How can I safely trade cryptocurrencies with leverage in Canada? That’s the million-dollar question, or should we say, the million-Bitcoin question! Navigating the wild west of leveraged crypto trading in Canada requires more than just a lucky horseshoe and a prayer; it demands a healthy dose of knowledge, a dash of caution, and perhaps a strong stomach for volatility.

This guide will arm you with the insights you need to approach this exciting (and potentially perilous) venture with a bit more confidence – and maybe even a chuckle or two along the way.

We’ll unravel the regulatory landscape, helping you understand the rules of the game before you even step onto the field. Then, we’ll delve into choosing a reputable exchange – because picking the wrong partner can be as disastrous as stepping into a bear trap wearing only socks. We’ll cover strategies, risk management (crucial!), and even the tax implications – because even crypto gains need to pay their dues to the Canadian Revenue Agency.

Finally, we’ll equip you to dodge the many scams lurking in the digital shadows, ensuring you’re not the next victim of a crypto con artist.

Understanding Canadian Cryptocurrency Regulations

Navigating the wild west of cryptocurrency trading in Canada requires more than just a lucky horseshoe and a prayer. While the digital gold rush is exciting, understanding the legal landscape is crucial to avoid a regulatory tumbleweed rolling over your profits. Let’s delve into the Canadian crypto regulatory framework – think of it as your trusty map in this digital frontier.Canadian Cryptocurrency Regulatory Bodies and their RolesThe regulatory landscape for cryptocurrency in Canada is a bit of a patchwork quilt, stitched together by several different agencies.

The primary players include the Ontario Securities Commission (OSC), the British Columbia Securities Commission (BCSC), and the Investment Industry Regulatory Organization of Canada (IIROC). These provincial and national bodies primarily focus on protecting investors from fraud and ensuring market integrity. The federal government, through bodies like the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC), tackles the anti-money laundering and terrorist financing aspects of crypto transactions.

So, you’re looking to safely trade crypto with leverage in Canada? That’s a brave (and potentially lucrative!) move. Remember, due diligence is key; before you leap into the world of amplified returns, check out resources like profit from cryptocoin to bolster your knowledge. Then, and only then, can you confidently navigate the Canadian crypto landscape and maybe, just maybe, avoid becoming another cautionary tale.

Think of it like this: the provincial commissions are the sheriffs keeping order in the individual towns, while FINTRAC is the federal marshal overseeing the entire territory.A Comparison of Canadian Regulations with Other G7 NationsCompared to some of its G7 counterparts, Canada’s regulatory approach to leveraged cryptocurrency trading is relatively less stringent. While countries like the UK and Japan have implemented more comprehensive frameworks, Canada is still finding its footing.

This doesn’t necessarily mean it’s a free-for-all, though. The lack of a unified, comprehensive federal framework leads to a degree of regulatory uncertainty and inconsistencies across provinces. This can make it challenging for businesses and traders to navigate the legal landscape. The lack of explicit regulation on leveraged trading specifically leaves a grey area that requires careful consideration and potentially cautious approach.

One could say Canada is still figuring out the best way to regulate the crypto rodeo, while other G7 nations have already started roping in some of the wilder aspects.

| Regulation | Description | Implications for Traders | Relevant Links |

|---|---|---|---|

| Provincial Securities Commissions (e.g., OSC, BCSC) | Oversee the registration and conduct of cryptocurrency exchanges and trading platforms. Focus on investor protection and preventing fraud. | Traders must ensure their chosen exchange is registered and compliant with applicable provincial regulations. Failure to do so can expose traders to significant risk. | osc.ca, bcsc.bc.ca |

| FINTRAC | Regulates financial transactions to combat money laundering and terrorist financing. Applies to cryptocurrency exchanges and certain traders. | Exchanges and potentially traders must comply with FINTRAC’s reporting requirements. Non-compliance can lead to severe penalties. | fintr.gc.ca |

| Absence of Specific Leveraged Trading Regulation | No explicit federal or provincial regulations specifically address leveraged cryptocurrency trading. | This creates a regulatory grey area, requiring traders to exercise extreme caution and due diligence when engaging in leveraged trading. | (No single link applies; requires research across multiple government sites) |

| Taxation | Cryptocurrency transactions are subject to Canadian income tax laws. Capital gains and losses are taxable events. | Traders must accurately report their cryptocurrency transactions for tax purposes to avoid penalties. | canada.ca/en/revenue-agency.html |

Choosing a Regulated Exchange

Picking the right cryptocurrency exchange in Canada for leveraged trading is like choosing a superhero sidekick – you want someone reliable, powerful, and not prone to spontaneously combusting your savings. The wrong choice can lead to headaches (and potentially empty wallets), so let’s navigate this carefully. We’ll focus on regulated exchanges, ensuring a layer of protection against the wild west aspects of the crypto world.Choosing a regulated exchange in Canada for leveraged trading involves carefully considering several key factors.

