Cryptocurrency trading options available through Questrade’s forex platform: Dive into the wild, wild west of digital assets, but with a surprisingly sensible guide. Forget tumbleweeds and dusty saloons; we’re talking sophisticated trading tools, a diverse crypto selection, and the potential to ride the rollercoaster of cryptocurrency markets – all from the comfort of your armchair (or hammock, if you’re feeling adventurous).

This isn’t your grandpappy’s stock market; this is where Bitcoin meets brokerage accounts, and the possibilities are as limitless as the blockchain itself. Buckle up, buttercup, it’s going to be a bumpy ride!

This exploration of Questrade’s cryptocurrency offerings will delve into the specifics of their forex platform’s capabilities, comparing them to industry giants. We’ll unravel the mysteries of order types (market orders? Limit orders? Sounds like a spy movie!), dissect fee structures (because nobody likes unexpected charges!), and explore the platform’s user-friendliness (or lack thereof – we’ll be brutally honest).

We’ll also examine Questrade’s security measures, because keeping your digital riches safe is paramount. Prepare for a comprehensive and, dare we say, entertaining journey through the world of crypto trading on Questrade!

Questrade’s Forex Platform and Cryptocurrency Access

So, you want to dive into the wild world of cryptocurrency trading, but you’re not sure if you’re ready to jump into the deep end with a less-than-reputable exchange? Questrade’s forex platform offers a potentially safer, more regulated approach – a sort of crypto wading pool, if you will. Let’s explore how they let you dip your toes in.Questrade’s access to cryptocurrency trading is achieved through their forex platform, offering a slightly different experience than dedicated crypto exchanges.

Instead of directly buying and holding crypto, you’re essentially trading CFDs (Contracts for Difference). This means you’re speculating on the price movements of cryptocurrencies without actually owning the underlying assets. Think of it as betting on the crypto rollercoaster, but with a slightly more grown-up safety net.

Cryptocurrencies Available on Questrade

Questrade offers a selection of major cryptocurrencies for CFD trading. While not as extensive as some dedicated crypto exchanges, their offerings generally include Bitcoin (BTC), Ethereum (ETH), and potentially Litecoin (LTC) and others, depending on market conditions and Questrade’s decisions. The exact selection is subject to change, so always check their website for the most up-to-date list. Don’t expect to find every obscure altcoin here; this isn’t your average crypto bazaar.

Comparison of Questrade’s Cryptocurrency Offerings with Competitors

Comparing Questrade to other major brokerage platforms in terms of crypto offerings reveals some interesting contrasts. While Questrade provides a regulated environment and access through a familiar forex platform, the selection of cryptocurrencies and trading features might be more limited than what you’d find on a dedicated exchange like Coinbase or Binance. However, this trade-off in variety might be worth it for traders who prioritize security and regulation over a vast array of obscure tokens.

Fee Comparison Table

The following table compares fees, minimum trade sizes, and available cryptocurrencies across three platforms: Questrade, Coinbase, and Binance. Remember, these are simplified examples and actual fees and minimums can vary depending on several factors, including your trading volume and account type. Always refer to each platform’s official fee schedule for the most accurate information.

So you’re eyeing Questrade’s forex platform for crypto trading? Smart move! But before you dive headfirst into those volatile waters, you’ll need killer charts. That’s where the question arises: check out this helpful guide, Which app offers the best charting tools for day trading? , to find the perfect visual aid for your crypto conquest. Then, armed with superior charting, you can confidently navigate Questrade’s crypto offerings.

| Feature | Questrade (CFD Trading) | Coinbase | Binance |

|---|---|---|---|

| Typical Spread (BTC/USD) | Variable, check platform | Variable, check platform | Variable, check platform |

| Minimum Trade Size | Varies by instrument | Varies by instrument | Varies by instrument |

| Available Cryptocurrencies | BTC, ETH, potentially others | Wide range of cryptocurrencies | Extremely wide range of cryptocurrencies |

| Commission Fees | Typically included in the spread | Variable, depending on payment method | Variable, depending on trading volume and payment method |

Trading Mechanisms and Order Types

So, you’ve dipped your toes into the exciting world of crypto trading through Questrade’s forex platform – congratulations! Now, let’s talk about the nitty-gritty: how you actually place those orders and, more importantly, how to do it without accidentally launching your portfolio into the sun. Understanding order types is crucial for navigating the sometimes-volatile crypto market. Think of it as learning the dance steps before hitting the dance floor.Understanding the different order types available on Questrade’s platform is key to successful cryptocurrency trading.

