FX Spot Trading vs. Futures Contracts Explained: Dive headfirst into the wild world of forex trading, where fortunes are made (and lost!) faster than you can say “margin call.” We’ll untangle the knotty differences between the electrifying speed of spot trading and the more measured pace of futures contracts, revealing the secrets to navigating these thrilling markets. Prepare for a rollercoaster ride of financial enlightenment, complete with enough jargon to impress even your broker!

This guide will dissect the core mechanics of both spot and futures trading, comparing and contrasting their settlement procedures, leverage, margin requirements, price discovery mechanisms, and risk management strategies. We’ll explore how speculation and hedging influence market dynamics, examining concepts like contango and backwardation. We’ll even delve into the nitty-gritty of trading costs and fees, helping you determine which approach best suits your trading style and risk tolerance.

Buckle up, it’s going to be a bumpy – but profitable – ride!

Defining FX Spot Trading and Futures Contracts

So you want to dive into the thrilling world of foreign exchange trading? Fantastic! But before you start picturing yourself sipping margaritas on a beach in Bali (funded, of course, by your forex profits), let’s get a grip on the fundamentals. This deep dive will illuminate the differences between FX spot trading and futures contracts, two distinct but equally exciting ways to play the global currency market.

FX Spot Trading Explained

FX spot trading is the simplest form of forex trading. It’s the equivalent of walking into a currency exchange booth and swapping your dollars for euros (or vice versa). The transaction settles within two business days, making it a relatively quick and straightforward process.Here’s a step-by-step breakdown of executing a spot trade:

1. Determine the trade

You decide you want to buy or sell a specific currency pair (e.g., EUR/USD). A “buy” means you believe the euro will appreciate against the dollar, and a “sell” means the opposite.

So you’re wrestling with the wild world of FX spot trading versus futures contracts? It’s a jungle out there! To navigate this, you’ll need a trusty guide – maybe even a Sherbrooke-based forex broker, check out this helpful comparison and reviews site: Forex brokers in Sherbrooke, Quebec: comparison and reviews. Once you’ve found your perfect broker, you can conquer the complexities of spot versus futures and finally understand the difference between immediate gratification and carefully planned trades.

2. Find a broker

You’ll need a forex broker to facilitate the trade. These brokers act as intermediaries, connecting buyers and sellers.

3. Place the order

Through your broker’s platform, you specify the currency pair, the amount you want to trade (usually in lots of 100,000 units), and the desired exchange rate.

4. Order execution

Your broker executes the trade, matching your order with a counterparty.

Confused about the wild west of FX spot trading versus the more predictable (but sometimes less exciting) world of futures contracts? Understanding the nuances is key, and to help you navigate this financial jungle, check out the A&O Trading platform review and comparison with competitors to see how different platforms handle these different beasts. Then, armed with this knowledge, you can conquer the forex markets like a seasoned pro (or at least a slightly less clueless newbie).

5. Settlement

The transaction settles within two business days, meaning the currencies are exchanged. You’ll see the change reflected in your account.

