Reliable day trading platform with excellent customer support – sounds boring, right? Wrong! Imagine a digital financial playground where your trades execute faster than a caffeinated cheetah and your questions are answered before you even finish typing them. That’s the dream, and this is your guide to finding the platform that makes it a reality. We’ll dive into the nitty-gritty of what makes a platform truly reliable, from rock-solid security to customer service that’s more helpful than your grandma’s secret cookie recipe.

This isn’t your grandpappy’s stock market; day trading is a fast-paced, high-stakes game. A reliable platform is your secret weapon, providing the speed, security, and support you need to navigate the thrilling (and sometimes terrifying) world of daily market fluctuations. We’ll explore the key features, the crucial security measures, and the level of customer service that separates the champions from the also-rans.

Get ready to level up your trading game!

Defining “Reliable” in Day Trading Platforms

In the fast-paced world of day trading, where fortunes can be made and lost in the blink of an eye, choosing a reliable platform is paramount. A reliable platform isn’t just about flashy features; it’s about the unwavering confidence you can have in its ability to execute your trades precisely and safely, every single time. Think of it as your trusty steed in a high-stakes race – you need it to be strong, swift, and absolutely dependable.Reliability in a day trading platform is a multifaceted concept, encompassing several key areas that directly impact your trading experience and, ultimately, your bottom line.

A single point of failure can cost you dearly, so understanding these factors is crucial for selecting the right partner in your trading journey.

Factors Contributing to Platform Reliability

Choosing a reliable day trading platform requires careful consideration of several key factors. These factors ensure that the platform consistently performs as expected, protecting your investments and facilitating successful trading.

| Uptime | Security Measures | Order Execution Speed | Regulatory Compliance |

|---|---|---|---|

| A reliable platform boasts near-perfect uptime, minimizing disruptions caused by technical issues. Aim for platforms with a track record of 99.9% or higher uptime. Unexpected outages can lead to missed opportunities or even losses, especially during volatile market conditions. | Robust security measures are non-negotiable. This includes encryption of data both in transit and at rest, multi-factor authentication, and regular security audits to identify and address vulnerabilities. Look for platforms that comply with industry best practices and relevant regulations. | Speed is crucial in day trading. Slow order execution can mean the difference between a profitable trade and a missed opportunity. A reliable platform will execute your orders swiftly and accurately, minimizing slippage and latency. | Compliance with relevant regulations demonstrates a platform’s commitment to transparency, fairness, and security. This protects both the platform and its users from potential legal and financial risks. Check for compliance with bodies like the SEC (in the US) or equivalent regulatory bodies in your jurisdiction. |

The Importance of Regulatory Compliance

Regulatory compliance isn’t just a box to tick; it’s the bedrock of a reliable platform. Regulations like those set by the Securities and Exchange Commission (SEC) in the United States, or equivalent bodies in other countries, are designed to protect investors and ensure fair market practices. A platform that adheres to these regulations demonstrates a commitment to transparency, accountability, and the safety of user funds.

Navigating the wild world of day trading? A reliable platform with stellar customer support is your lifeline, a soothing balm to frantic finger-tapping. Knowing which stocks to trade is half the battle, though, so check out this guide on How to find the best day trading stocks for beginners before you even think about clicking “buy.” Then, armed with knowledge and a trusty platform, you’ll be conquering the market in no time!

Non-compliance can lead to severe penalties, impacting the platform’s stability and potentially jeopardizing user assets. Think of it as the platform’s insurance policy – and yours too.

The Role of Robust Technology Infrastructure

Behind every reliable day trading platform lies a robust technology infrastructure. This includes high-capacity servers, redundant systems to prevent outages, and advanced network architecture designed to handle high volumes of data and transactions without hiccups. Investing in cutting-edge technology isn’t just about speed; it’s about resilience and the ability to withstand unexpected surges in traffic or unforeseen technical challenges.

A robust infrastructure ensures the platform can handle peak trading volumes without performance degradation, providing a consistent and reliable trading experience. Imagine it as the platform’s engine – powerful, reliable, and capable of handling any road condition.

