Day trading app recommendations with educational resources. – Day trading app recommendations with educational resources: Dive headfirst into the wild, wild west of day trading! Think of it as a high-stakes poker game, but instead of chips, you’re playing with…well, your money. This guide isn’t just a list of apps; it’s your survival manual for navigating this thrilling (and sometimes terrifying) world. We’ll arm you with the best apps, the smartest educational resources, and enough risk management advice to keep your heart rate (and your bank account) from going into cardiac arrest.

We’ll explore top-rated day trading apps, comparing their features, user interfaces, and – crucially – their pricing. Then, we’ll delve into the educational resources they offer, from beginner-friendly tutorials to advanced market analysis. Because let’s face it, throwing money at the market blindly is about as smart as playing Russian roulette with loaded dice. We’ll also uncover external resources to supercharge your trading knowledge, and cover essential risk management strategies.

Consider this your crash course in turning potential losses into potential profits (with a healthy dose of caution, of course!).

Top Day Trading Apps

So you want to dive into the thrilling (and sometimes terrifying) world of day trading? Buckle up, buttercup, because it’s a rollercoaster of potential profits and equally potential losses. But before you leap into the market like a caffeinated kangaroo, you’ll need the right tools. That’s where these top-notch day trading apps come in – your digital arsenal in the battle for financial freedom (or at least, a slightly less empty bank account).

Top Day Trading Apps: Features, Pros, and Cons

Choosing the right day trading app is like picking the perfect pair of shoes for a marathon – the wrong choice can leave you with blisters (and losses). Here’s a rundown of five popular options, complete with their strengths, weaknesses, and enough detail to make your head spin (in a good way, hopefully).

Picking the right day trading app is like choosing your trusty steed – you need both power and brains! Many apps offer educational resources, but true mastery hinges on understanding market signals. To unlock that secret sauce, check out this insightful guide: What are the best indicators for day trading success? Armed with this knowledge, you can then pick an app that complements your newfound indicator expertise, making you a day-trading ninja!

| App Name | Key Features | Pros | Cons |

|---|---|---|---|

| TradeStation | Advanced charting tools, extensive research resources, options trading, futures trading | Powerful platform for experienced traders, robust research capabilities | Steeper learning curve, can be overwhelming for beginners, higher fees |

| Webull | Fractional shares, commission-free trading (for stocks), educational resources, social trading features | User-friendly interface, excellent for beginners, commission-free stock trading | Limited research tools compared to others, some features are still developing |

| TD Ameritrade | Thinkorswim platform (advanced charting and analysis), excellent research tools, educational resources, wide range of order types | Comprehensive platform, caters to various trading styles, strong educational resources | Thinkorswim can be complex for beginners, some fees apply |

| Interactive Brokers | Global access to markets, margin rates, futures and options, advanced order types | Very powerful, access to global markets, competitive pricing for high-volume traders | Complex interface, high minimum account balance requirements |

| Robinhood | Commission-free trading (for stocks), simple and intuitive interface, easy account setup | Beginner-friendly, commission-free stock trading, easy navigation | Limited research tools, fewer advanced charting features, past regulatory issues |

Pricing Structures Comparison

The cost of day trading can vary wildly depending on your app and trading volume. Let’s break down the pricing models to avoid any nasty surprises.

Understanding the cost is crucial. Some apps offer commission-free trading for stocks, but might charge fees for options or futures. Others operate on a subscription model, charging a monthly or annual fee for access to their platform and features. Hidden fees can also lurk, so always read the fine print!

- TradeStation: Commission fees vary depending on the asset and volume traded. They also offer tiered pricing plans.

- Webull: Commission-free for stocks, but fees may apply to options and other asset classes.

- TD Ameritrade: Commission-free for stocks and ETFs, but fees may apply to options and other asset classes. Tiered pricing plans are available.

- Interactive Brokers: Pricing is tiered based on trading volume, offering competitive rates for high-volume traders. Commission fees vary based on asset class.