Each type offers a unique approach to managing risk and capitalizing on market opportunities. Let’s explore these essential tools.

Market Orders

Market orders are the simplest type. You’re essentially shouting, “I want to buy/sell NOW!” at the market. The order executes immediately at the best available price. This is great for speed, but less so for price certainty. Imagine you’re buying Bitcoin and its price is rocketing upwards.

A market order gets you in quickly, but you might pay a slightly higher price than you’d like. Conversely, if the price is plummeting, you’ll get a lower price, but you might miss out on better deals.

Limit Orders

A limit order is your sophisticated cousin. You specify the exact price at which you want to buy or sell. The order only executes if and when the market reaches your desired price. This is ideal for minimizing risk and maximizing profit. Let’s say you believe Ethereum will hit $2,000.

Questrade’s forex platform offers exciting cryptocurrency trading options, but remember, the wild west of finance can be a bit…wild. Before you dive headfirst into Bitcoin bonanzas, brush up on your scam-dodging skills by checking out this invaluable guide: How to avoid forex scams and recover losses from fraudulent activities. Knowing the risks keeps your crypto dreams from turning into crypto nightmares, allowing you to fully enjoy Questrade’s offerings responsibly.

You place a limit order to buy at $1,999. If it hits that price, your order executes; if not, nothing happens. It’s like setting a price alert and having the system automatically buy for you when the alert triggers.

Stop-Loss Orders

Stop-loss orders are your safety net. You set a price at which you automatically sell an asset to limit potential losses. Imagine you bought Bitcoin at $25,000 and want to protect yourself against a sudden drop. You might set a stop-loss order at $24,000. If the price falls to that level, your order triggers, and you sell, minimizing your losses.

It’s like a parachute for your investments.

So you’re thinking about riding the crypto rollercoaster via Questrade’s forex platform? Smart move! But before you dive headfirst into those volatile waters, you might want to broaden your horizons. Check out Compare the best day trading apps for options trading. to see what other exciting (and potentially less stomach-churning) options are out there. Then, armed with knowledge, you can conquer Questrade’s crypto offerings like a seasoned pro!

Stop-Limit Orders

This order type combines the features of stop-loss and limit orders. You set a stop price and a limit price. The order becomes a limit order once the stop price is reached. For example, if you own Bitcoin at $25,000 and want to sell if it drops to $24,000 but at a minimum of $24,200, you’d set a stop price of $24,000 and a limit price of $24,200.

Questrade’s forex platform offers a wild west of cryptocurrency trading options, from Bitcoin bandits to Ethereum explorers. Before you saddle up and risk your hard-earned cash, though, you might want to practice your trading skills first; check out this handy guide: Which app is best for practicing paper trading before live trading? Then, once you’ve mastered the art of virtual wealth, you can confidently dive into Questrade’s crypto offerings and potentially become a digital gold rush tycoon!

This strategy helps to minimize losses while aiming for a slightly better selling price than a pure stop-loss order.

Risk Management Best Practices

Effective risk management is crucial. Never invest more than you can afford to lose. Diversify your portfolio across different cryptocurrencies to mitigate risk. Use stop-loss orders to protect against significant losses. Regularly review your positions and adjust your orders as needed.

Avoid emotional trading – stick to your plan!

So you’re thinking about diving into the wild world of cryptocurrency trading via Questrade’s forex platform? It’s a rollercoaster, I tell ya! Need a break from the volatility? Check out the latest football news for some much-needed down time before you bravely return to those fluctuating crypto prices. Remember, though, Questrade offers a variety of options to manage your risk, so choose wisely, my friend!

Hypothetical Trading Scenario

Let’s say you believe Dogecoin will surge. You might place a limit order to buy at a slightly lower price than the current market price, aiming to secure a better entry point. Simultaneously, you’d place a stop-loss order to protect against a sudden downturn, limiting potential losses. If the price skyrockets, you’ll profit; if it plummets, your stop-loss order will help to minimize your losses.

As the price moves in your favor, you might adjust your stop-loss order to lock in profits and reduce risk.

