The best currency trading apps with advanced features aren’t just about buying and selling; they’re about wielding the power of financial markets with finesse. This isn’t your grandpappy’s piggy bank; we’re talking sophisticated charting tools, real-time data streams that are faster than a caffeinated cheetah, and enough technical indicators to make a meteorologist jealous. Forget staring blankly at spreadsheets – these apps transform forex and crypto trading into a sleek, intuitive experience, even if your knowledge of finance is currently limited to knowing that money is good.

We’ll delve into the exciting world of advanced features, comparing top contenders based on their charting prowess, order execution speed, and security measures (because protecting your hard-earned cash is paramount). We’ll also explore the often-overlooked aspects: user experience, cost structures, and the all-important regulatory compliance. Get ready to level up your trading game!

Introduction to Currency Trading Apps

The world of currency trading, once the exclusive domain of suited-and-booted brokers shouting orders across bustling trading floors, is now readily accessible through the sleek interface of a smartphone. The currency trading app market is booming, offering everything from simple platforms for casual dabblers to sophisticated tools for seasoned professionals. Think of it as the democratization of finance – but with potentially significantly higher stakes.

This explosion of apps reflects a growing interest in forex and cryptocurrency trading, leading to a diverse range of options catering to various levels of experience and investment strategies.The key difference between advanced and basic currency trading apps lies in their feature sets. Basic apps often offer limited charting capabilities, basic order types, and perhaps a smattering of market news.

Advanced apps, however, are powerhouses of information and analytical tools. They boast advanced charting packages with multiple indicators, a wider range of order types (including stop-loss and limit orders, crucial for risk management), real-time market data feeds, automated trading bots, and often integrated educational resources. Think of the difference between a bicycle and a Formula 1 car – both get you from point A to point B, but the experience and capabilities are vastly different.

Types of Currency Trading Apps

The currency trading app landscape is diverse, with apps specializing in specific markets or offering a more holistic approach. Some focus solely on forex (foreign exchange), allowing users to trade traditional currencies like USD, EUR, GBP, and JPY. Others specialize in cryptocurrency trading, providing access to Bitcoin, Ethereum, and a host of altcoins. A growing number of apps, however, offer both forex and crypto trading within a single platform, providing a convenient one-stop shop for diversified portfolios.

For example, an app might allow you to trade the EUR/USD pair alongside Bitcoin and Ripple, all from the same interface. This multi-asset approach is particularly attractive to traders who want to spread their risk across different markets. The key here is to find an app that aligns with your specific trading needs and risk tolerance. Choosing an app that’s too basic might limit your strategies, while an overly complex app could overwhelm a novice trader.

Mastering the best currency trading apps with advanced features requires nerves of steel – almost as much as watching your favorite team, especially when you need a quick break to check the latest football news. But hey, even the most dramatic penalty shootout can’t compare to the thrill (and potential profit!) of a well-timed trade using those sophisticated app features.

So, back to conquering those currency markets!

Top Features of Advanced Currency Trading Apps

So, you’ve decided to dive into the thrilling (and sometimes terrifying) world of currency trading. Smart move! But navigating this wild market requires more than just a lucky hunch and a caffeine IV drip. You need the right tools, and that’s where advanced currency trading apps come in – think of them as your trusty Sherpas guiding you up Mount Forex.

These aren’t your grandpappy’s calculator apps; these are sophisticated platforms packed with features designed to help you make informed decisions (and hopefully, some serious profit).Advanced currency trading apps offer a range of features that go far beyond the basics, providing traders with the tools they need to analyze markets, execute trades, and manage risk effectively. The right app can be the difference between a successful trade and a trading disaster – think of it as the difference between a seasoned mountaineer with top-of-the-line gear and someone attempting Everest in flip-flops.

