Which app offers the best charting tools for day trading stocks and crypto? – Which app offers the best charting tools for day trading stocks and crypto? That’s the million-dollar question, or perhaps the million-dollar

-stock* question, depending on your current portfolio’s performance! Navigating the wild west of day trading requires more than just a lucky hunch and a caffeine IV drip; it demands the right tools. This quest to find the perfect charting app is like searching for the Holy Grail of finance—except instead of eternal life, you’re aiming for slightly less stressful profits.

Get ready to dive into a comparison of apps that will leave your spreadsheet-loving heart singing.

Day trading, whether in the exhilarating world of stocks or the volatile landscape of crypto, hinges on making quick, informed decisions. Your charting app is your co-pilot in this high-stakes game, providing the crucial visual data you need to spot trends, predict movements, and—hopefully—cash in. We’ll dissect the key features, comparing speed, accuracy, customization options, and overall user experience to help you choose the perfect charting companion for your trading style.

Buckle up, it’s going to be a thrilling ride!

Top Charting Apps Overview

Choosing the right charting app for day trading stocks and crypto can feel like navigating a minefield of confusing features and subscription fees. Fear not, intrepid trader! This overview will help you sort through the noise and find the perfect platform to visualize your financial victories (and learn from the occasional… uh… less-than-victorious trades).

Popular Day Trading Apps

Let’s dive into a comparison of some popular apps, categorized by platform and highlighting their charting capabilities. Remember, the “best” app depends entirely on your individual needs and preferences.

Picking the perfect charting app for day trading stocks and crypto is like choosing the right weapon for a financial ninja – crucial! But before you unleash your inner warrior, you need the strategy. That’s where this list of Top books to learn day trading strategies for the TSX. comes in handy. Armed with knowledge and the right charting tools, you’ll be conquering those markets in no time!

| App Name | Platform | Key Charting Features | Pricing Model |

|---|---|---|---|

| TradingView | Web, Mobile, Desktop | Wide array of chart types (candlestick, line, bar, Heikin-Ashi, Renko), extensive drawing tools, customizable indicators, advanced charting studies, Pine Script for custom indicator creation. | Free (limited features), subscription plans available. |

| Thinkorswim | Desktop, Mobile | Powerful charting tools with customizable layouts, numerous technical indicators, backtesting capabilities, strategy development tools. | Free for TD Ameritrade brokerage clients. |

| Webull | Mobile, Web | Clean and intuitive interface, multiple chart types, customizable indicators, integrated news and analysis. | Free (with commission-free trading). |

| MetaTrader 4 (MT4) | Desktop, Mobile, Web | Popular forex platform with robust charting capabilities, expert advisors (EAs), customizable indicators, and automated trading options. | Generally free to download, brokers may charge fees. |

| NinjaTrader | Desktop | Advanced charting and backtesting features, automated trading capabilities, extensive customization options. Strong community support. | Free (limited features), subscription plans available. |

