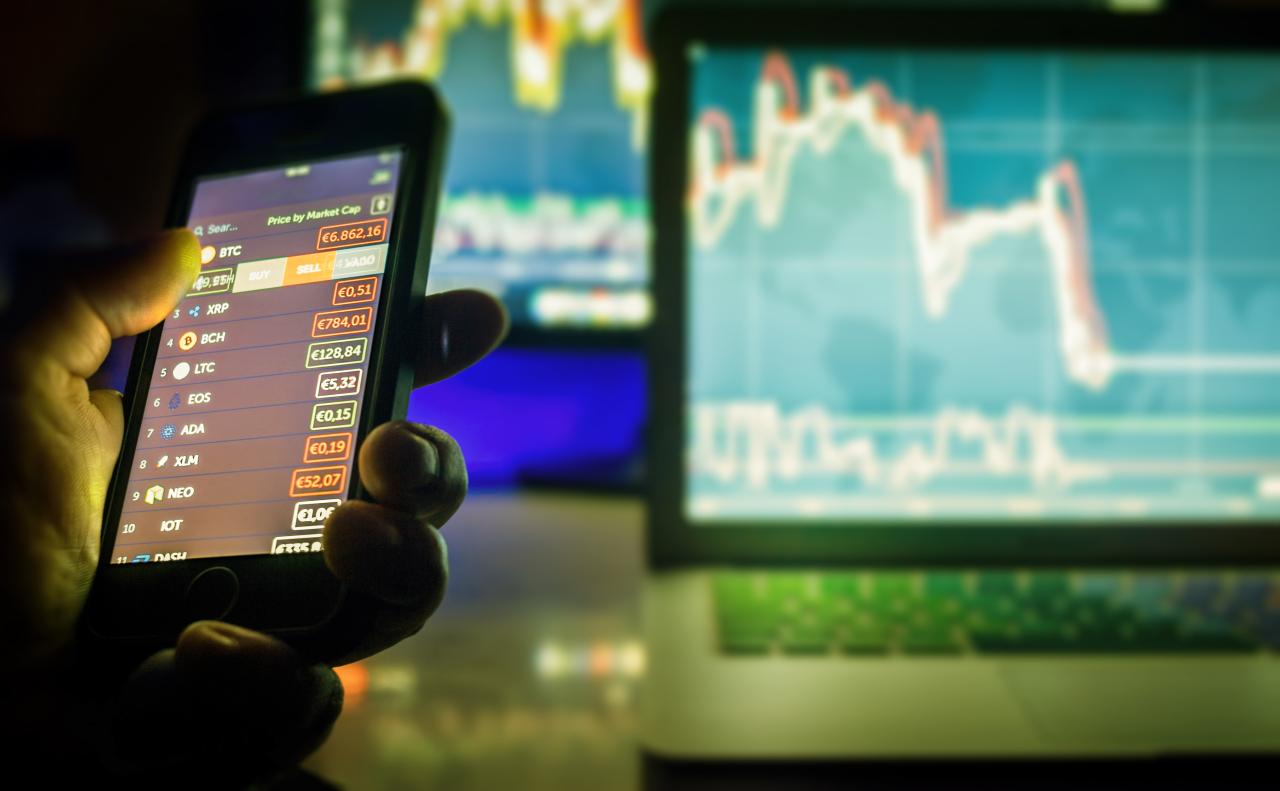

Best day trading app for quick execution speed and low latency. – Best day trading app for quick execution speed and low latency: In the high-stakes world of day trading, where milliseconds can mean the difference between riches and ruin, choosing the right app is like selecting the perfect racehorse – you need speed, agility, and a whole lot of horsepower under the hood. This isn’t about leisurely browsing; this is about lightning-fast execution and the kind of low latency that makes your rivals look like they’re trading with dial-up.

We’re diving deep into the wild west of day trading apps, lassoing the best contenders, and separating the speed demons from the slowpokes.

