Best crypto day trading platform with low fees and secure wallets? Ah, the holy grail of digital finance! Imagine: waking up, sipping your ethically-sourced coffee, and effortlessly raking in crypto riches, all while your digital fortune sleeps soundly in a vault guarded by cybernetic dragons (okay, maybe not dragons, but seriously robust security). This quest for the perfect platform involves navigating a minefield of fees, security protocols, and user interfaces that could make a seasoned astronaut weep.

But fear not, intrepid trader! We’re here to illuminate the path to crypto nirvana, one low fee and secure wallet at a time.

This guide dives deep into the criteria for selecting the best crypto day trading platform, comparing fee structures, analyzing security features, and exploring the user experience. We’ll dissect the nuances of maker/taker fees, the importance of two-factor authentication, and the sheer joy (or terror) of navigating complex trading interfaces. Get ready to arm yourself with the knowledge you need to conquer the crypto jungle and emerge victorious, wallet full and spirits high.

Defining “Best”

Choosing the “best” crypto day trading platform is less about finding the mythical unicorn and more about finding the steed that best suits your particular jousting style. There’s no single perfect platform, just platforms better tailored to individual needs and trading strategies. Consider your priorities – speed, security, fees, or advanced charting tools – to find your ideal match.

The search for the perfect crypto day trading platform can feel like navigating a minefield of jargon and hidden fees. To help you avoid a costly stumble, let’s establish some clear criteria for evaluation. By focusing on these key aspects, you can confidently compare platforms and choose the one that aligns perfectly with your trading goals and risk tolerance.

Essential Criteria for Evaluating Crypto Day Trading Platforms

To objectively assess different platforms, we need a structured approach. The following table Artikels five crucial criteria, each contributing to the overall “best” rating. We’ll also introduce a scoring system to help you quantify your preferences.

| Criterion | Description | Importance in Day Trading | Scoring (1-5, 5 being best) |

|---|---|---|---|

| Fees | Transaction fees, withdrawal fees, inactivity fees, etc. | High fees can significantly eat into profits, especially with high-frequency day trading. Lower fees directly translate to higher returns. | Consider the total cost per trade, including maker/taker fees and any other charges. |

| Speed & Execution | Order execution speed, latency, and reliability. | In day trading, speed is paramount. Slow execution can lead to missed opportunities and losses due to price fluctuations. | Evaluate order fill rates and average execution times. Look for platforms boasting sub-second execution. |

| Security | Wallet security measures, platform security protocols, and regulatory compliance. | Security is non-negotiable. Protecting your assets from theft or loss is crucial, especially when dealing with volatile cryptocurrencies. | Assess the platform’s security features (two-factor authentication, cold storage, etc.) and its track record. |

| Charting & Tools | Availability of advanced charting tools, technical indicators, and order types. | Effective day trading relies heavily on technical analysis. Robust charting tools are essential for making informed decisions. | Consider the range of charting tools, customizable layouts, and the availability of real-time data feeds. |

| Customer Support | Responsiveness, helpfulness, and accessibility of customer support channels. | Quick and effective customer support is invaluable when facing technical issues or urgent questions. | Evaluate the availability of support (live chat, email, phone) and the speed and quality of responses. |

Using this table, you can assign a score (1-5) to each criterion for each platform you are considering. Adding up the scores will give you a comparative ranking. For example, a platform scoring 4 in fees, 5 in speed, 4 in security, 3 in charting, and 2 in customer support would have a total score of 18. Remember that this is a subjective scoring system based on your priorities.

A higher score indicates a better fit for your needs.

Fee Structures and Comparisons

Navigating the world of crypto day trading fees can feel like trying to decipher an ancient scroll written in Klingon. But fear not, intrepid trader! We’re here to illuminate the murky depths of fee structures and help you choose a platform that won’t leave your wallet feeling as empty as a politician’s promise. Understanding these fees is crucial for maximizing your profits – because let’s face it, nobody wants to trade their way to ramen-only dinners.Fee structures vary wildly across different platforms, impacting your bottom line more than a rogue bear market.

