Best day trading app for beginners with detailed tutorials. – sounds thrilling, right? Think less Wall Street wolves and more… enthusiastic puppies learning to fetch stocks. Day trading might seem like a high-stakes casino, but with the right app and a healthy dose of patience (and maybe a few celebratory puppy treats), you can navigate the world of stocks without losing your shirt (or your sanity).

This guide is your paw-sitive path to mastering the art of the day trade, one tutorial at a time.

We’ll unravel the mysteries of user interfaces, demystify order types (market, limit, stop-loss – they sound scary, but they’re not!), and equip you with the beginner-friendly strategies you need to tiptoe into the exciting (and sometimes terrifying) world of day trading. We’ll even cover risk management – because even puppies need a safety net, especially when dealing with volatile markets.

Get ready to unleash your inner financial whiz!

Introduction to Day Trading Apps

So, you’re thinking about diving into the thrilling (and sometimes terrifying) world of day trading? Buckle up, buttercup, because it’s a wild ride. But before you leap headfirst into the chaotic ocean of buy and sell orders, let’s talk about the tools that can help you navigate – or at least, not completely drown – day trading apps.Day trading apps are essentially your digital cockpit for the stock market.

They provide a user-friendly interface to access real-time market data, execute trades, and manage your portfolio, all from the convenience of your smartphone or computer. Think of them as your trusty co-pilot, guiding you through the turbulence (hopefully). The benefits? Well, aside from potentially making a killing (or losing your shirt, let’s be honest), you get instant access to information, the ability to react quickly to market changes, and the convenience of trading anytime, anywhere (provided you have a signal, of course).

Day Trading Defined and its Inherent Risks

Day trading involves buying and selling financial instruments (like stocks, futures, or options) within the same trading day. The goal? To profit from small price fluctuations throughout the day. Sounds easy, right? Wrong.

Day trading is notoriously risky. It requires significant knowledge, skill, discipline, and, let’s be frank, a healthy dose of luck. Losses can be substantial and rapid. Think of it like a high-stakes poker game – you can win big, but you can also lose everything in a single hand (or trade, in this case). Remember, past performance is not indicative of future results.

A strategy that worked wonders yesterday might tank tomorrow. This is why thorough research and risk management are absolutely crucial. For example, imagine investing your entire life savings on a single, highly volatile stock based solely on a hunch – that’s a recipe for disaster.

Essential Features of a Beginner-Friendly Day Trading App

Choosing the right app is crucial, especially when you’re starting out. A good beginner-friendly app should have several key features. It needs to be intuitive and easy to navigate, even for someone who’s never traded before. Complicated interfaces can be overwhelming and lead to costly mistakes.A beginner-friendly app should offer educational resources, such as tutorials, articles, or videos, to help new traders understand the basics of day trading.

This is incredibly important to build a solid foundation and avoid costly errors. Imagine learning to drive a Formula 1 car without any lessons – you’d probably crash and burn.Real-time market data is essential. Delayed data is like trying to navigate a busy highway with a map from the 1980s. You need accurate, up-to-the-minute information to make informed decisions.Charting tools are vital for technical analysis.

These tools allow you to visualize price trends and identify potential trading opportunities. Think of them as your market X-ray machine. Without them, you’re trading blind.Order placement should be straightforward and efficient. You don’t want to be fumbling around with complicated order forms when the market is moving quickly. A simple, user-friendly interface is key.

Imagine trying to order a pizza during a rush hour – a quick and efficient process is essential.Finally, a good app will provide clear and concise account statements, allowing you to easily track your performance and manage your finances. This helps you to understand where you are succeeding and where you need improvement.

Top Day Trading Apps for Beginners

So, you’re ready to dive into the thrilling (and sometimes terrifying) world of day trading? Buckle up, buttercup, because it’s a wild ride. But before you leap headfirst into the market, choosing the right app is crucial. Think of it like picking the right surfboard – a clunky, outdated board will sink your chances faster than a lead balloon.

This section will help you navigate the app-tastic ocean and find your perfect wave-riding companion.

