Golden Currencies investment potential and risks: Analyzing the value and future of golden currencies in the crypto market – sounds like a treasure hunt, right? Prepare for a wild ride through the shimmering, sometimes treacherous, world of digital gold. We’ll unearth the secrets of these cryptocurrencies, weigh their potential for dazzling returns against the very real risk of losing your shirt (or, more accurately, your Bitcoin).

Buckle up, because this isn’t your grandpappy’s gold rush.

This exploration delves into the fascinating realm of cryptocurrencies aiming to replicate the stability and perceived value of gold. We’ll examine their defining characteristics, comparing and contrasting them with their traditional counterparts. We’ll navigate the thrilling landscape of potential profits and the perilous pitfalls of market volatility and regulatory uncertainty. Get ready to discover if these digital nuggets are truly worth their weight in…well, Bitcoin.

Defining Golden Currencies in the Crypto Market

So, you’re curious about “golden currencies” in the wild west of crypto? Think of them as the digital equivalent of Fort Knox, but with a bit more… pizzazz. These aren’t your grandpappy’s gold bars; they’re cryptocurrencies aiming for the same kind of safe-haven status, promising stability and value preservation in a volatile market. But, like a shiny new gold-plated bitcoin, they come with their own set of quirks.These digital golds are typically characterized by their perceived scarcity, relative price stability (compared to the rollercoaster of other cryptos), and potential for long-term value appreciation.

They’re often seen as a hedge against inflation or economic uncertainty, much like traditional gold. However, unlike a physical gold bar you can hold, these digital assets exist solely in the digital realm, making them susceptible to a different set of risks.

