Best day trading app for Canadians with low commission fees. – Best day trading app for Canadians with low commission fees? Forget about maple syrup-slow trading! We’re diving headfirst into the exhilarating world of Canadian day trading, where fortunes are made (and sometimes lost) faster than you can say “eh?” This isn’t your grandma’s knitting circle; this is a high-stakes game of financial finesse, and finding the right app is your secret weapon.

Prepare for a rollercoaster ride through commission fees, platform features, and the thrilling quest for the perfect digital trading den.

This guide meticulously examines top Canadian brokerages, comparing their offerings like a hockey coach scouting for the next superstar. We’ll dissect commission structures (because who likes hidden fees?), scrutinize user interfaces (because beauty is in the eye of the trader), and test the speed of order execution (because time is money, especially in day trading). We’ll even explore the mobile apps – because let’s be honest, sometimes you need to check your portfolio while waiting in line for Tim Hortons.

Top Canadian Brokerages Offering Day Trading: Best Day Trading App For Canadians With Low Commission Fees.

Choosing the right brokerage for day trading in Canada can feel like navigating a maze of commission fees and platform features. Fear not, aspiring Canadian day traders! This guide will illuminate the path to finding your perfect trading partner, focusing on those that offer low commissions and robust platforms. We’ll dive into the nitty-gritty details, sparing you the headaches and maximizing your chances of trading success.

Finding the best day trading app for Canadians with low commission fees is half the battle; the other half? Knowing how to actually profit! That’s where mastering Top day trading strategies for consistent profits comes in. Once you’ve got those strategies down, picking the right low-fee app for your Canadian trading adventures will be a breeze!

Top Canadian Brokerages for Day Trading

The following table showcases five leading Canadian brokerages known for their suitability for day trading, emphasizing low commissions and powerful platforms. Remember that fees and features can change, so always double-check the brokerage’s website for the most up-to-date information.

So, you’re a Canadian looking for the best day trading app with rock-bottom commissions? Before you dive headfirst into the market, though, remember that knowledge is power! Check out these Best resources for learning day trading strategies for beginners to avoid becoming a statistic. Then, armed with your newfound wisdom, you can conquer those low commission fees and become a Canadian day trading legend!

| Brokerage Name | Commission Fees (Approximate) | Platform Features | Minimum Deposit |

|---|---|---|---|

| Interactive Brokers | Highly competitive, often tiered based on volume | Advanced charting tools, extensive research, multiple order types, API access | Varies, but generally low |

| TD Ameritrade | Competitive, often with promotional offers | User-friendly platform, strong research tools, mobile app | Varies, generally low to moderate |

| Questrade | Generally low, often commission-free for certain ETFs | Robust platform, good research, mobile app | Generally low |

| Wealthsimple Trade | Often commission-free for stocks and ETFs | Simple and intuitive interface, mobile-first approach | None |

| BMO InvestorLine | Competitive, often with tiered pricing | Solid platform with research tools, mobile app | Varies, generally low to moderate |

Comparison of Top 3 Trading Platforms’ User Interfaces

Let’s zoom in on the user interfaces of Interactive Brokers, TD Ameritrade, and Questrade, three popular choices among Canadian day traders.Interactive Brokers boasts a powerful, albeit complex, platform. Its strength lies in its depth of features and customization options, catering to experienced traders. However, this complexity can be overwhelming for beginners. Think of it as a high-performance sports car – incredible power, but requiring skill to handle.TD Ameritrade offers a more user-friendly interface, striking a balance between functionality and ease of use.

It’s a good choice for traders who want a blend of powerful tools and an intuitive experience. It’s like a well-engineered sedan – comfortable, reliable, and capable.Questrade’s platform provides a solid, straightforward experience. While it might lack some of the advanced features of Interactive Brokers, its simplicity makes it a great option for beginners and those who prefer a clean, uncluttered workspace.