Top Day Trading Apps Compared

Choosing the right day trading app can feel like choosing a life partner – you need compatibility, reliability, and a whole lot of features. This table compares four popular options, highlighting their strengths and weaknesses. Remember, the “best” app depends entirely on your individual needs and trading style. Don’t be afraid to try a few before settling on your perfect match.

| App Name | Pros & Cons | Commission Fees (Example) | Features & UI/UX |

|---|---|---|---|

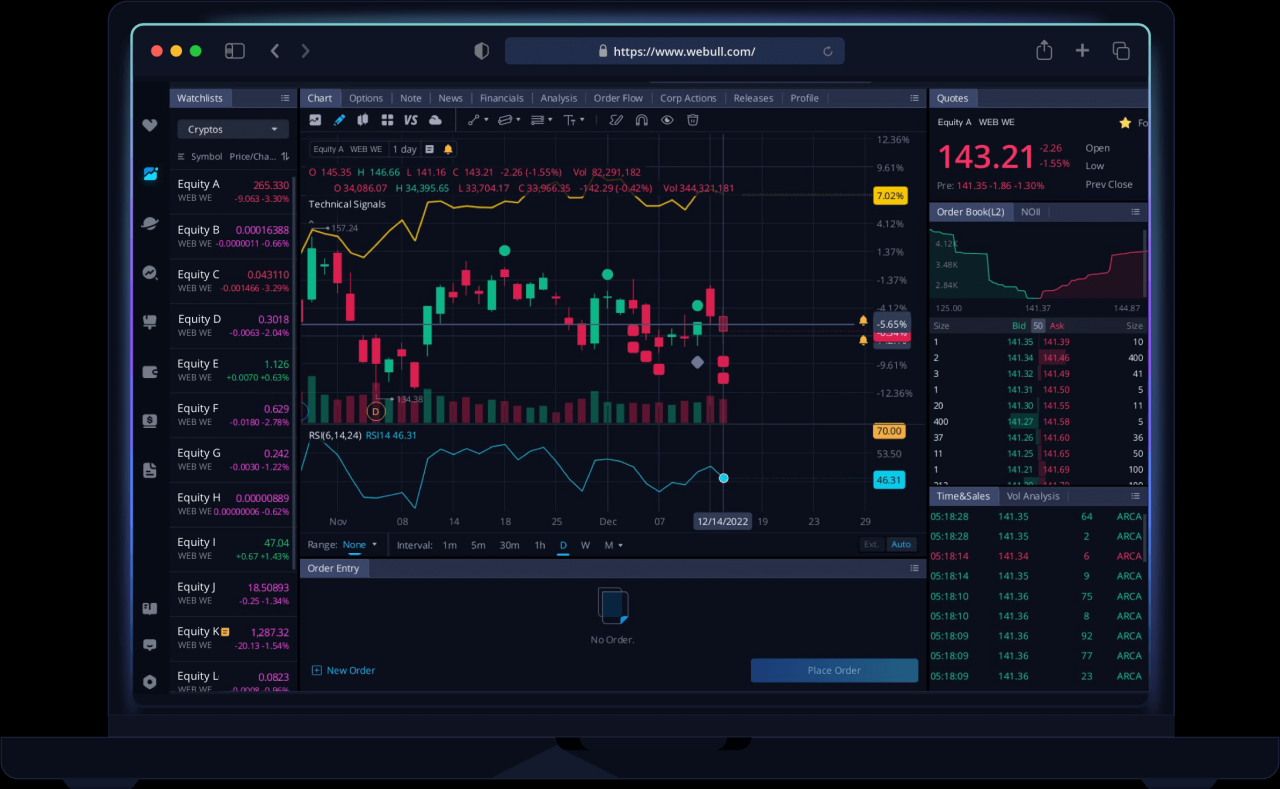

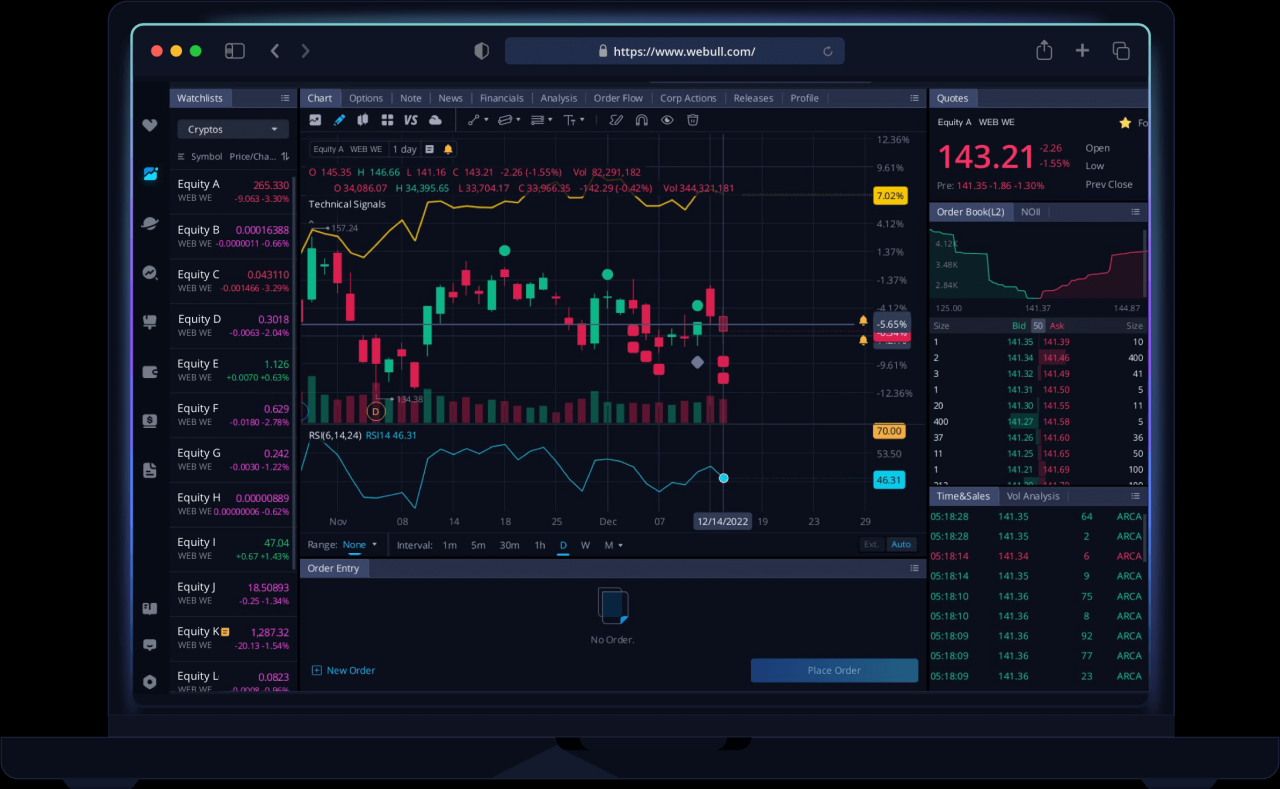

| Webull | Pros: Commission-free trading, user-friendly interface, excellent charting tools. Cons: Limited educational resources compared to others, some users report occasional glitches. | $0 per trade (stocks) | Intuitive interface, easy navigation for beginners. Offers customizable watchlists and charting tools. The overall design is clean and modern, minimizing visual clutter that could overwhelm beginners. Educational resources are limited to basic articles and videos. |

| Robinhood | Pros: Commission-free trading, simple and clean interface, popular among beginners. Cons: Limited advanced charting tools, customer support can be challenging to reach. | $0 per trade (stocks) | Extremely beginner-friendly interface. Navigation is incredibly straightforward, making it ideal for those new to trading. Lacks advanced features which may limit more experienced traders. Educational resources consist of simple articles and FAQs. |

