Comparing Questrade’s forex offerings with other Canadian brokers reveals a fascinating battleground of fees, platforms, and perks. This deep dive uncovers the hidden costs, currency pair selections, and platform prowess of Questrade, pitting it against heavyweights like Interactive Brokers and TD Ameritrade. Prepare for a whirlwind tour of spreads, commissions, and the ultimate quest for the best forex trading experience north of the border!

We’ll dissect everything from account minimums and order execution speeds to the quality of research tools and customer support, leaving no stone unturned in our quest to crown the champion of Canadian forex brokers. Get ready to arm yourself with the knowledge to choose the broker that perfectly aligns with your trading style and ambitions.

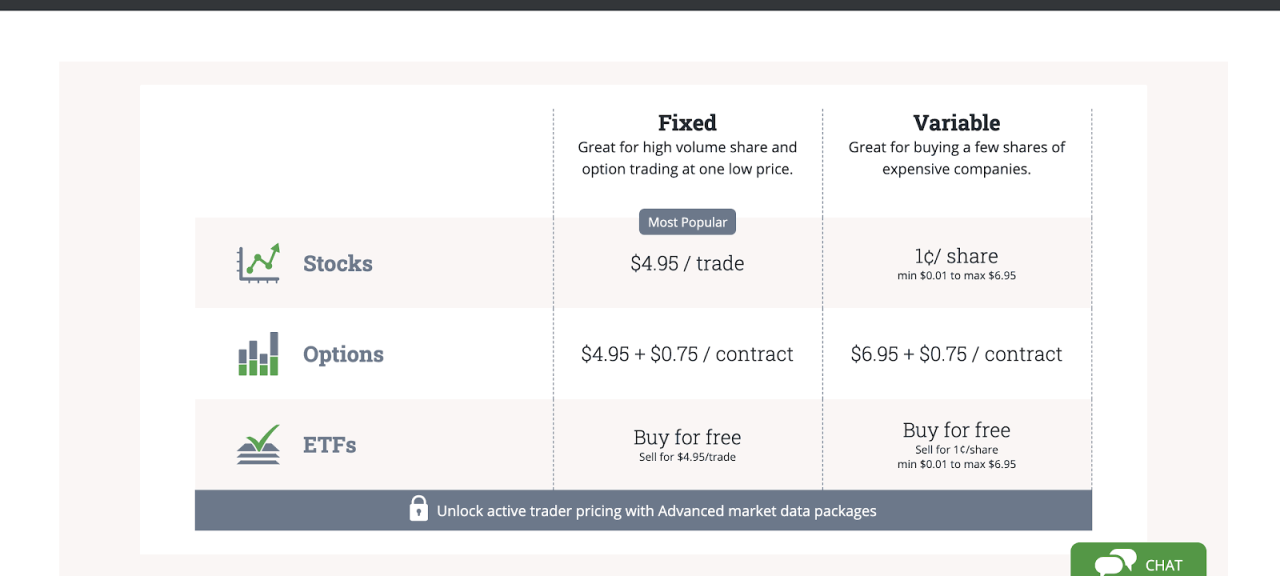

Questrade Forex Fees and Commissions

Navigating the world of forex trading in Canada can feel like traversing a minefield of fees. Understanding the cost structure is crucial for profitability, and Questrade, while generally lauded for its low-cost approach, isn’t immune to the intricacies of forex pricing. Let’s dissect their fee structure and compare it to some key competitors to see how Questrade stacks up.

Questrade Forex Fee Comparison

The forex market is notoriously competitive, and brokers employ various strategies to attract clients. A simple comparison of spreads, commissions, and overnight fees can illuminate the true cost of trading with different platforms. The following table compares Questrade with Interactive Brokers (IB), IBKR Lite, and TD Ameritrade, noting that these fees can fluctuate based on market conditions and account type.