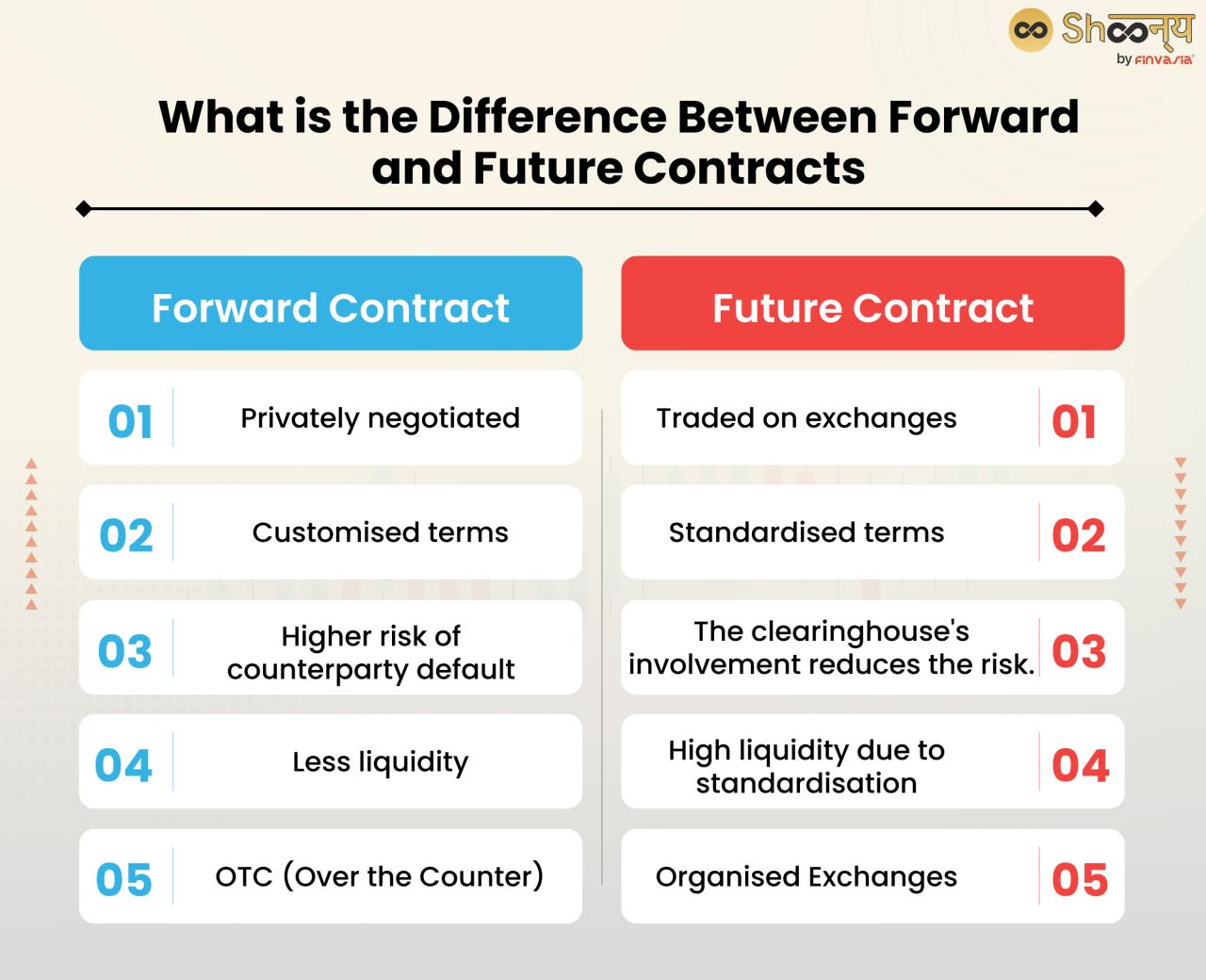

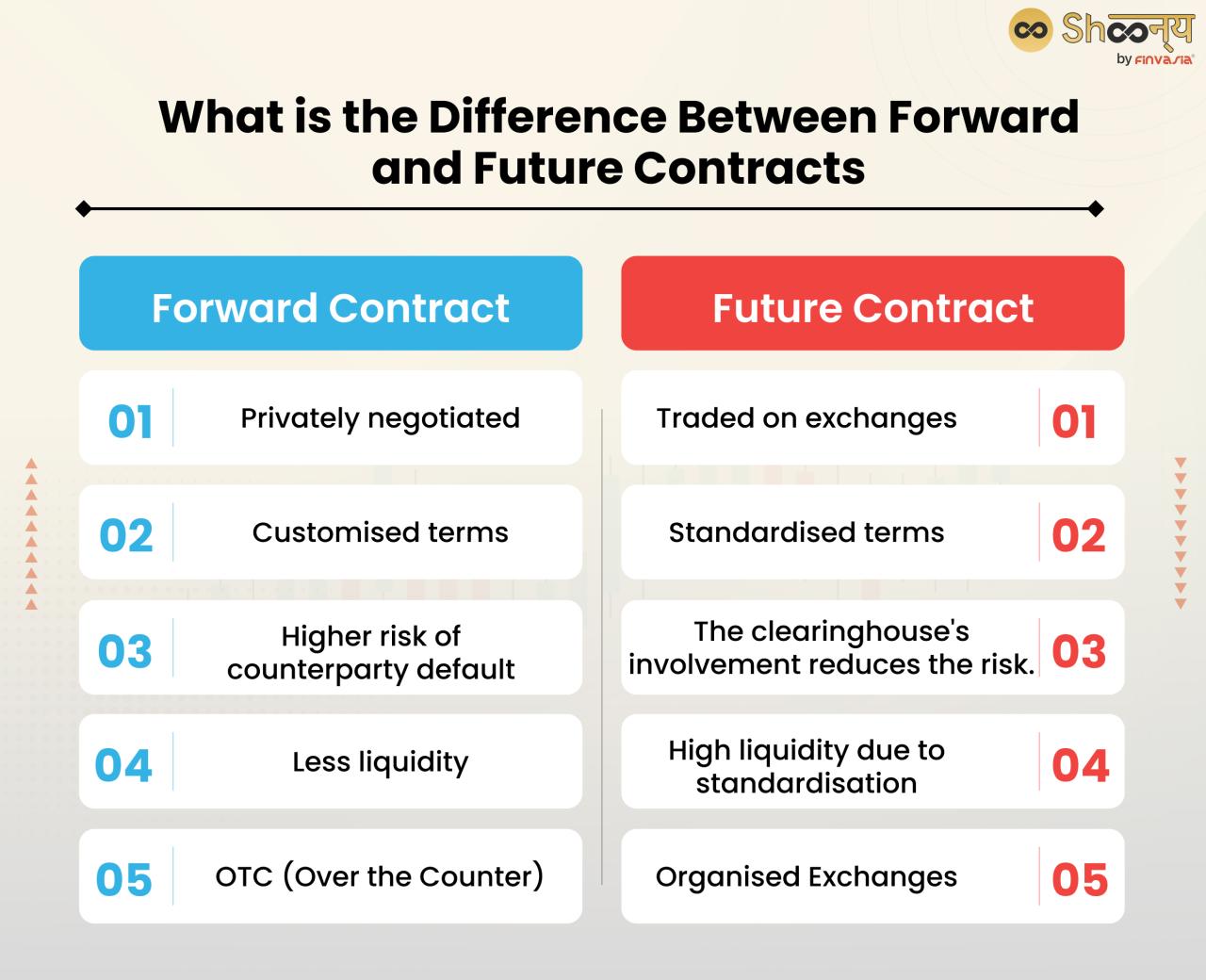

FX Futures Contracts Explained

FX futures contracts are standardized agreements to buy or sell a specific currency pair at a predetermined price on a future date. Think of them as pre-arranged currency swaps, with the terms set in advance. These contracts are traded on organized exchanges, such as the CME Group, and are highly regulated.Key characteristics include:* Standardized Contract Size: Each contract specifies a standard amount of currency.

Expiration Date

Futures contracts have a specific expiration date, after which the contract must be settled.

Trading Mechanism

Futures contracts are traded on exchanges, providing transparency and liquidity.

Margin Requirements

Traders need to deposit margin (collateral) to secure their positions. This acts as a guarantee against potential losses.

Spot vs. Futures: Settlement Procedures

Spot transactions settle within two business days, a relatively short timeframe. Futures contracts, on the other hand, can have settlement dates months or even years in the future. Spot settlements typically involve the direct exchange of currencies between the buyer and seller. Futures contracts can be settled by physical delivery of the currency or through cash settlement, where the difference between the contract price and the market price at expiration is paid.

Comparing Spot Trading and Futures Contracts

| Instrument | Settlement | Price Determination | Risk Profile |

|---|---|---|---|

| FX Spot | T+2 (two business days) | Current market rate at time of trade | Higher risk due to immediate exposure to market fluctuations |

| FX Futures | At contract expiration (future date) | Market forces on the exchange | Risk is mitigated by standardized contracts and margin requirements, but potential losses still exist |

Leverage and Margin Requirements: FX Spot Trading Vs. Futures Contracts Explained

The world of FX trading, whether you’re splashing around in the spot market or diving headfirst into futures, is all about leverage. Think of it as borrowing money to amplify your potential profits (and losses, unfortunately!). But with great power comes great responsibility, and that responsibility often manifests in the form of margin requirements. Let’s unpack this thrilling, yet potentially perilous, aspect of FX trading.Leverage in FX spot trading and futures contracts differs significantly.