Examples of Golden Currencies

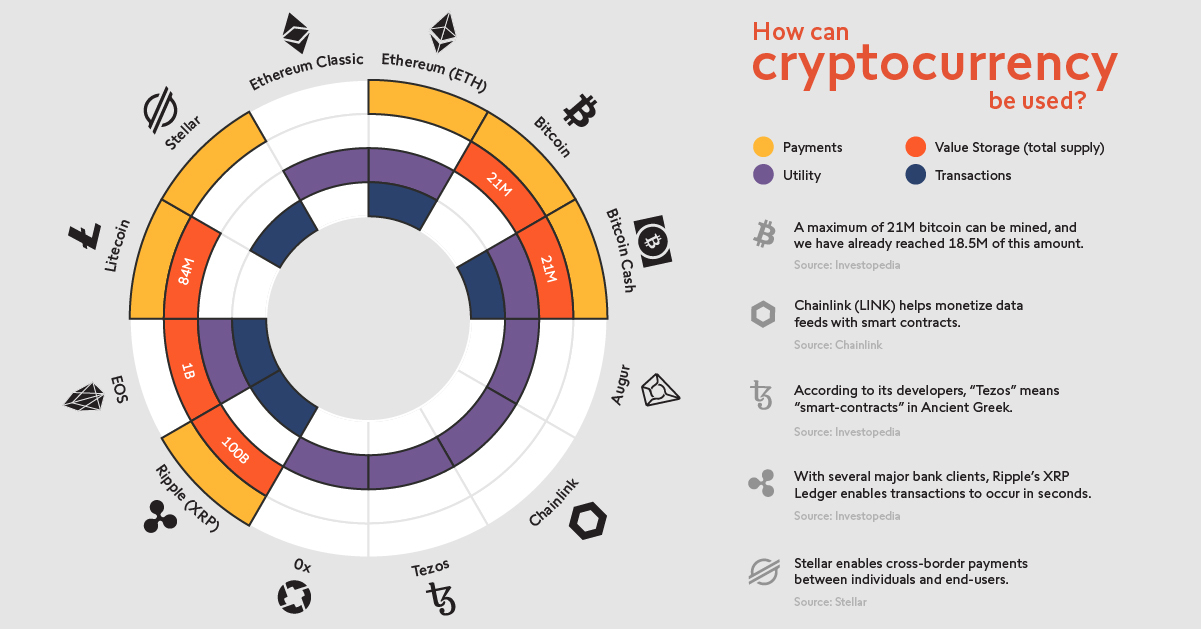

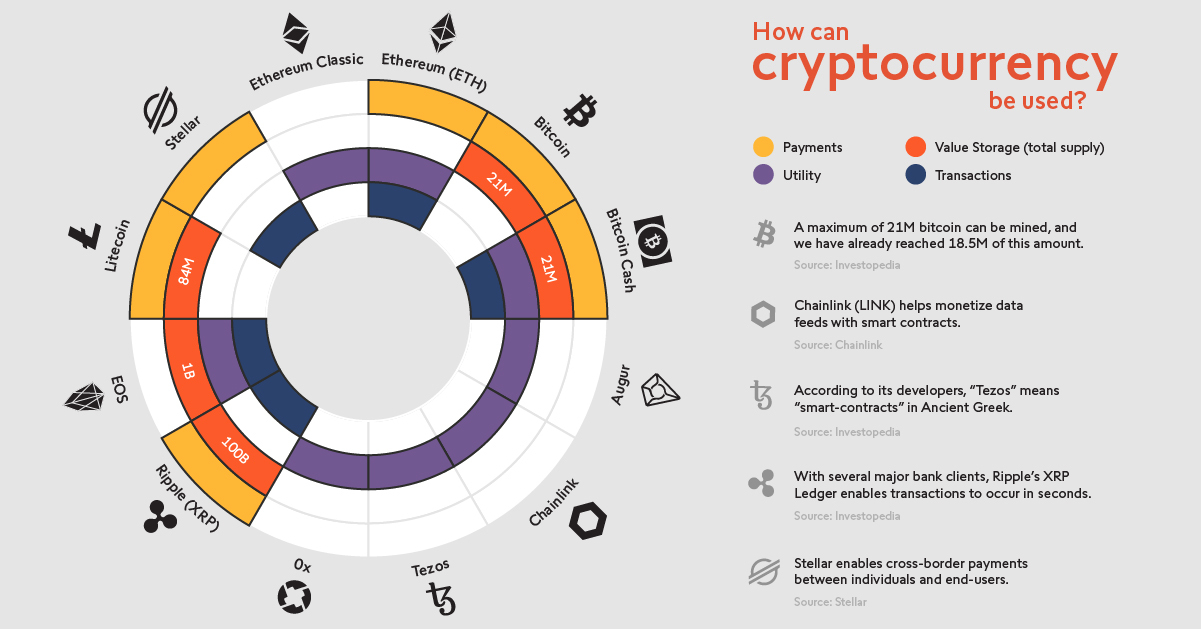

Several cryptocurrencies aspire to this “golden” status. Bitcoin, the OG cryptocurrency, is often cited as a prime example. Its limited supply of 21 million coins and its established history in the market contribute to its perceived value stability and scarcity, making it a digital store of value for many investors. However, Bitcoin’s price is still far from immune to market fluctuations.

So, you’re thinking about diving into the glittering, potentially lucrative world of golden cryptocurrencies? Remember, though, shiny doesn’t always mean safe! Before you leap, it’s wise to check out the security of any platform you might use, like Icryptox.com review and security analysis: Is Icryptox.com a safe and reliable platform? to avoid getting burned. Then, and only then, can you confidently assess the real value and future of your golden investment.

Other contenders include stablecoins pegged to the US dollar or other fiat currencies, which aim for a 1:1 ratio, providing a degree of stability. These stablecoins, while not exactly “gold” in nature, are frequently used as a haven during market turmoil. Finally, some newer projects attempt to replicate gold’s characteristics through algorithmic mechanisms or tokenomics, though their long-term success remains to be seen.

So, you’re eyeing golden currencies? Shiny, right? But remember, crypto’s a rollercoaster, not a golden chariot. To navigate this wild ride and pick winners, you need a strategy. Check out this guide on what cryptocurrencies to buy now for long-term investment before you leap.

Then, armed with knowledge, you can assess if those glittering golden currencies are truly worth their weight in digital gold, or just fool’s gold.

Think of them as the “gold rush” of the crypto world, with varying degrees of success.