- Robinhood: Commission-free for stocks and ETFs, but fees may apply to options and other asset classes. They also have subscription services for additional features.

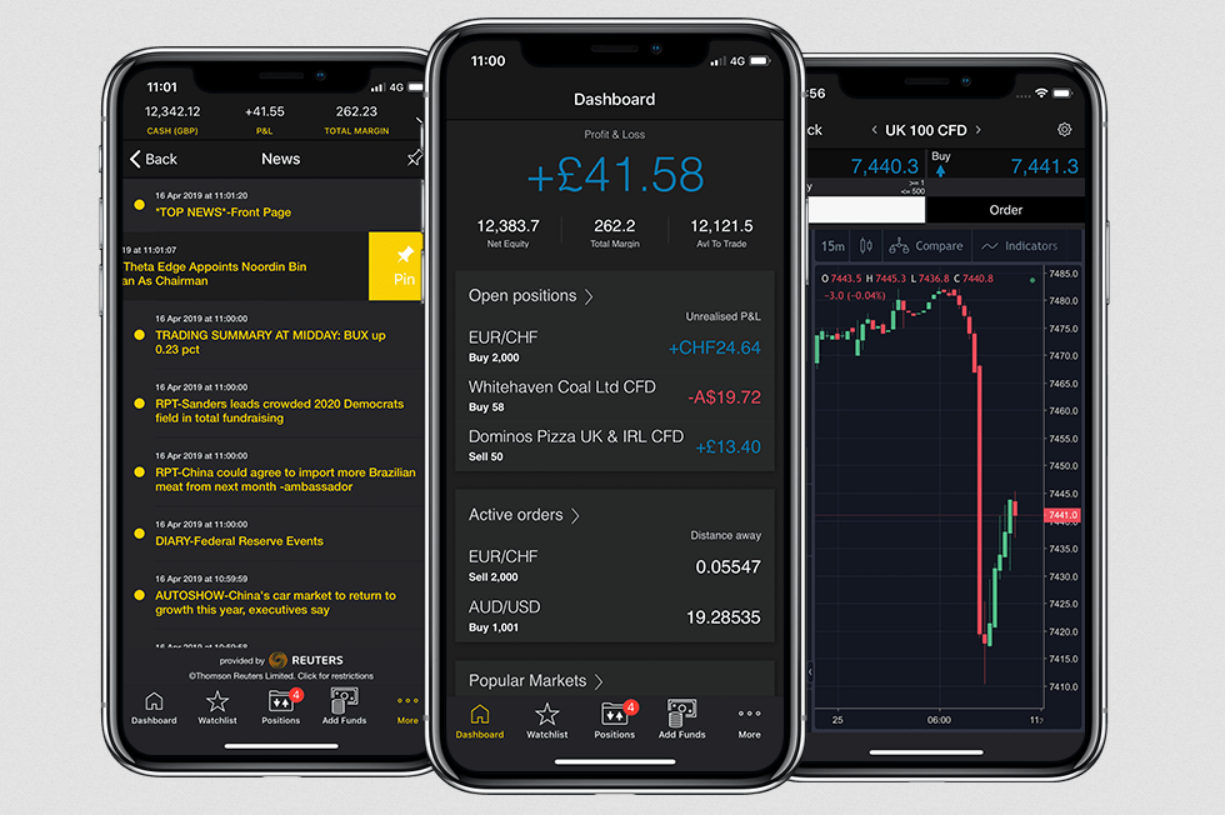

User Interface and User Experience

A good UI/UX is the difference between a smooth trading experience and a frustrating one. Imagine trying to navigate a maze blindfolded while juggling chainsaws – not ideal.

Ease of navigation, intuitive order placement, and powerful yet user-friendly chart analysis tools are paramount. Some apps excel in simplicity, ideal for beginners, while others offer advanced features that experienced traders crave. Consider your skill level and trading style when making your choice.

For example, Robinhood’s interface is praised for its simplicity, while TradeStation’s advanced charting capabilities are a boon for experienced traders. However, this complexity might overwhelm a novice. TD Ameritrade’s Thinkorswim platform offers a powerful suite of tools but requires a learning curve.

