Setting up a Questrade demo account for forex trading practice? Think of it as your very own virtual casino, except instead of losing your shirt, you’re losing (and gaining!) pretend money. This guide will walk you through the surprisingly simple process of setting up your risk-free trading playground, complete with virtual funds and enough charting tools to make a data scientist blush.

Get ready to conquer the forex markets… virtually, of course!

We’ll cover everything from finding the demo account registration on the Questrade website (don’t worry, we’ll provide a treasure map!), to navigating the trading platform like a seasoned pro. We’ll even throw in some tips and tricks for mastering those tricky forex indicators. By the end, you’ll be ready to trade like a boss… or at least, a very well-informed, virtually-rich boss.

Accessing the Questrade Website and Finding the Demo Account

Embarking on your forex trading adventure with a Questrade demo account is like taking a test drive of a Ferrari before committing to the purchase – exhilarating, risk-free, and potentially very, very educational. This section will guide you through the surprisingly straightforward process of finding and signing up for this virtual trading playground.Finding the Questrade demo account is easier than finding a decent cup of coffee at a busy airport.

Seriously, it’s that simple. We’ll navigate the website together, step-by-step, and even throw in some imaginary screenshots to illustrate the journey.

So you’re thinking of conquering the forex world with a Questrade demo account? Smart move! Before you dive headfirst into virtual millions, though, it’s wise to understand the real-world implications – like those pesky currency conversion fees. Check out this guide on Questrade currency conversion fees and how to avoid them to avoid any nasty surprises.

Then, armed with this knowledge, go forth and practice your forex trading prowess!

Locating the Demo Account Registration on the Questrade Website

The Questrade website, while packed with information, isn’t a labyrinth. The key is to know where to look. Here’s a visual guide (in words, because I can’t actually

show* you screenshots, alas!).

| Step | Screenshot Description | Desktop Experience | Mobile Experience |

|---|---|---|---|

| 1. Accessing Questrade | Shows the Questrade homepage; a clean, modern design with prominent navigation elements. Expect to see options like “Trade,” “Invest,” “Learn,” and potentially a login button. | The homepage will likely fill most of your desktop screen, making navigation intuitive. | The homepage will be adapted for smaller screens, with menus often collapsing into hamburger icons. Navigation may involve more tapping. |

| 2. Finding the “Practice Account” or Similar | Shows a section of the website, possibly within a “Trading” or “Accounts” section, highlighting a link or button clearly labeled “Practice Account,” “Demo Account,” or something similar. It might be subtly tucked away under a section labeled “Learn to Trade” or something along those lines. | This will likely be easily visible on a desktop, possibly within a prominent navigation bar. | On mobile, this section might require some scrolling or expanding of a menu. |

| 3. The Registration Page | This screenshot would show a form requiring basic information such as email address, password creation, and potentially some security questions. It’s a fairly standard registration form. | The form will be spacious and easy to fill out on a desktop. | The form will be adapted to fit the smaller screen, likely with fields stacking vertically. |

| 4. Account Confirmation | Shows a confirmation page, potentially with a message indicating successful account creation, along with instructions on accessing the demo account. | This will be displayed clearly on the desktop. | This will be displayed similarly on mobile, although the screen real estate may be more limited. |

Remember, the exact wording and placement of the demo account link might vary slightly depending on Questrade’s website updates. However, the general process remains consistent: find the main navigation, look for a “Practice,” “Demo,” or “Learn to Trade” section, and you’re practically there. Happy (virtual) trading!

Registration and Account Setup Process

So, you’ve braved the wilds of the Questrade website and found the demo account portal – congratulations, intrepid trader! Now comes the slightly less thrilling, but equally crucial, step: actuallycreating* the account. Think of it as building the foundation for your future (virtual) financial empire. Don’t worry, it’s not as daunting as it sounds.The registration process is fairly straightforward, a digital waltz through a series of forms.

You’ll be asked to provide some basic personal information to verify your identity and ensure Questrade knows who’s racking up (or losing) those virtual millions. This isn’t some shadowy back-alley operation; it’s about security and compliance, people!

