Best day trading app in Canada for active traders with high volume. – Best day trading app in Canada for active traders with high volume? Buckle up, buttercup, because navigating the wild world of Canadian high-volume day trading apps is like riding a rollercoaster blindfolded – exhilarating, terrifying, and potentially wildly profitable (or devastatingly unprofitable, let’s be honest). This guide cuts through the noise, offering insights into the best platforms, crucial features, and the regulatory minefield you’ll need to dodge to become a Canadian day-trading ninja.

Prepare for a whirlwind tour of commissions, charting tools, and the importance of not accidentally wiping out your life savings.

We’ll delve into the nitty-gritty of choosing the right app, considering factors like commission structures, platform usability, and security features – because losing your hard-earned loonies to a poorly designed app or a sneaky cybercriminal is about as fun as a root canal without anesthesia. We’ll examine top Canadian brokerages, essential app features, and the regulatory landscape, ensuring you’re armed with the knowledge to make informed decisions and maybe, just maybe, emerge victorious in the high-stakes game of Canadian day trading.

Top Canadian Brokerages for Active Day Trading

Choosing the right brokerage for high-volume day trading in Canada is like picking the perfect caffeinated beverage for a marathon – you need something powerful, reliable, and won’t leave you jittery and broke by the end of the day. The wrong choice can cost you serious coin, so let’s dive into the top contenders.

Top 5 Canadian Brokerages for Active Day Traders

The following table compares five leading Canadian brokerages, highlighting key features relevant to active day traders who execute numerous trades daily. Remember, the “best” brokerage depends on your individual needs and trading style.

Finding the best day trading app in Canada for active traders with high volume is a wild goose chase, unless you know where to look! Need options and futures? Then your search might lead you to Best platform for day trading with options and futures trading? , which can significantly impact your Canadian day trading app selection. Ultimately, the best app depends on your specific needs, but don’t forget speed and reliability are key for high-volume trading.

| Brokerage Name | Commission Structure | Platform Features | Minimum Account Size |

|---|---|---|---|

| Interactive Brokers Canada | Competitive tiered commission structure, often very low for high-volume traders. Expect fractional fees depending on the volume. | Powerful Trader Workstation (TWS) platform, excellent charting tools, advanced order types, margin rates vary. Access to global markets. | Varies, but generally lower than others for active traders. Contact them for specifics. |

| TD Ameritrade (Canada) | Commission structure varies depending on the account type and volume; can be competitive for active traders. | Thinkorswim platform, known for its advanced charting and analysis tools. Good order routing and execution speed. | Generally requires a larger minimum deposit than some competitors, but specific requirements vary. |

| Questrade | Generally commission-based, with tiered pricing structures potentially offering discounts for higher trading volume. | User-friendly platform, good for beginners, but might lack some advanced features of other platforms. Mobile app is considered strong. | Relatively low minimum account size, making it accessible to a wider range of traders. |

| Wealthsimple Trade | Commission-free trading, but this simplicity comes with potential limitations for high-volume day traders. | Simple, intuitive platform; great for beginners, but limited advanced features for sophisticated trading strategies. Excellent for basic trades. | Low minimum account size, even lower than Questrade. |

| BMO InvestorLine | Commission structure can be competitive, especially for high-volume traders. Pricing details should be checked directly with BMO. | Offers a range of platforms, including web-based and mobile options. Features vary across platforms. Generally considered reliable. | Minimum account size requirements vary depending on the chosen account type. |

Trading Platform Comparison for High-Volume Trading

Each platform’s strengths and weaknesses are magnified under high-volume trading conditions. Interactive Brokers’ TWS, for instance, excels with its speed and advanced order types, crucial for executing numerous trades swiftly and efficiently. However, its complexity might be overwhelming for some. In contrast, Questrade’s platform prioritizes ease of use, which might be preferable for traders prioritizing simplicity over highly specialized features.

Finding the best day trading app in Canada for active traders with high volume? It’s a jungle out there, but fear not! To navigate this wild market, you’ll want to check out a comprehensive comparison; for example, see this excellent Review of top day trading platforms in Canada for active traders? to help you choose wisely. Then, armed with knowledge, you can conquer the high-volume trading world and become the ultimate Canadian day trading ninja!