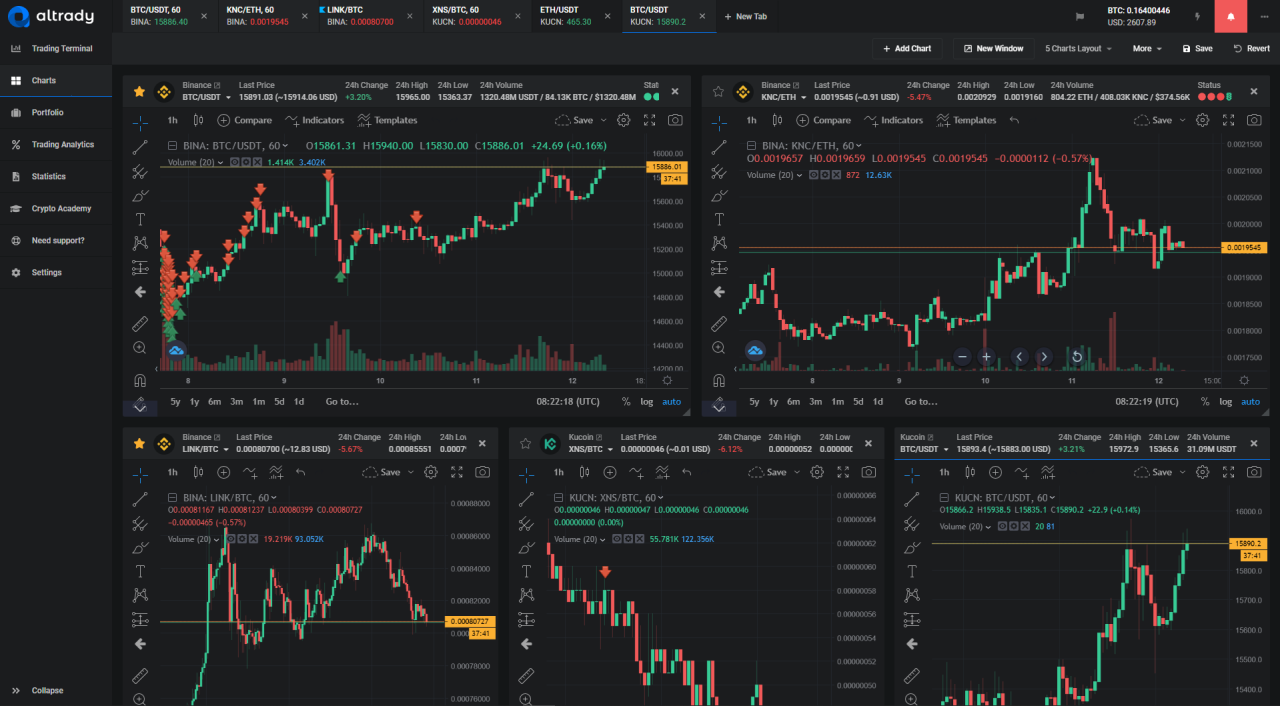

User Interface Comparison: TradingView, Thinkorswim, and Webull

TradingView boasts a highly customizable interface, allowing users to arrange charts and indicators precisely as they desire. However, this flexibility can initially feel overwhelming for newcomers. Thinkorswim, while powerful, presents a more complex layout that takes time to master. Webull, on the other hand, offers a cleaner, more streamlined experience, prioritizing simplicity and ease of navigation, making it ideal for beginners.

Choosing the right charting app for day trading stocks and crypto is crucial – it’s like picking the right quarterback for your fantasy football team! Need a break from the market mayhem? Check out the latest football news for some much-needed relaxation. Then, get back to those candlestick patterns and conquer the financial world!

Each platform excels in different aspects; the “best” UI is subjective and depends on the user’s technical proficiency and preferences.