Key Differences Between Traditional Gold and Golden Currencies, Golden Currencies investment potential and risks: Analyzing the value and future of golden currencies in the crypto market

The fundamental difference lies in their tangible nature. Traditional gold is a physical asset, while golden currencies are digital. This impacts storage, security, and regulation. Physical gold can be stored in a safe, a bank vault, or even buried in your backyard (we don’t recommend the last one). Digital gold, on the other hand, relies on secure digital wallets and exchanges, making it vulnerable to hacking and other cyber threats.

Furthermore, the regulatory landscape for cryptocurrencies is still evolving, unlike the well-established regulations surrounding gold trading. This regulatory uncertainty introduces additional risks for investors in golden currencies. Finally, the market capitalization and trading volume of even the most established cryptocurrencies are dwarfed by the overall gold market. This suggests a significant difference in market maturity and overall acceptance as a store of value.

While Bitcoin’s market cap might be impressive, it’s still a fraction of the global gold market.

Investment Potential of Golden Currencies

Forget chasing rainbows – let’s talk about the potential for serious gains in the glittering world of golden currencies. These crypto assets, often pegged to the value of gold or incorporating gold-backed mechanisms, offer a unique blend of digital innovation and the timeless appeal of a precious metal. While risk is inherent in any investment, the potential rewards for savvy investors could be truly dazzling.Golden currencies aim to leverage the stability of gold – a safe haven asset for centuries – while harnessing the advantages of blockchain technology.

This creates a fascinating proposition: a digital asset with the potential for both growth and security, a tempting combination in the often-volatile crypto market. The long-term value proposition rests on the enduring appeal of gold itself, combined with the potential for increased adoption and technological improvements within the digital gold space.

Price Appreciation Potential

The price appreciation of golden currencies is linked to several factors. Firstly, the inherent value of gold itself. When global uncertainty rises – geopolitical tensions, economic downturns, inflation fears – investors often flock to gold as a safe haven, driving up its price. This positive correlation directly benefits golden currencies. Secondly, technological advancements within the crypto space can enhance the efficiency and accessibility of these assets.

Improved scalability, faster transaction speeds, and more user-friendly interfaces could all boost adoption and drive price increases. Think of it like this: a more efficient gold delivery system for the digital age. Finally, increasing demand from investors seeking diversification and exposure to both the crypto and precious metals markets could fuel significant price appreciation. The limited supply of gold, a fundamental factor in its value, adds another layer of potential for long-term price growth.

Consider the historical price performance of gold itself; its value has consistently risen over the long term, despite periodic market fluctuations.

Comparative Return Potential

The table below offers a speculative comparison of potential returns. It’s crucial to remember that past performance is not indicative of future results, and these are estimates based on current market trends and expert predictions. The actual returns could vary significantly.

| Asset Class | Potential Annual Return (High Estimate) | Potential Annual Return (Low Estimate) | Risk Level |

|---|---|---|---|

| Golden Currencies | 15-20% | 5-10% | Medium-High |

| Bitcoin | 25-30% | -5% to 5% | High |

| Ethereum | 20-25% | -10% to 10% | High |

| S&P 500 Index | 7-10% | 0-5% | Medium |

Risks Associated with Golden Currency Investments

Investing in golden currencies, while potentially lucrative, isn’t a walk in the park. It’s a bit like panning for gold in a river filled with piranhas – there’s treasure to be found, but you’ll need to watch your step (and maybe wear some serious armor). This section dives into the inherent risks, so you can navigate the glittering waters with a clearer understanding of the potential dangers.Golden currencies, like all crypto assets, are notoriously volatile.

Their value can swing wildly in short periods, influenced by everything from market sentiment and technological advancements to regulatory pronouncements and even Elon Musk’s latest tweet. Imagine a rollercoaster that goes upside down multiple times in a single ride – that’s the kind of thrill (and potential for stomach-churning losses) you might experience. This inherent volatility makes it crucial to only invest what you can afford to lose.

Remember that past performance is not indicative of future results, and what glitters isn’t always gold.