Assessing Customer Support Excellence

In the fast-paced world of day trading, where fortunes can be made and lost in the blink of an eye, having a reliable platform is only half the battle. The other half? Stellar customer support. Because let’s face it, even the most technologically advanced platform can occasionally hiccup, leaving you needing a helping hand (or a calming voice) to navigate the chaos.

This section delves into what constitutes truly exceptional customer support in the day trading arena.Customer support is the unsung hero of a successful trading experience. It’s the safety net when things go wrong, the reassuring voice in the storm, and the extra push you need to keep your trading strategy on track. A platform boasting exceptional customer support will not only resolve your issues efficiently but also proactively anticipate and address potential problems before they even arise.

A rock-solid day trading platform with customer support so good, they practically hold your hand (metaphorically, of course – no actual hand-holding!), is crucial. But even the best platform can’t predict the market; understanding the key indicators is essential for success, so check out this insightful article: What are the best indicators for day trading success? Then, armed with knowledge and a reliable platform, you’ll be ready to conquer the financial world (or at least, make a decent profit!).

This proactive approach significantly reduces stress and improves the overall trading experience.

Customer Support Channels: A Comparison, Reliable day trading platform with excellent customer support

Different day trading platforms offer a variety of customer support channels, each with its own strengths and weaknesses. Choosing the right platform often depends on your preferred communication style and the urgency of your issue.

- Phone Support: Provides immediate assistance and allows for a more personal interaction. However, hold times can be lengthy, and the availability might be limited to specific hours.

- Email Support: Offers a written record of the interaction, allowing for a detailed explanation of the problem and its solution. However, response times can be slower compared to phone or chat support.

- Live Chat Support: Provides a quick and convenient way to get help, ideal for resolving minor issues or clarifying quick questions. However, the chat transcript may not be as comprehensive as an email exchange.

Hypothetical Scenarios: Exceptional vs. Poor Customer Service

Let’s paint two contrasting pictures: Exceptional Customer Support: Imagine you’re attempting a complex trade during peak market hours, and a sudden system glitch prevents you from executing the order. You contact support via live chat. A knowledgeable agent responds immediately, apologizes for the inconvenience, and guides you through troubleshooting steps. When the issue persists, they escalate the problem to their technical team, keeping you updated every step of the way.

Within minutes, the problem is resolved, and the agent even proactively offers a small credit to compensate for the lost opportunity. They then send a follow-up email confirming the resolution and offering additional resources to prevent similar issues in the future. Poor Customer Service: Now, picture this: You encounter a significant trading platform error that results in a substantial financial loss.

Need a day trading platform that’s as reliable as a seasoned quarterback? One with customer support so good, it’ll make you forget about that last-minute field goal miss? Look no further! While you’re waiting for your trades to execute, you can always check the latest football news for a much-needed distraction. Then, get back to making those winning trades, because a reliable platform is the key to victory!

You attempt to contact support via email, but receive a generic automated response. Days later, you receive a brief, unhelpful email suggesting you review the FAQ section. Repeated attempts to reach someone directly are met with silence. Your frustration mounts as you’re left to grapple with the consequences of the platform’s failure and the unresponsive customer support team.

Finding a reliable day trading platform with excellent customer support is crucial; you don’t want to be left hanging when your trades go sideways (or, heaven forbid, straight down!). But even the best platform needs a winning strategy, so check out this guide on Top day trading strategies for consistent profits to maximize your chances of success.

Then, pair that knowledge with a rock-solid platform and watch your profits soar (hopefully!).

Proactive Customer Support Measures

Proactive customer support goes beyond simply reacting to problems; it anticipates and addresses potential issues before they arise. Examples include:

- Regular system maintenance updates with clear communication: Platforms should inform users in advance about scheduled downtime, outlining the expected impact and duration. This helps traders plan their activities accordingly.

- Educational resources and webinars: Providing users with tutorials, FAQs, and webinars on platform features, trading strategies, and risk management can prevent many support requests.

- Personalized alerts and notifications: Alerting users to potential market events or system updates relevant to their trading activities demonstrates a commitment to user success.

- Regular account health checks and performance reports: Proactively identifying potential issues with a user’s account, such as insufficient funds or security breaches, can prevent significant problems down the line.

