Top 10 day trading stocks for beginners in 2024? Think of it as a thrilling treasure hunt, but instead of X marking the spot, it’s a ticker symbol promising (maybe) riches beyond your wildest dreams (or potentially, a slightly less wild, yet still disappointing, reality). This isn’t your grandma’s knitting circle; this is the wild west of finance, where fortunes are made and lost faster than you can say “margin call.” Buckle up, buttercup, because we’re about to dive headfirst into the exhilarating (and potentially terrifying) world of day trading.

This guide will equip you with the knowledge to navigate the choppy waters of the stock market. We’ll explore the best stocks for newbie day traders in 2024, arm you with essential strategies, and even sprinkle in some much-needed humor to keep you sane amidst the market’s inevitable ups and downs. Remember, though: while we’re aiming for riches, responsible risk management is your trusty steed in this wild ride.

Introduction to Day Trading for Beginners in 2024

Day trading, in its simplest form, is the practice of buying and selling financial instruments—like stocks, futures, or forex—within the same trading day. Think of it as a high-stakes game of financial musical chairs, where you’re trying to hop from one asset to another before the music stops (and the price plummets). It’s a fast-paced, adrenaline-fueled world, and definitely not for the faint of heart.Day trading offers the potential for significant profits, but it also carries immense risks.

The fast-paced nature of the market means that even small miscalculations can lead to substantial losses. Imagine a rollercoaster that goes both up and down incredibly quickly; that’s the day trading experience. You could make a killing in minutes, or lose your shirt just as rapidly. Success requires a unique blend of market knowledge, discipline, and a hefty dose of luck.

It’s crucial to remember that consistent profitability is exceptionally rare, and many day traders lose money.

Risks and Rewards of Day Trading

The allure of quick riches is a powerful magnet for many aspiring day traders. The potential for high returns is certainly a key attraction. However, it’s essential to understand that these potential rewards are inextricably linked to substantial risks. The leverage often used in day trading can amplify both profits and losses exponentially. A small percentage move against your position can result in a significant loss, potentially wiping out your entire trading account.

For instance, a 1% drop in a leveraged position can lead to a 10% loss if you’re using 10x leverage. The emotional toll can also be significant; the constant pressure of making quick decisions and managing risk can be incredibly stressful. Many successful day traders will emphasize the importance of managing emotions and sticking to a well-defined trading plan.

Essential Resources for Beginner Day Traders

Before you even think about jumping into the shark-infested waters of the day trading market, arming yourself with knowledge is paramount. There’s a wealth of information available, but sifting through it can be overwhelming. Here are a few resources to help you navigate this learning curve:

A solid foundation is crucial before you start risking your hard-earned money. These resources offer various approaches to learning, from structured courses to self-guided learning.

- Books: “How to Make Money in Stocks” by William J. O’Neil, “Mastering the Trade” by Michael S. Jenkins, “Japanese Candlestick Charting Techniques” by Steve Nison.

- Websites: Investopedia (for general financial knowledge), TradingView (for charting and technical analysis), and reputable brokerage websites often provide educational materials.

- Courses: Many online platforms offer day trading courses, but it’s crucial to choose reputable ones with a proven track record. Always be wary of get-rich-quick schemes.