Advanced Charting Tools and Technical Indicators

Advanced charting tools are the bread and butter of technical analysis. Imagine them as high-powered microscopes allowing you to scrutinize the intricate dance of currency prices. These tools go beyond simple line graphs, offering a multitude of chart types (candlestick, bar, line, etc.), customizable timeframes, and drawing tools (Fibonacci retracements, trend lines, support/resistance levels). Technical indicators, on the other hand, are like your trusty trading sidekicks, crunching vast amounts of data to provide insights into market momentum, volatility, and potential price reversals.

Popular indicators include the Relative Strength Index (RSI), Moving Averages (MA), and the MACD (Moving Average Convergence Divergence). By combining the visual representation of charts with the quantitative insights of indicators, traders can identify potential trading opportunities and manage risk more effectively. For example, a bearish divergence between price and RSI might signal a potential price drop, allowing traders to adjust their positions accordingly.

Real-Time Market Data and News Feeds

In the fast-paced world of currency trading, information is king. Real-time market data and news feeds are crucial for staying ahead of the curve. Imagine trying to navigate a busy highway blindfolded – not a good idea! Real-time data ensures you’re always working with the most up-to-date price information, preventing costly delays or missed opportunities. News feeds provide instant access to breaking economic news, political events, and central bank announcements – all of which can significantly impact currency values.

A sudden interest rate hike by the Federal Reserve? You’ll know about it instantly, allowing you to react swiftly and potentially capitalize on the market’s response.

Comparison of Currency Trading Apps

The following table compares five popular currency trading apps based on key features. Remember, the “best” app depends heavily on individual trading styles and preferences.

| App Name | Charting Capabilities | Order Execution Speed | Available Indicators |

|---|---|---|---|

| MetaTrader 4 (MT4) | Extensive, customizable charts; multiple chart types and timeframes | Generally fast, but can vary depending on market conditions | Wide range, including popular technical indicators and custom indicators |

| MetaTrader 5 (MT5) | Similar to MT4, with added features and improvements | Generally fast, improved compared to MT4 | Even wider range than MT4, including more advanced indicators |

| TradingView | Highly customizable charts with advanced drawing tools and social features | Not a brokerage, so execution speed depends on the connected broker | Vast library of technical indicators, including many custom indicators |

| cTrader | Clean interface, customizable charts with good range of indicators | Known for fast execution speeds | Good selection of technical indicators |

| Thinkorswim | Powerful charting tools with advanced analytics and backtesting capabilities | Generally fast execution | Comprehensive suite of technical indicators and analysis tools |

Security Features

Security should be your top priority when choosing a currency trading app. Your hard-earned money is at stake! Two-factor authentication (2FA) adds an extra layer of security, requiring a second verification step beyond your password. This significantly reduces the risk of unauthorized access. Encryption protects your data during transmission and storage, preventing hackers from intercepting sensitive information like your account details and trading activity.

Look for apps that utilize robust encryption protocols like SSL/TLS. Think of these security measures as the unbreakable vault protecting your trading fortune from nefarious digital bandits.

App-Specific Advanced Features: The Best Currency Trading Apps With Advanced Features

So, you’ve mastered the basics of currency trading apps, eh? Think you’re ready for the big leagues? Buckle up, buttercup, because we’re diving headfirst into the world of advanced features – the stuff that separates the casual traders from the… well, slightly less casual traders. We’ll be comparing and contrasting some of the more sophisticated tools available, because let’s face it, knowing

- how* to use a stop-loss order is one thing, knowing

- which* app offers the most intuitive implementation is quite another.

This section will illuminate the unique advanced features offered by different currency trading apps, exploring how these features can be used effectively and comparing their advantages and disadvantages. We will also explore the educational resources available to support traders in mastering these tools. Think of it as your advanced trading boot camp – minus the grueling physical training.

Advanced Order Types: A Comparative Analysis

Let’s talk order types. Stop-loss orders, limit orders, trailing stops – they sound like something out of a spy thriller, but they’re actually your best friends in the volatile world of forex. Different apps offer slightly different takes on these, so understanding the nuances is key. For instance, some apps might allow you to set a stop-loss order based on a percentage change in the price, while others might require a specific price point.