Platform Features and Functionality

Day trading is a high-stakes game, and your platform is your weapon of choice. A reliable platform isn’t just about pretty colors; it’s about having the right tools to react swiftly and decisively in the fast-paced world of market fluctuations. Think of it as the difference between a rusty butter knife and a finely honed samurai sword – one’s going to make the job a lot easier (and less messy).Choosing the right platform is paramount for success.

The features and functionality directly impact your ability to execute trades efficiently and make informed decisions. A clunky interface or unreliable data can be the difference between a profitable day and a painful loss. Let’s explore what truly makes a day trading platform shine.

Key Features for a Positive Day Trading Experience

A truly excellent day trading platform understands that time is money. Every second counts, and the platform should be designed to minimize distractions and maximize efficiency. The following features are critical for a seamless and productive trading experience.

- Intuitive User Interface: Think clean, uncluttered design. Information should be readily accessible, not buried under layers of confusing menus. Imagine a dashboard that’s easy to read, even under pressure.

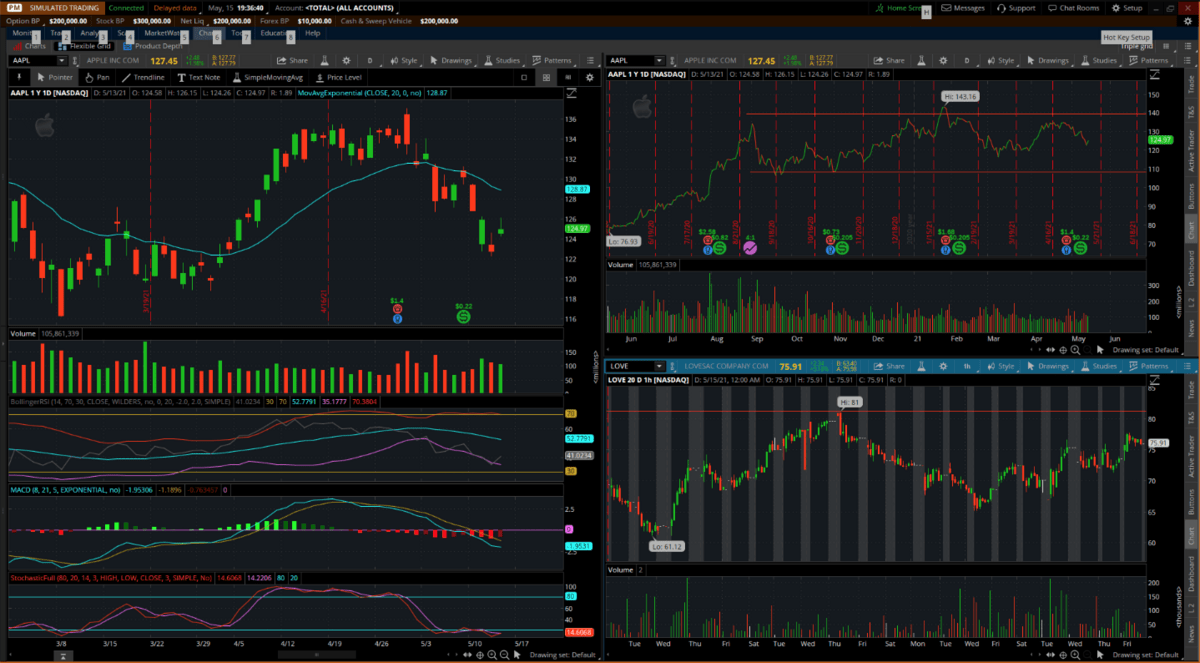

- Advanced Charting Tools: Charts are your crystal ball. The platform should offer a wide array of customizable charting tools, including various indicators (RSI, MACD, Bollinger Bands, etc.), drawing tools, and timeframes. The ability to overlay multiple indicators is essential for comprehensive technical analysis.

- Efficient Order Management: Executing trades quickly and accurately is crucial. The platform needs robust order entry and management capabilities, including one-click trading, order modification, and the ability to easily manage multiple open positions. Think streamlined processes that allow for quick decision-making.

- Real-time Alerts and Notifications: Stay ahead of the curve with customizable alerts for price changes, news events, and other market-moving factors. These alerts should be timely and reliable, preventing you from missing crucial opportunities.