| TD Ameritrade | Pros: Robust platform with advanced charting and analysis tools, excellent educational resources, strong customer support. Cons: Can be overwhelming for complete beginners due to the sheer number of features, higher minimum account balance requirements than some competitors. | Variable, depending on trade type and volume. (Example: $0 for online stock trades, fees may apply for options trading). | Offers a more complex interface with a wider range of features, which may feel overwhelming at first. While it’s powerful, it has a steeper learning curve than simpler apps. Provides extensive educational resources, including webinars, tutorials, and educational articles. |

| Interactive Brokers (IBKR) | Pros: Wide range of asset classes, powerful trading platform with advanced tools, competitive pricing. Cons: Steeper learning curve, interface can be complex for beginners, may not be ideal for casual traders. | Variable, depending on trade type and volume (Example: Low commission rates for active traders, but fees can add up for infrequent trades). | Highly customizable and powerful, but this comes at the cost of complexity. The interface is packed with features, potentially overwhelming new users. Offers extensive educational resources, including webinars, research materials, and a dedicated learning center. |

Navigating the User Interface of a Day Trading App: Best Day Trading App For Beginners With Detailed Tutorials.

Stepping into the world of day trading apps can feel like entering a cockpit of a spaceship – initially overwhelming, but ultimately exhilarating once you get the hang of it. The good news is that most apps are designed with user-friendliness in mind, even for newbies. Understanding the basic layout is the first step to mastering your trading destiny.The typical day trading app interface is a visual feast of information, cleverly organized to help you make quick, informed decisions.

Think of it as a highly efficient dashboard presenting crucial data at a glance. Key elements include charts displaying price movements, order entry windows for placing trades, and an account management section providing a bird’s-eye view of your portfolio. Let’s explore these in more detail.

Chart Navigation

Day trading apps use charts to visually represent price movements of stocks, futures, options, and other assets. These charts typically offer various display options such as candlestick charts, line graphs, and bar charts. Each chart type provides a unique perspective on price action. For instance, candlestick charts display open, high, low, and close prices for a given period (e.g., one minute, five minutes, or one day), making it easier to spot patterns and trends.

So, you’re a newbie day trader yearning for knowledge? Finding the best day trading app with killer tutorials is step one! But before you dive in, knowing which stocks to even look at is crucial, right? Check out this list of Top 10 best performing day trading stocks of the last year for some inspiration.

Then, armed with that intel, get back to finding that perfect beginner-friendly app and start your trading journey!

Navigating the chart involves using tools like zooming in and out to adjust the time frame, adding indicators (such as moving averages or relative strength index) to enhance analysis, and drawing trend lines to identify potential support and resistance levels. Understanding how to interpret these charts is crucial for successful day trading.

Placing and Managing Trades

Imagine the order entry window as your trading command center. It’s where you input your buy or sell orders. Let’s walk through a hypothetical example.A screenshot of the order entry window might show fields for:* Symbol: Where you type in the stock ticker (e.g., AAPL for Apple).

Order Type

Options like “Market,” “Limit,” or “Stop” would be selectable. A “Market” order executes immediately at the current market price, while a “Limit” order specifies a maximum (buy) or minimum (sell) price you’re willing to accept. A “Stop” order triggers when the price reaches a specified level.

Quantity

The number of shares or contracts you want to buy or sell.

Price

The price you’re willing to pay (buy) or receive (sell). This field is only relevant for Limit and Stop orders.

Time in Force

Specifies how long your order remains active (e.g., “Day” – until the market closes, or “Good Till Cancelled” – until you cancel it).

Submit Order

The button you click to execute your trade.After placing an order, a confirmation will typically appear. A subsequent screenshot showing the “Positions” or “Trades” tab would display your open and closed trades, including details like entry price, quantity, and current profit/loss. Managing trades might involve modifying existing orders (e.g., changing the price or quantity) or closing positions.

Utilizing the Watchlist Feature

The watchlist is your personalized dashboard of assets you’re monitoring. It’s essentially a curated list of stocks, options, or other assets that you are interested in trading.To add a stock to your watchlist, you would typically type the stock symbol into a search bar within the app. Once located, you select the “Add to Watchlist” or similar option. A screenshot of this process would show the search bar, the stock information (including price and chart), and the “Add to Watchlist” button.

