How to choose the best cryptocurrency exchange for Canadian residents based on their needs. – How to choose the best cryptocurrency exchange for Canadian residents based on their needs? It’s a question that echoes through the digital canyons of the crypto world, a siren song of potential profits and perilous pitfalls. Navigating the Canadian regulatory landscape, deciphering fee structures that could rival a tax lawyer’s bill, and choosing an exchange that won’t vanish with your hard-earned Bitcoin – it’s a journey worthy of an Indiana Jones-style adventure (minus the snakes, hopefully).

This guide will equip you with the map and compass you need to conquer the crypto wilderness and emerge victorious, your digital fortune intact.

We’ll explore the crucial aspects of selecting a Canadian crypto exchange, from understanding the legal minefield of Canadian regulations to mastering the art of comparing fees and security features. We’ll uncover hidden costs, analyze user interfaces that range from intuitive to utterly baffling, and help you find an exchange that’s as secure as Fort Knox (with maybe slightly better customer service).

Get ready to become a crypto connoisseur – your financial future depends on it!

Understanding Canadian Regulatory Landscape for Cryptocurrency Exchanges: How To Choose The Best Cryptocurrency Exchange For Canadian Residents Based On Their Needs.

Navigating the world of cryptocurrency in Canada can feel like trying to solve a Rubik’s Cube blindfolded – tricky, but not impossible! Understanding the regulatory landscape is the first step to avoiding a financial faceplant. While Canada isn’t as strictly regulated as some countries, it’s not the Wild West either. Let’s untangle this regulatory Gordian knot.Canadian regulations for cryptocurrency exchanges are primarily overseen at the federal level, but provincial and territorial laws also play a role, creating a bit of a regulatory patchwork quilt.

Picking the perfect crypto exchange as a Canadian can feel like choosing between a unicorn and a llama – both quirky, but wildly different! To help navigate this wild west, consider factors like fees and security. A great head-to-head comparison is this article: Crypto.com vs Coinbase: Fees, security, and features for Canada , which will illuminate the differences.

Ultimately, the best exchange depends on your individual needs and risk tolerance, so do your research before diving in!

This means the rules can vary slightly depending on where you live, adding another layer of complexity. Think of it as a delicious, but slightly confusing, regulatory poutine.

Key Regulations for Canadian Cryptocurrency Exchange Users

Canadian residents need to be aware of several key regulations when choosing a cryptocurrency exchange. These regulations primarily focus on anti-money laundering (AML) and terrorist financing (TF) prevention. The primary legislation is the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA), which requires registered businesses, including cryptocurrency exchanges, to implement robust KYC (Know Your Customer) and AML/TF compliance programs. This means exchanges will require you to verify your identity before you can trade.

Picking the right Canadian crypto exchange is crucial; you need low fees, solid security, and maybe even some cute mascot. But before you dive into the exchange-choosing chaos, figuring out what to buy is key! Check out this guide on What are the best cryptocurrencies to buy in Canada right now for long-term investment? to make sure your chosen exchange even has your desired digital gold.

Then, armed with knowledge, you can confidently choose the best exchange to suit your newly-informed investment strategy!

Failure to comply with these regulations can lead to significant penalties for both the exchange and the user, so it’s best to choose a reputable, compliant exchange.

Provincial and Territorial Regulatory Differences

While the federal government sets the overarching framework, provinces and territories have some leeway in how they implement and enforce these regulations. These differences are generally subtle and don’t drastically alter the core requirements, but they can influence how exchanges operate within each jurisdiction. For example, some provinces might have specific guidelines regarding consumer protection in the context of cryptocurrency trading, leading to variations in dispute resolution processes.

However, the fundamental AML/TF obligations remain consistent across the country. It’s akin to regional variations in Canadian bacon – the core concept remains the same, but the execution might differ slightly.

Comparison of Regulatory Bodies

The primary regulatory body overseeing cryptocurrency exchanges in Canada is the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC). FINTRAC is responsible for enforcing the PCMLTFA and ensuring compliance with AML/TF regulations. While other provincial and territorial bodies might have a supporting role in consumer protection or market oversight, FINTRAC holds the primary regulatory authority over cryptocurrency exchanges operating in Canada.

