Best Forex Trading Apps for Beginners in Canada: Dive headfirst into the thrilling world of forex trading without the terrifying plunge! This guide navigates the Canadian forex landscape, demystifying currency pairs, pips, and leverage—all while keeping your beginner status firmly in mind. We’ll equip you with the knowledge to choose the perfect app, mastering the art of risk management and responsible trading along the way.

Prepare for a financial adventure that’s both exciting and surprisingly manageable.

From understanding the regulatory environment to selecting an app that suits your needs, we’ll cover everything from user-friendly interfaces and robust security features to essential tools like demo accounts and charting capabilities. We’ll even explore funding methods, customer support options, and the all-important fine print (because nobody wants to be caught in the legal weeds!). Get ready to trade with confidence—Canadian style!

Introduction to Forex Trading in Canada

So, you’re thinking about dipping your toes into the exciting (and sometimes terrifying) world of forex trading in Canada? Buckle up, buttercup, because it’s a wild ride! This isn’t your grandma’s knitting circle; it’s the global marketplace where trillions of dollars change hands daily. Think of it as a giant, constantly fluctuating casino, but instead of chips, you’re trading currencies.

And instead of a croupier, you’ve got algorithms and market sentiment.Forex trading, at its core, involves buying one currency and simultaneously selling another. You’re essentially betting on the value of one currency rising against another. Imagine you think the Canadian dollar (CAD) is about to strengthen against the US dollar (USD). You’d buy CAD and sell USD.

If your prediction is right, you profit! If not…well, let’s just say there are lessons to be learned.

Choosing the best forex trading apps for beginners in Canada can feel like navigating a minefield of confusing jargon. But before you jump in, check out what seasoned traders are saying about popular platforms – like the insights you’ll find in this review of Questrade’s forex trading platform user reviews and ratings – to help you pick a beginner-friendly app that won’t leave your wallet feeling equally depleted.

Ultimately, the best app depends on your individual needs and risk tolerance, so do your research!

Currency Pairs, Pips, and Leverage: Decoded

Forex trading uses currency pairs, like CAD/USD (Canadian dollar/US dollar), EUR/USD (Euro/US dollar), or GBP/USD (British pound/US dollar). The first currency is the “base” currency, and the second is the “quote” currency. A pip (point in percentage) is the smallest price movement in a currency pair, usually 0. So, a 10-pip move in CAD/USD means the exchange rate changed by 0.

So, you’re a Canadian newbie eyeing those forex trading apps? Remember, even the best app won’t predict the market like a psychic predicting the next winning team in the football news. Stick to your strategy, though; unlike those unpredictable footballers, consistent trading can build your portfolio. Now, back to those Canadian forex apps – which one will you choose?

0010. Leverage is like borrowing money to amplify your potential profits (and losses!). A 1

100 leverage means you can control $100,000 worth of currency with only $1,000 of your own money. High leverage can lead to massive gains, but it also significantly increases the risk.

Regulatory Environment for Forex Trading in Canada

In Canada, forex trading is regulated primarily by the Investment Industry Regulatory Organization of Canada (IIROC) and provincial securities commissions. These bodies ensure that forex brokers operating in Canada adhere to specific rules and regulations designed to protect investors. This includes things like capital adequacy requirements for brokers, rules about client segregation of funds, and restrictions on misleading advertising.

Choosing a regulated broker is crucial for minimizing risks.

Canadian Forex Broker Account Types

Choosing the right account type depends on your trading experience and risk tolerance. Here’s a comparison (note that specific offerings can vary between brokers):

| Account Type | Minimum Deposit | Leverage Limits | Spreads |

|---|---|---|---|

| Standard Account | $250 – $1000 | 1:50 – 1:200 | Variable, typically higher |

| Mini Account | $50 – $250 | 1:50 – 1:200 | Variable, typically higher |

| Micro Account | $10 – $50 | 1:50 – 1:100 | Variable, often wider |

| VIP Account | $10,000+ | Negotiable | Variable, often tighter |

Choosing a Forex Trading App

So, you’re ready to dive into the thrilling (and sometimes terrifying) world of forex trading in Canada. But before you leap headfirst into a sea of fluctuating currencies, you need a reliable life raft – a forex trading app. Choosing the right one is crucial, as it’s your digital window into the global market. Picking the wrong one can be like trying to navigate the Niagara River in a canoe made of Swiss cheese.Choosing the right forex trading app isn’t just about finding the flashiest interface; it’s about finding the right tool for your specific needs and skill level as a beginner.

