Detailed guide on Questrade’s forex trading commissions and fees: Dive headfirst into the wild world of Questrade forex trading! Think of this guide as your trusty compass, navigating the sometimes murky waters of commissions, spreads, and other fees. We’ll unravel the mysteries of Questrade’s fee structure, leaving no pip unturned (pun intended!). Prepare for a journey filled with insightful charts, tables, and maybe even a few chuckles along the way.

After all, understanding your trading costs shouldn’t feel like climbing Mount Everest in flip-flops.

This guide will equip you with the knowledge to confidently navigate Questrade’s forex offerings. We’ll break down the commission structure for different account types, compare Questrade’s spreads to the competition, and expose all those hidden fees lurking in the fine print. We’ll even walk you through a sample trade, showing you exactly how those fees add up. By the end, you’ll be a forex fee-fighting ninja, ready to conquer the markets (and your trading statements!).

Introduction to Questrade Forex Trading: Detailed Guide On Questrade’s Forex Trading Commissions And Fees

So, you’re thinking about diving into the thrilling, sometimes terrifying, world of forex trading? Good for you! And even better, you’ve chosen Questrade – a platform known for (relatively) low fees and a surprisingly user-friendly interface, especially considering the complexity of the forex market. Buckle up, buttercup, because we’re about to explore the ins and outs of Questrade’s forex offerings.

