Top-rated day trading apps with advanced order types. – Top-rated day trading apps with advanced order types: Dive into the thrilling world of lightning-fast trades and sophisticated order strategies! Forget leisurely long-term investments; we’re talking about the adrenaline rush of day trading, where split-second decisions can make or break your day (and your bank account!). This isn’t your grandpappy’s stock market; we’re exploring the apps that give you the edge, the tools to execute complex trades with precision, and maybe, just maybe, enough profit to buy that island you’ve always dreamed of.

Buckle up, buttercup, it’s going to be a wild ride!

This guide explores the best day trading apps equipped with advanced order types, crucial for navigating the volatile world of day trading. We’ll break down the functionality of limit orders, stop-loss orders, and other sophisticated tools, comparing their strengths and weaknesses. We’ll then review top-rated apps, comparing their interfaces, features, and pricing. Finally, we’ll discuss essential non-order-related features and provide crucial risk management advice, because even the most advanced tools can’t guarantee a win every time (unless you’re secretly a financial wizard, in which case, please share your secrets!).

Introduction to Top-Rated Day Trading Apps

The world of day trading has exploded, transforming from a niche pursuit to a surprisingly accessible (and sometimes surprisingly perilous!) activity thanks to the proliferation of user-friendly mobile apps. These apps offer a gateway to the thrilling – and potentially lucrative – world of short-term stock trading, but navigating the app landscape can feel like trying to pick a winning lottery ticket from a mountain of them.

Choosing the right app is crucial; the wrong one can lead to lost profits and frayed nerves.This is where understanding the features of top-rated day trading apps becomes essential. The best apps aren’t just pretty interfaces; they’re powerful tools designed to empower even novice traders with the information and execution capabilities needed to compete in the fast-paced world of day trading.

The right app can be the difference between a successful trade and a swift exit strategy gone wrong.

Features of Top-Rated Day Trading Apps

Top-rated day trading apps typically offer a suite of features designed to streamline the trading process and provide traders with the information they need to make informed decisions. These features aren’t just bells and whistles; they’re crucial components that contribute to a robust and efficient trading experience. Lacking these features can significantly hinder a day trader’s ability to react quickly and effectively to market changes.

