Detailed analysis of Questrade Forex fees and commissions: Prepare for a wild ride through the exhilarating world of Questrade forex trading! We’ll dissect those fees like a financial surgeon, revealing the hidden costs and surprising truths lurking beneath the surface. Buckle up, because this isn’t your grandma’s finance lesson. We’re diving headfirst into spreads, commissions, overnight financing charges, and even those sneaky hidden fees that could make your profits vanish faster than a magician’s rabbit.

Get ready to become a forex fee ninja!

This deep dive will cover everything from the different Questrade account types and their associated fee structures to a comparison with competitors. We’ll explore how leverage impacts trading costs, provide illustrative examples of real-world trading scenarios, and even unearth those pesky hidden costs that often catch traders off guard. By the end, you’ll be armed with the knowledge to navigate the Questrade forex fee landscape with the confidence of a seasoned pro (or at least a slightly less clueless newbie).

Questrade Forex Account Types and Fee Structures

So, you’re thinking about diving into the thrilling (and sometimes terrifying) world of forex trading with Questrade? Buckle up, buttercup, because we’re about to dissect their account types and fee structures with the precision of a brain surgeon performing a delicate operation… on a particularly stubborn gnat. Prepare for a deep dive into the nitty-gritty of Questrade’s pricing.

Questrade’s Forex Account Offerings

Questrade, thankfully, doesn’t offer a bewildering array of account types designed to confuse even the most seasoned traders. Their approach is refreshingly straightforward, focusing on a single, unified account structure for forex trading. This eliminates the headache of choosing between various tiers and simplifies the fee structure considerably. This makes comparing costs and choosing the right platform much easier.