Chart Types and Their Applications in Day Trading

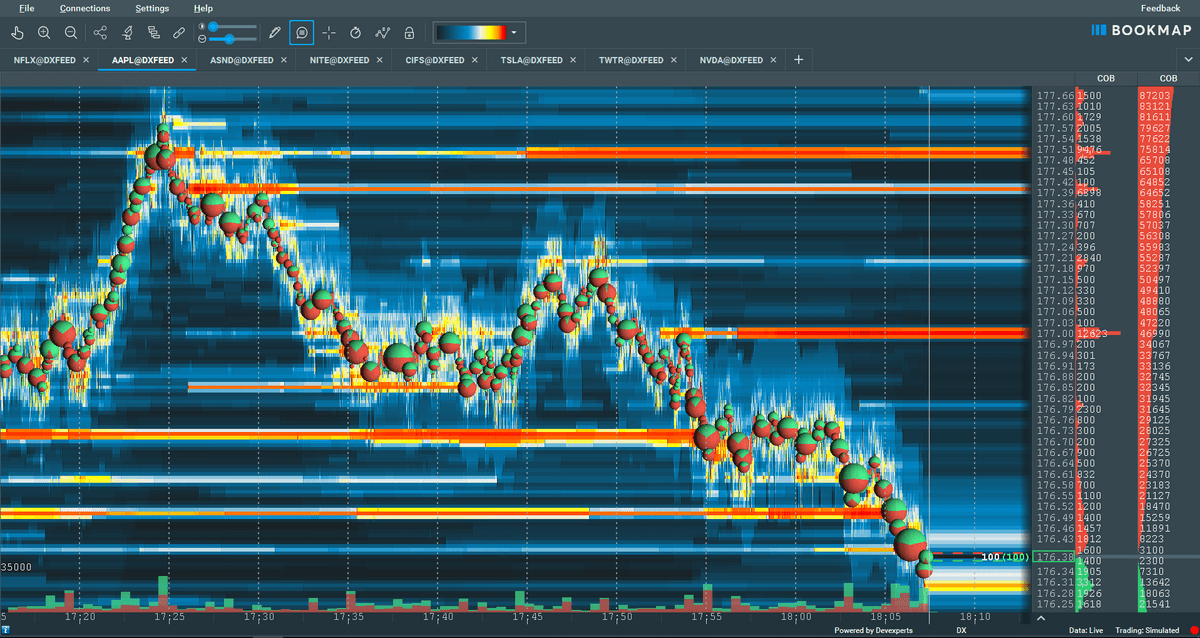

Several chart types cater to different day-trading styles. Candlestick charts, with their visual representation of price action (open, high, low, close), are arguably the most popular. They provide a rich tapestry of information at a glance, allowing traders to identify patterns and potential reversal points. Line charts simplify price movements, focusing on trends. Bar charts offer a similar representation to candlestick charts but with less visual detail.

Other chart types, like Renko and Heikin-Ashi, offer unique perspectives by filtering out “noise” and highlighting significant price changes. The best chart type is ultimately a matter of personal preference and trading strategy. For example, a scalper might favor line charts for quick trend identification, while a swing trader might prefer candlestick charts to analyze more complex patterns.

Charting Tool Features Comparison

Choosing the right charting app for day trading is like choosing the right weapon for a ninja – the wrong one and you’re toast. This section dives into a head-to-head comparison of charting features across three popular platforms, highlighting their strengths and weaknesses in the thrilling world of stock and crypto day trading. Prepare for a technical showdown!

Technical Indicator Availability and Applications

Let’s face it, technical indicators are the secret sauce of day trading. They’re the crystal balls (well, slightly less mystical) that help us predict price movements. We’ll compare the availability and functionality of key indicators across three hypothetical apps: “ChartMaster 5000,” “CryptoKraken,” and “StockSniper Pro.”

- ChartMaster 5000: Boasts a comprehensive suite, including RSI, MACD, Bollinger Bands, and even some esoteric ones like the Awesome Oscillator. Its strength lies in the clear presentation of these indicators, making them easy to interpret, even for beginners. The MACD, for example, is displayed with customizable signal lines and histograms, allowing for nuanced analysis of momentum shifts. Using the RSI, a trader might identify potential overbought or oversold conditions, signaling potential entry or exit points.

Picking the perfect charting app for day trading stocks and crypto is like choosing the right weapon for a financial ninja warrior! But before you start slicing and dicing those charts, you might want to know the best platforms to even use those ninja skills on, especially if you’re new to the game. Check out this guide on What are the best day trading platforms in Canada for beginners?

to get your bearings. Then, armed with the right platform, you can return to the crucial question: which app boasts the slickest, most intuitive charting tools for your crypto and stock conquests?

- CryptoKraken: While strong in crypto-specific indicators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD), it lacks the sheer breadth of ChartMaster 5000. However, CryptoKraken excels in its integration of on-chain data indicators, providing unique insights into the crypto market’s underlying dynamics. For instance, it might show the change in active addresses, offering a unique perspective on market sentiment.