Spot trading typically offers higher leverage, while futures contracts, while still leveraged, have stricter margin requirements. This difference stems from the underlying nature of each market and the regulatory frameworks governing them.

Leverage in FX Spot and Futures Trading

Spot FX trading often provides leverage ratios of 50:1 or even higher, depending on your broker and your account type. This means you can control a position worth $50,000 with only $1,000 of your own money. For example, if you leverage 50:1 and buy $50,000 worth of EUR/USD, a 1% move in your favor would yield a $500 profit (50,0000.01 = 500), representing a 50% return on your initial investment.

However, a 1% move against you would result in a $500 loss – equally significant.Futures contracts, on the other hand, generally offer lower leverage. The exact leverage depends on the contract specifications and the margin requirements set by the exchange. Let’s say a EUR/USD futures contract has a contract size of €125,000 and a margin requirement of $2,In this case, the leverage is 50:1 (€125,000 / $2,500 = 50).

A 1% move would still result in a $1,250 profit or loss, but your initial investment is $2,500, resulting in a 50% gain or loss. The key difference is the initial capital required.

Margin Requirements for FX Futures Contracts

Margin is the amount of money you must deposit with your broker to secure a futures position. It acts as collateral, protecting the broker against potential losses if the market moves against you. Margin requirements vary depending on the specific contract, the exchange, and your broker, and they can change based on market volatility. They are usually expressed as a percentage of the contract’s value.For example, if the margin requirement for a particular EUR/USD futures contract is 5% and the contract value is $100,000, you would need to deposit $5,000 ($100,0000.05 = $5,000) as initial margin.

If the market moves against you, and your account equity falls below a certain level (the maintenance margin), you’ll receive a margin call.

Margin Call Scenario

Imagine you’ve opened a EUR/USD futures contract with a $5,000 initial margin. The maintenance margin is 3%, or $3,000 ($100,0000.03 = $3,000). If the market moves against you, and your account equity drops below $3,000, your broker will issue a margin call. This is a demand for you to deposit additional funds to bring your account equity back up to the initial margin level.

Failure to meet a margin call can lead to the liquidation of your position. The broker will close your position to minimize their losses, potentially resulting in substantial financial losses for you.

Confused about the wild world of FX spot trading versus futures contracts? Understanding the difference is key, especially when dealing with real-world currency conversions. For a peek at how one brokerage handles this, check out the rates at Questrade foreign exchange services and currency conversion rates , then you’ll be better equipped to navigate the thrilling, yet sometimes terrifying, landscape of FX spot and futures trading.

Remember, timing is everything – even more so in the fast-paced world of forex!

Implications of Leverage and Margin on Risk Management

High leverage magnifies both profits and losses. While it allows you to control large positions with a smaller initial investment, it also increases the risk of substantial losses. In spot trading, the potential for losses is theoretically unlimited (though brokers often have stop-out levels), whereas in futures trading, losses are capped by the contract value. However, rapid market movements can still wipe out your margin, leading to a margin call and potential liquidation.

Effective risk management is crucial, involving techniques like stop-loss orders, position sizing, and diversification. Never trade with money you can’t afford to lose. This is a crucial aspect for both spot and futures trading. Understanding the leverage offered and the margin requirements is fundamental to responsible trading and minimizing your exposure to unforeseen losses.

Price Discovery and Market Dynamics

Spot and futures markets, while both dealing in the same underlying asset (in this case, currencies), reveal their price information through dramatically different mechanisms. Think of it like this: the spot market is a bustling farmer’s market, where prices are set by immediate supply and demand, a chaotic ballet of buyers and sellers haggling over the freshest produce (currency). Futures, on the other hand, are more like a sophisticated commodities exchange, where prices are determined by a more complex interplay of future expectations, speculation, and hedging strategies.Spot prices reflect the current market value of a currency pair, determined by the immediate forces of supply and demand.

Futures prices, however, anticipate future value, incorporating market participants’ expectations about future interest rates, economic growth, and geopolitical events. This leads to a fascinating dance between the two, where speculation and hedging play crucial roles in shaping both spot and futures prices. Speculators, the thrill-seekers of the financial world, bet on future price movements, while hedgers, the risk-averse pragmatists, use futures to mitigate their exposure to future price fluctuations.

Their collective actions influence both spot and futures prices, sometimes in unexpected and dramatic ways.

