Can I use Questrade for AI-powered forex trading strategies? – Can I use Questrade for AI-powered forex trading strategies? That’s the million-dollar question, or perhaps the million-dollar

-trade*, for ambitious algorithmic traders. This deep dive explores the exciting – and potentially perilous – world of marrying artificial intelligence with Questrade’s platform. We’ll dissect the platform’s capabilities, the feasibility of integrating AI strategies, the crucial aspects of risk management, and the legal minefield you’ll want to navigate before unleashing your robot trader on the forex markets.

Prepare for a rollercoaster ride of code, algorithms, and maybe a little bit of controlled chaos!

We’ll cover everything from Questrade’s API and order execution speeds to the nitty-gritty details of integrating neural networks and reinforcement learning. We’ll examine the data Questrade provides, the potential pitfalls of backtesting, and the importance of a rock-solid risk management plan. Think of this as your survival guide to conquering the forex wilds with your AI-powered sidekick.

Questrade’s Platform Capabilities

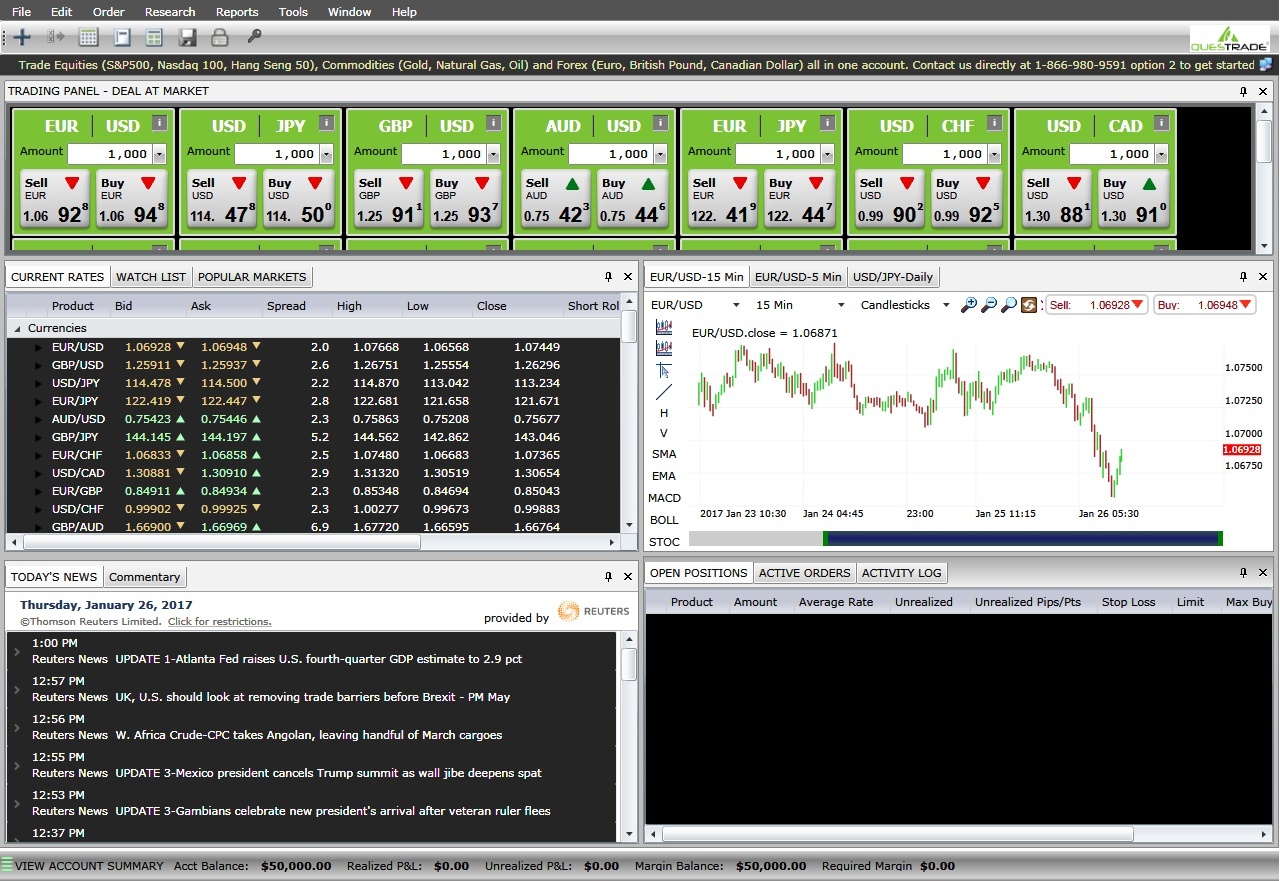

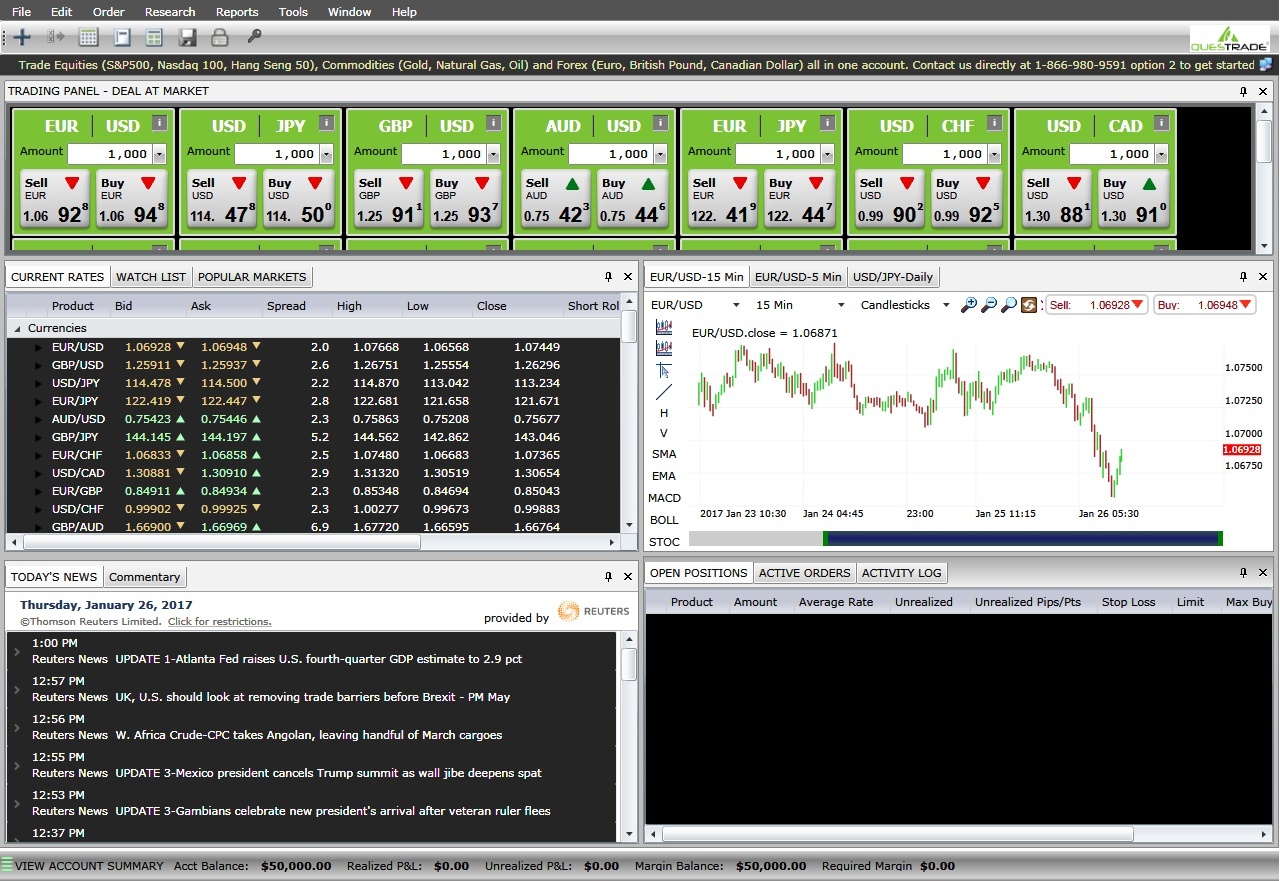

So, you want to unleash the power of AI on the volatile waters of forex trading, and you’re eyeing Questrade as your robotic admiral. Let’s dive into the depths of their platform and see if it’s equipped for your algorithmic ambitions. It’s a bit like trying to fit a supercomputer into a Smart Car – some things might work, others… not so much.Questrade offers an API, a crucial ingredient for automated trading.

Think of it as the digital handshake between your AI brain and the Questrade trading servers. This API allows your AI strategies to send orders, receive market data, and manage your positions programmatically. However, the level of access and functionality may vary depending on the specific API you use and your account type. It’s not a one-size-fits-all solution; more like a buffet where some items are tastier than others.