Wealthsimple Trade, while commission-free, might lack the speed and functionality needed for truly high-volume day trading.

Account Types and Suitability for High-Volume Day Trading

Brokerages typically offer various account types, such as cash accounts, margin accounts, and registered accounts (RRSPs, TFSAs). For high-volume day trading, a margin account is often preferred due to its ability to leverage funds and potentially amplify profits (and losses). However, margin trading carries significant risk, and only experienced traders should consider it. Always carefully review the terms and conditions and risk disclosures associated with each account type before opening one.

App Features Essential for High-Volume Day Trading in Canada

Day trading in Canada, especially at high volumes, demands a trading app that’s not just functional, but practically a caffeinated cheetah in a tuxedo. It needs to be fast, efficient, and packed with features designed to keep you ahead of the curve – or at least prevent you from falling hopelessly behind. Think of it as your trusty sidekick in the wild west of the Canadian stock market.

The right app can be the difference between a profitable day and a day spent staring blankly at a loss-making chart. Choosing wisely is crucial for minimizing slippage, maximizing speed, and ensuring your trades execute as intended. High-volume day trading requires an app that can handle the pressure – and the sheer volume of trades – without breaking a sweat (or crashing).

This means selecting an app with the right features is paramount to success.

Real-Time Data Feeds and Charting Tools’ Impact on High-Volume Day Trading

Real-time data feeds and sophisticated charting tools are the lifeblood of successful high-volume day trading. Imagine trying to navigate a busy highway blindfolded – not a pretty picture. Real-time data provides the constant stream of information you need to make informed, split-second decisions, while advanced charting tools allow you to visualize market trends and patterns with unparalleled clarity.

This combination enables the rapid identification of potential trading opportunities and allows for timely execution of trades, maximizing profitability and minimizing risk. For example, a sudden spike in volume on a particular stock, immediately visible on a real-time chart, could signal a short-term buying opportunity, allowing a quick trade before the price rises further. Conversely, a significant drop in price, coupled with increasing sell volume, could trigger a sell order to limit losses.

The speed and accuracy of this information are crucial in high-volume trading where even milliseconds can make a difference.

Essential App Features for High-Volume Canadian Day Traders

Before you dive headfirst into the thrilling world of high-volume day trading, you need the right equipment. Think of this list as your essential survival kit. Without these features, you’re essentially facing a grizzly bear with a spoon.

- Advanced Charting Capabilities: This isn’t your grandma’s candlestick chart. You need a robust charting package with customizable indicators, drawing tools, and multiple timeframes to analyze market trends effectively. Think Fibonacci retracements, moving averages, and relative strength index (RSI) indicators at your fingertips.

- Real-Time Data Feeds: Delayed data is like driving with a rearview mirror that shows you yesterday’s traffic. Real-time data ensures you’re always up-to-date on price changes, volume, and other crucial market information, allowing you to react swiftly to opportunities and threats.

- Multiple Order Types: Market orders, limit orders, stop-loss orders – you need them all, and the ability to execute them quickly and efficiently. Different order types cater to different trading strategies and risk tolerances.

- Level II Market Data: This offers a detailed view of the order book, showing you buy and sell orders at different price levels. This allows you to gauge market depth and anticipate price movements, giving you an edge in high-volume trading.

- Fast Order Execution: Speed is of the essence in day trading. A slow or unreliable app can cost you money, as even minor delays can mean missed opportunities or widened spreads. Choose an app known for its speed and reliability.

Benefits and Drawbacks of Different Order Types for High-Volume Trading, Best day trading app in Canada for active traders with high volume.

Choosing the right order type is like selecting the right weapon for a battle. Each has its strengths and weaknesses, and the best choice depends on your specific trading strategy and risk tolerance. Using the wrong order type can be as disastrous as bringing a knife to a gunfight.

- Market Orders: These execute immediately at the best available price. They are fast but can result in slippage (paying more than the quoted price) during periods of high volatility.

- Limit Orders: These are executed only when the price reaches a specified level. They offer price certainty but may not execute if the price doesn’t reach your limit. This is particularly important for high-volume trading where price fluctuations are more frequent.