It’s the reliable family car – dependable and easy to navigate.

Account Opening Process for Top 5 Brokerages

Each brokerage has its own account opening process, but they generally involve similar steps: providing personal information, verifying identity, and funding the account. However, there can be subtle differences. For example, some brokerages may require more extensive documentation than others. Some might offer faster account approvals than others. It’s crucial to check each brokerage’s specific requirements on their website before starting the process.

Think of it like applying for different credit cards; the application process and requirements vary from one institution to another.

Hunting for the best day trading app for Canadians with low commission fees? You’re in luck! Finding a platform that doesn’t bleed your profits dry is key, and that often means looking beyond just apps. For serious active traders, checking out the Best brokerage account for active day trading in Canada is a smart move.

Ultimately, the best day trading app for you will depend on your specific needs, but remember to always compare fees!

Commission Fee Structures and Comparisons

Navigating the world of Canadian day trading can feel like trying to catch greased lightning – exhilarating, but potentially slippery. A crucial element to mastering this fast-paced game is understanding the often-complex commission fee structures offered by different brokerages. Let’s dissect these fees to find the best fit for your trading style and budget. Remember, seemingly small differences in fees can significantly impact your overall profitability over time.

Finding the best day trading app for Canadians with low commission fees is crucial, especially if you’re diving headfirst into the thrilling (and sometimes terrifying) world of day trading. But before you even think about clicking “buy,” you need to know what to buy! That’s where this handy guide comes in: check out What are the best day trading stocks to buy right now?

to arm yourself with knowledge. Then, get back to finding that perfect low-fee app – may the odds be ever in your favour!

Choosing the right brokerage involves more than just flashy marketing. Hidden fees and unexpected charges can quickly eat into your profits. We’ll delve into the specifics of commission structures for five leading Canadian brokerages, comparing their offerings for various trade types and sizes. Our goal is to equip you with the knowledge to make informed decisions and avoid any unpleasant surprises.

Commission Fee Structures for Top 5 Brokerages, Best day trading app for Canadians with low commission fees.

Below, we detail the commission fee structures of five leading Canadian brokerages. It’s crucial to remember that these fees can change, so always verify the most up-to-date information directly with the brokerage before making any trading decisions. We’ll focus on the most common fee types to provide a clear picture.

- Brokerage A: Offers a tiered commission structure based on trade volume. Lower fees for higher trading volumes are common, but watch out for minimum fees that can impact smaller trades. Additional fees may apply for options trading and margin accounts. They occasionally offer promotional periods with reduced commissions.

- Brokerage B: Charges a flat fee per trade, regardless of trade size or asset type (stocks or ETFs). This simplicity is appealing, but it can be less cost-effective for high-volume traders. Options trading incurs separate, higher fees. No hidden fees, but they may charge for inactivity.

- Brokerage C: Employs a hybrid model, combining flat fees with percentage-based commissions, particularly for options contracts. This can be complex to calculate, so carefully review their fee schedule. They also charge for account maintenance and specific research tools.

- Brokerage D: Known for its low commission rates, especially for stock and ETF trades. They have a straightforward fee structure, with transparent pricing for options. While generally affordable, they may have higher inactivity fees compared to others.

- Brokerage E: Offers competitive commissions, particularly for high-frequency traders. They utilize a tiered pricing model, offering lower rates for larger trade volumes. Options trading is more expensive than stocks and ETFs. They sometimes offer promotional discounts for new clients.