Educational Resources within Day Trading Apps

So you’ve picked your day trading app (or maybe you’re still agonizing over the decision – we’ve all been there!), but now you need to learn the ropes. Luckily, many apps understand that throwing newbies into the shark tank of the stock market without a life vest is…well, reckless. That’s where built-in educational resources come in, offering a lifeline (and maybe a few profitable trades) to those brave enough to navigate the volatile waters of day trading.Many day trading apps now offer more than just a platform to execute trades; they’re providing comprehensive educational packages to empower traders of all skill levels.

So you’re diving into the wild world of day trading? Finding the right app with built-in educational resources is half the battle. But even the best app won’t help if you’re using subpar strategies! That’s where understanding the nuances comes in, and checking out this guide on Best day trading strategies for short-term gains is a great starting point.

Armed with knowledge and the right tools, you’ll be ready to conquer those volatile markets (or at least, not lose your shirt). Remember, the best app is just a launchpad; smart strategies are your rocket fuel!

This is a huge win for beginners who might feel overwhelmed, and a helpful refresher for seasoned pros looking to sharpen their skills. Let’s dive into the specifics.

Educational Resources Offered by Three Day Trading Apps

Three apps stand out for their integrated educational offerings: TradeStation, TD Ameritrade’s thinkorswim, and Webull. Each offers a different approach to teaching traders the ins and outs of the market.TradeStation, known for its robust platform and powerful charting tools, provides a wealth of educational resources. These include video tutorials covering various trading strategies, in-depth articles on technical analysis, and webinars led by experienced market experts.

The quality is generally high, with clear explanations and practical examples. While suitable for beginners, the depth of information also caters well to advanced traders seeking to refine their techniques. The material is well-organized, making it easy to find specific topics.TD Ameritrade’s thinkorswim platform boasts an extensive educational library. It goes beyond simple tutorials, offering paper trading simulations (practice trading with virtual money!), advanced charting techniques, and in-depth analysis of market trends.

Their educational materials are incredibly comprehensive, with resources covering fundamental analysis, options trading, and even risk management. The platform’s user interface might be slightly steeper for absolute beginners, but the wealth of resources makes it a powerful tool for those willing to invest the time.Webull, known for its user-friendly interface and commission-free trading, offers a more beginner-focused approach to education.

Their resources include basic tutorials on investing concepts, articles explaining market terminology, and short videos on common trading strategies. While not as comprehensive as TradeStation or thinkorswim, Webull’s materials are easy to understand and accessible, making it an excellent choice for those just starting their day trading journey. The quality is solid for its intended audience, but advanced traders may find it lacking in depth.

Comparison of Educational Features, Day trading app recommendations with educational resources.

The following table summarizes the key educational features of these three apps:

| Feature | TradeStation | thinkorswim | Webull |

|---|---|---|---|

| Content Format | Videos, Articles, Webinars | Videos, Articles, Webinars, Paper Trading Simulations | Videos, Articles |

| Beginner Suitability | High | Medium (steeper learning curve) | High |

| Advanced Trader Suitability | High | High | Low |

| Accessibility | Good, well-organized | Good, but requires some navigation | Excellent, very user-friendly |

External Educational Resources for Day Trading: Day Trading App Recommendations With Educational Resources.

So, you’ve got your day trading app all set up – congrats! But let’s be real, an app is just a tool. To wield that tool effectively and avoid turning your hard-earned cash into vaporware, you’ll need some serious knowledge. That’s where external educational resources come in – your secret weapon in the thrilling (and sometimes terrifying) world of day trading.Learning to day trade is like learning to ride a unicycle while juggling chainsaws – it takes practice, patience, and a healthy dose of understanding.

These resources will help you avoid the spectacular face-plants and master the art of the perfectly executed trade.