This exploration will cover everything from defining “quick execution speed” and “low latency” in practical terms to comparing the top apps on the market. We’ll uncover the hidden factors that influence speed (think internet connection, broker infrastructure, and even market mood swings!), analyze user experiences, and illustrate the impact of speed with real-life trade scenarios – some triumphant, some… less so.

Buckle up, buttercup, it’s going to be a thrilling ride!

Defining “Quick Execution Speed” and “Low Latency” in Day Trading Apps

In the high-stakes world of day trading, milliseconds matter. A fraction of a second can mean the difference between a profitable trade and a missed opportunity, or even a significant loss. Understanding execution speed and latency is crucial for choosing the right trading platform and maximizing your chances of success. Think of it like this: you’re a cheetah chasing a gazelle – even a tiny delay can mean the difference between a full belly and an empty one.Execution speed and latency, while related, are distinct concepts.

Execution speed refers to how quickly your order is processed and filled by the brokerage, while latency measures the delay in transmitting information between your trading app and the exchange. Both are vital for efficient and profitable day trading.

Execution Speed in Day Trading

Execution speed, in the context of day trading, is the total time elapsed from when you click the “buy” or “sell” button on your trading app until your order is confirmed as filled on the exchange. This encompasses several steps: your app sending the order, the brokerage receiving and routing the order, the exchange processing the order, and finally, confirmation of execution.

A fast execution speed minimizes the risk of slippage – the difference between the expected price and the actual execution price – which can significantly impact your profitability, especially during volatile market conditions. For example, imagine trying to buy a stock that’s rapidly rising; slow execution could mean buying at a much higher price than you intended.

Latency and its Impact on Day Trading Profitability

Latency, often measured in milliseconds or even microseconds, refers to the delay in data transmission. In day trading, this is the time it takes for your order to travel from your app to the exchange and back again. High latency can lead to missed opportunities, especially in fast-moving markets. Imagine trying to execute a trade based on a breaking news event; even a delay of a few hundred milliseconds could mean the price has already moved significantly against you, resulting in a smaller profit or even a loss.

Need lightning-fast trades? A best day trading app for quick execution speed and low latency is crucial, especially on Android. But speed’s nothing without security; that’s why checking out Finding a secure and user-friendly day trading app for Android. is a smart move before you risk your hard-earned cash. Ultimately, the best day trading app balances speed with safety – because a fast app that gets hacked is about as useful as a chocolate teapot.

This is particularly critical for strategies that rely on high-frequency trading (HFT) where speed is paramount.

Metrics for Measuring Execution Speed and Latency

Several metrics are used to measure execution speed and latency. These can include order-to-fill time (the time from order placement to execution), round-trip time (the time for a signal to travel to the exchange and back), and message latency (the delay in individual data packets). Each metric provides a different perspective on the overall speed and efficiency of the trading system.

Comparing these metrics across different platforms is essential for selecting a platform that meets your specific needs. While the precise measurement methodologies vary, the ultimate goal remains the same: to minimize delays and maximize trading efficiency.

Latency Measurements and Trade Types

| Latency Measurement | Typical Range | Impact on Scalping | Impact on Swing Trading |

|---|---|---|---|

| Milliseconds (ms) | 10-100+ ms | Critical; even small delays can lead to significant losses | Less critical; impact is usually minimal |

| Microseconds (µs) | <100 µs | Essential for high-frequency trading strategies | Generally negligible |

| Nanoseconds (ns) | <1 µs | Used in extremely high-frequency trading environments | Irrelevant |

Top Contenders: Best Day Trading App For Quick Execution Speed And Low Latency.

Choosing the right day trading app is like picking the perfect racehorse – you need speed, agility, and a jockey (you!) who knows how to handle it. The wrong choice can leave you trailing in the dust, watching your profits gallop away. Let’s saddle up and review some of the top contenders in the fast-paced world of day trading apps.