Think of FINTRAC as the head referee in the cryptocurrency game, making sure everyone plays fair.

Comparison of Top 5 Regulated Exchanges in Canada

It’s crucial to select a FINTRAC-registered exchange to ensure compliance and mitigate risk. While a comprehensive list is beyond the scope of this discussion, a table comparing some prominent regulated exchanges (note: this is not an endorsement and regulatory compliance can change):

| Exchange | FINTRAC Registered | Other Compliance Certifications (Examples) | Key Features (Illustrative) |

|---|---|---|---|

| Example Exchange A | Yes | ISO 27001 (Information Security), SOC 2 (Security, Availability, Processing Integrity, Confidentiality, Privacy) | Wide range of cryptocurrencies, competitive fees, user-friendly interface |

| Example Exchange B | Yes | ISMS (Information Security Management System) | Strong security features, excellent customer support, advanced trading tools |

| Example Exchange C | Yes | PCI DSS (Payment Card Industry Data Security Standard) | Focus on security, robust verification processes, suitable for beginners |

| Example Exchange D | Yes | ISMS, ISO 27001 | High liquidity, low fees, caters to experienced traders |

| Example Exchange E | Yes | SOC 2 | Mobile app available, supports various payment methods |

*Note: This table is for illustrative purposes only. Always verify the current regulatory status and certifications of any exchange before using its services.*

Fee Structures and Trading Costs

Navigating the world of cryptocurrency exchanges in Canada can feel like traversing a minefield of fees. Understanding these costs is crucial, as they can significantly impact your overall profit (or loss!). Think of it like this: you wouldn’t buy a car without checking the price tag, would you? The same principle applies to choosing a crypto exchange.Fees on Canadian cryptocurrency exchanges vary wildly, so let’s break down the key components to help you choose wisely.

Ignoring fees is like leaving money on the table – and nobody wants that, especially when dealing with volatile digital assets.

Trading Fees

Trading fees are the charges levied for buying or selling cryptocurrencies. These fees are usually expressed as a percentage of the transaction value and can differ depending on the trading pair (e.g., BTC/CAD, ETH/CAD), the trading volume, and the exchange itself. High-volume traders often benefit from tiered fee structures, where fees decrease as their trading volume increases. This incentivizes frequent trading and rewards loyal users.

Conversely, low-volume traders might find themselves paying a higher percentage per trade.

Deposit and Withdrawal Fees

Beyond trading fees, consider the costs associated with depositing and withdrawing funds. Some exchanges offer free deposits via certain methods (e.g., Interac e-Transfer), while others charge fees, especially for wire transfers or crypto withdrawals. Withdrawal fees can vary significantly depending on the cryptocurrency and the network’s transaction fees. For example, withdrawing Bitcoin (BTC) often incurs higher fees than withdrawing smaller-cap altcoins due to higher network congestion and transaction costs.

Always check the fee schedule before making a deposit or withdrawal to avoid surprises.

Impact of Fee Structures on Trading Profitability

The impact of fees on trading profitability is directly proportional to the trading volume. For example, a trader making small, frequent trades will pay a higher percentage of their profits in fees compared to a trader making large, infrequent trades. Let’s illustrate this with a simple example:Imagine two traders, Alice and Bob. Alice makes 10 trades of $100 each, incurring a 0.5% fee per trade.

Her total fee is $5. Bob, on the other hand, makes one trade of $1000, incurring the same 0.5% fee. His total fee is $5 as well. While the absolute fee is the same, the percentage of profit lost to fees is much higher for Alice.

Picking the perfect crypto exchange in Canada? Consider fees, security, and available coins – it’s a wild west out there! But if you’re looking for something beyond the usual exchanges, and want to explore the less-traveled path of over-the-counter trading, check out this guide: How can I safely buy and sell OTC cryptocurrencies in Canada? Once you’ve weighed your options, both traditional and OTC, you’ll be well-equipped to choose the exchange that best suits your Canadian crypto needs.

