GDax cryptocurrency exchange: fees and security – sounds thrilling, right? Think of it less as a high-stakes poker game and more like a meticulously planned heist…of your financial freedom (in a good way!). We’re diving headfirst into the world of Coinbase Pro (formerly GDax), dissecting its fee structure with the precision of a brain surgeon and examining its security measures with the skepticism of a seasoned detective.

Buckle up, buttercup, it’s going to be a wild ride!

This deep dive will explore Coinbase Pro’s maker-taker fee model, comparing it to industry giants like Binance and Kraken. We’ll also investigate the exchange’s security features, from two-factor authentication to its cold storage practices, ensuring you’re armed with the knowledge to navigate the crypto landscape with confidence. We’ll even tackle the regulatory hurdles and legal aspects, because let’s face it, knowing the rules of the game is half the battle.

GDax (now Coinbase Pro) Fee Structure

So, you’ve conquered the treacherous terrain of security and fees (phew!), and now you’re ready to dive headfirst into the thrilling world of Coinbase Pro’s fee structure? Buckle up, buttercup, because it’s a wild ride! We’ll unravel the mysteries of maker-taker fees, explore the tiered system, and even pit Coinbase Pro against its rivals in a high-stakes fee showdown.

Maker-Taker Fee Model

Coinbase Pro, like many other cryptocurrency exchanges, employs a maker-taker fee model. This system rewards users who add liquidity to the order book (makers) with lower fees than those who remove liquidity (takers). Think of it like this: makers are the generous souls who contribute to the bustling marketplace, while takers are the opportunistic shoppers swooping in to snatch up the best deals.

Makers generally receive rebates (negative fees), while takers pay a fee. This dynamic incentivizes a healthy, liquid market.

Fee Tiers Based on 30-Day Trading Volume

Coinbase Pro’s fee structure isn’t a one-size-fits-all affair. Instead, it’s a tiered system where your fees decrease as your 30-day trading volume increases. The more you trade, the less you pay – a reward for your loyalty and high-volume activity. This creates a system that favors active traders, offering them substantial savings compared to those with lower trading volumes.

Navigating GDax’s fees and security features can feel like a crypto-jungle, but don’t get lost! Understanding those fees is crucial, especially when it comes to calculating your capital gains. To make sure you’re not facing a tax audit from the CRA, check out this guide on How to accurately value cryptocurrencies for tax purposes in Canada. Then, armed with that knowledge, you can confidently conquer GDax’s fee structure and sleep soundly knowing your crypto taxes are in order.

The tiers are clearly defined on the Coinbase Pro website and adjust dynamically based on your trading history. It’s a self-adjusting system that rewards high-volume traders.

Comparative Analysis of Coinbase Pro Fees

Now for the main event – a head-to-head comparison of Coinbase Pro’s fees against other major players in the crypto exchange arena. Remember, fees can change, so always check the exchange’s website for the most up-to-date information.

| Exchange | Maker Fee | Taker Fee | Minimum Withdrawal Fee |

|---|---|---|---|

| Coinbase Pro | -0.05% to 0.00% | 0.10% to 0.00% | Varies by Cryptocurrency |

| Binance | -0.02% to 0.1% | 0.1% to 0.1% | Varies by Cryptocurrency |

| Kraken | -0.16% to 0.26% | 0.16% to 0.26% | Varies by Cryptocurrency |

Note: These are examples and may not reflect current fees. Always verify the latest fee schedules on the respective exchange websites.

So, you’re eyeing GDax’s fees and security? Smart move! Before you dive in, though, you might want to check out which cryptos are currently moon-shooting – Top performing cryptocurrencies to buy now for short-term gains in Canada. Knowing the market trends helps you make informed decisions about where to park your digital dough, and then you can confidently return to comparing GDax’s transaction costs with your potential profits.

Additional Fees

Beyond the maker-taker fees, Coinbase Pro might charge additional fees depending on the cryptocurrency and the payment method. Deposit fees are generally uncommon for cryptocurrencies, but withdrawal fees vary significantly depending on the coin and the network used for the transaction. For instance, withdrawing Bitcoin (BTC) might involve a higher fee than withdrawing a smaller-cap altcoin due to the network’s transaction costs.