- Stop-Loss Orders: These automatically sell your position when the price drops to a certain level, limiting potential losses. They are crucial for risk management, particularly in high-volume trading where rapid price swings can occur.

Regulatory Considerations and Compliance for Canadian Day Traders

Navigating the world of Canadian day trading isn’t just about finding the slickest app; it’s also about understanding the regulatory landscape. Ignoring the rules can lead to more than just a bruised ego – it can lead to hefty fines and even legal trouble. So, buckle up, buttercup, because we’re about to delve into the fascinating (yes, really!) world of Canadian financial regulations.The regulatory environment for day trading in Canada is designed to protect investors and maintain market integrity.

Finding the best day trading app in Canada for active traders with high volume is like searching for the Holy Grail of finance – a quest for speed, accuracy, and minimal lag. But to truly conquer the market, you need real-time data; that’s where the magic happens. Check out this resource for insights on finding the Best Canadian day trading app with real-time market data and analysis?

to boost your high-volume trading game. Armed with the right tools, conquering the Canadian day trading scene becomes a much more manageable (and profitable!) feat.

This means that choosing the right trading app isn’t solely about speed and features; it’s also about ensuring the app and the brokerage it’s connected to are compliant with all applicable regulations. Failure to do so could expose you to significant risks, including the loss of your investment and potential legal repercussions. Think of it as choosing a helmet before you hop on a rollercoaster – it might seem like an extra step, but it’s definitely worth it.

Key Regulatory Bodies Overseeing Canadian Brokerage Firms

Several key regulatory bodies oversee Canadian brokerage firms, ensuring they operate within the bounds of the law and protect investors’ interests. These organizations work together to create a robust and secure trading environment. Understanding their roles is crucial for any Canadian day trader.The primary regulator is the Investment Industry Regulatory Organization of Canada (IIROC). IIROC acts as a self-regulatory organization (SRO), meaning it sets and enforces rules for investment dealers and their employees.

Think of them as the referees of the Canadian financial market, ensuring fair play and preventing shady dealings. They are responsible for overseeing the conduct of brokerage firms, ensuring they adhere to strict standards of conduct, financial solvency, and client protection. They also handle complaints and disciplinary actions against firms and individuals who violate regulations.Another important player is the Ontario Securities Commission (OSC), a provincial securities regulator.

Finding the best day trading app in Canada for active traders with high volume is like searching for the Holy Grail of finance – a quest! But to truly conquer this market, you need the right tools. So, before diving into high-volume trading, consider this: What’s the best all-around day trading platform available in Canada? This will help you decide which platform best suits your needs before you unleash your inner day-trading ninja with those high-volume trades.

Ultimately, choosing the right platform is crucial for your success in this thrilling, high-stakes world.

While IIROC focuses on the industry as a whole, the OSC, along with similar provincial commissions across Canada, focuses on regulating securities markets within their specific jurisdiction. Their oversight complements IIROC’s national focus, ensuring a comprehensive regulatory framework.

Compliance Requirements for Canadian Day Traders Using Trading Apps

Before you start day trading with abandon, it’s vital to understand your compliance obligations. This isn’t a dry legal lecture; it’s your protection against potential problems. Following these guidelines is essential for a smooth and legally sound trading experience.Understanding your Know Your Client (KYC) obligations is paramount. Brokerages are required to verify your identity and financial information before allowing you to trade.

This involves providing documentation such as government-issued identification and proof of address. This might seem like a tedious process, but it’s a critical step in preventing fraud and ensuring the security of the financial system. Failure to provide the necessary documentation could prevent you from trading altogether.Furthermore, understanding your tax obligations is equally crucial. All profits from day trading are considered taxable income in Canada, and you are responsible for accurately reporting these gains to the Canada Revenue Agency (CRA).

This means keeping meticulous records of all your trades and associated expenses. Ignoring this could result in significant tax penalties. Consider consulting with a tax professional specializing in investment income to ensure compliance.Finally, always be aware of and adhere to the terms and conditions of your chosen trading app and brokerage. These documents Artikel your rights and responsibilities as a trader.

Ignoring these terms could lead to account suspension or other penalties. Take the time to read them thoroughly; it’s a small price to pay for peace of mind.

