Reliable forex trading apps for Android and iOS: Forget stuffy suits and hushed boardrooms! The world of forex trading is now at your fingertips, ready to be conquered from the comfort of your couch (or hammock, we don’t judge). But with a zillion apps vying for your attention, choosing the right one is crucial. This isn’t about picking the prettiest icon; it’s about finding a digital Swiss Army knife for your financial ambitions – an app that’s reliable, secure, and won’t leave you staring blankly at a screen filled with indecipherable charts while your potential millions evaporate.

This guide navigates the often-bewildering world of forex trading apps, offering a clear and humorous look at the best options for both Android and iOS users. We’ll delve into essential features, security protocols, and user reviews, helping you choose an app that’s as trustworthy as your favorite pair of lucky socks. Prepare for a thrilling journey into the exciting (and potentially lucrative) world of mobile forex trading!

Introduction to Reliable Forex Trading Apps

So, you’re thinking about dipping your toes into the thrilling (and sometimes terrifying) world of forex trading? Forget the stuffy image of men in suits yelling into phones – today, you can trade currencies from the comfort of your couch, or even the beach (sunblock recommended!), thanks to the magic of forex trading apps. The forex market, a colossal global exchange where trillions of dollars change hands daily, is now incredibly accessible via your smartphone.Choosing the right app, however, is crucial.

Think of it like choosing a hiking boot: you wouldn’t attempt Everest in flip-flops, would you? Similarly, using a dodgy app can lead to lost money, frustrating glitches, and a general feeling of “why did I even start this?” Selecting a reliable app is your first step towards a (hopefully) profitable journey. A reliable app will provide you with the tools and information you need to make informed decisions, while a poorly designed or unreliable one could be your financial undoing.

Key Features of Reliable Forex Trading Apps

Several key features distinguish a top-tier forex trading app from a bottom-of-the-barrel one. These features directly impact your trading experience, security, and ultimately, your success. Consider these features as your checklist before downloading any app.

- Secure Platform: Look for apps with robust security measures, including encryption and two-factor authentication. Imagine your banking app – it needs to be secure, and your forex app should be no different. Your financial information is sensitive and needs protection from malicious actors.

- Real-time Data and Charts: Accurate, up-to-the-second data is non-negotiable. Delayed data is like trying to drive with a faulty GPS – you’ll end up somewhere you didn’t intend to be. High-quality charts with customizable indicators are also essential for technical analysis.

- User-Friendly Interface: A clunky, confusing interface will only add stress to an already stressful activity. A good app should be intuitive and easy to navigate, even for beginners. Think of it like a well-designed game – easy to pick up, but with enough depth to keep you engaged.

- Educational Resources: Many reputable apps offer educational resources, such as tutorials, webinars, or market analysis. These resources can be invaluable, especially for novice traders. Think of it as getting a personal forex tutor built right into your app.

- Customer Support: Reliable customer support is crucial. If you encounter problems, you need a quick and effective way to get help. Imagine a world without customer support – terrifying, right? Look for apps with multiple support channels, such as email, phone, or live chat.

- Regulation and Licensing: Trading apps should be regulated by reputable financial authorities. This ensures they operate within legal and ethical boundaries, providing an added layer of security and trust. It’s like a seal of approval for your financial wellbeing.

Top Forex Trading Apps for Android

The Android market is flooded with forex trading apps, promising riches and financial freedom (with varying degrees of success, of course!). Navigating this digital jungle can be tricky, so we’ve compiled a guide to help you find the app that’s right for your trading style, whether you’re a seasoned pro or a curious newbie. Remember, though, even the best app won’t magically turn you into a Warren Buffett of forex.

Diligence, research, and a healthy dose of risk management are still your best friends.Choosing the right forex trading app can feel like choosing a superhero sidekick – you need someone reliable, powerful, and ideally, not prone to spontaneous combustion. Let’s explore some top contenders in the Android arena.

