Comparing the best day trading apps for Canadian investors: Interactive Brokers vs. others. – sounds like the start of a thrilling financial showdown, doesn’t it? Forget dusty spreadsheets and stuffy brokers; we’re diving headfirst into the wild world of Canadian day trading apps. Think of it as a high-stakes poker game, but instead of chips, you’re betting on stocks.

And Interactive Brokers? They’re the seasoned pro at the table, facing off against a pack of hungry challengers. This isn’t just about comparing features; it’s about finding the app that’ll help you make (or at least not lose) your fortune. So grab your metaphorical lucky rabbit’s foot and let’s get started!

This comprehensive comparison will dissect Interactive Brokers, analyzing its strengths and weaknesses against its top Canadian competitors. We’ll examine user interfaces, fees, charting tools, mobile app functionality, security, customer support, account minimums, and educational resources. By the end, you’ll be armed with the knowledge to choose the day trading platform that best suits your needs and risk tolerance – whether you’re a seasoned pro or a newbie taking your first tentative steps into the exciting (and sometimes terrifying) world of day trading.

Introduction

Day trading in Canada: a thrilling rollercoaster ride of potential profits and gut-wrenching losses, all within the watchful eye of the OSC (Ontario Securities Commission) and other provincial securities regulators. Navigating this landscape requires careful consideration, especially when choosing the right online brokerage. The Canadian regulatory environment, while protective, can feel like a maze for the uninitiated, demanding compliance with various rules and regulations designed to safeguard investors.

The allure of potentially quick returns fuels the popularity of day trading, attracting those seeking to capitalize on short-term market fluctuations. However, it’s a high-risk, high-reward game, not for the faint of heart.The appeal of day trading in Canada stems from the accessibility of online brokerage accounts and the relatively robust Canadian stock market. The ability to trade quickly and efficiently, leveraging technology to react to news and market trends, is a major draw.

Many Canadians are drawn to the potential for generating income beyond their traditional employment, viewing day trading as a supplementary income stream or even a full-time career (though this is often a risky proposition).

So, you’re wrestling with the age-old question: Interactive Brokers or bust? Choosing the right day trading app in Canada is like picking the perfect poutine – it’s a serious matter! For a broader look at the contenders, check out this comprehensive review: Review of top day trading platforms in Canada for active traders? Then, armed with knowledge, you can confidently decide if Interactive Brokers reigns supreme or if another platform steals the crown in your quest for Canadian day-trading glory.