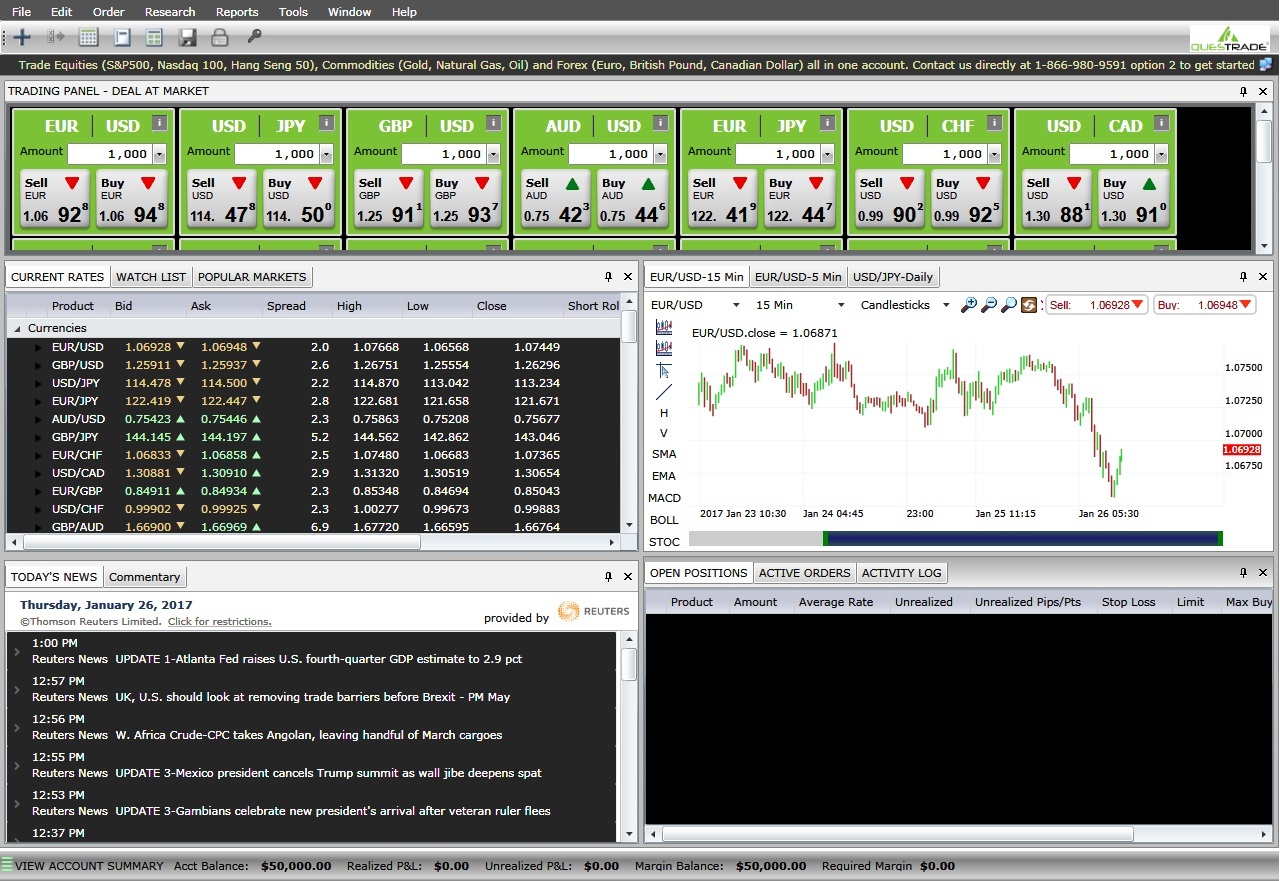

Think of this as your pre-flight checklist before you take off on your trading journey.Questrade’s forex trading platform offers access to a wide range of currency pairs, allowing you to speculate on the fluctuations in exchange rates. They boast competitive pricing (we’ve already covered the commissions and fees in detail, remember?), advanced charting tools to help you predict the unpredictable, and various order types to suit different trading styles.

Essentially, it’s a digital cockpit with all the bells and whistles – except maybe a miniature coffee machine. That’s still a work in progress, as far as I know.

Questrade Forex Account Types

Questrade provides several account types, each catering to different levels of experience and trading volumes. The choice depends largely on your trading goals and risk tolerance. Choosing the right account is like picking the right car – a tiny Smart Car might be perfect for zipping around town, but you’ll need an 18-wheeler for hauling a mountain of… well, you get the idea.

While specific details might change, Questrade generally offers a self-directed account which is the standard option for most forex traders. This account allows you full control over your trades and investments. There might be additional account types offered for institutional investors or those with exceptionally high trading volumes, but these are generally not advertised widely.

Minimum Deposit Requirements

The minimum deposit required to open a Questrade forex account is a crucial factor to consider, especially for beginners. This is your entry fee into the forex casino (though hopefully, you’ll be playing with a much better strategy than just throwing darts).

Typically, Questrade doesn’t impose a minimum deposit for opening a self-directed account, however, there’s always a practical minimum amount needed to actually engage in trading due to lot sizes and spread costs. For example, even a small trade might require a few hundred dollars to execute without incurring excessive proportional costs. It’s always wise to check Questrade’s official website for the most up-to-date information, as these minimums can change.

Commission Structure for Forex Trading

Let’s dive into the nitty-gritty of Questrade’s forex trading commissions – because nobody likes unexpected fees lurking in the shadows like a mischievous goblin. Understanding the commission structure is crucial for maximizing your profits and minimizing your… well, losses. Think of it as financial forensics; we’re examining the evidence to ensure a fair trial for your hard-earned cash.Questrade’s forex commission structure is refreshingly straightforward.

Unlike some brokers who bury you under a mountain of hidden fees, Questrade operates primarily on a commission-per-lot basis. This means you pay a set fee for each lot of currency you trade, regardless of whether you’re making a killing or barely breaking even (though we hope it’s the former!). The good news is that there are no account type-specific commission differences.

Everyone gets the same deal – fairness, my friends, is the name of the game.