Fees and Commissions

Let’s talk turkey – or rather, let’s talk about the not-so-fun part of crypto trading: fees. Nobody likes paying them, but understanding them is crucial to keeping your crypto portfolio healthy and happy. We’ll dissect Questrade’s fee structure, compare it to the competition, and hopefully, leave you feeling a little less… fleeced.

So you’re eyeing Questrade’s forex platform for crypto trading? Smart move! But before you dive headfirst into the volatile world of Bitcoin, maybe brush up on your skills. Check out this amazing resource for beginners: Best day trading app for beginners with detailed tutorials. Then, armed with knowledge (and maybe a lucky rabbit’s foot), conquer those Questrade crypto options!

Questrade’s fee structure for cryptocurrency trading, while generally competitive, involves several components that need careful consideration. Understanding these nuances will allow you to make informed decisions and potentially minimize your overall costs.

Trading Fees

Trading fees are the charges levied for each cryptocurrency transaction you execute. These fees are directly tied to the volume and type of trade. While Questrade doesn’t explicitly advertise a percentage-based fee structure like some competitors, their fees are typically embedded within the spread – the difference between the bid and ask price. This means the fees are implicitly included in the price you pay to buy or sell.

Think of it as a built-in, slightly sneaky fee, but it’s a common practice in the industry. The actual cost varies depending on market volatility and liquidity for the specific cryptocurrency.

Platform Fees

Beyond trading fees, there aren’t any explicit platform fees charged by Questrade for accessing or using their cryptocurrency trading platform. This is a positive aspect, as many competitors charge monthly subscription fees or minimum account balance fees. However, remember the implicit fees within the spread still apply. It’s always wise to compare the total cost of your trades across different platforms to get a true sense of value.

Other Applicable Charges

While Questrade is relatively transparent about its core fees, be aware of potential indirect costs. For instance, if you frequently transfer funds to and from your Questrade account, you might incur fees associated with these transactions, depending on your payment method. These aren’t directly related to cryptocurrency trading itself but can still impact your overall profitability. Always check the specifics of your funding method’s fee schedule.

Comparison to Other Platforms

Comparing Questrade’s fee structure to competitors like Coinbase Pro or Binance requires careful analysis. While Coinbase Pro and Binance might advertise lower percentage-based trading fees, Questrade’s embedded fees within the spread can sometimes be comparable, particularly for smaller trades. Larger trades, however, might reveal a slight advantage with platforms offering explicit percentage-based fees. The best approach is to compare the total cost of a hypothetical trade across multiple platforms to see which offers the most competitive pricing for your trading volume and style.

- Questrade: Implicit fees within the spread; no explicit platform fees; potential external transfer fees.

- Coinbase Pro: Explicit percentage-based trading fees; potential platform fees depending on account type; potential external transfer fees.

- Binance: Explicit percentage-based trading fees (often lower than Coinbase Pro); minimal platform fees; potential external transfer fees.

Remember, the “best” platform depends on your individual trading strategy and volume. Always do your research and compare fees across multiple platforms before committing to one.

Platform Features and User Experience: Cryptocurrency Trading Options Available Through Questrade’s Forex Platform