Think of it like choosing the right tool for a job: you wouldn’t use a sledgehammer to crack a nut (unless you’re particularly enthusiastic about making a mess).

Criteria for Selecting a Forex Trading App

Selecting a suitable forex trading app requires careful consideration of several key factors. A beginner trader needs an app that is both user-friendly and offers the essential tools to learn and grow without being overwhelmed by unnecessary complexity. Consider these factors as your checklist before committing to an app.

- Regulation and Security: Ensure the app and the broker it uses are regulated by a reputable Canadian financial authority, such as the Investment Industry Regulatory Organization of Canada (IIROC). This protects your funds and ensures the platform operates within legal boundaries. Look for features like two-factor authentication and encryption to safeguard your account.

- User-Friendliness and Intuitive Design: The app should be easy to navigate, even for a complete novice. Complex charts and jargon should be clearly explained, and the overall experience should be intuitive and stress-free. A cluttered interface can be more distracting than helpful.

- Educational Resources: A good app for beginners will offer tutorials, guides, or access to learning materials to help you understand the basics of forex trading. This is invaluable for building confidence and avoiding costly mistakes.

- Trading Features: While beginners don’t need every bell and whistle, the app should offer essential features such as order placement, charting tools, and real-time market data. Consider the types of orders you might need (market orders, limit orders, stop-loss orders) and ensure the app supports them.

- Fees and Commissions: Transparency is key. Understand the fee structure before you sign up. Look for apps with clear and competitive pricing models to avoid hidden costs.

- Customer Support: Access to reliable customer support is essential, especially when you’re just starting. Look for apps that offer multiple support channels, such as email, phone, and live chat.

User-Friendliness and Intuitive Design

For beginners, a user-friendly app is paramount. Imagine trying to learn to ride a bike on a wobbly, rusty old contraption – frustrating, right? Similarly, a poorly designed app can quickly turn a potentially exciting learning experience into a stressful one. An intuitive design ensures that you can easily access the information and tools you need without getting lost in a maze of menus and confusing jargon.

So, you’re a Canadian newbie eyeing the forex world? Finding the best forex trading apps can feel like searching for the Holy Grail of finance. But once you’ve picked your app, the real learning begins! Check out this fantastic resource if you’re thinking about Questrade: Step-by-step guide for beginners on how to trade forex on Questrade , then get back to comparing those Canadian apps – may the odds be ever in your favour!

Look for clear, concise layouts, easily understandable charts, and straightforward order placement processes. Think of it as the difference between a well-organized toolbox and a chaotic pile of tools – one makes the job easier, the other just adds to the headache.

Comparison of Popular Forex Trading Apps in Canada

Direct comparison of specific apps requires caution, as features and offerings can change rapidly. However, several popular apps cater to Canadian traders. Instead of a direct comparison (which would quickly become outdated), consider the features listed above as your guiding principles when researching apps available in Canada. Look for reviews and testimonials from other Canadian users to get a sense of real-world experiences.

Remember to check if the app is regulated by a Canadian authority before using it.

Security Features and Regulatory Compliance

Security is non-negotiable. You’re entrusting your money to these apps, so ensure they meet the highest security standards. Look for apps that are regulated by reputable Canadian authorities, such as the IIROC. Features like two-factor authentication, data encryption, and secure payment gateways are all crucial for protecting your funds and personal information. Think of it like this: you wouldn’t leave your wallet on a park bench, would you?

The same principle applies to your online trading accounts. Choosing a regulated and secure app is your first line of defense against potential threats.

Key Features of Beginner-Friendly Forex Apps

So, you’re ready to dive into the thrilling (and sometimes terrifying) world of forex trading, eh? But before you leap headfirst into a sea of pips and spreads, you need the right tools. Think of a forex trading app as your trusty sidekick, guiding you through the complexities of currency markets. Choosing the right one is crucial, especially when you’re just starting out.

So, you’re a Canadian newbie dreaming of forex riches? Finding the best forex trading apps for beginners in Canada is just step one! Before you dive headfirst into the world of pips and spreads, however, you’ll want a solid foundation, which is why checking out Best educational resources for learning forex trading in Canada is crucial.

Then, armed with knowledge, you can confidently choose the perfect app and start your trading journey (hopefully, without losing your shirt!).