Required Information During Registration

Expect to be asked for standard fare: your name, address, email address, and phone number. Think of it as filling out a slightly more sophisticated online dating profile – except instead of finding love, you’re finding…well, virtual financial freedom. You’ll also need to create a secure password; think something memorable but impossible for a digital cat burglar to crack.

Avoid “password123,” unless you enjoy the thrill of losing your virtual fortune. You’ll also likely be asked to select a security question and answer. Think carefully – this is your digital get-out-of-jail-free card if you ever forget your password.

Verification Process and Methods

Once you’ve submitted your application, Questrade will likely require verification. This is their way of making sure you’re not a mischievous bot or a particularly clever imposter. Common methods include email verification (they’ll send a code to your registered email), phone verification (a code sent via SMS), and potentially document verification (uploading a copy of your ID). Think of it as a digital handshake, proving you’re a real person with real (virtual) trading ambitions.

So you want to conquer the forex world? Start smart by setting up a Questrade demo account – practice makes perfect, right? But before you become a forex ninja, understanding the marketing strategies used by Canadian brokers is key, especially if you want to eventually trade big time; check out this insightful article on Effective exchange marketing strategies for forex brokers in Canada to see how the pros play the game.

Then, get back to that demo account and show those virtual currencies who’s boss!

This process is designed to protect both you and Questrade from any unwanted shenanigans.

Completing Account Setup: Profile and Security

After the verification hurdle, you’ll be guided through setting up your profile. This involves adding more details, possibly including your employment status and financial experience. Again, this is all part of Questrade’s responsible trading practices. Finally, you’ll need to set up your security preferences. This might involve enabling two-factor authentication (2FA), which adds an extra layer of security by requiring a second code in addition to your password.

Think of 2FA as a digital bodyguard for your virtual assets. It’s highly recommended to enable this; it’s like putting a burglar alarm on your virtual trading house. You’ll also have the opportunity to review and adjust your notification settings, so you’re alerted to important account activity.

Funding the Demo Account (Virtual Funds): Setting Up A Questrade Demo Account For Forex Trading Practice

So, you’ve bravely navigated the Questrade website and created your demo account. Congratulations, intrepid trader! Now comes the fun part: getting your virtual hands on some pretend money. Think of it as Monopoly money for grown-ups, but with the potential for slightly more realistic (and less board-game-related) stress.The process of receiving your virtual funds is remarkably straightforward. Unlike real-world investing, you won’t need to link a bank account or worry about pesky transfer fees.

Instead, your Questrade demo account is automatically loaded with a pre-set amount of virtual currency upon account creation. It’s like a digital casino, but instead of flashing lights and questionable cocktails, you’ll be staring intensely at charts and nervously calculating pip movements.

Virtual Fund Amount

Questrade typically provides a substantial amount of virtual funds for demo accounts – often in the range of $10,000 to $100,000 (USD equivalent). This generous sum allows for ample practice with various trading strategies and risk management techniques. It’s enough to feel the thrill of a winning trade, and the sting of a losing one, without actually losing any real cash.

Think of it as your training budget for the ultimate financial boot camp.

So, you’re thinking of setting up a Questrade demo account to practice your forex trading skills? Smart move! Before you dive headfirst into the wild world of currency fluctuations, though, you might want to check out some serious trading assistance. Consider exploring the options available with Best AI-powered forex trading robots for Canadian traders , to potentially boost your demo account performance.

Then, armed with newfound robotic wisdom, conquer that Questrade demo account!

Limitations on Virtual Funds

While the virtual funds are plentiful, it’s crucial to understand their limitations. These funds are, of course, not real money, and therefore cannot be withdrawn. The primary purpose is to simulate the trading environment and allow you to practice without any financial risk. However, there might be some limitations on the types of trades you can make; for example, there may be restrictions on the leverage available compared to a real account.

So, you’re thinking of conquering the forex world with a Questrade demo account? Smart move! Practice makes perfect, and before you know it, you’ll be predicting currency fluctuations like you’re predicting the next winning goal, maybe even checking out some football news for inspiration (seriously, the strategy is surprisingly similar!). Then, back to your Questrade demo account – may your virtual profits be plentiful!