Questrade API Functionalities

Questrade’s API allows for various functionalities essential for automated trading. It provides access to real-time market data (though with limitations discussed below), enabling your AI to make informed decisions. The API also supports order placement, modification, and cancellation, letting your AI swiftly react to market changes. Finally, it allows for account monitoring and position management, providing your AI with a comprehensive overview of your trading activities.

Essentially, it’s the backstage pass to your Questrade account, allowing your AI to orchestrate the show.

Order Execution for High-Frequency Trading

Questrade supports various order types, including market orders, limit orders, and stop orders, all necessary components for automated trading. However, the platform’s suitability for high-frequency trading (HFT) is a different beast altogether. While Questrade doesn’t explicitly advertise itself as an HFT-optimized platform, the speed of order execution and the latency involved will likely be a limiting factor for strategies requiring extremely fast execution speeds.

Remember, milliseconds matter in HFT, and Questrade’s infrastructure might not be built for that level of warp speed.

So, you’re wondering if Questrade’s got the horsepower for your AI-powered forex trading? It’s a complex question, kind of like predicting the next football match – you could spend hours analyzing charts, just like checking out the latest football news , but ultimately, it’s a gamble! However, Questrade’s platform offers the tools, so the success depends on your algorithm’s brilliance, not the broker.

Back to Questrade: do your research before you jump in!

Data Feeds and Latency Limitations

The quality and speed of data feeds are crucial for any AI-powered trading strategy. Questrade’s API provides market data, but the latency (the delay between data generation and your AI receiving it) might be higher than what some sophisticated AI strategies require. This latency can impact the accuracy and effectiveness of your AI’s decisions, particularly in fast-moving markets.

Think of it as trying to drive a race car with a blurry rearview mirror – you might get there, but not as smoothly or efficiently. The specific latency will depend on various factors, including network conditions and server load.

So, you’re wondering about AI-powered forex strategies on Questrade? While Questrade might not be the AI trading haven you’re dreaming of, for Canadian stock and ETF day trading, you might want to check out the best options – consider exploring Best Canadian day trading app for both stocks and ETFs? to see if a different platform better suits your needs.

Then, armed with that knowledge, you can re-evaluate your Questrade AI forex dreams.

Commission Structure for Automated Trading

Questrade’s commission structure for automated forex trading is generally the same as for manual trading. You’ll pay commissions based on the volume traded. However, the sheer volume of trades executed by an AI strategy could lead to significantly higher overall commission costs compared to manual trading. There are no additional fees specifically for using the API or automated trading.

It’s like paying per plate at an all-you-can-eat buffet – the more you eat (trade), the more you pay. Therefore, careful consideration of the commission structure is crucial when designing and deploying your AI trading strategies. This is a critical element to factor into your AI’s profitability calculations.