Questrade’s Forex Fee Structure: A Detailed Breakdown

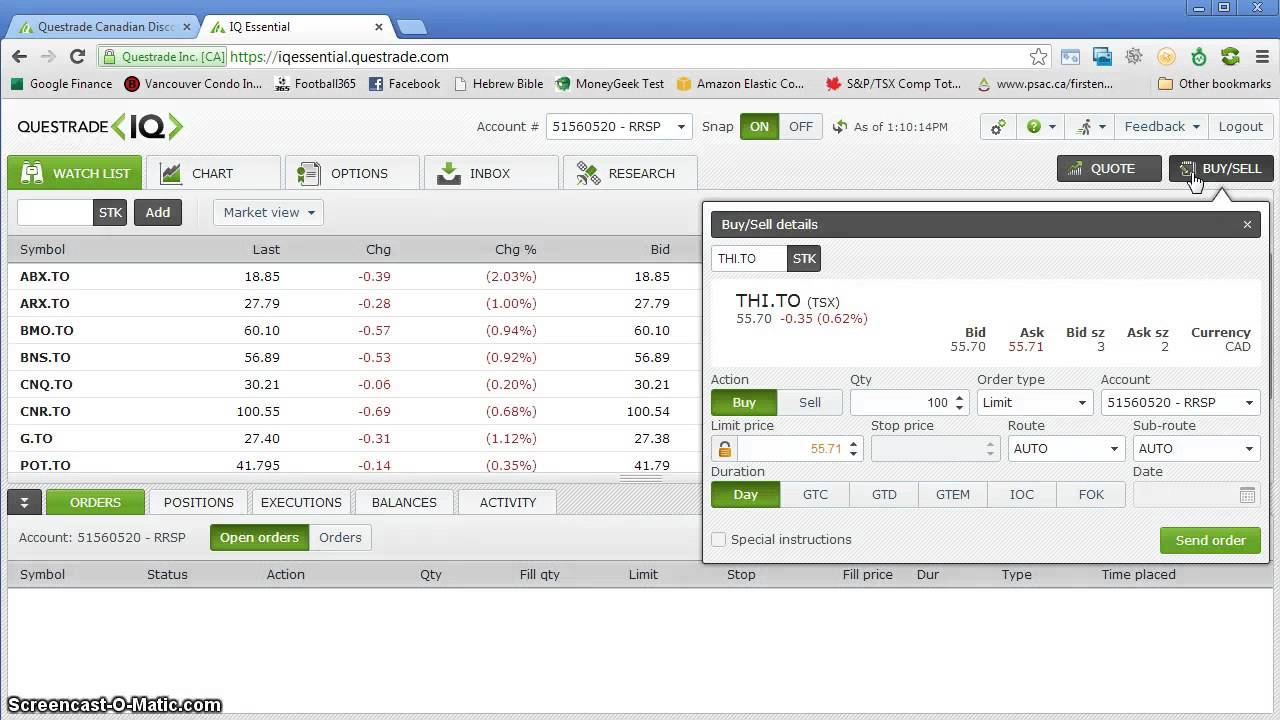

The beauty of Questrade’s forex offering lies in its simplicity. Forget juggling multiple commission structures and hidden fees – it’s all about the spread. The spread, for the uninitiated, is the difference between the bid (the price at which you can sell) and the ask (the price at which you can buy) price of a currency pair. Questrade’s spreads are variable, meaning they fluctuate based on market conditions and volatility.

Think of it as the price you pay for the privilege of accessing the forex market through their platform. There are no commissions charged on top of the spread.

Comparative Analysis of Cost-Effectiveness

Since there’s only one account type, the cost-effectiveness is largely dependent on your trading style and volume. High-frequency traders, executing numerous trades daily, might find their overall costs higher compared to someone who takes a more laid-back, long-term approach. However, the absence of commissions makes Questrade a potentially attractive option for traders of all stripes, especially those who prioritize transparency and simplicity over complex fee structures.

The key is to carefully monitor the spreads and choose your trading strategy accordingly. Think of it like choosing between a sports car (high-frequency trading) and a reliable sedan (long-term trading) – both get you where you need to go, but at different costs and speeds.

Questrade Forex Account Details

| Account Type | Commission Structure | Spread Details | Minimum Deposit |

|---|---|---|---|

| Standard Forex Account | $0 Commission | Variable, competitive spreads | $1,000 (Note: this is a general guideline and might vary. Always check the latest information on Questrade’s website) |

Questrade Forex Trading Fees

Let’s dive into the nitty-gritty of Questrade’s forex fees – because nobody likes unexpected charges, especially when dealing with the volatile world of currency trading. We’ll dissect their spread and commission structure, exploring how these costs can impact your bottom line and, more importantly, your ability to buy that much-needed vacation home on a tropical island (or at least a slightly nicer coffee machine).

Questrade’s forex trading fees primarily consist of spreads and, in some cases, commissions. Understanding these components is crucial for evaluating the overall cost of your trades and ultimately, your profitability. Think of spreads and commissions as the silent partners in your forex journey – they’re always there, quietly influencing your returns.

So you’re diving deep into the murky waters of Questrade Forex fees – a detailed analysis is crucial, right? But before you get bogged down in spreadsheets, consider the bigger picture: are you maximizing your returns? Perhaps exploring options like those listed in this fantastic guide to Best FX funds for long-term investment and high returns could make those Questrade fees seem like a small price to pay for potentially massive gains.

Then, armed with that knowledge, you can return to your Questrade fee analysis with a much clearer perspective on your overall investment strategy.

Questrade Forex Spreads: A Deep Dive

Questrade’s spreads, the difference between the bid and ask price of a currency pair, are variable and depend on several factors. Market volatility plays a significant role; during times of high uncertainty, spreads widen, reflecting the increased risk for market makers. Liquidity also matters; highly liquid currency pairs (like EUR/USD) generally have tighter spreads than less liquid ones (say, USD/TRY).

Finally, the time of day can impact spreads, with wider spreads often observed during periods of lower trading volume. Imagine it like this: a busy, bustling marketplace (high liquidity, low spread) versus a quiet, sleepy town (low liquidity, high spread).

Questrade Forex Commissions: A Breakdown

Questrade’s commission structure varies depending on the currency pair and account type. While many pairs are commission-free (the spread covers the brokerage’s costs), some might involve a per-lot commission. This commission is usually a small fixed amount per standard lot (100,000 units of the base currency). It’s important to check Questrade’s current fee schedule for the most up-to-date information on specific commission charges, as these can change.

Dissecting Questrade’s Forex fees can feel like navigating a minefield of tiny print, but understanding those costs is crucial. Before you get bogged down in the numbers, though, maybe brush up on your trading strategy with some helpful reading; check out this list of Top recommended Forex trading books for intermediate traders to sharpen your skills. Then, armed with knowledge and a better understanding of risk management, you can return to that Questrade fee analysis with a more confident, and hopefully profitable, approach.

Remember, transparency is key; always know exactly what you’re paying.