Similarly, the implementation of trailing stops can vary, with some apps offering more customization options than others. A key difference lies in the user interface; some apps present this information clearly and concisely, while others can feel cluttered and confusing. Choosing the right app depends on your personal preference and trading style. Imagine one app displaying these order types like a beautifully organized spreadsheet, while another resembles a chaotic jumble of numbers – your choice will influence your trading experience significantly.

So you’re hunting for the best currency trading apps with advanced features? Before you dive into the digital forex world, it’s wise to check out the brick-and-mortar options – you might find a hidden gem! For example, consider exploring the landscape of Forex brokers in Sherbrooke, Quebec: comparison and reviews , then return to your app hunt armed with valuable insights, ready to conquer the currency markets with your newfound knowledge and the perfect app!

Using Automated Trading Bots: A Step-by-Step Guide

Automated trading bots, also known as forex robots, are programs that execute trades automatically based on pre-programmed rules. Think of them as your tireless, caffeine-fueled trading assistants. While they can be incredibly powerful, it’s crucial to understand how they work before unleashing them on the market. Let’s take a hypothetical example using a popular app (names will be omitted to avoid endorsing any specific platform, but let’s call it “TradeBot 5000”).

Step 1: Defining Trading Strategy: First, you need a clear trading strategy. This involves specifying the currency pairs, technical indicators, and risk parameters the bot will use. For instance, you might program TradeBot 5000 to buy EUR/USD when the Relative Strength Index (RSI) falls below 30 and sell when it rises above 70, while also setting a stop-loss of 2%. Step 2: Backtesting: Before deploying your bot, it’s essential to backtest it on historical data.

This allows you to see how it would have performed in the past and identify potential weaknesses. TradeBot 5000, for example, might offer a robust backtesting environment that simulates different market conditions. Step 3: Paper Trading: Once you’re satisfied with the backtesting results, it’s recommended to use a paper trading account (a simulated account with virtual money) to test the bot in a live market environment without risking real capital.

Step 4: Live Trading: Finally, once you’re confident in your bot’s performance, you can deploy it for live trading. Remember to constantly monitor its performance and make adjustments as needed.

Algorithmic Trading: Pros and Cons

Before diving into the algorithmic trading waters, it’s wise to weigh the potential rewards against the inherent risks.The following points highlight the advantages and disadvantages of using algorithmic trading within different apps:

- Pros: Automation (24/7 trading), reduced emotional trading, potential for higher efficiency, backtesting capabilities, diversification across multiple assets.

- Cons: Complexity (requires technical expertise), potential for unexpected losses (bugs in algorithms, market volatility), reliance on technology (system failures), ongoing monitoring required, potential for overfitting (algorithm performs well on historical data but poorly in live trading).

Educational Resources: Level Up Your Trading Game

Many currency trading apps go beyond just providing a platform; they also offer valuable educational resources to help traders improve their skills. These resources often include tutorials, webinars, and educational materials covering various aspects of currency trading, from fundamental analysis to risk management. Some apps offer personalized learning paths tailored to individual skill levels, while others provide access to a vast library of articles and videos.

The quality and comprehensiveness of these resources vary significantly across different apps, so it’s worth investigating what’s available before committing to a particular platform. Think of it as choosing between a dusty old textbook and an interactive, engaging online course – your learning experience will be vastly different.

User Experience and Interface Design

Navigating the often-turbulent waters of currency trading requires more than just sharp instincts; it demands a user-friendly interface that doesn’t add to the stress. A clunky app can turn a potentially profitable trade into a frustrating, error-prone ordeal, leaving you feeling like you’ve just wrestled a greased piglet instead of conquered the forex market. The right app, however, can be your calm oasis in the trading storm.The impact of user-friendliness on trading efficiency and decision-making is profound.