Reputable Websites and Platforms Offering Day Trading Education

Finding reliable information in the often-murky waters of online day trading education can be a challenge. To help navigate this, we’ve compiled a list of five reputable sources offering diverse learning materials. Remember, consistent learning is key!

- Investopedia: Investopedia is a comprehensive resource covering a wide range of financial topics, including in-depth articles, tutorials, and even a glossary of trading terms. Think of it as the Wikipedia of finance, but with more charts and less cat videos (mostly).

- Babypips: This platform is particularly beginner-friendly, offering interactive lessons and quizzes that make learning forex trading (a popular day trading arena) surprisingly fun. It’s a great place to start if you’re feeling a bit overwhelmed.

- TradingView: TradingView is a social platform for traders, allowing you to chart stocks, follow other traders, and access educational content through articles, videos, and webinars. It’s like a bustling marketplace of trading ideas, but be discerning – not every idea is a goldmine.

- Warrior Trading: This platform offers a more structured approach with courses and mentorship programs, catering to those seeking a more hands-on learning experience. It’s a good choice if you prefer a guided path rather than self-study.

- The Motley Fool: While not solely focused on day trading, The Motley Fool offers insightful articles and analyses that can enhance your understanding of market trends and company fundamentals – crucial for informed decision-making.

Examples of Learning Materials and Their Strengths and Weaknesses

Here’s a closer look at specific examples from these resources, highlighting both their upsides and potential drawbacks.

| Resource | Description of Content |

|---|---|

| Investopedia’s “Day Trading Guide” | A comprehensive guide covering various aspects of day trading, from basic concepts to advanced strategies. Strengths: Broad coverage, clear explanations. Weaknesses: Can feel overwhelming for absolute beginners. |

| Babypips’ Forex Trading Course | An interactive course teaching the fundamentals of forex trading through engaging lessons and quizzes. Strengths: Beginner-friendly, interactive learning. Weaknesses: Focuses primarily on forex, not other asset classes. |

| TradingView’s educational webinars | Live and recorded webinars presented by experienced traders on various trading topics. Strengths: Practical insights, real-time Q&A sessions. Weaknesses: Requires active participation and may not be suitable for all learning styles. |

| Warrior Trading’s “Mastering the Market” course | A structured course covering risk management, technical analysis, and trading psychology. Strengths: In-depth learning, mentorship opportunities. Weaknesses: Can be expensive, requires significant time commitment. |

| The Motley Fool’s stock analysis articles | Articles providing in-depth analysis of specific companies and market trends. Strengths: In-depth company research, long-term perspective. Weaknesses: Not directly focused on day trading strategies. |

Hypothetical Online Day Trading Strategies Course

This hypothetical course, “Conquer the Day: Mastering Day Trading Strategies,” would provide a structured approach to day trading, focusing on practical application and risk mitigation. The curriculum would cover:* Module 1: Foundations of Day Trading: Introduction to day trading concepts, market mechanics, and different asset classes.

Module 2

Technical Analysis Mastery: In-depth exploration of chart patterns, indicators (like RSI, MACD, moving averages), and candlestick analysis. Students would learn to identify potential entry and exit points.

Module 3

Risk Management Strategies: Crucial for survival! This module would cover position sizing, stop-loss orders, and risk-reward ratios, emphasizing the importance of protecting capital.

Module 4

So you’re diving into the wild world of day trading apps? Smart move! But before you start flinging your hard-earned cash around like confetti, remember that knowledge is power. That’s where the awesome resources at Best resources for learning day trading strategies for beginners come in handy. Arm yourself with the right strategies, then pick your app wisely – the best app in the world won’t help if you’re clueless about the market!

Order Execution and Trade Management: A practical guide to executing trades efficiently, managing open positions, and adapting to changing market conditions.

Module 5

So, you’re diving into the wild world of day trading? Finding the right app with killer educational resources is half the battle. But before you even think about charting, you’ll need a solid brokerage account – check out this guide for the Best brokerage account for active day trading in Canada to get started. Then, armed with the right tools and knowledge, you can conquer those day trading apps and their educational materials like a pro!