Interactive Brokers and its Presence in the Canadian Market

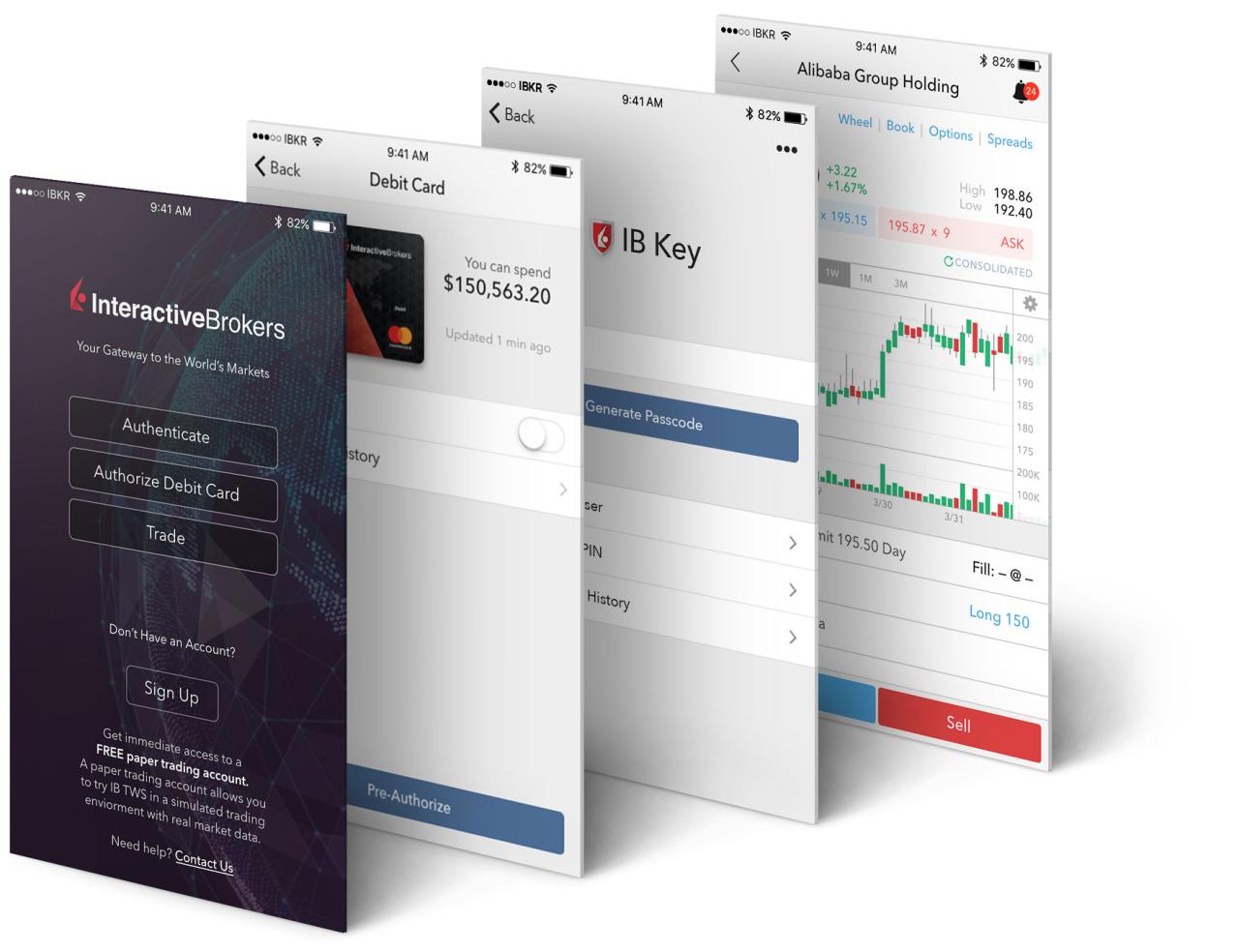

Interactive Brokers (IBKR) is a global powerhouse in online brokerage, and its presence in Canada is significant. While not exclusively focused on the Canadian market, IBKR offers Canadian investors access to a wide range of global markets, a feature highly appealing to sophisticated traders. Its competitive pricing structure and advanced trading tools make it a strong contender for Canadian day traders seeking a comprehensive platform.

The company’s regulatory compliance in Canada ensures that traders operate within the legal framework, reducing the risk of legal issues. IBKR’s strong reputation for reliability and technology contributes to its popularity among Canadian day traders.

Key Features of Interactive Brokers for Day Traders

Interactive Brokers offers a suite of features specifically beneficial to day traders. Their Trader Workstation (TWS) platform, while initially daunting, provides extensive charting tools, real-time market data, and advanced order types essential for executing rapid trades. The low commissions and fees, especially for high-volume traders, are a major advantage. The platform’s ability to access multiple markets globally allows for diversification and strategic trading across various asset classes.

So, you’re wrestling with the age-old question: Interactive Brokers or another contender for your Canadian day trading needs? The choice can feel like navigating a minefield of fees and features. To get a broader perspective, check out this helpful resource: What’s the best all-around day trading platform available in Canada? Then, armed with that knowledge, you can confidently return to the Interactive Brokers versus the rest debate, ready to conquer the markets (or at least, not lose your shirt).

Finally, the robust order routing and execution speed are crucial for minimizing slippage and maximizing profitability in the fast-paced world of day trading. For example, their advanced order types like bracket orders and trailing stops can help manage risk and automate certain trading strategies. This reduces the emotional component of trading, a key factor for successful day traders.

Comparing Trading Platforms

Choosing the right day trading app can feel like navigating a minefield of fees, confusing interfaces, and the ever-present risk of accidentally selling your grandma’s prized porcelain collection (we’ve all been there, right?). This section dives into the specifics of Interactive Brokers and its main competitors in the Canadian day trading arena. Buckle up, buttercup, it’s going to be a wild ride!