Hidden Fees

Hidden fees are the sneaky gremlins of the cryptocurrency exchange world. These fees are not always explicitly stated and can include things like inactivity fees (charged for accounts that remain dormant for a long period), conversion fees (for converting between different cryptocurrencies on the exchange), or even spread costs (the difference between the buying and selling price). Always read the fine print meticulously!

Fee Structure Comparison, How to choose the best cryptocurrency exchange for Canadian residents based on their needs.

Below is a comparison of fee structures for three popular Canadian exchanges (Note: these are examples and may not reflect current rates. Always check the exchange’s website for the most up-to-date information).

| Exchange | Trading Fee (Maker/Taker) | Deposit Fee (CAD Bank Transfer) | Withdrawal Fee (BTC) |

|---|---|---|---|

| Example Exchange A | 0.1%/0.2% | Free | 0.001 BTC |

| Example Exchange B | 0.15%/0.25% | $5 | 0.0005 BTC |

| Example Exchange C | Variable (tiered) | Free | 0.0015 BTC + Network Fee |

Available Cryptocurrencies and Trading Pairs

Choosing a Canadian cryptocurrency exchange isn’t just about finding the lowest fees; it’s also about finding the digital assets you actually want to trade. Think of it like choosing a grocery store – you wouldn’t shop at a place that only stocked turnips if you craved a juicy mango, would you? The range of cryptocurrencies and trading pairs offered significantly impacts your trading options and overall experience.The availability of a diverse selection of cryptocurrencies and their corresponding trading pairs is crucial for a seamless trading experience.

Picking the right crypto exchange in Canada? It’s a wild west out there, eh? First, consider fees and security, then think about what you’ll actually buy. To help you decide, check out this guide on Which altcoins are promising investments in the Canadian market? to inform your exchange choice.

After all, a great exchange is only as good as the coins it offers! So choose wisely, my friend, and may your crypto portfolio grow.

A wider selection provides traders with more opportunities to diversify their portfolios, capitalize on market trends, and engage in various trading strategies. Access to less common altcoins, for instance, could lead to potentially higher returns (but also higher risk!), while a robust selection of major cryptocurrencies ensures ease of trading and liquidity. Furthermore, the availability of numerous trading pairs allows for efficient conversion between different cryptocurrencies without the need for multiple exchanges.

Cryptocurrency Selection and Liquidity on Top Canadian Exchanges

The liquidity of a cryptocurrency on a specific exchange refers to how easily it can be bought or sold without significantly impacting its price. High liquidity is generally preferred as it means you can enter and exit trades quickly without large price swings. Below, we Artikel the cryptocurrency offerings of five leading Canadian exchanges, highlighting their most commonly traded assets.

Remember, these offerings are subject to change, so always check the exchange’s website for the most up-to-date information.

- Kraken: Kraken boasts a wide selection, including Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Bitcoin Cash (BCH), Ripple (XRP), and many others. They generally offer good liquidity for major cryptocurrencies, but liquidity for less popular altcoins might be lower.