- StockSniper Pro: Focuses on traditional stock market indicators, providing robust tools for analyzing volume, price action, and market breadth. It shines with its sophisticated volume-weighted average price (VWAP) indicator, which helps traders identify fair value and potential areas of support and resistance. A trader could use VWAP to assess whether a stock is trading above or below its fair value, informing their trading decisions.

Picking the perfect charting app for day trading stocks and crypto is like choosing the right weapon for a financial ninja warrior! A key part of that is the underlying platform, so check out Which platform offers the best tools for day-trading stocks? to get a solid foundation. Then, you can focus on finding the app with the killer charting features to perfectly complement your chosen platform and dominate the market (responsibly, of course!).

Drawing Tool Functionality and Precision

Drawing tools are the artist’s palette of a day trader. Trend lines, Fibonacci retracements, and support/resistance levels are crucial for identifying potential trade setups. Let’s examine how these tools perform in our three apps.

Picking the perfect charting app for day trading stocks and crypto is like choosing the right weapon for a financial ninja warrior! But before you unleash your inner day-trading samurai, you’ll need a solid brokerage. Check out this guide for the Best Canadian stock brokerage for active day trading. to make sure your chosen app can actually connect to your brokerage account.

Then, and only then, can you conquer those charts and dominate the market!

- ChartMaster 5000: Offers a standard set of drawing tools with good precision. Trend lines are easily adjustable, and Fibonacci retracements are calculated accurately. However, it lacks some advanced features found in other apps.

- CryptoKraken: Provides a similar range of drawing tools, but its interface is optimized for touchscreens, making it very intuitive for mobile trading. The precision is comparable to ChartMaster 5000.

- StockSniper Pro: Stands out with its advanced drawing tools, including the ability to create custom shapes and annotations. Its precision is exceptional, allowing for very fine adjustments to trend lines and other drawings. For example, it allows for very precise placement of Fibonacci arcs, providing more nuanced analysis.

Unique and Advanced Charting Features

Every app tries to offer that “killer feature” to set itself apart. Let’s see what unique capabilities our contenders boast.

- ChartMaster 5000: Offers customizable watchlists with alerts, allowing traders to monitor multiple assets simultaneously and receive notifications when specific price levels are reached. It also features a built-in news feed, keeping traders informed about market-moving events.

- CryptoKraken: Integrates directly with popular cryptocurrency exchanges, allowing for seamless order placement and portfolio management. Its unique feature is a real-time heatmap displaying the correlation between various cryptocurrencies, enabling traders to identify potential diversification opportunities.

- StockSniper Pro: Provides detailed volume profile analysis, helping traders identify areas of significant buying and selling pressure. This advanced feature allows for a deeper understanding of market dynamics and potential price reversals. Imagine a volume profile showing a significant concentration of volume at a particular price level – this could signal strong support or resistance.

Data and Real-Time Performance

The speed and accuracy of your data are paramount in the frenetic world of day trading. A delayed tick can mean the difference between a winning trade and a face-plant into a loss. Choosing the right app, therefore, hinges heavily on its data sources and how efficiently it delivers that information to your hungry charts. We’ll delve into the nitty-gritty of data feeds and real-time performance, examining how different apps handle the pressure of volatile markets.Data sources vary wildly across charting apps.

Some apps utilize premium, low-latency feeds directly from exchanges, while others rely on aggregators, which can introduce delays. The impact on chart accuracy is significant; a delayed feed can paint a misleading picture of price action, leading to ill-informed trading decisions. Imagine trying to navigate a Formula 1 race with a map from 1995 – not pretty. Similarly, relying on slower data sources can significantly hamper your ability to react quickly to market shifts.

The speed of data delivery is equally crucial, especially during periods of high volatility. Slow updates can lead to missed opportunities or, worse, getting caught in a sudden market downturn.