These factors are crucial for ensuring the security of your investments and a smooth trading experience. Ignoring them is like trying to build a castle out of jellybeans – it might look fun initially, but the whole thing will crumble under pressure.

Reputable Canadian Cryptocurrency Exchanges Offering Leveraged Trading

Several reputable exchanges operate in Canada and offer leveraged trading. It’s important to remember that the availability of specific features and cryptocurrencies can change, so always check the exchange’s website for the most up-to-date information. Think of this list as a starting point for your research, not the final word. Due diligence is your best friend in the crypto realm.

Factors to Consider When Selecting a Regulated Exchange

Selecting the right exchange requires careful consideration of several factors. This isn’t about picking the shiniest button; it’s about choosing the most robust and secure platform for your needs.

- Security Measures: Look for exchanges with robust security protocols, including two-factor authentication (2FA), cold storage for a significant portion of their assets, and regular security audits. Think of these as the exchange’s bodyguards, protecting your digital assets from nefarious actors.

- Fees: Trading fees, withdrawal fees, and deposit fees can significantly impact your profitability. Compare fees across different exchanges to find the most cost-effective option. This is where you want to be a savvy shopper, comparing prices like you would when buying groceries.

- Available Cryptocurrencies: Ensure the exchange offers the cryptocurrencies you intend to trade with leverage. Don’t get stuck with an exchange that only offers a limited selection, limiting your trading opportunities.

- User Interface and Experience: A user-friendly platform is crucial, especially when dealing with leveraged trading, which can be complex. A clunky interface can lead to costly mistakes.

- Regulation and Licensing: Verify that the exchange is registered and regulated by relevant Canadian authorities. This provides an additional layer of security and consumer protection.

Decision Matrix: Comparing Canadian Cryptocurrency Exchanges

Below is a comparison of three hypothetical Canadian cryptocurrency exchanges offering leveraged trading. Remember that this is a simplified example and the actual offerings and fees can vary. Always verify the current information on each exchange’s website.

| Exchange | Security Measures | Fees (Example) | Available Cryptocurrencies (Example) |

|---|---|---|---|

| Exchange A | 2FA, Cold Storage, Regular Audits | 0.1% trading fee, $10 withdrawal fee | BTC, ETH, LTC, XRP |

| Exchange B | 2FA, Cold Storage, Insurance Fund | 0.2% trading fee, $5 withdrawal fee | BTC, ETH, SOL, ADA |

| Exchange C | 2FA, Cold Storage, Regular Audits, Advanced Security Features | 0.15% trading fee, Free withdrawal (up to a limit) | BTC, ETH, LTC, XRP, DOGE, several others |

Security Protocols Implemented by Reputable Canadian Cryptocurrency Exchanges

Reputable Canadian cryptocurrency exchanges employ various security protocols to safeguard user funds. These protocols often include:

- Two-Factor Authentication (2FA): This adds an extra layer of security by requiring a second verification method, such as a code from your phone, in addition to your password.

- Cold Storage: A significant portion of the exchange’s cryptocurrency holdings is stored offline in secure, physically protected locations, reducing the risk of hacking.

- Regular Security Audits: Independent security audits identify and address potential vulnerabilities in the exchange’s systems.

- Encryption: Data encryption protects sensitive user information from unauthorized access.

- Advanced Security Features: Some exchanges may utilize additional security measures, such as advanced firewall systems and intrusion detection systems.

Leveraged Trading Strategies and Risk Management

So, you’ve navigated the regulatory minefield and chosen your Canadian crypto exchange – congratulations! Now comes the exciting (and potentially terrifying) part: leveraging your trades. Think of leverage as a financial turbocharger – it can drastically amplify your profits, but equally, it can send your portfolio into a nosedive faster than a Bitcoin price crash on a Tuesday afternoon.

