Reliable and affordable day trading broker in Canada for active traders? Ah, the holy grail of Canadian finance! Picture this: you, perched atop a mountain of meticulously charted data, effortlessly predicting market movements with the precision of a seasoned hawk. But before you can conquer the financial Everest, you need the right gear – a broker who won’t drain your profits faster than a leaky canoe.

This journey delves into the wild world of Canadian brokerage firms, dissecting fees, platforms, and regulatory landscapes to help you find your perfect trading partner. Prepare for a thrilling ride!

Choosing a day trading broker in Canada requires careful consideration. The regulatory landscape is complex, fees can vary wildly, and platform functionality directly impacts your trading success. We’ll examine the leading Canadian brokers, comparing their offerings across key areas like account types, available instruments, customer support, and – most importantly – their impact on your bottom line. Our goal?

To arm you with the knowledge to make an informed decision and avoid costly mistakes. So, grab your metaphorical hard hat and let’s get digging!

Regulatory Landscape in Canada for Day Trading Brokers: Reliable And Affordable Day Trading Broker In Canada For Active Traders?

Navigating the Canadian regulatory landscape for day trading brokers can feel like traversing a particularly tricky ice rink – exhilarating, potentially lucrative, but with a high chance of a spectacular fall if you’re not careful. Understanding the rules is key to avoiding a wipeout. This section will illuminate the key players and protections in place for Canadian day traders.

The Canadian securities market isn’t a free-for-all; several regulatory bodies keep a watchful eye on brokers to ensure fair play and protect investors. Think of them as the referees of the financial world, making sure everyone plays by the rules.

Finding a reliable and affordable day trading broker in Canada for active traders can be a workout in itself! You need the stamina of a marathon runner and the focus of a ninja, so maybe sneak in some muscular strength exercises to build up that mental fortitude before diving into the market. After all, a strong mind and a strong body are essential for navigating the wild world of Canadian day trading.

Canadian Regulatory Bodies Overseeing Day Trading Brokers

The primary regulatory body is the Investment Industry Regulatory Organization of Canada (IIROC). IIROC is a self-regulatory organization (SRO) that oversees all investment dealers and trading activity in Canada. Think of them as the head referee, calling the major fouls. Provincial securities commissions, such as the Ontario Securities Commission (OSC) and the British Columbia Securities Commission (BCSC), also play a significant role, often focusing on specific aspects of regulation within their respective provinces.

They’re like the assistant referees, making sure everything is running smoothly on the local level. Finally, the federal government, through bodies like the Canadian Securities Administrators (CSA), sets overarching policy and coordinates the efforts of the provincial commissions. They’re the league commissioner, setting the overall rules of the game.

Licensing Requirements for Brokers Operating in Canada

To operate legally in Canada, day trading brokers must obtain the necessary licenses from IIROC and the relevant provincial securities commission. This involves rigorous background checks, demonstrating financial stability, and meeting specific capital requirements. The licensing process is designed to weed out the cowboys and ensure only reputable firms are allowed to operate. Failure to obtain the correct licenses can lead to significant fines and legal repercussions.

It’s like getting your coaching certification before you can lead a team – without it, you’re not playing the game legitimately.

Comparison of Regulatory Frameworks Across Canadian Provinces

While the overarching regulatory framework is largely consistent across Canada, minor variations exist between provinces. These differences often relate to specific registration requirements, reporting procedures, and enforcement priorities. For example, one province might focus more heavily on anti-money laundering regulations, while another might prioritize investor education initiatives. These variations are subtle but important, highlighting the need for brokers to comply with the specific regulations of each province in which they operate.

It’s like having slightly different rule books for different leagues within the same sport. The core principles remain, but the specifics may vary.

Finding a reliable and affordable day trading broker in Canada for active traders can be a wild goose chase, but don’t let the fees ruffle your feathers! Before you dive in headfirst, though, consider the ethical implications: check out this insightful article on whether your chosen trading style aligns with your beliefs – Is forex trading halal according to Islamic finance principles?