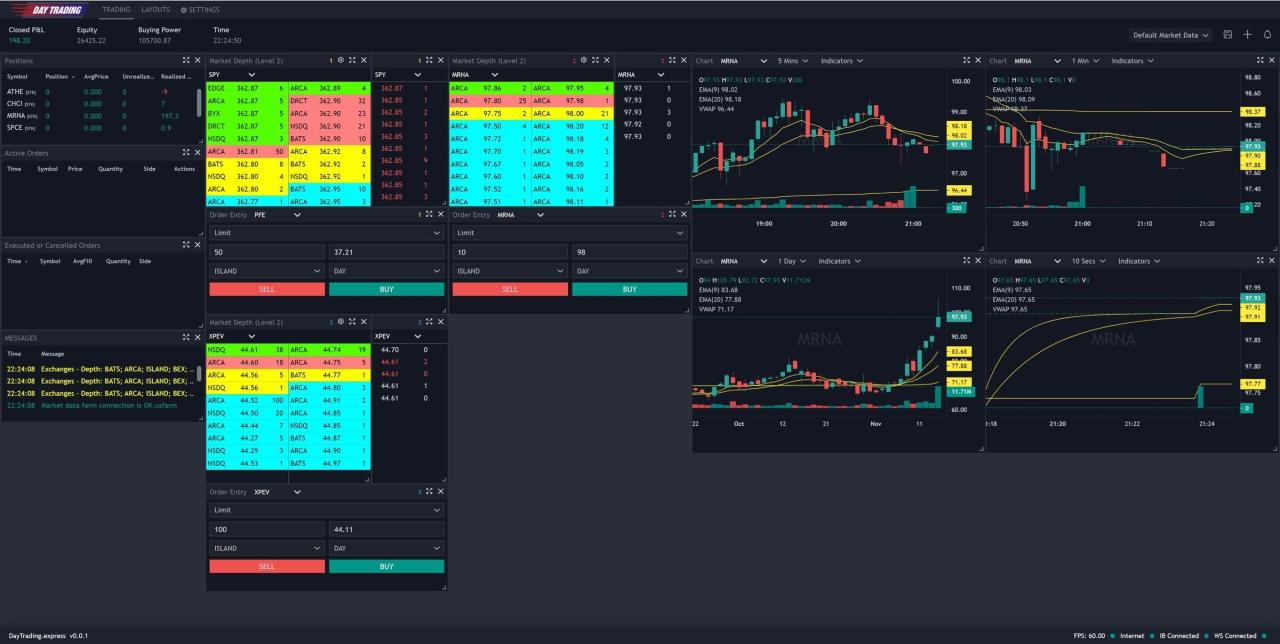

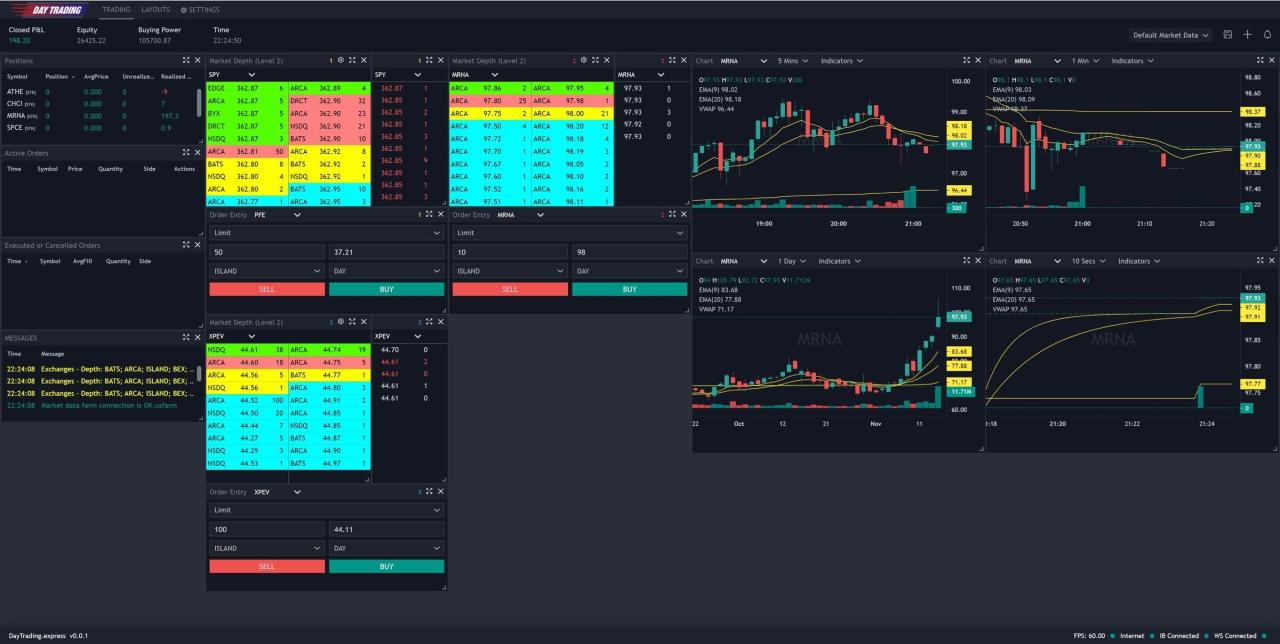

- Real-time market data: Access to live, streaming quotes is non-negotiable. Delayed data is like driving with a rearview mirror that’s perpetually a few seconds behind – not ideal for the speed of day trading.

- Advanced charting tools: Sophisticated charting packages allow traders to analyze price movements, identify trends, and use technical indicators to predict future price action. Think of these charts as a trader’s map, guiding them through the complex terrain of the market.

- Order types: This is where the real power lies. Beyond simple buy and sell orders, advanced order types allow traders to set precise entry and exit points, minimizing risk and maximizing potential profits. We’ll delve deeper into this shortly.

- News and analysis: Access to breaking news and market analysis is vital for informed decision-making. These features provide crucial context, allowing traders to understand the factors influencing price movements.

- Mobile-first design: Day trading often requires quick reactions. A well-designed mobile app ensures seamless trading on the go, allowing traders to capitalize on opportunities wherever they are.

The Importance of Advanced Order Types for Day Traders

Advanced order types are not merely a luxury; they’re a necessity for successful day trading. These orders go beyond simple market orders, offering sophisticated tools to manage risk and execute trades with precision. Imagine trying to build a skyscraper with only a hammer and nails; advanced order types are the specialized tools that allow for the construction of a complex and robust trading strategy.

