Bitget availability and legality in Canada for crypto trading: A land of maple syrup, hockey, and… cryptocurrency? Navigating the regulatory landscape of digital assets in Canada can feel like trying to find a loonie in a snowdrift, especially when considering exchanges like Bitget. This exploration dives into the frosty realities of using Bitget in Canada, examining its official stance, comparing it to competitors, and highlighting the potential pitfalls (and maybe even a few hidden treasures) for Canadian crypto enthusiasts.

We’ll uncover user experiences, analyze the legal framework, and offer a glimpse into the future of Bitget’s presence north of the border.

From understanding Bitget’s official statements regarding Canadian operations and compliance with local regulations to comparing its features and fees with other established Canadian exchanges, we’ll paint a comprehensive picture. We’ll delve into real user experiences, both positive and negative, and analyze the potential risks involved in using Bitget for crypto trading in Canada. We’ll also explore the evolving regulatory environment and offer insights into Bitget’s potential future in the Canadian market.

Buckle up, it’s going to be a wild ride!

Bitget’s Official Stance on Canadian Operations

Navigating the world of cryptocurrency exchanges and their legal standing in various countries can be a bit of a minefield, especially for newcomers. Let’s shine a light on Bitget’s official position regarding its services and operations within Canada. While they haven’t exactly rolled out the red carpet with a massive press conference announcing their Canadian conquest, their stance is subtly woven into their overall approach.Bitget’s official communication regarding its Canadian operations is, shall we say, less than explicitly detailed.

There isn’t a flashy press release declaring “Bitget conquers Canada!” Instead, their position is inferred from their general terms of service and a cautious approach to global expansion. They haven’t specifically excluded Canada from their services, but neither have they made a grand proclamation of full-fledged Canadian support. This leaves room for interpretation, and it’s advisable for Canadian users to proceed with caution and due diligence.

Bitget’s Terms of Service and Canadian Users

Bitget’s terms of service, like most exchanges, are extensive and legally dense. However, a careful review doesn’t reveal any specific clauses explicitly barring Canadian users. This lack of explicit exclusion doesn’t automatically equate to full support or endorsement of operations within Canada. It simply means they haven’t actively stated, “Canadians, stay away!” The absence of a specific mention of Canada in their terms doesn’t guarantee full regulatory compliance or protection under Canadian law.

It’s a nuanced situation that highlights the complexities of international cryptocurrency regulation. Users should independently verify the legal implications of using Bitget’s services from within Canada. This includes understanding potential tax implications and any other relevant Canadian financial regulations.

Publicly Available Documents Regarding Canadian Compliance

To date, no publicly available documents or press releases explicitly address Bitget’s regulatory compliance within Canada. This lack of transparency underscores the need for Canadian users to exercise extra caution. The absence of such documentation does not necessarily indicate a violation of any laws, but it certainly highlights the need for increased clarity and communication from Bitget regarding their operations in Canada.

This lack of official statements could be interpreted in various ways, ranging from a strategic decision to a simple oversight. Regardless, it leaves potential Canadian users in a position requiring more information before committing.

Absence of Specific Canadian Regulatory Compliance Statements

The lack of specific statements regarding Canadian regulatory compliance from Bitget is notable. Many exchanges operating in multiple jurisdictions actively publish statements confirming their adherence to local regulations. Bitget’s silence on this matter leaves room for speculation and emphasizes the importance of individual responsibility for understanding the legal landscape. While the absence of such statements doesn’t automatically imply non-compliance, it does underscore the need for greater transparency from the exchange to ensure user confidence and protect users from potential legal risks.

A proactive approach by Bitget in this area would greatly benefit both the exchange and its potential Canadian user base.

