Coinbase vs Wealthsimple Crypto: Comparing fees, security, and features of these popular platforms – Coinbase vs Wealthsimple Crypto: Comparing fees, security, and features of these popular platforms – sounds like the ultimate crypto cage match, right? Prepare for a no-holds-barred comparison of these digital titans, where we’ll dissect their fees (because who

-doesn’t* love a good fee breakdown?), scrutinize their security measures (because your crypto’s safety is paramount!), and explore their feature sets (because let’s face it, a boring crypto platform is a sad crypto platform).

Get ready to rumble!

This deep dive will leave no digital stone unturned. We’ll compare transaction fees for Bitcoin, Ethereum, and other popular cryptos, examining the impact of payment methods like bank transfers and credit cards. We’ll also analyze their security protocols, insurance coverage, and two-factor authentication (2FA) options, because a secure platform is a happy platform. Finally, we’ll pit their user interfaces, trading features, and customer support against each other, leaving no aspect of the crypto experience unexplored.

Fees Comparison: Coinbase Vs Wealthsimple Crypto: Comparing Fees, Security, And Features Of These Popular Platforms

Let’s dive into the murky world of cryptocurrency transaction fees – a place where fortunes can be made and lost, not just in trading, but also in the seemingly insignificant charges levied by platforms like Coinbase and Wealthsimple Crypto. Think of it as a hidden tax on your digital riches, and understanding it is crucial to maximizing your profits.

Choosing between Coinbase and Wealthsimple Crypto? It’s a fees, security, and features free-for-all! But before you dive into the crypto-deep end, a crucial question arises: can you even legally stash your digital gold in a TFSA? Check out this link to find out: Is it possible to buy cryptocurrency within my TFSA in Canada? Knowing this will help you decide which platform best suits your Canadian crypto-investing strategy, since TFSA eligibility drastically impacts your long-term tax planning.

We’ll dissect the fee structures of both, comparing apples to… well, slightly different-shaped apples.

Transaction Fee Comparison Table

Understanding the fees is crucial for making informed decisions. The fees can vary based on factors such as the cryptocurrency traded, the transaction amount, and the payment method used. Below is a simplified comparison table; always check the most up-to-date information directly on the platforms’ websites. Note that these are examples and may not reflect current real-time pricing.

| Platform | Cryptocurrency | Transaction Amount | Fee (USD Example) |

|---|---|---|---|

| Coinbase | Bitcoin (BTC) | $100 | $1.49 + 0.5% |

| Coinbase | Ethereum (ETH) | $500 | $2.99 + 0.5% |

| Wealthsimple Crypto | Bitcoin (BTC) | $100 | $0 (For many transactions, but check for spread) |

| Wealthsimple Crypto | Ethereum (ETH) | $500 | $0 (For many transactions, but check for spread) |

Fee Structures and Hidden Charges

Coinbase generally employs a tiered fee structure, meaning fees decrease as your trading volume increases. They’re upfront about their fees, but it’s crucial to understand the percentage-based component, which can quickly add up on larger transactions. Wealthsimple Crypto, on the other hand, often advertises “no fees,” but this is a simplification. They may not charge explicit transaction fees, but they make their profit through a “spread,” which is the difference between the buying and selling price of the cryptocurrency.

This spread can be less transparent than a direct fee. Think of it as a slightly inflated price you pay. Both platforms may also charge additional fees for specific services, such as withdrawals or conversions between different cryptocurrencies. Always scrutinize the fine print!

Impact of Payment Methods on Fees

Using a credit card to buy crypto will usually result in significantly higher fees on both platforms, compared to using a bank transfer or debit card. This is due to the processing fees associated with credit card transactions. Think of it as the credit card company taking a cut of your crypto investment before you even get started.

Bank transfers, while often slower, tend to be the most cost-effective option. The specific fees will vary depending on the platform, the amount, and your bank’s policies. Coinbase and Wealthsimple Crypto will clearly display these fees during the purchase process, so always check before confirming your transaction. It’s often a worthwhile trade-off to wait for a bank transfer if you’re concerned about fees.

Coinbase vs Wealthsimple Crypto? It’s a battle of the titans, a clash of the crypto-colossi! We’re weighing fees, security, and features – a truly epic showdown. But before we crown a champion, you might wonder, what’s the overall best choice for Canadian crypto-enthusiasts? To find out, check out this helpful guide: What’s the top-rated and most reliable platform for crypto trading in Canada?

Then, armed with that knowledge, we can return to the Coinbase vs Wealthsimple Crypto debate with renewed vigor!