“Advanced order types are the secret weapon of successful day traders, allowing them to fine-tune their strategies and navigate the complexities of the market with precision.”

Examples of advanced order types include limit orders (buying or selling at a specified price or better), stop-loss orders (automatically selling if the price drops below a certain level), stop-limit orders (a combination of stop and limit orders), and trailing stop orders (automatically adjusting the stop-loss order as the price moves in your favor). These tools are vital for managing risk and capitalizing on opportunities.

Without them, day trading becomes significantly more challenging and riskier.

Advanced Order Types Explained: Top-rated Day Trading Apps With Advanced Order Types.

Day trading, the thrilling rollercoaster of buying and selling stocks within a single day, demands precision and speed. To navigate this fast-paced world, understanding advanced order types is crucial. These aren’t just fancy terms; they’re your safety net and your ticket to potentially maximizing profits (and minimizing losses!). Let’s dive into the nitty-gritty.

Limit Orders

A limit order is your polite request to the market: “Hey, I’d love to buy this stock, but only if the price drops to $X.” You set a maximum price (for buying) or a minimum price (for selling), and the order only executes if the market reaches your specified limit. This helps you avoid overpaying or selling too cheaply, offering a degree of control in volatile markets.

For example, if you believe a stock will dip to $50, you place a limit order to buy at $50 or less, ensuring you don’t buy at a higher price. The downside? Your order might not fill if the price doesn’t reach your limit.

Stop-Loss Orders

Think of a stop-loss order as your emergency brake. It’s designed to limit potential losses if the price moves against you. You set a stop price, and once the market hits that price, your order converts to a market order, selling your shares immediately. For example, if you bought a stock at $60 and set a stop-loss at $55, your shares will be sold automatically once the price falls to $55, preventing further losses.

While effective in minimizing losses, it’s not foolproof; rapid price drops might lead to selling at a lower price than anticipated.

Stop-Limit Orders

This order type combines the best (and worst) of both worlds. It’s a hybrid of limit and stop-loss orders. You set a stop price and a limit price. Once the stop price is triggered, the order converts to a limit order, attempting to sell your shares at your specified limit price or better. This offers a degree of protection against rapid price drops while still aiming for a better selling price than a pure stop-loss order.

So you’ve got your shiny new top-rated day trading app with all the bells and whistles – limit orders, stop-losses, the whole shebang! But even the fanciest tools are useless without a solid plan. That’s where knowing the best day trading strategies comes in; check out this guide for short-term gains: Best day trading strategies for short-term gains.

Armed with the right strategy, those advanced order types in your app will become your secret weapons for conquering the market (or at least, making a decent profit!).

However, there’s a risk that the limit price may not be reached, resulting in the order not being filled.

Bracket Orders

Bracket orders are a sophisticated strategy involving three simultaneous orders: a market or limit entry order, a stop-loss order, and a take-profit order. This strategy sets your entry point, your maximum loss tolerance, and your desired profit target all at once. For example, you might enter a long position, setting a stop-loss slightly below your entry point and a take-profit order at your desired profit level.

Top-rated day trading apps boast advanced order types, letting you unleash your inner Wall Street wolf (responsibly, of course!). But before risking real cash, you’ll want to hone your skills – check out Which app is best for practicing paper trading before live trading? to find the perfect practice ground. Then, armed with virtual victories, you can conquer those advanced order types on the best day trading app for your style.

This automated approach manages risk and potential profit simultaneously. The downside is that you are locked into these parameters; market movements outside these parameters will not be capitalized upon.

Trailing Stop Orders

A trailing stop order is like a persistent shadow, following the price of your asset as it rises. You set a trailing percentage or a fixed dollar amount behind the current market price. If the price drops below the trailing stop, your order triggers and sells your shares. This protects your profits as the price moves in your favor while allowing you to ride the wave of gains.

However, in a rapidly fluctuating market, the trailing stop might trigger prematurely, resulting in missed profit opportunities.

