Mastering the ATS trading system for forex trading success isn’t about summoning magic money trees; it’s about taming the wild beast of the forex market with the precision of a seasoned robo-trader. This journey will equip you with the knowledge to build, deploy, and (crucially) profit from your own automated forex trading system. Prepare for a rollercoaster of algorithms, backtests, and the exhilarating (and sometimes terrifying) thrill of letting your code do the trading for you.

We’ll delve into the nitty-gritty of ATS design, exploring different system types, and guiding you through the process of choosing the perfect system for your trading style. We’ll cover setting up your ATS, backtesting strategies, implementing robust risk management, and even navigating the sometimes-treacherous waters of advanced techniques. By the end, you’ll be ready to unleash your inner coding ninja and conquer the forex world, one automated trade at a time.

(Disclaimer: Actual riches not guaranteed, but the thrill of the ride is!).

Understanding the ATS Trading System

So, you’re thinking about automating your forex trading? Smart move! Manually staring at charts all day is about as glamorous as watching paint dry (unless you’re into that sort of thing). An Automated Trading System (ATS) can be your ticket to a more relaxed, potentially more profitable, trading life. But before you dive headfirst into the world of algorithmic trading, let’s get a handle on what these systems are all about.

An ATS, in essence, is a computer program that executes trades based on pre-defined rules and algorithms. Think of it as your tireless, caffeine-fueled robot trader, working 24/7, tirelessly scanning the markets and executing trades according to your meticulously crafted strategy. It eliminates emotional trading, allowing you to stick to your plan even when the market throws a tantrum.

Core Components of an ATS, Mastering the ATS trading system for forex trading success

An effective ATS isn’t just a random collection of code; it’s a carefully constructed system with several key components. These include a strategy (the brain), a backtesting engine (the historian), an order management system (the executioner), and a risk management module (the safety net). The strategy defines the rules for entering and exiting trades, while backtesting helps evaluate its performance using historical data.

The order management system ensures smooth trade execution, and the risk management module sets limits to protect your capital from catastrophic losses. Think of it as a well-oiled machine, each part crucial to the overall function.