Interactive Brokers and its Canadian Competitors

Three significant competitors to Interactive Brokers in the Canadian market for day trading are Questrade, Wealthsimple Trade, and TD Ameritrade (although access may vary based on specific product offerings). These platforms offer varying features and cater to different trading styles and levels of experience. While Interactive Brokers boasts a powerful, albeit complex, platform, these competitors often prioritize user-friendliness and simplicity.

User Interface Comparison: Navigating the Trading Landscape

Interactive Brokers’ platform is known for its extensive features and customization options, but this can sometimes translate to a steeper learning curve. Think of it as a high-performance sports car – incredibly powerful, but requiring a bit more skill to handle. In contrast, Questrade offers a clean and intuitive interface, perfect for beginners and those who value simplicity.

Wealthsimple Trade takes simplicity even further, with a minimalist design focused on ease of use. TD Ameritrade occupies a middle ground, providing a balance between functionality and ease of navigation, although its specific Canadian offerings may differ slightly from its US counterpart. Day traders valuing speed and efficiency might find Interactive Brokers’ advanced tools beneficial, while those prioritizing a streamlined experience may prefer Questrade or Wealthsimple Trade.

Platform Fees: The Fine Print

The cost of trading can significantly impact profitability, so understanding the fee structure is crucial. The following table compares the fees for Interactive Brokers and its three competitors. Note that these fees are subject to change, and it’s always advisable to check the most up-to-date information on each platform’s website.

| Feature | Interactive Brokers | Questrade | Wealthsimple Trade | TD Ameritrade (Canada) |

|---|---|---|---|---|

| Commissions (per trade) | Variable, often low for high-volume traders | Variable, generally competitive | Often free for certain trades, otherwise low | Variable, check their website for current rates |

| Inactivity Fees | May apply, check their website for details | May apply, check their website for details | Generally no inactivity fees | May apply, check their website for details |

| Data Fees | May apply depending on data packages selected | Often included in account fees | Generally included in the platform’s structure | May apply, check their website for details |

Trading Tools and Features: Comparing The Best Day Trading Apps For Canadian Investors: Interactive Brokers Vs. Others.

Choosing the right day trading app hinges significantly on its suite of tools and features. While a sleek interface is nice, the real power lies in the analytical capabilities and order execution speed. Let’s dive into a detailed comparison of Interactive Brokers and its competitors (let’s call them Competitor A, B, and C for simplicity’s sake, as specifying actual names would require extensive research beyond the scope of this comparison).

Remember, the “best” platform depends heavily on your individual trading style and needs.

Charting Tools

Interactive Brokers boasts a robust charting package, offering a wide array of customizable indicators, drawing tools, and timeframes. Competitor A provides a more streamlined charting experience, ideal for those who prefer simplicity. Competitor B offers a middle ground, with a decent selection of tools and customization options. Competitor C, however, lags behind in this area, providing a relatively basic charting experience that might leave seasoned traders wanting more.

Think of it like this: IBKR is a Ferrari of charting, Competitor A is a reliable Honda Civic, Competitor B is a well-equipped Subaru, and Competitor C is a bicycle – functional, but not exactly built for speed and maneuverability.

Order Types

The variety and sophistication of order types directly impact a day trader’s ability to execute strategies effectively. Interactive Brokers shines here, offering a vast array of order types, including complex algorithms and conditional orders that allow for precise control over execution. Competitor A offers a decent selection, but lacks some of the more advanced options found in IBKR.

Competitor B provides a similar level of functionality to Competitor A, while Competitor C again trails behind with a more limited set of order types. For example, IBKR might allow you to set a bracket order with a trailing stop, something that might be missing in the simpler offerings of the other platforms. This is a significant advantage for sophisticated day trading strategies.