Impact of Spreads and Commissions on Profitability

The cumulative effect of spreads and commissions can significantly influence your trading results, especially for scalpers and day traders who execute numerous trades. For example, a consistently wide spread on a high-frequency trading strategy can eat into profits quickly, even if individual trades are profitable. Conversely, a low-spread environment can be beneficial for such strategies. Swing traders and long-term investors, on the other hand, are often less sensitive to the impact of daily spread fluctuations, as their profit targets usually overshadow the relatively smaller spread costs.

Comparative Chart of Spreads and Commissions

The following illustrative chart presents hypothetical examples of spreads and commissions for several popular currency pairs. Remember, these values are for illustrative purposes only and can fluctuate significantly. Always check Questrade’s platform for real-time data.

| Currency Pair | Typical Spread (Pips) | Commission (per Standard Lot) |

|---|---|---|

| EUR/USD | 0.5 – 1.5 | $0 |

| GBP/USD | 0.8 – 2.0 | $0 |

| USD/JPY | 0.2 – 0.8 | $0 |

| USD/CAD | 0.6 – 1.8 | $0 |

| USD/CHF | 0.7 – 2.0 | $0 |

Non-Commission Fees and Charges

So, you’ve conquered the commission jungle of Questrade forex trading. Congratulations! But wait, there’s more! Like a mischievous gremlin hiding in your trading account, lurks a collection of non-commission fees. These sneaky little charges might not be as obvious as commissions, but they can definitely add up if you’re not careful. Let’s shine a light on these hidden costs and arm you with the knowledge to avoid unnecessary expenses.

Understanding these non-commission fees is crucial for effective forex trading strategy. Ignoring them can lead to unpleasant surprises and significantly impact your overall profitability. Let’s dissect these fees, providing clear explanations and illustrative examples.

Inactivity Fees

Questrade, like many brokerages, charges an inactivity fee if your account remains dormant for an extended period. This fee acts as an incentive for active trading and helps cover the costs associated with maintaining inactive accounts. The exact amount and duration required to trigger this fee should be checked on Questrade’s website or your account statement, as it is subject to change.

For example, let’s say the inactivity fee is $25 per month after 12 months of inactivity. If your account remains inactive for two years, the total inactivity fee would be $600. Ouch! That’s a hefty price to pay for simply forgetting about your account.

Overnight Financing Charges

Ah, the joys (and sometimes pains) of overnight financing. These charges, also known as swap fees or rollover fees, apply when you hold a forex position open past the daily settlement time. The calculation involves the difference between the interest rates of the two currencies involved in the trade.

The formula is generally something like: Swap Fee = (Interest Rate Difference) x (Trade Size) x (Number of Days)

The exact calculation can be complex, and the interest rate difference is often adjusted based on interbank rates and other market factors. Let’s illustrate with an example. Imagine you hold a long position in EUR/USD, and the interest rate differential favors the USD. This means you might incur a negative swap fee (a small payment to you) – which is great.

However, if the interest rate differential favors the EUR, you’ll pay a positive swap fee. For example, if the swap fee is 0.0005 per 100,000 units of currency and you hold 100,000 units overnight, the cost would be $5. Holding this position for a week could cost you $35.

Wire Transfer Fees

Wire transfers, while sometimes necessary, often come with associated fees. These fees vary depending on the amount transferred and the receiving institution. Questrade might charge a fee for incoming or outgoing wire transfers, and the receiving bank might also impose its own fees. Always confirm the specific fees with both Questrade and your bank before initiating a wire transfer to avoid unexpected charges.

For example, Questrade might charge $25, and your bank might charge another $20, resulting in a total fee of $45 for a single wire transfer.

- Inactivity Fees: Charged for accounts remaining inactive for a specified period. The fee amount and duration vary.

- Overnight Financing Charges (Swap Fees): Apply when holding positions open past the daily settlement. Calculated based on the interest rate differential between the currencies involved, the trade size, and the number of days the position is held.

- Wire Transfer Fees: Charged for incoming or outgoing wire transfers. Fees vary depending on the amount transferred and the institutions involved.

Questrade Forex Fee Comparison with Competitors

So, you’ve bravely navigated the labyrinthine world of Questrade’s forex fees. Congratulations! But the quest doesn’t end there, intrepid trader! To truly conquer the forex fee mountain, we must compare Questrade’s offerings to those of its rivals. Think of it as a forex fee gladiatorial contest – may the best (lowest-fee) broker win!Let’s pit Questrade against two formidable opponents in the forex arena: Interactive Brokers (IBKR) and OANDA.