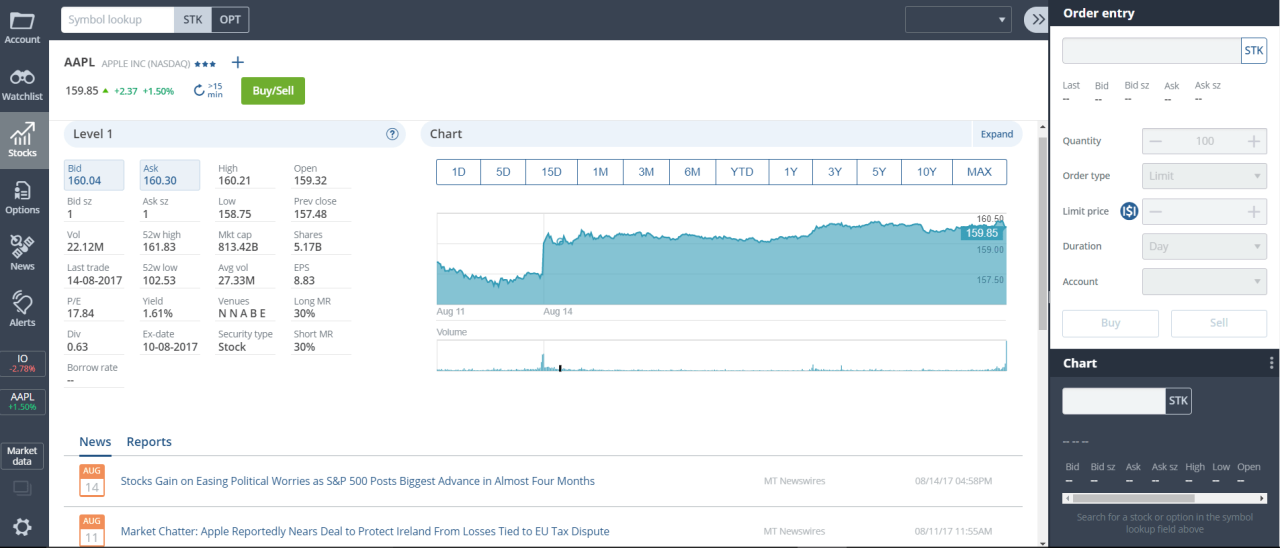

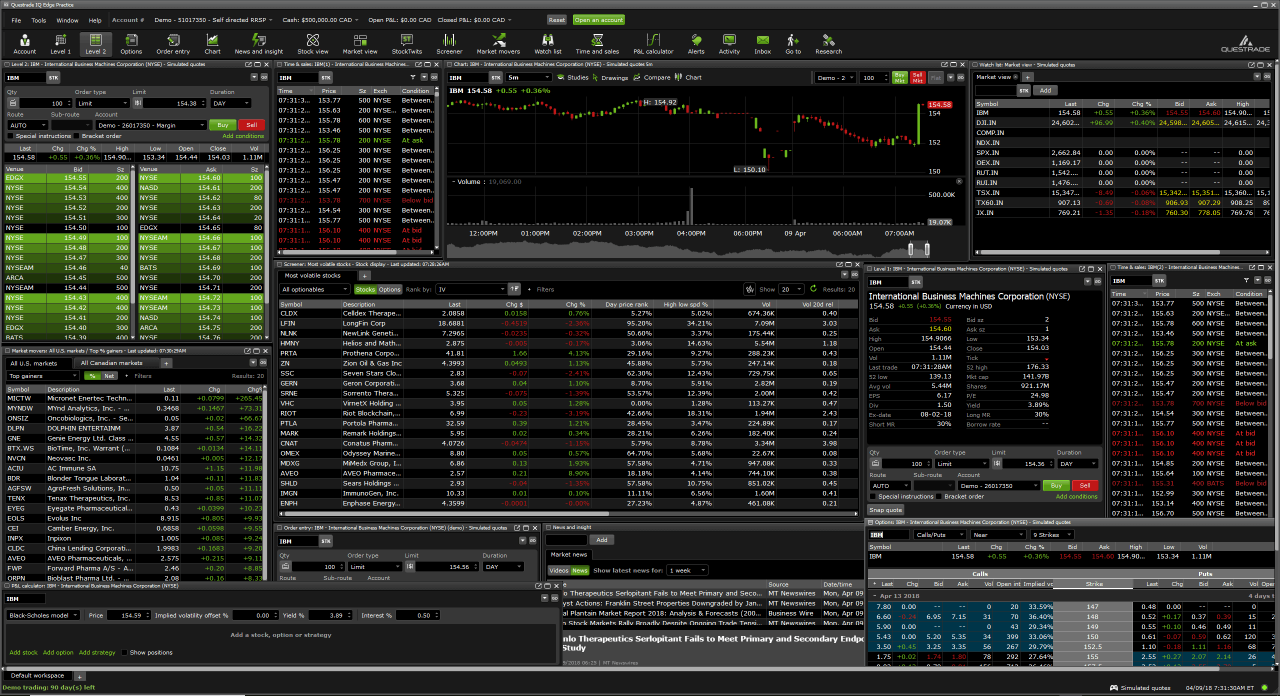

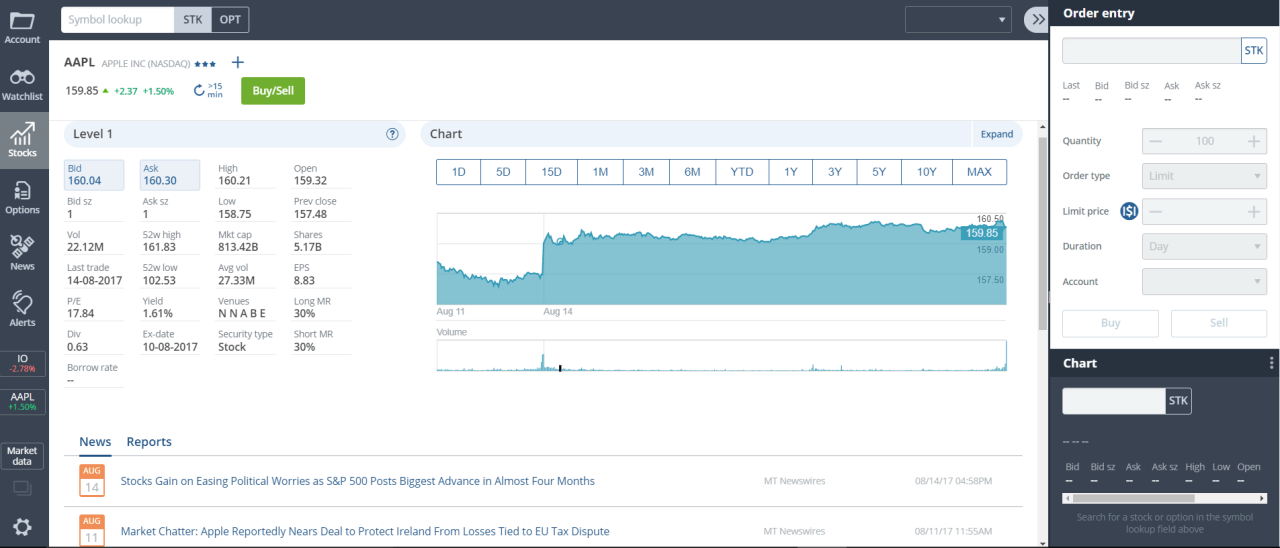

Navigating Questrade’s cryptocurrency trading platform is like piloting a spaceship – initially daunting, but ultimately rewarding once you get the hang of the controls. The interface, while initially appearing complex, is surprisingly intuitive after a short learning curve. Its clean design prevents information overload, a common pitfall of many trading platforms. The overall usability, however, is subjective and depends on prior experience with trading platforms and technical analysis tools.The platform’s strength lies in its integration with Questrade’s broader trading ecosystem.

This seamless transition between different asset classes offers a convenient experience for users already familiar with Questrade’s other offerings. However, newcomers might find themselves needing a little more hand-holding initially.

Charting Tools and Technical Analysis

Questrade’s charting tools are a mixed bag. While they offer a decent selection of standard indicators (moving averages, RSI, MACD, etc.), the customization options feel somewhat limited compared to dedicated charting platforms like TradingView. For instance, drawing tools could be more intuitive and allow for more precise adjustments. However, the charts are responsive and generally load quickly, which is crucial for time-sensitive trading decisions.

The effectiveness of the charting tools in technical analysis ultimately depends on the user’s skill and familiarity with the indicators employed. A seasoned trader might find them adequate, while a novice might find the lack of advanced features somewhat restrictive. For example, the candlestick charts provide clear visual representation of price action, allowing traders to identify patterns like hammer candles or engulfing patterns.

The overlay of moving averages provides dynamic support and resistance levels, aiding in trend identification.

Research Tools and Resources, Cryptocurrency trading options available through Questrade’s forex platform

Questrade offers a respectable, albeit not exhaustive, suite of research tools. News feeds are integrated directly into the platform, providing real-time updates on market movements and relevant news impacting cryptocurrency prices. However, in-depth fundamental analysis resources are somewhat lacking. While you can access basic information on listed cryptocurrencies, the platform doesn’t provide comprehensive financial reports or analyst ratings to the extent you might find on dedicated financial news websites.

The available research tools are sufficient for a basic understanding of market trends, but serious fundamental analysis will likely require supplementary research from external sources. For example, the integrated news feed might alert you to a major regulatory announcement impacting Bitcoin’s price, but deeper dives into the specifics of the announcement would need to come from other resources.