So you’re hunting for the best currency trading apps with advanced features? Before you dive into the tech, though, you might want to check out the landscape of forex dealers – choosing the right one is crucial! That’s where a resource like Comparing top forex dealers in Canada comes in handy. Then, armed with that knowledge, you can confidently pick the perfect app to manage your newfound forex empire!

A well-designed interface allows traders to quickly access crucial information, execute trades swiftly, and monitor their positions without unnecessary cognitive load. This translates directly to better decision-making under pressure, reducing the risk of costly mistakes born from confusion or frustration. Think of it as the difference between using a finely tuned sports car and a rusty old jalopy – both might get you to your destination, but the experience (and speed!) will be vastly different.

Examples of Apps with Excellent User Interfaces, The best currency trading apps with advanced features

Several currency trading apps stand out for their intuitive design and ease of use. MetaTrader 4 (MT4), for example, is renowned for its customizability. While its initial appearance might seem somewhat dated, the extensive options for chart customization, indicator integration, and automated trading strategies make it incredibly powerful and adaptable to individual trading styles. The ability to tailor the interface to your specific needs is a key element of its success.

In contrast, TradingView, with its modern, sleek design and powerful charting capabilities, offers a visually appealing and highly functional experience. Its clean layout and intuitive navigation make it accessible to both beginners and experienced traders, allowing for quick analysis and seamless order execution. These examples showcase how different design philosophies can both achieve excellent usability.

So you’re hunting for the best currency trading apps with advanced features? Before you dive in, understanding the market nuances is key. To make informed decisions, check out this excellent resource explaining the crucial differences between FX spot trading and futures contracts: FX spot trading vs. futures contracts explained. Armed with this knowledge, you’ll be better equipped to choose an app that suits your trading style and conquer the forex world!