Advanced Order Types Comparison, Top-rated day trading apps with advanced order types.

| Order Type | Functionality | Advantages | Risks |

|---|---|---|---|

| Limit Order | Buy/sell at a specified price or better. | Control over price, avoids overpaying/selling too cheaply. | Order may not fill. |

| Stop-Loss Order | Sell when price drops to a specified level. | Limits potential losses. | May sell at a lower price than desired, not foolproof in rapid drops. |

| Stop-Limit Order | Converts to a limit order when stop price is hit. | Combines benefits of limit and stop-loss, potentially better selling price than stop-loss. | May not fill if limit price isn’t reached. |

| Bracket Order | Entry order, stop-loss, and take-profit order all at once. | Automated risk and profit management. | Locked into pre-set parameters, missed opportunities outside range. |

| Trailing Stop Order | Follows price, triggers when price drops below trailing stop. | Protects profits as price rises. | May trigger prematurely in volatile markets, resulting in missed profits. |

Top Apps with Advanced Order Type Support

Day trading is a high-octane sport, and just like a Formula 1 driver needs a finely-tuned machine, you need a day trading app that can keep up with your lightning-fast moves. Choosing the right app isn’t just about pretty charts; it’s about access to advanced order types that give you the edge in a fiercely competitive market. This section dives into some of the top contenders, comparing their features and user interfaces to help you find your perfect trading pit stop.

Selecting the ideal day trading app hinges on several factors, including the sophistication of its order types, the intuitiveness of its user interface, and, of course, the cost. While many apps offer basic order types, the ability to utilize more advanced options is crucial for experienced day traders looking to fine-tune their strategies and manage risk effectively. This comparison focuses on those apps that go beyond the basics, providing the tools needed to navigate the complexities of the market.

Top Day Trading Apps and Their Advanced Order Capabilities

The following table compares three leading day trading apps, highlighting their user interfaces, supported advanced order types, and pricing models. Remember, the “best” app depends heavily on your individual trading style and preferences.

| App Name | User Interface | Advanced Order Types | Pricing |

|---|---|---|---|

| TradeStation | Powerful, but can feel overwhelming to beginners. Highly customizable with numerous chart layouts and indicators. Think cockpit of a fighter jet – powerful but requires training. | Trailing Stops, OCO (One Cancels Other), Stop Limit, Bracket Orders, Fill or Kill (FOK), Immediate or Cancel (IOC), and more. They offer a vast array of order types, catering to almost any trading strategy. | Commission-based; pricing varies depending on trading volume and plan. Offers both commission-free and commission-based accounts. |

| Interactive Brokers (IBKR) | Highly configurable and customizable. A vast array of tools and features are available, making it powerful but requiring a steeper learning curve. Think of it as a Swiss Army knife for trading – incredibly versatile, but might take some time to master. | All the above, plus sophisticated algorithms and API access for automated trading. Their advanced order types are incredibly extensive, allowing for very precise order management. | Commission-based; known for competitive pricing, particularly for high-volume traders. Offers various account types with differing fee structures. |

| TD Ameritrade Thinkorswim | Known for its user-friendly interface, even with its advanced features. It strikes a balance between power and ease of use, making it a popular choice among both beginners and experienced traders. Think of it as a sports car – sleek, powerful, and relatively easy to handle. | Trailing Stops, OCO, Stop Limit, Bracket Orders, FOK, IOC, and others. While not as extensive as IBKR’s, it still provides a comprehensive set of advanced order types. | Commission-free for many stocks and ETFs, but commissions may apply to options and other instruments. A range of account types are available. |

| Webull | Clean and intuitive interface, particularly well-suited for beginners. Offers a simplified yet effective trading experience. Think of it as a well-designed, efficient sports sedan. | Stop-Limit, Stop-Market, Limit orders, and some more sophisticated orders are available. The advanced order type selection is less extensive than the others listed. | Commission-free for stocks and ETFs, but fees may apply to options and other asset classes. |

App Features Beyond Order Types

Day trading isn’t just about fancy order types; it’s about making informed, lightning-fast decisions in a volatile market. While advanced orders are crucial, a truly top-tier day trading app needs much more to help you navigate the whirlwind of market activity. Think of it like this: advanced orders are the sports car, but you also need a detailed map, a reliable GPS, and a mechanic on speed dial (customer support!).The success of your day trading hinges on access to robust tools and features that go beyond the ability to place complex orders.

Top-rated day trading apps with advanced order types often come with a hefty price tag, making them intimidating for newbies. But fear not, fledgling traders! If you’re starting your journey in the Great White North, check out this handy guide: What are the best free day trading apps for beginners in Canada? to find your footing.