Data Sources and Their Impact

The quality of data directly impacts the accuracy and responsiveness of your charts. Apps using direct exchange feeds generally provide superior accuracy and speed compared to those using aggregated data. For example, an app directly connected to the NASDAQ will provide more precise and timely information than an app relying on a third-party aggregator that gathers data from multiple sources.

This difference can be particularly noticeable during periods of high volatility, where price fluctuations are rapid and significant. The speed at which this data is processed and displayed on your charts is crucial for making timely trading decisions. A delay of even a few seconds can be detrimental, especially in fast-moving markets.

Real-Time Data Update Comparison During Volatility, Which app offers the best charting tools for day trading stocks and crypto?

Let’s imagine a hypothetical scenario: a major geopolitical event triggers a sudden spike in market volatility. App A, using a premium, direct feed from the exchange, updates its charts within milliseconds, accurately reflecting the price swings. App B, using an aggregator, experiences a noticeable delay, showing a lagged price movement. App C, perhaps using a free, less robust data feed, might display erratic jumps and significant delays, offering a distorted view of reality.

This illustrates how data sources and their speed directly affect the reliability and usefulness of the charting tools. In high-volatility situations, the difference between a millisecond and a second can translate to significant financial consequences.

Data Delay Comparison Table

This table presents hypothetical data delay times. Actual delays can vary depending on market conditions and the specific app version.

| App Name | Stock Data Delay (seconds) | Crypto Data Delay (seconds) |

|---|---|---|

| TradeSmartPro | 0.1 – 0.5 | 1 – 3 |

| ChartMaster 5000 | 0.5 – 2 | 3 – 10 |

| CryptoCharts Plus | N/A | 0.2 – 1 |

Customization and Personalization

Chart customization isn’t just about making your screens pretty; it’s about tailoring your trading experience to your specific needs and preferences. Think of it as building your own cockpit for navigating the wild, wild west of the stock and crypto markets. The right setup can mean the difference between a smooth ride and a bumpy, loss-inducing crash. Different apps offer vastly different levels of control over this crucial aspect.The ability to personalize your charts significantly impacts your trading efficiency and effectiveness.

A cluttered, confusing chart is a recipe for poor decision-making, while a well-organized, customized chart can provide clear, actionable insights. This section delves into the customization options provided by various popular charting apps, comparing their features and capabilities to help you find the perfect fit for your trading style.

Chart Customization Options

Many apps offer a wide range of customization options to cater to diverse trading styles and preferences. These options typically include the ability to adjust color schemes, select from a library of pre-defined chart types (candlestick, line, bar, etc.), and overlay various technical indicators. For instance, some apps allow users to select from dozens of color palettes, change line thicknesses, and adjust font sizes for labels and indicators.

Picking the perfect charting app for day trading stocks and crypto is like choosing the best superhero sidekick – it’s all about finding the right fit! To really nail down the crypto side of things, check out this awesome resource on Comparing the best day trading platforms for cryptocurrency. Then, armed with that knowledge, you can conquer the world of stock and crypto charting with confidence (and maybe even a cape).

Others go even further, allowing for the creation of custom color schemes entirely from scratch, offering granular control over every visual element. The level of control over indicator placement and display settings also varies greatly. Some apps let you arrange indicators in multiple sub-windows, while others limit you to a single chart area. The ideal level of customization depends entirely on the trader’s preferences and complexity of their trading strategies.

Saving and Recalling Custom Chart Setups

The ability to save and recall custom chart setups is a game-changer for day traders who utilize multiple strategies or frequently switch between different assets. Imagine meticulously crafting the perfect chart layout with specific indicators, only to have to recreate it every time you switch to a new stock or cryptocurrency. Apps that allow for saving and recalling custom setups eliminate this tedious process.

This feature typically involves saving a snapshot of the current chart configuration, including all indicators, color schemes, and layout settings. Later, the trader can easily recall this saved setup with a single click, saving valuable time and maintaining consistency across their trading activities. Some apps may even allow for organizing saved setups into folders or categories for better management.