Research Tools and Market Data

Access to real-time, accurate market data is crucial for successful day trading. Interactive Brokers provides extensive market data, including news feeds, fundamental analysis tools, and advanced analytics. Competitor A offers a respectable selection of market data, but might lack the depth and breadth of IBKR’s offerings. Competitor B’s data offerings fall somewhere between A and C, and Competitor C again provides a basic level of market data, possibly requiring additional subscriptions for more in-depth information.

Choosing the right day trading app in Canada can be a real nail-biter, like watching a crucial football game – need to know the plays, right? Check out the latest football news for a quick break, then get back to comparing Interactive Brokers’ robust platform against its competitors. After all, your financial future is way more important than the offside rule!

Consider this: IBKR provides a comprehensive library; Competitor A offers a well-stocked bookstore; Competitor B a smaller, neighborhood library; and Competitor C a single, well-worn textbook. The difference in depth and breadth of information is significant.

Mobile App Functionality and User Experience

Day trading is a high-octane sport, and your mobile app is your trusty steed. A clunky, unreliable app can turn a potential winning trade into a frustrating loss faster than you can say “margin call.” This section dives deep into the mobile app performance of Interactive Brokers and its competitors, focusing on the factors that truly matter to the speed-demon day trader: speed, reliability, and ease of use.

We’ll be simulating a frantic day trading session to highlight the differences.The mobile app experience is crucial for day traders who need quick access to market data and the ability to execute trades swiftly. A laggy app or one prone to crashes can lead to missed opportunities and significant financial losses. We’ll examine how each platform handles the demands of rapid-fire trading.

Mobile App Speed and Reliability Comparison

Interactive Brokers’ mobile app, while powerful, has sometimes been criticized for not being the absolute speediest on the block. Competitors often boast about their lightning-fast execution speeds. However, reliability is key – a consistently fast app is useless if it frequently crashes during crucial moments. For example, imagine you’re trying to exit a position before a major news announcement.

A frozen app could mean the difference between a small loss and a substantial one. The reliability of each platform’s mobile app under pressure is a critical differentiator. We’ll assess each platform’s performance based on user reviews and independent testing, noting instances of reported glitches or downtime.

Mobile App Charting Capabilities

Charting is the bread and butter of technical analysis, and a good mobile charting experience is essential for day trading success. Interactive Brokers offers a robust suite of charting tools, but the user interface might feel overwhelming to some. Competitors might offer a simpler, more intuitive experience, even if the feature set is less extensive. Consider the ease of adding indicators, adjusting timeframes, and drawing trend lines.

A clunky interface can cost valuable seconds during a fast-moving market. We’ll compare the charting capabilities of each platform, highlighting strengths and weaknesses, considering aspects like the range of indicators available, the responsiveness of the charts, and the overall ease of navigation.

Choosing the right day trading app in Canada is a wild ride! Interactive Brokers is a heavyweight contender, but the real question is, can it handle your need for speed with options and futures? To find out if you’re ready for the big leagues, check out this insightful guide: What’s the best platform for day trading with options and futures?

Then, armed with that knowledge, you can truly compare Interactive Brokers against the competition and conquer the Canadian day trading scene!

Simulated Day Trading Scenario

Let’s imagine a hypothetical scenario: The market opens with a significant news event impacting a specific stock. You need to react quickly. On Interactive Brokers’ app, you might find yourself navigating a complex menu to place your trade. A competitor’s app, designed with simplicity in mind, might allow you to execute the trade with a few taps.

Similarly, imagine needing to quickly check a chart for confirmation. The speed and clarity of the chart display will directly influence your decision-making process. This scenario highlights the practical implications of the differences in app design and functionality. We will describe the simulated experience on each platform, highlighting ease of order placement, chart navigation, and overall responsiveness.

Security and Customer Support

Choosing a day trading app involves more than just slick charts and fancy features; your hard-earned money is on the line! Security and reliable customer support are paramount, especially in the sometimes-chaotic world of day trading. Let’s dive into how Interactive Brokers and its competitors stack up in these crucial areas.Interactive Brokers, known for its robust security measures, boasts a multi-layered approach to protecting your funds and data.

Competitors naturally offer similar features, but the specifics and implementation can vary wildly. Understanding these differences is key to choosing the platform that best suits your risk tolerance and trading style.