We’ll examine their advertised speeds, user interfaces, and pricing, so you can find the perfect steed for your trading style.The following section details the advertised execution speeds and latency of several popular day trading applications. Remember, advertised speeds are just one piece of the puzzle; real-world performance can vary based on network conditions and server load. Always test an app thoroughly before committing your hard-earned cash.

Popular Day Trading Applications: Speed, UI, and Pricing

Let’s dive into the specifics of five popular day trading apps, examining their strengths and weaknesses. Note that advertised speeds and latency can fluctuate, so always conduct your own testing.

Here are five widely used day trading applications, along with their advertised execution speeds and latency (where available), user interface analysis, and pricing comparisons:

- TradeStation: TradeStation often boasts sub-millisecond execution speeds and extremely low latency. Their user interface is powerful but can feel overwhelming to beginners, potentially slowing down trade execution for those unfamiliar with its features. This powerful platform requires a steep learning curve to use efficiently.

- Interactive Brokers (IBKR): IBKR is known for its lightning-fast execution speeds, often advertised in the microsecond range. The interface is highly customizable, allowing experienced traders to optimize it for speed, but this customization can also add complexity. The platform caters to a wide range of trading styles and offers a sophisticated, but complex, interface.

- TD Ameritrade Thinkorswim: Thinkorswim is lauded for its user-friendly interface, although execution speed isn’t always its primary selling point. While not boasting the absolute fastest speeds, its intuitive design can contribute to quicker trade execution for many users. The platform offers a balance between ease of use and functionality.

- Webull: Webull targets beginner and mobile-first traders. While not advertising specific microsecond figures, it’s generally considered to have relatively quick execution speeds. Its clean and simple interface is a significant advantage for speed, especially for less experienced users. It sacrifices some advanced features for simplicity.

- Fidelity Active Trader Pro: Fidelity’s Active Trader Pro offers a balance between speed and user-friendliness. While it may not match the raw speed of some competitors, its efficient interface and robust charting tools help facilitate quick decision-making and execution. The platform aims to provide a comprehensive trading experience without overwhelming the user.

Understanding the pricing models of these apps is crucial. Different apps cater to different budgets and trading volumes.

Need lightning-fast trades? A day trading app with quick execution speed and low latency is your secret weapon. But equally crucial for Canadian traders is keeping those commission fees down, which is why you should check out Best day trading app for Canadians with low commission fees. Ultimately, the best app balances speed – for those crucial milliseconds – with wallet-friendly pricing, ensuring you’re not losing money before you even make a trade!

- TradeStation: Offers tiered pricing plans based on trading volume and features.

- Interactive Brokers (IBKR): Uses a tiered commission structure based on trading activity; can be very competitive for high-volume traders.

- TD Ameritrade Thinkorswim: Commission-free for many trades, but fees may apply for certain options and other instruments.

- Webull: Generally commission-free for stocks and ETFs, but may charge for options and other products.

- Fidelity Active Trader Pro: Offers commission-free trading for many stocks and ETFs, with fees potentially applicable for options and other instruments.

Factors Affecting Execution Speed and Latency

Day trading is a high-stakes game where milliseconds matter. While a lightning-fast app is crucial, it’s only one piece of the puzzle. Many factors beyond the app itself can dramatically impact your execution speed and latency, turning a potentially profitable trade into a missed opportunity (or worse!). Let’s dive into the often-overlooked culprits.

Think of it like this: the app is your race car, but the track condition, your pit crew (broker), and even your own driving skills (order type selection) all play a vital role in your final time. A Ferrari on a bumpy, gravel road won’t win the race, no matter how powerful the engine.

Need a day trading app that’s faster than a caffeinated cheetah? Low latency is your jam, right? Well, for lightning-fast execution in both stocks and cryptos, you’ll want to check out the top contenders; finding the Best mobile app for day trading cryptocurrencies and stocks. can help you navigate this, ensuring your trades are executed with the speed you need.

Ultimately, the best day trading app boils down to your personal preference and trading style, but speed is key!