Spot and Futures Price Relationships: Contango and Backwardation

The relationship between spot and futures prices isn’t always straightforward. Sometimes, futures prices are higher than the spot price (contango), and sometimes they are lower (backwardation). Contango occurs when the market anticipates higher future prices, perhaps due to expected increases in demand or storage costs. Backwardation, conversely, indicates that the market anticipates lower future prices, possibly due to an oversupply or negative outlook.Let’s imagine a scenario with the EUR/USD currency pair.

Confused about the wild west of FX spot trading versus the slightly-less-wild-west of futures contracts? Understanding the difference is crucial, especially if you’re looking to diversify your portfolio – perhaps by checking out how to profit from cryptocoin – before diving headfirst into leveraged trades. After all, mastering these FX concepts will make any financial adventure, crypto or otherwise, significantly less hairy.

Suppose the current spot price is 1.1000. If the market expects the Euro to strengthen against the dollar in the future (perhaps due to anticipated positive economic data), the three-month futures contract might trade at 1.1100, exhibiting contango. The difference reflects the market’s expectation of future price appreciation, plus any associated carrying costs. Conversely, if the market anticipates a weakening of the Euro, the three-month futures contract might trade at 1.0900, showcasing backwardation.

This indicates a belief that the spot price will fall in the near future.

Factors Influencing Price Movements

Understanding the factors driving price movements in both spot and futures markets is crucial for successful trading. The following factors exert significant influence:

- Economic Data Releases: Macroeconomic news, such as GDP growth, inflation figures, and unemployment rates, can significantly impact currency values and, consequently, both spot and futures prices. A surprisingly strong GDP report might boost a currency’s value, affecting both spot and futures prices.

- Central Bank Policies: Interest rate decisions, quantitative easing programs, and other monetary policy actions by central banks are major drivers of currency movements. An unexpected interest rate hike, for instance, might strengthen a currency’s value.

- Geopolitical Events: Political instability, wars, and other geopolitical events can trigger significant volatility in currency markets, affecting both spot and futures prices. A major international conflict, for example, could lead to significant currency fluctuations.

- Speculation and Hedging: The actions of speculators and hedgers significantly impact both spot and futures markets. Large-scale speculative buying can drive prices upward, while heavy hedging activity can exert downward pressure.

- Market Sentiment: Overall market sentiment—whether optimistic or pessimistic—can influence currency prices. Positive sentiment often leads to higher prices, while negative sentiment can trigger declines.

- Technical Analysis: Technical indicators such as moving averages, support and resistance levels, and chart patterns can be used to predict price movements in both spot and futures markets. These indicators help traders identify potential trading opportunities.

Risk Management Strategies

Navigating the thrilling, yet sometimes treacherous, waters of FX trading requires a sturdy vessel—and that vessel is a robust risk management plan. Whether you’re a spot trader chasing fleeting pips or a futures aficionado riding the waves of contracts, understanding and implementing effective risk management is paramount to avoiding a watery grave (or, you know, a significant financial loss).

Let’s dive into the strategies that can keep your trading ship afloat.

Risk management isn’t about eliminating risk entirely – that’s about as likely as finding a unicorn riding a unicycle on Wall Street. It’s about intelligently managing your exposure to potential losses, ensuring that even the inevitable losing trades don’t sink your entire portfolio. This involves a careful balance of ambition and prudence, a delicate dance between maximizing potential profits and minimizing potential pain.

Risk Management in Spot FX Trading

Spot FX trading, with its immediate execution and relatively simple structure, offers both opportunities and challenges. Effective risk management here hinges on two key pillars: stop-loss orders and position sizing. Stop-loss orders act as automated life rafts, automatically closing your position when the market moves against you by a predetermined amount, limiting your potential losses. Position sizing, on the other hand, determines how much capital you allocate to each trade.

Think of it as deciding how many lifeboats you need based on the size of your ship.

For example, a trader might decide to risk only 1% of their account balance on any single trade. If their account is $10,000, they would only risk $100 per trade. This helps to prevent catastrophic losses, even if multiple trades go against them. The art lies in finding the right balance: too small, and your profits will be minuscule; too large, and a single bad trade could be devastating.

The goal is to find a risk level that is both comfortable and profitable in the long run.