Then, once you’ve mastered the basics, you can graduate to those fancy, expensive apps with all the bells and whistles of advanced order types.

These additional features are the unsung heroes, quietly working behind the scenes to give you the edge you need to thrive in the fast-paced world of day trading.

Charting Tools and Real-Time Market Data

Charting tools are your crystal ball, allowing you to visualize market trends, identify potential trading opportunities, and understand price action. Imagine trying to navigate a city without a map – chaotic, right? Similarly, day trading without comprehensive charts is a recipe for disaster. Real-time market data ensures you’re always working with the most up-to-date information, preventing costly delays and inaccurate decisions.

Features like customizable chart types (candlestick, bar, line), technical indicators (RSI, MACD, Bollinger Bands), and drawing tools (trend lines, Fibonacci retracements) are essential for effective analysis. Without real-time data, you’re essentially trading blindfolded.

News Feeds and Educational Resources

Staying informed is paramount in day trading. A sudden news announcement can send the market into a frenzy, presenting both opportunities and risks. Integrated news feeds provide instant access to market-moving headlines, allowing you to react quickly and adjust your strategy accordingly. Educational resources, such as tutorials, webinars, and glossary of terms, are invaluable, especially for beginners.

So you’re after top-rated day trading apps with advanced order types, huh? The kind that let you unleash your inner Wall Street wizard? Well, before you dive headfirst into limit orders and stop-losses, check out this amazing resource for Day trading app recommendations with educational resources. to avoid becoming a market casualty. Then, armed with knowledge, you can conquer those advanced order types like a pro!

These resources can help you understand complex concepts, refine your trading skills, and build confidence. Think of them as your personal trading coach, always available to offer guidance and support.

Mobile Accessibility and Customer Support

In the fast-paced world of day trading, you need to be able to act quickly. Mobile accessibility is crucial, allowing you to monitor the market and execute trades from anywhere, anytime. Imagine being stuck at the airport, missing a crucial market shift because you’re tied to your desktop! Furthermore, robust customer support is essential. When things go wrong (and they inevitably will), you need a reliable support team to help you resolve issues promptly and efficiently.

This could involve anything from technical glitches to questions about platform functionality. Think of customer support as your emergency contact in the world of day trading.

Five Must-Have Features Beyond Advanced Order Types

The following features are vital for a successful day trading experience, supplementing the advanced order types already discussed:

- Real-time market data with customizable alerts: Stay ahead of the curve with instant updates and personalized notifications.

- Advanced charting tools with multiple technical indicators: Visualize market trends and identify opportunities with precision.

- Integrated news feeds and market analysis: Make informed decisions based on the latest market intelligence.

- Intuitive mobile interface: Trade on the go with ease and efficiency.

- Responsive and knowledgeable customer support: Get quick assistance when you need it most.

Risks and Considerations for Day Trading

Day trading, the thrilling pursuit of profiting from short-term market fluctuations, can be a rollercoaster ride. While the potential for quick gains is undeniably alluring, it’s crucial to understand that this high-octane strategy comes with a hefty dose of risk. Ignoring these risks can quickly transform exciting wins into devastating losses. Let’s delve into the inherent dangers and explore how to navigate them.The inherent volatility of the market forms the bedrock of day trading’s risk profile.

So you’re hunting for top-rated day trading apps with advanced order types? Finding the right one can feel like searching for the Holy Grail of finance! But fear not, intrepid trader, because choosing a secure platform is key; that’s why checking out resources like Finding a secure and user-friendly day trading app for Android. is a smart move.

Then, armed with this knowledge, you can conquer those advanced order types and become a day trading ninja!

Prices can swing wildly in seconds, leaving even the most seasoned traders vulnerable. Unexpected news, sudden shifts in investor sentiment, or even algorithmic trading glitches can trigger dramatic price movements, potentially wiping out your profits – or worse. Furthermore, the speed and pressure of day trading demand unwavering focus and discipline; a momentary lapse in judgment can have significant consequences.

While advanced order types can provide a safety net, they’re not a magic bullet against market forces.