These brokers represent different approaches to forex trading, offering a good range of fee structures to compare against Questrade’s. Remember, the “best” broker depends heavily on your individual trading style and volume.

Questrade, IBKR, and OANDA Forex Fee Comparison

The following table provides a snapshot comparison of forex fees. Remember, these are simplified examples and specific fees can vary based on account type, trading volume, and other factors. Always check the broker’s website for the most up-to-date information. (Because, let’s face it, fees are notoriously fickle creatures.)

So you’re diving deep into the murky waters of Questrade Forex fees – a detailed analysis is crucial, right? But before you get bogged down in spreadsheets, consider the bigger picture: are you maximizing your returns? Perhaps exploring options like those listed in this fantastic guide to Best FX funds for long-term investment and high returns could make those Questrade fees seem like a small price to pay for potentially massive gains.

Then, armed with that knowledge, you can return to your Questrade fee analysis with a much clearer perspective on your overall investment strategy.

| Broker | Spreads (Typical EUR/USD) | Commissions | Other Fees (Examples) |

|---|---|---|---|

| Questrade | Variable, typically 0.7-1.2 pips | None (spread-only pricing) | Inactivity fees, potential markup on certain currency pairs. |

| Interactive Brokers (IBKR) | Variable, competitive spreads | Commission-based pricing options available, varies by volume. | Financing rates, inactivity fees, potential platform fees. |

| OANDA | Variable, tight spreads often advertised | Generally spread-only pricing; some commission-based accounts may be available. | Inactivity fees, potential conversion fees for deposits/withdrawals. |

Advantages and Disadvantages of Questrade’s Fee Structure

Questrade’s simplicity, with its primarily spread-only pricing, can be appealing to many traders. This straightforward approach eliminates the need to calculate commissions, making it easy to understand your trading costs. However, this simplicity can also be a disadvantage. If Questrade’s spreads consistently widen compared to competitors offering commission-based models for high-volume traders, the overall cost could be higher.

Conversely, for low-volume traders, the simplicity and often tighter spreads may be advantageous.IBKR, with its commission-based options, might offer better value for very high-volume traders who can negotiate favorable commission rates. However, this approach requires careful calculation of total trading costs. OANDA often boasts tight spreads, making it competitive for many traders, but like Questrade, lacks the commission-based flexibility of IBKR.In short, there’s no single “best” broker.

The optimal choice depends entirely on your individual trading style, volume, and risk tolerance. Consider your trading habits carefully before committing to a platform.

Impact of Leverage on Trading Costs

Leverage in forex trading is a double-edged sword: it can amplify profits, but it can also magnify losses to a terrifying degree. With Questrade, understanding how leverage impacts your trading costs is crucial to avoiding a financial meltdown that would make a volcano look like a gentle simmer. Think of leverage as a financial supercharger – powerful, but potentially explosive if not handled carefully.Leverage essentially allows you to control a larger position in the forex market than your actual capital would normally permit.

Questrade offers various leverage ratios, meaning you can borrow a multiple of your deposited funds to execute trades. However, this borrowed capital increases your potential profit, but equally increases your potential loss. The higher the leverage, the thinner the margin for error becomes. A small market movement against your position can quickly wipe out your initial investment and lead to a margin call.

So you’re diving deep into the murky waters of Questrade Forex fees – a detailed analysis is crucial, right? But before you get bogged down in spreadsheets, consider the bigger picture: are you maximizing your returns? Perhaps exploring options like those listed in this fantastic guide to Best FX funds for long-term investment and high returns could make those Questrade fees seem like a small price to pay for potentially massive gains.

Then, armed with that knowledge, you can return to your Questrade fee analysis with a much clearer perspective on your overall investment strategy.

Margin Calls and Their Relationship to Leverage

A margin call is essentially a dreaded phone call from your broker (in this case, Questrade) saying, “Uh oh, you’re underwater!” It happens when the value of your open trades falls below a certain level, known as the maintenance margin. This means your borrowed funds are at risk, and Questrade needs you to deposit more funds to cover potential losses.

The likelihood of a margin call increases dramatically with higher leverage. Imagine you’re using 100:1 leverage – a small 1% movement against you could trigger a margin call, demanding additional funds to cover the losses. Failure to meet a margin call can lead to your positions being forcibly closed, resulting in significant losses.