Navigating GDax’s fees and security features can feel like a crypto-jungle, but don’t get lost! Understanding those fees is crucial, especially when it comes to calculating your capital gains. To make sure you’re not facing a tax audit from the CRA, check out this guide on How to accurately value cryptocurrencies for tax purposes in Canada. Then, armed with that knowledge, you can confidently conquer GDax’s fee structure and sleep soundly knowing your crypto taxes are in order.

These fees are usually clearly displayed before you initiate a withdrawal. It’s crucial to review these fees to avoid unpleasant surprises. Think of it as a small price to pay for securing your crypto riches.

Security Measures Implemented by Coinbase Pro

Coinbase Pro, formerly GDAX, understands that your crypto is, well,your* crypto. Losing it would be about as fun as finding a sock with a hole in it – only significantly more expensive. That’s why they’ve implemented a robust security system designed to keep your digital assets safe from the clutches of nefarious actors (and rogue socks). Think of it as a high-tech fortress, complete with digital moats and laser grids (okay, maybe not laser grids, but the security is pretty darn impressive).Coinbase Pro employs a multi-layered approach to security, combining various methods to create a formidable defense against threats.

This isn’t your grandma’s piggy bank; this is a digital vault worthy of Fort Knox (minus the armed guards, thankfully). Let’s delve into the specifics of how they keep your crypto safe and sound.

Two-Factor Authentication (2FA) Options

Coinbase Pro offers several 2FA options, providing an extra layer of security beyond just your password. This is like adding a second lock to your front door – one password isn’t enough to keep the digital burglars out. They offer authenticator apps like Google Authenticator and Authy, providing time-based one-time passwords (TOTP). These apps generate unique codes that change every few seconds, ensuring that even if someone manages to steal your password, they still can’t access your account without the constantly changing code from your authenticator app.

So, you’re eyeing GDax’s fees and security? Smart move! Before you dive in, though, you might want to check out which cryptos are currently moon-shooting – Top performing cryptocurrencies to buy now for short-term gains in Canada. Knowing the market trends helps you make informed decisions about where to park your digital dough, and then you can confidently return to comparing GDax’s transaction costs with your potential profits.

This is a far more secure method than using SMS-based 2FA, which is susceptible to SIM swapping attacks.

Insurance Policies and Asset Protection

While Coinbase Pro doesn’t offer insurance in the traditional sense (like your car insurance), they employ robust security measures and maintain reserves to protect against potential losses. Think of it as a self-insured model. They invest heavily in security infrastructure and procedures to minimize the risk of theft or loss, thereby reducing the need for external insurance. This approach focuses on prevention rather than relying on post-incident compensation.

This proactive strategy means they’re working tirelessly to prevent problems before they even arise.

Security Protocols for Account and Fund Protection, GDax cryptocurrency exchange: fees and security

Coinbase Pro utilizes a variety of security protocols to protect user accounts and funds. This includes advanced encryption techniques to safeguard data both in transit and at rest. They also employ sophisticated monitoring systems to detect and prevent suspicious activity, like unusual login attempts or large, unexpected withdrawals. Imagine it as a team of digital security guards constantly patrolling your account, ready to spring into action at the slightest sign of trouble.

Navigating GDax’s fees and security features can feel like a crypto-jungle, but don’t get lost! Understanding those fees is crucial, especially when it comes to calculating your capital gains. To make sure you’re not facing a tax audit from the CRA, check out this guide on How to accurately value cryptocurrencies for tax purposes in Canada. Then, armed with that knowledge, you can confidently conquer GDax’s fee structure and sleep soundly knowing your crypto taxes are in order.

They’re constantly updating and improving these protocols to stay ahead of evolving threats in the ever-changing landscape of cybersecurity.

Cold Storage Practices for Cryptocurrency Assets

A significant portion of Coinbase Pro’s cryptocurrency assets are stored in cold storage, which are offline wallets not connected to the internet. This is like storing the bulk of your valuables in a secure, off-site vault – it’s significantly harder for hackers to access. Keeping the majority of the crypto offline drastically reduces the risk of theft from online attacks.

Only a small portion of assets is kept online to facilitate trading, further minimizing the risk associated with online storage. This is a critical component of their security strategy, minimizing exposure to online vulnerabilities.

Key Security Features of Coinbase Pro

Here’s a summary of the key security features implemented by Coinbase Pro to safeguard user assets:

- Two-Factor Authentication (2FA) with multiple options (Authenticator apps, etc.)