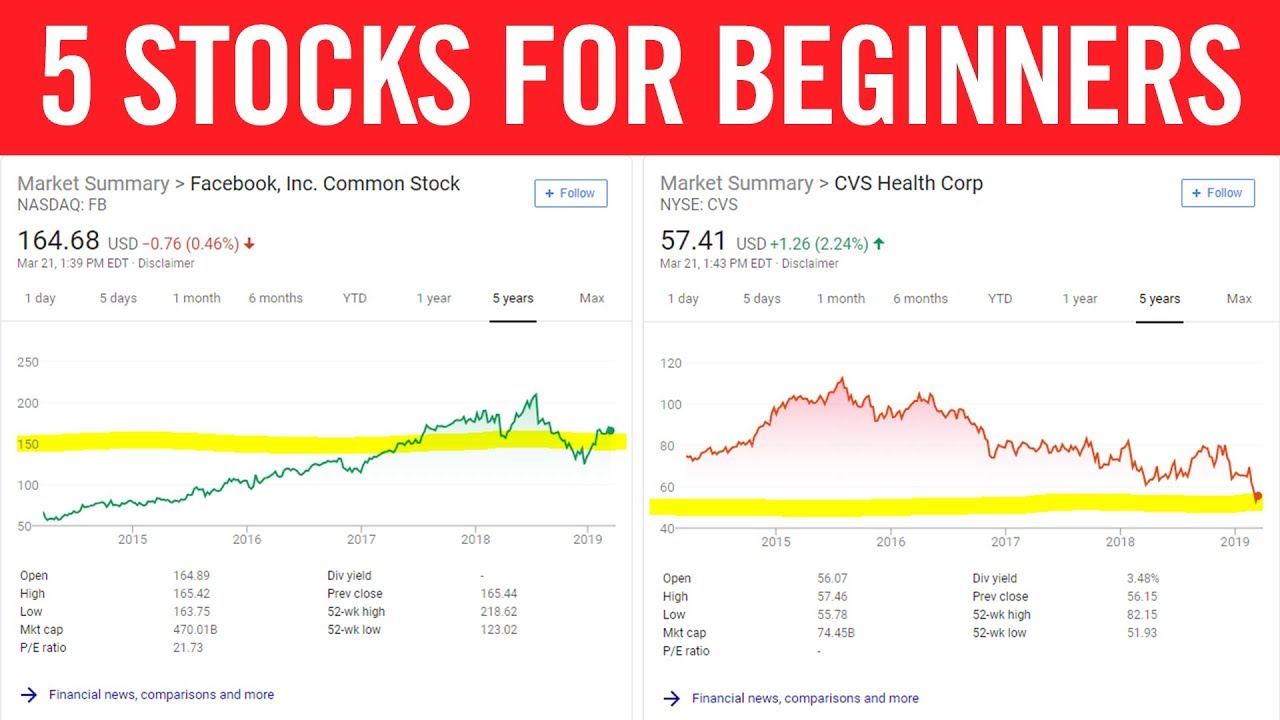

Identifying Top 10 Stocks Suitable for Beginners: Top 10 Day Trading Stocks For Beginners In 2024

So, you’re ready to dive into the thrilling (and sometimes terrifying) world of day trading? Fantastic! But before you leap into the market like a caffeinated kangaroo, remember that choosing the right stocks is crucial. Think of it like choosing your weapon in a video game – a rusty spoon isn’t going to cut it against a dragon.

We’re going to arm you with some solid, beginner-friendly stock picks.Picking stocks for day trading is a bit like picking the perfect avocado – you want it ripe enough to be exciting, but not so overripe that it’s mush. We need stocks with enough movement to make a profit, but not so volatile they’ll give you a heart attack. This means considering factors like liquidity (how easily you can buy and sell), volatility (how much the price swings), and market capitalization (the total value of the company’s stock).

Stock Selection Criteria for Beginners

The selection of these 10 stocks prioritizes liquidity, moderate volatility, and a relatively large market capitalization. High liquidity ensures easy entry and exit from positions, minimizing slippage (the difference between the expected price and the actual execution price). Moderate volatility offers opportunities for profit without the excessive risk associated with highly volatile stocks. A larger market capitalization generally indicates greater stability and lower risk compared to smaller companies.

It’s important to remember that even with these criteria, day trading involves inherent risk.

Top 10 Day Trading Stocks for Beginners (2024)

| Stock Symbol | Company Name | Sector | Brief Description |

|---|---|---|---|

| AAPL | Apple Inc. | Technology | A tech giant with consistently high trading volume and moderate daily price fluctuations. |

| MSFT | Microsoft Corp. | Technology | Another tech behemoth, known for its stability and substantial trading volume. |

| AMZN | Amazon.com Inc. | Consumer Discretionary | E-commerce giant; high volume, but can be more volatile than AAPL or MSFT. |

| GOOGL | Alphabet Inc. (Google) | Technology | A dominant player in the tech sector, offering substantial liquidity and moderate volatility. |

| NVDA | NVIDIA Corp. | Technology | A semiconductor company experiencing significant growth, leading to higher volatility. |

| TSLA | Tesla Inc. | Consumer Discretionary | Electric vehicle manufacturer; known for its high volatility, but also high trading volume. |

| JPM | JPMorgan Chase & Co. | Financials | A major financial institution; generally less volatile than tech stocks. |

| BAC | Bank of America Corp. | Financials | Another large financial institution; similar characteristics to JPM. |

| DIS | Walt Disney Co. | Communication Services | A media and entertainment giant; moderate volatility and high liquidity. |

| NFLX | Netflix Inc. | Communication Services | Streaming giant; can experience periods of higher volatility depending on earnings reports and other news. |