This section will illuminate the key features that make a forex app truly beginner-friendly.Choosing the right app can feel like selecting a superhero for your financial journey – you need one with the right powers (features) to help you succeed!

Educational Resources

A good beginner-friendly forex app doesn’t just throw you into the deep end; it provides a life raft of educational resources. This is crucial for navigating the often-confusing world of forex trading. Think of it as getting a crash course in financial wizardry before you start casting spells (placing trades). Without proper guidance, you risk becoming another casualty in the forex battlefield.

The following table showcases the educational resources offered by some popular apps (note that offerings can change, so always check the app’s website for the most up-to-date information).

| App Name | Tutorials | Webinars | Glossary |

|---|---|---|---|

| Example App 1 | Video tutorials covering basic concepts, interactive lessons | Regular webinars on market analysis and trading strategies | Comprehensive glossary defining key forex terms |

| Example App 2 | Step-by-step guides on placing orders and managing risk | Occasional webinars focusing on specific trading techniques | A concise glossary with explanations and examples |

| Example App 3 | Animated tutorials explaining complex topics in a simple way | No regularly scheduled webinars, but recordings available | Glossary integrated directly into the app for easy access |

Demo Accounts: Practice Makes Perfect (and Prevents Financial Pain)

Demo accounts are like the training wheels of the forex world. They allow you to practice trading with virtual money before risking your hard-earned cash. The benefits are obvious: you can experiment with different strategies, learn how the platform works, and develop your trading skills without the fear of significant losses. However, there are drawbacks. The biggest one?

It’s not quite the same as real trading. The emotional pressure and the potential for real financial consequences are absent in a demo environment. This can lead to overconfidence when you finally start trading with real money. Think of it as practicing your free throws in an empty gym versus a packed stadium – the pressure is very different.

Charting Tools and Technical Analysis

Charts are the maps of the forex world, and understanding them is essential. Beginner-friendly apps should offer a variety of charting tools, allowing you to visualize price movements and identify potential trading opportunities. Technical analysis, which involves studying charts to predict future price movements, is a powerful tool, but it requires practice and understanding. Think of it as learning to read tea leaves, but instead of predicting your love life, you’re predicting currency fluctuations.

Don’t expect to become a chart-reading guru overnight; it takes time and dedication. However, mastering charting tools can significantly improve your trading decisions and give you a crucial edge in the market.

So, you’re a Canadian newbie dreaming of forex riches? Choosing the right app is half the battle, but before you start chasing those pips, remember the legal side of things! Understanding the rules is crucial, so check out this resource on the Legal and regulatory aspects of forex trading in Quebec, Canada to avoid any unwanted surprises.

Then, armed with knowledge, you can confidently explore the best forex trading apps for beginners in Canada and start your journey!

Risk Management and Responsible Trading

Forex trading, while potentially lucrative, is a rollercoaster ride. Beginner traders in Canada, armed with the best apps, need to understand that consistent profits aren’t guaranteed; losses are a very real possibility. This section focuses on taming the wild beast of forex trading through smart risk management strategies. Think of it as equipping yourself with a safety harness before scaling that financial cliff.Successful forex trading isn’t about getting rich quick; it’s about consistent, calculated growth.

Ignoring risk management is like driving a Formula 1 car without brakes – exciting, but ultimately disastrous. This section will equip you with the knowledge to navigate the market safely and responsibly.

Stop-Loss and Take-Profit Orders

Stop-loss and take-profit orders are your best friends in the forex world. A stop-loss order automatically sells your currency pair when it reaches a predetermined price, limiting your potential losses. Think of it as your emergency brake. A take-profit order, conversely, automatically sells your currency pair when it reaches a predetermined price, securing your profits. It’s like setting a target and celebrating your victory when you hit it.

Setting both orders is crucial; it defines your risk tolerance and helps you avoid emotional trading decisions. For example, if you buy EUR/CAD at 1.45, a stop-loss order at 1.43 would limit your losses, while a take-profit order at 1.47 would secure your profits.

Position Sizing

Position sizing determines how much capital you allocate to each trade. It’s about not putting all your eggs in one basket. A common rule of thumb is to risk no more than 1-2% of your trading capital on any single trade. This means if you have $1000 in your trading account, you shouldn’t risk more than $10-$20 on a single trade.

This helps prevent catastrophic losses and allows you to withstand a series of losing trades. For instance, if you’re trading with $5000 and decide on a 1% risk, your maximum loss per trade should be $50. This ensures that even a string of unsuccessful trades won’t wipe out your account.