- Robust encryption of data in transit and at rest

- Sophisticated monitoring systems for suspicious activity detection

- Significant use of cold storage for offline asset protection

- Regular security audits and vulnerability assessments

- Commitment to industry best practices and regulatory compliance

User Experience and Interface of Coinbase Pro

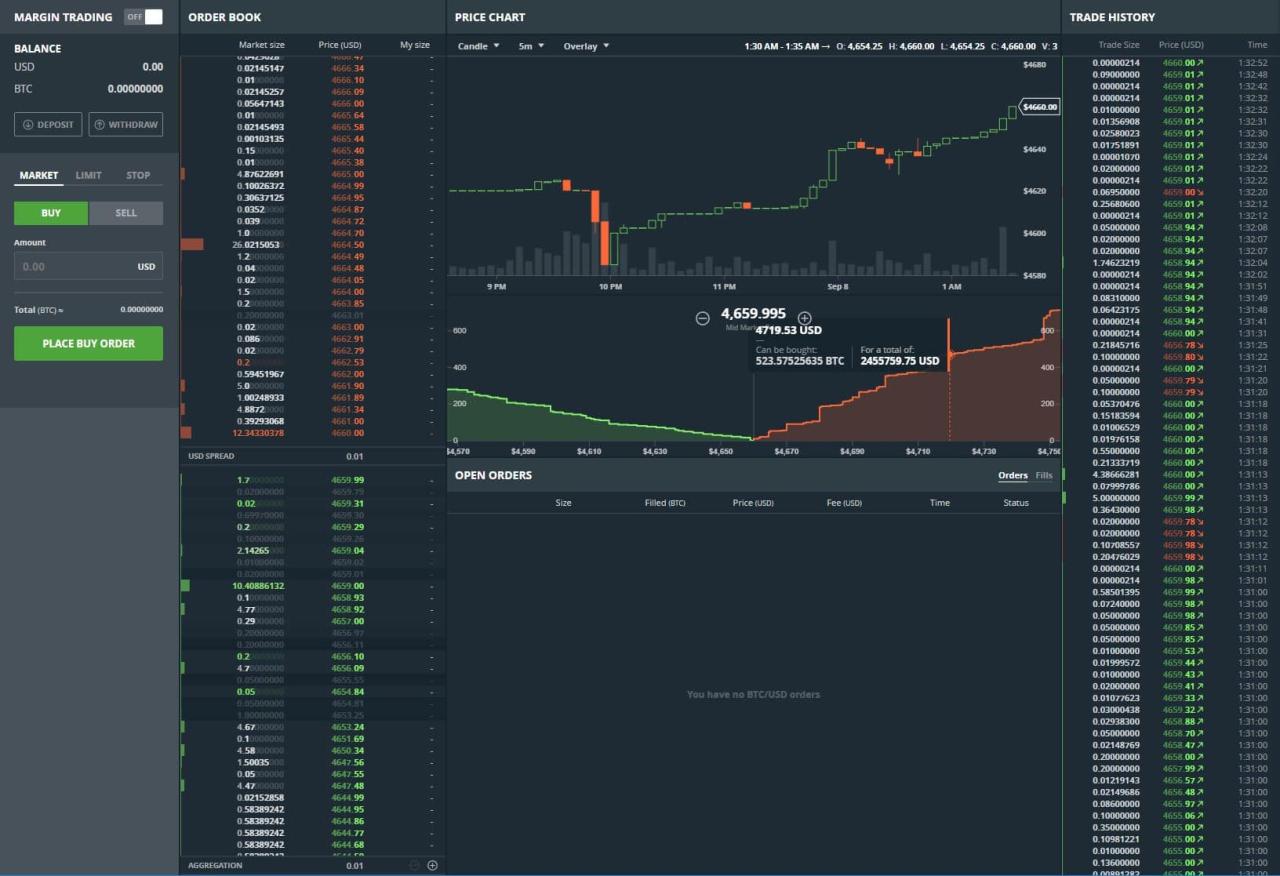

Coinbase Pro, formerly GDAX, boasts a user interface designed for the seasoned crypto trader, prioritizing efficiency and functionality over flashy aesthetics. While it might seem initially daunting compared to its simpler sibling, Coinbase, the intuitive layout and powerful tools quickly become second nature with a little practice. Think of it as a finely tuned sports car – it might take some getting used to, but the performance is unparalleled.The platform’s clean design emphasizes clear data presentation.