Canadian Regulatory Landscape for Crypto Exchanges

Navigating the Canadian crypto landscape is like navigating a Canadian winter – beautiful, but potentially treacherous if you’re not properly equipped. The regulatory framework is still evolving, a bit like a hockey game in overtime, with plenty of action and uncertainty. Understanding the rules is crucial for both exchanges and users to avoid a penalty shot (or worse!).The Canadian regulatory landscape for cryptocurrency exchanges is a patchwork quilt of federal and provincial laws, stitched together with varying degrees of clarity.

Currently, there isn’t one overarching federal law specifically designed for crypto exchanges, leading to a situation where different regulatory bodies have a piece of the puzzle, sometimes overlapping and sometimes leaving gaps. This makes compliance a complex balancing act.

Provincial Securities Regulations

Provincial securities commissions, like the Ontario Securities Commission (OSC) and the British Columbia Securities Commission (BCSC), play a significant role. They primarily focus on the offering and trading of crypto assets that they deem to be securities. This means that if a cryptocurrency is classified as a security, its exchange listing and trading fall under their purview, necessitating registration and adherence to securities laws.

Failure to comply could result in hefty fines and legal battles that are as lengthy as a Canadian winter. The determination of whether a crypto asset qualifies as a security often involves a detailed analysis based on the Howe Test, a legal precedent that examines various factors, including the expectation of profit and the involvement of a common enterprise.

Anti-Money Laundering and Terrorist Financing (AML/TF) Regulations

Canada’s Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA) applies to all businesses that deal in virtual currencies, including crypto exchanges. This means Bitget, like other exchanges, must implement robust Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures to identify and report suspicious transactions. These regulations are designed to prevent the use of cryptocurrencies for illicit activities, a critical aspect of maintaining financial integrity and preventing the use of digital currencies in funding illicit activities.

Non-compliance can lead to severe penalties, including substantial fines and even criminal charges. Think of it as the referee blowing the whistle on any suspicious plays.

Comparison of Bitget’s Operating Model with Canadian Regulatory Requirements

Bitget’s global operating model needs to be carefully adapted to meet Canadian regulatory standards. While Bitget may operate under different regulatory frameworks in other jurisdictions, the Canadian context demands a rigorous approach to compliance. This involves not only meeting the minimum requirements of AML/TF regulations but also navigating the complexities of provincial securities laws, particularly concerning the classification of crypto assets as securities.

A mismatch between Bitget’s global operations and Canadian regulatory expectations could create significant compliance challenges. For instance, if Bitget lists a crypto asset deemed a security by a Canadian provincial commission without the necessary registration, it could face enforcement action.

So, you’re wondering about Bitget’s Canadian crypto-legalities? Navigating the frosty landscape of Canadian regulations can be a chilly affair. If stocks are more your speed, though, check out this killer review of Gemini’s platform: Gemini stock trading platform review and comparison. Then, armed with that knowledge, you can return to the slightly more slippery slope of understanding Bitget’s availability north of the border.

Potential Areas of Non-Compliance or Compliance Challenges for Bitget in the Canadian Market

The evolving nature of cryptocurrency regulation in Canada presents ongoing challenges for exchanges like Bitget. One key area is the lack of a comprehensive federal framework, leading to uncertainty about the exact regulatory requirements. Another challenge lies in the classification of crypto assets as securities. The line between a utility token and a security can be blurry, making it difficult to determine which regulatory regime applies.

This necessitates a proactive and adaptable approach to compliance, involving continuous monitoring of regulatory developments and seeking legal advice to ensure ongoing adherence to evolving standards. The potential for non-compliance hinges on several factors, including the interpretation of existing laws and the future direction of regulation in Canada. It’s a bit like trying to predict the next move in a game of shinny – you have to be quick on your feet and anticipate the changes.

User Experiences and Testimonials from Canadian Residents

Navigating the world of cryptocurrency can feel like traversing a digital minefield, especially for Canadians dealing with a constantly evolving regulatory landscape. Understanding the experiences of fellow Canadians who have used Bitget is crucial for anyone considering the platform. These testimonials, while not exhaustive, offer a glimpse into the joys and frustrations of using Bitget for crypto trading in Canada.

