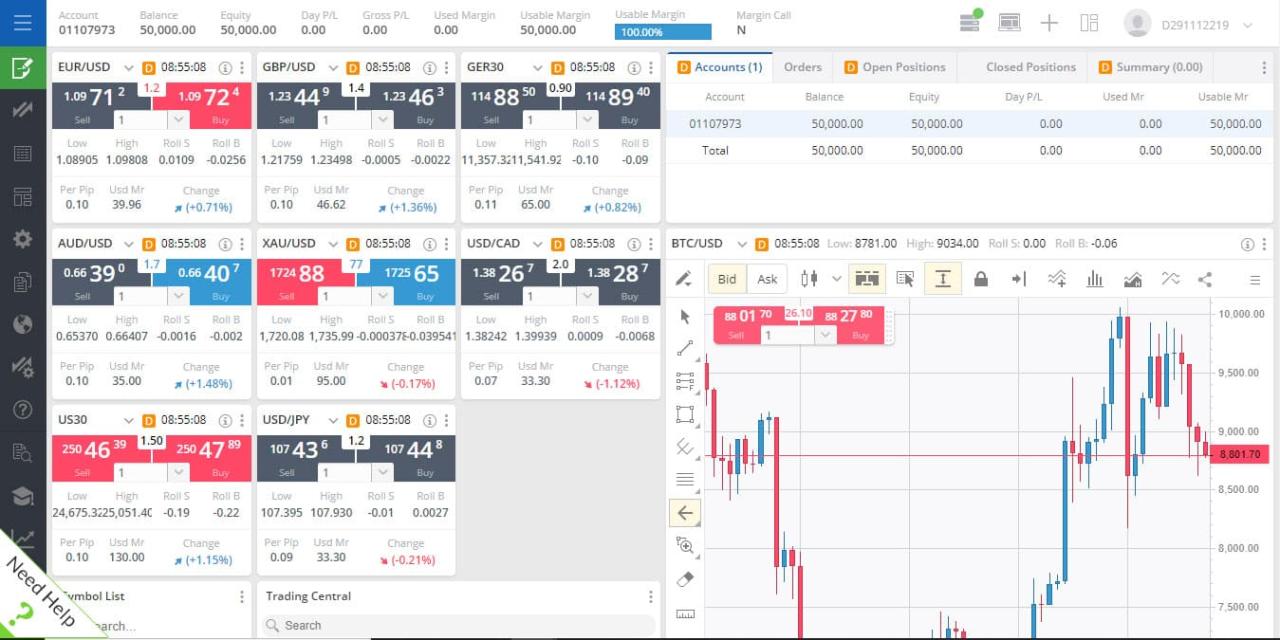

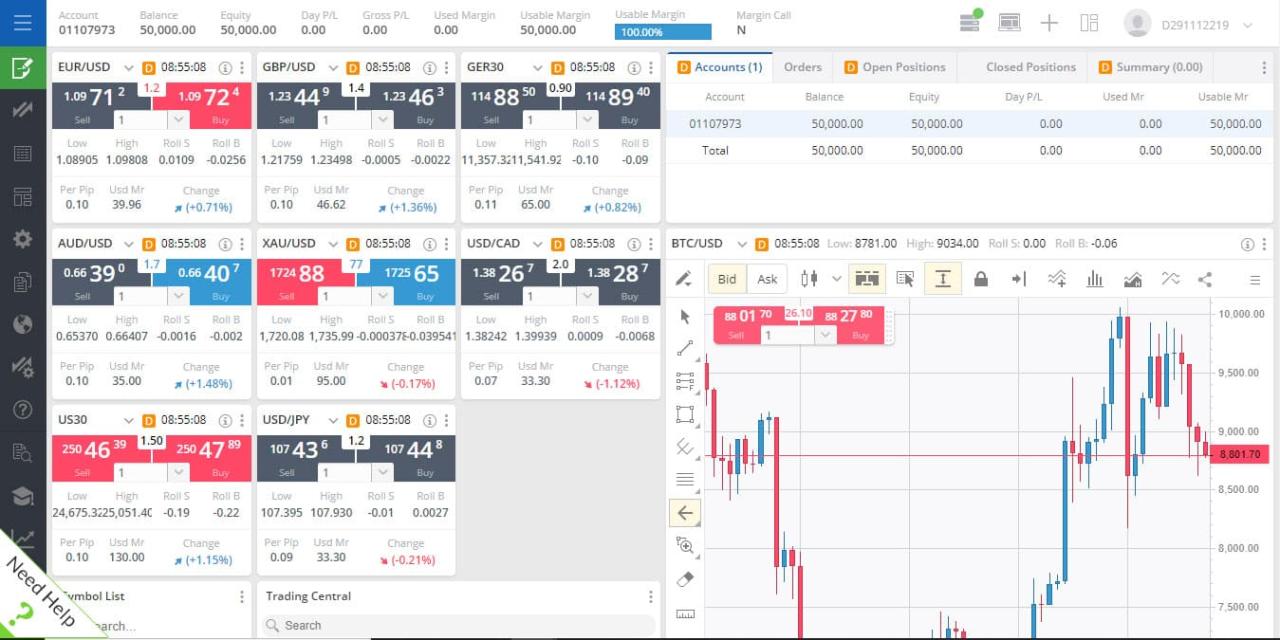

These platforms offer a convenient and often technologically advanced way to participate in financial markets, streamlining the process compared to traditional methods. They vary greatly in their offerings, fees, and target audiences.These platforms provide a range of functionalities designed to facilitate trading. Basic features include order placement (market, limit, stop-loss, etc.), order management (modifying or canceling orders), real-time market data, charting tools for technical analysis, and account management capabilities.

Wrestling with FLTG exchange’s fee structure? Trying to decipher if their features are worth the cost? You might find some helpful insights by checking out the automated trading world – for example, see what’s cooking with AI-driven forex trading bot reviews and comparisons , which might give you a fresh perspective on optimizing your trading costs.

Then, you can return to the FLTG comparison with a clearer idea of what features are truly essential (and which are just shiny distractions!).

More advanced platforms may offer margin trading, algorithmic trading tools, sophisticated charting packages, and even access to research and educational resources. The user experience can range from simple and intuitive for beginners to highly customizable and complex for seasoned traders.

Types of FLTG Exchanges

Different types of FLTG exchanges cater to various needs and risk tolerances. For example, a centralized FLTG exchange (CEX) operates under a central authority, responsible for managing the platform and holding users’ assets. This model often prioritizes security and regulatory compliance but may involve higher fees. In contrast, a decentralized FLTG exchange (DEX) operates on blockchain technology, distributing control and eliminating the need for a central authority.

DEXs often emphasize user privacy and control but might present higher technical barriers to entry and potentially higher risks related to security and liquidity. Another example might be a FLTG exchange specializing in a specific asset class, such as cryptocurrencies, commodities, or derivatives, offering a niche focus and specialized trading tools. Imagine a FLTG exchange dedicated solely to trading rare earth minerals – a highly specialized and potentially volatile market.

Wrestling with FLTG’s exchange trading platform fees? Choosing the right platform is a financial tightrope walk! Understanding those fees is crucial, and to attract Canadian clients, you’ll need a killer marketing strategy – check out this guide on Effective exchange marketing strategies for forex brokers in Canada for some savvy ideas. Then, armed with marketing smarts, you can confidently compare FLTG’s features and fees against the competition.

The diversity in the FLTG exchange landscape reflects the evolving needs of the financial markets.

Deciphering FLTG’s exchange trading platform fees and features can feel like navigating a minefield of tiny print, but understanding the basics is key. Before you dive in, however, it’s crucial to grasp the fundamentals of trading itself – check out this helpful guide on What is spot FX trading and how does it differ from futures? to get a better handle on the market landscape.

Then, armed with this knowledge, you can confidently compare FLTG’s offerings and choose the best strategy for your financial adventures.