Market Volatility and Regulatory Uncertainty

The cryptocurrency market, including the golden currency segment, is known for its extreme price fluctuations. A sudden negative news event, a change in investor sentiment, or a technological disruption can cause significant and rapid drops in value. Furthermore, the regulatory landscape surrounding cryptocurrencies is still evolving, creating uncertainty. Different jurisdictions have different rules, and these rules can change, impacting the legality and accessibility of golden currencies.

This regulatory uncertainty adds another layer of risk, making it essential to stay informed about legal developments in your region and the regions where the golden currency operates. For example, a sudden ban on a particular golden currency in a major market could trigger a dramatic price decline.

So you’re eyeing those glittering golden currencies in the crypto-verse, eh? High potential for riches, but remember, it’s a wild west out there! Before you jump in headfirst, though, you might want to check if you can even legally stash your crypto gains in a tax-advantaged account – because figuring out if you can buy cryptocurrency within your TFSA in Canada, as explained in this helpful guide: Is it possible to buy cryptocurrency within my TFSA in Canada?

, is a crucial first step. Then, and only then, can you confidently assess the true risk/reward of those golden digital nuggets.

Potential for Scams and Fraudulent Projects

The crypto space, unfortunately, attracts its share of unscrupulous actors. Golden currencies are not immune to scams and fraudulent projects. Many projects promise unrealistic returns or utilize deceptive marketing tactics to lure unsuspecting investors. Some might even be outright Ponzi schemes, designed to collapse once enough money has been collected. It’s crucial to conduct thorough due diligence before investing in any golden currency project.

Look for transparent teams, verifiable audits, and well-defined whitepapers that clearly explain the project’s technology and goals. Remember, if something sounds too good to be true, it probably is. Think of it like this: if a deal looks like a golden goose laying golden eggs, it might be a cleverly disguised cuckoo in a gilded cage.

So you’re thinking about diving into the glittering, potentially gold-plated world of cryptocurrencies? Golden currencies offer huge upside, but remember, they’re as volatile as a caffeinated squirrel. To make smart trades, you’ll need a solid platform – check out this guide to find the best one for Canadian investors: What’s the top-rated and most reliable platform for crypto trading in Canada?

Then, armed with knowledge and a trusty exchange, you can start your quest for digital gold, hopefully avoiding any catastrophic dips along the way!

Risk Assessment Framework for Golden Currency Investments

Before investing in golden currencies, it’s vital to conduct a comprehensive risk assessment. This should involve considering several factors:

- Market Research: Thoroughly research the specific golden currency, its underlying technology, and its market position. Analyze its price history, trading volume, and community engagement.

- Team Due Diligence: Investigate the team behind the project. Are they experienced and reputable? Is there transparency about their identities and backgrounds?

- Technological Assessment: Evaluate the technology underpinning the golden currency. Is it innovative and secure? Have independent audits been conducted?

- Regulatory Compliance: Assess the regulatory compliance of the project. Is it operating within the legal framework of relevant jurisdictions?

- Risk Tolerance: Honestly assess your own risk tolerance. Golden currencies are high-risk investments. Only invest what you can afford to lose completely.

By carefully considering these factors and developing a robust risk management strategy, investors can mitigate some of the inherent risks associated with golden currency investments. Remember, diversification is key. Don’t put all your digital eggs in one golden basket.

Technological Aspects and Future Outlook

The shimmering world of golden currencies, while alluring with the promise of digital gold, rests upon a foundation of complex technologies and protocols. Understanding these underpinnings is crucial for navigating the potential, and pitfalls, of this exciting sector. Let’s delve into the nuts and bolts of what makes these cryptocurrencies tick, and what the future might hold.The underlying technologies powering golden currencies are as varied as the currencies themselves.

Some leverage established blockchain technologies like Bitcoin’s proof-of-work (PoW) consensus mechanism, emphasizing security and decentralization. Others explore more energy-efficient alternatives such as proof-of-stake (PoS), aiming for improved scalability and transaction speeds. Still others might incorporate novel consensus mechanisms or layer-2 scaling solutions to address the inherent limitations of blockchain technology. This diversity reflects the ongoing innovation within the cryptocurrency space and the constant search for the optimal balance between security, scalability, and energy efficiency.