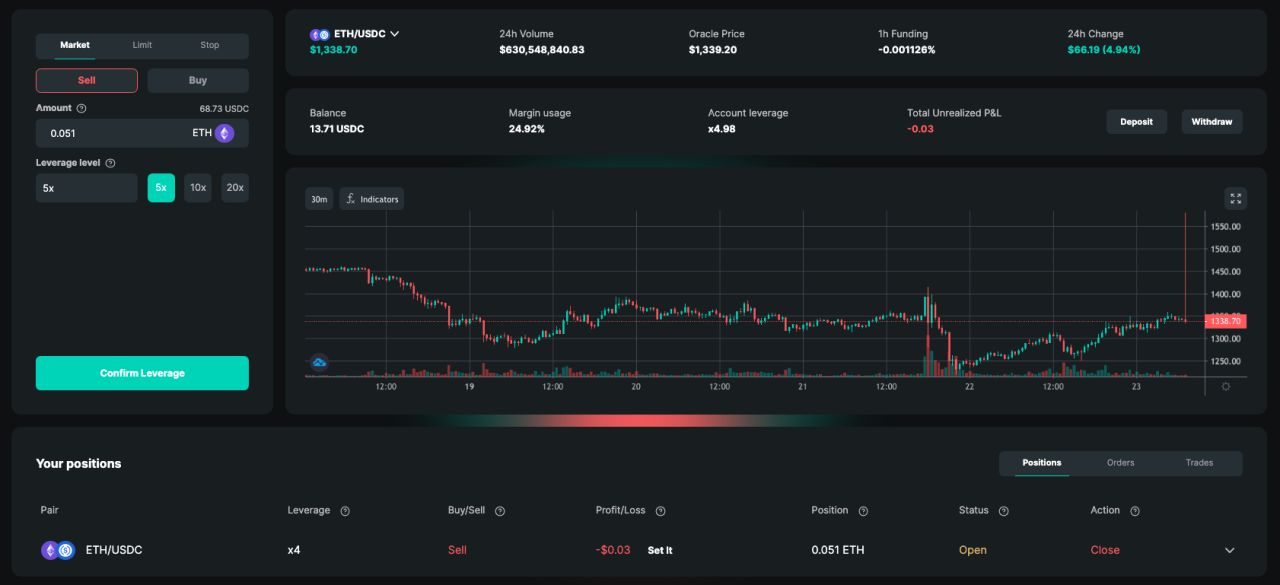

Let’s explore how to harness this powerful tool safely.Leverage magnifies both gains and losses. A 5x leverage means a 1% price increase nets you a 5% profit, but a 1% drop costs you 5%. This isn’t just theoretical; it’s a rollercoaster ride where even small market fluctuations can have significant consequences.

Safe leverage trading in Canadian crypto? It’s a wild ride, my friend! First, you need to pick a platform, and minimizing fees is key – so check out this handy guide to find out Which Canadian crypto exchange offers the absolute lowest trading fees? Once you’ve got that sorted, remember, leverage is a double-edged sword; proceed with caution and only risk what you can afford to lose! Happy (and hopefully profitable) trading!

Margin Trading Explained

Margin trading allows you to borrow funds from your exchange to increase your trading position size. Imagine you have $1000 and want to buy $5000 worth of Bitcoin. With 5x leverage, the exchange lends you $4000, allowing you to control a position five times larger than your initial capital. The risk is that if the price drops significantly, you could face liquidation – the exchange selling your assets to cover its loan.

This can happen swiftly and unexpectedly, leaving you with a significantly reduced balance or even nothing.

Futures Contracts: A Different Beast, How can I safely trade cryptocurrencies with leverage in Canada?

Futures contracts are agreements to buy or sell a cryptocurrency at a specific price on a future date. They offer leverage because you only need to deposit a small percentage of the contract’s value (the margin) to enter the trade. The potential for profit is high, but so is the risk of substantial losses if the market moves against your prediction.

So, you want to ride the crypto rollercoaster with leverage in Canada? Hold your horses, friend! Safe leverage trading means choosing your platform wisely. Check out this list of Secure crypto trading platforms in Canada with leverage to find a reputable site before you start flinging your funds around like a caffeinated chimpanzee. Remember, due diligence is your best friend in this wild, wild west of finance!

Futures contracts require a good understanding of technical analysis and market trends. Misjudging the market can lead to significant losses and even liquidation.

Risks of Leveraged Cryptocurrency Trading

The crypto market is famously volatile. News, tweets, and even a random celebrity endorsement can send prices soaring or plummeting. Leverage intensifies this volatility. Liquidation, as mentioned, is a constant threat. It’s like walking a tightrope with a blindfold on – one wrong step, and you’re out.