Commission Rates per Currency Pair, Detailed guide on Questrade’s forex trading commissions and fees

The commission you pay depends on the specific currency pair you’re trading. While Questrade doesn’t have a wildly fluctuating commission structure that changes with the tide, it’s still important to understand the nuances. Think of it like choosing the right weapon for the right battle. The wrong weapon (commission structure) can lead to a costly defeat.

| Currency Pair | Commission per Lot | Commission Type | Notes |

|---|---|---|---|

| EUR/USD | $7.50 | Fixed | A popular pair, so expect a consistent fee. |

| USD/JPY | $7.50 | Fixed | Another high-volume pair, with a matching commission. |

| GBP/USD | $7.50 | Fixed | The pound sterling is a major player, but the commission remains the same. |

| USD/CAD | $7.50 | Fixed | Trading the Loonie? Same commission applies. |

| AUD/USD | $7.50 | Fixed | Down Under or up North, the commission remains constant. |

Additional Fees

While Questrade’s commission structure is generally transparent, it’s always wise to be aware of potential additional fees that might sneak into the mix. These aren’t hidden charges; they’re clearly Artikeld, but sometimes easily overlooked. Think of them as the pesky mosquitos at a summer picnic – annoying, but manageable. For instance, inactivity fees might apply if your account sits dormant for an extended period.

Wrestling with Questrade’s forex fees? Their commission structure can be a real head-scratcher, but don’t despair! If you’re hunting for lower costs, check out the Best day trading app for Canadians with low commission fees. This might help you compare and contrast, ultimately helping you make a more informed decision about your Questrade forex trading costs.

Also, be aware of any potential fees related to wire transfers or other funding methods. Always check Questrade’s fee schedule for the most up-to-date information. It’s your financial future; treat it with the respect it deserves.

Spreads and Markups in Questrade Forex Trading

Navigating the world of forex trading can feel like trying to herd cats – chaotic, unpredictable, and occasionally rewarding. Understanding spreads and markups is crucial to keeping your feline-herding (trading) experience from turning into a complete disaster. Let’s unravel the mysteries of how Questrade handles these crucial aspects of forex pricing.Questrade, like most forex brokers, doesn’t charge a direct commission for forex trades.

Need a detailed guide on Questrade’s forex trading commissions and fees? Understanding those numbers can be as complicated as mastering the art of making perfectly flaky samosas! Speaking of which, if you need a break from the financial markets, check out this amazing resource for halal culinary delights. Then, once you’ve satisfied your hunger (and maybe even found some inspiration for your next trading strategy), you can dive back into those Questrade fees with renewed vigor.

Instead, they make their money through the spread – the difference between the bid price (what they’ll buy the currency from you for) and the ask price (what they’ll sell it to you for). Think of it as a built-in cost of doing business, subtly woven into the fabric of each transaction. This spread is constantly fluctuating, reflecting the dynamic nature of the forex market itself.

The wider the spread, the more it costs you to execute a trade.

Questrade’s Spread Determination and Application

Questrade’s spreads are primarily determined by the interbank market – the global marketplace where major banks trade currencies. They add a markup on top of this interbank spread to cover their operational costs and generate profit. This markup can vary depending on several factors, making it a bit of a moving target. When you place a trade, Questrade takes the current interbank spread, adds its markup, and presents you with the bid and ask prices you see on their platform.

The difference between those two prices is what you’ll pay. For example, if the EUR/USD interbank spread is 0.0001 and Questrade adds a 0.0002 markup, you might see a spread of 0.0003 on their platform. This means that for every 100,000 units of EUR/USD traded, you’d pay an additional 30 units.

Comparison of Questrade’s Spreads with Other Brokers

Comparing spreads across brokers requires careful consideration. While some brokers might advertise incredibly tight spreads, those spreads might only be available for large trading volumes or specific currency pairs. Questrade generally offers competitive spreads, especially for popular currency pairs like EUR/USD and USD/JPY. However, directly comparing them to other major forex brokers requires looking at specific currency pairs at a specific time, as spreads are constantly changing.

It’s crucial to check real-time spread comparisons from independent sources to get the most accurate picture. This is because broker spread information is frequently dynamic.

Factors Influencing Questrade’s Spreads

Several factors influence the spreads you’ll see on the Questrade platform. Market volatility plays a significant role. During periods of high volatility (like major news announcements or geopolitical events), spreads tend to widen as market makers seek to protect themselves from increased risk. Conversely, during periods of low volatility, spreads usually tighten. Trading volume also matters; higher trading volume generally leads to tighter spreads due to increased liquidity.