Internet Connection’s Influence on Execution Speed

Your internet connection is the unsung hero (or villain) of your day trading journey. A slow or unstable connection can introduce significant latency, causing delays in sending and receiving order information. Imagine trying to play a fast-paced online game with a dial-up connection – not pretty! Factors like bandwidth, ping (the time it takes for data to travel to and from the server), and network congestion all contribute.

Need a day trading app that’s faster than a caffeinated cheetah? You want blazing-fast execution, low latency – the kind of speed that makes your rivals weep! But speed’s only half the battle; you also need the intel to make those split-second decisions. That’s where knowing the market comes in – check out this resource for real-time data and news: Reliable day trading app with real-time market data and news.

Armed with that knowledge, you’ll be a day-trading ninja, conquering the market with your lightning-fast app!

A high-bandwidth, low-latency connection with minimal packet loss is essential for optimal performance. Consider upgrading to a fiber optic connection or using a wired connection instead of Wi-Fi for a more reliable experience.

Order Routing’s Impact on Trade Execution

Order routing is the process your broker uses to send your order to the market. Different brokers use different routing algorithms, which can significantly affect execution speed. Some brokers prioritize speed, while others may prioritize price improvement (finding the best possible price for your order). A slow or inefficient routing algorithm can add considerable latency, especially during periods of high market volatility.

The path your order takes to reach the exchange can be longer or shorter, influencing execution time. For example, a broker might route orders through multiple exchanges or dark pools to find the best price, but this can introduce delays. Faster execution usually means direct routing to the primary exchange.

Market Conditions and Their Effects

Market conditions can significantly impact execution speed and latency. During periods of high trading volume, such as major news announcements or market-moving events, the exchange servers can become overloaded, leading to slower order processing and increased latency. This is similar to rush hour traffic on a highway; the more cars (orders), the slower things move. High volatility can also contribute to slippage, where your order is executed at a less favorable price than anticipated due to rapid price changes.

Conversely, during periods of low volume, execution is usually much faster and smoother.

Order Type and Execution Speed

Different order types have different execution characteristics. Market orders, which are executed immediately at the best available price, generally have the fastest execution speed. However, they may not always be filled at the most favorable price. Limit orders, which are executed only when the price reaches a specified level, may take longer to execute or may not be executed at all if the price doesn’t reach your limit.

Need a day trading app that’s faster than a greased lightning bolt? You want execution speed so rapid it makes even the fastest wide receiver look sluggish. For a break from the market frenzy, check out the latest football news – then get back to your lightning-fast trades before the next opportunity zooms past! Low latency is key, so choose wisely, your financial future depends on it!

Stop orders, which are triggered when the price reaches a certain level, fall somewhere in between. The complexity of the order type and the market conditions determine the execution speed. A simple market order will always be faster than a complex order involving multiple conditions.