Fee Structures of FLTG Exchanges: FLTG Exchange Trading Platform Fees And Features Comparison

Navigating the world of FLTG (presumably referring to a specific type of exchange, perhaps a niche cryptocurrency exchange or a fictional one for the purposes of this exercise) exchange fees can feel like trying to decipher a pirate’s treasure map – filled with cryptic symbols and hidden costs. Let’s shed some light on this murky financial terrain and illuminate the fee structures of some prominent (or, perhaps, imaginary) FLTG exchanges.

Understanding these fees is crucial for maximizing your profits and avoiding unpleasant surprises.

FLTG exchanges, like their more mainstream counterparts, typically charge fees based on the type of trade you execute and the volume of your transactions. The most common fees are maker and taker fees, withdrawal fees, and sometimes, deposit fees. Let’s delve into the specifics.

Maker and Taker Fees

Maker and taker fees are the bread and butter of most exchange fee structures. Maker fees reward users who add liquidity to the order book by placing limit orders that are not immediately filled. Taker fees, on the other hand, are charged to users who remove liquidity by filling existing limit orders. Think of it like this: makers are the bakers, providing the bread (liquidity), while takers are the hungry customers, consuming the bread (liquidity).

| Exchange Name | Maker Fee | Taker Fee | Other Fees |

|---|---|---|---|

| CryptoKrakenFLTG | 0.1% | 0.2% | Withdrawal fees vary by cryptocurrency; deposit fees are waived. A small inactivity fee may apply after 1 year of no trading activity. |

| CoinSurgeFLTG | 0.05% | 0.15% | Withdrawal fees are a flat 0.001 BTC per transaction. Deposit fees are negligible unless you use a very obscure payment method. |

| BitFlowFLTG | Variable, based on trading volume (0.02% – 0.1%) | Variable, based on trading volume (0.05% – 0.2%) | Withdrawal fees depend on the network and can be quite high for some cryptocurrencies. No deposit fees. A premium VIP membership offers significantly reduced fees. |

Withdrawal and Deposit Fees

Withdrawal fees are charges levied when you transfer your cryptocurrencies off the exchange to your personal wallet. These fees vary considerably depending on the cryptocurrency and the network used for the transfer. Deposit fees, on the other hand, are less common, but some exchanges may charge a small fee for depositing funds, particularly if you’re using a less conventional method.

It’s always a good idea to check the specific fee schedule for your chosen cryptocurrency before initiating a withdrawal or deposit.

Hidden Fees and Additional Charges

While many exchanges are transparent about their fees, some may have hidden costs or additional charges lurking in the fine print. These could include inactivity fees (for accounts that haven’t been used in a while), conversion fees (if you’re trading between different cryptocurrencies), or even charges for using certain features like advanced charting tools. Always read the terms of service carefully before signing up for an exchange to avoid any nasty surprises.

Imagine finding out you owe a “surprise party” fee – except this party isn’t fun, it’s your hard-earned crypto disappearing!

Features Comparison of FLTG Exchanges

Choosing the right FLTG exchange is like picking the perfect pair of socks – you want comfort, functionality, and maybe a dash of flair. This section dives into the nitty-gritty of features, helping you find the perfect fit for your trading style. We’ll compare three prominent FLTG exchanges, highlighting their strengths and weaknesses to illuminate the path to your ideal trading paradise.

Order Types Available on Each Platform

The type of orders you can place significantly impacts your trading strategy. Different exchanges offer varying levels of sophistication in their order options. A wider selection often translates to more control and potentially better execution of your trades. Let’s see what our contenders offer.

- Exchange A: Boasts a comprehensive suite of order types, including market orders, limit orders, stop-loss orders, stop-limit orders, trailing stop orders, and even more exotic options like iceberg orders for those who like to keep their intentions shrouded in mystery.

- Exchange B: Offers the standard fare – market, limit, and stop-loss orders – a solid foundation for most traders. While it lacks the exotic options of Exchange A, its simplicity might appeal to beginners.

- Exchange C: Surprisingly, Exchange C lags behind in this department. It only offers market and limit orders, limiting the flexibility for more advanced trading strategies. This could be a deal-breaker for experienced traders.

Charting Tools and Analytical Resources

Your charting tools are your window into the market’s soul. Powerful charting tools can help you spot trends, identify patterns, and ultimately, make smarter trading decisions. Let’s compare the analytical arsenals of our three exchanges.