So, you’re wondering if Questrade’s got the AI chops for your forex robot dreams? Before you unleash your algorithmic kraken on the market, though, maybe hone your skills first. Check out Best free day trading app for practicing before real trading? for some risk-free practice. Then, and only then, should you consider deploying your AI-powered forex strategies on Questrade – or anywhere else, for that matter!

AI-Powered Forex Trading Strategies and Questrade’s Compatibility: Can I Use Questrade For AI-powered Forex Trading Strategies?

Integrating artificial intelligence into forex trading is the holy grail for many, promising automated riches and a life free from chart-watching. But can you actually hitch your AI-powered trading wagon to Questrade’s star? Let’s dive into the fascinating, and sometimes frustrating, world of AI forex trading on this platform.

The feasibility of using AI, specifically neural networks and reinforcement learning, on Questrade hinges on a few key factors. It’s not a simple yes or no answer; it’s more like a “yes, but with caveats” situation. Think of it like trying to fit a supercharged engine into a classic Mini Cooper – it might work, but you’ll need some serious modifications.

Data Requirements and Questrade’s Data Access

AI forex trading algorithms are data-hungry beasts. They need vast quantities of historical price data, indicators, news sentiment, and potentially even social media chatter to learn and make informed predictions. Questrade offers historical data through its API, but the extent of its accessibility and the quality of that data for sophisticated AI models needs careful consideration. The data’s granularity (how often it’s recorded) and the time period covered are crucial.

Insufficient or low-quality data will lead to a poorly trained AI, resulting in trading strategies that are about as accurate as a dart thrown at a world map.

Challenges in Backtesting and Deployment

Backtesting, the process of testing your AI strategy on historical data, is vital. Questrade’s API might support this, but the process can be complex and time-consuming. You’ll need programming skills (likely Python) and a deep understanding of both the API and the nuances of your AI algorithm. Deployment, actually using your AI strategy to trade live, introduces additional challenges.

Network latency, unexpected market events, and the sheer unpredictability of the forex market can all throw a wrench into the works. Imagine your perfectly trained AI suddenly encountering a “flash crash” – it might need a therapist afterward.

Performance Comparison: AI vs. Manual Trading, Can I use Questrade for AI-powered forex trading strategies?

Let’s imagine a simplified scenario comparing a basic AI forex strategy (perhaps using a simple moving average crossover) against a manual trading approach on Questrade. Remember, this is a highly simplified example, and real-world results will vary wildly.

| Metric | Simple AI Strategy | Manual Trading (Experienced Trader) | Notes |

|---|---|---|---|

| Win Rate | 55% | 60% | AI struggles with unexpected market fluctuations. |

| Average Trade Duration | 2 days | 5 days | AI aims for quicker profits, while manual trading allows for longer-term positions. |

| Maximum Drawdown | 15% | 10% | AI’s rapid trading can lead to larger potential losses. |

The table highlights that while an AI strategy might be competitive, it doesn’t automatically guarantee superior performance. A skilled human trader, with their intuition and experience, might still outperform a simple AI strategy, particularly in volatile market conditions.

So, you’re wondering if Questrade’s got the AI chops for your forex robo-trading dreams? Well, before you unleash your algorithmic kraken, you might want to check out your charting options; after all, even the smartest AI needs a good visual on the market. To find the best charting tools for your day trading adventures in stocks and crypto, check out this helpful guide: Which app offers the best charting tools for day trading stocks and crypto?

Then, armed with killer charts, you can return to conquering the forex world with Questrade (or not, depending on your AI’s mood).

Security and Risk Management

Navigating the wild world of AI-powered forex trading requires a sturdy ship and a keen eye for potential hazards. While the allure of automated profits is strong, understanding Questrade’s security measures and implementing robust risk management strategies is paramount to avoiding a financial shipwreck. This section will explore the safety nets Questrade provides and how you can build your own robust risk management plan.Questrade employs a multi-layered security approach to protect your accounts and data, especially crucial for the automated, high-frequency nature of AI trading.