Order books are readily accessible, showing bid and ask prices with volume, allowing for precise order placement. Charts are integrated directly into the trading interface, offering various indicators and timeframes for technical analysis. This all-in-one approach minimizes the need to switch between multiple windows or platforms, streamlining the trading workflow.

Coinbase Pro Order Placement: A Step-by-Step Guide

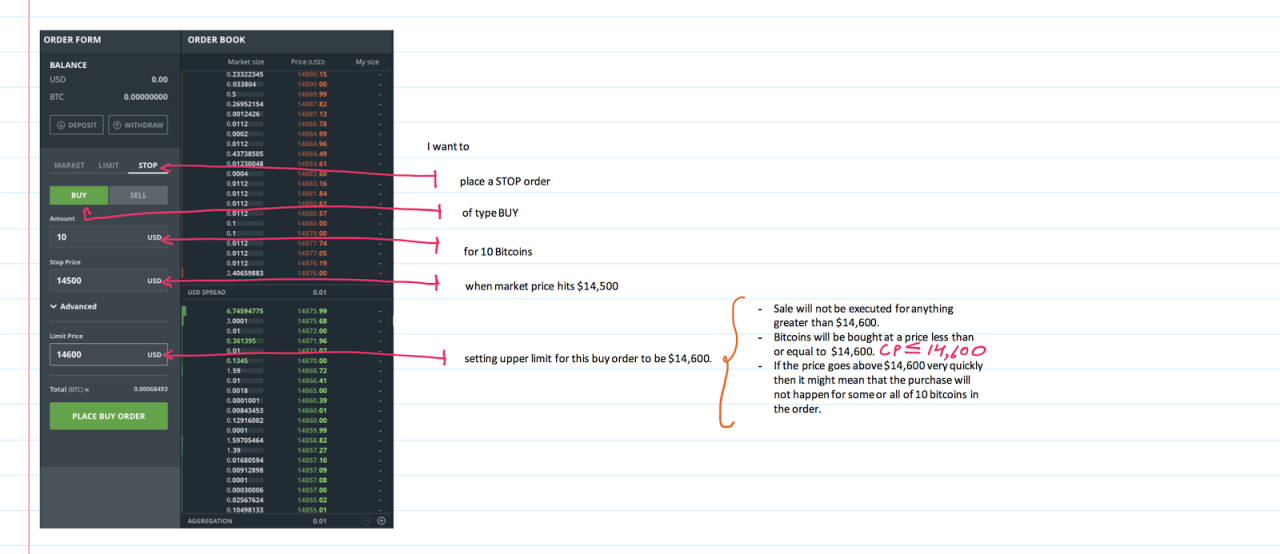

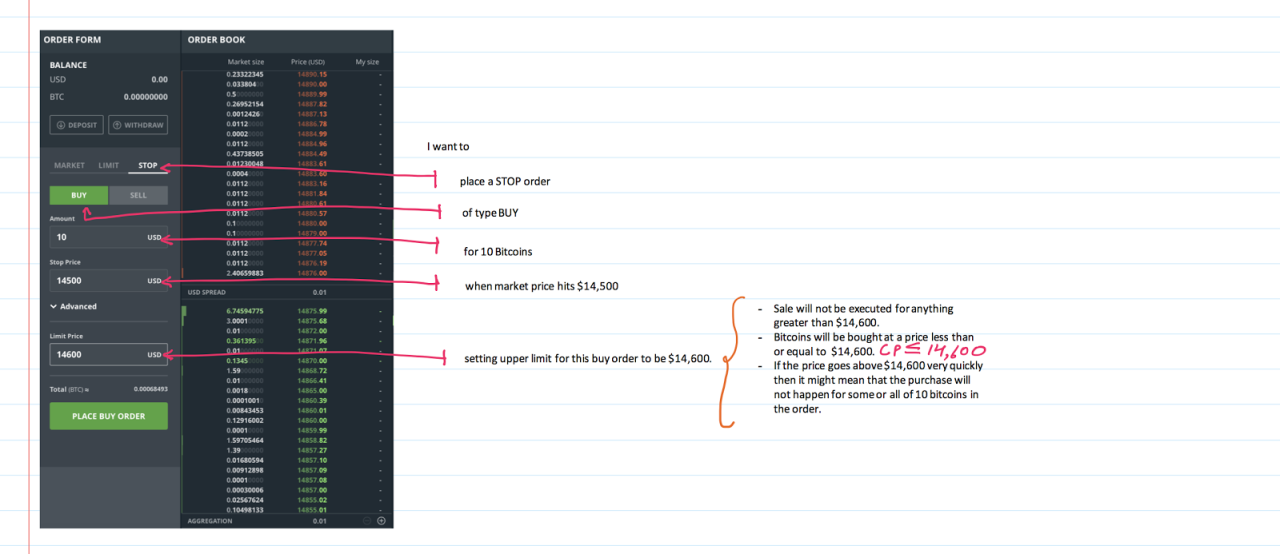

Navigating the order placement process on Coinbase Pro is straightforward. First, select the cryptocurrency pair you wish to trade (e.g., BTC-USD). Then, choose between market, limit, or stop orders. A market order executes immediately at the best available price, while a limit order specifies a price at which you’re willing to buy or sell. A stop order triggers a market order once a specific price is reached.

Next, input the quantity of cryptocurrency you want to buy or sell. Finally, review your order details before clicking “Place Order.” The platform provides clear confirmations at each stage, minimizing the risk of accidental trades.

Coinbase Pro User Experience Compared to Other Exchanges

Compared to exchanges like Binance or Kraken, Coinbase Pro offers a more streamlined, albeit less feature-rich, experience. Binance, for example, is known for its vast selection of cryptocurrencies and advanced charting tools, but its interface can feel overwhelming for beginners. Kraken offers a similar level of complexity. Coinbase Pro sits comfortably in the middle ground, offering a balance between functionality and ease of use, making it ideal for intermediate traders who value clarity and security over sheer volume of options.

It lacks the overwhelming array of features found on some competitor platforms, instead prioritizing a clean and efficient interface.

Coinbase Pro Security and Fee Management Tutorial Video Script

[Visual: Coinbase Pro login screen. On-screen text: “Welcome to Coinbase Pro: Secure and Efficient Trading”] (Narrator): Welcome to our quick tutorial on maximizing security and minimizing fees on Coinbase Pro. First, let’s talk about security. Always use two-factor authentication (2FA)![Visual: Screenshot showing the 2FA setup process on Coinbase Pro. On-screen text: “Enable 2FA for Enhanced Security”] (Narrator): This adds an extra layer of protection, preventing unauthorized access to your account, even if your password is compromised.