Types of ATS Systems and Their Functionalities

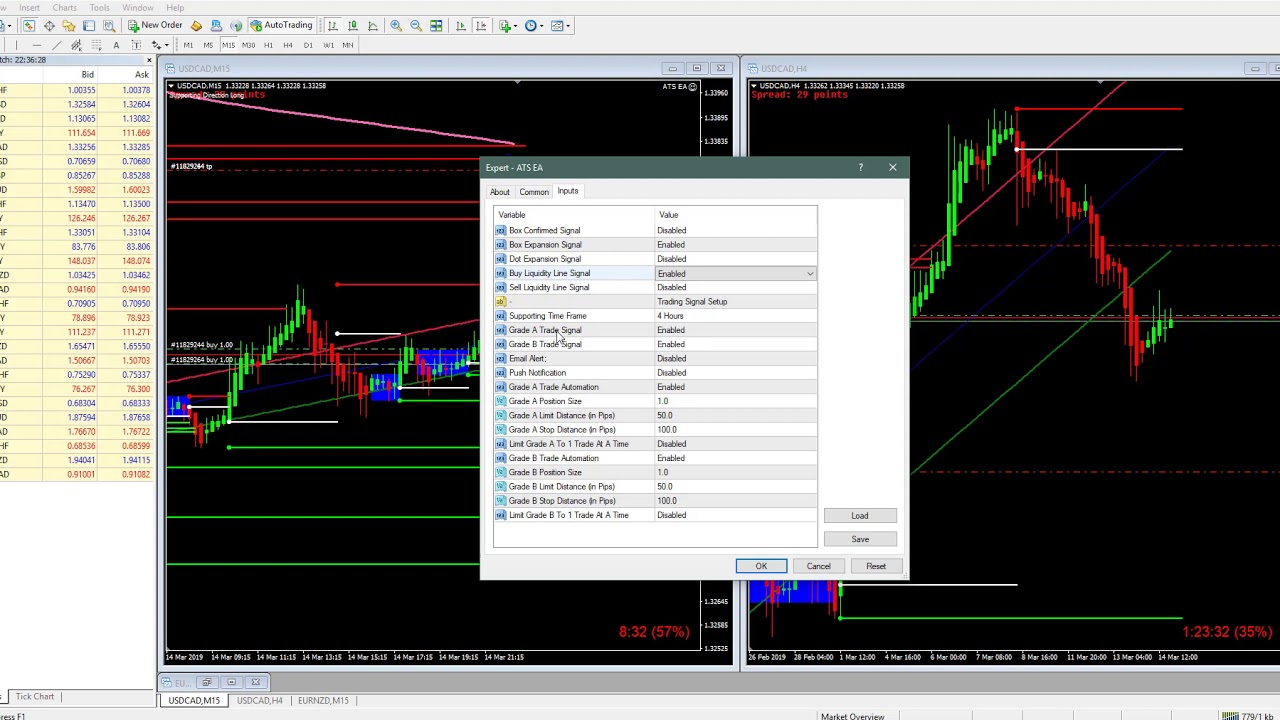

There’s no one-size-fits-all ATS. Systems vary widely in complexity and functionality, ranging from simple Expert Advisors (EAs) for MetaTrader platforms to sophisticated, custom-built systems incorporating machine learning and artificial intelligence. Simple EAs might use basic indicators like moving averages to generate trading signals, while more advanced systems might employ complex algorithms and predictive models. For example, a scalping system might execute trades within seconds, aiming for small profits, whereas a swing trading system might hold positions for days or even weeks.

Mastering the ATS trading system can unlock forex riches, but let’s be real, even seasoned traders started somewhere. If you’re feeling a bit lost, check out this Step-by-step guide for beginners on how to trade forex on Questrade to get your feet wet. Then, armed with the basics, you can conquer the complexities of ATS and become a forex ninja!

The choice depends entirely on your trading style and risk tolerance.

Advantages and Disadvantages of Using an ATS

The allure of an ATS is undeniable: automation, consistency, and the ability to trade multiple markets simultaneously. However, it’s not all sunshine and rainbows. Advantages include 24/7 market monitoring, elimination of emotional biases, and the ability to backtest strategies rigorously. Disadvantages include the potential for significant losses due to unforeseen market events or coding errors, the need for technical expertise to develop or manage the system, and the ongoing costs of maintenance and updates.

Essentially, it’s a powerful tool, but it requires careful management and understanding.

Mastering the ATS trading system is like unlocking the secrets of forex fortune, but choosing the right broker is crucial! Before you dive in headfirst, check out this insightful comparison: Comparing Questrade’s forex offerings with other Canadian brokers , to ensure your platform’s up to snuff. Then, and only then, can you confidently conquer the ATS and its forex riches!

Selecting an Appropriate ATS

Choosing the right ATS is a crucial step. Begin by clearly defining your trading style (scalping, day trading, swing trading, etc.) and your experience level. Beginners might opt for pre-built EAs with clear documentation and support, while experienced traders might prefer to develop their own systems or customize existing ones. Thoroughly backtest any system before live trading, using a range of historical data to assess its performance under different market conditions.

Consider factors like transaction costs, slippage, and the system’s robustness against unexpected market events. Remember, due diligence is key to success. Think of it like choosing a car – you wouldn’t buy a sports car if you only needed a family sedan.

Developing and Implementing Trading Strategies

Designing effective trading strategies for an Automated Trading System (ATS) is like crafting a finely tuned Swiss watch – each component must work in perfect harmony to achieve precision and profitability. The key is to create strategies that exploit market inefficiencies while managing risk effectively. Remember, even the best-designed watch needs regular maintenance and adjustments!

Three ATS Trading Strategies

We’ll explore three distinct trading strategies, each with its unique approach to entry, exit, and risk management. These strategies aren’t a guaranteed path to riches (if only!), but they offer a framework for developing your own ATS strategies. Remember to backtest rigorously before deploying any strategy with real money – losing your virtual fortune is far less painful than losing your real one!

| Strategy Name | Entry Rules | Exit Rules | Risk Management Parameters |

|---|---|---|---|

| Mean Reversion Scalper | Enter long when price crosses below a 20-period moving average and short when it crosses above. Confirm with a bullish/bearish candlestick pattern. | Exit long when price crosses above a 5-period moving average or a trailing stop-loss is hit. Exit short when price crosses below a 5-period moving average or a trailing stop-loss is hit. | Risk no more than 1% of your account balance per trade. Use a tight stop-loss order (e.g., 10 pips). |

| Trend Following Breakout | Enter long when price breaks above a defined resistance level with high volume confirmation. Enter short when price breaks below a defined support level with high volume confirmation. | Exit long when price breaks below a support level or a trailing stop-loss is hit. Exit short when price breaks above a resistance level or a trailing stop-loss is hit. | Risk no more than 0.5% of your account balance per trade. Use a wider stop-loss order (e.g., 20-30 pips) based on volatility. |

| News-Based Momentum | Enter long immediately after significant positive news impacting the currency pair, aiming to capture the initial price surge. Enter short immediately after significant negative news, anticipating a price drop. | Exit long when the price retraces a predetermined percentage (e.g., 2%) from the entry point or after a specified time frame. Exit short using a similar approach. | Risk no more than 1.5% of your account balance per trade, given the higher volatility associated with news events. Use a wider stop-loss, adjusted based on historical volatility around similar news events. |