Ideal User Interface Design for a Currency Trading App

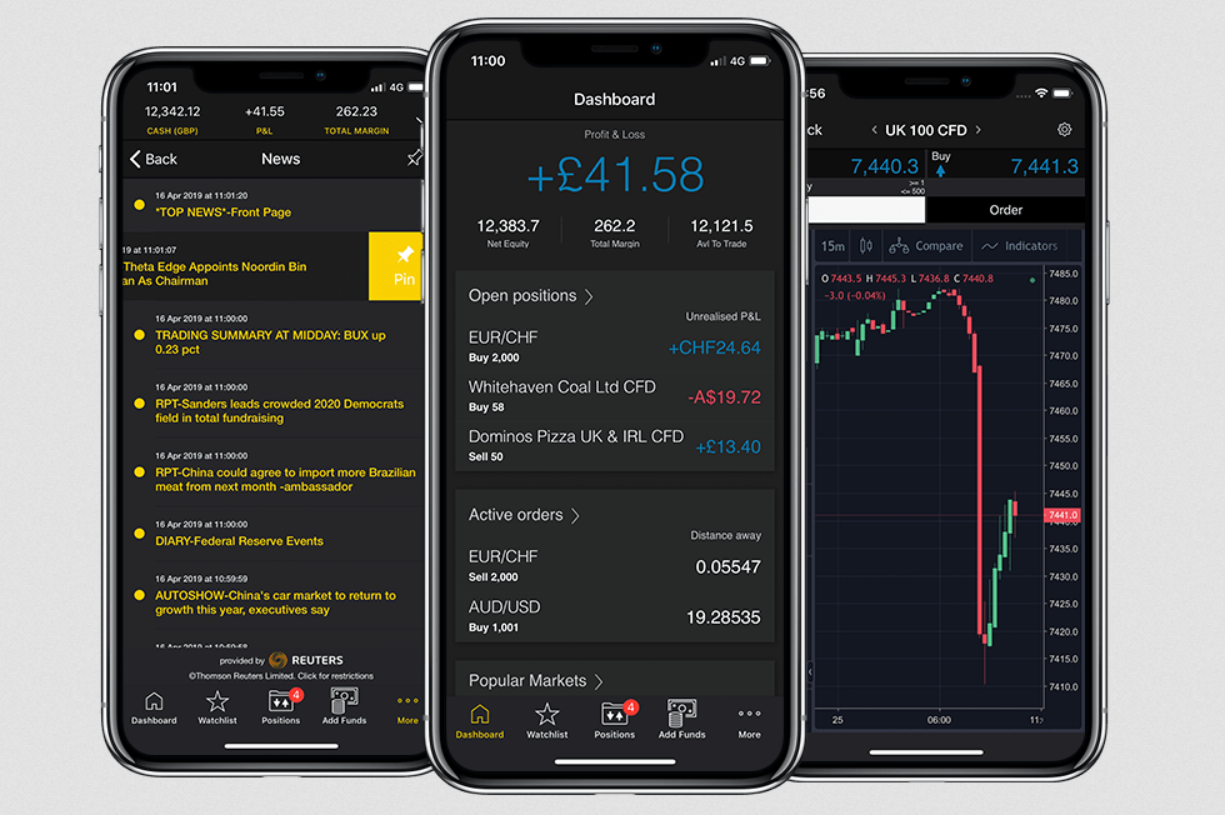

The ideal currency trading app interface should prioritize clarity and efficiency. Imagine a dashboard that displays key information at a glance: current exchange rates, open positions, profit/loss summaries, and upcoming economic events, all presented in a clean, uncluttered manner. Interactive charts with customizable timeframes and indicators are essential, allowing traders to analyze price movements and identify potential trading opportunities.

Order execution should be streamlined and straightforward, with clear confirmation screens to prevent accidental trades. The ability to easily manage alerts for price movements and news events is crucial for staying informed and reacting quickly to market changes. Think of it as a well-organized cockpit – everything within easy reach, clearly labeled, and designed for optimal performance.

Furthermore, a dark mode option would significantly improve the user experience for night trading, reducing eye strain and enhancing focus. Finally, robust security features and multi-factor authentication should be seamlessly integrated to protect user accounts and funds.

Cost and Fees Associated with Advanced Features

Let’s face it: trading apps aren’t always free. While some offer enticing features at first glance, the true cost often lurks beneath the surface, like a sneaky kraken in a digital ocean. Understanding the fee structure is crucial to maximizing your profits and avoiding those painful “where did my money go?” moments. This section dives into the murky depths of currency trading app fees, so you can navigate them like a seasoned captain.

Currency trading apps employ various pricing models, each with its own set of fees. These charges can significantly impact your bottom line, influencing your trading strategy and overall profitability. A seemingly small fee can quickly accumulate, especially with frequent trading. Therefore, meticulous comparison of fee structures is essential before committing to a specific platform.

Types of Fees

Several types of fees can apply to advanced features within currency trading apps. Understanding these is paramount to making informed decisions. Ignoring these costs can lead to significant losses over time, even negating any profits generated from successful trades.

Commissions are straightforward charges levied per trade. Spreads, the difference between the bid and ask price, are a more subtle cost that can significantly eat into profits over time, especially with high-frequency trading. Inactivity fees, surprisingly common, penalize users for not actively trading, a cruel twist for those who prefer a more measured approach. Finally, some apps charge fees for accessing specific advanced features, such as charting tools or real-time market data, adding another layer of complexity.

Hunting for the best currency trading apps with advanced features? You’ll want slick charting tools and real-time data, right? To get started, check out this amazing resource for finding Reliable forex trading apps for Android and iOS , because let’s face it, even the most advanced app is useless if it doesn’t work on your phone! Then, you can return to comparing the best currency trading apps with advanced features to find your perfect match.