Advanced Order Types: A Double-Edged Sword

Advanced order types, such as stop-loss orders, limit orders, and trailing stops, offer tools to manage risk more effectively. A stop-loss order automatically sells your asset when it reaches a predetermined price, limiting potential losses. Limit orders ensure you buy or sell only at a specific price or better, preventing impulsive trades at unfavorable prices. Trailing stops dynamically adjust the stop-loss price as the asset’s price moves in your favor, locking in profits while minimizing risk.

However, even these sophisticated tools can’t predict every market twist. A sudden, sharp drop can still trigger a stop-loss order before the price recovers, or a limit order might not execute if the price doesn’t reach your specified level.

Conquering the volatile world of top-rated day trading apps with advanced order types requires nerves of steel and a well-stocked fridge. After a particularly stressful trade, though, you might find yourself craving something delicious and comforting, like the amazing halal culinary delights you can find online. Then, refreshed and rejuvenated, it’s back to mastering those limit orders and stop-losses on your favorite trading platform!

Examples of Advanced Order Types in Action

Consider a scenario where you’re day trading a volatile stock. You anticipate a price increase and place a limit order to buy at $100. The price surges past $100, and your order is filled. However, if the price suddenly drops sharply before your order can execute, you might miss the opportunity. Conversely, if you place a stop-loss order at $95, protecting your investment against significant losses, the stock price might rebound before your order is triggered, potentially missing out on a profitable recovery.

A well-placed trailing stop could have allowed you to capture a significant portion of the profit while mitigating the risk of a sharp reversal. The key is careful planning and understanding the nuances of each order type.

Best Practices for Day Traders Using Advanced Order Types

Before employing any advanced order types, thorough research and planning are paramount. Understanding the specific characteristics of the assets you’re trading, including their historical volatility and typical price movements, is crucial for setting appropriate order parameters.

- Develop a robust trading plan: Define your risk tolerance, entry and exit strategies, and the specific advanced order types you’ll use for each trade. This plan should be based on your individual trading style and risk appetite.

- Practice with a demo account: Before risking real capital, hone your skills and test your strategies using a simulated trading environment. This allows you to learn from mistakes without financial consequences.

- Monitor market conditions closely: Stay informed about relevant news and events that could impact your trades. Be prepared to adjust your strategies based on evolving market dynamics.

- Use appropriate position sizing: Never risk more capital than you can afford to lose on any single trade. Proper position sizing is a fundamental aspect of risk management.

- Regularly review and refine your strategy: Track your performance, analyze your wins and losses, and adapt your approach accordingly. Consistent review is essential for continuous improvement.

Choosing the Right Day Trading App

Picking the perfect day trading app is like choosing a superhero sidekick – you need someone reliable, powerful, and ideally, not prone to spontaneous combustion. The wrong app can lead to missed opportunities, frustrating delays, and potentially, a significant dent in your wallet. So, let’s navigate this crucial decision with a blend of strategy and a dash of humor.Finding the right day trading app requires careful consideration of your individual needs and trading style.

Think of it as a tailor-made suit for your financial adventures – one size doesn’t fit all. The following steps will guide you through the process, ensuring you’re equipped with the right tools for success (and hopefully, a hefty profit).

Factors to Consider When Selecting a Day Trading App

Selecting a day trading app involves a thorough evaluation of several key aspects. Ignoring these critical factors could lead to costly mistakes and a less-than-optimal trading experience.

- Fees and Commissions: These are the silent assassins of your profits. Compare commission structures across different platforms. Some apps charge per trade, others might offer tiered pricing based on volume. Look for transparency in fee disclosure – hidden charges are a major red flag.

- Platform Reliability and Speed: In the fast-paced world of day trading, milliseconds matter. A slow or unreliable platform is a recipe for disaster. Research the app’s uptime, speed of order execution, and user reviews regarding platform stability. Imagine trying to catch a falling knife with a rusty spoon – not ideal.

- Available Advanced Order Types: This is where the real power lies. Do you need stop-loss orders, limit orders, trailing stops, or more exotic options like bracket orders or OCO (One Cancels Other) orders? Ensure the app supports your preferred strategies.

- Charting and Technical Analysis Tools: Your charts are your crystal ball (sort of). Look for apps with robust charting tools, customizable indicators, and drawing tools. The ability to analyze price movements effectively is crucial for successful day trading.

- Customer Support: When things go wrong (and they will sometimes), you need a lifeline. Assess the quality of customer support offered by the app. Are they readily available? Is their support responsive and helpful? A quick response time is crucial during market volatility.