Factors to Consider When Evaluating Stock Suitability for Day Trading

Beyond liquidity, volatility, and market capitalization, several other factors influence a stock’s suitability for day trading. These include:* Trading Volume: High volume ensures you can easily buy and sell shares without significantly impacting the price. Low volume can lead to slippage and difficulty exiting trades.

News and Events

Major news announcements, earnings reports, and other events can dramatically impact a stock’s price, creating both opportunities and risks. Being aware of the news calendar is essential.

Chart Patterns

Analyzing price charts can help identify potential trading opportunities and trends. Understanding technical analysis is a valuable skill for day traders.

Your Risk Tolerance

Day trading is inherently risky. Choose stocks that align with your comfort level and risk appetite. Don’t invest more than you can afford to lose.

Understanding Stock Market Dynamics for Day Trading

Day trading, the thrilling rollercoaster of buying and selling stocks within the same day, is heavily influenced by the ever-shifting sands of the market. Think of it like surfing – you need to understand the waves (market dynamics) to ride them successfully, or risk getting wiped out. This section will explore the key forces shaping your day trading decisions.Market news and events act as powerful catalysts, sending ripples – sometimes tsunamis – through the stock market.

A surprise interest rate hike, a major company announcing unexpectedly stellar (or disastrous) earnings, or even a geopolitical event halfway across the globe can dramatically alter stock prices in a matter of minutes. Understanding the potential impact of these events is crucial for navigating the daily chaos. For example, a positive earnings report from a tech giant could send its stock soaring, while negative news about a specific industry could trigger a widespread sell-off.

Successful day traders are masters of anticipating and reacting to these shifts.

The Role of Technical Analysis in Day Trading Decisions

Technical analysis is the day trader’s secret weapon, a method of evaluating investments by analyzing statistics generated by market activity, such as past prices and volume. It focuses on chart patterns and indicators to predict future price movements, essentially trying to decipher the market’s language. Instead of relying solely on fundamental analysis (evaluating a company’s financial health), technical analysts look for clues in the price action itself.

They believe that the market price already reflects all available information, making past price movements a reliable predictor of future trends. This approach allows day traders to identify potential entry and exit points with greater precision, optimizing their trading strategies.

Common Technical Indicators Used by Day Traders, Top 10 day trading stocks for beginners in 2024

Technical indicators provide visual cues on charts, helping day traders identify potential trading opportunities. These indicators are mathematical calculations based on historical price and volume data. While no indicator is foolproof, they offer valuable insights when used in conjunction with other analytical tools and risk management strategies.

- Moving Averages: These smooth out price fluctuations, highlighting underlying trends. A common example is the 50-day moving average, often used to identify support and resistance levels. Imagine it like a rolling average of the stock’s price over the past 50 days, providing a smoother picture of the trend than the raw daily price data. A break above the 50-day moving average might signal a bullish trend, while a break below could indicate bearish pressure.

- Relative Strength Index (RSI): This indicator measures the magnitude of recent price changes to evaluate overbought or oversold conditions. RSI values typically range from 0 to 100. Readings above 70 often suggest the stock is overbought (potentially ripe for a price correction), while readings below 30 might indicate it’s oversold (potentially ready for a bounce). Think of it as a gauge of momentum; high RSI suggests a strong upward trend that might be unsustainable, and low RSI might signal a trend reversal.

- Moving Average Convergence Divergence (MACD): This indicator uses moving averages to identify changes in momentum. It consists of two lines: the MACD line and the signal line. Crossovers between these lines can signal potential buy or sell signals. When the MACD line crosses above the signal line, it might suggest a bullish signal, while a crossover below might indicate a bearish signal.

This is a more complex indicator, often used in conjunction with other indicators to confirm potential trading opportunities.