The watchlist itself might be a separate tab or section within the app, displaying the selected assets with their current prices and potentially other key data points like volume and percentage change. Removing an asset from the watchlist is equally straightforward; it often involves a simple “Remove” or “Delete” button associated with each entry in the watchlist. The watchlist is an invaluable tool for staying updated on the performance of your chosen assets, allowing you to quickly identify potential trading opportunities.

Understanding Order Types and Execution

Day trading, my friend, is like a high-stakes game of chicken with the market. Knowing your order types is the difference between a triumphant “cluck” and a disastrous “squawk.” Let’s dissect the crucial elements of placing and executing orders, ensuring your trades are as smooth as a freshly-buttered croissant.Understanding how to place different order types is fundamental to successful day trading.

Choosing the wrong order type can lead to missed opportunities or unexpected losses, so let’s get this straight.

Market Orders

A market order is the simplest type. You’re essentially shouting, “I want to buy/sell this NOW!” at the market. The order executes immediately at the best available price. This is great for speed, but you might not get theexact* price you hoped for, especially during volatile periods. Think of it as grabbing a seat on a crowded bus – you get on, but maybe not in your preferred spot.

Limit Orders

A limit order is more refined. You specify the maximum price you’re willing to pay (for a buy order) or the minimum price you’re willing to accept (for a sell order). The order only executes if the market price reaches your limit. This gives you more control, ensuring you don’t overpay or undersell. It’s like haggling at a market – you get what you want, at the price you want, or you walk away.

So you’re a newbie day trader craving those killer tutorials? Finding the perfect app is half the battle, and choosing one with excellent beginner guides is crucial. But hold up, eh? If you’re a Canadian, you’ll want to check out Best day trading app for Canadians with low commission fees. to keep those fees from eating your profits.

Then, armed with that knowledge, you can return to conquering those beginner tutorials and becoming a day-trading maestro!

Stop-Loss Orders

Stop-loss orders are your safety net. You set a price at which your position is automatically sold (or bought, in case of a short position) to limit potential losses. If the market moves against you, the order triggers, preventing further damage. It’s like having a parachute in case your trading rocket malfunctions – you won’t reach the moon, but you’ll survive the fall.

Order Execution and Confirmation, Best day trading app for beginners with detailed tutorials.

Once you place an order, the app will process it. A confirmation message, usually showing the order ID, execution price, and quantity, will appear. This confirmation is your proof that the order was successfully placed. Check your trade history regularly to review all executed trades, including the details of each transaction. It’s a good idea to keep a separate spreadsheet or journal to track your trades and analyze your performance over time.

This record keeping helps you understand your wins and losses, and identify any patterns in your trading style.

Examples of Order Type Usage

Let’s say you believe Stock XYZ will surge to $50. You could place a limit order to buy at $48, ensuring you don’t overpay. If the price drops unexpectedly, a stop-loss order at $47 would limit your potential losses. Conversely, if you already own Stock XYZ at $50 and anticipate a price drop, you could use a stop-loss order at $49 to protect your profits.

If you’re feeling bold and want to jump in quickly, a market order is your go-to for immediate execution.

Risk Management and Beginner Strategies

Day trading can be thrilling, like riding a rollercoaster of profits and losses. But unlike a rollercoaster, a crash in the market can leave you with more than just a bruised ego. That’s where risk management steps in – your safety net, your financial parachute, your very own superhero cape (metaphorically speaking, of course). Without it, even the best strategies can turn sour faster than a forgotten yogurt in your backpack.Risk management in day trading isn’t about avoiding risk entirely; it’s about intelligently managing it.

So you’re a newbie day trader looking for an app with tutorials that’ll make you feel like a Wall Street wolf (without the questionable ethics, of course)? Finding the right platform is key, and that might involve branching out beyond stocks. For those ready to dive into the wild world of crypto, check out the amazing options at Best mobile app for day-trading cryptocurrencies and stocks.