– then, armed with this knowledge, you can confidently hunt for that perfect Canadian broker!

Investor Protection Mechanisms Under Canadian Regulations

Canadian regulations provide several mechanisms to protect investors. These include mandatory client account segregation, meaning that client funds are kept separate from the broker’s own assets; the Canadian Investor Protection Fund (CIPF), which provides compensation to investors in the event of a broker’s insolvency; and robust enforcement actions against brokers who violate regulations. These safeguards act as a safety net, minimizing the risk of investor losses in case of broker failure or fraudulent activity.

They’re the safety equipment ensuring a smoother, safer game for everyone involved.

Brokerage Fees and Pricing Structures

Navigating the world of Canadian day trading brokers can feel like traversing a minefield of fees – some obvious, some hidden like ninjas in a rice paddy. Understanding these costs is crucial to maximizing your profits and minimizing your… well, losses. Let’s dissect the fee structures to see which brokers offer the best bang for your buck (or, more accurately, your loonie).

Brokerage fees are the silent assassins of your trading profits. They can significantly impact your bottom line, especially for active traders executing numerous trades daily. Ignoring these fees is like ignoring a leaky faucet – a small drip can eventually drain your entire account. Therefore, a thorough understanding of commission structures, platform fees, and other potential charges is paramount.

Commission Rates and Structures

Canadian day trading brokers typically employ various pricing models. Understanding these models is key to choosing a broker that aligns with your trading frequency and volume.

| Broker Name | Account Minimum | Commission Rates | Non-Commission Fees |

|---|---|---|---|

| (Example Broker 1 – Replace with Actual Broker) | $1,000 (Example) | $5 per trade (Example) or tiered pricing (Example) | Inactivity fee (Example: $10/month after 3 months of inactivity), platform fee (Example: $0) |

| (Example Broker 2 – Replace with Actual Broker) | $2,500 (Example) | Per-share pricing (Example: $0.01 per share) or tiered pricing (Example) | Inactivity fee (Example: $5/month after 6 months of inactivity), platform fee (Example: $10/month) |

| (Example Broker 3 – Replace with Actual Broker) | $500 (Example) | Tiered commission structure (Example: lower rates for higher trade volume) | Inactivity fee (Example: $20/quarter after 3 months of inactivity), platform fee (Example: $0) |

| (Example Broker 4 – Replace with Actual Broker) | $10,000 (Example) | Commission-free trading on certain stocks (Example), fees on others (Example) | Data fees (Example: $10/month), inactivity fee (Example: none) |

| (Example Broker 5 – Replace with Actual Broker) | $0 (Example) | Subscription model (Example: $50/month for unlimited trades), commission-free options (Example) | Regulatory fees (Example: passed on to the client) |

Note: The above examples are for illustrative purposes only and should not be considered financial advice. Actual fees and pricing structures vary depending on the broker and the specific account type. Always check the broker’s website for the most up-to-date information.

Typical Fee Breakdown

Beyond the headline commission rates, various other fees can nibble away at your trading profits. Let’s examine some common culprits.

Commissions: These are charges per trade, often calculated as a flat fee or a percentage of the trade value. Some brokers offer tiered pricing, where commissions decrease with increased trading volume. Others may offer commission-free trading on certain instruments but charge for others.

Inactivity Fees: Many brokers charge fees if your account remains inactive for a specified period. This discourages dormant accounts and helps offset the broker’s costs.

Platform Fees: Some brokers charge monthly or annual fees for access to their trading platforms. These fees can vary significantly depending on the platform’s features and capabilities. Others include the platform fees within the commission structure.

Data Fees: Real-time market data can come with a separate cost, especially for advanced charting and analytics tools.

Regulatory Fees: These fees cover regulatory compliance costs and are usually passed on to the client.