Cost Analysis

Let’s get down to brass tacks – the cold, hard cash involved in your day trading adventures. High-volume trading means high transaction costs, so understanding your brokerage’s fee structure is crucial to ensuring your profits aren’t eaten alive by commissions. Choosing the right platform can be the difference between a comfortable retirement and ramen noodles for dinner.The impact of commission structures on profitability for high-volume day traders is significant.

Even small differences in fees can drastically alter your bottom line, especially when you’re executing hundreds of trades daily. Think of it like this: a tiny leak in a massive dam can still cause catastrophic damage over time. Let’s dive into the specifics to see how these seemingly minor differences can have a major impact.

Commission Structures of Leading Canadian Brokerages

The following table compares the commission structures of three leading Canadian brokerage apps for active traders. Remember, these are examples and can change, so always verify directly with the brokerage before making any decisions. Hidden fees are the bane of a day trader’s existence, so we’ll try to unearth any lurking charges.

| Brokerage | Commission per Trade | Inactivity Fees | Other Fees |

|---|---|---|---|

| Example Brokerage A | $5.99 + $0.01 per share | None | Potential data fees, margin interest (if applicable) |

| Example Brokerage B | $4.95 flat fee per trade | $10 per month after 6 months of inactivity | Regulatory fees, potential platform fees |

| Example Brokerage C | $0.01 per share (minimum $1.00) | None | Possible account maintenance fee |

Impact of Commission Structures on Profitability

Consider a scenario where a day trader makes 100 trades per day, with an average profit of $10 per trade before commissions. Let’s see how the different fee structures affect the net profit.Scenario: 100 trades per day, $10 profit per trade before commissions.Example Brokerage A: (100 trades

Finding the best day trading app in Canada for active traders with high volume is a quest for the holy grail of finance! But hey, even seasoned pros need to diversify; consider branching out to explore other avenues like learning how to profit from cryptocoin to boost your portfolio. Ultimately, the best app for you depends on your strategy, but mastering both stock and crypto trading could be your ticket to financial freedom.

- $5.99) + (100 trades

- average shares traded

- $0.01) = Significant cost depending on average shares traded. Let’s assume 100 shares traded per trade. Total commission = $600 + $100 = $700. Net profit = (100 trades

- $10)

- $700 = $300.

Example Brokerage B: (100 trades

- $4.95) = $495. Net profit = (100 trades

- $10)

- $495 = $505.

Example Brokerage C: (100 trades

- $1.00) = $100. Net profit = (100 trades

- $10)

- $100 = $900.

The above calculations are for illustrative purposes only. Actual commissions will vary based on trade volume, share prices, and other factors.

This simple example clearly demonstrates that seemingly small differences in commission structures can significantly impact a high-volume day trader’s overall profitability. The choice of brokerage can mean the difference between a successful trading year and a year spent staring at a dwindling account balance.