Risk Management in FX Futures Trading

FX futures trading introduces a new dimension of complexity, requiring more sophisticated risk management techniques. Hedging, a strategy that involves taking an offsetting position to mitigate potential losses, becomes crucial. For instance, if a trader is long EUR/USD futures, they might hedge their position by simultaneously taking a short position in a related currency pair, or perhaps even by using options.

Offsetting positions is another key strategy. Futures contracts are standardized, allowing traders to easily close out their positions before expiration. This flexibility enables traders to manage risk actively, adjusting their exposure based on market movements and their evolving risk tolerance. Imagine it like having a spare parachute – you hope you won’t need it, but it’s comforting to know it’s there if things go south.

Comparison of Risk Profiles

The risk profiles of spot and futures trading differ significantly. Spot trading offers more flexibility but less leverage, while futures trading provides higher leverage but involves more complex risk management considerations. The table below summarizes these differences:

| Risk Factor | Spot FX Trading | FX Futures Trading | Mitigation Strategy |

|---|---|---|---|

| Leverage | Generally lower | Significantly higher | Careful position sizing, margin monitoring |

| Liquidity | Generally high | High, but can vary depending on contract and market conditions | Diversification, monitoring market depth |

| Volatility | Subject to market fluctuations | Subject to market fluctuations and contract expiry | Stop-loss orders, hedging, offsetting positions |

| Margin Requirements | Typically lower or non-existent | Substantial, subject to changes based on market volatility | Proper capital management, margin calls awareness |

Trading Costs and Fees

Navigating the world of FX trading, whether you’re a seasoned pro or a curious newbie, requires understanding the often-hidden costs lurking beneath the surface. These fees can significantly impact your profitability, so let’s shine a light on the financial realities of both spot and futures trading. Think of it as a financial “treasure hunt,” except instead of gold, you’re looking for ways to minimize your expenses.Spot FX trading and futures contracts each have their own unique cost structures.

While both involve the exchange of currencies, the mechanisms and associated fees differ considerably. Understanding these differences is crucial for optimizing your trading strategy and maximizing your potential returns (or, at the very least, minimizing your losses!).

Spot FX Trading Costs

Spot FX trading primarily involves the bid-ask spread, which represents the difference between the buying and selling price of a currency pair. This spread is the primary cost for most spot transactions. Think of it as a built-in commission, often tiny for large trades but noticeable for smaller ones. Commissions, while less common in retail spot trading, might be charged by some brokers, particularly for institutional clients or high-volume traders.

Wrestling with the wild world of FX spot trading versus futures contracts? Feeling like you need a forex Rosetta Stone? Then grab a copy from this list of Top recommended forex trading books for intermediate traders to level up your game. Understanding the nuances between spot and futures is crucial; one’s a quick sprint, the other a marathon with potential for different rewards and risks!

These commissions can be a percentage of the trade value or a fixed fee per transaction. In essence, the spread and any commissions represent the broker’s profit margin, acting as a middleman facilitating the transaction.

So, you’re wrestling with the age-old question: spot trading or futures? It’s like choosing between a rollercoaster (thrilling, immediate) and a comfy train (predictable, less exciting). To truly master the forex game, though, you need a solid strategy, and that’s where Langlois’ beginner’s guide comes in handy: Forex trading strategies for beginners explained by Langlois. Understanding those strategies will help you navigate the choppy waters of FX spot trading vs.

futures contracts much more effectively. Ultimately, the best choice depends on your risk tolerance and trading style.

FX Futures Contract Costs

Trading FX futures contracts introduces a slightly more complex cost structure. The primary cost is the commission charged by the exchange or broker. These commissions vary widely based on the contract size, trading volume, and the specific broker. Furthermore, you’ll encounter margin interest. This is the interest charged on the margin required to maintain your open positions.

This interest cost can accumulate over time, especially for longer-term positions. It’s akin to a loan, and the interest rate depends on prevailing market rates. Finally, there might be additional fees, such as clearing fees, depending on the exchange and your broker. These fees are generally smaller than commissions and margin interest but still need to be considered in your overall cost analysis.