So you’re diving deep into the murky waters of Questrade Forex fees – a detailed analysis is crucial, right? But before you get bogged down in spreadsheets, consider the bigger picture: are you maximizing your returns? Perhaps exploring options like those listed in this fantastic guide to Best FX funds for long-term investment and high returns could make those Questrade fees seem like a small price to pay for potentially massive gains.

Then, armed with that knowledge, you can return to your Questrade fee analysis with a much clearer perspective on your overall investment strategy.

Illustrative Examples of Leverage Impact

Let’s illustrate with some examples. Suppose you have $1,000 in your Questrade account.Scenario 1: Low Leverage (10:1)You decide to trade EUR/USD with a 10:1 leverage. You can control a $10,000 position. If the EUR/USD moves 1% in your favor, you make a $100 profit (1% of $10,000). If it moves 1% against you, you lose $100.

Your initial $1000 remains relatively safe.Scenario 2: High Leverage (50:1)Now, let’s say you use a 50:1 leverage. With the same $1,000, you control a $50,000 position. A 1% movement in your favor nets you a $500 profit – five times higher than with 10:1 leverage! However, a 1% movement against you results in a $500 loss – again, five times higher.

A 2% adverse movement could easily wipe out your entire $1,000.Scenario 3: Extreme Leverage (200:1)

A cautionary tale

With 200:1 leverage, your $1,000 controls a $200,000 position. A seemingly small 0.5% movement against you would result in a $1,000 loss – your entire initial investment! This highlights the extreme risk associated with high leverage. It’s a risky game, and you could be playing with fire.

Leverage and Overall Trading Costs

While leverage itself doesn’t directly charge a fee, it indirectly increases your trading costs through the potential for larger losses. The more leverage you use, the higher the risk of incurring significant losses, which ultimately increase your overall trading costs. These losses are not just about the initial investment; they can include margin calls, the cost of additional deposits, and the emotional toll of watching your account dwindle.

Smart leverage management is key to minimizing these costs. Remember, leverage is a tool; use it wisely, or it might use you.

Illustrative Examples of Questrade Forex Trading Costs

Let’s ditch the dry financial jargon and dive into some real-world examples of how Questrade’s forex fees can impact your bottom line. We’ll explore three distinct scenarios, each highlighting the interplay of trade size, leverage, and the resulting costs. Remember, these examples are for illustrative purposes only and actual costs may vary slightly based on market conditions and Questrade’s fee schedule at the time of your trade.

Understanding these examples will help you get a better grasp of how fees can eat into your profits (or add to your losses!), empowering you to make more informed trading decisions. We’ll be transparent about all fees involved, including spreads and any other applicable charges.

Scenario 1: A Small, Conservative EUR/USD Trade

This scenario depicts a small trade with low leverage, ideal for risk-averse traders dipping their toes into the forex market. We’ll see how even small trades incur fees, though the impact is proportionally smaller.

- Trade Setup: Buying 1,000 EUR/USD at a rate of 1.1000, using 1:10 leverage.

- Trade Size: 1,000 EUR (equivalent to $1,100 USD).

- Profit/Loss: Let’s assume the EUR/USD rises to 1.1010. This yields a profit of 10 pips (1 pip = 0.0001). With a trade size of 1,000 EUR, the profit is 10 pips

– 1000 units = $10. - Fees: Assuming a spread of 1 pip (0.0001), the spread cost is $1. Other potential fees, such as inactivity fees or overnight financing fees, are negligible for this short-term trade. Let’s assume zero additional fees for simplicity.

- Total Cost: $1 (spread).

- Net Profit: $10 (profit)

-$1 (spread) = $9.

Scenario 2: A Larger, Moderately Leveraged GBP/USD Trade

This example shows a larger trade with moderate leverage, representing a more ambitious trading strategy. Here, we’ll see how fees become more significant with increased trade size and leverage.

- Trade Setup: Buying 10,000 GBP/USD at a rate of 1.2500, using 1:20 leverage.

- Trade Size: 10,000 GBP (equivalent to $12,500 USD).

- Profit/Loss: Let’s say the GBP/USD drops to 1.2480, resulting in a loss of 20 pips. The loss is 20 pips

– 10000 units = $200. - Fees: With a spread of 1.5 pips (0.00015), the spread cost is $15. We will again assume zero additional fees for simplicity.