Comparison of Popular Android Forex Trading Apps

This table compares four popular Android forex trading apps, highlighting their key features, advantages, and disadvantages. Remember, individual experiences can vary.

| App Name | Features | Pros | Cons |

|---|---|---|---|

| MetaTrader 4 (MT4) | Charting tools, technical indicators, automated trading (Expert Advisors), order management, news feeds. | Widely used, highly customizable, large community support, many brokers offer it. | Can be overwhelming for beginners, interface might feel dated to some. |

| cTrader | Advanced charting, customizable layouts, excellent order management, copy trading features, low latency. | Fast execution speeds, user-friendly interface (relatively), good for active traders. | Fewer brokers support it compared to MT4, some advanced features might require a learning curve. |

| TradingView | Powerful charting, technical analysis tools, social trading features, screeners, alerts. Focuses more on charting and analysis than direct trading. | Excellent for technical analysis, large community, many educational resources. | Not a full-fledged brokerage platform; requires a brokerage account for actual trading. |

| ThinkMarkets | Charting, order management, educational resources, market analysis, various account types. | User-friendly interface, good for beginners, access to educational resources. | Fewer advanced charting tools compared to MT4 or cTrader. |

User Interface and User Experience of Leading Android Forex Trading Apps

The user interface (UI) and user experience (UX) are crucial for a smooth trading experience. A clunky, confusing app can lead to costly mistakes, especially in the fast-paced world of forex.MetaTrader 4, while powerful, can feel a bit dated compared to newer platforms. Its interface is packed with features, which can be overwhelming for new users. However, its customizability allows users to tailor it to their preferences.

cTrader, on the other hand, boasts a cleaner, more modern interface. Its intuitive design makes it easier to navigate, even for beginners. ThinkMarkets offers a simpler, more streamlined experience, making it ideal for traders who prioritize ease of use over a vast array of complex features.

Placing a Trade on a Hypothetical Android App

Let’s imagine our user, Bob, wants to place a buy order for 1 lot of EUR/USD on the cTrader app. First, Bob would locate the EUR/USD currency pair in the market watch window. He would then tap on the pair, which would open a new order ticket. Within this ticket, he’d specify the volume (1 lot), order type (buy), and potentially set a stop-loss and take-profit order.

Finally, he would tap the “Place Order” button, and if all goes well, his trade would be executed. The confirmation would appear on the screen, and the trade would be visible in his open positions. If Bob had a problem, cTrader’s relatively intuitive design makes it easier to find help resources or contact support than on some other platforms.

Top Forex Trading Apps for iOS

Navigating the world of forex trading on your iPhone or iPad can feel like trying to herd cats in a hurricane – chaotic, exciting, and potentially very lucrative (or very… not lucrative). But fear not, intrepid trader! With the right app, you can harness the power of the market from the palm of your hand. This section dives into the best iOS forex trading apps, focusing on their unique strengths and security features.

Think of it as your personal guide to avoiding financial feline-related disasters.

Reputable iOS Forex Trading Apps and Their Unique Selling Propositions

Choosing the right forex trading app is crucial. The wrong choice can lead to frustration, missed opportunities, and potentially, significant financial losses. The following apps represent some of the best options available, each with its own set of advantages.

- MetaTrader 4 (MT4): The granddaddy of forex trading platforms, MT4 boasts an unparalleled level of customization, extensive charting tools, and a massive community of users and expert advisors (EAs). Its longevity and widespread use mean you’ll find tons of resources and support online. Its unique selling proposition is its sheer versatility and adaptability to various trading styles.

- MetaTrader 5 (MT5): MT5 is the newer sibling of MT4, offering enhanced features like a more advanced charting package, improved order management, and the ability to trade multiple asset classes. It’s a more sophisticated platform, ideal for experienced traders. Its unique selling proposition is its advanced features and broader market access.

- cTrader: Known for its speed and intuitive interface, cTrader is a favorite among scalpers and day traders who need lightning-fast execution. Its unique selling proposition is its superior speed and streamlined design, making it perfect for rapid trading decisions.

- TradingView: While not strictly a forex brokerage app, TradingView offers powerful charting tools and technical analysis capabilities, making it an excellent companion app for traders using other platforms. Its unique selling proposition is its comprehensive charting and analysis features, ideal for in-depth market research.