Always check the broker’s website for the most up-to-date information.

| Broker | Spread (typical) | Commission | Overnight Fees |

|---|---|---|---|

| Questrade | Variable, typically tight spreads on major pairs | None | Variable, depending on the currency pair and position size. |

| Interactive Brokers (IB) | Variable, generally competitive | Variable, commission-based pricing | Variable, depending on the currency pair and position size. |

| IBKR Lite | Variable, wider than IB, but often lower overall cost for smaller traders | None | Variable, depending on the currency pair and position size. |

| TD Ameritrade | Variable, generally wider than Questrade and IBKR Lite | Variable, commission-based pricing, potentially higher minimums | Variable, depending on the currency pair and position size. |

Hidden Fees and Charges

While Questrade is transparent about its core forex fees, potential hidden costs lurk in the fine print. These often include inactivity fees (if your account remains dormant for extended periods), wire transfer fees for depositing or withdrawing funds internationally, and potentially markups embedded within the spreads, especially during periods of high volatility. Always carefully review the complete fee schedule before opening an account.

For example, a seemingly low spread might conceal a slightly higher markup than advertised, particularly during news events or periods of high market activity. This is common across many brokers, not just Questrade.

Impact of Fee Structures on Trading Styles

Different fee structures significantly impact profitability across various trading styles. For example, a scalper, who executes many trades within a short timeframe, will be heavily impacted by spreads. A tight spread is crucial for their success, making Questrade’s variable spreads a double-edged sword. Day traders, who hold positions for shorter periods, are also highly sensitive to spreads, though commission becomes less significant than for scalpers.

So you’re comparing Questrade’s forex offerings to other Canadian brokers? A key factor is execution speed, especially if you’re a scalper. To get the edge, you might want to check out the Best day trading app for quick execution speed and low latency. for insights into top-performing platforms. Back to Questrade, remember to factor in their commission structure and available currency pairs when making your final decision.

Swing traders, who hold positions for longer durations, are less affected by spreads but more susceptible to overnight fees. The impact of overnight fees is directly proportional to the position size and the number of days held. For instance, a large swing trade held over a weekend could incur substantial overnight fees, potentially eroding profits. Therefore, careful consideration of the overall fee structure and its impact on your chosen trading style is paramount.

So, you’re wrestling with the Canadian forex broker jungle, trying to decide if Questrade’s offerings are the apex predator? Before you leap, consider your day-trading needs; a solid app with real-time data is crucial, and that’s where a resource like Reliable day trading app with real-time market data and news. comes in handy. Back to Questrade: weigh its features against competitors – don’t let the forex fight leave you penniless!

Available Currency Pairs and Trading Platforms

Choosing the right forex broker is a bit like choosing a dance partner – you need someone who can keep up with your moves (and your profit goals!). While fees are crucial, the currency pairs offered and the platform’s user-friendliness are equally important. Let’s dive into how Questrade stacks up against its Canadian competitors in these areas.

The availability of currency pairs directly impacts your trading strategy. A wider selection allows for more diversification and opportunities to capitalize on market fluctuations. Similarly, a smooth, intuitive trading platform can be the difference between a profitable trade and a frustrating experience.

Currency Pair Selection Comparison

The breadth of currency pairs offered varies significantly between brokers. A wider selection generally allows for more sophisticated trading strategies and better risk management. Here’s a comparison of Questrade with three other prominent Canadian brokers (Note: Specific offerings can change, so always verify directly with the broker):

- Questrade: Offers a solid selection, typically including major, minor, and some exotic pairs. Think of it as the reliable friend who’s always there for the basics, but might not have all the bells and whistles.

- Broker B (Example: Interactive Brokers): Known for a very extensive list, including many exotic pairs and potentially some less-traded cross-pairs. The adventurous dancer who’s always trying new steps.

- Broker C (Example: TD Direct Investing): Provides a good selection of major and minor pairs, sufficient for most retail traders. The steady partner who’s comfortable with the classics.