Best Practices for Responsible Forex Trading, Best forex trading apps for beginners in Canada

Developing a solid trading plan is paramount. This involves defining your trading goals, risk tolerance, and preferred trading strategies. It’s like creating a roadmap for your forex journey. Sticking to your plan, even during market volatility, is crucial. Furthermore, continuous learning is essential.

So, you’re a Canadian newbie eyeing the forex world? Finding the best forex trading apps can feel like navigating a maze, but fear not! To make informed decisions, check out this killer comparison – A comprehensive comparison of Questrade and other popular forex brokers – before diving in. It’ll help you choose wisely and avoid becoming another forex statistic (the losing kind!).

Then, you can confidently pick the perfect app for your budding trading genius.

The forex market is dynamic; staying updated on market trends and news is vital. Regularly reviewing your trades and identifying areas for improvement is also crucial. Finally, avoid emotional trading. Fear and greed are your worst enemies in the forex market. Discipline and patience are key.

“Never risk more than you can afford to lose.”

Customer Support and Resources

Navigating the sometimes-treacherous waters of forex trading requires a sturdy life raft – and that life raft is excellent customer support. Think of it as your personal financial Sherpa, guiding you through the peaks and valleys of currency fluctuations. Without readily available help, even the most beginner-friendly app can feel like a deserted island.The availability and responsiveness of customer support directly impacts your trading experience and, frankly, your sanity.

A quick response to a burning question can prevent costly mistakes, while a slow or unhelpful response can leave you feeling stranded and frustrated. Different apps offer various support channels, each with its own strengths and weaknesses. Choosing an app with robust support is as important as choosing one with a user-friendly interface.

Customer Support Channels

The range of customer support channels offered by forex trading apps varies significantly. Some apps offer a comprehensive suite of options, while others might rely on a single, less-than-ideal method. A truly beginner-friendly app will prioritize multiple channels to cater to diverse preferences and needs.

- Phone Support: Provides immediate assistance and allows for detailed explanations. However, it can be less convenient and may involve longer wait times.

- Email Support: Allows for detailed queries and provides a written record of the interaction. However, it’s generally slower than phone or live chat.

- Live Chat Support: Offers a quick and convenient way to get immediate answers to simple questions. However, it might not be suitable for complex issues.

- FAQ Section: A well-organized FAQ section can answer many common questions without requiring direct contact with support. However, it may not cover every scenario.

Educational Resources and Tools

A reputable forex trading app will provide more than just a platform; it will offer educational resources to help beginners understand the complexities of the forex market. These resources are crucial for building confidence and making informed trading decisions. Think of them as your forex trading textbooks and tutorials, all rolled into one.

- Tutorials and Videos: These can provide a visual and engaging way to learn about forex trading concepts.

- Glossary of Terms: A comprehensive glossary can help beginners understand the jargon associated with forex trading.

- Webinars and Seminars: These provide opportunities to learn from experienced traders and ask questions in real-time.

- Demo Accounts: Practice accounts allow beginners to experiment with trading strategies without risking real money.

Interpreting Terms and Conditions

Before signing up for any forex trading app, carefully review the terms and conditions. This crucial step often gets overlooked, but it’s essential for understanding the app’s policies, fees, and limitations. Think of it as reading the fine print before you embark on a thrilling (and potentially risky) adventure. Don’t just skim it; take your time and understand what you’re agreeing to.

Look for information on:

- Fees and Commissions: Understand all associated costs, including spreads, commissions, and inactivity fees.

- Data Security and Privacy: Ensure the app protects your personal and financial information.

- Risk Disclosures: Understand the inherent risks associated with forex trading and the app’s role in managing those risks.

- Dispute Resolution: Know the process for resolving any disputes with the app provider.

Illustrative Examples of App Features: Best Forex Trading Apps For Beginners In Canada