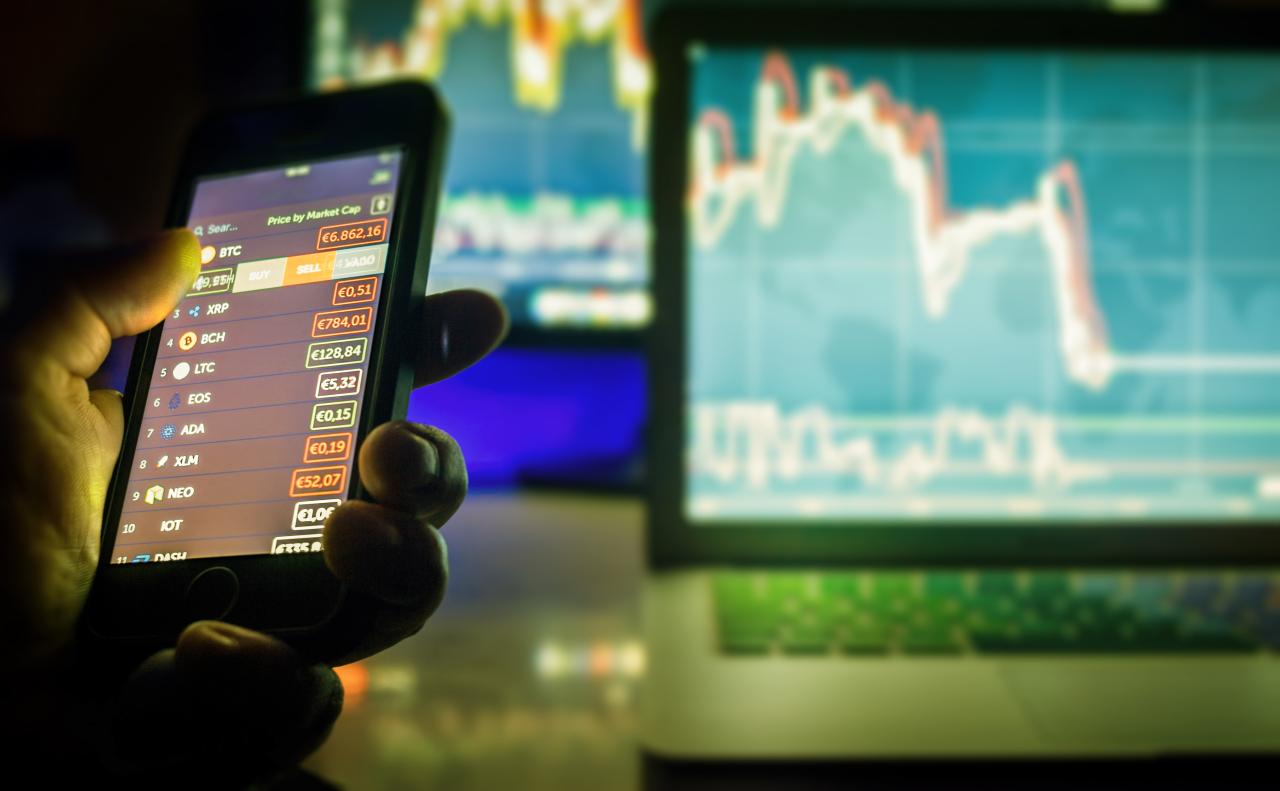

User Experience and App Features Related to Speed

Speed in day trading isn’t just about milliseconds; it’s about the seamless integration of speed into every aspect of the user experience. A lightning-fast execution engine is useless if the app itself is clunky and frustrating to navigate. The best day trading apps understand this, prioritizing a smooth, intuitive interface that complements their raw speed.The perceived speed of execution is a complex interplay of various factors, all contributing to the trader’s overall experience.

A delay of a few milliseconds might be insignificant in isolation, but when compounded by slow charting, cumbersome order entry, and delayed notifications, it significantly impacts the trader’s ability to react effectively to market opportunities.

Need a day trading app that’s faster than a caffeinated cheetah? Low latency is your jam, right? Well, before you dive headfirst into the speed-demon world of milliseconds, check out this fantastic resource for choosing the right app: Day trading app recommendations with educational resources. Then, armed with knowledge, you can conquer those lightning-fast trades and leave the slowpokes in the dust!

Advanced Charting Tools and Order Entry Methods

Efficient charting and order entry are crucial for rapid decision-making. Advanced charting tools, such as those offering multiple timeframes, customizable indicators, and drawing tools, allow traders to quickly analyze price action and identify potential trading opportunities. Simultaneously, intuitive order entry methods, including one-click trading, pre-set orders, and drag-and-drop functionality, minimize the time spent placing trades. Consider the difference between meticulously typing in an order versus a single tap to execute a pre-configured strategy.

The latter clearly wins the speed race. Apps that streamline these processes give traders a significant edge.

The Impact of Real-Time Data Feeds

Real-time data is the lifeblood of day trading. The speed and reliability of the data feed directly impact a trader’s ability to react to market changes. A delayed data feed, even by a fraction of a second, can mean the difference between profiting from a fleeting opportunity and missing out entirely. Imagine relying on a feed that shows a stock price at $10 when it’s already jumped to $10.50 – the impact on trading decisions is immediately clear.