Next, regularly review your account activity for any suspicious transactions.[Visual: Screenshot showing Coinbase Pro’s transaction history. On-screen text: “Regularly Check Your Transaction History”] (Narrator): Coinbase Pro offers various order types to manage your fees. Market orders are fast but may result in slightly higher fees. Limit orders allow you to specify your price, potentially saving you money, but they may not execute immediately.[Visual: Screenshot highlighting the different order types (Market, Limit, Stop) on the Coinbase Pro interface.

On-screen text: “Choose the Right Order Type to Optimize Fees”] (Narrator): Understanding these features ensures a secure and cost-effective trading experience. Remember, always practice safe trading habits.

Navigating GDax’s fees and security features can feel like a crypto-jungle, but don’t get lost! Understanding those fees is crucial, especially when it comes to calculating your capital gains. To make sure you’re not facing a tax audit from the CRA, check out this guide on How to accurately value cryptocurrencies for tax purposes in Canada. Then, armed with that knowledge, you can confidently conquer GDax’s fee structure and sleep soundly knowing your crypto taxes are in order.

Regulatory Compliance and Legal Aspects of Coinbase Pro

Navigating the wild west of cryptocurrency requires a sturdy regulatory framework, and Coinbase Pro, despite its playful name, takes this seriously. Let’s delve into the legal landscape they inhabit, a place where compliance isn’t just a suggestion, but a necessity for survival (and avoiding hefty fines!).Coinbase Pro operates in a complex and ever-evolving regulatory environment. Their compliance efforts are a significant factor in their overall stability and reputation.

Understanding their approach to legal and regulatory matters is crucial for users who want to trade with confidence.

Regulatory Jurisdictions

Coinbase Pro’s operations are subject to a multitude of regulatory jurisdictions, varying depending on the specific location of its users and the nature of its services. These jurisdictions often overlap and have differing requirements. For example, they must adhere to regulations in the United States at a federal level, as well as individual state regulations. Internationally, they face a patchwork quilt of laws in various countries where they offer services.