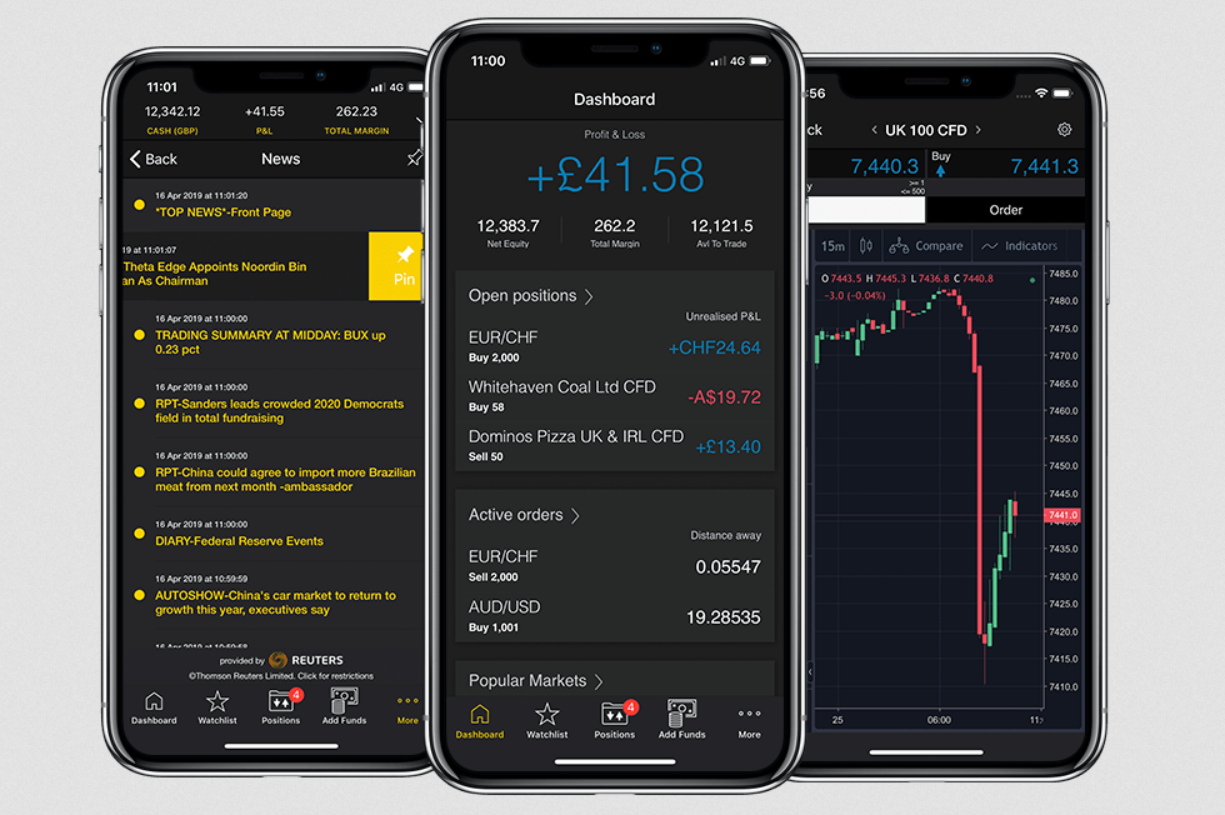

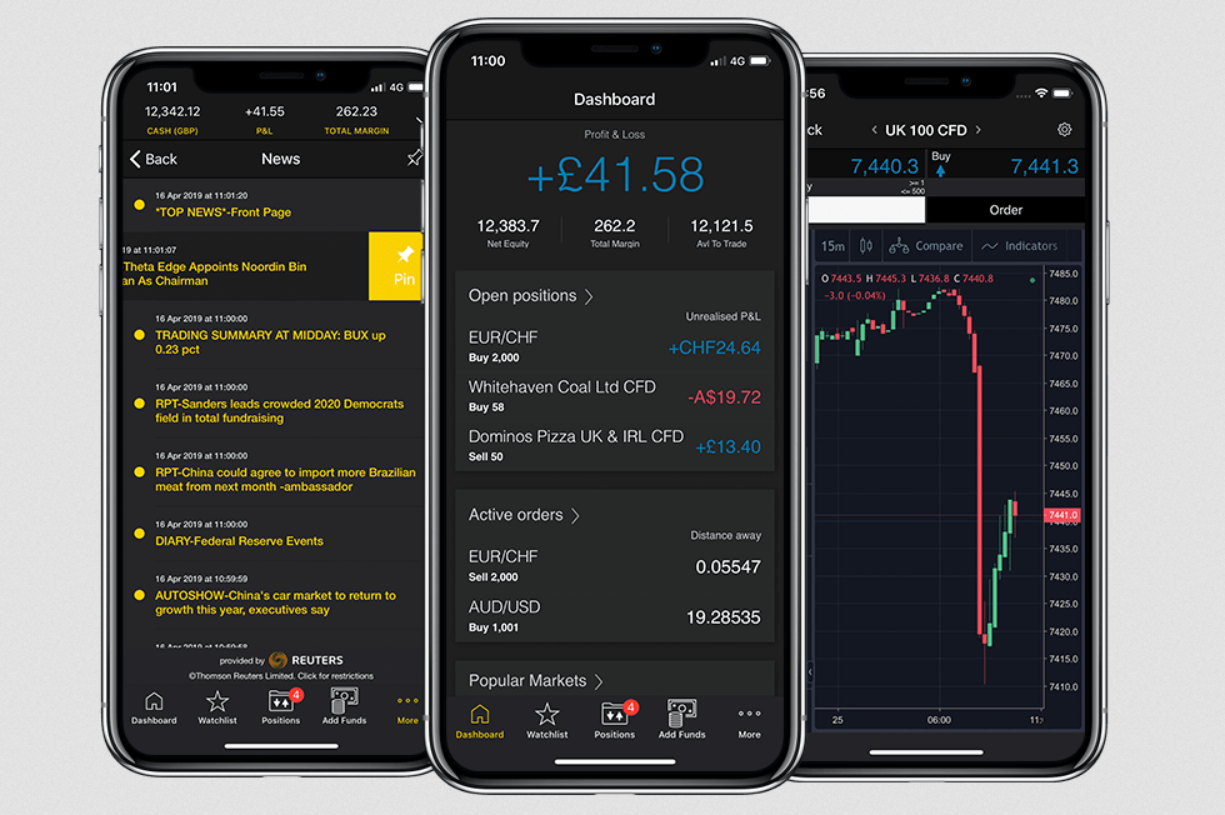

Let’s dive into the fantastical world of forex trading apps, specifically focusing on one imaginary but remarkably user-friendly app called “Forex Fiesta.” Imagine Forex Fiesta as your personal, pocket-sized financial guru, ready to guide you through the exciting (and sometimes terrifying) world of currency trading. We’ll explore its interface, trade execution, and chart interpretation, all without needing a single pixel!Forex Fiesta’s user interface is designed with the beginner in mind.

Think of a clean, brightly coloured dashboard. At the top, you’ll find a concise summary of your account balance, available margin, and any open positions – all presented in a clear, easy-to-understand format, free from confusing jargon. Below that, you’ll find a neatly organized list of currency pairs, each with its current bid and ask prices displayed prominently. Navigation is intuitive; a simple swipe or tap will bring you to different sections, like charts, news, or your trade history.

The whole thing feels less like navigating a spaceship control panel and more like browsing a well-organized online store.

Placing a Trade with Forex Fiesta

Imagine you’ve decided to buy Euros (EUR) against the US dollar (USD). First, you locate the EUR/USD pair on the main screen. A tap on the pair reveals a trade ticket. This ticket is like a simple order form. You input the amount of EUR you wish to buy (this could be in units or as a monetary value, the app will do the conversion for you), specify your stop-loss and take-profit levels (more on these later), and finally hit the “Buy” button.