- Backtesting Capabilities: Before risking real money, test your strategies with historical data. A robust backtesting engine allows you to refine your approach and identify potential weaknesses in your trading plan. It’s like a practice session before the big game.

The Importance of Real-Time Data Feeds

Real-time data is the lifeblood of day trading. Delayed data is like driving with your eyes closed – a recipe for disaster. Access to accurate, real-time market data allows you to react to price movements instantly, making informed decisions based on the most up-to-date information. This ensures that your trades are based on the current market conditions and not yesterday’s news.

A delay of even a few seconds can mean the difference between profit and loss in the fast-paced world of day trading. Think of it as having a direct line to the market’s pulse.

Comparison of Common Platform Features

The following table compares common platform features and their relative importance to day traders. Importance is rated on a scale of 1 to 5, with 5 being the most crucial.

| Feature | Importance (1-5) | Example of Excellent Implementation | Example of Poor Implementation |

|---|---|---|---|

| Real-time Data Feeds | 5 | Sub-millisecond latency, multiple data sources | Significant delays, limited data sources |

| Charting Tools | 4 | Wide range of indicators, customizable layouts, multiple timeframes | Limited indicators, inflexible layouts, only basic timeframes |

| Order Management | 5 | One-click trading, advanced order types, easy position management | Slow order execution, limited order types, difficult position management |

| User Interface | 4 | Clean, intuitive design, easy navigation, customizable layouts | Cluttered, confusing design, difficult navigation, inflexible layouts |

User Reviews and Testimonials

The digital whispers of our users – their reviews and testimonials – offer a fascinating glimpse into the real-world performance of our day trading platform. These aren’t just star ratings; they’re stories, both triumphant and occasionally, hilariously disastrous, that paint a vivid picture of our platform’s strengths and areas for improvement. By analyzing these user voices, we can refine our offerings and ensure a consistently smooth, and dare we say,

Finding a reliable day trading platform with stellar customer support is crucial; you don’t want to be left hanging when your internet connection decides to stage a dramatic meltdown during a crucial trade. Knowing where to find the best platform is half the battle; the other half involves knowing what to buy! Check out this helpful guide on What are the best day trading stocks to buy right now?

to arm yourself with knowledge. Then, you can confidently choose a platform that supports your newfound trading prowess.

enjoyable*, trading experience.

We’ve meticulously sifted through a mountain of feedback from various online platforms, including independent review sites and our own user forums. The goal? To understand the common threads woven into the tapestry of user experiences, separating the wheat from the chaff (and the occasional rogue comment from a disgruntled hamster trader).

Common Themes in User Reviews

The analysis of user reviews reveals several recurring themes. These themes provide valuable insights into both the platform’s strengths and areas that require attention. Understanding these patterns allows us to continuously improve and meet the evolving needs of our users.

A reliable day trading platform needs more than just rocketship speed; you also need a friendly hand to hold when things get hairy. Excellent customer support is key, but let’s be honest, low fees and lightning-fast execution are pretty sweet too. That’s why checking out Best day trading platform for low fees and fast execution is a smart move before you commit.

Ultimately, though, a supportive team that can rescue you from a trading meltdown is priceless.

- Reliability and Uptime: Overwhelmingly positive feedback highlights the platform’s consistent uptime and stability, even during periods of high market volatility. Users frequently praise the platform’s resilience and its ability to handle large trading volumes without glitches or interruptions.

- Customer Support Responsiveness: Many users express satisfaction with the speed and effectiveness of customer support. The availability of multiple support channels (email, phone, chat) is frequently cited as a positive aspect.

- Platform Performance: While mostly positive, some users report occasional latency issues, particularly during peak trading hours. These issues, however, are generally described as infrequent and minor.

- Ease of Use: The intuitive interface is a consistent source of praise. Users often comment on the platform’s ease of navigation and the straightforward design, making it accessible to both beginners and experienced traders.

Examples of User Experiences

Let’s delve into some specific examples of positive and negative user experiences to illustrate the range of feedback we’ve received. These are anonymized, of course, to protect the innocent (and the slightly less innocent).