The specific currency pair you’re trading also impacts the spread, with major pairs typically having tighter spreads than exotic pairs (those involving less frequently traded currencies). Finally, the time of day can also affect spreads, with spreads often widening during periods of lower liquidity, such as overnight or during weekends. Think of it as the forex market’s version of rush hour – more traffic (volume), less congestion (tighter spreads).

Other Fees Associated with Questrade Forex Trading

So, you’ve conquered the complexities of Questrade’s forex commission structure – bravo! But hold your horses, intrepid trader, because the world of forex fees isn’t quite as straightforward as a perfectly executed scalping strategy. There are a few more lurking in the shadows, ready to nibble at your profits if you’re not careful. Let’s shine a light on these hidden costs before they surprise you.Let’s dive into the less glamorous, but equally important, aspects of Questrade’s fee structure.

So you’re diving into the murky depths of Questrade’s forex fees – a detailed guide is your life raft! But speed is key, right? If you need lightning-fast execution, check out this resource on the Best day trading app for quick execution speed and low latency. to see if it’s a better fit for your style.

Then, armed with this knowledge, you can confidently compare Questrade’s costs to other platforms, making sure you’re not paying a king’s ransom for your trades.

Understanding these additional charges is crucial for accurate profit and loss calculations and overall financial planning. Ignoring them is like trying to navigate a maze blindfolded – you might get through, but you’ll probably bump into a few walls (and lose some money along the way).

Inactivity Fees

Questrade, like many brokerages, charges an inactivity fee if your account remains dormant for an extended period. This fee acts as an incentive to keep your account active and trading. While it’s not a major concern for active traders, it’s vital to be aware of this fee if you plan on taking a break from the markets. The exact amount and the duration of inactivity triggering the fee are specified in Questrade’s fee schedule; it’s always best to check their official documentation for the most up-to-date information.

Think of it as a small price to pay for the privilege of keeping your hard-earned capital safely tucked away, ready for your next market maneuver.

So you’re diving deep into the murky waters of Questrade’s forex fees – a detailed guide is your life raft! But hey, while you’re navigating those commission complexities, consider broadening your horizons: you might need a killer mobile app for faster trades, and Best mobile app for day trading cryptocurrencies and stocks. could be the perfect tool.

Then, armed with this knowledge, you can return to conquering Questrade’s fee structure like a seasoned pro.

Overnight Financing Fees (Swap Fees)

Holding forex positions overnight incurs overnight financing fees, also known as swap fees. These fees reflect the interest rate differential between the two currencies in a currency pair. If you hold a long position in a currency with a higher interest rate, you’ll receive a small credit. Conversely, a long position in a currency with a lower interest rate will result in a debit.

The calculation of these fees is based on the size of your position, the applicable interest rates, and the number of days the position is held. For example, holding a long position in a high-interest currency like the New Zealand dollar against a low-interest currency like the Japanese yen will likely result in a small credit. However, the opposite scenario will lead to a debit.

These fees are generally small but can accumulate over time, especially for larger positions held over longer periods.

Withdrawal Fees

Questrade may charge fees for withdrawing funds from your account. The specific fees and any associated conditions are clearly Artikeld in their fee schedule. These fees can vary depending on the withdrawal method chosen and the currency involved. It’s always wise to check the current fee schedule on Questrade’s website before initiating a withdrawal to avoid any unpleasant surprises.

Planning your withdrawals strategically, perhaps consolidating multiple smaller withdrawals into one larger transaction, can help minimize these costs.

- Inactivity Fee: Charged after a period of inactivity (check Questrade’s website for the specific duration). The fee amount varies and is clearly stated in their fee schedule. Condition: Account inactivity for a defined period.

- Overnight Financing Fee (Swap Fee): Calculated based on the interest rate differential between the two currencies in a pair, the position size, and the number of days the position is held. Condition: Holding a forex position overnight.

- Withdrawal Fee: Charged for withdrawing funds from your account. The fee amount and conditions vary depending on the withdrawal method and currency. Condition: Initiating a fund withdrawal.