Executing a Cryptocurrency Trade

Let’s imagine a scenario where you want to buy Bitcoin (BTC). First, you’d navigate to the cryptocurrency section of the Questrade platform.

- (Imagine a screenshot here showing the main dashboard with a prominent “Crypto” section, perhaps highlighted in a box.)* Then, you’d locate the BTC/CAD trading pair (assuming you’re trading in Canadian Dollars).

- (Screenshot showing the search bar and the selected BTC/CAD pair.)* Next, you’d enter your desired order type (market order for immediate execution, or a limit order to buy at a specific price).

- (Screenshot showing the order entry window with options for market and limit orders, quantity field, and price field.)* You would specify the quantity of Bitcoin you wish to purchase. Finally, click the “Buy” button to execute the trade.

- (Screenshot showing confirmation of the trade execution, with details of the order and trade price.)* The entire process, once familiar with the interface, is relatively straightforward and mirrors the process for trading other assets on the Questrade platform. Remember to always review your order details before submitting to avoid costly mistakes.

Security and Regulatory Compliance

Navigating the wild west of cryptocurrency requires a sturdy steed and a trusty sheriff – in this case, Questrade’s robust security measures and unwavering commitment to regulatory compliance are your safeguards against the digital bandits. We understand that entrusting your digital assets to a platform requires absolute confidence, so let’s delve into the specifics of how we keep your crypto safe and sound.Questrade employs a multi-layered security approach designed to protect both your funds and your personal information.

This isn’t your grandma’s piggy bank; we’re talking state-of-the-art encryption, rigorous access controls, and constant monitoring for suspicious activity. Think of it as Fort Knox, but with more gigabytes.

Data Encryption and Access Controls

Questrade utilizes advanced encryption technologies, including AES-256 encryption, to protect your data both in transit and at rest. This means your sensitive information is scrambled beyond recognition to unauthorized individuals. Access to your account is controlled through multi-factor authentication (MFA), requiring multiple verification steps before anyone can gain entry. This is like having a combination lock, a fingerprint scanner, and a retinal scan all protecting your crypto vault.

Think of it as a digital fortress, with multiple layers of protection ensuring only you can access your funds.

Regulatory Compliance

Questrade adheres to all applicable laws and regulations related to cryptocurrency trading in the jurisdictions where we operate. This involves stringent Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures, designed to prevent illicit activities and maintain the integrity of the financial system. We work closely with regulatory bodies to ensure we are meeting and exceeding expectations, acting as responsible stewards of your digital assets.

Compliance isn’t just a box to check; it’s the foundation upon which we build trust and security.

Fraud Prevention and Detection

Questrade employs sophisticated fraud detection systems that continuously monitor transactions for any suspicious patterns or anomalies. These systems leverage machine learning algorithms to identify and flag potentially fraudulent activities in real-time, allowing our security team to intervene swiftly and prevent losses. Imagine a team of digital detectives constantly on patrol, ready to thwart any attempted heist before it even begins.

This proactive approach ensures that your crypto investments remain protected from malicious actors. We use advanced algorithms and real-time monitoring to detect unusual activity, preventing fraud before it affects our clients. For example, unusual login attempts from unfamiliar locations or large, sudden withdrawals would trigger immediate alerts and investigation.

Comparison to Industry Best Practices

Questrade’s security protocols are benchmarked against industry best practices, ensuring we’re constantly evolving our defenses to stay ahead of emerging threats. We regularly conduct security audits and penetration testing to identify vulnerabilities and strengthen our systems. Think of it as a continuous game of cat and mouse, with us constantly improving our security measures to outwit the digital villains.

Our commitment to security isn’t a one-time event; it’s an ongoing process of adaptation and improvement, ensuring we remain at the forefront of industry standards.

Conclusion

So, there you have it: a whirlwind tour of Questrade’s cryptocurrency trading options. While the digital frontier can be daunting, Questrade offers a relatively user-friendly gateway to the exciting (and sometimes terrifying) world of crypto. Remember, though, this isn’t a get-rich-quick scheme. It’s a complex landscape demanding careful consideration, strategic planning, and perhaps a healthy dose of caffeine.

Do your research, manage your risk, and may your trades be ever in your favor. Happy trading!