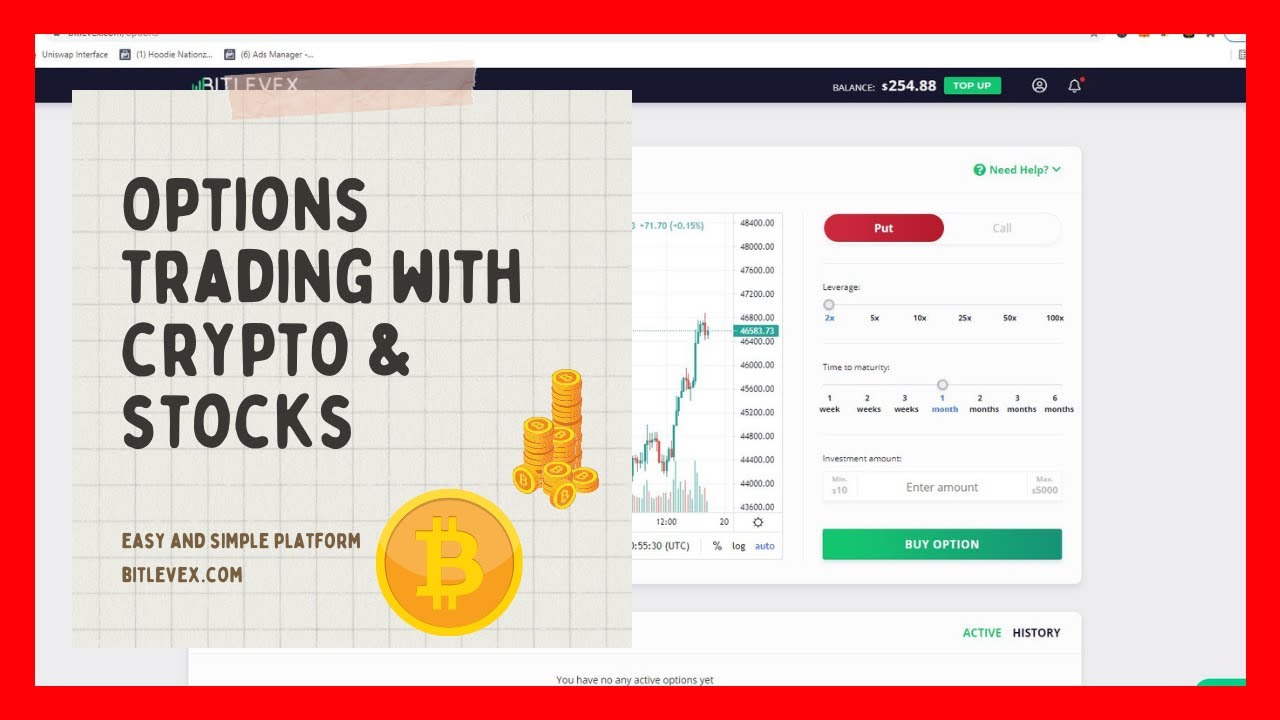

Three popular platforms will be compared to illustrate the differences, focusing on the fees that can really sting.

Fee Types and Their Impact on Profitability

Different platforms employ various fee structures, primarily maker-taker fees and withdrawal fees. Maker fees reward users who add liquidity to the order book (placing limit orders), while taker fees are charged to users who remove liquidity (placing market orders). Withdrawal fees are charged when you transfer your crypto off the platform. These fees, seemingly small individually, can significantly impact profitability, especially with high-volume trading.

Imagine them as tiny crypto leeches, slowly but surely sucking the life out of your profits.

Comparison of Fee Structures on Three Popular Platforms

Let’s analyze the fee structures of three hypothetical platforms (Platform A, Platform B, and Platform C) to highlight the differences. Note that actual fees are subject to change and can depend on factors such as trading volume and the specific cryptocurrency.

- Platform A: This platform boasts low maker fees (0.05%) but charges a higher taker fee (0.1%). Withdrawal fees are a flat $10 per transaction. Deposit fees are negligible.

- Platform B: Platform B offers a tiered fee structure, with maker fees ranging from 0.02% to 0.08% and taker fees from 0.05% to 0.15% based on your 30-day trading volume. Withdrawal fees vary by cryptocurrency but average around $5. Deposits are free.

- Platform C: Platform C charges a flat 0.1% for both maker and taker fees, regardless of volume. Withdrawal fees are a relatively high $20 per transaction, and there are small deposit fees (0.01%).

Illustrative Example: A $10,000 Trading Day

Let’s see how these fees affect a hypothetical $10,000 trading day involving 10 trades, each worth $1000, with 5 maker orders and 5 taker orders.

- Platform A: Maker fees: 5 trades

– $1000

– 0.05% = $2.50; Taker fees: 5 trades

– $1000

– 0.1% = $5; Withdrawal fees (assuming one withdrawal): $10; Total Fees: $17.50 - Platform B: Assuming average fees within the tiered structure, let’s approximate maker fees at $1.50 and taker fees at $7.