Cost-Effectiveness Across Trading Volumes

A comparative chart would visually illustrate how the cost-effectiveness of different brokers varies with different trading volumes. For example, a broker with a high per-trade commission might be cheaper for low-volume traders, while a broker with a tiered structure or subscription model might be more cost-effective for high-volume traders. A visual representation (which I cannot create here as per instructions) would clearly showcase this relationship.

Platform Features and Functionality for Active Traders

Choosing the right trading platform is like picking the perfect superhero sidekick – you need someone reliable, powerful, and ideally, not prone to spontaneous combustion. For active traders in Canada, the platform is your battlefield, and the right tools can mean the difference between a heroic profit and a villainous loss. Let’s dive into the features that make or break a platform for the fast-paced world of day trading.

Comparison of Trading Platforms for Active Traders

Three major Canadian brokers – let’s call them Broker A, Broker B, and Broker C (to keep things delightfully vague and avoid any unintentional endorsements) – offer distinct platforms catering to active traders. Broker A boasts a sleek, intuitive interface, while Broker B emphasizes customization and advanced charting, and Broker C prides itself on speed and a massive range of order types.

Hunting for a reliable and affordable day trading broker in Canada? Active traders need sharp skills, and that means understanding the market’s whispers. Before you even think about commissions, master the art of reading the tea leaves (or, you know, charts!), by checking out this guide on Understanding forex trading charts and technical analysis indicators. Once you’ve got that down, finding the perfect broker for your Canadian day trading adventures will be a breeze!

The best choice depends heavily on individual preferences and trading styles. Each platform’s strengths and weaknesses will be discussed in detail below.

Finding a reliable and affordable day trading broker in Canada for active traders can be a goldmine (pun intended!), especially if you’re eyeing XAUUSD. To master those price swings, check out this insightful discussion on Discussion on XAUUSD price movements and trading strategies before choosing your broker; understanding the market is half the battle! Then, armed with knowledge, you can confidently select a broker that fits your active trading needs and budget.