So, you’re wondering how to safely trade crypto with leverage in Canada? It’s a wild ride, let me tell you! Before you jump in headfirst, though, remember that even seemingly stable investments like gold carry risks – check out this article on Understanding the risks and rewards of golden currency investments for a dose of reality.

Understanding those risks will help you approach leveraged crypto trading in Canada with a bit more, shall we say, financial sanity.

Another risk is the potential for cascading losses. A significant market downturn can trigger margin calls, forcing you to sell assets at a loss, potentially leading to further losses.

So, you wanna tango with leverage in the Canadian crypto market? That’s a bold move, friend! To navigate this thrilling, yet potentially perilous, dance, you need a solid platform. Check out this Detailed review of Newton crypto exchange’s legality and security to see if it’s your perfect partner. Remember, even the best dance requires careful steps, so always research thoroughly before leaping into leveraged trades.

Happy trading (responsibly, of course!).

Effective Risk Management Techniques

Successful leveraged trading isn’t about gambling; it’s about calculated risk. Diversification, for example, means not putting all your eggs in one basket (or one cryptocurrency). Spread your investments across different assets to reduce your overall risk. Stop-loss orders are crucial. These automatically sell your assets when the price reaches a predetermined level, limiting potential losses.

Position sizing involves determining how much capital to allocate to each trade, preventing a single bad trade from wiping out your entire portfolio. It’s like having a financial parachute.

Placing a Leveraged Trade: A Step-by-Step Guide

- Choose your exchange: Select a regulated Canadian exchange that offers leveraged trading.

- Understand the leverage offered: Each exchange has different leverage ratios. Choose a ratio you’re comfortable with.

- Select your cryptocurrency: Research and choose the cryptocurrency you want to trade.

- Set your stop-loss order: Determine your acceptable loss and set a stop-loss order to protect your capital.

- Determine your position size: Calculate how much capital to allocate to the trade, considering your risk tolerance.

- Place your leveraged trade: Execute your trade through the exchange’s trading platform, specifying the leverage ratio and order type.

- Monitor your position: Regularly monitor the market and your trade’s performance.

- Manage your risk: Adjust your stop-loss order or close your position if necessary.

Tax Implications of Leveraged Cryptocurrency Trading in Canada

Navigating the Canadian tax system while riding the rollercoaster of leveraged cryptocurrency trading can feel like trying to solve a Rubik’s Cube blindfolded – challenging, but not impossible! Understanding the tax implications is crucial to avoid a nasty surprise from the Canada Revenue Agency (CRA). Let’s unravel this financial puzzle together.Leveraged cryptocurrency trading in Canada is treated similarly to other forms of capital gains or losses.

Essentially, any profit you make is considered a capital gain, while losses are considered capital losses. However, the complexities arise from the leveraged nature of the trades, requiring meticulous record-keeping and careful calculation. Remember, the CRA considers cryptocurrencies as property, not currency, so the rules surrounding property transactions apply.

Capital Gains and Losses from Leveraged Trading

Capital gains are calculated as 50% of your profit. This means only half of your profit is actually taxed. Conversely, capital losses can be used to offset capital gains in the same year or carried forward to reduce taxes in future years. In the context of leveraged trading, this means meticulously tracking each trade, including the initial investment, leverage applied, resulting profit or loss, and any associated fees.

Failing to accurately record these details could lead to significant tax complications.

Reporting to the Canadian Revenue Agency (CRA)

Reporting your cryptocurrency trading activities to the CRA involves filing Schedule 3 of your income tax return (Form T1). This schedule is specifically designed for reporting capital gains and losses. You’ll need to accurately report the proceeds of disposition (the amount you received from selling your cryptocurrency), the adjusted cost base (ACB) (the original cost plus any improvements), and any expenses incurred in relation to the trade.

The CRA is increasingly scrutinizing cryptocurrency transactions, so thorough record-keeping is paramount to avoid penalties.

Example Calculation of Capital Gains Tax

Let’s say you invested $1,000 CAD in Bitcoin using 5x leverage. This means your effective investment was $5,000 CAD. The Bitcoin price increased, and you sold your position for $7,000 CAD. Your profit is $2,000 CAD ($7,000 – $5,000). Your taxable capital gain is 50% of this profit, which is $1,000 CAD.

So, you wanna tango with leveraged crypto in Canada? First, buckle up, buttercup, it’s a wild ride. Safe leverage trading hinges on choosing the right platform, and that means keeping an eye on those fees. To find the best deal, check out this helpful guide: Which Canadian crypto exchange provides the cheapest trading fees overall? Once you’ve found a low-fee exchange, remember to always diversify and never invest more than you can afford to lose – because even the cheapest fees sting when you’re down.