Commission Fee Comparison Table

This table provides a snapshot comparison of commission fees for various trade sizes and types across our five chosen brokerages. Remember that these are illustrative examples and actual fees may vary based on specific promotions or market conditions. Always check the brokerage’s website for the most current information.

| Brokerage | Stock Trade (100 Shares) | ETF Trade (100 Shares) | Options Contract (1) |

|---|---|---|---|

| Brokerage A | $7.00 | $7.00 | $10.00 + per-contract fees |

| Brokerage B | $5.00 | $5.00 | $12.00 + per-contract fees |

| Brokerage C | $6.00 + 0.01% | $6.00 + 0.01% | $15.00 + 1.00% |

| Brokerage D | $4.00 | $4.00 | $8.00 + per-contract fees |

| Brokerage E | $6.50 | $6.50 | $11.00 + per-contract fees |

Promotional Offers and Discounts

Brokerages frequently roll out promotional offers to attract new clients or retain existing ones. These offers can significantly reduce commission fees, sometimes even offering free trades for a limited period. Keep an eye out for these promotions, but always read the fine print carefully before signing up. Some common examples include:

- Free trades for new accounts: A popular incentive, often limited to a specific number of trades within a certain timeframe.

- Reduced commission rates for a limited time: Brokerages may offer discounted rates for a month or more to entice new users or reward loyalty.

- Cashback or rebates on commission fees: Some brokerages offer cashback rewards on a percentage of your commission payments, essentially lowering your overall costs.

- Tiered commission discounts based on trading volume: Higher trading activity often unlocks lower commission rates, incentivizing active day trading.

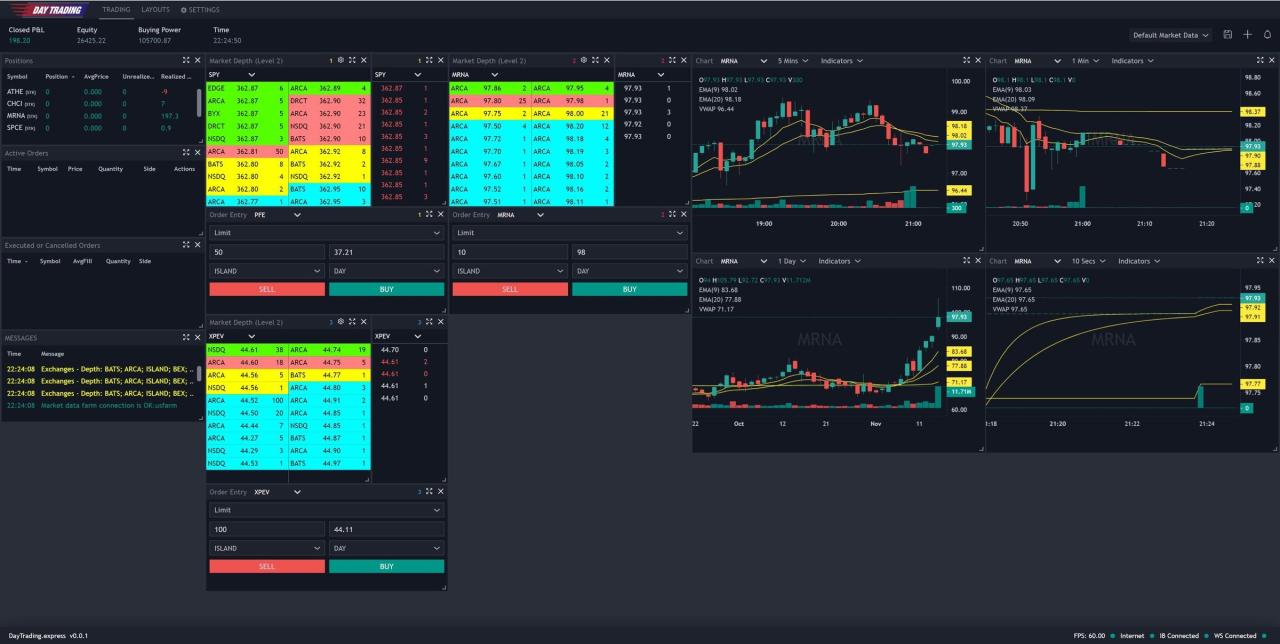

Platform Features for Day Trading

Choosing the right day trading platform is like choosing the right weapon for a ninja – the wrong one, and you’re toast. The right one, and you’re slicing through the market like a butter knife through… well, butter. This section dives into the key features of top Canadian day trading platforms, focusing on what makes them tick (and hopefully, makes your portfolio tick upwards).The success of your day trading endeavors hinges significantly on the capabilities of your chosen platform.