Security Measures

Coinbase and Wealthsimple Crypto, while both offering crypto trading, take different approaches to safeguarding your digital assets. Think of it like this: Coinbase is the heavily fortified bank, while Wealthsimple Crypto is the well-guarded, but slightly more minimalist, credit union. Both offer security, but their methods and philosophies differ. Let’s delve into the nitty-gritty of their security protocols.Coinbase boasts a multi-layered security approach, including robust firewalls, intrusion detection systems, and cold storage for a significant portion of user funds.

They emphasize regulatory compliance, which, while not a direct security measure, adds a layer of accountability and transparency. Wealthsimple Crypto, on the other hand, leans on established financial institution security practices, benefiting from its parent company’s infrastructure and expertise. While they don’t publicly detail their exact security measures with the same level of granularity as Coinbase, their security is implicitly backed by their regulatory compliance and established security reputation.

Choosing between Coinbase and Wealthsimple Crypto? It’s a battle of the titans, a clash of fees and features! But if you’re feeling adventurous and want a different crypto playground, you might wonder, “Oh, and by the way, Is Kraken stock publicly traded and where can I buy it? ,” before diving back into comparing security protocols and transaction costs on those other platforms.

Ultimately, the best choice depends on your risk tolerance and crypto goals.

Insurance Coverage

Coinbase and Wealthsimple Crypto handle insurance differently. Coinbase doesn’t explicitly advertise a specific insurance policy covering user funds in case of a hack or loss. Instead, their security measures are presented as the primary protection. This approach relies heavily on their internal security protocols and, implicitly, on their financial stability. Wealthsimple Crypto, while not openly detailing specific insurance policies, benefits from the broader insurance and security protocols of its parent company, Wealthsimple, which likely includes coverage for various risks, including those associated with holding and managing digital assets.

The exact details of this coverage are not publicly available, but it provides an additional layer of indirect protection for users.

Two-Factor Authentication (2FA)

Choosing the right 2FA is like picking the perfect lock for your digital vault. Both platforms offer 2FA, but the options and their strengths vary.

| Feature | Coinbase | Wealthsimple Crypto |

|---|---|---|

| 2FA Methods Offered | Authenticator apps (Google Authenticator, Authy), SMS, email | Authenticator apps (likely Google Authenticator and similar), possibly SMS (this needs verification) |

| Strengths | Wide range of options, generally considered more secure than SMS. | Authenticator apps offer strong security, relying on less vulnerable methods than SMS. |

| Weaknesses | SMS 2FA is vulnerable to SIM swapping attacks. | Limited public information on specific 2FA options and their potential weaknesses. Reliance on a single method could be a vulnerability. |

Feature Set Comparison

Choosing between Coinbase and Wealthsimple Crypto often boils down to more than just fees and security; the features themselves play a starring role in the decision-making process. Think of it like choosing between a sleek sports car and a rugged SUV – both get you where you need to go, but the journey and the cargo capacity are vastly different.

Let’s dive into the nitty-gritty of what each platform offers.

Choosing between Coinbase and Wealthsimple Crypto? It’s a fees, security, and features free-for-all! But before you dive in, consider this: are you even allowed to use other platforms like MEXC? Check out if Is MEXC exchange officially available and regulated for use in Canada? before making your final decision. Back to Coinbase vs.

Wealthsimple: remember to factor in those pesky transaction fees!

Cryptocurrency Support

The range of cryptocurrencies available on each platform significantly impacts their appeal to different users. Some investors focus on established coins like Bitcoin and Ethereum, while others seek exposure to a wider variety of altcoins. This is where the platforms diverge, offering different avenues for diversification.

- Coinbase: Coinbase boasts a robust selection, including Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Bitcoin Cash (BCH), and many more. They frequently add new cryptocurrencies to their roster, keeping pace with the ever-evolving crypto landscape. Think of it as the crypto supermarket – plenty of choices for every palate.

- Wealthsimple Crypto: Wealthsimple Crypto’s selection is more curated. While they offer major players like BTC and ETH, their range is generally narrower than Coinbase’s. This might be preferable for users who want a simpler, less overwhelming experience. Imagine it as a carefully selected boutique – fewer choices, but all high-quality.

User Interface and User Experience (UI/UX), Coinbase vs Wealthsimple Crypto: Comparing fees, security, and features of these popular platforms

Navigating a crypto platform should feel intuitive, not like solving a Rubik’s Cube. Both Coinbase and Wealthsimple Crypto aim for user-friendliness, but their approaches differ.Coinbase, with its broader feature set, presents a slightly more complex interface. While still manageable, users might find themselves needing a short learning curve to fully utilize all its functionalities. Think of it as a powerful tool with many buttons – mastering them takes time, but the rewards are great.