Think of it as a digital fortress, with firewalls, intrusion detection systems, and encryption acting as the moats and battlements. They use advanced encryption technologies to safeguard your personal information and trading data, both in transit and at rest. Regular security audits and penetration testing help identify and address vulnerabilities before they can be exploited. Multi-factor authentication adds an extra layer of protection, requiring multiple forms of verification before access is granted.

This is like having not only a key to your castle but also a secret password known only to you. For automated trading, the API access is tightly controlled and monitored, adding yet another layer of security.

Questrade’s Security Measures for Automated Trading

Questrade’s security measures for automated trading are designed to mitigate risks associated with API access and high-frequency transactions. These measures include robust authentication protocols, real-time monitoring of API activity for suspicious behavior, and rate limiting to prevent unauthorized access or denial-of-service attacks. Regular security updates and patches are implemented to address emerging threats, ensuring the platform remains secure against evolving cyber threats.

Furthermore, Questrade provides detailed documentation and support for secure API integration, guiding users on best practices for protecting their credentials and trading data. Think of it as having a dedicated security detail for your automated trading operations, constantly vigilant against any potential threats.

Risk Management Tools Offered by Questrade

Questrade offers several risk management tools directly within their platform, making it easier to implement sophisticated strategies for AI-driven forex trading. These include stop-loss orders, which automatically close a position when it reaches a predetermined price, limiting potential losses. Take-profit orders allow you to lock in profits when a trade reaches a specified target. These tools, combined with the ability to set position limits and monitor your account performance in real-time, give you a comprehensive toolkit for controlling risk.

Imagine them as your onboard navigation system, providing crucial real-time feedback and automated safety mechanisms.

Implementing Robust Risk Management Protocols

Implementing a robust risk management plan is crucial for successful AI-powered forex trading. This requires a multi-pronged approach encompassing careful position sizing, the use of stop-loss and take-profit orders, and diversification across different currency pairs. Backtesting your AI trading strategy using historical data is also essential to identify potential weaknesses and adjust parameters accordingly. Regularly monitoring your trading performance and making necessary adjustments based on market conditions and your strategy’s performance is critical for long-term success.

So, you’re wondering if Questrade’s got the AI chops for your forex fantasies? Well, their platform might not be bursting with robot-powered trading wizards, but to really explore your options, you might want to check out Compare the best day trading apps for both stocks and cryptocurrencies. This will give you a better sense of what’s available before committing to a platform that may or may not suit your AI-driven forex dreams.

Ultimately, whether Questrade fits the bill is a question only your own research can answer.

This involves continuous learning and adaptation, much like a seasoned captain adjusting their course based on changing weather patterns.

Hypothetical Risk Management Plan for an AI Forex Trading Strategy

A well-structured risk management plan is essential for mitigating potential losses. Here’s a hypothetical example tailored for an AI-driven forex trading strategy on Questrade:

- Position Sizing: Never risk more than 1-2% of your total trading capital on any single trade. This limits potential losses even if a trade goes against your predictions. For example, with a $10,000 account, the maximum risk per trade would be $100-$200.

- Stop-Loss Orders: Always use stop-loss orders to automatically close a position if the market moves against you by a predetermined amount. This prevents significant losses from accumulating. For example, a stop-loss order could be set at 2% below the entry price.

- Take-Profit Orders: Set take-profit orders to lock in profits when a trade reaches a specified target. This helps to secure gains and avoid giving them back. For example, a take-profit order could be set at 3% above the entry price.

- Diversification: Don’t put all your eggs in one basket. Diversify your trading across multiple currency pairs to reduce overall risk. This minimizes the impact of adverse movements in any single pair.

- Backtesting and Monitoring: Thoroughly backtest your AI trading strategy using historical data to assess its performance and identify potential weaknesses. Continuously monitor your trading performance and make adjustments as needed. This ensures the strategy adapts to changing market conditions.