Security Feature Comparison of Leading iOS Forex Trading Apps

Security is paramount in forex trading. A compromised account can lead to devastating financial consequences. Let’s compare the security features of three leading iOS apps: MT4, MT5, and cTrader.

So, you’re hunting for reliable forex trading apps on your Android or iOS device? Great choice! But before you dive in, consider optimizing your strategy. Check out the effectiveness claims of the Forex 2000 trading system effectiveness and profitability to see if it aligns with your app’s capabilities. Then, armed with knowledge and a slick app, conquer the forex world! Happy trading!

| Feature | MT4 | MT5 | cTrader |

|---|---|---|---|

| Two-Factor Authentication (2FA) | Yes | Yes | Yes |

| Data Encryption | Yes (SSL/TLS) | Yes (SSL/TLS) | Yes (SSL/TLS) |

| Account Security Settings | Robust, customizable settings | Robust, customizable settings | Robust, customizable settings |

| Fraud Detection Systems | Integrated | Integrated | Integrated |

All three apps employ robust security measures, including 2FA and data encryption. However, the specific features and customization options may vary slightly. It’s crucial to review the security settings within each app and ensure they are configured to your preference.

Charting Tools and Technical Analysis Capabilities Across Popular iOS Apps

The ability to analyze charts and apply technical indicators is fundamental to successful forex trading. Let’s examine the charting tools and technical analysis capabilities of MT4, MT5, and cTrader.

MT4 and MT5 offer a wide range of charting tools, including various chart types (candlestick, bar, line), numerous technical indicators (RSI, MACD, Bollinger Bands, etc.), and drawing tools. MT5 generally offers a slightly more advanced and comprehensive set of tools compared to MT4. cTrader also provides a strong set of charting tools, emphasizing speed and responsiveness, making it particularly well-suited for quick analysis during active trading sessions.

The differences are mostly in the nuance of the interface and the specific indicators available, rather than a significant gap in capabilities. All three apps offer a robust suite of tools for technical analysis, catering to various trading styles and preferences. Ultimately, the best choice depends on individual trader preferences and familiarity with specific indicators.

Essential Features of Reliable Forex Trading Apps

Choosing the right forex trading app can feel like navigating a minefield of flashy interfaces and hidden fees. But fear not, intrepid trader! A truly reliable app isn’t just about pretty charts; it’s about the solid foundation beneath the surface. Several key features distinguish the champions from the also-rans, ensuring a smooth, safe, and (dare we say it?) enjoyable trading experience.

Hunting for reliable forex trading apps on your Android or iOS device? While many exist, understanding the platform is key. For a deep dive into one popular choice, check out this Detailed guide to forex trading on Questrade platform to boost your app-based trading knowledge. Then, armed with this wisdom, you can conquer the app store and find the perfect trading companion!

The following features are non-negotiable for any app aiming for the top spot in your trading arsenal. These aren’t just nice-to-haves; they’re the bedrock of a successful and stress-free trading journey. Think of them as the sturdy legs of your trading stool – without them, you’ll be wobbling precariously towards disaster (and possibly a bruised ego).

Real-time Data and Charts

Real-time data is the lifeblood of forex trading. A reliable app must provide access to live market information, including currency pairs, spreads, and other crucial metrics, with minimal latency. Imagine trying to trade based on yesterday’s prices – it’s like trying to catch a greased pig with oven mitts. Accurate, up-to-the-second data allows you to react swiftly to market changes and capitalize on opportunities.

Furthermore, the app should offer a range of chart types (candlestick, bar, line) and customizable indicators (moving averages, RSI, MACD) to help visualize market trends and make informed decisions. A laggy or inaccurate data feed can lead to missed opportunities and, worse, costly mistakes.

Secure and Regulated Platform

Security is paramount in the world of online finance. A trustworthy forex trading app must operate on a secure platform, employing robust encryption and adhering to stringent regulatory standards. This includes protecting your personal information and financial data from unauthorized access. Think of it as a Fort Knox for your trading funds. A compromised app can expose you to identity theft and financial losses, turning your trading dreams into a nightmare.