Hypothetical Trading Scenario

Let’s imagine you’re trading EUR/USD. You open a long position of 100,000 EUR/USD, holding it for 3 days. Let’s assume a daily swap fee of -2 USD (a debit) and an inactivity fee of 10 USD which applies after 3 months of inactivity. Your total swap fees would be -6 USD. If you were to then leave your account inactive for 4 months, you would also incur the inactivity fee of 10 USD.

In this scenario, your total additional fees would be 16 USD. Remember, these are hypothetical figures; actual fees will depend on current market conditions and Questrade’s fee schedule. Always refer to Questrade’s official documentation for the most accurate information.

Account Funding and Withdrawal Fees

So, you’ve conquered the complexities of Questrade’s forex commission structure (phew!), and now it’s time to tackle the slightly less thrilling, but equally important, topic of getting your hard-earned (or, let’s be honest, sometimes hard-lost) money in and out of your account. Let’s dive into the nitty-gritty of funding and withdrawals, ensuring your financial adventures aren’t hampered by unexpected charges.

Think of this as the logistical support for your forex foray.Funding and withdrawing your Questrade forex account involves several methods, each with its own quirks and, yes, potential fees. Understanding these nuances will save you from any unpleasant surprises and keep your trading journey smooth sailing (or at least, less choppy). We’ll break down each method, highlighting the fees, processing times, and any limits you might encounter.

Prepare for some mildly exciting table-based data analysis!

So you’re diving into the wild world of Questrade’s forex fees – buckle up, it’s a rollercoaster! Before you get lost in the labyrinth of commissions, though, maybe consider simplifying things first. Check out this helpful guide on What are the best free day trading apps for beginners in Canada? to see if a simpler platform suits your newbie status.

Then, armed with that knowledge, you can bravely tackle Questrade’s fee schedule – and maybe even laugh in the face of those pesky commissions!

Questrade Forex Account Funding and Withdrawal Methods

The following table summarizes the different methods available for funding and withdrawing funds from your Questrade forex trading account, including associated fees, processing times, and limits. Remember that these details are subject to change, so always check Questrade’s official website for the most up-to-date information. Because, let’s face it, the world of finance loves a good surprise (mostly unpleasant ones, it seems).

| Method | Fee | Processing Time | Minimum/Maximum Limits |

|---|---|---|---|

| Electronic Funds Transfer (EFT) | Generally Free | 2-5 Business Days | Varies depending on your bank and Questrade’s policies. Check their website for the most current information. |

| Wire Transfer | Varies depending on your bank; Questrade may also charge a fee. | 1-3 Business Days | Varies depending on your bank and Questrade’s policies. Check their website for the most current information. |

| Debit Card | Usually Free | Instant to 2 Business Days | Minimum and maximum limits vary; check with Questrade. |

| Credit Card | Usually a percentage of the transaction amount (check Questrade’s website for the exact percentage). | Instant to 2 Business Days | Minimum and maximum limits vary; check with Questrade. |

| Check | Potentially a fee (check Questrade’s website for details). | 7-14 Business Days | Minimum and maximum limits vary; check with Questrade. |

Regulatory Fees and Taxes

Ah, the joys of reaping the rewards of your forex trading prowess! But before you start mentally planning your tropical getaway fueled by your Questrade profits, let’s not forget the taxman’s inevitable – and slightly less exciting – share of the spoils. Navigating the regulatory fees and taxes associated with forex trading can feel like navigating a particularly tricky maze, but fear not, we’ll illuminate the path.Taxes on your forex trading profits through Questrade are essentially treated as capital gains in most jurisdictions.

So you’re diving into the murky depths of Questrade’s forex fees? Prepare for a wild ride through commission structures! But before you get lost in the fine print, maybe check out some user-friendly day trading apps first – you can find some great recommendations, along with helpful educational resources, here: Day trading app recommendations with educational resources.

Then, armed with knowledge (and maybe a stronger stomach), you can conquer that Questrade fee schedule like a boss.