So, you’re wondering about Bitget’s Canadian crypto-legalities? Navigating the frosty landscape of Canadian regulations can be a chilly affair! For a slightly warmer alternative (or at least, one with more user reviews!), check out the BitUnix Canada exchange: fees, security, and user reviews before making any final decisions about where to park your digital dough. Ultimately, though, the Bitget situation in Canada remains a question of careful research.

Below, we present a curated selection of user experiences, highlighting both the positive and negative aspects reported by Canadian Bitget users. Remember that individual experiences can vary widely, and these examples should not be taken as definitive statements about the platform’s overall performance.

Canadian User Experiences with Bitget, Bitget availability and legality in Canada for crypto trading

- User experience 1: Brenda from Toronto found Bitget’s user interface surprisingly intuitive and easy to navigate, even as a relative newcomer to crypto trading. She particularly appreciated the comprehensive educational resources available on the platform, which helped her understand the risks involved before making any investments. However, she did mention that customer support response times could be improved, especially during peak hours.

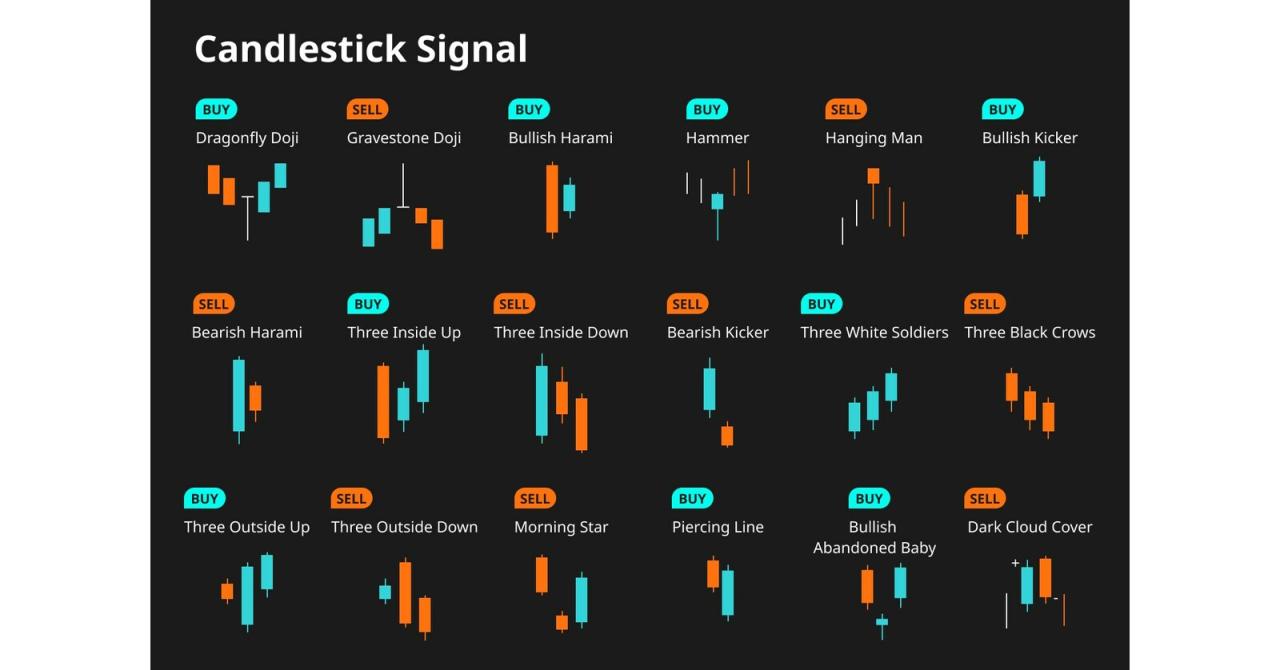

- User experience 2: Marc, a seasoned trader from Vancouver, praised Bitget’s wide range of trading pairs and competitive fees. He found the platform’s advanced charting tools invaluable for his technical analysis. His only complaint was a minor glitch he experienced with a deposit, which was ultimately resolved after contacting support (though it took a few attempts).