Market Condition Impact

The performance of each strategy is heavily influenced by prevailing market conditions. The Mean Reversion Scalper thrives in range-bound markets, where prices oscillate around a central point. The Trend Following Breakout strategy excels in trending markets, capitalizing on sustained price movements. The News-Based Momentum strategy, as its name suggests, is most effective around high-impact news releases. In volatile markets, all strategies may require adjustments to stop-loss levels.

Strategy Limitations and Modifications

Each strategy has inherent limitations. The Mean Reversion Scalper can struggle in strong trends, leading to frequent losses. Adding a filter to identify the trend direction before entering trades could mitigate this. The Trend Following Breakout strategy might generate false signals in choppy markets, so incorporating volume confirmation is crucial. The News-Based Momentum strategy is highly dependent on accurate news interpretation and rapid execution; false news or delayed execution can lead to losses.

To improve robustness, we could integrate sentiment analysis to refine entry signals and use more sophisticated risk management techniques, such as position sizing algorithms.

Monitoring and Optimizing Your ATS: Mastering The ATS Trading System For Forex Trading Success

So, you’ve built your amazing Automated Trading System (ATS). Congratulations! But building it is only half the battle. Think of it like baking a cake – you can have the best recipe, but if you don’t monitor the oven temperature and adjust accordingly, you’ll end up with a brick, not a delicious dessert. Monitoring your ATS is crucial for long-term success and preventing disastrous (and potentially expensive) surprises.

Mastering the ATS trading system for forex trading success isn’t just about charts and indicators; it’s about strategy and discipline. Need a break from the market’s rollercoaster? Check out the latest football news for a dose of exhilarating (and hopefully less volatile) action. Then, refocus on your forex game, remembering consistent application of the ATS system is key to long-term profits.

We’re talking about keeping your forex trading dreams alive, not turning them into a financial nightmare.Regularly reviewing your ATS’s performance is not just a good idea; it’s essential for survival in the cutthroat world of forex. This isn’t about passively watching the numbers; it’s about actively engaging with your system, understanding its strengths and weaknesses, and adapting to the ever-shifting sands of the market.

Think of it as a constant feedback loop – your ATS tells you how it’s performing, you analyze that information, and then you make adjustments to improve its performance.

Performance Metrics Tracking

Tracking key performance indicators (KPIs) is the bedrock of ATS optimization. This involves diligently recording various metrics for each trade and aggregating them over time. Imagine a spreadsheet (or a fancy database!) meticulously recording win rate, average win/loss, maximum drawdown, Sharpe ratio, and other relevant metrics. These numbers paint a clear picture of your ATS’s health and efficiency.

Mastering the ATS trading system for forex success isn’t just about charts and indicators; it’s about speed! Your execution needs to be lightning-fast to capitalize on those fleeting opportunities, which is why choosing the right app is crucial. That’s where a killer app like the one reviewed here Best day trading app for quick execution speed and low latency.

comes in handy. With blazing-fast execution, your ATS mastery will truly shine, turning those theoretical profits into real-world gains!

For example, a consistently low win rate might indicate a flaw in your entry or exit strategies, while a high maximum drawdown suggests a need for more robust risk management. Analyzing these trends allows for targeted improvements and minimizes potential losses.

Identifying and Resolving Common Issues

Let’s face it: bugs happen. Even the most meticulously crafted ATS can encounter problems. One common issue is slippage – the difference between the expected price and the actual execution price. High slippage can significantly impact profitability. Solutions might involve using limit orders instead of market orders, or choosing a broker with tighter spreads.

Another common problem is over-optimization. This occurs when you tweak your strategies too much based on historical data, leading to poor performance in live trading. The solution? Employ robust out-of-sample testing and focus on strategies with solid theoretical foundations, rather than chasing past performance.