Underlying Technologies and Protocols

Many golden currencies utilize established blockchain technologies, drawing inspiration from Bitcoin’s robust security model or Ethereum’s smart contract functionality. However, variations exist. For example, some projects may implement unique consensus mechanisms to optimize for specific needs, such as faster transaction processing or reduced energy consumption. Others may integrate sidechains or layer-2 scaling solutions to enhance the throughput of their networks.

The choice of technology significantly impacts the overall performance and characteristics of the golden currency. Consider, for instance, a hypothetical golden currency employing a directed acyclic graph (DAG) technology; this could result in significantly faster transaction confirmation times compared to a traditional blockchain, but potentially at the cost of reduced security.

So you’re eyeing those glittering golden currencies, eh? The potential for riches is dazzling, but remember, crypto’s a rollercoaster! To navigate this wild ride, especially as a newbie, you’ll need a solid strategy. Check out this guide on What are the best crypto day trading strategies for beginners in Canada? before diving headfirst into golden coin investments.

Remember, even gold can turn to dust if you’re not careful!

Scalability and Security Comparisons

The scalability and security of different golden currencies are often inversely related. High security, typically achieved through robust consensus mechanisms like PoW, can come at the cost of slower transaction speeds and higher energy consumption. Conversely, highly scalable systems, often employing PoS or layer-2 solutions, may be more susceptible to attacks. A direct comparison requires careful consideration of specific implementation details and the trade-offs involved.

For example, a golden currency using a sharded blockchain architecture could achieve high throughput while maintaining a relatively high level of security, offering a better balance compared to a simple PoW system. Analyzing the security audits and the technical white papers of different projects is essential to understand their respective strengths and weaknesses.

So you’re thinking about diving headfirst into the glittering, unpredictable world of golden currencies? Remember, it’s a high-stakes game, like trying to predict the next winning goal in a Champions League final – check out the latest football news for some perspective on unpredictable outcomes! Ultimately, the value of these crypto gold nuggets depends on market whimsy, so tread carefully, my friend, because fortune favors the bold… and the well-informed.

Potential Future Developments and Milestones

Predicting the future is, of course, a risky business, but based on current trends, we can Artikel some potential milestones for the golden currency sector.

- Increased Regulatory Clarity (2024-2026): As the sector matures, we can expect clearer regulatory frameworks in various jurisdictions, leading to increased institutional adoption and potentially more stable market conditions. This could be similar to the evolution of the traditional financial markets’ response to new asset classes.

- Enhanced Interoperability (2025-2028): The development of cross-chain communication protocols could allow for seamless transfer of value between different golden currencies, fostering greater liquidity and utility.

- Integration with Decentralized Finance (DeFi) (2026-2030): Golden currencies are likely to become increasingly integrated with DeFi protocols, enabling new financial instruments and applications, mirroring the current growth of DeFi around established cryptocurrencies.

- Mainstream Adoption (2028-2035): Widespread adoption by businesses and individuals could drive significant price appreciation and establish golden currencies as a recognized asset class, potentially following a similar trajectory to Bitcoin’s gradual acceptance.

Market Analysis and Comparative Study

The shimmering world of golden currencies in the crypto market isn’t just about pretty names and shiny promises; it’s a complex ecosystem with its own unique history, booms, busts, and surprising correlations. Understanding this requires a deep dive into market performance, comparing these digital gold nuggets to their more established crypto counterparts, and visualizing how they react to broader market forces.

Let’s get our magnifying glasses out and examine the evidence.Analyzing the historical performance of golden currencies reveals a rollercoaster ride, much like a particularly enthusiastic theme park. Some have experienced meteoric rises, only to plummet faster than a lead balloon. Others have maintained a steadier, albeit less exciting, trajectory. These fluctuations are influenced by a myriad of factors, from technological advancements and regulatory changes to overall market sentiment and, of course, the price of actual gold.

The key is to identify the patterns, understand the drivers, and learn to differentiate between hype and genuine potential.