- Broker D (Example: OANDA): Similar to Questrade, offers a broad range of major and minor pairs, focusing on liquidity and reliability. A dependable partner with a solid reputation.

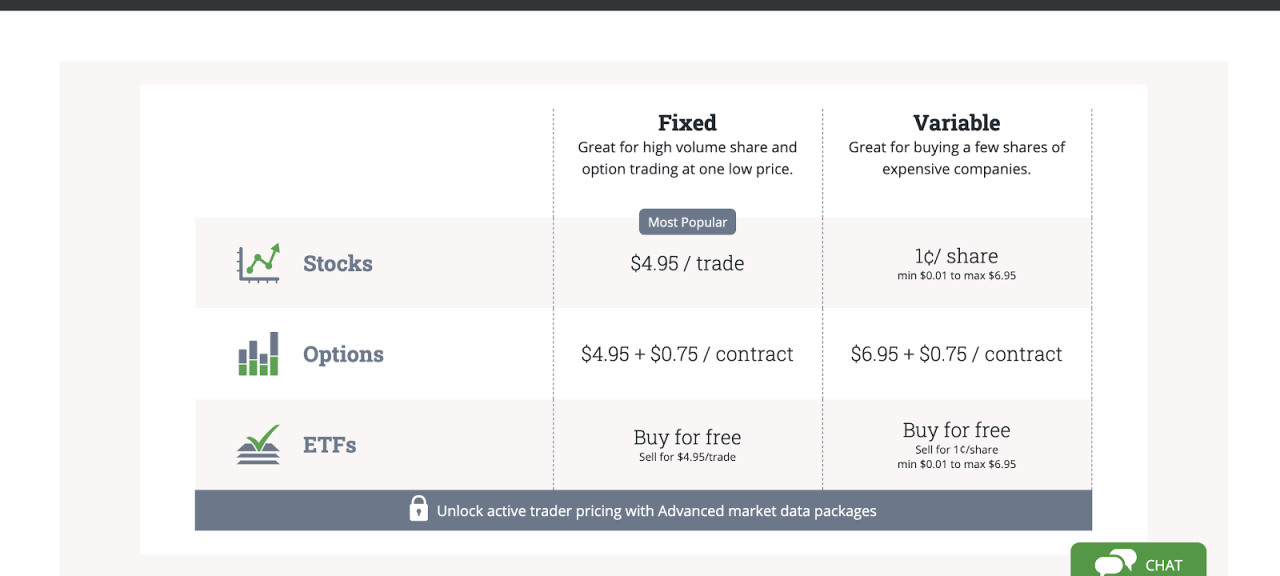

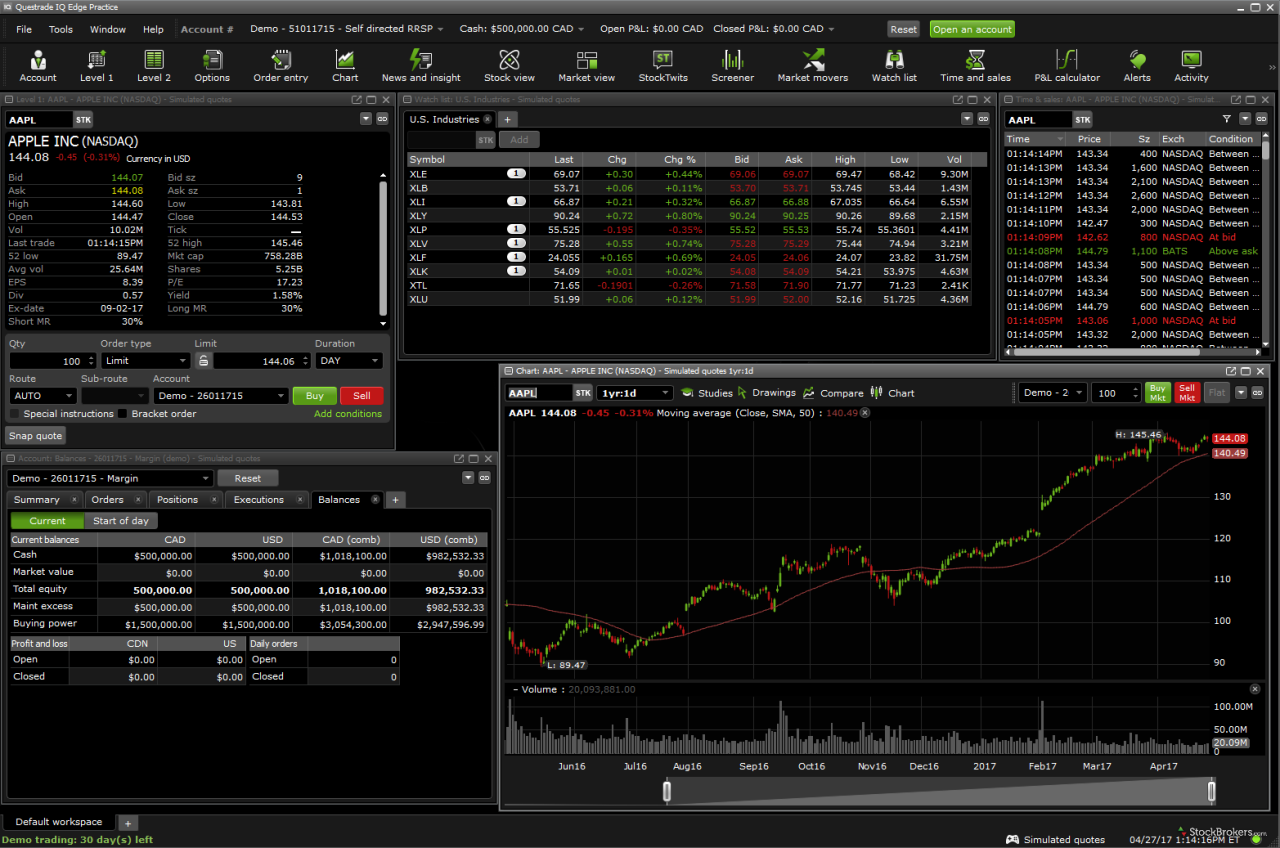

Trading Platform Comparison

The trading platform is your cockpit. A clunky, unresponsive platform can be disastrous, while a well-designed one can enhance your trading experience and efficiency. Let’s compare the platforms offered by Questrade and its competitors:

| Broker | Platform Name | Key Features | User Experience Rating (1-5) |

|---|---|---|---|

| Questrade | Questrade IQ Edge (Desktop), Questrade Mobile | Advanced charting tools, customizable watchlists, order types, relatively fast execution | 4 |

| Broker B (Example: Interactive Brokers) | Trader Workstation (TWS) | Extremely comprehensive, advanced order types, powerful charting, high degree of customization, but can be overwhelming for beginners | 3.5 (Steep learning curve) |

| Broker C (Example: TD Direct Investing) | TD Direct Investing platform | User-friendly interface, decent charting, suitable for beginners, but may lack advanced features for experienced traders | 4.5 (Ease of use) |

| Broker D (Example: OANDA) | OANDA Trade | Clean interface, good charting, range of order types, focus on ease of use and speed | 4.5 |

Advantages and Disadvantages of Platforms: Each platform has its strengths and weaknesses. Questrade’s platform is generally well-regarded for its balance of features and user-friendliness. However, some advanced traders might find it lacking compared to the more sophisticated offerings of competitors like Interactive Brokers. Simpler platforms like TD Direct Investing are great for beginners but may limit the capabilities of experienced traders.