- User experience 3: Alia from Montreal had a less positive experience. She reported difficulties verifying her account, a process she found unnecessarily complicated and time-consuming. While she eventually managed to complete verification, the lengthy delay prevented her from participating in a time-sensitive trading opportunity, resulting in a missed profit. She also mentioned encountering some issues with the mobile app’s stability.

Summary of Common Themes in User Testimonials

The following table summarizes recurring themes from Canadian user testimonials about Bitget, providing a concise overview of both positive and negative experiences.

So, you’re wondering about Bitget’s Canadian crypto-legalities? Navigating the world of digital assets can be a wild ride, but before you dive headfirst into Bitcoin, maybe consider broadening your horizons. If forex tickles your fancy, check out these Essential tutorials for beginners in forex currency trading first. Then, armed with some financial know-how, you can tackle the Bitget situation with a more informed (and hopefully less chaotic) approach.

| Experience Type | Positive/Negative | Specific Issue | Date (Approximate) |

|---|---|---|---|

| Account Verification | Negative | Lengthy and complicated process, delays in accessing trading opportunities | Q3 2023 |

| User Interface | Positive | Intuitive and easy to navigate, especially for beginners | Q4 2023 |

| Trading Fees & Pairs | Positive | Competitive fees, wide range of trading pairs available | Q2 2023 |

| Customer Support | Mixed | Response times can be slow during peak hours; some users reported difficulties resolving issues | Ongoing |

| Mobile App Stability | Negative | Occasional glitches and instability reported | Q4 2023 |

Comparison with Other Major Exchanges Operating in Canada

Choosing a crypto exchange can feel like navigating a minefield of fees, features, and security concerns. This section compares Bitget with other major players in the Canadian crypto market, helping you decide which platform best suits your needs and risk tolerance. We’ll delve into the nitty-gritty of fees, security protocols, and the overall user experience, providing a clearer picture of how Bitget stacks up against the competition.

While Bitget offers a compelling platform with its own unique strengths, it’s crucial to understand how it measures up against established Canadian exchanges. This comparison considers factors vital to Canadian users, such as regulatory compliance, customer support accessibility within Canada, and the availability of Canadian dollar (CAD) trading pairs.

So, you’re wondering about Bitget’s Canadian crypto-legalities? Navigating the rules can feel like a wild goose chase, but hey, at least it’s not as confusing as the forex market! If you’re looking for a less volatile (and arguably less exciting) introduction to trading, check out this fantastic beginner’s guide to successful forex trading in Canada: Beginner’s guide to successful forex trading in Canada.

Then, armed with newfound trading wisdom (and maybe a slightly less frantic heartbeat), you can tackle the Bitget beast with more confidence!

Fee Structures and Trading Costs

Bitget’s fee structure is competitive, though specific details are subject to change. It’s essential to check their website for the most up-to-date information. Many exchanges, including Bitget, offer maker-taker fee models, rewarding users who add liquidity to the order book. Direct comparisons require checking the current fee schedules of each platform, as these can fluctuate based on trading volume and other factors.

For instance, a competitor might offer lower fees for high-volume traders, while Bitget might excel with its tiered fee system based on trading volume. Always factor in any potential withdrawal fees when calculating your overall trading costs.

Security Measures and Platform Robustness

Security is paramount in the crypto world. Bitget employs various security measures, including two-factor authentication (2FA), cold storage for a significant portion of its assets, and potentially other advanced security technologies. However, a direct comparison necessitates reviewing the security features and practices of each exchange individually. For example, one competitor might highlight its insurance fund to protect user assets, while another might focus on its robust KYC/AML procedures.

It’s recommended to independently research the security protocols of each platform before making a decision.