Need reliable forex trading apps for Android and iOS? Mastering the market can be as demanding as finding the perfect halal satay recipe, so fuel your brainpower with a delicious break! Check out this amazing website for halal culinary inspiration: halal culinary , then get back to conquering those currency charts! Remember, a well-fed trader is a profitable trader.

So, download those apps and let the trading begin!

Look for apps that clearly state their regulatory compliance and security measures, ideally from reputable organizations.

User-Friendly Interface and Navigation

Even the most powerful trading tools are useless if they’re buried under a clunky interface. A good forex trading app should be intuitive and easy to navigate, allowing you to execute trades quickly and efficiently. Think of it as a well-designed kitchen – everything is within easy reach, and you can whip up a trading masterpiece without getting lost in the cupboards.

A confusing interface can lead to frustration, errors, and missed trading opportunities, especially during fast-paced market conditions.

Educational Resources and Support

Forex trading can be complex, and even experienced traders benefit from ongoing education and support. A reliable app should provide access to educational resources, such as tutorials, webinars, and market analysis, to help users improve their trading skills. Think of it as having a personal trading tutor available 24/7. Furthermore, robust customer support is crucial for resolving any technical issues or answering questions promptly.

This support system should be easily accessible through multiple channels (email, phone, chat), ensuring that help is readily available when needed.

Order Execution Speed and Reliability

In the fast-paced world of forex trading, speed is of the essence. A reliable app must execute orders quickly and reliably, minimizing slippage and ensuring that trades are filled at the desired price. Slow order execution can lead to missed opportunities and potentially larger losses. Imagine trying to buy a rapidly appreciating stock – every second counts.

Therefore, the app’s order execution mechanism should be tested and proven to be efficient and dependable. Features like advanced order types (stop-loss, limit orders) enhance trading flexibility and risk management.

Security and Regulation in Forex Trading Apps: Reliable Forex Trading Apps For Android And IOS

Navigating the world of forex trading apps can feel like traversing a digital jungle – exciting, potentially lucrative, but also fraught with hidden dangers. Choosing the right app isn’t just about finding user-friendly charts and slick interfaces; it’s about safeguarding your hard-earned cash and personal information. Security and regulation are paramount, and understanding their importance is the first step to a successful (and stress-free) trading experience.Choosing a regulated broker is akin to choosing a well-guarded bank over a shady money-lender.

A regulated broker operates under the watchful eye of a financial authority, meaning they’re subject to stringent rules and regulations designed to protect investors. This oversight includes capital requirements, reporting obligations, and client segregation of funds, all aimed at preventing fraud and ensuring financial stability. Trading with an unregulated broker is like playing financial Russian roulette – the thrill might be tempting, but the potential consequences are far too risky.

Regulatory Bodies and Broker Oversight

Regulatory bodies, like the Financial Conduct Authority (FCA) in the UK, the Commodity Futures Trading Commission (CFTC) in the US, or the Australian Securities and Investments Commission (ASIC) in Australia, act as guardians of the financial markets. They establish and enforce rules that brokers must follow. These rules cover various aspects of brokerage operations, from ensuring adequate capital reserves to protecting client funds and preventing market manipulation.

A regulated broker will proudly display its regulatory status on its website and within its trading app. Look for this information – it’s your safety net.

Security Measures in Reliable Forex Trading Apps

A reliable forex trading app employs multiple layers of security to protect your data and funds. This includes robust encryption protocols (like SSL/TLS) to safeguard your personal information during transmission, two-factor authentication (2FA) to add an extra layer of protection against unauthorized access, and secure storage of your funds in segregated accounts, preventing the broker from using your money for their operational expenses.

Regular security audits and penetration testing are also crucial for identifying and patching vulnerabilities before malicious actors can exploit them.