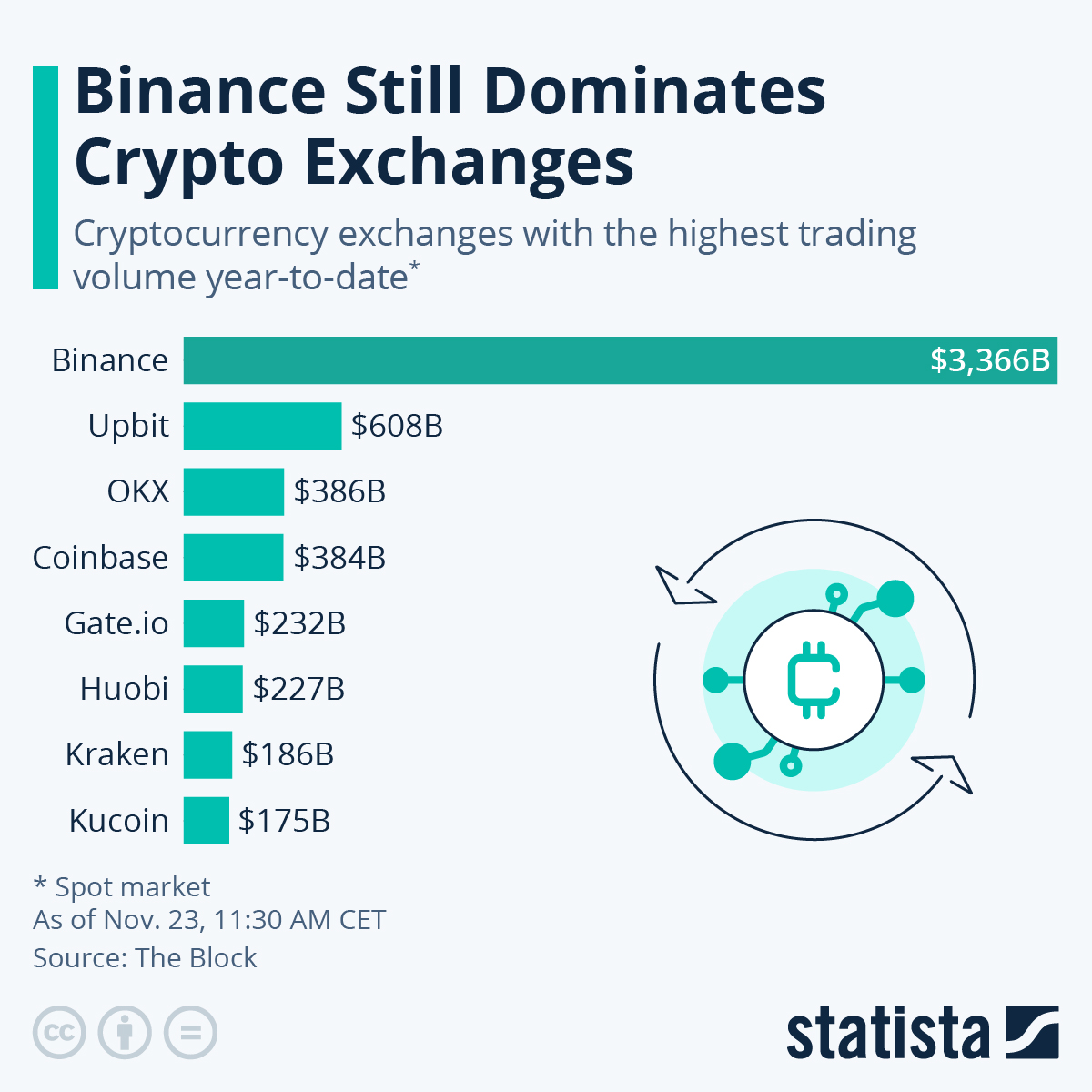

- Binance: Known for its massive selection, Binance offers a vast array of cryptocurrencies, including many lesser-known altcoins. Liquidity is generally high for popular coins but can vary significantly for less-traded assets. Navigating their extensive offerings might feel a bit overwhelming for beginners.

- Coinbase: Coinbase prioritizes a user-friendly interface and focuses on a curated selection of well-established cryptocurrencies such as BTC, ETH, and LTC. While their selection is smaller than Binance or Kraken, liquidity is usually high for the assets they do offer, making it a good choice for those prioritizing ease of use and security.

- NDAX: NDAX, a Canadian exchange, provides a solid selection of major cryptocurrencies, focusing on regulatory compliance. They offer BTC, ETH, LTC, and several others, prioritizing stability and security over a massive selection. Liquidity is generally good for their offered assets.

- Wealthsimple Crypto: Wealthsimple Crypto is a popular choice for beginners, offering a simplified experience with a smaller, but carefully selected range of cryptocurrencies, predominantly BTC and ETH. While the selection is limited, the high liquidity for these major assets and user-friendly platform makes it a good starting point for new investors.

Security Features and User Protection

Choosing a cryptocurrency exchange in Canada isn’t just about finding the best rates; it’s about safeguarding your digital assets. Think of your crypto as your digital gold – you wouldn’t leave it lying around unattended, would you? The security features offered by an exchange are your digital vault, and choosing the right one is crucial for peace of mind.