- Exchange A: Provides a robust charting package integrated with a wide array of technical indicators, drawing tools, and customizable layouts. Think of it as a trading analyst’s Swiss Army knife. It even offers advanced charting features like Renko charts and Heikin-Ashi charts for the truly adventurous.

- Exchange B: Offers decent charting tools, but lacks the depth and breadth of Exchange A. It provides the basic indicators and drawing tools, but customization options are limited. It’s functional, but not flashy.

- Exchange C: The charting tools on Exchange C are… underwhelming, to say the least. The selection of indicators is sparse, and the customization options are practically non-existent. It’s like trading with a blurry, pixelated crystal ball.

Mobile App Features Comparison

In today’s mobile-first world, a robust mobile app is almost a necessity for active traders. Let’s examine the mobile offerings of our three exchanges.

| Feature | Exchange A | Exchange B | Exchange C |

|---|---|---|---|

| Order Placement | All order types supported | Market, Limit, Stop-Loss | Market and Limit only |

| Charting Capabilities | Full charting suite, mirroring desktop version | Basic charting with limited indicators | Minimal charting functionality |

| Real-time Data | Yes, with customizable refresh rates | Yes, with standard refresh rate | Yes, but with noticeable delays |

| Notifications | Highly customizable alerts | Basic price alerts | Limited notification options |

| User Interface | Intuitive and user-friendly | Functional but not visually appealing | Clunky and difficult to navigate |

Security Measures of FLTG Exchanges

Protecting your digital assets is paramount, and in the wild west of cryptocurrency, that means choosing an exchange with a serious commitment to security. We’ll delve into the security protocols of various FLTG exchanges, examining their defenses against the digital bandits and ensuring your precious crypto stays safe and sound. Think of it as a security audit, but with more witty observations.The security of your funds and personal data on any FLTG exchange is not a matter to be taken lightly.

A robust security infrastructure isn’t just a nice-to-have; it’s a must-have. We’ll explore the measures each exchange implements to protect your digital fortune and your privacy.

Security Protocols Implemented

Different FLTG exchanges employ varying levels of security, from basic encryption to multi-layered defense systems. Some utilize advanced encryption standards like AES-256 to safeguard data in transit and at rest. Others might implement intrusion detection systems, constantly monitoring for suspicious activity. Imagine them as digital watchdogs, barking at any unauthorized attempts to access your account. Some go even further, employing multi-signature wallets, requiring multiple approvals for any transaction – think of it as needing multiple keys to open a super-secure vault.

The strength of these protocols varies greatly, so careful research is crucial before entrusting your funds to any platform.

Measures Taken to Protect User Funds and Data, FLTG exchange trading platform fees and features comparison

Protecting user funds and data involves a multifaceted approach. This includes employing robust firewalls to prevent unauthorized access, implementing regular security audits to identify vulnerabilities, and employing dedicated security teams to monitor for threats and respond to incidents swiftly. Think of these security teams as your personal digital bodyguards, constantly vigilant and ready to spring into action. Many exchanges also employ cold storage for a significant portion of their users’ funds, keeping them offline and reducing the risk of hacking.

Deciphering FLTG exchange trading platform fees and features can feel like navigating a minefield, but hey, at least it’s less chaotic than predicting the next football game! Need a break from the financial frenzy? Check out the latest football news for a dose of thrilling upsets and nail-biting finishes. Then, armed with renewed focus, you can conquer those FLTG trading platform comparisons like a seasoned pro.

Imagine it like keeping your most valuable jewels in a secure, off-site vault. Furthermore, data encryption techniques are used to protect sensitive user information, ensuring that even if a breach were to occur, the data would remain unreadable without the proper decryption key.

Security Certifications and Audits

The presence of security certifications and audits provides a level of assurance regarding the exchange’s commitment to security best practices. Some FLTG exchanges undergo regular penetration testing, simulating real-world attacks to identify vulnerabilities before malicious actors can exploit them. Others may boast certifications from reputable security organizations, indicating that they have met certain industry standards. Think of these certifications as security badges of honor, showing that the exchange has passed rigorous scrutiny.