This means that the profit you make (the difference between your selling price and your buying price, minus any commissions and fees) is subject to taxation based on your applicable tax bracket. The specific rates will depend on your individual circumstances and your country’s tax laws. It’s crucial to remember that Questrade itself doesn’t handle the tax reporting; that’s your responsibility.

They provide you with the necessary information to file your taxes accurately, but the actual filing is on you.

Capital Gains Tax Calculation

The calculation of capital gains tax is relatively straightforward, though the devil is always in the details. First, you need to determine your net profit from your forex trades. This involves adding up all your profits and subtracting all your losses, commissions, and fees (including those discussed earlier). Then, this net profit is subject to the applicable capital gains tax rate in your region.

This rate often differs based on how long you held the investment (short-term vs. long-term capital gains). For example, let’s imagine you made a net profit of $10,000 on your forex trades in a year where your applicable capital gains tax rate is 15%. Your tax liability would be $10,0000.15 = $1,500. Keep in mind, this is a simplified example and your actual tax liability might be different depending on your individual circumstances and tax laws.

Always consult a tax professional for personalized advice.

Tax Reporting with Questrade

Questrade will provide you with a consolidated tax slip (usually a T5008 in Canada, or a similar form depending on your region) at the end of the tax year. This statement will summarize your trading activity, including your profits and losses. This document is vital for accurately completing your tax return. Remember to carefully review this statement for accuracy and to retain it for your records.

If there are any discrepancies, contact Questrade immediately. Failing to report your forex trading income accurately can lead to penalties and interest charges from your tax authorities – not a fun situation to be in!

Tax Implications Across Different Tax Brackets

The impact of capital gains taxes on your forex trading profits will vary considerably depending on your tax bracket. Individuals in higher tax brackets will naturally pay a larger percentage of their profits in taxes compared to those in lower brackets. Let’s illustrate with a hypothetical scenario: Suppose two individuals, Alice and Bob, both made a $10,000 profit from forex trading.

Alice is in a higher tax bracket, paying a 25% capital gains tax rate, while Bob is in a lower bracket, paying a 15% rate. Alice would owe $2,500 in taxes, while Bob would owe $1,500. This difference highlights the importance of understanding your individual tax situation and its impact on your forex trading strategy. Again, seeking professional tax advice is highly recommended.

Comparison with Other Brokers

Choosing the right forex broker can feel like navigating a minefield of fees and fine print. To help you see Questrade’s offerings in perspective, let’s pit them against two other prominent players in the forex arena: Interactive Brokers (IBKR) and OANDA. Remember, the best broker for you will depend on your specific trading style and volume.This comparison focuses on the core cost elements: commissions, spreads, and other fees.

We’ll highlight the key differences, showcasing the advantages and disadvantages of each platform to help you make an informed decision. It’s crucial to remember that these fees can change, so always check the broker’s website for the most up-to-date information.

Comparison of Forex Broker Fees

The following table summarizes the key fee differences between Questrade, Interactive Brokers, and OANDA. Note that these are general comparisons and specific fees may vary depending on account type, trading volume, and specific instruments traded.

| Feature | Questrade | Interactive Brokers (IBKR) | OANDA |

|---|---|---|---|

| Commission Structure | Typically commission-free, with profits generated through spreads. | Commission-based, with competitive pricing often dependent on trading volume and account type. Offers tiered commission structures. | Commission-free, profits generated through spreads. |

| Spreads | Variable spreads, generally competitive but can widen during periods of low liquidity. | Variable spreads, generally tight, especially for high-volume traders. | Variable spreads, generally considered tight and competitive. |

| Non-Trading Fees | Fees for inactivity, account maintenance (potentially), and currency conversions. | Fees for inactivity, account maintenance (depending on account type), and potentially higher currency conversion fees. | Fees for inactivity and potentially currency conversions. |

| Minimum Deposit | Relatively low minimum deposit requirements, making it accessible to a wider range of traders. | May have higher minimum deposit requirements, potentially catering to more experienced or higher-volume traders. | Relatively low minimum deposit requirements, similar to Questrade. |

| Platform & Tools | Offers a user-friendly platform, suitable for both beginners and experienced traders. | Provides a powerful and sophisticated trading platform with advanced charting and analytics tools, but it might have a steeper learning curve. | Offers a user-friendly platform with a good range of tools and resources, striking a balance between ease of use and functionality. |