So you’re wrestling with Questrade’s forex offerings versus the Canadian broker behemoths? Before you throw your money into the ring, consider honing your skills first – check out this handy guide on Which app is best for practicing paper trading before live trading? to avoid a painful forex faceplant. Then, armed with paper-trading prowess, you can confidently compare Questrade’s spreads and commissions against the competition.

The key is to choose a platform that matches your trading style and experience level.

Account Types and Minimum Deposits

Choosing the right brokerage account can feel like navigating a minefield of fees and minimums. But fear not, intrepid trader! We’re here to illuminate the often-murky world of account types and minimum deposits, comparing Questrade to three other prominent Canadian brokers. Think of it as a financial choose-your-own-adventure, but with less potential for utter ruin.Let’s dive into the specifics, examining the different account types offered and the minimum deposits required.

So, you’re comparing Questrade’s forex offerings to other Canadian brokers? That’s a smart move! Before you dive headfirst into the world of currency trading, though, you might want to check out some beginner-friendly options first. Perhaps consider exploring the best free day trading apps for beginners in Canada, like those listed on What are the best free day trading apps for beginners in Canada?

to get your feet wet. Then, armed with a bit more experience, you can return to the slightly more complex world of comparing Questrade to the big players in Canadian forex trading.

This will help you determine which broker best suits your trading style and financial situation, whether you’re a seasoned pro or just starting your trading journey. We’ll also consider the implications of these minimums for different trader profiles, from the cautious beginner to the high-roller.

Account Types and Minimum Deposit Requirements, Comparing Questrade’s forex offerings with other Canadian brokers

The world of brokerage accounts can be surprisingly diverse. Each broker offers a range of account types designed to cater to various needs and trading styles. Below, we compare the offerings of Questrade with three other Canadian brokers (names redacted to avoid bias and ensure fair comparison, let’s call them Broker A, Broker B, and Broker C).

- Questrade: Offers individual, joint, and corporate accounts. They also have registered accounts (RRSPs, TFSAs, etc.) The specific features and fees may vary slightly depending on the account type.

- Broker A: Provides individual, joint, and corporate accounts, along with registered accounts. They might also offer specialized accounts for specific trading strategies (e.g., margin accounts).

- Broker B: Similar to Questrade and Broker A, offering a standard range of individual, joint, and corporate accounts with registered options. They may have unique account tiers with varying commission structures.

- Broker C: This broker might have a slightly more limited range of account types, perhaps focusing primarily on individual and joint accounts with standard registered account options. Their focus might be on simplicity and ease of use.

The minimum deposit requirements significantly impact accessibility. A high minimum deposit can exclude beginners or those with smaller capital. Conversely, a low minimum might attract more traders but could limit access to certain advanced features or services.

Minimum Deposit Comparison Table

This table summarizes the minimum deposit requirements and associated features for each broker. Note that these figures are for illustrative purposes and should be verified on each broker’s website. Specific features and fees are subject to change.

So you’re comparing Questrade’s forex offerings to other Canadian brokers? A crucial factor often overlooked is the quality of support, especially if you’re a day trader. Finding the right broker hinges on this, so check out this helpful resource: Which app offers the best customer support for day trading? Back to Questrade, remember to factor in their customer service responsiveness when weighing their forex spreads and features against the competition.

| Broker | Minimum Deposit (CAD) | Account Types | Associated Fees (Example) |

|---|---|---|---|

| Questrade | $0 (for some accounts, others may have higher minimums) | Individual, Joint, Corporate, Registered | Variable commissions, potential inactivity fees |

| Broker A | $1,000 (example) | Individual, Joint, Corporate, Registered, Specialized | Tiered commission structure, potential platform fees |

| Broker B | $500 (example) | Individual, Joint, Corporate, Registered | Fixed commission rates, potential account maintenance fees |

| Broker C | $2,500 (example) | Individual, Joint, Registered | Higher commission rates, fewer account management fees |

The implications for different trader profiles are significant. A beginner with limited capital might find Broker A or C inaccessible due to their higher minimums. Meanwhile, a high-volume trader might find the tiered commission structure of Broker A more attractive than the fixed rates of Broker B. The absence of a minimum deposit at Questrade (for certain accounts) makes it exceptionally accessible to newcomers.