Developing a Day Trading Strategy

Day trading, while potentially lucrative, is a high-risk endeavor. Think of it like a high-stakes poker game – you need a solid strategy, nerves of steel, and a healthy dose of luck. A well-defined day trading strategy is your lifeline, helping you navigate the volatile waters of the stock market and, hopefully, emerge victorious. It’s not about gambling; it’s about calculated risk-taking.A successful day trading strategy combines market analysis, technical indicators, risk management, and, importantly, your own psychological fortitude.

It’s a personalized plan, tailored to your risk tolerance, trading style, and available time. Remember, there’s no one-size-fits-all approach. What works for a seasoned trader might be disastrous for a beginner.

Sample Day Trading Strategy for Beginners

This sample strategy focuses on a simple, low-risk approach suitable for beginners. It emphasizes identifying clear entry and exit points, minimizing losses, and building confidence. We’ll use a hypothetical stock, “Acme Corp” (ACM), for illustrative purposes.First, identify a stock with relatively high liquidity and consistent daily price fluctuations. ACM, for example, might show consistent price movement within a predictable range.

Next, utilize a simple moving average (SMA) crossover strategy. We’ll use a 10-period and a 20-period SMA. When the 10-period SMA crosses above the 20-period SMA, it’s a potential buy signal. Conversely, a crossover below signals a potential sell.Always set a stop-loss order. For ACM, let’s say you buy at $50.

A stop-loss order at $48 would limit your potential loss to $2 per share. Similarly, set a take-profit order, perhaps at $53, locking in a $3 profit. This limits risk and secures profits. Remember to adjust these levels based on your risk tolerance and the stock’s volatility. This is a simplified example; real-world scenarios require more detailed analysis.

Different Day Trading Strategies

Choosing the right strategy is crucial for success. Different strategies suit different traders based on their risk appetite, time commitment, and trading style.

- Scalping: This high-frequency strategy aims for small profits on numerous trades throughout the day. It requires quick decision-making and a deep understanding of market microstructure. Think of it as snatching pennies from the sidewalk. High volume and low risk per trade are key.

- Swing Trading: This strategy holds positions for a few days or even weeks, capitalizing on short-term price swings. It’s less demanding than scalping, requiring less constant monitoring. Think of it as catching a wave rather than picking up pennies.

- Momentum Trading: This strategy identifies stocks with strong upward or downward momentum and rides the wave. It relies on identifying trends and acting quickly. Think of it as surfing a big wave – exciting, but potentially risky if you wipe out.

Importance of Position Sizing and Stop-Loss Orders

Position sizing determines how many shares you buy. It’s crucial for risk management. Never risk more than a small percentage (e.g., 1-2%) of your trading capital on any single trade. This prevents a single losing trade from wiping out your account.Stop-loss orders automatically sell your shares when the price drops to a predetermined level, limiting potential losses. They are your safety net, preventing catastrophic losses.

Think of them as your parachute in a skydiving analogy. Always use them. It’s not a question of

- if* you’ll need them, but

- when*.

Never risk more than you can afford to lose. This is the golden rule of trading.

Essential Tools and Resources for Day Trading

Day trading, while potentially lucrative, requires the right tools and a strategic approach. Think of it like a Formula 1 race: you need a top-notch car (brokerage), a detailed map (market data), and a pit crew (reliable news sources) to even stand a chance. Without these essential components, you’re more likely to end up in the ditch than on the podium.

This section will equip you with the knowledge to build your own high-performance day trading pit crew.

Success in day trading hinges on access to real-time information and efficient execution. The right tools can significantly impact your ability to make informed decisions and act quickly. Choosing the wrong ones, however, can lead to costly mistakes and missed opportunities. Consider your tools as your secret weapons in the daily stock market battle.

Brokerage Platforms

Choosing a brokerage is like choosing a trusty steed for your trading journey. Different platforms cater to different needs and skill levels. Some excel in user-friendliness, perfect for beginners, while others offer advanced charting tools and analytics for seasoned professionals. Fees, account minimums, and the availability of educational resources also play crucial roles in your decision.

For instance, Interactive Brokers offers a wide array of tools and a robust platform, but it might be overwhelming for beginners. On the other hand, Robinhood, with its user-friendly interface and commission-free trades, is a popular choice for those starting out. However, Robinhood’s limited charting capabilities might become a drawback as your skills develop. TD Ameritrade provides a solid middle ground, offering a balance of user-friendliness and advanced features.