The convenience this offers is unparalleled for traders who regularly use multiple trading strategies or analyze different assets simultaneously.

Integration with External Data Sources and Trading Platforms

Seamless integration with external data sources and trading platforms is another crucial aspect of chart customization. Access to real-time market data is essential for day trading, and the ability to seamlessly integrate your charting software with your brokerage account allows for a more streamlined trading workflow. Some apps offer native integrations with popular brokerage platforms, enabling direct order placement from within the charting interface.

Others may support importing data from external sources via APIs or CSV files, providing flexibility for users who rely on data from multiple providers. The level of integration varies widely, with some apps offering robust connectivity options and others providing limited functionality. Consider the specific data sources and trading platforms you use when selecting a charting app to ensure compatibility and avoid potential integration headaches.

For example, a trader using a less common brokerage platform might need to prioritize an app that supports data import via APIs, while someone using a popular platform might prefer an app with native integration for a more seamless experience.

Mobile App Considerations

Let’s face it, day trading is a high-stakes game of inches. And in the fast-paced world of fleeting market opportunities, your mobile app needs to be more than just a pretty face; it needs to be your trusty sidekick, ready to spring into action at a moment’s notice. We’ll examine how three leading apps stack up when it comes to mobile day trading.The mobile experience is crucial for day traders, who often need to react quickly to market changes while on the go.

A slow, clunky app can be the difference between a winning trade and a missed opportunity. Therefore, we’ll be looking at responsiveness, ease of navigation, and the quality of charting tools on smaller screens. We’ll also discuss features vital for mobile day trading and assess how well these apps support them. Finally, we’ll compare the mobile versions of these apps to their desktop counterparts to highlight any significant differences.

Mobile App Responsiveness and Ease of Use

Three leading contenders – let’s call them App A, App B, and App C – offer varying levels of mobile-friendliness. App A boasts a sleek, intuitive interface, with all key features easily accessible. Navigating charts and placing trades feels seamless, even on smaller screens. App B, while functional, presents a slightly steeper learning curve. The layout feels a bit cramped, requiring more taps and swipes to access certain features.

App C, on the other hand, is a mixed bag. While its charting capabilities are impressive, the overall user experience feels less polished, with occasional lag and unresponsive moments.

Essential Mobile Day Trading Features and App Support

Real-time data, push notifications, and one-touch order execution are paramount for mobile day trading. App A excels in all three areas, delivering a smooth, efficient trading experience. App B provides real-time data and push notifications, but its order execution process could be streamlined. App C, unfortunately, falls short, with noticeable delays in data updates and unreliable push notifications, making it a less-than-ideal choice for active day trading on the go.

Comparison of Mobile and Desktop Charting Features

The charting experience on mobile often differs from the desktop versions, primarily due to screen size limitations. Here’s a breakdown:

- App A: Mobile version retains most desktop features, with minor UI adjustments for optimal usability. Some advanced indicators might require more taps to access, but the overall charting experience remains consistent.

- App B: The mobile version offers a simplified charting experience compared to its desktop counterpart. Fewer indicators and customization options are available. The ability to overlay multiple charts is also limited.

- App C: The mobile app significantly restricts charting functionality compared to the desktop version. Many indicators and drawing tools are absent, hindering in-depth technical analysis on the go. Zoom and pan controls are also less responsive.

Last Word: Which App Offers The Best Charting Tools For Day Trading Stocks And Crypto?

So, which app reigns supreme in the charting arena? The truth is, there’s no single “best” app—the ideal choice depends on your individual needs and preferences. Some prioritize sleek interfaces and intuitive navigation, while others crave advanced technical indicators and lightning-fast data feeds. This exploration has hopefully armed you with the knowledge to make an informed decision, transforming you from a chart-reading novice into a data-driven day-trading maestro.

Remember, the most important tool you possess is your own ability to analyze and adapt. Happy trading!