This means navigating a complex web of rules and regulations to ensure compliance. This isn’t a game of whack-a-mole, but more like a sophisticated game of regulatory chess.

Know Your Customer (KYC) and Anti-Money Laundering (AML) Compliance

Coinbase Pro rigorously adheres to KYC and AML regulations. These are designed to prevent illicit activities like money laundering and terrorist financing. The platform employs robust verification processes, including identity checks, address verification, and transaction monitoring. This involves collecting and verifying personal information from users, a process that might seem tedious but is crucial for maintaining the integrity of the platform and complying with global financial regulations.

Failure to comply with these regulations could result in severe penalties and damage to their reputation.

Legal Challenges and Controversies

Like any major player in the cryptocurrency space, Coinbase Pro has faced its share of legal scrutiny and challenges. These have ranged from investigations into alleged market manipulation to lawsuits related to specific trading practices. While Coinbase Pro has generally successfully navigated these challenges, these instances highlight the inherent risks and complexities of operating within the evolving regulatory landscape of digital assets.

It’s a testament to their legal team’s skills that they’ve managed to avoid any truly catastrophic legal setbacks. However, the constant need to adapt to changing regulations adds a significant layer of complexity to their operations.

Comparison of Coinbase Pro’s Security Features with Other Exchanges: GDax Cryptocurrency Exchange: Fees And Security

Let’s dive into the thrilling world of cryptocurrency exchange security! It’s less about ninjas guarding servers and more about robust systems and clever coding, but the stakes are just as high. We’ll compare Coinbase Pro’s security posture with two other heavy hitters in the crypto space, to see who’s got the best digital fortress.Choosing the right exchange is like choosing a bank – you want your money (or, in this case, your crypto) to be safe and sound.

Security features are paramount, and a comparison helps you make an informed decision. While no system is impenetrable, some are definitely more fortified than others.

Security Feature Comparison: Coinbase Pro, Binance, and Kraken

The following table compares the security features of Coinbase Pro, Binance, and Kraken. Remember, the crypto security landscape is constantly evolving, so this is a snapshot in time. Always check the latest information from the exchanges themselves.

| Feature | Coinbase Pro | Binance | Kraken |

|---|---|---|---|

| Two-Factor Authentication (2FA) | Offered, highly recommended, various methods available. | Offered, various methods, highly recommended. | Offered, multiple options, strongly encouraged. |

| Multi-Factor Authentication (MFA) | Supports multiple MFA methods beyond 2FA, enhancing security. | Supports various MFA methods, including hardware keys. | Supports multiple MFA methods for enhanced security. |

| Cold Storage | A significant portion of user funds are held in cold storage, offline and secure from online threats. | Utilizes cold storage for a large percentage of user assets. | Employs cold storage as a key component of its security strategy. |

| Insurance Fund | Coinbase, the parent company, has insurance policies in place to cover potential losses. The specifics are not publicly detailed. | Binance has its own Secure Asset Fund for User Protection (SAFU). The fund’s size and specifics are publicly reported (though details of specific insurance policies are not public). | Kraken does not publicly disclose the details of its insurance or security fund. |

| Withdrawal Limits and Delays | Withdrawal limits and delays vary depending on verification levels and withdrawal methods. These are designed to enhance security and deter theft. | Withdrawal limits and delays are in place, varying based on verification and withdrawal amounts. | Similar to Binance and Coinbase Pro, Kraken uses withdrawal limits and delays as a security measure. |

| Regular Security Audits | Coinbase Pro undergoes regular security audits, though specifics and frequency are not publicly announced. | Binance also undergoes regular security audits, though details are not consistently made public. | Kraken also undertakes regular security audits, but details are not consistently published. |

While all three exchanges offer robust security features, the level of transparency regarding specifics varies. Coinbase Pro benefits from the resources and reputation of its parent company, Coinbase, but lacks the same level of public detail about specific security measures as Binance with its SAFU. Kraken occupies a middle ground, offering strong security without the same level of publicized detail.

Ultimately, the “best” exchange depends on individual risk tolerance and priorities.

Conclusive Thoughts

So, there you have it – a whirlwind tour of Coinbase Pro’s fees and security. While no system is impenetrable, Coinbase Pro clearly prioritizes security, offering a robust platform with competitive fees. Remember, though, due diligence is your best friend in the crypto world. Stay informed, stay vigilant, and may your crypto journey be filled with (legal) riches!