Wealthsimple Crypto, on the other hand, opts for a cleaner, minimalist design. Navigation is straightforward, making it ideal for beginners or users who prioritize simplicity over extensive features. It’s like a well-designed smartphone – easy to use, even for a first-timer.

Coinbase vs. Wealthsimple Crypto? It’s a battle of the titans for your digital dough! Choosing the right platform depends on your needs – fees, security, and features all play a part. But if you’re feeling adventurous and want to boost your returns, you might wonder about leverage. That’s where this guide comes in handy: How can I safely trade cryptocurrencies with leverage in Canada?

Understanding leverage is key before diving into the wild world of amplified crypto gains (or losses!). Back to Coinbase and Wealthsimple – consider their insurance policies before choosing your crypto champion.

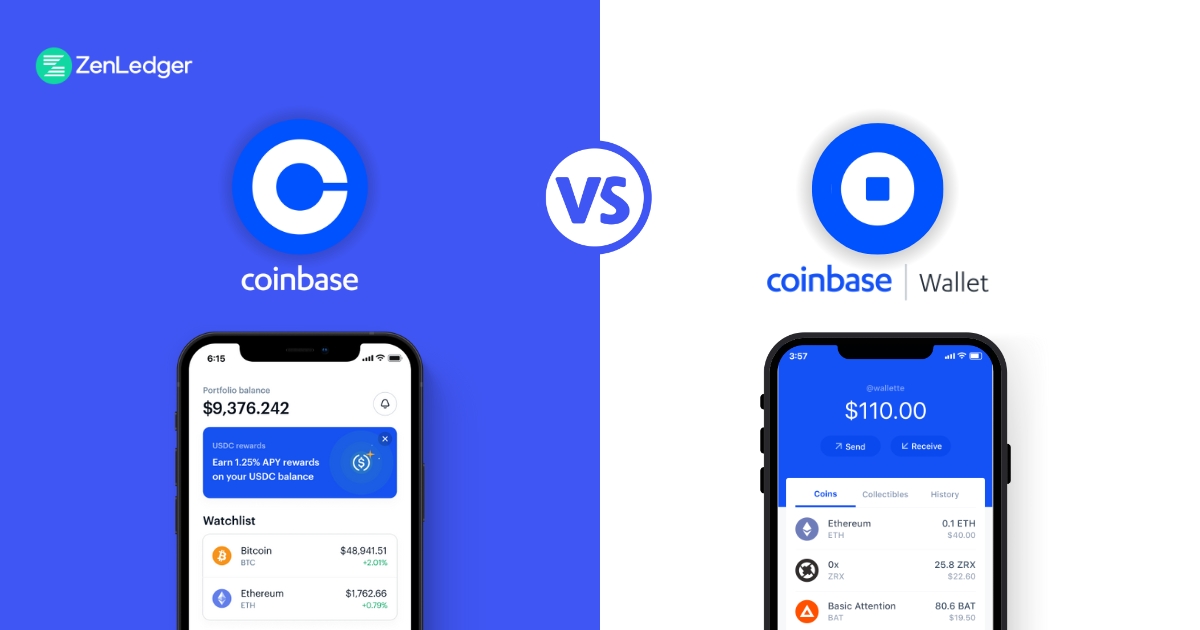

Trading Features Comparison

The trading tools available significantly impact a trader’s ability to execute strategies and manage risk. Let’s compare the core features offered by each platform.

| Feature | Coinbase | Wealthsimple Crypto |

|---|---|---|

| Limit Orders | Yes | Yes |

| Stop-Loss Orders | Yes | No |

| Margin Trading | Yes (Coinbase Pro) | No |

Note: Coinbase offers a professional trading platform, Coinbase Pro, which provides access to margin trading and advanced charting tools. These features are not available on the standard Coinbase platform.

Account Management and Customer Support

Navigating the world of cryptocurrency can feel like traversing a digital jungle, but thankfully, platforms like Coinbase and Wealthsimple Crypto offer varying levels of support to guide you through the leafy green (and sometimes thorny) undergrowth. Let’s examine how these platforms handle account management and customer service, comparing their approaches to onboarding and providing assistance.Account opening and verification on both platforms generally involve providing personal information, including identification documents.

However, the specific requirements and the overall smoothness of the process differ. Think of it as comparing a meticulously planned, well-oiled express train (one platform) to a slightly more chaotic, but ultimately still functional, jeep safari (the other).

Account Opening and Verification Processes

Coinbase’s verification process is generally considered more thorough, requiring multiple forms of identification and potentially more steps. This rigorous approach, while potentially time-consuming, contributes to a higher level of security. Wealthsimple Crypto, on the other hand, may have a slightly quicker onboarding experience, albeit potentially with a less stringent verification process. Both platforms adhere to Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations, but the implementation varies.