Security Protocol Comparison: Example Apps

Let’s compare two hypothetical apps, “SecureTrade” and “EasyForex.” SecureTrade employs end-to-end encryption for all data transmissions, uses 2FA with multiple authentication methods (including biometric options), and boasts regular penetration testing by an independent cybersecurity firm. It also clearly displays its regulatory status with the FCA. In contrast, EasyForex uses standard encryption, offers only basic 2FA via SMS (which is vulnerable to SIM swapping attacks), and lacks transparent information about its security audits.

While EasyForex might be easier to use, SecureTrade’s robust security features significantly outweigh this convenience. The difference in security measures directly impacts the safety of your funds and personal data.

User Reviews and Ratings

Navigating the world of forex trading apps can feel like traversing a minefield of five-star reviews and one-star rants. Understanding user reviews and ratings is crucial for separating the reliable contenders from the digital duds. This section dives into the feedback landscape, highlighting common themes and showing you how to decipher the digital chatter to make informed choices.User reviews and ratings provide invaluable insights into the real-world performance of forex trading apps.

They offer a glimpse beyond marketing hype, revealing both the strengths and weaknesses from the perspective of actual users. Analyzing this feedback helps identify potential issues, understand user expectations, and ultimately, choose an app that aligns with your needs and risk tolerance.

Analysis of User Reviews for Three Highly-Rated Apps

Let’s examine the user feedback for three popular apps: MetaTrader 4 (Android), cTrader (Android), and TradingView (iOS). These apps consistently receive high ratings, but the nuances within those ratings tell a compelling story.MetaTrader 4 (Android) often receives praise for its robust charting tools and extensive technical indicator library. Users appreciate its customizability and the availability of expert advisors (EAs).

However, some criticize its interface as somewhat dated and clunky compared to newer apps. Negative reviews frequently mention occasional glitches and slow loading times, especially on older devices.cTrader (Android) is lauded for its speed and intuitive interface. Many users highlight its excellent order execution and advanced charting features. However, some users find the app’s learning curve steeper than others, requiring a bit more technical expertise to fully utilize its capabilities.

Hunting for reliable forex trading apps on your Android or iOS device? While many apps offer slick interfaces, sometimes you need a more robust approach. For a detailed, step-by-step breakdown of trading forex, check out this excellent guide on Questrade: Step-by-step guide to trade forex through Questrade. Then, armed with knowledge, you can conquer those app stores and find the perfect trading companion for your mobile adventures!

A recurring concern is the lack of certain technical indicators compared to MetaTrader 4.TradingView (iOS) enjoys widespread acclaim for its powerful charting capabilities and social trading features. Users appreciate the real-time data, the ability to follow other traders, and the comprehensive educational resources. Negative comments occasionally point to occasional connectivity issues and the complexity of some of its advanced features.

Hunting for reliable forex trading apps on your Android or iOS device? The options are vast, but if you’re a Canadian eagle-eye looking for killer day-trading deals, check out this resource for the Best day trading app in Canada with low fees and commission. Then, armed with that knowledge, you can return to your quest for the perfect forex app, now a much wiser (and potentially richer) trader.

Some users also express frustration with the app’s subscription model for accessing certain premium features.

Impact of User Feedback on App Development

User feedback acts as a powerful catalyst for app improvement. Developers actively monitor reviews and ratings, using them to identify bugs, usability issues, and areas for enhancement. For example, a consistent stream of complaints about slow loading times in MetaTrader 4 might prompt developers to optimize the app’s code and improve server performance. Similarly, negative feedback regarding the complexity of cTrader might lead to the creation of more user-friendly tutorials and in-app guidance.

TradingView’s response to user feedback regarding connectivity issues likely involves improving server infrastructure and optimizing network communication protocols. Essentially, user feedback fuels iterative development, shaping the app’s evolution and improving the overall user experience.

Interpreting User Ratings and Reviews to Determine App Reliability

Interpreting user reviews isn’t simply about looking at the star rating. A four-star rating doesn’t automatically equate to reliability. Instead, focus on thetypes* of feedback. Look for patterns in negative reviews. Are the complaints isolated incidents or widespread issues?