- Total Cost: $15 (spread).

- Net Loss: $200 (loss) + $15 (spread) = $215.

Scenario 3: A High-Leverage, High-Risk USD/JPY Trade, Detailed analysis of Questrade Forex fees and commissions

This final scenario illustrates a high-risk, high-reward trade with significant leverage. This highlights the amplified impact of fees and the potential for substantial losses when using high leverage.

- Trade Setup: Selling 50,000 USD/JPY at a rate of 110.00, using 1:50 leverage.

- Trade Size: 50,000 USD/JPY.

- Profit/Loss: The USD/JPY rises to 110.50, resulting in a loss of 50 pips. The loss is 50 pips

– 50000 units = $500. - Fees: Let’s assume a spread of 2 pips (0.0002), costing $100. In addition, assume a small overnight financing fee of $5. This fee reflects the cost of borrowing money to maintain the leveraged position overnight.

- Total Cost: $100 (spread) + $5 (financing) = $105.

- Net Loss: $500 (loss) + $105 (fees) = $605.

Hidden Costs and Potential Surprises

While Questrade boasts competitive forex trading fees, the devil, as they say, is in the details. A seemingly straightforward fee structure can harbor unexpected costs that can significantly nibble away at your profits, especially for less experienced traders. Understanding these hidden expenses is crucial for maximizing your trading success and avoiding unpleasant surprises. Let’s delve into the potential pitfalls.

Many hidden costs are related to inactivity, specific trading practices, or the nuances of forex trading itself. These aren’t necessarily nefarious; rather, they’re often associated with the operational realities of providing a global trading platform. However, ignoring them can lead to a substantial reduction in your bottom line, turning a potentially profitable trade into a loss-making venture.

Overnight Financing Costs (Swap Fees)

Overnight financing costs, or swap fees, are charged when holding forex positions open overnight. These fees reflect the interest rate differential between the two currencies in the pair. For example, if you hold a long position in USD/JPY and the interest rate on the US dollar is lower than the Japanese yen, you’ll pay a swap fee. Conversely, if the US dollar rate is higher, you might receive a small credit.

These fees are calculated based on the size of your position and the prevailing interest rate differentials, which fluctuate daily. A large position held open for an extended period could accumulate substantial swap fees, negating any potential profit. For instance, holding a significant long position in a high-interest currency pair over a weekend could result in a surprisingly large swap fee deduction.

Inactivity Fees

Some brokerage accounts, while not explicitly stated by Questrade in their publicly available documentation, might impose inactivity fees after a prolonged period of no trading activity. These fees, though typically small, can accumulate over time and become significant if the account remains dormant for many months or years. This is a common practice among brokers to offset the administrative costs associated with maintaining inactive accounts.

It’s essential to review Questrade’s terms and conditions thoroughly to ascertain their specific policy on inactivity fees.

Data Feed Costs

While Questrade provides basic market data, access to advanced charting tools or real-time data feeds from premium providers might incur additional subscription fees. These costs can vary depending on the level of detail and the features offered. Traders relying on advanced technical analysis tools may find these extra costs essential, but it’s crucial to factor them into your overall trading expenses.

The cost of these premium data services could easily offset small profits, making it essential to assess the value proposition before subscribing.

Spread Widening During High Volatility

Spreads, the difference between the bid and ask price, can widen significantly during periods of high market volatility or news events. This widening isn’t a hidden fee per se, but it can drastically impact trading costs. A wider spread means you pay more to enter and exit a trade, potentially reducing your profit margins or even turning a profitable trade into a loss.

For example, during a major geopolitical event, spreads might widen substantially, increasing the cost of executing trades and impacting the overall profitability of your strategy. Understanding market volatility and adjusting your trading strategy accordingly is crucial to mitigate this risk.

Closure: Detailed Analysis Of Questrade Forex Fees And Commissions

So, there you have it – a comprehensive, slightly sarcastic, and hopefully enlightening journey through the world of Questrade forex fees. Remember, while the pursuit of profits can be thrilling, understanding the costs is crucial. Don’t let those hidden fees sneak up on you like a ninja in flip-flops! Armed with this knowledge, you can confidently choose the right account, strategize your trades, and hopefully, end up with more money in your pocket than you started with.

Now go forth and conquer (those forex fees!).

1 thought on “Detailed analysis of Questrade Forex fees and commissions”