Carefully weigh the pros and cons before making your choice.

Charting Software

Charting software is your crystal ball, providing visual representations of price movements and trends. It allows you to identify patterns, support and resistance levels, and potential trading opportunities. Features like technical indicators, drawing tools, and customizable layouts are essential.

Popular charting software options include TradingView (known for its community features and vast array of indicators), Thinkorswim (TD Ameritrade’s powerful platform), and MetaTrader 4 (MT4) – a versatile platform favored by forex traders but also suitable for stocks. The best choice depends on your personal preferences and the complexity of your trading strategies. Consider the ease of use, the available indicators, and the cost before selecting a platform.

News Sources and Market Data

Reliable news sources and market data are your lifeline, providing real-time updates on market-moving events. Staying informed about economic indicators, company announcements, and geopolitical events is crucial for making sound trading decisions. Consider a mix of reputable financial news outlets and specialized market data providers.

Examples include Bloomberg (a premium service known for its comprehensive data and analysis), Reuters (another major provider of financial news and data), and Yahoo Finance (a free, widely accessible source, though its data might lag behind premium services). Remember that speed is often key in day trading, so access to real-time, accurate information is paramount. Don’t rely solely on free sources; consider supplementing them with more reliable, real-time data providers if your budget allows.

So, you’re diving into the thrilling world of Top 10 day trading stocks for beginners in 2024? Remember, it’s a rollercoaster, much like the unpredictable nature of a crucial penalty shootout – need a break from the market action? Check out the latest football news for a dose of adrenaline. Then, get back to those stocks, because the market waits for no man (or his perfectly timed trade!).

Risk Management and Emotional Control in Day Trading

Day trading, while potentially lucrative, is a high-stakes game. Think of it as a thrilling rollercoaster – exhilarating highs and stomach-churning lows. To survive (and thrive!) on this rollercoaster, you absolutelyneed* a solid risk management plan and ironclad emotional control. Without them, even the best trading strategies can crumble under the weight of fear and greed.The importance of a well-defined risk management plan cannot be overstated.

It’s your safety net, your parachute, your escape hatch from the financial freefall. A well-structured plan protects your capital, minimizes potential losses, and allows you to weather market storms without capsizing your entire portfolio. It’s not about avoiding risk altogether – that’s impossible in day trading – but about intelligently managing it so it doesn’t sink your ship.

Stop-Loss Orders and Position Sizing

Stop-loss orders are your automatic life preservers. They’re pre-set instructions to sell a security once it reaches a specified price, limiting potential losses. Imagine you buy a stock at $10, and set a stop-loss at $9.50. If the price drops below $9.50, your order automatically sells, preventing further losses. Position sizing complements stop-loss orders.

It determines how much of your capital you allocate to each trade. Never bet the farm on a single trade! Diversify your investments across multiple stocks, limiting your exposure to any single risk. For example, instead of putting all your money into one stock, split it across 3-5 different stocks based on your risk tolerance and trading strategy.

Managing Emotional Biases

Fear and greed are the day trader’s arch-nemeses. Fear can cause you to sell too early, locking in small profits or even cutting losses too soon, missing out on potential gains. Greed, conversely, can lead to holding onto losing positions for too long, hoping for a miracle turnaround, ultimately exacerbating losses. To combat these biases, practice mindfulness. Take breaks, step away from the screen when emotions run high, and review your trading journal regularly to identify patterns in your emotional responses.

Develop a trading plan that prioritizes discipline over emotion, sticking to it regardless of market fluctuations.

Diversification and Risk Tolerance

Diversification is your portfolio’s best friend. Don’t put all your eggs in one basket. Spread your investments across different sectors and asset classes. This reduces the impact of any single investment performing poorly. Understanding your own risk tolerance is equally critical.

Are you a conservative investor comfortable with small, steady gains? Or are you more aggressive, willing to take on higher risks for potentially larger rewards? Your risk tolerance should guide your investment choices and position sizing. A good rule of thumb is to never invest more than you can afford to lose. Think of it like this: if a trade goes south, can you still afford groceries this month?

If not, you’ve likely taken on too much risk.