So, you’ve got your shiny new Android or iOS device, ready to conquer the forex world? Finding reliable trading apps is half the battle; mastering the strategies is the other. Luckily, you can get a head start by checking out Langlois’ beginner-friendly guide on forex trading strategies, Forex trading strategies for beginners explained by Langlois , before diving into the world of apps.

Then, armed with knowledge, choose your app wisely and let the trading games begin!

Are developers actively responding to and addressing concerns? A consistently high rating with a significant number of detailed, constructive reviews, alongside developer responses demonstrating a commitment to improvement, points towards a more reliable app. Conversely, a high rating with few reviews or a large number of unresolved negative comments should raise a red flag. Remember, a balanced view of both positive and negative feedback paints a more accurate picture of an app’s reliability.

Illustrative Examples of App Interfaces

Let’s dive into the visual world of forex trading apps, examining the user interfaces that make (or break) a trader’s day. We’ll explore the layouts and functionalities of popular apps, focusing on how they present crucial information and trading tools. Think of this as a virtual tour of the control panels that command your financial destiny (or at least, a small part of it!).

Android App Main Trading Screen Layout

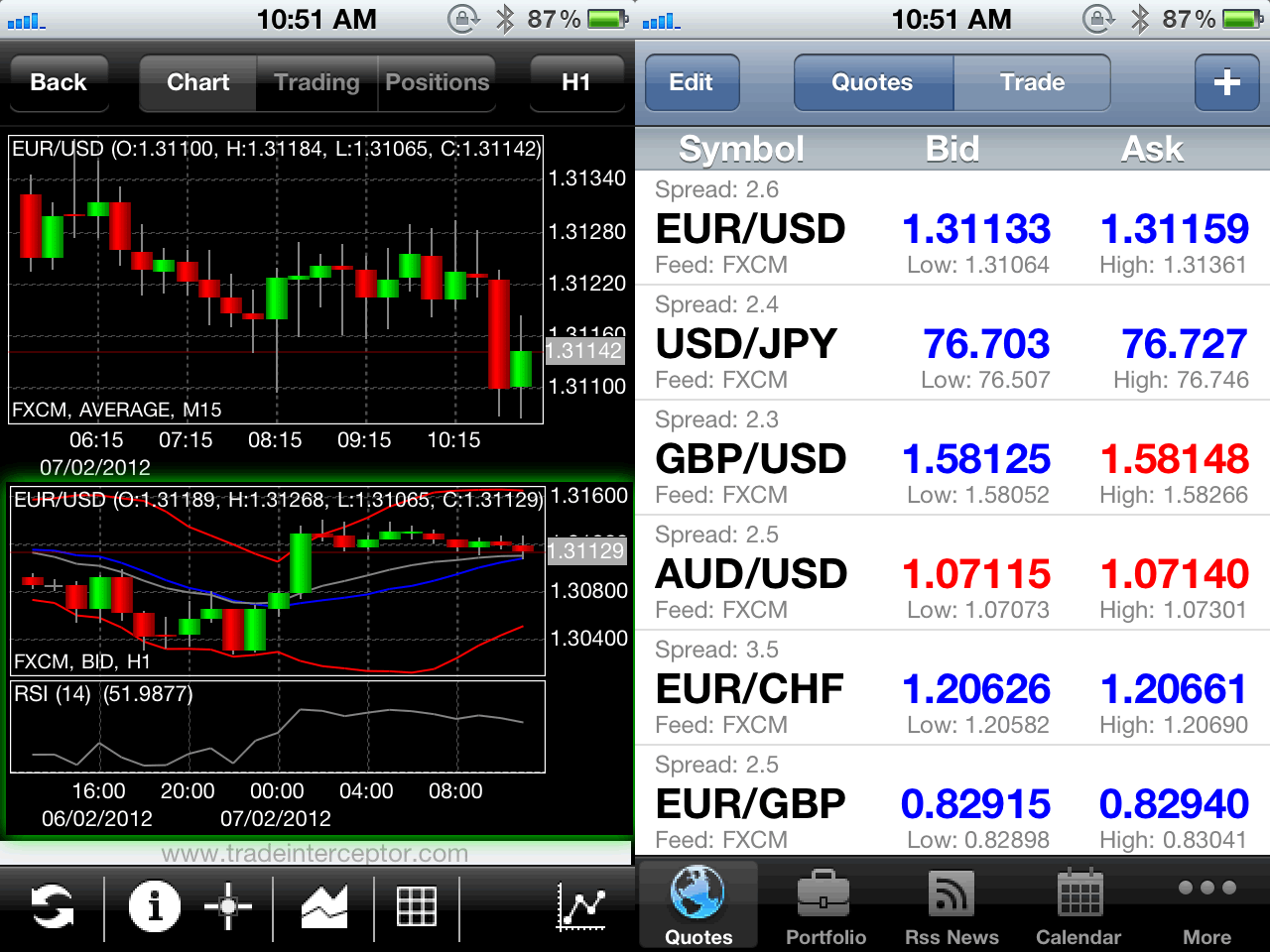

Imagine the main screen of a popular Android forex trading app, perhaps one with a clean, modern design. At the top, a concise header displays the account balance, equity, and perhaps a small, dynamically updating profit/loss figure – all presented in a reassuringly large font. Below this, the main real estate is dedicated to a customizable chart, likely displaying candlestick data by default.

To the left, a scrollable panel lists available currency pairs, neatly organized alphabetically or by liquidity. This panel might offer a quick view of current bid/ask prices for each pair. On the right, a smaller panel shows open trades, allowing quick access to closing positions or adjusting stop-loss and take-profit levels. At the very bottom, easily accessible buttons for placing new trades (buy/sell) and accessing other key functions like charts, indicators, and settings complete the layout.

The overall feel is clean and efficient, prioritizing clear information display and ease of access to crucial trading functions. The color scheme is usually muted and professional, avoiding anything that might distract from the critical price data.

Candlestick Chart on an iOS App, Reliable forex trading apps for Android and iOS