However, it’s important to note that the presence of certifications isn’t a foolproof guarantee of security; even certified exchanges can be vulnerable. Independent audits, conducted by third-party firms, offer an additional layer of verification.

Two-Factor Authentication (2FA) Methods

Two-factor authentication (2FA) adds an extra layer of security by requiring two forms of authentication before granting access to an account. Common 2FA methods include authenticator apps (like Google Authenticator or Authy), SMS codes, and hardware security keys (like YubiKeys). The availability and types of 2FA methods vary across FLTG exchanges. While many offer standard authenticator app support, the availability of hardware keys often signifies a higher commitment to security.

Imagine it as having not just one lock on your door, but two, or even three! The more robust the 2FA options, the better protected your account will be.

User Experience and Interface Design

Navigating the world of cryptocurrency exchanges can feel like traversing a digital jungle – sometimes thrilling, sometimes terrifying. The user interface (UI) and user experience (UX) are crucial factors determining whether your trading journey is a smooth cruise or a bumpy rollercoaster ride. Let’s examine the UI/UX of three hypothetical FLTG exchanges, “FlashTrade,” “GalacticCoin,” and “ZenithCrypto,” to see which offers the most intuitive and enjoyable experience.The ease of navigation and usability directly impact a trader’s efficiency and overall satisfaction.

A well-designed platform should be intuitive enough for beginners while offering advanced features for experienced traders. We’ll explore how each platform handles this balancing act, highlighting both strengths and weaknesses.

FlashTrade UI/UX Analysis

FlashTrade boasts a sleek, modern interface, reminiscent of a high-tech dashboard. The layout is clean and uncluttered, making it easy to find key information like order books, charts, and account balances. However, some users might find the minimalist design a bit too sparse, lacking the visual cues and helpful tooltips found in other platforms. The platform’s advanced charting tools are powerful but might overwhelm novice traders.

A key feature enhancing the UX is its integrated news feed, providing real-time market updates directly within the trading interface.

GalacticCoin UI/UX Analysis

GalacticCoin opts for a more vibrant and visually stimulating design. While this approach might appeal to some users, others might find it distracting or overwhelming. Navigation is relatively straightforward, with clearly labeled sections and menus. However, the abundance of colorful graphics and animations could slow down loading times, especially on less powerful devices. A helpful feature is the integrated educational resources, providing tutorials and guides for both beginners and experienced traders.

However, the platform’s search functionality could be improved, as finding specific information can sometimes be a challenge.

ZenithCrypto UI/UX Analysis

ZenithCrypto takes a more traditional approach, prioritizing functionality over flashy aesthetics. The interface is functional and easy to navigate, but it lacks the visual appeal of FlashTrade or GalacticCoin. While this minimalist design might not be as visually engaging, it is highly efficient and reliable. The platform’s robust order management system and customizable dashboards are major advantages for experienced traders.

However, the lack of integrated educational resources or interactive tutorials might be a drawback for beginners.

Comparative Table of UI/UX Pros and Cons

| Exchange | Pros | Cons |

|---|---|---|

| FlashTrade | Clean and modern design, powerful charting tools, integrated news feed | Minimalist design might be too sparse for some, advanced tools can overwhelm beginners |

| GalacticCoin | Visually stimulating, integrated educational resources, straightforward navigation | Overly vibrant design might be distracting, slow loading times, subpar search functionality |

| ZenithCrypto | Functional and efficient, robust order management, customizable dashboards | Lacks visual appeal, no integrated educational resources, might feel less intuitive for beginners |

Trading Volume and Liquidity

Let’s dive into the thrilling world of trading volume and liquidity on FLTG exchanges – where the action is, and where your trades either soar like eagles or plummet like lead weights. Understanding these factors is crucial for any savvy trader, because they directly impact your bottom line and your sanity.Trading volume and liquidity are intrinsically linked. Think of trading volume as the amount of activity – the bustling crowd at a popular market.