The specific documentation needed might include government-issued IDs, proof of address, and potentially additional verification steps depending on the user’s location and transaction volume.

Customer Support Options and Responsiveness

Coinbase offers a range of support options, including email, phone support (in select regions), and a help center with extensive FAQs. While their response times can vary, many users report generally adequate support, especially through the help center. Wealthsimple Crypto primarily relies on email support and an online help center. Their response times might be slower than Coinbase’s, but the quality of support is often praised for its clarity and helpfulness.

The availability of phone support is a key differentiator, offering immediate assistance for urgent issues.

Educational Resources and Tools

Both platforms understand that the crypto world can be intimidating for newcomers. Therefore, they provide various resources to educate users. These resources are crucial for building confidence and making informed decisions.Coinbase offers:

- A comprehensive learning center with articles, videos, and tutorials covering various aspects of cryptocurrency.

- Interactive guides to help users understand trading strategies and risk management.

- Regular blog posts and updates on market trends and news.

Wealthsimple Crypto provides:

- Educational materials within their app, focusing on the basics of cryptocurrency investing.

- Access to market analysis and insights, although less extensive than Coinbase’s offerings.

- A more streamlined approach to education, focusing on simplicity and ease of understanding for beginners.

Regulatory Compliance and Legal Aspects

Coinbase and Wealthsimple Crypto, while both offering crypto trading services, navigate the complex world of financial regulation with distinct approaches. Understanding their compliance strategies is crucial for users concerned about the legal and security implications of their investments. This section will dissect their regulatory compliance measures, operational jurisdictions, and KYC/AML policies.Coinbase, being a publicly traded company operating on a larger, more global scale, faces a higher level of scrutiny.

Their compliance efforts are often cited as a benchmark for the industry, though this doesn’t necessarily translate to a completely risk-free environment. Wealthsimple Crypto, while also committed to compliance, operates within a more regionally focused framework, with varying regulatory landscapes impacting their approach.

Coinbase’s Regulatory Compliance

Coinbase operates under a multi-jurisdictional framework, adapting its practices to meet the specific requirements of each region. They are registered with various financial authorities globally, including the SEC (Securities and Exchange Commission) in the US and equivalent bodies in other countries. This extensive registration process demands a robust internal compliance program covering areas like anti-money laundering (AML), know your customer (KYC), and data privacy.

Their commitment to transparency is reflected in their readily available compliance reports and published policies. Non-compliance could lead to hefty fines or operational restrictions, making compliance a top priority for the company.

Wealthsimple Crypto’s Regulatory Compliance

Wealthsimple Crypto’s regulatory compliance strategy is primarily focused on the regions where it operates, primarily Canada. As a Canadian company, they are subject to the regulations of the Canadian Securities Administrators (CSA) and other relevant authorities. Their compliance program encompasses KYC/AML measures, adhering to the stringent requirements imposed by Canadian regulators. Compared to Coinbase’s global reach, Wealthsimple Crypto’s more geographically limited operations simplify their compliance efforts, although the need for rigorous compliance remains crucial to maintaining their operational license and reputation.

KYC/AML Compliance: A Comparative Look

Both platforms employ robust KYC/AML procedures. This typically involves verifying user identity through documents like passports or driver’s licenses, and monitoring transactions for suspicious activity. Coinbase, given its broader reach, might employ more sophisticated AML technologies and data analysis to detect and prevent potentially illicit activities. Wealthsimple Crypto, while adhering to similar standards, might have a less complex system due to its more concentrated operational focus.

Failure to comply with KYC/AML regulations can result in significant penalties and reputational damage for both companies, underscoring the importance of these measures. Both platforms clearly Artikel their KYC/AML policies on their respective websites.

Legal Jurisdictions and User Implications

The legal jurisdiction where a platform operates significantly impacts its users. Coinbase’s global reach means users in different countries are subject to the laws and regulations of their respective jurisdictions, in addition to Coinbase’s own terms of service. This can lead to variations in tax implications, data protection rights, and dispute resolution mechanisms. Wealthsimple Crypto, with its primary focus on Canada, provides a more streamlined legal framework for Canadian users, though international users might encounter complexities.

Understanding these jurisdictional nuances is crucial for users to manage their risks and ensure compliance with relevant regulations in their own region.

Final Wrap-Up

So, Coinbase or Wealthsimple Crypto? The winner? It depends on your individual needs and priorities. If you prioritize a vast selection of cryptos and advanced trading features, Coinbase might be your champion. If a simple, user-friendly interface and robust security are your main concerns, Wealthsimple Crypto could be the underdog that steals the show.

Ultimately, the best platform for you is the one that best suits your crypto fighting style. Now go forth and conquer the crypto world!