Furthermore, your demo account may not offer access to all the features or instruments available on a live account, but it will still provide a valuable learning experience. This is not a get-rich-quick scheme; it’s a get-smarter-and-possibly-richer-later scheme.

Navigating the Questrade Forex Trading Platform

So, you’ve successfully navigated the treacherous waters of demo account creation. Congratulations, intrepid trader! Now, let’s dive headfirst into the exciting, slightly overwhelming, but ultimately rewarding world of the Questrade forex trading platform. Think of it as a high-tech cockpit for your financial jet fighter – except instead of dogfights, you’re battling market fluctuations.The Questrade platform, while initially appearing complex, is actually quite intuitive once you’ve gotten your bearings.

It’s designed to provide a wealth of information and tools, but don’t let that intimidate you. We’ll break it down step-by-step, turning you from a bewildered newbie into a confident chart-reading pro.

So, you’re thinking of setting up a Questrade demo account to practice your forex wizardry? Smart move! But before you start conjuring profits, remember that even the best virtual trades hinge on good information. That’s where understanding Reliable forex trading signals and their impact on profitability comes in – it’s like having a crystal ball (but, you know, less mystical and more data-driven).

Once you’ve got the signal situation sorted, get back to that Questrade demo and become a forex trading legend!

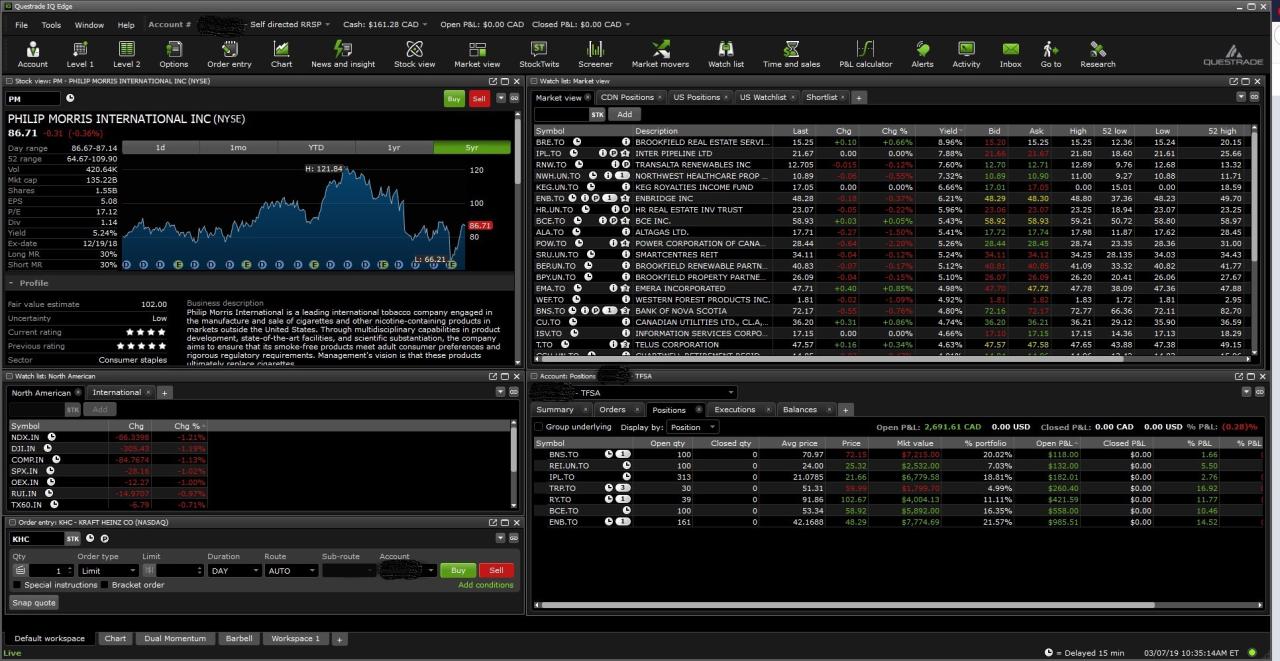

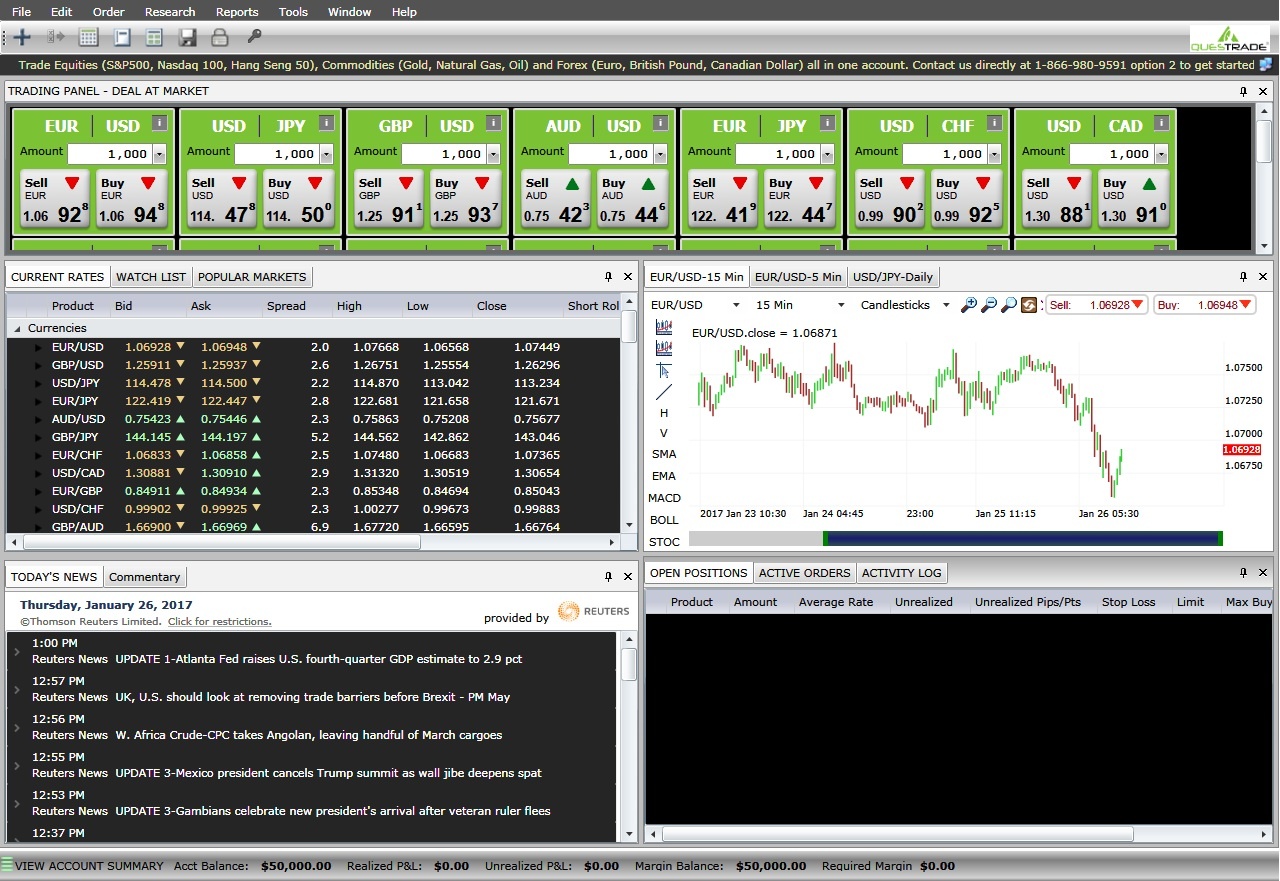

Platform Interface Overview

The Questrade platform presents a clean, modern interface. At first glance, you’ll see several key areas: a chart window displaying price movements, an order entry panel where you’ll place your trades, a watchlist to track your favorite currency pairs, and various other tabs offering market news, research tools, and account information. The layout is customizable, allowing you to arrange these elements to suit your trading style.

Think of it as a customizable dashboard – arrange your widgets (charts, order forms, etc.) to best suit your needs and monitor your progress. You can even switch between different views depending on your preference and the type of analysis you’re performing.