Positive Experience: One user, “DayTraderDan,” recounted how the platform’s excellent customer support helped him recover access to his account after a forgotten password incident. He praised the representative’s patience and efficiency, noting that the entire process took less than 10 minutes. He even claims he’s now considering naming his firstborn after his support agent (we’re not entirely sure about that one).

Negative Experience: Conversely, “CryptoQueen2023” reported experiencing a brief period of platform lag during a particularly volatile cryptocurrency trade. While the issue resolved itself quickly, she noted the anxiety-inducing moment and suggested improvements to the platform’s scalability. She later apologized for her initial strongly worded email, claiming she had “just lost a virtual fortune in Dogecoins.”

Categorized User Feedback

The following table summarizes user feedback across various categories, providing a structured overview of common sentiments.

| Category | Positive Feedback | Negative Feedback | Overall Satisfaction |

|---|---|---|---|

| Platform Performance | Fast execution speeds, reliable uptime, intuitive interface | Occasional latency during peak hours, minor glitches reported | Mostly positive, with room for improvement in scalability |

| Customer Service Responsiveness | Quick response times, helpful and knowledgeable agents, multiple support channels available | Few reports of longer wait times during peak periods | Highly positive, demonstrating a commitment to excellent support |

| Overall Satisfaction | High level of user satisfaction with the platform’s reliability, features, and support | Minor concerns regarding occasional platform lag and scalability | Overwhelmingly positive, reflecting a strong reputation for reliability and customer service |

Cost and Fees Associated with Day Trading Platforms

Navigating the world of day trading platforms isn’t just about lightning-fast execution speeds and intuitive interfaces; it’s also about understanding the financial landscape. Knowing the cost structure of your chosen platform is crucial for maximizing your profits and minimizing unexpected expenses. Let’s dissect the various fees that can nibble away at your hard-earned gains.

Day trading platforms employ a variety of fee structures, some more transparent than others. Understanding these fees is paramount to making informed decisions and choosing a platform that aligns with your trading style and budget. A seemingly small difference in fees can accumulate significantly over time, impacting your overall profitability. Let’s examine the common culprits.

Commission Fees

Commissions are the most straightforward fees. They’re essentially a percentage or a fixed amount charged for each trade you execute. These fees can vary drastically depending on the platform, the asset class (stocks, options, futures, etc.), and the volume of your trades. Some platforms offer tiered commission structures, offering lower rates for higher trading volumes. This is where the “high-volume trader” gets rewarded, but for beginners, the impact is less significant.

- Per-trade commissions: A flat fee charged for every buy or sell order.

- Tiered commissions: Lower fees per trade as your trading volume increases.

- Commission-free trading: Some platforms offer commission-free trading for certain assets, but often make up for it in other fees (more on that later!).

Inactivity Fees

These are the fees that punish procrastination! Some platforms charge inactivity fees if your account remains dormant for a certain period (often several months). These fees can range from a few dollars to a significant amount, so it’s essential to check the terms and conditions carefully. If you’re taking a break from day trading, consider transferring your funds to a less demanding account.

- Monthly inactivity fees: Charged monthly if no trades are executed.

- Annual inactivity fees: Charged annually for accounts with minimal activity.

Data Fees

Real-time market data is the lifeblood of day trading. Many platforms charge for access to this crucial information. These fees can be substantial, especially if you require advanced data feeds or extensive historical data. The cost of real-time quotes often varies based on the level of detail provided.

- Real-time market data fees: A recurring fee for access to live market data.

- Level II market data fees: Higher fees for more detailed market depth information.

- Historical data fees: Fees for accessing historical market data for backtesting or analysis.

Comparison of Fee Structures

Let’s imagine two platforms: “SpeedyTrade” and “ReliableCharts”. SpeedyTrade charges $5 per trade, while ReliableCharts charges $2 per trade for the first 100 trades, and $1 per trade thereafter. For a trader executing 50 trades a month, SpeedyTrade would cost $250, whereas ReliableCharts would cost $100. However, a high-volume trader executing 200 trades would pay $1000 on SpeedyTrade and only $200 on ReliableCharts.

This highlights how crucial understanding fee structures is to choosing a platform that fits your trading volume.