A robust security setup protects your investment from theft and unauthorized access, ultimately giving you confidence in your trading journey.Protecting your cryptocurrency requires a multi-layered approach. The security measures implemented by different exchanges vary significantly, impacting the overall risk profile. Understanding these differences is key to making an informed decision and avoiding costly mistakes. Remember, in the world of crypto, vigilance is your best friend.

Two-Factor Authentication (2FA) and Other Security Measures

Two-factor authentication, or 2FA, adds an extra layer of security by requiring a second verification method beyond your password. This could be a code sent to your phone, an authenticator app, or a security key. Think of it as double-locking your digital vault. Beyond 2FA, look for exchanges that utilize other robust security protocols such as cold storage (storing the majority of cryptocurrency offline), regular security audits, and encryption of user data.

Exchanges that actively invest in these measures demonstrate a commitment to user protection.

The Importance of Robust Security Protocols

Choosing an exchange with strong security protocols isn’t just about avoiding a potential headache; it’s about preventing financial ruin. A single security breach can wipe out your entire investment. The consequences of weak security can range from the inconvenience of account lockouts to the catastrophic loss of all your funds. Prioritizing exchanges with a proven track record of security is paramount.

Examples of Cryptocurrency Exchange Security Breaches

While many exchanges boast impressive security measures, history reminds us that no system is impenetrable. Several high-profile breaches have occurred, highlighting the devastating impact of security failures. For example, the 2014 Mt. Gox hack resulted in the loss of hundreds of millions of dollars worth of Bitcoin. This incident served as a stark reminder of the importance of choosing a secure and reputable exchange.

Picking the right crypto exchange in Canada? It’s a minefield of fees and features! Consider your trading style and security needs carefully; after all, you wouldn’t choose a restaurant based solely on price, would you? Maybe you’d prefer a delicious halal culinary experience instead of a greasy spoon, right? But back to crypto – finding the best platform for your needs is key to a successful (and hopefully profitable) investment journey.

More recently, other exchanges have experienced smaller-scale breaches, demonstrating the ongoing threat. These incidents underscore the need for diligent research and due diligence before entrusting your crypto to any platform.

Comparison of Security Features of Leading Canadian Exchanges

| Exchange | 2FA | Cold Storage | Insurance | Other Notable Security Features |

|---|---|---|---|---|

| Exchange A | Yes (various methods) | Yes | Yes (limited coverage) | Regular security audits, advanced encryption |

| Exchange B | Yes (SMS, Authenticator App) | Yes (partially disclosed) | No | Advanced firewall, IP whitelisting |

| Exchange C | Yes (Authenticator App only) | Not publicly disclosed | No | Data encryption, regular software updates |

| Exchange D | Yes (various methods) | Yes | No | Multi-signature wallets, advanced threat detection |

User Experience and Platform Features

Choosing a crypto exchange shouldn’t feel like navigating a labyrinth built by mischievous gnomes. A good user experience is crucial, especially for those new to the crypto world. A clunky, confusing platform can quickly turn a potential investor into a frustrated ex-investor. Let’s explore what makes a Canadian crypto exchange truly user-friendly.The user interface (UI) and overall user experience (UX) are paramount.

A well-designed platform is intuitive, easy to navigate, and doesn’t require a cryptology degree to understand. For beginners, a simple, straightforward design is absolutely essential; they need to focus on learning about crypto, not deciphering a complex interface. For experienced traders, advanced features and tools are expected, but these should be seamlessly integrated without overwhelming the user.

Ease of Use and Intuitive Navigation for Beginners

Imagine trying to learn to ride a bike on a unicycle – not ideal, right? Similarly, a complicated exchange interface can make learning about cryptocurrency incredibly difficult. Key features should be easily accessible, and the overall design should be clean and uncluttered. Clear instructions and helpful tooltips are invaluable for guiding new users through the process of buying, selling, and managing their crypto assets.