Placing a Sample Trade: A Step-by-Step Guide

Before you start throwing virtual money at the market like confetti at a wedding, let’s walk through a sample trade. This is crucial for understanding the process and avoiding any accidental (and potentially embarrassing) large losses. Remember, this is a demo account – your virtual funds are unlimited, allowing you to experiment freely.

- Select Currency Pair: First, choose the currency pair you want to trade (e.g., EUR/USD). Click on the pair to open the chart and see its price action. This is where the fun (and potentially the stress) begins.

- Choose Order Type: Questrade offers various order types. For our sample trade, let’s use a simple “Market Order.” This executes at the current market price. Other options include Limit Orders (buying or selling at a specified price or better) and Stop Orders (automatically placing a market order once a specific price is reached).

- Specify Order Details: In the order entry panel, enter the desired trade size (usually in lots – a standard lot is 100,000 units of the base currency). For our demo, start small – a mini-lot (10,000 units) is a good place to begin. Indicate whether you’re buying (going long) or selling (going short).

- Review and Submit: Double-check all the details – currency pair, order type, trade size, and buy/sell direction. Once everything is correct, click “Submit Order.” You’ve officially placed your first forex trade!

- Monitor Your Trade: Keep an eye on your trade’s performance. The platform will show your profit or loss in real-time. This is where the real thrill lies (or the slight stomach churning, depending on how your trade is performing).

Questrade Forex Platform Features

This table showcases some of the key features of the Questrade forex trading platform. It’s not exhaustive, but it gives you a good overview of what’s available. Remember, explore the platform – you’ll discover hidden gems and features that make trading easier and more efficient.

| Feature Category | Feature Name | Description | Benefit |

|---|---|---|---|

| Charting | Multiple Chart Types | Candlestick, bar, line, etc. | Allows for versatile technical analysis. |

| Order Types | Market, Limit, Stop | Different ways to enter and manage trades. | Provides flexibility and risk management tools. |

| Analysis Tools | Technical Indicators | Moving averages, RSI, MACD, etc. | Helps identify trends and potential trading opportunities. |

| Account Management | Real-time P&L | Displays your current profit or loss. | Provides constant monitoring of your trading performance. |

Practicing Forex Trading Strategies

So, you’ve got your Questrade demo account humming along, brimming with virtual cash. Now for the fun part: actuallytrading*! Don’t worry, this isn’t a high-stakes casino; it’s a virtual playground to hone your skills and avoid the heartbreak of real-world losses. Remember, even seasoned traders started somewhere, likely with a demo account and a healthy dose of (virtual) humility.This section will walk you through implementing a basic forex strategy, managing risk like a pro (even in the demo world!), and getting acquainted with different order types.

So, you’re thinking of conquering the forex world? Smart move! Start by setting up that Questrade demo account – practice makes perfect, and trust me, you’ll need it. Then, once you’re comfortable with the basics, level up your game by checking out this amazing resource on Advanced forex trading strategies using TradingView indicators in Canada to avoid becoming another forex statistic.

After mastering those advanced strategies, return to your Questrade demo account and unleash your newfound forex wizardry!

Think of it as your crash course in virtual forex mastery.

A Simple Forex Trading Strategy: The Moving Average Crossover

This strategy uses two moving averages – a fast one (e.g., 20-period) and a slow one (e.g., 50-period) – to identify potential buy and sell signals. When the fast moving average crosses above the slow moving average, it’s a bullish signal (potential buy). Conversely, a crossover from above to below signals a potential sell. This is a simplified approach; in reality, successful trading often involves a much more complex strategy and a holistic understanding of market trends and analysis.

However, it’s a great starting point for your practice. Remember to always combine this simple strategy with additional indicators and analyses before placing any trades.

Risk Management in Forex Trading, Setting up a Questrade demo account for forex trading practice

Effective risk management is crucial, even in a demo account. It’s about protecting your (virtual) capital and preventing emotional decisions from derailing your trading plan. Key aspects include:

- Position Sizing: Never risk more than a small percentage (e.g., 1-2%) of your account balance on any single trade. This limits potential losses and allows you to withstand a series of losing trades without wiping out your account.