Paper Trading and Simulated Practice

Before you unleash your inner Gordon Gekko on the real stock market, it’s crucial to hone your skills in a risk-free environment. Think of paper trading as the stock market equivalent of practicing your free throws before the big game – except instead of sweat, you’ll be dealing with virtual profits (or losses!). It allows you to test your strategies, learn from mistakes, and build confidence without the financial sting of real-world losses.Paper trading, or simulated trading, lets you experience the thrill (and sometimes the terror) of day trading without risking a single penny of your hard-earned cash.

It’s like a high-tech trading simulator, mirroring real market conditions, allowing you to execute trades and observe their outcomes without any actual monetary consequences. This invaluable practice period helps refine your strategies, identify weaknesses in your approach, and develop the discipline necessary for success in the live market.

Setting Up a Paper Trading Account

Many brokerage firms offer paper trading accounts alongside their real money accounts. The process is typically straightforward: you’ll create an account (often using the same credentials as your real account, if you have one), select the paper trading option, and you’re ready to dive in. The platform will usually provide access to real-time market data, charting tools, and order placement functionalities, all mirroring the experience of live trading, but without the financial repercussions.

Some popular platforms even offer a virtual portfolio with a predetermined amount of virtual cash to start with, allowing for a realistic simulation of capital management. The key is to treat your paper trading account as if it were real; this approach helps you develop the necessary mental discipline and emotional control for real-world trading.

Testing and Refining Trading Strategies with Simulated Trading

Once your paper trading account is set up, you can start testing different strategies. Perhaps you’ve developed a system based on technical indicators like moving averages and RSI. Using your paper trading account, you can meticulously backtest this strategy, observing how it performs under various market conditions. You can also try different risk management techniques, such as setting stop-loss orders, to see how they affect your overall performance.

For instance, you might simulate a scenario where you use a stop-loss order at a 2% loss for each trade. By tracking your virtual profits and losses, you can identify the effectiveness of your risk management approach and adjust it accordingly. Remember, the goal is not just to make virtual money; it’s to refine your process, improve your decision-making, and identify areas for improvement before entering the live market.

The data you collect during paper trading provides invaluable insights that inform and improve your live trading strategies. Consider it a valuable investment in your trading education, paying dividends in the long run.

Legal and Regulatory Considerations

Day trading, while potentially lucrative, operates within a strict legal and regulatory framework. Ignoring these rules can lead to hefty fines, legal battles, and even criminal charges. Understanding the legal landscape is as crucial to successful day trading as mastering technical analysis. This section will illuminate the key legal and regulatory aspects you need to know before you even think about buying your first share.Day trading, unlike long-term investing, often involves frequent transactions, resulting in a higher volume of taxable events.

The tax implications can be complex, varying significantly depending on your location and trading activity. Failing to properly account for these implications can result in significant tax liabilities and potential penalties. It’s not just about the profits; losses also have tax implications that need careful consideration.

Tax Implications of Day Trading

The tax treatment of day trading profits and losses differs significantly from long-term capital gains. In many jurisdictions, day trading profits are taxed as ordinary income, subject to higher tax rates than long-term capital gains. Losses, however, can be used to offset other income, up to a certain limit, providing a valuable tax advantage. For example, if a day trader in the United States earns $50,000 in profits, this entire amount would be taxed as ordinary income, unlike long-term capital gains, which are often taxed at lower rates.

Accurate record-keeping is paramount; maintaining detailed transaction records, including dates, amounts, and security information, is crucial for accurate tax reporting. Consulting with a tax professional experienced in day trading is highly recommended to ensure compliance and maximize tax efficiency. Ignoring these complexities can lead to unexpected tax bills and potential legal repercussions.

Legal Risks Associated with Day Trading

Several legal risks are inherent in day trading. One significant risk involves insider trading, the illegal practice of trading securities based on non-public information. Even unintentional involvement can lead to severe penalties. Another risk stems from market manipulation, which includes activities designed to artificially inflate or deflate stock prices. Such actions are strictly prohibited and carry substantial legal consequences.

Furthermore, violations of securities laws, such as failing to disclose relevant information or engaging in fraudulent activities, can result in substantial fines and imprisonment. For instance, a day trader who spreads false information about a company to manipulate its stock price could face severe penalties, including significant fines and potential jail time. Always trade ethically and within the bounds of the law; ignorance is not a defense.