But remember, even with the best app, detailed tutorials are your secret weapon to mastering the market!

It’s about understanding your tolerance for loss and setting boundaries to protect your hard-earned capital. Think of it as a game with carefully defined rules – you can still play aggressively, but you know when to fold ’em.

Beginner-Friendly Day Trading Strategies and Risk Mitigation

Scalping and swing trading are two popular approaches for beginners, each with its own risk profile and mitigation techniques. Scalping focuses on small, quick profits from tiny price fluctuations, while swing trading aims for larger gains over a few days or weeks. Both require discipline and a clear understanding of market dynamics.Scalping, for instance, involves capitalizing on minuscule price movements.

So, you’re a newbie day trader yearning for enlightenment? Finding the best day trading app for beginners with detailed tutorials is half the battle. But knowing how to actually make those short-term gains is the other, equally crucial, half! That’s where mastering some killer strategies comes in, and you can find a treasure trove of them by checking out this awesome resource on Best day trading strategies for short-term gains.

Armed with the right app and the right strategy, you’ll be raking in the virtual dough (hopefully real dough too!) in no time.

A trader might buy a stock at $10.00 and sell it at $10.02, aiming for a small but frequent profit. Risk mitigation here lies in limiting position size – never bet more than you can afford to lose on any single trade. Using stop-loss orders, which automatically sell your shares if the price drops to a predetermined level, is crucial.

Imagine a stop-loss order as a safety net preventing a small dip from turning into a significant fall. Diversification across multiple stocks also spreads the risk.Swing trading, on the other hand, involves holding positions for a longer period, aiming to profit from larger price swings. A trader might buy a stock at $20.00, anticipating a rise to $25.00 within a week.

Risk mitigation involves thorough fundamental and technical analysis to support your predictions, setting realistic price targets, and using stop-loss orders to limit potential losses. For example, a trader might set a stop-loss order at $18.00, accepting a 10% loss to protect against a sudden downturn.

Common Day Trading Mistakes Beginners Should Avoid

Before you dive headfirst into the exhilarating (and sometimes terrifying) world of day trading, understanding common pitfalls is crucial. Avoiding these mistakes can significantly improve your chances of success.It’s vital to understand that consistent profitability in day trading is not guaranteed. Many beginners enter with unrealistic expectations of quick riches, leading to impulsive decisions and excessive risk-taking. A well-defined trading plan, including risk management rules and clear entry/exit strategies, is paramount.

Ignoring market volatility and failing to adapt your strategy based on changing market conditions can also lead to significant losses. Furthermore, emotional trading – letting fear and greed dictate your decisions – is a recipe for disaster. Remember, patience and discipline are as important as skill. Finally, neglecting proper research and relying solely on tips or hype can lead to poor investment choices.

Thorough due diligence is key.

Educational Resources and Tutorials

So, you’ve downloaded your day trading app, maybe even placed a few (hopefully profitable!) trades. But the real key to success in day trading isn’t just knowing

- how* to use the app, it’s understanding the

- why* behind every click. This section dives into the resources and strategies that will transform you from a fledgling trader into a (hopefully) more financially-savvy bird.

Day trading is a high-stakes game, and continuous learning is your secret weapon. Think of it like this: you wouldn’t try to climb Mount Everest without proper training, right? The same principle applies here. Arming yourself with knowledge is the difference between a thrilling adventure and a financial freefall. We’ll explore reputable sources for education and provide practical strategies to build your skills.

Reputable Sources for Day Trading Education

Finding reliable information in the often-murky waters of online trading advice can be tricky. But fear not, intrepid trader! We’ve compiled a list of sources that offer a blend of theory and practical application, helping you avoid the common pitfalls and build a solid foundation.

- Books: “How to Make Money in Stocks” by William J. O’Neil offers a classic approach to fundamental analysis. “Japanese Candlestick Charting Techniques” by Steve Nison is a must-read for understanding candlestick patterns. “Trading in the Zone” by Mark Douglas emphasizes the psychological aspects of trading, crucial for long-term success.