50. Withdrawal fees (assuming one withdrawal): $5; Total Fees: $14 - Platform C: Maker fees: 5 trades

– $1000

– 0.1% = $5; Taker fees: 5 trades

– $1000

– 0.1% = $5; Withdrawal fees (assuming one withdrawal): $20; Total Fees: $30

This example illustrates how seemingly small differences in fees can significantly impact your profits. On a $10,000 trading day, the difference between the cheapest and most expensive platform is a whopping $12.50. Scale that up to a month or a year of active trading, and the savings (or losses) become substantial. Choosing the right platform is therefore crucial for long-term success.

Hunting for the best crypto day trading platform? Low fees and secure wallets are a must, right? But before you dive in headfirst, checking out the market trends is key – that’s where understanding Live forex trading charts and real-time market data comes in handy. This helps inform your crypto decisions, so you can pick the perfect platform for your needs and avoid any regrettable trades!

Remember, even small fees can add up faster than you can say “HODL!”

Platform Features and User Experience: Best Crypto Day Trading Platform With Low Fees And Secure Wallets?

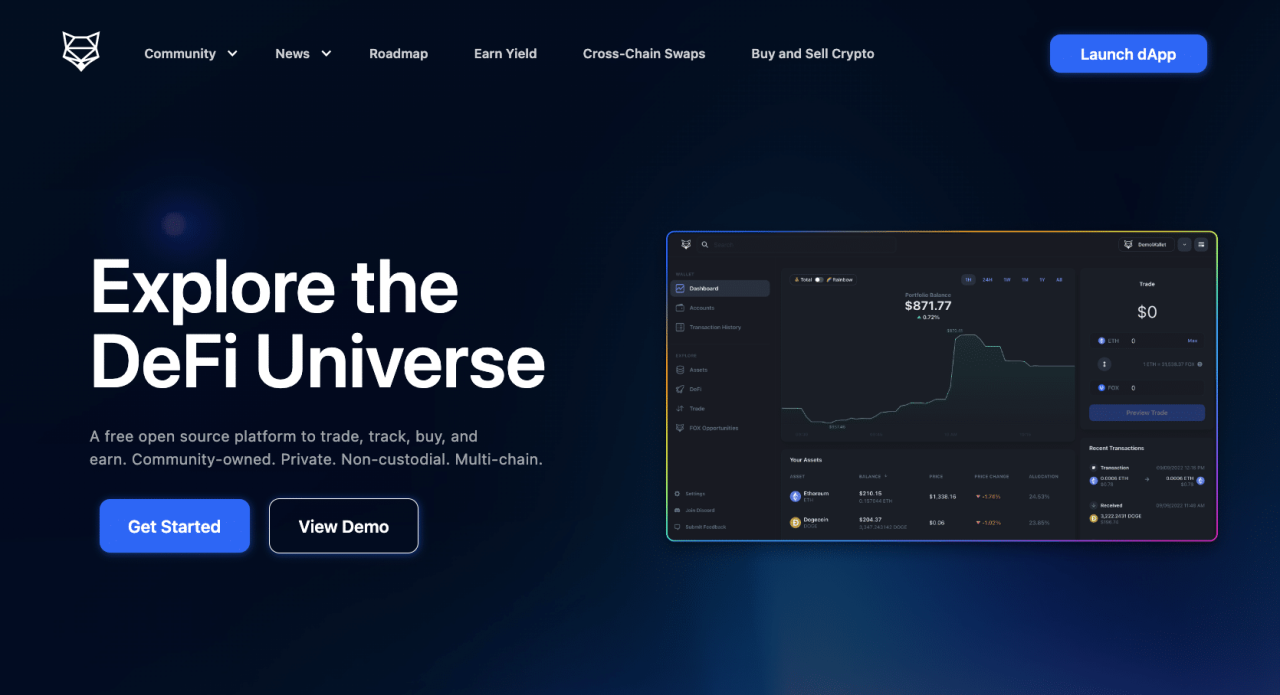

Day trading cryptocurrencies is a high-octane sport, demanding speed, precision, and a platform that doesn’t feel like navigating a labyrinth blindfolded. The right platform can be the difference between a profitable day and a frustrating one, so choosing wisely is crucial. A user-friendly interface, powerful charting tools, and a responsive mobile app are no longer luxuries; they’re necessities for navigating the volatile world of crypto day trading.The user experience (UX) of a crypto trading platform significantly impacts a trader’s efficiency and profitability.