User Experience and Platform Usability for High-Volume Trading

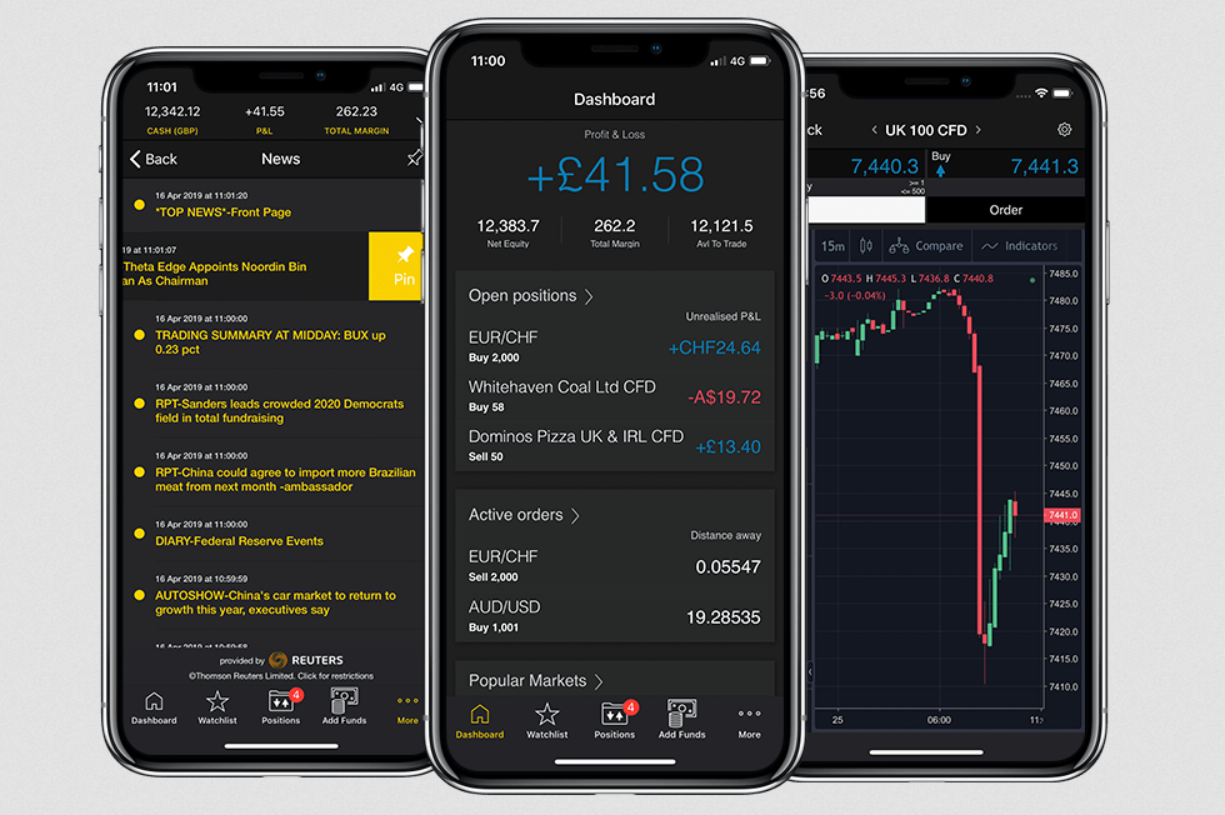

Day trading, especially at high volumes, is a high-stakes game where milliseconds matter. A poorly designed trading app can be the difference between a profitable day and a catastrophic loss. The ideal platform needs to be intuitive, lightning-fast, and robust enough to handle the pressure of numerous simultaneous trades without hiccups or freezes. Think of it as a finely tuned race car – every component needs to be optimized for peak performance.The user interface (UI) should prioritize speed and efficiency.

Information needs to be readily accessible, with key metrics prominently displayed and easily navigable. Imagine a dashboard displaying real-time quotes, order books, charts, and account balances all within a single, easily digestible view. Clutter is the enemy; every element should serve a clear purpose. Intuitive controls are essential – placing orders, modifying positions, and managing risk should be effortless, requiring minimal clicks or keystrokes.

So, you’re a high-volume day trading ninja in Canada, eh? Need an app that can handle your breakneck speed and not melt down like a popsicle in July? Before you dive headfirst into the whirlwind, maybe check out the basics first. For those just starting, finding the right platform is crucial; check out this guide for beginners: Best Canadian day trading platform for beginners in 2024?

Once you’ve mastered the fundamentals, then you can return to the exhilarating world of high-volume Canadian day trading apps – may the odds be ever in your favor!

Think of it as a cockpit, designed for optimal control and immediate access to critical information.

Comparison of User Interfaces of Two Popular Canadian Day Trading Apps

Let’s hypothetically compare “TradeFast” and “QuickTrade,” two popular Canadian day trading apps. TradeFast boasts a sleek, modern interface, but its order placement process, while visually appealing, involves multiple steps. In high-volume trading, this extra time spent navigating menus can lead to missed opportunities or worse, delayed executions that result in losses. QuickTrade, on the other hand, prioritizes functionality over aesthetics.

Its interface is less visually striking but remarkably efficient. Order entry is streamlined and intuitive, with hotkeys enabling rapid order placement. During periods of high market volatility, this efficiency translates to a significant advantage. QuickTrade’s superior speed and efficiency are crucial for active traders executing numerous trades within short timeframes.