Regulatory Bodies and Compliance

Various regulatory bodies oversee day trading activities. In the United States, the Securities and Exchange Commission (SEC) is the primary regulator, enforcing federal securities laws and protecting investors. Other regulatory bodies may also be involved, depending on your location and the specific securities being traded. Staying informed about the regulations set forth by these bodies is crucial for compliance.

Failure to comply with these regulations can result in significant penalties, including fines, suspension of trading privileges, and even criminal charges. Understanding the rules and regulations governing day trading in your jurisdiction is not optional; it’s a non-negotiable requirement for responsible and legal trading.

Further Learning and Continuous Improvement

Day trading, my friend, isn’t a “set it and forget it” kind of gig. It’s a dynamic, ever-evolving landscape where continuous learning is not just beneficial – it’s absolutely essential for survival. Think of it like this: if you stopped learning after getting your driver’s license, you’d probably be a bit rusty, right? The market is similar; it constantly throws curveballs, and you need to be ready to swing.The market’s a fickle beast; what worked yesterday might be a disaster today.

Staying ahead of the curve requires dedication to ongoing education and the ability to adapt your strategies as market conditions change. This isn’t just about making more money; it’s about minimizing losses and preserving your capital. Think of it as investing in your own day-trading expertise – the best investment you’ll ever make.

Reputable Educational Resources

Numerous resources exist to bolster your day-trading knowledge. Choosing reliable sources is crucial to avoid misinformation and potentially costly mistakes. While some resources are free, others require a financial commitment. The value proposition of each should be carefully considered before investing time or money.

- Investopedia: This website offers a vast library of articles, tutorials, and educational resources covering various aspects of finance, including day trading. Their explanations are generally clear and accessible, making them perfect for beginners.

- TradingView: More than just a charting platform, TradingView provides educational content, including webinars and articles from experienced traders. It’s a great place to learn technical analysis and interact with a community of traders.

- Online Courses (Coursera, Udemy, edX): Reputable platforms like Coursera, Udemy, and edX offer structured courses on finance and trading, often taught by academics and industry professionals. Look for courses with high ratings and positive reviews.

- Books: Classic trading books remain invaluable resources. Look for books that focus on risk management, trading psychology, and specific trading strategies. Some popular choices include “How to Make Money in Stocks” by William J. O’Neil and “Japanese Candlestick Charting Techniques” by Steve Nison.

Strategies for Tracking Performance and Identifying Areas for Improvement

Tracking your performance is crucial for understanding your strengths and weaknesses. This isn’t just about looking at your profit and loss; it’s about analyzing your decision-making process and identifying patterns in your trading. Consider this: a mechanic wouldn’t fix a car without diagnosing the problem first, right? The same principle applies here.

Regularly reviewing your trading journal (which you

-should* be keeping!), noting your entry and exit points, reasons for trades, and the overall market conditions at the time, will help illuminate areas for improvement. Look for patterns in your winning and losing trades. Were there common factors that contributed to success or failure? Did you stick to your trading plan?

Identifying these patterns allows you to refine your strategy and avoid repeating mistakes. Quantitative analysis, such as calculating win rate, average profit/loss per trade, and maximum drawdown, can provide a more objective assessment of your performance.

The Importance of Continuous Learning and Adapting to Market Changes

The stock market is a living, breathing organism, constantly changing and adapting. Successful day traders understand this and make continuous learning a core part of their trading routine. Think of it as a martial arts master: they constantly refine their techniques, adapting to new challenges and opponents. The same principle applies to day trading.

“The market can stay irrational longer than you can stay solvent.”

John Maynard Keynes

Staying informed about economic news, geopolitical events, and market trends is crucial. Following reputable financial news sources, attending webinars, and participating in trading communities can help you stay ahead of the curve. Remember, adaptability is key to long-term success in this dynamic field. Rigid adherence to outdated strategies will likely lead to losses.

Closing Summary

So, there you have it – your crash course (pun intended!) in day trading for beginners in

2024. Remember, the stock market is a rollercoaster; there will be heart-stopping climbs and stomach-churning drops. But with careful planning, a dash of courage (and maybe a healthy dose of caffeine), you can navigate the twists and turns and hopefully, emerge victorious.

Don’t forget: paper trading is your best friend, and patience is your most valuable asset. Now go forth, young Padawan, and may the odds (and the market) be ever in your favor!