Supported Cryptocurrencies and Trading Pairs

The range of cryptocurrencies and trading pairs offered varies significantly between exchanges. Bitget supports a diverse range of cryptocurrencies, but a comprehensive comparison demands a review of the specific assets offered by each competitor. Consider whether your preferred cryptocurrencies are available on each platform before making a selection. The availability of CAD trading pairs is also a key factor for Canadian users, simplifying the process of buying and selling crypto using Canadian dollars.

Customer Support and User Experience

Customer support is crucial, particularly when dealing with a complex financial product like cryptocurrency. Bitget offers various support channels, but the responsiveness and helpfulness of these channels may vary. A comparative analysis requires evaluating the accessibility, responsiveness, and overall quality of customer support provided by each exchange. Factors such as the availability of phone support, email support, and live chat support should be considered.

The user interface (UI) and overall user experience (UX) should also be factored into the decision-making process.

Comparative Table: Bitget vs. Competitors

| Feature | Bitget | Kraken | Coinbase |

|---|---|---|---|

| Trading Fees (Maker/Taker) | Variable, check website | Variable, check website | Variable, check website |

| Security Measures | 2FA, Cold Storage, etc. | Various security features, check website | Various security features, check website |

| Supported Cryptocurrencies | Extensive list, check website | Extensive list, check website | Extensive list, check website |

| Customer Support | Multiple channels, check website | Multiple channels, check website | Multiple channels, check website |

Potential Risks and Considerations for Canadian Users of Bitget

Navigating the world of cryptocurrency can feel like traversing a digital jungle, especially when dealing with international exchanges like Bitget. While potentially lucrative, using Bitget for crypto trading in Canada presents certain risks that savvy investors need to understand and mitigate. This section Artikels those potential pitfalls and offers strategies for minimizing your exposure.Regulatory uncertainty looms large in the Canadian crypto landscape.

The regulatory framework is still evolving, leaving a grey area for some exchanges. This means the legal status of Bitget’s operations in Canada might be subject to change, impacting your access and potentially your assets. Security breaches are another significant concern; no exchange is entirely immune to hacking attempts. The theft of your cryptocurrency could have devastating financial consequences.

Finally, the ever-present risk of fraud, from phishing scams to sophisticated Ponzi schemes, demands constant vigilance.

Regulatory Uncertainty and its Impact

The Canadian government is actively working to establish a clearer regulatory framework for cryptocurrency exchanges. However, until these regulations are fully implemented and Bitget’s compliance is explicitly confirmed, Canadian users face uncertainty. This uncertainty could manifest in several ways: changes to Bitget’s services available in Canada, limitations on withdrawals, or even a complete cessation of operations within the country.

Understanding this evolving regulatory environment is crucial for informed decision-making. Staying updated on regulatory announcements from the Ontario Securities Commission (OSC) and other relevant authorities is essential.

Security Risks and Mitigation Strategies

Bitget, like any exchange, is a potential target for cyberattacks. Hackers constantly seek vulnerabilities to exploit, aiming to steal user funds. To mitigate these risks, Canadian users should employ robust security practices. This includes using strong, unique passwords, enabling two-factor authentication (2FA), regularly reviewing account activity for suspicious transactions, and being wary of phishing emails or text messages.

Consider using a hardware security key for an extra layer of protection. Diversifying your holdings across multiple exchanges (and even offline wallets) can also reduce the impact of a single exchange being compromised. Remember, “Don’t put all your eggs in one basket” applies even more strongly in the crypto world.

So, you’re wondering about Bitget’s Canadian crypto-legality? It’s a wild west out there, folks! Before you dive headfirst into digital gold rushes, though, understanding the differences between trading styles is crucial. For a deep dive into the nuances of forex versus futures, check out this fantastic resource: In-depth analysis of forex and futures trading differences. This knowledge will help you navigate the Bitget landscape (and avoid any regulatory tumbleweeds!).