Adapting Strategies to Market Changes

The forex market is a dynamic beast, constantly evolving and throwing curveballs. What worked wonders last month might be a complete flop this month. Therefore, regular updates to your ATS strategies are not optional; they’re mandatory. For example, if a particular currency pair consistently underperforms, you might need to adjust your trading parameters or even remove it from your strategy altogether.

Analyzing market trends, news events, and economic indicators is crucial for proactively adapting your ATS. Consider using moving averages to detect shifts in market momentum, or incorporating sentiment analysis to gauge market mood.

Mastering the ATS trading system is key to forex riches, but let’s be real, nobody wants to accidentally trade away their profits in fees! Before you conquer the forex world, check out this Detailed guide on Questrade’s forex trading commissions and fees to make sure you’re not leaving money on the table. Then, armed with this knowledge, you can truly focus on dominating the ATS and making your forex dreams a reality!

Maintaining Accurate Trade Records

Accurate record-keeping is paramount. Imagine trying to diagnose a medical condition without proper patient records – it’s impossible! Similarly, you can’t effectively optimize your ATS without meticulously documenting every trade. This includes the entry and exit prices, the profit or loss, the timeframe, and any relevant notes. Using a dedicated trading journal or software will streamline this process.

This data will form the foundation for your performance analysis, allowing you to identify patterns, pinpoint weaknesses, and make data-driven decisions to improve your ATS’s efficiency and profitability. Think of it as your ATS’s personal diary – full of valuable insights and lessons learned.

Risk Management and Money Management

Conquering the forex market with your automated trading system (ATS) isn’t just about hitting the “go” button and watching the profits roll in (though that’s certainly a nice dream!). It’s about navigating the choppy waters of risk and managing your money wisely. Think of it as piloting a spaceship – you need a solid plan, precise controls, and a healthy dose of caution to avoid asteroid collisions (aka, devastating losses).This section details how to design a robust risk management plan tailored specifically for your ATS, explore effective money management techniques, and understand the critical role of emotional detachment in automated trading.

Remember, even the most sophisticated ATS needs a human brain at the helm to make smart decisions.

Mastering the ATS trading system can be your ticket to forex fortune, but beware of those sneaky forex sharks! Before you dive in headfirst, make sure you understand how to avoid getting swindled; check out this guide on How to avoid forex scams and recover losses from fraudulent activities to protect your hard-earned cash. Then, armed with knowledge and a trusty ATS, you’ll be swimming in profits (responsibly, of course!).

Risk Management Plan for Automated Forex Trading

A comprehensive risk management plan for your ATS should be a multi-layered defense against unforeseen market fluctuations. It’s not about avoiding risk entirely – that’s impossible – but about minimizing its impact. Key components include setting hard stop-loss orders on every trade, diversifying your trading strategies across different currency pairs to avoid over-reliance on any single market, and regularly monitoring your system’s performance for signs of weakness.

Regular backtesting and forward testing of your ATS with various market conditions is also crucial to ensure robustness. Consider incorporating a risk-reward ratio to ensure that potential profits outweigh potential losses. For example, aiming for a 2:1 risk-reward ratio (potentially earning twice as much as you risk) is a common strategy.

Money Management Techniques for ATS Trading

Effective money management is the bedrock of long-term success in forex trading, particularly when using an ATS. Position sizing, which determines how much capital to allocate to each trade, is paramount. Never risk more than a small percentage (e.g., 1-2%) of your total trading capital on any single trade. This strategy protects you from catastrophic losses if a trade goes south.

Stop-loss orders, automatically triggered when a trade reaches a predetermined loss level, are essential for limiting potential damage. They are your automated safety net. Additionally, consider using trailing stop-loss orders, which adjust automatically as the trade moves in your favor, to lock in profits while reducing the risk of sudden reversals.

Leverage and its Impact on Profits and Losses

Imagine leverage as a magnifying glass for your trading results. It amplifies both profits and losses. Let’s say you have $1000 in your trading account and use 1:100 leverage. A 1% increase in the value of your traded currency would result in a $100 profit (100 x $10). However, a 1% decrease would result in a $100 loss.

If you increase your leverage to 1:500, a 1% increase yields a $500 profit, but a 1% decrease results in a $500 loss. This illustrates the double-edged sword of leverage: it can accelerate gains but also magnify losses dramatically. The visual representation would be two bar graphs, one showing significantly larger gains and losses with higher leverage compared to lower leverage.