The app will confirm your order, and it will appear in your open positions tab. Selling is just as straightforward; you simply follow the same process, but hit the “Sell” button instead. It’s all remarkably simple and straightforward.

Interpreting Charts and Indicators

Forex Fiesta offers a variety of chart types, including candlestick, line, and bar charts. Let’s focus on a candlestick chart. Each candlestick represents a specific time period (e.g., one hour, one day). The body of the candlestick shows the price range between the open and closing prices. A green candlestick indicates a closing price higher than the opening price (a bullish signal), while a red candlestick signifies the opposite (a bearish signal).

The “wicks” (the thin lines extending above and below the body) represent the high and low prices during that period. Forex Fiesta also offers several technical indicators, like moving averages. A moving average smooths out price fluctuations, helping identify trends. For example, a 20-day moving average might indicate a longer-term upward trend if the price consistently remains above the average.

Understanding these visual cues helps you anticipate potential price movements and make informed trading decisions. The app presents this information clearly, overlaying indicators directly on the charts, making analysis less daunting.

Conclusion

So, there you have it! Navigating the world of forex trading in Canada as a beginner doesn’t have to be a daunting task. By carefully considering the factors discussed—from app features and risk management to customer support and regulatory compliance—you can confidently select a platform that empowers your trading journey. Remember, responsible trading is key, and with the right tools and knowledge, you’ll be well-equipped to explore the exciting possibilities of the forex market.

Happy trading!