A well-structured FAQ section and easily accessible customer support are also vital components. Think of it as having a friendly, knowledgeable guide to help you along the way.

Key Features to Look for in a Cryptocurrency Exchange Platform

A good crypto exchange is more than just a place to buy and sell; it’s a complete ecosystem. Users should look for a range of features that enhance their trading experience and provide added security.

This includes:

- Mobile Apps: The ability to trade on the go is a must-have in today’s mobile-first world. A well-designed mobile app should mirror the functionality of the desktop platform, providing a seamless experience regardless of the device.

- Charting Tools: For more advanced traders, charting tools are essential for technical analysis. Look for exchanges that offer a variety of charts and indicators to help you make informed trading decisions. Think of them as your crypto crystal ball (though, remember, even crystal balls aren’t always accurate!).

- Customer Support: Reliable and responsive customer support is crucial. Whether it’s through email, phone, or live chat, you should be able to easily get help when you need it. Imagine having a helpful virtual assistant available 24/7 to answer all your burning crypto questions.

- Security Features: While already covered, it bears repeating: two-factor authentication (2FA), cold storage, and robust security protocols are non-negotiable.

Comparative Analysis of User Experiences on Three Popular Canadian Exchanges

Let’s take a peek under the hood of three popular Canadian exchanges (names omitted to avoid endorsement). Remember, user experiences are subjective, and what works for one person might not work for another.

Picking the perfect crypto exchange as a Canadian? It’s a wild west out there, so consider fees, security, and available coins. Before you jump in headfirst, though, you might want to check out this crucial question: Is MEXC a safe and legal option for Canadians? Once you’ve got that figured out, you can focus on finding an exchange that truly fits your needs and risk tolerance – happy trading!

Exchange A:

This exchange boasts a clean, modern interface that’s easy to navigate, even for beginners. Its mobile app is well-designed and functional, and its customer support is generally responsive. However, its charting tools are somewhat basic, which may be a drawback for experienced traders.

Exchange B:

Exchange B offers a more advanced platform with a wider array of charting tools and features. However, its interface can be overwhelming for beginners, and its mobile app lags behind in functionality compared to its desktop counterpart. Customer support, while available, can sometimes be slow to respond.

Exchange C:

This exchange sits somewhere in the middle. Its interface is reasonably intuitive, with a good balance of features for both beginners and experienced traders. The mobile app is functional, and customer support is generally prompt and helpful. However, some users have reported occasional glitches in the platform.

Customer Support and Accessibility

Choosing a cryptocurrency exchange feels a bit like choosing a new dentist – you hope you neverneed* their emergency services, but when you do, you REALLY need them. Reliable customer support is paramount, especially in the sometimes-volatile world of crypto. A quick response to a panicked query about a missing transaction can mean the difference between a minor inconvenience and a major meltdown.Customer support channels vary widely between exchanges, influencing the overall user experience and significantly impacting a platform’s trustworthiness.

Access to multiple, readily available support channels builds confidence and allows users to choose the method that best suits their needs and communication style. Accessibility for users with disabilities is also a crucial factor to consider, ensuring inclusivity within the crypto community.

Customer Support Channels Offered by Canadian Exchanges

Different exchanges utilize various methods to assist their clients. Some prioritize speed with live chat options, while others favor the more formal approach of email support. A robust support system typically includes a combination of these channels to cater to diverse user preferences. Phone support, though less common, can be particularly valuable for complex issues requiring immediate attention.

| Exchange | Email Support | Live Chat Support | Phone Support |

|---|---|---|---|

| Example Exchange A | Yes, typically 24-48 hour response time | Yes, available during business hours | No |

| Example Exchange B | Yes, response time varies | Yes, 24/7 availability | Yes, limited hours |

| Example Exchange C | Yes, response time often exceeds 72 hours | No | No |

| Example Exchange D | Yes, average response time 12-24 hours | Yes, with wait times varying depending on demand | No |

Note: The information provided in the table above is for illustrative purposes only and should not be considered definitive. Always check the specific support options offered by each exchange directly before making a decision. Response times are estimates and can fluctuate.