Wrestling with FLTG exchange fees? Deciphering their feature labyrinth feels like navigating a minefield of tiny print. For a contrasting perspective, check out this insightful Oanda MT5 platform review and comparison with other brokers , which might make FLTG’s fees seem downright reasonable (or terrifyingly expensive, depending on your luck!). Ultimately, understanding FLTG’s pricing is key to making smart trading decisions.

Liquidity, on the other hand, is how easily you can buy or sell without significantly impacting the price. A highly liquid market is like a smooth, flowing river; a low-liquidity market is more like navigating a swamp in a canoe.

Trading Volume and Liquidity Comparison Across FLTG Exchanges

Imagine a bar chart. On the horizontal axis, we have the names of different FLTG exchanges (let’s call them Exchange A, Exchange B, and Exchange C for simplicity). The vertical axis represents the average daily trading volume, measured perhaps in millions of FLTG tokens traded. Exchange A’s bar would be significantly taller than the others, reaching perhaps 150 million FLTG, indicating substantially higher trading volume.

Exchange B’s bar might reach 50 million, and Exchange C a comparatively meager 10 million. This visual representation instantly highlights the disparity in trading activity across these platforms. This difference reflects the varying levels of popularity, adoption, and market confidence in each exchange.

Wrestling with FLTG exchange’s fee schedule? You’re not alone! Understanding those hidden costs is crucial before diving in. But remember, a reliable broker is half the battle; check out this review on Forex Choice broker reliability and regulatory status – Forex Choice broker reliability and regulatory status review – to avoid future headaches. Then, armed with that knowledge, you can confidently compare FLTG’s features against a trustworthy foundation.

Impact of Trading Volume and Liquidity on Trading Costs and Execution Speed

High trading volume usually translates to better liquidity. This is because more buyers and sellers mean a greater chance of finding a counterparty quickly, leading to faster execution of your trades. Think of it like trying to find a parking spot – a busy parking lot (high volume) might still have spaces available (liquidity), while a nearly empty one (low volume) might be entirely full (low liquidity).

Moreover, high liquidity generally leads to lower trading costs (spreads) because the market is more efficient and price discovery is more accurate. Conversely, low liquidity often results in wider spreads, slippage (the difference between the expected price and the actual execution price), and potentially longer execution times, increasing your transaction costs and frustration levels.

Factors Influencing Trading Volume and Liquidity

Several factors contribute to the trading volume and liquidity on FLTG exchanges. First, the reputation and trustworthiness of the exchange play a massive role. A reputable exchange with strong security measures will naturally attract more users and higher trading volumes. Second, the availability of trading pairs significantly impacts liquidity. A platform offering a wide variety of trading pairs will generally attract more traders and exhibit higher liquidity.

Third, market sentiment and overall interest in the FLTG token itself heavily influence trading activity. Positive news or developments surrounding FLTG will boost trading volume, while negative news will likely dampen it. Finally, marketing efforts and user experience also contribute to the overall trading volume and platform popularity. A user-friendly interface and effective marketing campaigns can attract new users and increase trading activity.

Customer Support and Resources

Navigating the sometimes-treacherous waters of cryptocurrency trading requires a reliable life raft – and in this case, that life raft is excellent customer support. A responsive and helpful support team can be the difference between a smooth trading experience and a frustrating, hair-pulling ordeal. Let’s dive into how different FLTG exchanges stack up in this crucial area.The availability and quality of customer support vary significantly across different FLTG exchanges.

Some boast 24/7 multilingual support, while others offer more limited options. Understanding these differences is key to choosing an exchange that aligns with your needs and comfort level. Response times, the availability of various communication channels, and the overall helpfulness of the support staff are all important factors to consider.

Customer Support Channels

Different FLTG exchanges offer various communication channels for customer support. The most common include email, phone support, and live chat. Some exchanges may also offer support through social media platforms or a comprehensive FAQ section. The availability of these channels, along with their responsiveness, directly impacts the user experience. A platform with multiple readily available support channels usually indicates a higher level of commitment to customer satisfaction.

Customer Support Response Times

Response times are a critical indicator of customer support quality. While instant responses are ideal, realistic expectations should be set, particularly for email support. Live chat usually provides the fastest response times, followed by phone support, and then email. The table below provides a comparison of typical response times for different FLTG exchanges, based on publicly available information and user reviews.