If your marginal tax rate is 25%, your capital gains tax would be $250 CAD ($1,000 x 0.25). Remember that this is a simplified example, and other factors like fees and commissions need to be considered in real-world scenarios.

Resources for Canadian Cryptocurrency Traders

Understanding the tax implications of cryptocurrency trading can be daunting, but several resources are available to help Canadian traders navigate the system.

The CRA website offers comprehensive guides and publications on capital gains and losses. They also provide specific information regarding the taxation of digital currencies. While not cryptocurrency-specific, tax professionals specializing in cryptocurrency taxation can provide personalized guidance. Many accounting firms now have specialists familiar with the nuances of digital asset taxation. Finally, various online forums and communities dedicated to Canadian cryptocurrency traders often share experiences and insights on tax reporting.

Protecting Yourself from Scams and Fraud: How Can I Safely Trade Cryptocurrencies With Leverage In Canada?

Navigating the wild west of cryptocurrency, especially with leverage, requires more than just a keen eye for market trends; it demands a healthy dose of skepticism and a robust defense against the digital bandits lurking in the shadows. Leveraged trading, with its amplified potential for profit, unfortunately, also amplifies the risk of falling prey to scams. This section will equip you with the knowledge to spot and avoid these digital pitfalls.The cryptocurrency world is a breeding ground for scams, preying on the excitement and potential for quick riches.

Understanding the common tactics employed by fraudsters is the first step in protecting your hard-earned capital. We’ll examine various schemes, offering practical strategies to stay one step ahead of these cybercriminals.

Phishing Attempts

Phishing emails are a staple of the scammer’s toolkit. These deceptive emails mimic legitimate communications from cryptocurrency exchanges, wallet providers, or even government agencies. They often contain urgent requests, enticing offers, or warnings about account security breaches, all designed to trick you into revealing your login credentials, private keys, or seed phrases. These seemingly innocuous emails can lead to the complete depletion of your cryptocurrency holdings.

Example of a Phishing Email

Imagine receiving an email with the subject line: “Urgent Security Alert: Suspicious Activity on Your Binance Account.” The email body might contain a link to a website that looks almost identical to Binance’s official website, urging you to verify your account details immediately. This fake website is designed to capture your login information and redirect you to a seemingly legitimate page while quietly stealing your credentials.

The sender’s email address may appear legitimate at first glance, but a closer inspection reveals a slightly altered domain name or a less-than-perfect mimicry of the official email address. Always double-check the sender’s email address and website URL before clicking any links. Hover over the link to see the actual URL; if it looks suspicious, avoid clicking.

Ponzi Schemes

Ponzi schemes, infamous for their pyramid-like structure, are also prevalent in the cryptocurrency space. These schemes promise high returns with little or no risk, attracting investors with the allure of quick profits. Early investors are paid with funds from later investors, creating a false sense of legitimacy. However, the scheme inevitably collapses when new investors become scarce, leaving the majority with significant losses.

A telltale sign of a Ponzi scheme is the promise of exceptionally high and consistent returns, often exceeding the market average. Always be wary of investment opportunities that seem too good to be true. Legitimate investments carry inherent risks; guaranteed high returns are a major red flag.

Other Fraudulent Activities

Beyond phishing and Ponzi schemes, other fraudulent activities include fake ICOs (Initial Coin Offerings), rug pulls (where developers abandon a project and run off with the funds), and pump-and-dump schemes (where traders artificially inflate the price of a cryptocurrency before selling their holdings, leaving other investors with losses). These scams often involve sophisticated marketing techniques and social media manipulation to lure unsuspecting victims.

Thorough research and due diligence are crucial before investing in any cryptocurrency project, especially those promising exceptionally high returns. Check the project’s whitepaper, team background, and online reputation before investing. Look for independent reviews and avoid projects with opaque or misleading information. Remember, if it sounds too good to be true, it probably is.

Last Point

So, there you have it – a whirlwind tour through the world of leveraged cryptocurrency trading in Canada. Remember, while the potential rewards can be enticing, the risks are very real. This isn’t a get-rich-quick scheme; it’s a calculated journey that requires research, planning, and a healthy respect for the market’s unpredictable nature. By understanding the regulations, choosing your exchange wisely, employing sound risk management strategies, and staying vigilant against scams, you can significantly increase your chances of success.

Now go forth and conquer (responsibly, of course!).