Comparative Cost Analysis

Let’s imagine two scenarios: trading 100,000 USD/JPY via spot and futures. For spot, let’s assume a spread of 2 pips. With a pip value of approximately $0.0001 per unit, the spread cost would be $20 (2 pips

- $0.0001/pip

- 100,000 units). If a broker charged a $10 commission, the total cost would be $30. Now, let’s look at futures. Suppose the commission is $25 per contract, and the margin interest rate is 5% annually. For a 100,000 USD/JPY contract, the margin requirement might be $2,000.

Holding the position for one month, the margin interest cost would be approximately $8.33 ($2000

- 0.05

- (1/12)). Therefore, the total cost would be approximately $33.33.

In this simplified example, the costs are relatively close. However, the cost differential can significantly widen with larger trade sizes, longer holding periods, and fluctuating interest rates. Factors like slippage (the difference between the expected price and the actual execution price) also need to be considered, particularly in spot trading during periods of high volatility.

This illustrates that while the spot market might seem cheaper at first glance due to the absence of margin interest, other costs like commissions and slippage can easily make the total cost comparable to or even higher than that of futures trading. The optimal choice depends heavily on your trading style, risk tolerance, and the specific market conditions.

Suitability for Different Traders

Choosing between spot FX trading and FX futures contracts depends heavily on your trading style, risk tolerance, and capital. Think of it like choosing between a nimble sports car (spot) and a sturdy pickup truck (futures) – both get you where you need to go, but the journey and the cargo they carry differ significantly.Spot trading, with its immediate execution and high leverage, is a playground for those who relish the thrill of quick profits and losses.

Futures contracts, on the other hand, offer a more structured and potentially less volatile approach, better suited for those who prefer a more measured and planned trading experience.

Spot FX Trading Suitability for Different Trader Profiles

Spot FX trading offers a diverse landscape of opportunities, each tailored to a specific trading style. Scalpers, with their lightning-fast trades aiming for tiny price movements, thrive in the liquidity-rich spot market. Day traders, holding positions for hours, benefit from the market’s responsiveness and flexibility. Swing traders, who hold positions for days or weeks, can leverage the spot market’s ability to capitalize on longer-term trends.

However, the high leverage inherent in spot trading necessitates a keen understanding of risk management; a single wrong move can quickly wipe out your account. For example, a scalper might use very tight stop-loss orders to limit potential losses on numerous small trades, whereas a swing trader might use a broader stop-loss to accommodate potential price fluctuations over longer periods.

FX Futures Contract Suitability for Different Trader Profiles

Futures contracts, with their standardized contracts and margin requirements, appeal to a different set of traders. The higher capital requirements act as a natural filter, attracting traders with larger accounts and a higher risk tolerance. Day traders and swing traders can utilize futures to manage risk more effectively, hedging positions or implementing more sophisticated strategies. However, the less flexible nature of futures contracts might not suit scalpers who rely on rapid execution and immediate price adjustments.

For instance, a day trader might use futures to establish a position in a currency pair and then use options to fine-tune their risk profile, limiting potential losses while still participating in the market’s price movements.

Trading Strategies Better Suited to Spot or Futures Markets, FX spot trading vs. futures contracts explained

The choice between spot and futures markets often dictates the type of trading strategy employed. Arbitrage strategies, exploiting price discrepancies between spot and forward rates, are almost exclusively done in the spot market. Hedging strategies, protecting against currency fluctuations, are often better implemented using futures contracts due to their standardized nature and predictable expiration dates. Furthermore, sophisticated strategies involving options on futures contracts provide even greater flexibility in risk management.

For example, a multinational corporation might use FX futures contracts to hedge against potential losses from foreign currency exchange rate fluctuations on upcoming payments, ensuring predictable financial outcomes. Conversely, a currency speculator might employ a momentum-based trading strategy in the spot market, capitalizing on short-term price swings.

Outcome Summary

So, spot versus futures – which reigns supreme? The answer, my friend, is blowing in the wind (or, more accurately, fluctuating with market volatility). Ultimately, the “best” method hinges entirely on your individual trading style, risk appetite, and financial goals. Whether you’re a seasoned pro or a wide-eyed newbie, understanding the nuances of both spot and futures trading empowers you to make informed decisions and navigate the forex market with confidence (and maybe even a chuckle or two along the way).

Remember, the market is a beast; treat it with respect, but don’t be afraid to tame it!