Trading Psychology and Discipline: Addressing the emotional challenges of day trading, focusing on developing a disciplined approach and managing stress.The course would utilize a combination of video lectures, interactive exercises, and real-world case studies to provide a comprehensive and engaging learning experience. The ultimate goal? To empower students with the knowledge and skills to navigate the exciting – and sometimes chaotic – world of day trading with confidence (and hopefully, profit!).

So, you’re diving into the wild world of day trading? Finding the right app with killer educational resources is half the battle. Want to supercharge your gains? Consider expanding your horizons to explore other markets, like learning how to profit from cryptocoin , before returning to refine your day trading strategies with those awesome apps and tutorials.

Remember, knowledge is power (and potentially, serious profit!).

Risk Management and Responsible Trading Practices

Day trading, while potentially lucrative, is a high-risk endeavor. Think of it like a rollercoaster – exhilarating, but with the potential for a stomach-churning drop. Successful day traders aren’t just lucky; they’re meticulously prepared, with a robust risk management strategy acting as their safety harness. Ignoring this crucial aspect is like riding that rollercoaster without a seatbelt – a recipe for disaster.

Let’s explore the essential elements of responsible trading.Risk management isn’t about avoiding losses entirely (that’s impossible!), it’s about controlling them, ensuring that any single trade doesn’t wipe out your account. It’s about playing the game smart, not just playing to win.

Position Sizing

Effective position sizing is the cornerstone of risk management. It’s about determining the appropriate amount of capital to allocate to each trade, minimizing potential losses while maximizing potential gains. This isn’t a one-size-fits-all approach; it requires understanding your risk tolerance and the volatility of the assets you’re trading. A general rule of thumb is to never risk more than 1-2% of your total trading capital on any single trade.

This means if you have $10,000 in your trading account, you shouldn’t risk more than $100-$200 on a single trade, regardless of how confident you are.

Stop-Loss Orders

Stop-loss orders are your safety net. They’re pre-set instructions to automatically sell a security when it reaches a specified price, limiting your potential losses. Think of them as an automated “panic button” that prevents emotional decisions from derailing your strategy. Setting appropriate stop-loss orders is crucial, as it helps you avoid emotional trading decisions when the market moves against you.

The placement of a stop-loss order depends on the individual trade and the market conditions, but it should always be placed at a level that is acceptable to you in case of a loss.

Diversification

Don’t put all your eggs in one basket! Diversification involves spreading your investments across different assets, reducing your exposure to any single risk. This doesn’t mean trading a dozen different stocks simultaneously; it’s about strategically selecting assets that are not highly correlated. For example, instead of concentrating on only tech stocks, consider diversifying into other sectors such as healthcare or energy.

This helps mitigate the risk of significant losses if one sector underperforms.

Understanding Your Risk Tolerance

Before you even think about placing a trade, you need to honestly assess your risk tolerance. Are you a thrill-seeker comfortable with potentially significant losses, or are you more risk-averse, prioritizing capital preservation? Your risk tolerance dictates your position sizing and your overall trading strategy. Ignoring this crucial step is like driving a race car without knowing how to brake – potentially disastrous.

It’s essential to understand your comfort level with risk before starting to trade. There’s no right or wrong answer; it’s entirely personal.

Hypothetical Trading Scenario: Risk Management in Action

Let’s say you have a $5,000 trading account and you’ve identified a potential trade in XYZ stock. You’ve determined your risk tolerance is 1%, meaning you’re willing to risk a maximum of $50 per trade. You decide to buy 100 shares of XYZ at $50 per share. You set a stop-loss order at $48, limiting your potential loss to $200 (2% of your investment, or $2 per share).

So, you’re diving into the wild world of day trading apps and need some solid educational resources? Finding the right platform is half the battle, and that’s where a reliable system with top-notch support comes in – like the one offered at Reliable day trading platform with excellent customer support. With a dependable platform under your belt, you can focus on mastering those crucial day trading strategies and maximizing your learning from those educational resources.