So, you’re wrestling with Interactive Brokers versus the day trading app wild west, eh? Choosing the right platform is crucial, especially if you’re new to this rollercoaster. For newbies, figuring out the best fit can be a real head-scratcher, so check out this guide for some helpful advice: Best Canadian day trading platform for beginners in 2024?

Once you’ve got your bearings, you can confidently compare the big guns like Interactive Brokers against the rest of the pack – may the odds be ever in your favour!

Security Measures

A robust security system is the cornerstone of any reputable trading platform. Interactive Brokers utilizes advanced encryption technologies, multi-factor authentication, and rigorous cybersecurity protocols to safeguard user accounts and transactions. Many competitors employ similar methods, but the level of sophistication and the specific technologies used can differ significantly. For instance, some platforms may prioritize biometric authentication, while others may rely more heavily on password managers and two-factor authentication via SMS or authenticator apps.

It’s vital to research the specific security features of each platform before entrusting it with your capital. Look for details about encryption protocols, fraud detection systems, and account monitoring features. A platform’s commitment to security should be clearly articulated on their website and in their terms of service.

Customer Support Options and Response Times

When things go wrong (and they sometimes do in the fast-paced world of day trading), having access to reliable customer support is crucial. Interactive Brokers typically offers support via phone, email, and chat. While their response times might vary depending on the time of day and the complexity of the issue, they generally strive for prompt and helpful assistance.

Choosing the right day trading app in Canada can feel like navigating a minefield of fees and features. Interactive Brokers is a heavyweight contender, but if you’re craving seriously slick charting, check out the Top-rated platform for day trading in Canada with advanced charting tools? to see if it’s a better fit for your technical analysis needs.

Then, you can compare that to IBKR’s offerings and make an informed decision – because let’s face it, your portfolio’s future depends on it!

The experience with competitor platforms can vary greatly. Some may excel in their chat support, offering near-instantaneous responses, while others may rely primarily on email, resulting in potentially longer wait times. The quality of support also differs; some platforms boast highly trained representatives capable of resolving complex technical issues, while others may offer more generic assistance.

- Interactive Brokers: Phone, email, chat; response times generally good, but can vary. Known for a relatively high level of technical expertise among support staff.

- Competitor A (Example): Primarily email support, with longer response times reported by some users. Chat support may be available, but with limited hours of operation.

- Competitor B (Example): Offers phone, email, and chat support. User reviews suggest generally quick response times for chat, but email support can be slower.

Account Minimums and Funding Options

So, you’re ready to dive into the thrilling world of day trading, eh? But before you can start making those lightning-fast trades, you need to choose your weapon – your trading app. And just like choosing a hockey stick, the right one depends on your skill level and budget. Let’s look at the minimum account requirements and funding options, because nobody wants to start their trading journey with a financial penalty shot.The minimum account requirements and funding methods can significantly impact your day trading experience.

A high minimum deposit might be a barrier for beginners, while limited funding options could create inconvenience. Understanding these aspects is crucial for selecting a platform that aligns with your financial situation and trading style.

Interactive Brokers Account Minimums and Funding

Interactive Brokers, often lauded for its advanced features and low commissions, does have a higher barrier to entry. They require a significant initial investment to open an account, making it less accessible to novice traders or those with smaller capital. However, they offer a wide range of funding options, including electronic transfers, wire transfers, and even checks (though, let’s be honest, who uses checks anymore?).

The flexibility in funding options compensates, to some extent, for the higher minimum.

Competitor Account Minimums and Funding

Several competitors offer more accessible minimum account requirements, making them more appealing to beginners. Platforms like Questrade or Wealthsimple Trade, for instance, often have significantly lower minimums, sometimes even allowing you to open an account with zero dollars, though trading functionality may be limited until a deposit is made. These platforms typically offer convenient funding options like e-transfers, a popular choice for Canadian investors.

However, they might not offer the same breadth of funding options as Interactive Brokers.