Historical Performance of Golden Currencies

A comprehensive review of golden currency performance requires examining individual projects. For instance, let’s imagine “AurumCoin” (fictional example), which experienced a 500% surge in its first year, fueled by early adopter enthusiasm and a clever marketing campaign. However, after a period of consolidation, it experienced a 30% correction due to a security vulnerability discovered and addressed. Another example, “GoldenBit” (also fictional), showed a more gradual, consistent growth over three years, demonstrating a less volatile but ultimately more sustainable pattern.

These examples highlight the diverse trajectories and underlying reasons for success or failure. Careful analysis of on-chain data, trading volume, and market sentiment surrounding each specific golden currency is crucial for accurate assessment.

Comparative Market Capitalization and Trading Volume

To truly understand the standing of golden currencies, we need to compare them to established crypto heavyweights like Bitcoin and Ethereum. Imagine a bar chart. Bitcoin and Ethereum would tower over the landscape, representing their massive market capitalizations and high trading volumes. Golden currencies, while showing promise, would generally occupy a smaller section of the chart, reflecting their relatively nascent stage.

However, within this smaller segment, there would be significant variations. Some golden currencies might boast surprisingly high trading volumes, indicating a dedicated and active community, while others might struggle to attract significant attention, leading to lower trading activity. This visual representation underscores the need for careful selection and risk assessment.

Correlation Between Golden Currency Prices and Market Indicators

A scatter plot would effectively illustrate the correlation between golden currency prices and various market indicators. For example, plotting the price of a specific golden currency against the price of gold would reveal a positive correlation (assuming the golden currency is indeed designed to track gold’s value). A similar analysis could be performed against the overall cryptocurrency market capitalization, revealing whether the golden currency’s price moves in tandem with the broader crypto market or demonstrates independent behavior.

Furthermore, examining the correlation with macroeconomic indicators, such as inflation rates or interest rates, could uncover additional insights into the factors influencing the price. A strong positive correlation with gold’s price would suggest the golden currency is successfully fulfilling its intended function as a digital gold store of value. A strong correlation with broader market trends would indicate susceptibility to general market sentiment.

A weak correlation with both would signify a degree of independence, potentially influenced by project-specific factors.

Regulatory Landscape and Legal Considerations: Golden Currencies Investment Potential And Risks: Analyzing The Value And Future Of Golden Currencies In The Crypto Market

Navigating the wild west of cryptocurrencies, especially those with a “golden” sheen, requires a sturdy legal compass. The regulatory landscape for golden currencies is, to put it mildly, a work in progress, varying wildly depending on your geographical location. Think of it as a global patchwork quilt, with each square representing a different country’s approach to these digital assets.The current regulatory landscape is a fascinating blend of cautious optimism and outright confusion.

Many jurisdictions are still grappling with how to classify golden currencies – are they securities, commodities, or something entirely new? This lack of clear classification creates uncertainty for both investors and developers. This uncertainty can stifle innovation, but it also provides an opportunity for careful navigation and strategic planning for those who understand the complexities.

Jurisdictional Differences in Golden Currency Regulation

The regulatory approach to golden currencies differs significantly across countries. Some countries, like Switzerland, have adopted a relatively progressive stance, fostering innovation while implementing safeguards. Others, like China, have taken a much more restrictive approach, effectively banning certain crypto activities. The United States, meanwhile, is navigating a complex web of federal and state regulations, with ongoing debates about the appropriate level of oversight.

This patchwork approach leads to significant legal complexities for projects aiming for international reach. For example, a golden currency project might face stringent Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements in one jurisdiction, while operating in a relatively unregulated environment in another. This uneven playing field creates both opportunities and challenges. A thorough understanding of each jurisdiction’s specific rules is crucial for success.

Impact of Future Regulations on Golden Currency Adoption

Predicting the future of regulation is, of course, a fool’s errand, but we can make some educated guesses. The trend seems to be toward greater regulatory clarity and harmonization, though the speed and specifics remain uncertain. Increased regulation could lead to greater investor confidence and mainstream adoption, but it could also stifle innovation and limit the potential of golden currencies.