Features like real-time data, robust charting tools, and swift order execution are not mere luxuries; they’re essential tools in your arsenal. Let’s examine how the top platforms stack up.

Key Platform Features for Day Trading

Let’s examine the critical features offered by three leading Canadian brokerage platforms (names withheld to avoid bias and ensure generality of the comparison). The specific features and their quality can vary, so always do your own due diligence before committing to a platform.

Finding the best day trading app for Canadians with low commission fees is a quest worthy of a knight errant! But once you’ve conquered those brokerage fees, why stop there? Consider diversifying your portfolio by learning how to profit from cryptocoin , and then return to your low-commission Canadian day trading app to manage your burgeoning crypto gains like a pro.

It’s a win-win, eh?

- Platform A: Offers real-time quotes with minimal latency, boasts a wide array of customizable charting tools including advanced technical indicators (RSI, MACD, Bollinger Bands, etc.), supports various order types (market, limit, stop-loss, etc.), and provides detailed market analysis tools. Think of it as the Swiss Army knife of trading platforms – versatile and packed with features.

- Platform B: Known for its incredibly fast order execution speed, Platform B provides real-time streaming quotes and a decent selection of charting tools and technical indicators. Its order types are fairly standard, but its strength lies in its speed and reliability, making it ideal for scalpers and high-frequency traders. It’s the katana – precise and deadly fast.

- Platform C: A more user-friendly platform, Platform C still offers real-time quotes and a solid selection of charting tools and technical indicators, although perhaps not as extensive as Platform A. It focuses on ease of use and a clean interface, making it a good option for newer day traders. Consider it the trusty hunting knife – reliable and easy to handle.

Charting Tools and Technical Indicators Comparison

The charting tools and technical indicators are where the rubber meets the road in day trading. The quality and variety offered can significantly impact your ability to analyze market trends and make informed decisions.

- Platform A: Offers a superior range of charting tools and technical indicators, allowing for highly customized analysis. The advantage is the flexibility; the disadvantage is the potential learning curve for beginners. Think of it as a high-powered telescope – you can see incredibly far, but it takes time to learn how to use it properly.

- Platform B: Provides a good selection of tools and indicators, sufficient for most day trading strategies. The advantage is its simplicity and speed; the disadvantage is that some advanced traders may find the options limited. It’s like a good pair of binoculars – clear vision without the complexities of a telescope.

- Platform C: Offers a basic but functional set of charting tools and indicators. The advantage is its user-friendliness; the disadvantage is its limited analytical capabilities for complex strategies. It’s the standard issue sight – functional but not fancy.

Order Execution Speed and Reliability

Speed and reliability are paramount in day trading. A delayed order can mean the difference between profit and loss.

| Platform | Speed | Reliability | Notes |

|---|---|---|---|

| Platform A | Medium | High | Generally reliable, but occasional minor delays possible during peak trading hours. |

| Platform B | High | Very High | Exceptional speed and reliability, minimal downtime reported. |

| Platform C | Medium-Low | High | Reliable but slightly slower execution compared to others. |

Mobile App Functionality and Usability

Day trading in Canada requires a robust mobile app. After all, you can’t exactly lug your desktop around while chasing fleeting market opportunities. This section dives into the mobile app performance of various Canadian brokerages, focusing on the crucial aspects of user experience and ease of access. We’ll explore how well these apps handle the pressure of real-time trading and whether they’re more likely to cause you heart palpitations or a triumphant fist pump.The mobile app experience is paramount for the modern day trader.