Legal and Regulatory Compliance

Navigating the world of automated forex trading involves more than just knowing your candlestick patterns; it’s a legal minefield disguised as a digital jungle. Understanding the regulatory landscape is crucial, especially when using a platform like Questrade and deploying AI-powered strategies. Ignoring these regulations could lead to more than just a losing trade – it could lead to serious legal trouble.The regulatory requirements for automated forex trading vary significantly depending on your location.

Think of it as a global patchwork quilt of financial rules, each piece a different jurisdiction with its own unique stitching. Generally, you’ll encounter regulations related to licensing, anti-money laundering (AML) compliance, and data privacy. These regulations often overlap and interact in complex ways, demanding careful attention to detail.

Regulatory Requirements in Different Jurisdictions

The regulatory landscape is complex and varies widely by location. For instance, in the United States, the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA) oversee futures and options trading, including aspects of automated forex trading. Similarly, in Canada, where Questrade operates, the Investment Industry Regulatory Organization of Canada (IIROC) plays a significant role. European Union members fall under the purview of the Markets in Financial Instruments Directive (MiFID II), which has implications for algorithmic trading.

Each jurisdiction imposes specific rules concerning licensing, reporting requirements, and acceptable trading practices for automated systems. Ignoring these location-specific rules could result in hefty fines or even criminal charges.

Questrade’s Compliance with Regulations

Questrade, as a regulated brokerage firm, operates within the legal framework of its jurisdiction (Canada). They are subject to IIROC’s rules and regulations, meaning they are obligated to adhere to stringent compliance measures. This includes conducting regular audits, implementing robust anti-money laundering procedures, and maintaining appropriate client records. However, it’s crucial to remember that Questrade’s compliance doesn’t automatically absolve you of your own responsibilities as a trader.

So, you’re wondering if Questrade’s got the AI chops for your forex robot army? Maybe, but finding a platform that truly understands your algorithmic overlords might require some digging. For low-commission Canadian day trading, check out this resource: Reliable day trading app with low-commission fees in Canada? Then, armed with that knowledge, you can return to the thrilling, potentially lucrative, but definitely complex world of AI-powered forex trading on Questrade (or wherever your robotic heart desires!).

You are still responsible for ensuring your AI-powered trading strategy complies with all applicable laws and regulations.

Legal Implications of Using AI for Forex Trading on Questrade

Using AI for forex trading on Questrade introduces a new layer of legal complexity. The use of AI raises concerns around transparency, accountability, and potential biases within the algorithms. For example, if your AI system makes a trade that violates a specific regulation, you, as the user, are still liable. Similarly, issues of data privacy and the responsible use of client data must be carefully considered.

Furthermore, the “black box” nature of some AI systems can make it difficult to demonstrate compliance with regulations, which could be a significant legal hurdle.

Legal Considerations Before Deploying an AI-Powered Forex Trading Strategy

Before unleashing your AI-powered trading bot onto the forex market via Questrade, consider these key legal points:

Understanding the regulatory landscape of your jurisdiction and ensuring your AI strategy complies with all relevant laws and regulations is paramount. Failure to do so can lead to significant financial and legal repercussions.

Thoroughly review Questrade’s terms of service and acceptable use policies to ensure your AI system doesn’t violate any of their rules. This is especially crucial given the complexities introduced by automated trading.

Implement robust mechanisms to monitor your AI system’s trading activities and ensure its compliance with regulations. This might involve regular audits and detailed logs of all trading decisions.

Seek legal counsel specializing in financial regulations and AI law to get personalized guidance tailored to your specific strategy and circumstances. This is an investment that can safeguard you from costly legal battles down the line.