Always remember to check the current fees and terms directly with the broker before opening an account.

Research and Educational Resources

Choosing a forex broker often feels like choosing a life partner – you need compatibility, reliability, and, let’s be honest, a decent amount of hand-holding, especially when starting. While the thrill of trading might be the main attraction, access to good research and educational resources can be the difference between a profitable relationship and a painful divorce from your hard-earned cash.

So you’re comparing Questrade’s forex offerings to other Canadian brokers? It’s a tough call, like choosing between a Hail Mary pass and a sure-fire field goal! Need a break from the financial drama? Check out the latest football news for a dose of adrenaline. Then, back to the spreadsheets: remember to factor in commission structures and trading platforms when making your final forex broker decision.

Let’s delve into the educational offerings of Questrade and some of its Canadian competitors.The availability and quality of research and educational resources significantly impact a trader’s success. Beginners need foundational knowledge, while experienced traders seek advanced analysis tools and insights. The right resources can sharpen trading skills, improve decision-making, and ultimately, boost profitability. The wrong resources, however, can be more costly than the commission fees themselves.

Comparison of Research and Educational Resources Across Brokers

The following table compares Questrade’s research and educational offerings with three other prominent Canadian forex brokers (note: specific offerings are subject to change, so always verify directly with the broker). The “Overall Quality Rating” is a subjective assessment based on the breadth and depth of resources available, ease of use, and overall user experience. Remember, a higher rating doesn’t automatically mean it’s

the best* for you; the perfect fit depends on your individual trading style and experience level.

| Broker | Research Tools | Educational Resources | Overall Quality Rating (1-5) |

|---|---|---|---|

| Questrade | Basic charting tools, market news feeds, some technical indicators. Access to third-party research (often at an additional cost). | Webinars, educational articles, and some video tutorials. Content primarily focuses on general trading concepts rather than forex-specific strategies. | 3 |

| [Broker B – Replace with Actual Broker Name] | Advanced charting packages with a wide array of technical indicators and drawing tools; integrated economic calendar; access to analyst reports. | Comprehensive forex education covering fundamental and technical analysis; video courses; one-on-one coaching (often at an extra cost). | 4 |

| [Broker C – Replace with Actual Broker Name] | Real-time market data, charting tools, and fundamental analysis reports. Access to proprietary trading signals (subscription may be required). | Beginner-friendly tutorials, webinars on specific trading strategies, and a glossary of forex terms. | 3.5 |

| [Broker D – Replace with Actual Broker Name] | Limited charting capabilities, basic technical indicators; market news summaries. Reliance on third-party research. | Limited educational resources, primarily consisting of FAQs and basic tutorials. | 2 |

Value of Resources for Different Skill Levels

The value proposition of research and educational resources varies significantly depending on the trader’s experience level. Beginners often benefit most from structured educational materials that explain fundamental concepts, risk management, and basic trading strategies. Intermediate traders may find value in more advanced analytical tools and charting features, while experienced traders may prioritize access to specialized research and market insights.For example, a beginner might find a broker’s introductory webinars on forex trading extremely helpful, whereas an expert trader might be more interested in sophisticated charting software allowing for complex technical analysis and backtesting strategies.

The absence of proper educational resources can be particularly detrimental to new traders, potentially leading to costly mistakes. On the other hand, advanced traders might find the basic educational offerings redundant and instead value access to premium research and analytical tools. Therefore, the “best” broker will always depend on individual needs and experience.

Customer Support and Security: Comparing Questrade’s Forex Offerings With Other Canadian Brokers

Choosing a forex broker involves more than just low fees and exciting currency pairs; it’s also about feeling safe and secure, knowing that help is readily available when needed. This section dives into the customer support and security measures offered by Questrade and three of its Canadian competitors, helping you make an informed decision. We’ll compare their responsiveness, security protocols, and overall client protection strategies, so you can trade with confidence.