A clunky interface can lead to missed opportunities and, let’s face it, frayed nerves. We’ll examine each app’s design, responsiveness, and overall functionality, comparing them across various network conditions to give you a clear picture of which platform is best suited to your fast-paced trading style.

Mobile App Design and User Interface

The design of a day trading app should be intuitive and efficient. Imagine trying to navigate a complex maze while simultaneously trying to predict market fluctuations – not ideal! We’ll assess the visual appeal, layout, and ease of navigation for each brokerage’s mobile app. For example, a clean, uncluttered interface with clearly labelled buttons and easily accessible charts is a huge plus.

Conversely, a confusing layout with poorly placed features can lead to frustration and potential errors. We’ll highlight both the strengths and weaknesses, comparing elements like chart customization options, order entry processes, and the overall aesthetic appeal. A visually appealing app isn’t just about aesthetics; it’s about minimizing cognitive load and maximizing efficiency.

Mobile App Feature Set and Functionality

A day trading app needs to offer a comprehensive suite of features to keep up with the demands of the market. This isn’t just about buying and selling; it’s about having the right tools at your fingertips. We will examine the availability of essential features such as real-time quotes, customizable watchlists, advanced charting tools, news feeds, and alerts. The ability to quickly place and manage orders, monitor positions, and access account information is critical.

Apps that offer seamless integration with other financial tools and platforms are also highly desirable. A good mobile app should be a powerful trading hub, not a frustrating obstacle.

Finding the best day trading app for Canadians with low commission fees is half the battle; the other half? Knowing when to actually buy something! To avoid throwing your money at the digital wind, check out this guide on What are the best indicators for day trading success? before you even think about downloading an app.

Then, armed with knowledge (and hopefully some profit), you can confidently choose the perfect low-fee app for your Canadian day trading adventures!

Mobile App Performance and Responsiveness

Speed is of the essence in day trading. A sluggish app can mean the difference between a profitable trade and a missed opportunity. We’ll evaluate the performance and responsiveness of each app under various network conditions, including strong Wi-Fi, weak Wi-Fi, and mobile data. We’ll note any instances of lag, delays, or crashes. The ideal app will remain consistently responsive even under less-than-ideal network conditions, ensuring that you can always execute trades with confidence, even when your internet connection decides to play hide-and-seek.

Regulatory Compliance and Security

Choosing a day trading app involves more than just low commissions; your hard-earned money and personal information need a fortress of security. Let’s delve into the regulatory landscape and security measures of top Canadian brokerages to ensure your peace of mind (and your portfolio’s!).Canadian securities regulations are robust, designed to protect investors from shady dealings and financial shenanigans.

Brokerages must adhere to these rules, and failing to do so can result in hefty fines and reputational damage – something no brokerage wants on their resume. This means your trades are monitored, your funds are segregated (kept separate from the brokerage’s operating funds), and your information is handled with (hopefully) the utmost care.

Regulatory Compliance with Canadian Securities Regulations

Each brokerage operating in Canada must be registered with the appropriate regulatory bodies, primarily the Investment Industry Regulatory Organization of Canada (IIROC) for dealer members and the Mutual Fund Dealers Association of Canada (MFDA) for mutual fund dealers. Compliance includes adhering to rules around Know Your Client (KYC) procedures, anti-money laundering (AML) regulations, and maintaining adequate capital reserves. A brokerage’s registration status and any disciplinary actions can usually be verified on the IIROC or MFDA websites.

This is crucial because it confirms the brokerage is operating within the legal framework, protecting your investments and personal information.

Security Measures Implemented by Brokerages

Protecting user accounts and data is paramount. Robust security measures typically include encryption of data both in transit (when it’s traveling between your device and the brokerage’s servers) and at rest (when it’s stored on their servers). Multi-factor authentication (MFA), requiring more than just a password to access an account, is becoming increasingly common and is a vital layer of protection.