A poorly designed platform can lead to missed opportunities, incorrect orders, and increased stress levels. Conversely, a well-designed platform can streamline the trading process, allowing traders to focus on making informed decisions. Think of it like this: would you rather race a Formula 1 car or a rusty bicycle? The choice is clear.

Platform Feature Comparison, Best crypto day trading platform with low fees and secure wallets?

The following table compares three hypothetical platforms (Platform A, Platform B, and Platform C) across key features. Note that specific features and performance may vary depending on the platform’s updates and your individual experience.

| Feature | Platform A | Platform B | Platform C |

|---|---|---|---|

| User Interface | Clean and modern, but some features require extra clicks. | Intuitive and visually appealing, with easy navigation. | Slightly cluttered; could benefit from improved organization. |

| Charting Tools | Offers basic charting tools; advanced indicators require a separate subscription. | Provides a wide range of customizable charting tools and indicators. | Limited charting capabilities; lacks advanced technical analysis features. |

| Order Types | Supports market, limit, and stop-loss orders. | Offers market, limit, stop-loss, stop-limit, and trailing stop orders. | Only supports market and limit orders. |

| Mobile App Functionality | Full functionality mirrored on the mobile app; responsive and reliable. | Mobile app is functional but lacks some advanced features found on the desktop version. | Mobile app is basic and slow; not ideal for active day trading. |

Importance of User-Friendly Design and Intuitive Navigation

A user-friendly design is paramount for day trading. Day traders need to react quickly to market changes, and a confusing or slow platform can lead to missed opportunities or costly mistakes. Intuitive navigation allows traders to quickly access the information and tools they need, minimizing delays and maximizing efficiency. Imagine trying to execute a trade during a volatile market surge while battling an unwieldy interface – it’s a recipe for disaster!

Crypto Day Trading Platform UX Checklist

This checklist provides a framework for evaluating the UX of a crypto day trading platform. Remember, a platform should work

for* you, not against you.

- Ease of Navigation: Can you easily find the information and tools you need?

- Charting Capabilities: Does the platform offer the charting tools and indicators you require for your trading strategy?

- Order Execution Speed: How quickly are your orders executed?

- Order Type Variety: Does the platform support the types of orders you use (market, limit, stop-loss, etc.)?

- Mobile App Functionality: Is the mobile app fully functional and reliable?

- Security Features: Does the platform offer robust security features to protect your funds?

- Customer Support: Is customer support readily available and helpful?

- Overall User Experience: Is the platform intuitive, efficient, and enjoyable to use?

Trading Tools and Resources

Day trading, the thrilling rollercoaster of buying and selling crypto within a single day, demands more than just gut feeling. It requires a finely tuned arsenal of tools and resources to navigate the volatile crypto markets effectively. The right platform can provide the edge you need to make informed decisions and, hopefully, profit handsomely. Let’s delve into the crucial trading tools and educational resources offered by leading platforms.

Access to sophisticated trading tools and educational resources is paramount for successful day trading. The right platform will empower you with the knowledge and capabilities to make quick, informed decisions in a fast-paced market.

Advanced Trading Tools Comparison

Two prominent platforms, let’s call them “CryptoPro” and “CoinGalaxy,” offer a range of advanced trading tools to cater to experienced day traders. The availability and quality of these tools can significantly impact your trading strategy and success.

- CryptoPro: Offers an intuitive charting package with customizable timeframes, numerous technical indicators (RSI, MACD, Bollinger Bands, etc.), and various order types (market, limit, stop-loss, trailing stop). Their charting interface is highly praised for its responsiveness and the ability to overlay multiple indicators simultaneously for in-depth analysis. They also boast advanced drawing tools to identify patterns and support/resistance levels.

Imagine drawing a Fibonacci retracement on a candlestick chart in real-time – that’s the level of precision CryptoPro offers.

- CoinGalaxy: Provides a similar array of charting tools and indicators, but its strength lies in its advanced order types. Beyond the standard options, CoinGalaxy offers iceberg orders (partially hidden order execution to avoid market manipulation), and bracket orders (automatically setting stop-loss and take-profit orders simultaneously). Their charting is functional, but some users prefer CryptoPro’s more visually appealing and customizable interface.

Real-Time Market Data and Analytical Tools

Real-time data is the lifeblood of day trading. Delayed data is like driving a race car with your eyes closed – a recipe for disaster. Access to accurate, real-time market data feeds, coupled with powerful analytical tools, is essential for identifying fleeting opportunities and mitigating risks.