Charting Tools and Technical Indicators

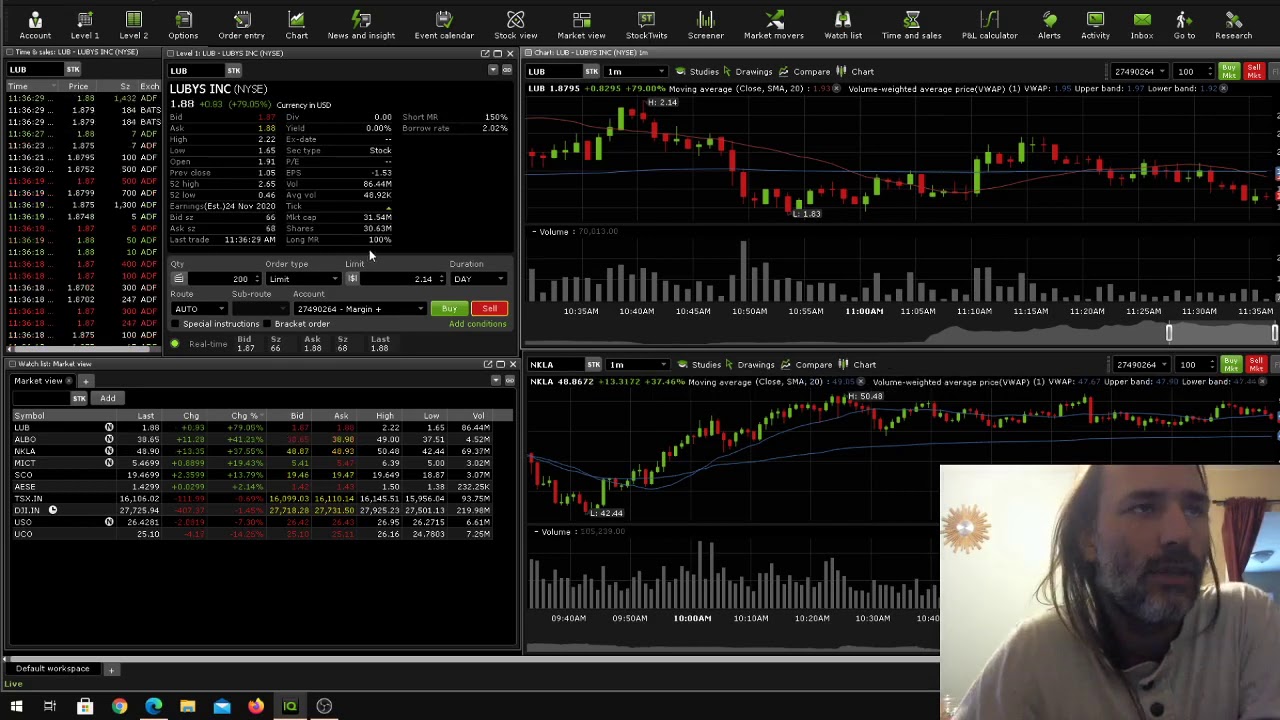

Broker A provides a robust charting package with a wide selection of technical indicators, including popular choices like moving averages, RSI, MACD, and Bollinger Bands. Their charting tools are intuitive, allowing for easy customization of timeframes, overlays, and drawing tools. Broker B goes a step further, offering a more customizable charting environment with advanced features like multiple chart layouts, customizable templates, and the ability to create and save personalized indicator combinations.

Broker C leans toward speed and efficiency, providing essential charting tools but focusing less on extensive customization options. For example, while all three offer candlestick charts, Broker B might allow for the addition of volume profiles and market profile overlays, features that might be less prominent on Broker A or C’s platforms.

Order Types and Execution Speed

The speed and variety of order types are crucial for active traders. Broker A offers a standard suite of orders including market, limit, stop-loss, and stop-limit orders. Broker B expands on this with advanced order types such as trailing stops, OCO (One Cancels Other) orders, and bracket orders. Broker C is known for its lightning-fast order execution, a key feature for scalpers and high-frequency traders.

Consider a scenario where a trader needs to react to a sudden market shift: Broker C’s speed might be the deciding factor in capturing a fleeting opportunity. The availability of advanced order types like OCO orders, which allow setting a simultaneous buy and sell order with a specific profit target and stop-loss, is crucial for risk management.

User-Friendliness and Ease of Navigation

While powerful features are essential, a platform’s usability is equally critical. Broker A’s platform is praised for its clean, uncluttered interface, making it easy for even novice users to navigate. Broker B’s highly customizable nature might present a steeper learning curve for some, while Broker C’s focus on speed might mean a less visually appealing interface, prioritizing functionality over aesthetics.

Imagine a trader needing to quickly place a trade during a volatile market: a cluttered or confusing interface could cost precious seconds, highlighting the importance of intuitive design.

Essential Features for Active Traders and Broker Offerings

Active traders need a specific set of features to succeed. Let’s Artikel some essentials and see how our hypothetical brokers measure up:

- Real-time Data: All three brokers provide real-time market data, though the specific data feeds and their cost may vary.

- Level II Market Depth: Broker B and C offer this; Broker A may require a premium subscription.

- Advanced Charting Tools: As discussed above, Broker B excels here.

- Wide Range of Order Types: Broker B offers the most comprehensive selection.

- News and Analysis Integration: All three integrate some level of news and analysis, but the depth and quality vary.

- Mobile App Functionality: All three provide mobile apps, but the features and performance can differ.

Account Types and Minimum Requirements

Choosing the right account type for your day trading adventures in Canada is like picking the perfect kayak for a whitewater rafting trip – you need one that fits your skill level and appetite for adventure (and potential spills!). Let’s navigate the options available to Canadian day traders.Different account types offer varying degrees of flexibility and risk, impacting your trading strategies and, importantly, your potential for both profit and loss.

Understanding the nuances is key to avoiding a financial wipeout.

Cash Accounts

Cash accounts are the low-risk, low-reward rookies of the day trading world. With a cash account, you only trade with the money you’ve actually deposited. No borrowing, no leverage, just pure, unadulterated trading power fueled by your own hard-earned cash. Think of it as the training wheels of the day trading world – safe, but maybe not the fastest route to the top of the mountain.