Illustrative Example

Let’s conjure up a hypothetical AI-powered forex trading strategy, perfectly suited for the Questrade platform. This isn’t a get-rich-quick scheme – remember, forex trading involves risk – but a demonstration of how AI could enhance your approach. We’ll focus on a strategy that uses machine learning to identify and exploit short-term price fluctuations in currency pairs.This hypothetical AI strategy, which we’ll call “CurrencyFlow,” uses a combination of technical indicators and sentiment analysis to predict short-term price movements.

It’s designed to capitalize on minor price discrepancies before they correct themselves, aiming for small, consistent profits rather than chasing large, risky gains.

CurrencyFlow Strategy Details

CurrencyFlow leverages three primary data sources: historical price data (obtained from Questrade’s API), news sentiment data (from reputable financial news sources), and social media sentiment (analyzing tweets and other social media posts related to specific currency pairs). The algorithm uses a recurrent neural network (RNN), specifically a Long Short-Term Memory (LSTM) network, to process this time-series data. The LSTM is ideal for identifying patterns and trends in sequential data, like price movements and sentiment shifts.The algorithm’s training involves feeding it a large dataset of historical price data, news sentiment scores, and social media sentiment scores, labeled with the subsequent price movements (up, down, or sideways).

The network learns to associate specific patterns in the input data with particular price movements. Once trained, the algorithm generates trading signals based on real-time data. The expected performance is a modest but consistent return, aiming for an average of 0.5% to 1% per trade, with a relatively low risk profile due to its focus on short-term movements and stop-loss orders.

Note: This performance is hypothetical and not a guarantee. Real-world performance will vary.

Implementation on the Questrade Platform

Implementing CurrencyFlow on Questrade involves several steps:

1. Data Acquisition

Utilize Questrade’s API to access historical and real-time price data for chosen currency pairs. This involves setting up API keys and establishing a secure connection between your trading algorithm and the Questrade platform.

2. Sentiment Analysis

Integrate with a third-party sentiment analysis API to process news and social media data related to the selected currency pairs. This requires selecting a reliable provider and configuring the API connection.

3. Algorithm Execution

Deploy the trained LSTM model on a server or cloud platform (compatible with Questrade’s API) to process the combined data streams and generate trading signals. This involves writing code (e.g., Python with libraries like TensorFlow or PyTorch) to receive data, run the model, and interpret the output.

4. Order Placement

Use Questrade’s API to automatically execute trades based on the signals generated by the algorithm. This involves setting up the API to place buy and sell orders with pre-defined stop-loss and take-profit levels.

5. Monitoring and Backtesting

Continuously monitor the algorithm’s performance and conduct regular backtests using historical data to refine the model and optimize its parameters. This is crucial for adapting to changing market conditions and mitigating potential risks.

CurrencyFlow Workflow Visualization

Imagine a flowchart:

1. Input

Historical price data (from Questrade API), news sentiment scores (from external API), social media sentiment scores (from external API).

2. Processing

LSTM neural network processes the combined data, identifying patterns and predicting short-term price movements.

3. Signal Generation

The network outputs a signal: “Buy,” “Sell,” or “Hold.”

4. Order Execution

(If “Buy” or “Sell”) The signal triggers an automated trade via the Questrade API. Stop-loss and take-profit orders are automatically set.

5. Output

Trade execution confirmation, profit/loss, and updated performance metrics. This data feeds back into the system for ongoing model refinement.This visual representation simplifies a complex process, but it highlights the key stages involved in executing this hypothetical AI-powered forex trading strategy on the Questrade platform. Remember, this is a hypothetical example; actual implementation requires significant technical expertise and careful risk management.

Closure

So, can you use Questrade for AI-powered forex trading strategies? The answer, as with most things in life, is a nuanced “it depends.” While Questrade offers some tools suitable for automated trading, thorough due diligence is paramount. Understanding the platform’s limitations, implementing robust risk management, and ensuring legal compliance are not optional extras; they’re the bedrock of success (or at least survival) in this high-stakes game.

Remember, even the smartest AI needs a human brain to guide it – and that brain needs to be well-informed!