- Websites: Investopedia provides a vast library of articles on various trading topics, from beginner-level explanations to advanced strategies. TradingView offers charting tools and educational resources, allowing you to analyze market trends and practice your skills.

- Courses: Many online platforms, such as Coursera and Udemy, offer courses on day trading and financial markets. Look for courses with high ratings and instructors with proven experience in the field. Remember to carefully check reviews before enrolling!

Effective Practice Strategies for Beginners

Before you risk your hard-earned cash, practicing your skills is essential. Think of it as a virtual trading boot camp. It’s where you’ll learn to handle the pressure, test your strategies, and build your confidence without facing real financial consequences.

Conquering the world of day trading? Grab the best day trading app for beginners with detailed tutorials – you’ll need all the focus you can muster! Need a break from the charts? Check out the latest football news for a quick dose of exhilarating action before diving back into your profitable trades. Remember, patience and thorough tutorials are key to mastering those day trading apps.

One highly effective method is using a paper trading account. Many brokerage platforms offer this feature, allowing you to simulate trades with virtual money. This lets you test strategies and get comfortable with the platform’s interface without risking actual funds. Another excellent strategy is to meticulously track your trades (even simulated ones) and analyze your successes and failures. This self-reflection is crucial for identifying patterns and improving your decision-making process.

So, you want the best day trading app for beginners with detailed tutorials? Fantastic! But before you dive headfirst into the digital market, you’ll need a solid strategy. That’s where Best resources for learning day-trading strategies for beginners comes in handy – because even the best app is useless without the know-how! Once you’ve mastered the strategies, you can pick your perfect app and conquer those charts.

Happy trading!

Consider keeping a detailed trading journal; it will become your invaluable guide.

Key Terms and Concepts for Beginner Day Traders

Understanding the lingo is half the battle! Here’s a glossary of essential terms to get you started.

- Bid/Ask Spread: The difference between the highest price a buyer is willing to pay (bid) and the lowest price a seller is willing to accept (ask).

- Candlestick Charts: Visual representations of price movements over time, showing open, high, low, and closing prices.

- Technical Analysis: Studying past market data (price and volume) to predict future price movements.

- Fundamental Analysis: Evaluating a company’s financial health and prospects to determine its intrinsic value.

- Stop-Loss Order: An order to automatically sell a security when it reaches a specified price, limiting potential losses.

- Limit Order: An order to buy or sell a security only at a specified price or better.

- Volatility: The degree of price fluctuation in a security or market.

- Risk Management: Strategies and techniques to minimize potential losses while trading.

Paper Trading and Simulated Environments

Before you unleash your inner Warren Buffett (or even your inner moderately successful investor) on the real stock market, it’s crucial to understand that practicing with play money is just as important as practicing your free throws before the big game. Paper trading, or simulated trading, allows you to test your strategies and hone your skills without risking a single penny of your hard-earned cash.

Think of it as the ultimate day-trading training wheels.Paper trading replicates the real market experience, offering a risk-free environment to experiment with different approaches, learn from mistakes, and build confidence. It’s your personal day-trading sandbox where you can build castles (or maybe just avoid financial craters) without worrying about the cleanup.

Finding and Using a Paper Trading Platform

Many brokerage firms and day trading apps offer paper trading accounts alongside their real money accounts. These platforms often mirror their real-money counterparts, providing a seamless transition when you’re ready to trade for real. Some apps specifically cater to beginners, offering tutorials and educational resources within their paper trading environments. Look for features like realistic market data, order execution, and charting tools to ensure a truly representative simulation.

For example, many popular brokerage platforms like TD Ameritrade, Schwab, and Webull offer robust paper trading features. Checking their websites for details on how to set up a paper trading account is a great first step.

Benefits and Limitations of Simulated Trading

The primary benefit of paper trading is, of course, the absence of financial risk. You can test aggressive strategies, explore different market sectors, and experiment with various indicators without the fear of losing real money. This allows you to develop a solid understanding of market dynamics and build confidence in your trading abilities before risking your capital. It’s a valuable tool for learning about order types, risk management techniques, and overall market behavior.However, paper trading isn’t a perfect replica of real-world trading.