Evaluating Fees, Commissions, and Platform Reliability

Let’s delve deeper into the crucial aspects of fees, commissions, and platform reliability. These are not mere technicalities; they directly impact your bottom line and your trading experience.

For example, consider two hypothetical apps: App A charges $5 per trade, while App B charges $2 per trade but offers a tiered system where higher trading volumes result in reduced fees. If you’re a high-volume trader, App B might be more cost-effective. Always calculate the total cost based on your expected trading frequency.

Regarding reliability, look for platforms with a proven track record. Check independent reviews and ratings to gauge the general user experience regarding platform stability and speed. A platform with frequent outages or slow execution speeds can be extremely detrimental to your day trading success.

Questions to Ask Before Choosing a Day Trading App

Before committing to a particular app, it’s crucial to address several key questions. This proactive approach ensures you make an informed decision that aligns with your trading style and risk tolerance.

Instead of asking “What are the fees?”, consider examining the detailed fee schedule to identify any hidden charges or unusual pricing structures. Instead of simply asking “How reliable is the platform?”, investigate user reviews and platform uptime statistics to get a realistic picture of its performance. Instead of “What advanced order types are supported?”, research the specifics of each order type to ensure they align with your trading strategies.

Illustrative Examples of Advanced Order Types in Action

Let’s ditch the dry textbook examples and dive into some real-world scenarios where advanced order types become your day-trading superheroes. These aren’t just theoretical constructs; they’re tools that can make or break your trading day, so understanding them is crucial. We’ll explore how limit, stop-loss, and bracket orders can help you navigate the volatile waters of the day trading market.

Limit Orders: Securing a Specific Price

Imagine you’re eyeing Widget Corp (WGT) stock. You’ve done your research, and you believe the price is primed to rise to $25. Instead of blindly buying at the current market price of $24.50, you place alimit order* to buy 100 shares of WGT at $25. This means you’ll only buy the shares if and when the price drops to your target.

If the price never reaches $25, your order simply expires. This approach helps you avoid overpaying and secure a better entry point, potentially boosting your profits. It’s like patiently waiting for the perfect sale at your favorite store, instead of impulsively buying at full price.

Stop-Loss Orders: Shielding Against Losses

Now, let’s say you’ve already bought 100 shares of WGT at $25 and the market takes a sudden downturn. Fear not, your trustystop-loss order* is here. You set a stop-loss order at $24. This means if the price drops to $24, your order automatically sells your 100 shares, limiting your potential loss to $100 (ignoring commissions). This protective measure prevents emotional decision-making during market panic, ensuring you don’t lose your shirt (or, in this case, your investment).

It’s like having a safety net in place to catch you if you fall.

Bracket Orders: Risk Management and Profit Taking

Bracket orders are the ultimate all-in-one risk management tool. Let’s say you’re confident about WGT’s potential. You place a bracket order to buy 100 shares at $25, with a stop-loss at $24 and a profit target at $

27. This means

you buy at $25, your shares automatically sell at $24 if the price falls (protecting your investment), and they automatically sell at $27 if the price rises (locking in your profit). This order type simplifies your trading, allowing you to set and forget, without constant monitoring. It’s like setting your autopilot for both safety and success.

A Hypothetical Day Trading Scenario with Advanced Order Types

Let’s imagine you’re trading XYZ Corp (XYZ). You believe XYZ is poised for a short-term surge. You place a

- limit order* to buy 50 shares at $50. Simultaneously, you place a

- stop-loss order* at $48 to protect against unexpected drops. If the price reaches $50, your limit order executes, and your stop-loss order becomes active. If the price rises to, say, $53, you could then choose to adjust your stop-loss order to $51 to lock in some profits while allowing for further upside potential. This strategy utilizes both orders to strategically manage risk and maximize profit opportunities.

The key is to choose your entry and exit points based on sound analysis and risk tolerance. This isn’t a get-rich-quick scheme; it’s about intelligent risk management and calculated moves.

Final Review

So, there you have it – a whirlwind tour of the top day trading apps and the advanced order types that can make or break your trading career (or at least your weekend brunch fund). Remember, while these apps offer powerful tools, successful day trading requires skill, discipline, and a healthy dose of luck. Don’t gamble your rent money, folks! Do your research, choose your app wisely, and may your trades always be green (or at least not deeply, deeply red).

Happy trading!