Both CryptoPro and CoinGalaxy provide real-time data feeds. However, the speed and reliability of these feeds can vary. For instance, a delay of even a few seconds can mean the difference between a profitable trade and a missed opportunity, particularly in fast-moving markets. Furthermore, access to advanced analytical tools such as sentiment analysis or news-driven algorithms can provide an extra layer of insight, helping traders anticipate market shifts.

Educational Resources Provided

Even the most seasoned traders can benefit from ongoing education. Platforms offering comprehensive educational resources empower users to enhance their skills and stay ahead of the curve in the ever-evolving crypto landscape. A good platform will provide more than just basic tutorials.

- CryptoPro: Offers a robust educational library encompassing video tutorials, webinars, and articles covering various trading strategies, risk management techniques, and fundamental crypto analysis. They also host regular live Q&A sessions with experienced traders, providing valuable insights and personalized guidance. Their approach is akin to a crypto trading boot camp, offering a structured learning path.

- CoinGalaxy: While CoinGalaxy also provides tutorials and webinars, their educational resources are less comprehensive compared to CryptoPro. Their focus seems more geared towards practical application rather than in-depth theoretical knowledge. Think of it as a “learn-by-doing” approach, with less emphasis on formal courses and more on interactive tools and guides.

Customer Support and Accessibility

Navigating the sometimes-treacherous waters of crypto day trading requires more than just sharp instincts and a lucky streak. A reliable support system is your life raft when the market throws a curveball (or, let’s be honest, a whole tsunami). Having access to prompt and effective customer support can be the difference between a minor setback and a major meltdown.Customer support is your lifeline when things go sideways – and in the fast-paced world of crypto, thingswill* go sideways at some point.

Whether it’s a technical glitch, a confusing fee, or a sudden dip that leaves you questioning your life choices, having a responsive support team can make all the difference. A good support system can prevent costly mistakes, offer guidance during turbulent times, and ultimately, help you keep your sanity (and your crypto).

Customer Support Channels

Major crypto day trading platforms typically offer a variety of customer support channels, catering to different communication preferences. Email support is a common staple, providing a written record of your interaction. Live chat offers instant communication, perfect for quick questions or urgent issues. Phone support, while less common in the crypto world, provides a more personal touch and can be beneficial for complex problems requiring detailed explanations.

Some platforms even integrate ticketing systems, allowing you to track the progress of your support request. The availability and responsiveness of these channels vary significantly between platforms, so careful investigation is crucial.

The Impact of Effective Customer Support on Trader Experience

Effective customer support significantly enhances the overall trading experience. Imagine this: you’re mid-trade, a critical error pops up, and you’re facing a potential loss. Quick, helpful support can prevent this from escalating into a full-blown disaster. Conversely, unhelpful or unresponsive support can amplify stress, leading to poor decision-making and potentially significant financial losses. A platform with excellent customer support fosters trust and confidence, allowing traders to focus on their strategies without the constant worry of technical issues or unanswered questions.

Think of it as having a knowledgeable guide navigating the sometimes-murky waters of the crypto market. A good support team isn’t just a safety net; it’s a strategic advantage.

Factors to Consider When Assessing Customer Support Quality

When evaluating the quality of a crypto trading platform’s customer support, several key factors should be considered.

- Response Time: How quickly do they respond to inquiries? Aim for platforms with quick response times across all channels – minutes, not hours or days.

- Accessibility: Are multiple support channels available (email, live chat, phone)? A diverse range of options caters to various preferences and urgency levels.

- Knowledge and Helpfulness: Are support agents knowledgeable about the platform’s features and the cryptocurrency market in general? Can they provide clear, concise, and helpful solutions?

- Availability: What are the support hours? 24/7 support is ideal, especially for a global market like cryptocurrency.

- Problem Resolution Rate: How effectively does the support team resolve issues? Look for platforms with a high success rate in resolving user problems.

- User Reviews and Ratings: Check independent reviews and ratings to get a sense of other users’ experiences with the platform’s customer support.

Final Summary

So, the quest for the “best” crypto day trading platform is less about finding a single, perfect solution and more about finding the platform that best fits

-your* specific needs and risk tolerance. Remember, due diligence is your best friend in this wild world of digital assets. Carefully weigh the fees, scrutinize the security measures, and test drive the user interface before committing your hard-earned crypto.

Happy trading (and may your profits be plentiful!).