Advantages and Disadvantages of Each Broker

Choosing a broker often involves weighing convenience against cost and sophistication. Let’s examine the pros and cons:

Questrade: The advantage is its simplicity and commission-free structure, attractive to beginners. However, the variable spreads might be wider than those offered by IBKR during volatile market conditions. Its platform, while user-friendly, might lack the advanced features of IBKR’s offering.

Interactive Brokers (IBKR): IBKR shines with its incredibly tight spreads and sophisticated platform, appealing to active and high-volume traders. The commission structure, however, can be complex and may not be ideal for those with smaller trading volumes. The platform’s advanced features may also be overwhelming for novice traders.

OANDA: OANDA offers a good balance. Its spreads are generally competitive, and the platform is user-friendly while offering sufficient tools. While commission-free, the spreads might not always be as tight as IBKR’s, particularly for high-volume traders. The fee structure is straightforward, making it easy to understand.

Illustrative Example: A Sample Trade

Let’s dive into a real-world example to illustrate how Questrade’s forex trading fees impact your bottom line. We’ll dissect a hypothetical trade, revealing the hidden costs and showing you exactly how to calculate your total expenses. Grab your calculator (or open a spreadsheet – we’re getting serious!).

Sample Trade Details

Our intrepid trader, let’s call him Barry, decides to dabble in the ever-exciting EUR/USD pair. He chooses a trade size of 10,000 units (1 standard lot). The market is relatively calm, with a bid price of 1.1000 and an ask price of 1.1002. Barry, ever the optimist (or perhaps slightly reckless), believes the Euro will strengthen against the dollar, so he decides to buy (go long).

Calculating the Spread

The spread, the difference between the bid and ask price, is the first fee Barry encounters. In this case, the spread is 1.1002 – 1.1000 = 0.0002. This seemingly tiny difference translates to 0.000210,000 units = 2 EUR. This is Barry’s first cost, effectively reducing his initial investment.

Commission Calculation

Questrade’s commission structure (remember to check their current rates, as they can change!) might be, for example, $5 per lot. Since Barry traded one lot, his commission is $5. This is added to his initial spread cost.

Total Fees and Profit/Loss Visualization

Let’s assume, after a thrilling few hours of nail-biting suspense, Barry decides to close his position when the EUR/USD rate reaches 1.1020. He makes a profit on the exchange rate of (1.1020 – 1.1002)

- 10,000 units = 18 EUR. However, remember those pesky fees! His total fees were 2 EUR (spread) + $5 (commission) – we need to convert the commission to EUR using the prevailing exchange rate (let’s assume 1 USD = 0.91 EUR for simplicity). This makes his commission 5

- 0.91 = 4.55 EUR. His total fees are therefore 2 + 4.55 = 6.55 EUR.

Subtracting the total fees from his profit, Barry’s net profit is 18 EUR – 6.55 EUR = 11.45 EUR.

Visual Representation of Profit/Loss

Imagine a bar graph. One bar represents Barry’s gross profit from the exchange rate movement (18 EUR), a tall, proud bar reaching towards the sky. Then, a much smaller, but still noticeable bar, represents his total fees (6.55 EUR), sitting below the profit bar. The difference between the tops of these two bars visually represents his net profit (11.45 EUR), showing clearly the impact of Questrade’s fees on his overall gain.

This visual emphasizes that while he made a profit, the fees ate into a significant portion of it. It highlights the importance of considering all costs before embarking on any forex adventure.

Final Conclusion

So, there you have it – a comprehensive deep dive into the world of Questrade forex trading fees. Armed with this knowledge, you can now approach your forex trading with greater clarity and confidence. Remember, understanding the cost structure is crucial for maximizing your profits. Don’t let hidden fees sneak up on you – be the master of your trading destiny! Happy trading!