Impact of Poorly Designed Interface on High-Volume Trader Performance

Consider a scenario where a day trader, let’s call him Alex, is using a trading app with a clunky interface. He’s trying to execute a complex spread trade during a period of high market volatility. The app’s slow response time and convoluted order placement process cause a delay of even just a few seconds. During this delay, the market moves against Alex’s intended trade, leading to a significant loss.

Had Alex been using a more efficient platform, he might have executed the trade successfully and avoided the loss, illustrating the crucial role of a well-designed user interface in high-volume day trading. This example highlights how a poorly designed app, with its lag, confusing menus, and lack of customizability, can lead to missed opportunities, increased stress, and ultimately, financial losses.

Security and Data Protection in Canadian Day Trading Apps

Your hard-earned money is dancing a delicate tango with the market – you want to make sure it’s a safe dance, not a chaotic tumbleweed roll into oblivion. Protecting your funds and data in the fast-paced world of Canadian day trading is paramount. This section dives into the crucial security measures you should expect from your chosen app and the steps you can take to bolster your own digital defenses.Choosing a day trading app is like choosing a bodyguard for your investments – you need someone reliable, vigilant, and equipped to handle anything thrown their way.

Let’s explore what constitutes robust security in this context.

Critical Security Features for Canadian Day Trading Apps

A robust security system isn’t just a checklist; it’s a fortress protecting your financial future. The following features are non-negotiable for any Canadian day trading app worth its salt.

- Encryption: Think of encryption as a secret code that scrambles your data, making it unreadable to anyone who doesn’t have the key. Look for apps that use robust encryption protocols like AES-256 to protect your data both in transit (as it travels to and from the app) and at rest (while stored on the app’s servers).

- Firewall Protection: A firewall acts as a digital bouncer, blocking unauthorized access to your account. A strong firewall is essential for preventing malicious actors from breaching your defenses.

- Regular Security Audits: Just like a doctor’s checkup, regular security audits ensure that the app’s defenses are up-to-date and effective. Look for transparency in how often these audits are conducted.

- Multi-Factor Authentication (MFA): This is your digital Swiss Army knife, adding an extra layer of security beyond just a password. We’ll delve deeper into its importance below.

- Fraud Detection Systems: Sophisticated algorithms constantly monitor your account for suspicious activity, alerting you to potential threats before they become major problems. Think of it as your app’s ever-vigilant security guard.

- Data Backup and Recovery: Accidents happen. A reliable backup and recovery system ensures that your data is safe even in the event of a system failure or cyberattack. It’s like having a spare tire for your financial journey.

Best Practices for Securing a Day Trading Account

Even the most secure app needs a vigilant user. Here’s how to up your security game:

- Strong Passwords: Avoid easily guessable passwords. Use a password manager to generate and store complex, unique passwords for each of your online accounts.

- Keep Software Updated: Outdated software is a hacker’s playground. Ensure your operating system, browser, and the trading app itself are always running the latest versions.

- Beware of Phishing Scams: Legitimate companies will never ask for your login credentials via email or text. If something seems suspicious, contact your brokerage directly.

- Use a Secure Network: Avoid using public Wi-Fi for trading, as it’s more vulnerable to hacking.

- Regularly Review Account Statements: Keep a close eye on your account activity for any unauthorized transactions.

Importance of Two-Factor Authentication and Other Security Protocols

Two-factor authentication (2FA) is like having a second key to your castle. Even if someone manages to get your password, they’ll still need a second form of verification (like a code sent to your phone) to access your account. This dramatically reduces the risk of unauthorized access, especially crucial for high-volume trading where even a brief window of vulnerability could be costly.

Other security protocols, such as biometric authentication (fingerprint or facial recognition) and IP address restrictions, offer further layers of protection. Think of these measures as adding more bricks to the wall of your digital fortress.

Wrap-Up: Best Day Trading App In Canada For Active Traders With High Volume.

So, there you have it – a crash course in conquering the Canadian high-volume day trading app jungle. Remember, while this guide offers valuable insights, the world of day trading is inherently risky. Do your own research, understand the risks, and maybe, just maybe, you’ll find the perfect app to help you turn your day trading dreams into a reality (or at least a slightly less empty bank account).

Happy trading (and may the odds be ever in your favor!).