- Stop-Loss Orders: Always use stop-loss orders to automatically exit a trade if the price moves against you. This prevents large losses if your trade goes south. Setting your stop-loss based on technical analysis or support/resistance levels is crucial.

- Take-Profit Orders: Set take-profit orders to lock in profits when your trade reaches a predetermined target price. This helps you secure gains and avoid giving them back.

Different Order Types and Their Applications

Understanding different order types is key to executing your trading strategies effectively. Here are a few examples:

- Market Order: This executes immediately at the current market price. Use this when you need to enter a position quickly.

- Limit Order: This allows you to buy or sell at a specific price or better. Use this when you want to enter a trade only at a particular price level to potentially secure a better deal.

- Stop Order: This triggers a market order when the price reaches a specific level. This is essential for protecting your capital or capturing a quick trade.

- Stop-Limit Order: This combines elements of a stop order and a limit order, allowing for entry at a specified price or better once a certain trigger price is reached.

Remember, practicing with a demo account is all about experimenting and learning. Don’t be afraid to try different strategies, order types, and risk management techniques. The key is to develop a trading plan that suits your personality and risk tolerance. The Questrade platform provides excellent tools and resources to help you on your way.

Monitoring and Analyzing Trading Performance

So, you’ve bravely ventured into the wild world of forex demo trading with Questrade. You’ve bought, you’ve sold, you’ve probably even experienced the exhilarating (or terrifying) thrill of a near-miss margin call. Now comes the crucial part: figuring out what the heck just happened. Analyzing your performance isn’t just about bragging rights; it’s about learning from your mistakes (and celebrating your successes, of course!).Questrade provides several tools to help you dissect your trading history and become a more informed (and hopefully, more profitable) trader.

Understanding these tools is key to transforming your demo account experience from a chaotic rollercoaster into a finely tuned, profit-generating machine.

Trade History and Reporting

Questrade’s platform offers a detailed history of all your trades. This isn’t just a list of buys and sells; it’s a treasure trove of data. You can easily filter this history by date, currency pair, profit/loss, and more. This allows you to pinpoint specific trades, examine the market conditions at the time, and analyze your decision-making process. The platform often provides visual representations of your trades as well, making it easier to spot patterns and trends.

Imagine it as your personal forex detective agency, helping you solve the mystery of your trading performance.

Analyzing Profit and Loss

Beyond simply seeing if a trade made or lost money, Questrade’s reporting tools allow you to delve deeper into the specifics. You can calculate your win rate (percentage of profitable trades), average profit per trade, and average loss per trade. These metrics offer a valuable overview of your overall trading effectiveness. For instance, a high win rate but low average profit per trade might indicate you’re taking too many small profits, while a low win rate but high average profit suggests you’re potentially over-leveraging and risking too much on each trade.

Understanding these nuances is crucial for refining your strategy.

Sample Performance Report

Let’s imagine a week of demo trading. Here’s a simplified report illustrating how you might organize and interpret your data:

| Trade Date | Currency Pair | Profit/Loss (USD) | Notes |

|---|---|---|---|

| 2024-10-27 | EUR/USD | +15.50 | Successful breakout trade; good risk management |

| 2024-10-28 | GBP/USD | -8.00 | Entered trade too late; stop-loss triggered |

| 2024-10-29 | USD/JPY | +22.00 | Excellent entry point; news event played out as expected |

| 2024-10-30 | AUD/USD | -12.75 | Poor risk/reward ratio; emotional trading |

This simple table provides a snapshot of your performance. By consistently tracking your trades in a similar manner, you can easily identify recurring patterns, both positive and negative. The “Notes” column is particularly important; it allows you to record your thought process for each trade, which is invaluable for future analysis. Remember, consistency is key to improving your trading.

Ending Remarks

So there you have it! You’ve successfully navigated the thrilling world of Questrade’s demo account. You’re now armed with the knowledge to practice your forex trading strategies without the stomach-churning fear of real-world losses. Remember, practice makes perfect, and even the most seasoned traders started somewhere. Go forth, experiment, and may your virtual profits be plentiful!