Your target profit is $53. If the price drops to $48, your stop-loss order automatically sells your shares, limiting your loss to $200. If the price rises to $53, you achieve your target profit and sell your shares for a profit of $300. This scenario demonstrates the practical application of position sizing and stop-loss orders to manage risk.

Remember, even with a well-defined strategy, losses are inevitable; this is simply about managing the size and frequency of those losses.

Illustrative Examples of Successful Day Trading Strategies

Day trading, while potentially lucrative, is a high-risk endeavor. Successful strategies rely on a deep understanding of market mechanics, disciplined risk management, and the ability to adapt to constantly shifting conditions. Let’s explore a strategy that leverages the power of price action and momentum.This example focuses on a mean reversion strategy using the Relative Strength Index (RSI) and candlestick patterns.

The core principle is that assets tend to oscillate around a mean, and extreme price movements often lead to corrections. By identifying these overbought and oversold conditions, we can aim to profit from the reversion to the mean.

Mean Reversion Strategy with RSI and Candlestick Patterns

This strategy combines the RSI indicator, which measures the speed and change of price movements, with candlestick patterns to confirm potential reversal points. The RSI oscillates between 0 and 100. Readings above 70 are generally considered overbought, suggesting a potential price drop, while readings below 30 are considered oversold, hinting at a possible price increase. We’ll use candlestick patterns like hammer and shooting star patterns to reinforce these signals.A hammer candlestick, characterized by a small body with a long lower wick, typically appears at the bottom of a downtrend, suggesting a potential reversal to the upside.

Conversely, a shooting star, with a small body and a long upper wick, often forms at the top of an uptrend, signaling a possible reversal to the downside.The strategy involves identifying an asset that shows signs of overbought or oversold conditions on the RSI. A confirmation from a relevant candlestick pattern (hammer for oversold, shooting star for overbought) will provide a stronger trading signal.

Stop-loss orders should be placed to limit potential losses, and take-profit orders should be set to secure profits at a predetermined level.

Hypothetical Successful Day Trade Example

Let’s imagine a hypothetical trade on a fictional stock, “XYZ Corp.” The stock is trading at $50. The RSI shows a reading of 85 (overbought), and a clear shooting star candlestick pattern forms. This suggests a potential price drop.We enter a short position (selling) at $50, placing a stop-loss order at $51 (to limit losses to $1 per share) and a take-profit order at $48 (to secure a $2 per share profit).

The price subsequently drops to $48 as anticipated, allowing us to exit the trade and realize our profit.Visual Representation (Textual):Imagine a chart. The price of XYZ Corp. is trending upwards, reaching a peak at $50. At this peak, a shooting star candlestick appears – a small body with a long upper wick, extending significantly above the body. The RSI is at 85.

Our short position is entered at $50. The price then drops, crossing our take-profit order at $48. Our stop-loss order at $51 remains untouched.Profit Calculation: Assuming a trade size of 100 shares, the profit is ($50 – $48) – 100 shares = $200.

Benefits and Drawbacks

This mean reversion strategy, like any other, has its advantages and disadvantages. The benefits include the potential for consistent profits if the market exhibits mean reversion behavior and the relative simplicity of the strategy. However, drawbacks include the risk of false signals, particularly in volatile or trending markets. A significant downside risk exists if the price continues to move in the opposite direction of the anticipated reversion.

Adaptability is key; during strong trends, this strategy might yield poor results, necessitating a switch to trend-following strategies or a temporary suspension of trading.

Final Conclusion

So, you’ve journeyed through the treacherous yet potentially rewarding landscape of day trading. You’ve armed yourself with app recommendations, educational resources, and a healthy respect for risk management. Remember, day trading is a marathon, not a sprint – a rollercoaster of emotions, not a guaranteed ticket to riches. But with the right tools, knowledge, and a dash of controlled recklessness, you might just find yourself riding that rollercoaster to success.

Now go forth, young Padawan, and may the market be ever in your favor (or at least, not completely against you!).