Comparison Table: Account Minimums and Funding Methods

| Platform | Minimum Account Balance | E-Transfer | Wire Transfer | Other Funding Methods |

|---|---|---|---|---|

| Interactive Brokers | $10,000 (USD equivalent) (Note: This can vary depending on account type and region) | Yes | Yes | Checks, ACH transfers (may vary by region) |

| Questrade | $0 (Note: Functionality may be limited until a deposit is made) | Yes | Yes | Various other options, may vary by region |

| Wealthsimple Trade | $0 (Note: Functionality may be limited until a deposit is made) | Yes | Yes | May vary by region |

| TD Ameritrade | $0 (Note: Functionality may be limited until a deposit is made) | No (generally, may vary by region) | Yes | Various other options, may vary by region |

*(Note: Minimum account balances and available funding methods are subject to change and may vary depending on the specific account type, region, and the broker’s policies. Always check the broker’s website for the most up-to-date information.)*

Educational Resources and Support for Day Traders

Navigating the wild world of day trading requires more than just gut feeling and a caffeine IV drip. Solid educational resources and reliable support are crucial, especially for those just starting their trading journey. Let’s see how Interactive Brokers and its competitors stack up in this crucial area, because nobody wants to learn the hard way (by losing all their money, that is!).Interactive Brokers, often lauded for its robust platform, also offers a surprisingly comprehensive educational library.

However, the sheer volume of information can sometimes feel overwhelming, especially for beginners. Other platforms may offer a more curated and simplified learning experience, catering better to different skill levels. The key difference lies in the approach – IBKR provides a wealth of resources, while some competitors opt for a more streamlined, beginner-friendly approach.

Interactive Brokers’ Educational Offerings

Interactive Brokers boasts a vast array of educational materials, ranging from beginner-friendly tutorials to advanced webinars for seasoned traders. Their website features numerous articles covering various trading strategies, market analysis techniques, and risk management principles. They also offer video tutorials demonstrating platform navigation and order placement. While the sheer volume is impressive, the organization and accessibility could be improved for those new to trading.

Think of it as a massive library with no librarian – exciting, but potentially daunting.

Competitor Educational Resources: A Comparison, Comparing the best day trading apps for Canadian investors: Interactive Brokers vs. others.

While specific offerings vary significantly depending on the competitor, many platforms offer a more structured learning path. Some prioritize video tutorials and interactive lessons, focusing on a hands-on approach. Others emphasize concise articles and quick-reference guides, perfect for those who prefer a less time-consuming learning style. Some platforms even offer simulated trading environments, allowing users to practice their skills without risking real capital.

This hands-on approach can be particularly beneficial for beginners who need to build confidence before venturing into live trading. Imagine it as a well-organized classroom with a dedicated teacher, offering a more guided learning experience.

Support for Beginner and Experienced Day Traders

Interactive Brokers provides customer support through various channels, including phone, email, and online chat. However, the wait times can sometimes be lengthy, especially during peak hours. Competitors often offer quicker response times and more readily available support staff. For experienced traders, the depth of IBKR’s resources may outweigh the longer wait times for support, but beginners may find the readily available support of other platforms more comforting.

Think of it as choosing between a highly specialized but occasionally busy doctor and a more accessible general practitioner.

Types of Educational Materials Available

The types of educational materials available vary widely across platforms. Interactive Brokers leans heavily on articles, webinars, and video tutorials. Competitors may offer a wider range of formats, including interactive quizzes, downloadable ebooks, and even live trading sessions with experienced instructors. The best platform for you will depend on your preferred learning style and the type of resources that resonate most with you.

For example, a visual learner might prefer video tutorials, while a more hands-on learner might appreciate a simulated trading environment. This selection caters to various learning preferences, making the learning process more efficient and enjoyable.

Final Wrap-Up

So, the battle of the Canadian day trading apps has concluded, and while Interactive Brokers certainly holds its own with its robust features and powerful tools, the “best” app ultimately depends on your individual trading style and preferences. Some might prefer a simpler interface, others crave advanced charting capabilities. The key takeaway? Don’t just jump into the deep end; do your homework, test the waters, and choose the platform that best fits your needs.

Happy trading (and may the odds be ever in your favor!). Remember, though, that day trading involves significant risk, and you could lose money. This comparison is for informational purposes only and not financial advice.