Minimum deposit requirements typically range from $0 to $1000, depending on the broker. This simplicity makes it ideal for beginners learning the ropes or those who prefer a conservative approach.

Margin Accounts

Now, this is where things get interesting. Margin accounts are the turbocharged engines of the day trading world. They allow you to borrow money from your broker to amplify your trading power, effectively leveraging your capital. This means you can control a larger position with a smaller initial investment. However, the higher the leverage, the higher the risk of substantial losses if your trades go south faster than a runaway toboggan.

Minimum deposit requirements for margin accounts are usually higher, often starting at $2,000 to $5,000, reflecting the increased risk involved. Some brokers may have even higher requirements or tiered systems based on experience and risk tolerance.

So, you’re hunting for a Canadian day trading broker that won’t break the bank? Finding the right fit is like searching for the Holy Grail of finance! The search might even lead you down unexpected paths, like needing to know how to find a reputable forex dealer in Austria, for instance, Finding a reputable forex dealer in Austria might offer some unexpected insights into the broker selection process.

Ultimately, though, the best Canadian broker for you will depend on your specific trading style and risk tolerance.

Implications of Account Types on Trading Strategies and Leverage

The choice between a cash and margin account directly influences your trading strategies. Cash accounts restrict you to strategies that rely solely on your available capital, limiting your potential gains but also shielding you from significant losses. Margin accounts, on the other hand, open the door to more aggressive strategies involving higher leverage, potentially leading to greater profits (or greater losses).

For instance, a day trader using a margin account might employ more frequent trades or larger position sizes compared to someone with a cash account. The leverage offered can range from 2:1 to 5:1 or even higher, depending on the broker and the trader’s risk profile. However, remember that high leverage is a double-edged sword; it magnifies both gains and losses.

Margin Rates and Borrowing Costs

Margin rates, the interest charged on borrowed funds, vary among brokers. These rates are typically expressed as an annual percentage rate (APR) and can fluctuate based on market conditions and the broker’s own lending policies. For example, one broker might offer a margin rate of 8% APR, while another might charge 10% APR. These seemingly small differences can significantly impact your overall trading costs, especially for traders who frequently utilize margin.

It’s crucial to compare margin rates across different brokers to find the most cost-effective option. Understanding the exact fee structure and any associated charges is vital before choosing a broker.

Available Trading Instruments and Markets

So, you’re a Canadian day trader itching to get your fingers on some serious market action? Let’s dive into the delicious buffet of tradable assets Canadian brokers offer. Think of it as a financial smorgasbord – but instead of questionable meatloaf, you’ve got stocks, options, futures, and more! The key is finding the right broker with the right menu to suit your appetite for risk and reward.The world of trading instruments is vast and varied, and the access a broker provides significantly impacts your trading strategies.

Different exchanges offer different assets, trading hours, and liquidity levels, all crucial factors for active traders who need to react quickly and efficiently. Choosing a broker with access to the markets you need is paramount to success. A broker with limited market access is like trying to bake a cake with only flour – you’re severely limiting your potential.

Types of Tradable Assets, Reliable and affordable day trading broker in Canada for active traders?

Canadian brokers typically offer a range of tradable assets, catering to diverse trading styles and risk tolerances. Stocks, the backbone of many portfolios, provide ownership in companies. Options offer leverage and flexibility, allowing traders to bet on price movements without owning the underlying asset. Futures contracts, on the other hand, involve agreements to buy or sell an asset at a future date, exposing traders to significant risk and reward.

Finally, forex trading, the buying and selling of currencies, provides another avenue for profit, but it’s known for its high volatility.

Market Access for Canadian Day Traders

Access to major exchanges like the Toronto Stock Exchange (TSX), the New York Stock Exchange (NYSE), and the NASDAQ is crucial for active traders. The TSX provides access to Canadian companies, while the NYSE and NASDAQ open doors to a much wider selection of US-listed stocks. Broader market access allows diversification and participation in global market trends, giving traders more opportunities to profit.