Fee Comparison Across Different Apps

The following table compares the fees charged by five popular currency trading apps. Remember, these fees can change, so always verify the current rates directly with the app provider. This table provides a snapshot in time and should not be considered exhaustive or definitive.

| App Name | Commission (per trade) | Spread (typical) | Inactivity Fee | Advanced Feature Fees |

|---|---|---|---|---|

| TradeApp A | $0.00 | Variable, typically 1-2 pips | $10/month after 3 months of inactivity | Varies by feature, starting at $5/month |

| TradeApp B | $2.50 | Fixed, 2 pips | None | Included in subscription fee of $20/month |

| TradeApp C | $0.00 | Variable, typically 0.5-1.5 pips | $5/month after 6 months of inactivity | $10/month for advanced charting |

| TradeApp D | $1.00 | Variable, typically 1-3 pips | None | No additional fees for advanced features |

| TradeApp E | $0.00 | Variable, typically 0.8-2 pips | $20/quarter after 3 months of inactivity | Varies by feature, check app for details |

Impact of Fees on Profitability and Trading Strategies

High fees can significantly reduce your trading profits, sometimes even leading to losses. For example, a trader making 100 trades per month with a $2.50 commission per trade would pay $250 in commissions alone, a considerable sum. This can drastically alter your trading strategy; you might opt for fewer, larger trades to minimize commission costs, or adjust your risk tolerance to account for these added expenses.

The choice of app, therefore, directly impacts your trading approach and potential for success. Careful consideration of fees is paramount to developing a sustainable and profitable trading strategy.

Regulatory Compliance and Security

Navigating the world of currency trading apps requires more than just a sharp eye for market trends; it demands a keen awareness of the regulatory landscape and the security measures in place to protect your hard-earned cash. Choosing the right app means understanding the rules of the game and ensuring your money and data are safe from prying eyes and unscrupulous actors.

Let’s delve into the crucial aspects of regulatory compliance and security in the exciting, yet sometimes perilous, realm of currency trading apps.The regulatory bodies overseeing currency trading apps vary significantly depending on your geographical location. This isn’t a one-size-fits-all situation; what’s considered acceptable in London might be strictly prohibited in Tokyo. Understanding the specific regulations in your jurisdiction is paramount to ensuring you’re trading within the legal framework and protecting yourself from potential scams.

Failure to do so can lead to significant financial losses and legal ramifications.

Regulatory Bodies and Jurisdictions

The regulatory landscape for currency trading apps is complex and fragmented. For example, in the United States, the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA) play key roles in overseeing futures and options trading, while the Securities and Exchange Commission (SEC) regulates securities trading. In the United Kingdom, the Financial Conduct Authority (FCA) is the primary regulatory body, setting standards for brokers and protecting consumers.

The European Union has its own regulatory framework under the Markets in Financial Instruments Directive (MiFID II), while other jurisdictions like Australia (ASIC), Japan (FSA), and Singapore (MAS) have their own independent regulatory bodies with specific rules and guidelines. It’s essential to research the specific regulatory body in your region before selecting a currency trading app.

Importance of Choosing a Regulated Broker and App

Selecting a regulated broker and app is akin to choosing a well-guarded fortress over a ramshackle hut in a warzone. A regulated broker is subject to strict oversight, ensuring they adhere to specific standards regarding client funds segregation, transparency, and operational integrity. This means your money is more likely to be protected from unauthorized access or misuse. Unregulated brokers, on the other hand, operate in a legal grey area, often lacking the safeguards necessary to protect your investments.

They might vanish overnight with your funds, leaving you with nothing but regret and a hefty lesson learned. Think of it as the difference between a bank with FDIC insurance and a back-alley money lender. The choice is clear.

Security Measures Employed by Reputable Apps

Reputable currency trading apps employ a robust arsenal of security measures to protect user data and funds. These typically include encryption protocols (like SSL/TLS) to safeguard data transmitted between your device and the app’s servers, multi-factor authentication (MFA) to add an extra layer of security to your account login, and robust firewalls to prevent unauthorized access. Many reputable apps also utilize advanced fraud detection systems that monitor transactions for suspicious activity, alerting both the app and the user to potential threats.

Think of it as a sophisticated security system for your digital wallet, constantly vigilant and ready to repel intruders.