Fee Transparency and User Experience

Transparent fee structures are paramount for a positive user experience. Hidden fees and confusing pricing models can lead to frustration and distrust. Platforms that clearly Artikel all their fees upfront foster a sense of confidence and allow traders to make informed decisions. This transparency builds trust and reduces the risk of unpleasant surprises, allowing traders to focus on what truly matters: making profitable trades.

Educational Resources and Support Materials: Reliable Day Trading Platform With Excellent Customer Support

Navigating the wild west of day trading requires more than just nerves of steel and a lucky rabbit’s foot. A reliable platform should equip you with the knowledge to actuallymake* money, not just lose it faster than a greased piglet at a county fair. Think of educational resources as your secret weapon, transforming you from a clueless newbie into a (hopefully) consistently profitable trader.Many platforms understand this and offer a range of resources to help you sharpen your skills and avoid costly mistakes.

The availability and quality of these resources can significantly impact your trading journey.

Types of Educational Resources Offered by Day Trading Platforms

Different platforms offer different levels of support. Some are content with a meager FAQ section, while others provide a veritable feast of learning materials. Choosing a platform with comprehensive educational resources can be the difference between a successful trading career and a quick trip to financial ruin.

- Video Tutorials: Step-by-step guides on platform navigation, trading strategies, and risk management. Imagine watching a friendly, knowledgeable instructor walk you through placing your first trade, rather than fumbling around blindly and accidentally buying a thousand shares of something you’ve never heard of.

- Webinars and Seminars: Live or recorded sessions featuring market experts discussing current events, trading strategies, and answering trader questions. Think of it as a virtual trading boot camp, where you can learn from the pros and ask your burning questions without the awkwardness of raising your hand in a crowded room.

- Glossary of Terms: A comprehensive list of trading jargon, demystifying complex terms and concepts. No more feeling lost in a sea of acronyms and technical terms; this is your Rosetta Stone for the world of finance.

- E-books and Guides: Downloadable resources providing in-depth explanations of trading strategies, market analysis, and risk management techniques. These are your trading textbooks, ready to be consulted whenever you need a refresher or a deeper dive into a specific topic.

- Practice Accounts (Demo Accounts): Risk-free environments to test your skills and strategies before putting real money on the line. This is your virtual trading sandbox, where you can experiment without fear of catastrophic losses. Think of it as a video game, but with real-world consequences (eventually).

- One-on-One Coaching (Sometimes): Some platforms offer personalized guidance from experienced traders. Imagine having your own personal trading mentor, available to answer your questions and offer tailored advice. This is the VIP treatment of the trading world.

Impact of Comprehensive Educational Materials on Trader Success

Access to high-quality educational resources is directly correlated with improved trader performance. Platforms offering comprehensive training programs often see their users experience fewer losses and higher returns. Imagine the difference between learning to drive in a deserted parking lot versus jumping straight onto a busy highway. Proper education acts as your “deserted parking lot,” providing a safe space to learn and practice before facing the challenges of the real market.

The more you learn, the better equipped you are to make informed decisions, manage risk effectively, and ultimately, increase your chances of success. Consider the example of a trader who meticulously studied chart patterns and risk management techniques. They were able to anticipate market movements and avoid significant losses during a period of market volatility, ultimately outperforming traders who lacked similar educational foundations.

Importance of Readily Available Tutorials and FAQs

Tutorials and FAQs are your go-to resources for quick solutions to common problems. A well-structured FAQ section can address the most frequently asked questions, saving you time and frustration. Imagine having immediate access to answers to questions like “How do I deposit funds?” or “What happens if my internet connection goes down during a trade?”. Easy access to clear, concise answers means less time spent troubleshooting and more time focusing on what matters: making money (hopefully!).

A platform with poorly organized or inadequate tutorials and FAQs can lead to confusion, delays, and ultimately, missed opportunities. The absence of readily available support materials can translate to lost time and potential losses.

Epilogue

So, there you have it – the lowdown on finding the perfect day trading platform. Remember, it’s not just about slick graphics and fancy features; it’s about finding a platform that’s as reliable as your lucky socks and provides customer support that’s as responsive as your pet goldfish begging for food. Do your research, read reviews, and don’t be afraid to ask questions.

With the right platform by your side, you’ll be ready to conquer the markets – one trade at a time (and hopefully, with a healthy profit!). Happy trading!