However, trading on multiple exchanges also means navigating different regulatory environments and potential time zone challenges. Imagine trying to juggle flaming torches while riding a unicycle – it’s exciting, but requires skill and focus!

Hunting for a reliable and affordable day trading broker in Canada? Finding the right platform is crucial, especially if you’re an active trader. Before diving in headfirst, though, check out this guide on Comparing the best forex trading platforms for beginners to avoid any rookie blunders. Then, armed with knowledge, you can confidently search for that perfect Canadian broker to fuel your trading ambitions!

Comparison of Trading Instruments Across Brokers

Let’s compare the trading instrument offerings of three hypothetical Canadian brokers (note: these are examples and don’t represent specific brokers):

The following table illustrates the differences in trading instrument availability across three hypothetical brokers. Remember, always verify the current offerings with each broker directly.

| Broker | Stocks | Options | Futures | Forex |

|---|---|---|---|---|

| Broker A | TSX, NYSE, NASDAQ | Yes | No | No |

| Broker B | TSX, NYSE | Yes | Yes (limited selection) | Yes |

| Broker C | TSX | No | No | No |

This table highlights the importance of researching which broker best fits your specific trading needs. Broker A provides excellent breadth, while Broker B offers more variety, and Broker C is best suited for those solely focused on Canadian equities.

Customer Support and Resources

Navigating the sometimes-treacherous waters of day trading requires more than just a sharp eye and a lucky hunch. A reliable broker with robust customer support and readily available educational resources can be the difference between a smooth sailing profit and a stormy loss. Let’s delve into the support systems and learning opportunities offered by various Canadian brokers.Finding the right support can feel like searching for the Holy Grail of customer service, but fear not! We’ll examine the accessibility and effectiveness of different channels, ensuring you’re equipped to tackle any trading tribulations.

Customer Support Channels

Canadian brokers generally offer a range of customer support channels to cater to diverse preferences. These typically include phone support, email, and live chat functionalities. However, the availability and responsiveness of these channels can vary significantly between brokers. Some may boast 24/7 phone support, while others might limit their phone hours, relying more heavily on email or chat.

The speed of response also differs, with some brokers providing near-instantaneous chat support and others taking longer to respond to emails. Consider your personal communication style and preferences when choosing a broker; if you’re a hands-on, immediate feedback type, 24/7 phone support might be your preferred choice. If you prefer a more asynchronous approach, email might suffice.

Responsiveness and Helpfulness of Customer Support

Evaluating the effectiveness of customer support is subjective and depends heavily on individual experiences. However, independent reviews and online forums often provide insights into the general responsiveness and helpfulness of various brokers’ support teams. For instance, some brokers are praised for their knowledgeable and patient support staff who can efficiently resolve complex issues. Others, unfortunately, receive criticism for slow response times, unhelpful responses, or a lack of expertise in addressing specific trading-related queries.

Before committing to a broker, it’s wise to check online reviews and assess the overall sentiment regarding their customer support.

Educational Resources Offered by Brokers

Many Canadian brokers understand the importance of empowering their clients with knowledge. Therefore, they provide a range of educational resources to help traders hone their skills and improve their trading strategies. These resources often include webinars, tutorials, market analysis reports, and access to research tools. The quality and comprehensiveness of these resources can differ considerably, however. Some brokers offer comprehensive learning platforms with detailed courses and interactive exercises, while others might provide only basic tutorials or limited market analysis.

Accessibility and Quality of Educational Materials

The accessibility and quality of educational materials are crucial factors to consider. Ideally, educational resources should be easily accessible through the broker’s platform, with clear navigation and well-structured content. High-quality materials should be informative, engaging, and tailored to different levels of trading expertise. For example, a beginner might benefit from introductory tutorials on fundamental analysis, while an experienced trader might prefer advanced webinars on options strategies or algorithmic trading.