For example, stricter KYC/AML rules might make it harder for smaller investors to participate, while overly burdensome regulations could stifle the development of new, potentially groundbreaking technologies. The balance between protecting investors and fostering innovation will be a key challenge for regulators in the years to come. One can imagine a scenario where robust regulatory frameworks emerge, leading to the creation of safer and more reliable golden currency ecosystems.

However, overly restrictive regulations could drive innovation underground, potentially leading to less transparent and less secure markets.

Legal Implications for Investors and Developers

Investors in golden currencies face a range of legal risks, including the possibility of fraud, market manipulation, and regulatory uncertainty. Developers, meanwhile, must navigate complex legal requirements related to securities laws, data privacy, and intellectual property. Both investors and developers need to understand their rights and responsibilities and seek expert legal advice to mitigate these risks. Failure to comply with applicable laws and regulations can result in significant financial penalties and even criminal prosecution.

For example, developers who fail to properly register their tokens as securities could face substantial fines and legal action from regulatory bodies. Similarly, investors who engage in insider trading or market manipulation could face severe consequences. Therefore, due diligence and adherence to best practices are paramount.

Case Studies of Successful and Unsuccessful Golden Currencies

The world of golden currencies, aiming to bridge the gap between crypto’s volatility and gold’s perceived stability, has seen both dazzling successes and spectacular flameouts. Analyzing these contrasting narratives reveals crucial lessons for investors and developers alike, shedding light on the factors that contribute to either soaring valuations or catastrophic collapses. Let’s delve into some compelling case studies.

Successful Golden Currency: Pax Gold (PAXG)

Pax Gold represents a relatively successful example of a tokenized gold asset. Its strategy centers on a 1:1 backing of each PAXG token with physical gold held in secure, audited vaults. This transparency and verifiable asset backing have instilled a level of trust that many other golden currencies lack. PAXG has achieved widespread adoption due to its integration with major cryptocurrency exchanges and its ease of use for investors seeking exposure to gold without the complexities of physical storage and handling.

The project’s success is largely attributed to its straightforward approach, regulatory compliance, and focus on delivering a reliable and transparent product.

Unsuccessful Golden Currency: (Hypothetical Example – “GoldCoin”)

For a contrasting example, let’s consider a hypothetical project, “GoldCoin,” which promised to be backed by gold but lacked the robust infrastructure and transparency of PAXG. GoldCoin failed due to a combination of factors. Firstly, its claims of gold backing were never independently verified, leading to significant distrust among potential investors. Secondly, the project suffered from poor communication and a lack of a clear roadmap, leaving investors uncertain about its long-term viability.

Finally, the developers’ anonymity and lack of accountability further eroded investor confidence, ultimately resulting in the project’s collapse and the loss of funds for its early adopters. This highlights the critical importance of transparency, verifiable backing, and a well-defined development plan in the success of any golden currency.

Comparison of Success and Failure Factors

| Factor | Successful Projects (e.g., PAXG) | Unsuccessful Projects (e.g., GoldCoin) |

|---|---|---|

| Transparency and Auditability | Regularly audited, verifiable gold reserves | Lack of transparency and independent verification |

| Regulatory Compliance | Compliant with relevant regulations | Lack of regulatory compliance, leading to legal issues |

| Team and Development | Experienced team with a clear roadmap | Anonymous team, unclear roadmap, poor communication |

| Market Adoption | Integration with major exchanges, ease of use | Limited adoption, lack of user-friendly interface |

| Security | Robust security measures to protect assets | Vulnerable to hacks or exploits due to poor security practices |

Final Summary

So, is investing in golden currencies a fool’s gold or a genuine path to riches? The answer, like the crypto market itself, is volatile and complex. While the allure of long-term value and potential price appreciation is undeniable, the risks are equally substantial. Ultimately, thorough research, a well-defined risk tolerance, and a healthy dose of skepticism are your best tools in this glittering, unpredictable goldmine.

Remember, even digital gold can turn to dust if you’re not careful. Happy hunting (but please, invest responsibly!).