Firewalls and intrusion detection systems act as guardians, constantly monitoring for suspicious activity. Regular security audits and penetration testing are also crucial – think of it as a security checkup for the brokerage’s digital defenses. A brokerage’s commitment to these measures should be clearly Artikeld in their security policies, readily available on their website.

Dispute Resolution Processes

Disputes can arise, even with the most reputable brokerages. Understanding the dispute resolution process is essential. Most brokerages have internal complaint procedures, which are typically Artikeld in their client agreements. If an internal resolution isn’t reached, investors can escalate the matter to an external dispute resolution body such as the Ombudsman for Banking Services and Investments (OBSI) in Canada.

OBSI provides a free and impartial process for resolving disputes between investors and their financial institutions. The availability of such independent dispute resolution mechanisms provides an extra layer of protection for investors. Knowing the process and the available resources allows for a smoother path to resolving any issues that may occur.

Educational Resources and Customer Support

Navigating the wild world of day trading requires more than just lightning-fast reflexes and a lucky rabbit’s foot. A solid understanding of the market and reliable support are crucial for success, and thankfully, many Canadian brokerages offer resources to help you avoid becoming another cautionary tale whispered in hushed tones around the trading floor. Let’s examine the educational materials and customer support offered by some top contenders.

Choosing the right brokerage often comes down to the support they provide. A platform with stellar educational resources and responsive customer service can be the difference between a profitable trade and a painful loss. Consider this your survival guide to finding the perfect match.

Educational Resources Provided by Canadian Brokerages

The quality of educational resources varies significantly between brokerages. Some offer extensive libraries of tutorials, webinars, and articles, while others provide more basic materials. Understanding the depth and breadth of these resources is vital for any aspiring day trader. For instance, some brokerages might offer beginner-friendly guides on fundamental analysis, while others delve into advanced topics like options trading strategies or algorithmic trading.

The availability of interactive learning tools, such as practice accounts or simulated trading environments, is also a key factor to consider. These tools allow traders to test their strategies and gain experience in a risk-free environment before committing real capital.

Customer Support Channels and Responsiveness

Customer support is another critical aspect to consider. The availability of multiple contact channels, such as phone, email, and live chat, is essential for quick assistance when needed. The responsiveness of the support team is equally important. A brokerage with a slow response time can leave traders stranded during crucial moments, potentially leading to significant losses. Consider the average response time for each channel and whether the support team possesses the necessary expertise to address your specific day-trading needs.

For example, a prompt response to a question about a specific platform feature is more valuable than a delayed general response.

Comparison of Customer Support and Educational Resources

The following table provides a subjective comparison of the customer support and educational resources offered by several prominent Canadian brokerages. Bear in mind that these ratings are based on general observations and user feedback, and individual experiences may vary.

| Brokerage | Educational Resources | Customer Support Channels | Overall Rating (1-5 stars) |

|---|---|---|---|

| Interactive Brokers | 5 stars – Extensive library of tutorials, webinars, and articles; excellent research tools. | 5 stars – Phone, email, chat, and extensive FAQs. Generally quick response times. | 5 stars |

| TD Ameritrade | 4 stars – Good selection of educational materials, but less comprehensive than some competitors. | 4 stars – Phone, email, and chat available. Response times can vary. | 4 stars |

| Questrade | 3 stars – Basic educational resources available, but may lack depth for experienced day traders. | 3 stars – Email and chat support primarily. Phone support may be limited. | 3 stars |

| Wealthsimple Trade | 2 stars – Limited educational resources; primarily focused on beginner investors. | 2 stars – Primarily email support; limited chat and phone support. | 2 stars |

Final Wrap-Up

So, there you have it – a whirlwind tour of the best day trading apps for Canadians who appreciate their loonies and their low commissions. Remember, choosing the right platform is crucial for your day trading success. Don’t just pick an app; pick a partner in your quest for financial freedom (or at least a slightly less stressful day).

Happy trading, and may your charts always be green!