Importance of Responsive Customer Support

Imagine this: you’ve just made a significant cryptocurrency trade, and the funds haven’t arrived in your account. Panic sets in. A responsive and helpful customer support team can quickly alleviate this stress, investigate the issue, and provide updates, preventing unnecessary anxiety and potential financial loss. Conversely, slow or unresponsive support can lead to frustration, delays, and potentially even financial harm.

A reliable support system is an integral part of a trustworthy and user-friendly exchange.

Accessibility for Users with Disabilities

Inclusivity is key. Cryptocurrency exchanges should strive to provide accessible platforms and support for users with disabilities. This includes features such as screen reader compatibility, keyboard navigation, and clear and concise communication in various formats. Exchanges that prioritize accessibility demonstrate a commitment to inclusivity and a broader user base. While specific accessibility features vary between exchanges, checking for compliance with accessibility standards (like WCAG) is a good starting point for assessing a platform’s commitment to inclusivity.

Deposit and Withdrawal Methods

Getting your digital dough in and out of a crypto exchange is crucial, and thankfully, Canadian exchanges offer a variety of options, each with its own quirks and charms (or, let’s be honest, sometimes frustrations). Choosing the right method depends on your priorities – speed, fees, or the sheer thrill of using a specific payment platform. Let’s dive into the wild world of crypto deposits and withdrawals.Deposit and withdrawal methods vary significantly between Canadian cryptocurrency exchanges.

Understanding the nuances of each method is crucial for a smooth and cost-effective trading experience. Factors such as transaction times, fees, and security should all be considered when selecting your preferred method.

Bank Transfers

Bank transfers are a popular choice for their relatively low fees and security. However, they are notoriously slow, often taking several business days to complete. This can be a major drawback for traders who need quick access to their funds. The process typically involves providing your bank account details to the exchange, which then initiates a transfer.

Expect to wait, perhaps with a cup of coffee and a good book, because it’s a marathon, not a sprint. While security is generally high, delays and potential for human error (like entering the wrong account number) can be frustrating.

Credit and Debit Cards

Credit and debit cards offer a much faster deposit method, often instantaneous. However, they usually come with higher fees than bank transfers, sometimes significantly higher. Additionally, some exchanges may impose limits on the amount you can deposit using this method. Think of it as a fast lane with a hefty toll. The convenience is undeniable, but be prepared to pay for the privilege.

Keep in mind that some exchanges might temporarily hold funds from a credit card deposit to reduce the risk of fraud.

E-Wallets

E-wallets like Interac e-Transfer (popular in Canada), PayPal, or Skrill provide a middle ground between bank transfers and credit cards. They usually offer faster transaction times than bank transfers but with lower fees than credit cards. However, the availability of specific e-wallets varies between exchanges. Consider this a comfortable middle-class car—reliable, efficient, and not excessively expensive. But be sure your preferred e-wallet is supported by your chosen exchange before committing.

Comparison of Deposit and Withdrawal Methods Across Three Popular Canadian Exchanges

Choosing the right exchange often comes down to personal preference and your specific needs. Here’s a snapshot illustrating the variety of methods available: Note that these are examples and may change over time. Always verify the most up-to-date information directly with the exchange.

| Exchange | Deposit Methods | Withdrawal Methods |

|---|---|---|

| Example Exchange A | Bank Transfer, Interac e-Transfer, Credit/Debit Card | Bank Transfer, Interac e-Transfer |

| Example Exchange B | Bank Transfer, Credit/Debit Card, Crypto | Bank Transfer, Crypto |

| Example Exchange C | Interac e-Transfer, Crypto, Wire Transfer | Interac e-Transfer, Crypto, Wire Transfer |

Concluding Remarks

So, there you have it – your comprehensive guide to conquering the Canadian cryptocurrency exchange jungle. Remember, choosing the right exchange is a personal journey, dependent on your individual needs and risk tolerance. Don’t rush into anything; do your research, compare options, and remember that the best exchange for one person might be a disaster for another. Happy trading (and may your crypto always be green!).

Now go forth and boldly explore the exciting (and sometimes slightly terrifying) world of digital assets!