The emotional aspect of trading with real money – the pressure, the adrenaline, the potential for loss – is absent in a simulated environment. This can lead to overconfidence and unrealistic expectations when transitioning to live trading. Furthermore, the simulated environment might not perfectly reflect real-market conditions, such as sudden spikes in volatility or unexpected news events that can drastically impact trading decisions.

Therefore, while paper trading is an invaluable learning tool, it shouldn’t be the sole method of preparation. It’s best used in conjunction with thorough research, education, and a well-defined trading plan.

Choosing the Right App Based on Individual Needs

Picking the perfect day trading app is like choosing the right superhero sidekick – it needs to complement your unique skills and weaknesses. One size definitely doesn’t fit all in the fast-paced world of day trading, so careful consideration is key to avoiding a Robin-to-Batman-level mismatch.The ideal day trading app should seamlessly integrate with your trading style and risk tolerance, offering the tools and features that empower you, not overwhelm you.

Ignoring this crucial step can lead to frustrating losses, and let’s be honest, nobody wants a portfolio that resembles a deflated balloon animal.

Factors to Consider When Selecting a Day Trading App

Selecting the right app involves more than just a pretty interface; it requires a thorough evaluation of several key factors. A hasty decision can lead to a less-than-optimal trading experience, so take your time and do your homework.

- Platform Fees: These can significantly impact your profitability. Compare commission structures, inactivity fees, and any other hidden charges. Some platforms offer tiered pricing based on trading volume, so consider your anticipated activity level. For example, a high-volume trader might find a platform with volume-based discounts more beneficial than one with fixed fees per trade.

- Charting Tools: These are your visual guides to market trends. Look for apps with customizable charts, technical indicators (like moving averages and RSI), and drawing tools to help you analyze price action. A visually intuitive charting system can make all the difference in identifying potential trading opportunities and avoiding costly mistakes. Imagine trying to navigate a maze blindfolded – not ideal!

- Customer Support: Technical glitches and questions are inevitable. Ensure the app offers reliable customer support through various channels (phone, email, chat) with readily available resources like FAQs and tutorials. A responsive support team can be a lifesaver when you’re facing a time-sensitive trading issue.

How Different App Features Cater to Various Trading Styles

Different trading styles demand different tools. A scalper, for instance, needs blazing-fast execution speeds and real-time market data, while a swing trader might prioritize robust charting tools and fundamental analysis features.

- Scalpers: Need ultra-low latency, advanced order types (like market orders and limit orders), and real-time market data feeds to capitalize on tiny price fluctuations. Think of them as the sprinters of the trading world – speed is everything.

- Swing Traders: Prioritize charting tools, technical indicators, and fundamental analysis resources to identify longer-term trends and potential breakout points. They’re the marathon runners, focusing on sustained gains.

- Day Traders (General): Need a balance of speed and analytical tools, depending on their specific strategies. They’re the all-round athletes, adapting to various market conditions.

Understanding App Security Measures and Data Privacy Policies

Your financial information is sensitive, so protecting it is paramount. Before committing to an app, carefully review its security protocols and data privacy policy. Look for features like two-factor authentication, encryption, and a clear explanation of how your data is handled and protected. Think of it as safeguarding your digital castle – robust security is non-negotiable.

Choosing a day trading app is a personal journey. Take your time, research thoroughly, and select the platform that best aligns with your unique trading style, risk tolerance, and technological comfort level. Remember, the right app can be your secret weapon in the exciting, yet challenging, world of day trading.

Last Word

So, there you have it – a beginner’s guide to conquering the world of day trading apps. Remember, Rome wasn’t built in a day (and neither is a successful trading strategy!). Start with paper trading, learn from your (inevitable) mistakes, and celebrate your small victories. With the right tools, a dash of courage, and a whole lot of patience, you’ll be barking up the right financial tree in no time.

Now go forth and trade… responsibly!