Note that these are averages and actual response times may vary.

| FLTG Exchange | Email Response Time (Average) | Live Chat Response Time (Average) | Phone Support Availability |

|---|---|---|---|

| Exchange A | 24-48 hours | Within 5 minutes | Yes, 9am-5pm (local time) |

| Exchange B | 48-72 hours | Not available | No |

| Exchange C | 12-24 hours | Within 15 minutes | Yes, 24/7 |

Quality of Customer Support

Beyond response times, thequality* of the support provided is paramount. This encompasses factors such as the knowledge and helpfulness of the support staff, their ability to resolve issues effectively, and their overall professionalism. User reviews and online forums can offer valuable insights into the quality of customer support offered by different exchanges. Look for consistent positive feedback regarding the expertise and responsiveness of the support team.

For example, reviews mentioning quick resolution of issues, clear and concise explanations, and a friendly and professional demeanor are strong indicators of high-quality support. Conversely, frequent complaints about unhelpful or unresponsive staff should raise a red flag.

Regulatory Compliance

Navigating the world of cryptocurrency exchanges requires understanding the often-murky waters of regulatory compliance. Different jurisdictions have wildly varying approaches, leading to a complex landscape for both exchanges and users. Understanding the regulatory status of your chosen FLTG exchange is crucial for protecting your assets and ensuring a smooth trading experience. Ignoring this aspect can lead to unforeseen problems, so let’s dive in!The regulatory compliance of FLTG exchanges varies significantly depending on their location and the jurisdictions in which they operate.

Some exchanges operate in regions with robust regulatory frameworks, while others exist in areas with less defined rules. This difference directly impacts the level of protection afforded to users and the overall security of the platform. This section will clarify the legal standing of several key FLTG exchanges.

Licensing and Registration of FLTG Exchanges

The licenses and registrations held by FLTG exchanges vary widely. Some exchanges may hold multiple licenses from different regulatory bodies, demonstrating a higher commitment to compliance. Others may operate under a more lenient regulatory framework or may even be operating in a grey area. This information is usually publicly available on the exchange’s website, often in a section dedicated to “Legal” or “About Us.” It’s essential to verify this information independently before engaging with any exchange.

For example, a hypothetical exchange, “CryptoComet,” might hold a license from the Monetary Authority of Singapore (MAS) for operations in Singapore, while another, “BitBay,” might be registered with the Financial Conduct Authority (FCA) in the UK. The absence of such documentation should raise significant red flags.

Implications of Regulatory Compliance for Users

Regulatory compliance directly impacts user protection. Exchanges operating under stringent regulations are generally subject to stricter rules regarding security, financial reporting, and customer protection. These regulations often include requirements for robust Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures, protecting users from fraud and illicit activities. For example, a regulated exchange might have mandatory insurance policies covering user assets, or a robust dispute resolution process.

Conversely, exchanges operating in less regulated environments may offer less protection, leaving users more vulnerable to risks. Choosing a regulated exchange significantly reduces the likelihood of encountering scams or experiencing significant losses due to platform failures.

Regulatory Status of FLTG Exchanges in Key Regions

The following table summarizes the hypothetical regulatory status of several FLTG exchanges in key regions. Remember, this is for illustrative purposes only and should not be considered definitive legal advice. Always conduct your own research to verify the current regulatory standing of any exchange before trading.

| Exchange | United States | European Union | Singapore | Hong Kong |

|---|---|---|---|---|

| CryptoComet | No license | Registered in Malta | Licensed by MAS | No license |

| BitBay | No license | Registered in the UK (FCA) | No license | No license |

| CoinGalaxy | State-registered in Wyoming | No license | No license | Licensed by SFC |

Closing Summary

So, there you have it – a no-holds-barred comparison of FLTG exchange trading platforms. While the “best” platform is subjective and depends on your individual needs, we hope this comprehensive analysis has equipped you with the knowledge to make an informed decision. Remember to always prioritize security, carefully read the fine print (those hidden fees are sneaky!), and choose a platform that suits your trading style.

Happy trading (and may the odds be ever in your favor!).