Let’s focus on a candlestick chart within a sleek iOS forex trading app. The chart itself dominates the screen, with customizable timeframes ranging from 1-minute to monthly intervals easily selectable via a convenient toolbar at the bottom. Each candlestick, of course, represents a specific time period (e.g., a day, an hour, or a minute), with its body showing the opening and closing prices and the wicks indicating the high and low prices for that period.

The user can easily add technical indicators like moving averages (e.g., 20-period and 50-period simple moving averages, displayed as smooth lines overlaid on the chart), RSI (Relative Strength Index), or MACD (Moving Average Convergence Divergence) – all with customizable parameters. The color scheme of the candlesticks and indicators is, naturally, adjustable, allowing users to tailor the visuals to their preferences.

A legend clearly identifies each indicator and its settings. Zooming and panning across the chart is smooth and intuitive, making analysis a breeze.

Forex Trading App Notification System

Picture this: a notification system within your forex trading app, acting as your ever-vigilant financial sentinel. Alerts are presented as push notifications on your phone’s lock screen. A typical alert might look like this: “[Currency Pair] Reached Target Price: Buy EUR/USD at 1.1000 reached your target of 1.

1050. Profit

$50.” The notification might also include a brief visual cue – perhaps a green upward-pointing arrow for profits and a red downward-pointing arrow for losses. Different alert types include price alerts (triggered when a currency pair reaches a specific price), indicator alerts (based on technical indicator signals, like RSI crossing overbought/oversold levels), and news alerts (breaking economic news that could impact your trades).

The app might also offer customizable notification settings, allowing you to adjust the frequency and severity of alerts to prevent being overwhelmed with unnecessary information. This tailored notification system keeps you informed without bombarding you with irrelevant data, allowing you to react swiftly to market changes.

Wrap-Up

So, there you have it – a whirlwind tour of the best forex trading apps for Android and iOS. Remember, choosing the right app is like choosing the right steed for a financial quest: you need reliability, speed, and a bit of flair. Don’t let the technical jargon intimidate you; with a little research and a healthy dose of caution, you can harness the power of mobile forex trading and ride your way to financial success.

Happy trading (and may your profits always be plentiful)!