Emotional Detachment and Discipline in Automated Trading

While your ATS handles the technical aspects of trading, your role is crucial in maintaining emotional detachment and discipline. The allure of constantly monitoring your trades and second-guessing your system’s decisions can be tempting, but it’s counterproductive. Let your ATS do its job. Avoid making impulsive decisions based on fear or greed. Stick to your predetermined risk management plan and trust the system you’ve developed.

Regularly review your trading journal, noting both successes and failures to identify areas for improvement, without letting emotions cloud your judgment. This is where the human element becomes critical, ensuring you maintain a rational approach despite market volatility.

Advanced Techniques and Considerations

So, you’ve built your amazing Automated Trading System (ATS). Congratulations! You’re practically swimming in pips, right? Well, maybe not yet. This section delves into the more nuanced aspects of ATS mastery, moving beyond the basics and into the realm of true algorithmic wizardry. We’ll explore how to supercharge your system’s performance and navigate the trickier aspects of automated forex trading.

Think of it as upgrading from a bicycle to a rocket-powered unicycle – exhilarating, potentially terrifying, and definitely more efficient.The performance of any ATS hinges on a delicate dance between clever algorithms and insightful indicators. Choosing the right tools and implementing them effectively can mean the difference between consistent profits and a swift descent into the red. This is where the art truly meets the science.

Indicator and Algorithm Enhancement

The effectiveness of an ATS can be significantly boosted by strategically integrating various indicators and algorithms. For example, incorporating a moving average crossover strategy alongside a Relative Strength Index (RSI) can provide a more robust signal generation mechanism, reducing false signals and improving overall accuracy. Sophisticated algorithms, such as genetic algorithms or machine learning models, can be used to optimize trading parameters, dynamically adapt to market changes, and discover profitable trading patterns that might be missed by human traders.

These algorithms can backtest different strategies and parameters to find optimal settings, improving both profitability and risk management. Imagine a tireless, highly analytical robot working 24/7 to perfect your strategy – that’s the power of advanced algorithms.

Order Type Comparison and Suitability

Different order types are better suited to different trading strategies and market conditions. Market orders execute immediately at the best available price, offering speed but potentially incurring slippage. Limit orders, on the other hand, allow you to set a specific price at which you want to buy or sell, mitigating slippage risk but potentially missing out on opportunities if the price doesn’t reach your target.

Stop orders are useful for protecting profits or limiting losses, automatically triggering a trade when the price reaches a predetermined level. Stop-limit orders combine the features of stop and limit orders, offering both price control and risk management. The choice of order type is crucial in automated trading and needs careful consideration based on the specific trading strategy and risk tolerance.

For example, scalpers might favor market orders for speed, while swing traders might prefer limit orders to ensure they enter at a desired price.

Technical Analysis in ATS Strategy Development

Technical analysis plays a pivotal role in developing and refining ATS strategies. By identifying trends, support and resistance levels, and chart patterns, traders can create rules-based systems that capitalize on recurring market behaviors. For example, an ATS could be programmed to automatically enter a long position when the price breaks above a key resistance level, supported by bullish candlestick patterns and positive momentum indicators.

Conversely, it might automatically exit a position if a predetermined stop-loss level is breached. The integration of technical analysis enhances the decision-making process of the ATS, leading to more informed and potentially profitable trades. This allows the ATS to adapt to dynamic market conditions and make more accurate predictions, resulting in improved trading performance.

Challenges and Limitations of ATS

While ATS offers numerous advantages, it’s crucial to acknowledge potential challenges. Slippage, the difference between the expected price and the actual execution price, is a common issue, especially during periods of high volatility or low liquidity. Latency, the delay between the time a trade signal is generated and the time the order is executed, can also impact profitability. Network connectivity issues, software bugs, and unexpected market events can further complicate automated trading.

For instance, a sudden news event causing a large price gap might trigger an unexpected loss, highlighting the need for robust risk management strategies within the ATS. Careful consideration of these factors is vital for successfully implementing and managing an ATS.

Ending Remarks

So, you’ve conquered the complexities of automated forex trading! You’ve learned to build, optimize, and monitor your own ATS, mastering the art of letting your code do the heavy lifting. Remember, while an ATS can significantly enhance your trading game, it’s not a get-rich-quick scheme. Consistent monitoring, meticulous risk management, and a dash of healthy skepticism are your secret weapons to long-term success.

Now go forth and unleash your automated trading empire – may your profits be plentiful and your losses…minimal!