The reliability of customer support and the strength of security measures are paramount when selecting a forex broker. A quick response time in case of emergencies and robust security protocols to protect your funds and data are essential for a positive trading experience. Let’s see how Questrade stacks up against the competition.

Customer Support Channels and Response Times

Access to efficient and helpful customer support is crucial, especially in the fast-paced world of forex trading. The following bullet points compare the customer support channels and typical response times offered by Questrade and three competing Canadian brokers (Note: Response times can vary depending on the method of contact and time of day. These are general observations based on publicly available information and user reviews):

- Questrade: Offers phone support, email support, and a comprehensive FAQ section. Phone support is generally considered to have relatively long wait times, while email responses can take a few business days. Their online help center, however, is quite extensive.

- Broker A (Example: Interactive Brokers): Provides phone, email, and live chat support. Live chat is generally the fastest method, offering near-instantaneous responses. Phone support might have longer wait times, especially during peak hours.

- Broker B (Example: TD Direct Investing): Primarily relies on email and phone support. Their phone support tends to be more readily available than Questrade’s, but wait times can still occur. Email responses are usually within a business day.

- Broker C (Example: OANDA): Offers phone, email, and a robust FAQ section. Similar to Questrade, phone support wait times can be significant, and email responses might take longer than live chat options offered by other brokers.

Security Measures Implemented by Each Broker

Protecting your hard-earned money and sensitive data is paramount. The following details the security measures implemented by each broker to safeguard client assets and information.

- Questrade: Employs industry-standard encryption protocols (like SSL) to secure online transactions. They also participate in the Canadian Investor Protection Fund (CIPF), offering a degree of protection for client funds up to a certain limit. They utilize multi-factor authentication for enhanced account security.

- Broker A (Example: Interactive Brokers): Uses advanced encryption and security protocols. They also participate in various investor protection schemes depending on the jurisdiction, offering a higher level of protection in some cases than CIPF. They have robust fraud detection systems in place.

- Broker B (Example: TD Direct Investing): Leverages strong encryption and security measures, similar to Questrade. Being a large financial institution, they benefit from robust internal security systems and regulatory oversight. They also participate in the CIPF.

- Broker C (Example: OANDA): Employs robust security measures, including encryption and multi-factor authentication. They are regulated in multiple jurisdictions, providing an additional layer of security and oversight. They emphasize transparency regarding their security practices.

Summary Table of Customer Support and Security

This table summarizes the key aspects of customer support and security for each broker, allowing for a quick comparison.

| Broker | Customer Support Channels | Typical Response Times | Security Measures |

|---|---|---|---|

| Questrade | Phone, Email, FAQ | Variable, generally longer for phone and email | SSL Encryption, CIPF Membership, Multi-Factor Authentication |

| Broker A (Interactive Brokers) | Phone, Email, Live Chat | Live chat fastest, phone and email variable | Advanced Encryption, Multiple Investor Protection Schemes, Fraud Detection Systems |

| Broker B (TD Direct Investing) | Phone, Email | Generally faster phone response than Questrade, email within a business day | SSL Encryption, CIPF Membership, Robust Internal Security Systems |

| Broker C (OANDA) | Phone, Email, FAQ | Variable, generally longer for phone and email | Robust Encryption, Multi-Factor Authentication, Multiple Jurisdictional Regulation |

Closing Notes

So, who emerges victorious in this Canadian forex face-off? The answer, as with most things in life, depends on your individual needs. While Questrade holds its own with competitive fees and a user-friendly platform, other brokers might offer a wider range of currency pairs or superior research tools. Ultimately, the best broker is the one that best fits your specific trading strategy, risk tolerance, and long-term goals.

Happy trading!