High-quality, low-latency data feeds are therefore non-negotiable for a truly speedy trading experience.

Mobile App Optimization for Faster Execution on Different Devices

A fast execution engine is only as good as the platform it runs on. Optimized mobile apps are crucial for ensuring consistent speed across different devices. Factors such as efficient code, optimized graphics, and effective caching mechanisms all play a role. An app that runs smoothly on a high-end smartphone might lag significantly on an older model.

The best apps account for this variability, ensuring a responsive experience regardless of the device’s processing power. This is often achieved through intelligent resource management and adaptive rendering techniques.

Notification Systems and Their Impact on Reaction Time, Best day trading app for quick execution speed and low latency.

Notification systems act as a trader’s early warning system, alerting them to significant market events. The speed and effectiveness of these notifications are critical for timely responses. A system that delivers alerts with minimal delay, using customizable parameters and multiple channels (push notifications, email, SMS), allows traders to react swiftly to potentially lucrative or risky situations. Conversely, delayed or unreliable notifications can leave traders blindsided, potentially leading to missed opportunities or increased risk.

The best systems provide options for customized alerts based on price movements, volume, or other key indicators.

Illustrative Examples of Trade Scenarios

Let’s dive into some real-world scenarios to illustrate the dramatic impact of execution speed (or lack thereof) in the fast-paced world of day trading. Think of it as a high-stakes game of chicken, where milliseconds can separate riches from ruin.These examples will highlight how even tiny delays can translate into significant financial losses or missed opportunities. We’ll see how the difference between a lightning-fast trade and a sluggish one can be the difference between a celebratory champagne toast and a quiet contemplation of what could have been.

Scenario 1: Speed Equals Profit

The market is buzzing with news of a major tech company exceeding earnings expectations. The stock, currently trading at $150, is expected to jump significantly. Our trader, armed with a blazing-fast day trading app, spots the price surge before the broader market reacts. With sub-millisecond latency, they execute a buy order for 100 shares at $150.05. Within seconds, the price shoots up to $152. They immediately sell, securing a profit of $195 ($2 per share minus commissions). A delay of even a few hundred milliseconds could have meant missing the initial surge and buying at a higher price, significantly reducing the profit or even resulting in a loss.

Scenario 2: Slow Execution Equals Loss

The market is experiencing a flash crash – a sudden, dramatic drop in prices across multiple assets. Our trader, using a slower app, identifies an opportunity to buy a dip in a specific stock that they believe will bounce back quickly. However, their app’s slow execution speed means their buy order is placed several seconds after they identify the opportunity. By the time the order is executed, the stock has already rebounded, and they miss the chance to buy at the low price. What could have been a profitable trade turns into a missed opportunity, costing them a potential profit of several hundred dollars. The delay, even though it seems small, was enough to wipe out the opportunity. Imagine the frustration!

Visual Comparison of Scenarios

Let’s visualize this difference with a simple text-based comparison:| Feature | Scenario 1: Fast Execution | Scenario 2: Slow Execution ||—————–|—————————–|—————————–|| Market Condition | Earnings surprise, upward trend | Flash crash, volatile market || Trade Type | Buy low, sell high | Buy the dip || Execution Speed | Sub-millisecond latency | Several seconds delay || Outcome | Profit of $195 | Missed opportunity, potential loss of several hundred dollars |

Ending Remarks

So, the quest for the ultimate speed demon day trading app is far from a simple sprint. It’s a marathon of meticulous research, careful consideration, and a dash of gut feeling. While the perfect app might not exist (yet!), understanding the intricacies of execution speed and latency empowers you to make informed choices. Remember, in the fast-paced world of day trading, even a fraction of a second can be the difference between a winning trade and a missed opportunity.

Now go forth and conquer those markets – swiftly!