The availability of materials in both English and French is also an important factor for Canadian traders. Look for brokers who offer a variety of formats, including video tutorials, downloadable guides, and interactive learning modules. The presence of a dedicated research section with up-to-date market analysis and economic indicators can also significantly enhance the learning experience.

Security and Reliability of Brokerage Firms

Choosing a day trading broker is like choosing a financial bodyguard – you need someone trustworthy and capable of protecting your assets. In Canada, the regulatory landscape helps ensure a degree of safety, but due diligence on your part is crucial. This section will illuminate the security measures, dispute resolution processes, and methods for assessing the financial health of Canadian brokerage firms.

Canadian brokers are subject to stringent regulations designed to protect client funds and data. These regulations, primarily overseen by the Investment Industry Regulatory Organization of Canada (IIROC) and provincial securities commissions, dictate security protocols and mandate specific practices to maintain investor confidence. Think of it as a multi-layered security system for your hard-earned cash.

Client Fund Protection and Data Security Measures

Canadian brokerage firms employ a range of security measures to protect client funds and data. These include robust cybersecurity systems, such as firewalls and intrusion detection systems, to safeguard against unauthorized access and cyberattacks. Many firms also utilize encryption technologies to protect sensitive client information both in transit and at rest. Furthermore, segregation of client assets is a standard practice, meaning your money is kept separate from the brokerage’s operating funds, providing an extra layer of protection in case of financial difficulties.

Imagine your money safely tucked away in a vault, separate from the brokerage’s everyday expenses.

Dispute Resolution Processes

Disputes inevitably arise. Fortunately, there are established processes for handling complaints. IIROC provides a dispute resolution mechanism, allowing investors to seek redress for grievances related to brokerage services. This involves a formal complaint process, potentially leading to arbitration or other forms of dispute resolution. Provincial securities commissions also have their own mechanisms for handling investor complaints.

The process may involve mediation, negotiation, or formal hearings. This system aims to provide a fair and efficient way to resolve disagreements between investors and their brokers. Think of it as a financial ombudsman, ensuring fair play in the market.

Assessing Financial Stability and Reputation

Assessing the financial stability of a brokerage firm requires a multi-pronged approach. Checking the firm’s history for any regulatory infractions or significant financial setbacks is paramount. You can find this information on the IIROC website and the websites of provincial securities commissions. Examining the firm’s financial statements (if publicly available) can provide insights into its financial health and liquidity.

Independent ratings agencies may also provide assessments of brokerage firms’ financial strength. Online reviews and testimonials, while subjective, can offer a glimpse into the firm’s customer service and overall reputation. Remember, a good reputation is built on years of consistent performance and ethical conduct.

Factors to Consider When Evaluating Security and Reliability

Before entrusting your funds to a day trading broker, consider these factors:

The importance of thorough due diligence cannot be overstated. Choosing a reliable broker is fundamental to a successful and secure trading experience.

- Regulatory Compliance: Verify that the broker is registered with IIROC and the relevant provincial securities commission.

- Client Fund Protection: Confirm the measures in place to safeguard client funds, such as segregation of assets and participation in investor protection funds.

- Cybersecurity Measures: Inquire about the broker’s cybersecurity protocols and data encryption practices.

- Dispute Resolution Process: Understand the broker’s complaint handling procedures and access to alternative dispute resolution mechanisms.

- Financial Stability: Review the broker’s financial statements (if available) and check for any regulatory actions or financial difficulties.

- Reputation and Reviews: Research the broker’s reputation online through independent reviews and testimonials.

Last Recap

So, there you have it – a whirlwind tour of the Canadian day trading broker landscape. Finding the “perfect” broker is a deeply personal quest, heavily influenced by your trading style, risk tolerance, and financial goals. Remember, the best broker for one active trader might be a complete disaster for another. By carefully weighing the factors discussed – regulatory compliance, fee structures, platform capabilities, and customer support – you can navigate the complexities and confidently select a partner that aligns with your unique needs.

Happy trading!