Hunting for the best currency trading apps with advanced features? Before you dive in headfirst, understanding the nitty-gritty of forex fees is crucial. Check out this breakdown of Questrade forex fees and commission structure explained to avoid any nasty surprises. Armed with this knowledge, you can confidently choose the app that best suits your trading style and budget, maximizing your profits (and minimizing your losses, naturally!).

Potential Risks Associated with Using Unregulated Apps

Using unregulated apps is like walking a tightrope without a net. The risks are substantial and include the possibility of fraud, identity theft, loss of funds due to lack of regulatory oversight, and exposure to manipulative trading practices. Unregulated brokers are not bound by the same rules and regulations as their regulated counterparts, leaving you vulnerable to scams and exploitation.

There’s no guarantee your funds are safe, your data is secure, or that the platform operates fairly. The potential for financial ruin is significantly higher when dealing with unregulated entities. Consider it a high-stakes gamble with odds heavily stacked against you.

Illustrative Examples of Advanced Features in Action

Let’s ditch the dry theory and dive into some real-world scenarios where advanced currency trading app features become your secret weapon (shhh…don’t tell anyone!). We’ll explore how these features can transform your trading experience, turning potential losses into profitable wins. Prepare for some seriously illuminating examples!

Technical Analysis Leading to Profitable Trades

Imagine you’re trading EUR/USD. Your app boasts a sophisticated charting package, displaying a candlestick chart with multiple overlaid technical indicators. The Relative Strength Index (RSI) is colored a vibrant green, hovering comfortably above 30, suggesting the pair is not oversold. Simultaneously, a moving average crossover – beautifully rendered in a contrasting blue and orange – indicates a potential bullish trend.

The chart’s background subtly shifts to a calming green as the price approaches a key support level, visually reinforcing the positive signals. You spot a clear “buy” signal, and based on this confluence of technical indicators and visual cues, you execute a long position, which, thanks to the accurate predictions based on the visual representation, proves highly profitable.

The app’s alert system even notifies you of your profit target being reached, allowing you to exit the trade at the optimal moment.

Risk Management Limiting Potential Losses

This time, you’re eyeing GBP/JPY, but you’re feeling a bit cautious. Your app’s risk management tools are your best friends here. You set a stop-loss order, visually represented as a bright red horizontal line on your chart, well below your entry price. This stop-loss, clearly visible on the candlestick chart, ensures your potential losses are capped. The app also allows you to set a take-profit order, shown as a crisp green line above your entry price, helping to lock in profits once your desired target is reached.

Let’s say the market takes an unexpected turn, plummeting downwards. Your stop-loss order automatically triggers, limiting your losses to a predetermined amount. This prevents a potentially devastating loss and protects your trading capital, all thanks to a clear, color-coded visual representation of your risk management strategy. The post-trade analysis features then clearly show the efficacy of your risk management strategy, highlighting how it prevented substantial losses.

Automated Trading Strategies Boosting Efficiency

Now, picture this: You’re juggling a busy schedule but still want to capitalize on market opportunities. Your app offers automated trading strategies (bots), allowing you to set predefined rules based on technical indicators. You create a simple strategy, visualizing it through a flowchart within the app, that automatically executes trades when specific conditions are met. For example, you might set it to buy when the RSI crosses above 70 and sell when it falls below 30.

The app’s backtesting feature allows you to test this strategy against historical data, displaying the results in a clear, concise table showing potential profits and losses. Then, you activate the bot, and it diligently executes trades according to your predetermined rules, even while you’re busy with other things. The app provides a real-time dashboard displaying the bot’s performance, using a color-coded system to indicate whether trades are profitable or losing, enabling you to monitor and adjust the strategy as needed.

Conclusion

So, there you have it – a whirlwind tour of the best currency trading apps with advanced features. Remember, choosing the right app is a personal journey, dependent on your trading style, risk tolerance, and the specific markets you want to conquer. While advanced features offer incredible potential, always prioritize security, understand the associated fees, and remember that even the most sophisticated tools can’t guarantee riches (unless you’re exceptionally lucky, in which case, buy us a drink!).

Happy trading!