Fraud Prevention and Reporting Mechanisms

The cryptocurrency space attracts scammers like moths to a flame. Phishing attempts, fake investment opportunities, and rug pulls are common tactics used to defraud unsuspecting users. To protect yourself, only use official Bitget communication channels, verify the legitimacy of any investment opportunity before committing funds, and be extremely cautious of unsolicited offers promising high returns with minimal risk.

If you suspect you’ve been a victim of fraud, report it immediately to the Canadian Anti-Fraud Centre (CAFC) and to Bitget’s customer support. Document all interactions and transactions meticulously. While recovering lost funds isn’t guaranteed, reporting helps authorities identify and prosecute perpetrators. The CAFC provides resources and guidance on reporting cybercrime. Prompt reporting significantly improves the chances of preventing further victimization.

Future Outlook and Predictions for Bitget in the Canadian Market: Bitget Availability And Legality In Canada For Crypto Trading

Predicting the future of any cryptocurrency exchange, especially in the rapidly evolving Canadian regulatory landscape, is akin to predicting the next Bitcoin price – a risky but potentially rewarding endeavor. Bitget’s success in Canada hinges on several interconnected factors, making a definitive forecast challenging but certainly not impossible to speculate on with reasoned arguments.Bitget’s future in Canada will likely be shaped by its ability to navigate the increasingly stringent regulatory environment and adapt to the preferences of Canadian crypto users.

Success will depend on a careful balancing act between growth ambitions and compliance with evolving laws.

Regulatory Compliance and Adaptation

The Canadian government is actively working to establish a comprehensive regulatory framework for cryptocurrencies. Bitget’s proactive engagement with these evolving regulations will be crucial. Failure to comply could lead to significant penalties, operational restrictions, or even a complete withdrawal from the Canadian market. Conversely, early and complete compliance could position Bitget as a trusted and reliable platform, attracting both institutional and retail investors.

We can look to the example of Coinbase, which has invested heavily in regulatory compliance globally, as a model for success. Conversely, exchanges that have failed to adapt to changing regulations in other jurisdictions have faced significant challenges, illustrating the importance of proactive compliance.

Market Penetration and Competitive Landscape

Bitget will need to effectively compete with established players already operating in the Canadian market. This requires a compelling value proposition, whether it be through competitive fees, innovative features, or superior customer service. Consider the success of Kraken, which has established itself as a reliable and well-regarded exchange in Canada. Bitget’s success will depend on differentiating itself from the competition and carving out a niche for itself.

Failure to gain market share could lead to limited growth or even a contraction of its Canadian operations.

User Adoption and Trust

Building trust with Canadian users is paramount. This involves transparent operations, robust security measures, and readily available customer support. Negative publicity or security breaches could severely damage Bitget’s reputation and hinder user adoption. Conversely, positive user experiences and testimonials can foster trust and attract new customers. We can learn from the experience of exchanges that have experienced significant user trust issues, such as those that have suffered from security breaches or have been accused of unethical practices.

These incidents serve as cautionary tales of the importance of building and maintaining trust.

Technological Innovation and Adaptability

The cryptocurrency industry is characterized by rapid technological advancements. Bitget’s ability to adapt to these changes and innovate will be crucial for its long-term success. This includes adopting new technologies, offering a wide range of cryptocurrencies, and providing user-friendly platforms. Exchanges that fail to keep up with technological advancements often fall behind their competitors, losing market share and potentially their relevance.

Conversely, exchanges that embrace innovation and adapt quickly often thrive. Examples of successful innovation in the crypto space include the introduction of decentralized finance (DeFi) protocols and the development of new blockchain technologies.

Final Wrap-Up

So, is Bitget a viable option for Canadian crypto traders? The answer, like a Canadian winter, is complex. While Bitget offers certain advantages, navigating the regulatory landscape and understanding the inherent risks are crucial. Ultimately, the decision rests with the individual investor. Remember to do your own thorough research, compare options, and prioritize security above all else.

Happy trading (responsibly, of course!), and may your crypto portfolio always be as bountiful as a Canadian harvest!