Top performing cryptocurrencies in Quebec: Forget maple syrup, eh? Quebec’s crypto scene is heating up faster than a poutine-fueled hockey game! This exploration dives into the frosty peaks and icy valleys of Quebec’s cryptocurrency landscape, uncovering the digital assets that are making waves (and maybe a few ripples) in the province. Get ready to discover which cryptos are reigning supreme, and why Quebec investors are betting big on the blockchain.

We’ll unravel the regulatory maze, explore the most popular digital currencies among Quebec’s savvy investors, and even peek into some clever investment strategies (and how to avoid becoming a digital snow bunny). We’ll also look at the potential economic impact of crypto in Quebec – will it fuel economic growth, or will it freeze the market? Buckle up, it’s going to be a wild ride!

Regulatory Landscape of Cryptocurrencies in Quebec

Navigating the world of cryptocurrency in Quebec requires a healthy dose of legal awareness. While the digital frontier is exciting, understanding the rules of the road is crucial to avoid any unexpected bumps in the crypto-coaster. This section will illuminate the legal and tax implications of cryptocurrency transactions and businesses within Quebec.

Current Legal Framework Governing Cryptocurrency Trading and Investment

Quebec, like the rest of Canada, doesn’t have specific legislation solely dedicated to cryptocurrencies. Instead, existing securities laws and anti-money laundering (AML) regulations apply. This means that the legality of a cryptocurrency transaction hinges on its classification. If a cryptocurrency is deemed a security, it falls under the purview of the Autorité des marchés financiers (AMF), Quebec’s securities regulator.

Transactions involving cryptocurrencies not considered securities are still subject to AML regulations, aiming to prevent illicit activities. The AMF’s stance is evolving, and they actively monitor the cryptocurrency space, issuing warnings about fraudulent schemes and providing guidance on regulatory compliance.

Tax Implications of Cryptocurrency Transactions for Quebec Residents

The Canada Revenue Agency (CRA) treats cryptocurrency as property. This means that any gains from selling, trading, or otherwise disposing of cryptocurrency are considered capital gains and are subject to taxation. Losses can be used to offset capital gains. The CRA’s approach is fairly comprehensive, covering various scenarios, including mining, staking, and even receiving cryptocurrency as payment for goods or services.

It’s highly recommended that Quebec residents consult a tax professional for personalized advice, as the tax implications can be complex depending on individual circumstances and the frequency and type of cryptocurrency transactions.

Regulations and Licensing Requirements for Cryptocurrency Businesses

Businesses operating in the cryptocurrency space in Quebec must comply with relevant federal and provincial laws. This includes obtaining the necessary licenses for activities such as money services businesses (MSB) or securities dealing. The specific requirements depend on the nature of the business. For example, a cryptocurrency exchange would need to comply with stricter regulations compared to a company offering cryptocurrency consulting services.

Failure to comply can result in significant penalties. The AMF plays a key role in overseeing these businesses and ensuring adherence to regulatory standards.

Comparison of Quebec’s Cryptocurrency Regulations with Other Canadian Provinces

Quebec’s regulatory approach to cryptocurrencies largely mirrors that of other Canadian provinces. The federal government sets the overall framework, while provincial securities regulators, such as the AMF in Quebec, handle enforcement and licensing within their respective jurisdictions. There might be subtle differences in interpretation or enforcement practices, but the core principles remain consistent across the country. This pan-Canadian approach aims to provide a relatively unified regulatory landscape for cryptocurrency businesses and investors, though the specifics can vary slightly depending on the province.

So, you’re eyeing those top-performing cryptocurrencies in Quebec, eh? Smart move! But before you dive headfirst into the frosty world of digital assets, consider bolstering your security with a solid wallet. Check out this comprehensive review on the Crypto.com DeFi wallet’s security and usability for Canadian users: Crypto.com DeFi wallet security and usability review for Canadian users.

Then, armed with knowledge and a secure wallet, you can conquer the Quebec crypto market like a true digital lumberjack!

Summary of Key Aspects of Quebec’s Cryptocurrency Regulatory Environment

| Aspect | Description | Relevant Authority | Key Considerations |

|---|---|---|---|

| Legal Framework | Existing securities and AML laws apply; no specific crypto legislation. | AMF (Autorité des marchés financiers), CRA (Canada Revenue Agency) | Classification of cryptocurrency as a security or property is crucial. |

| Taxation | Cryptocurrency gains are considered capital gains and are taxable. | CRA | Consult a tax professional for personalized advice. |

| Business Regulations | Compliance with MSB and securities regulations; licensing requirements vary. | AMF | Obtain necessary licenses; ensure ongoing compliance. |

| Provincial Comparison | Similar to other provinces; federal framework provides overall guidance. | Federal government, provincial securities regulators | Slight variations in interpretation and enforcement may exist. |

Popular Cryptocurrencies Among Quebec Investors

Quebec, with its blend of progressive thinking and robust financial infrastructure, has seen a surge in cryptocurrency adoption. While precise data on individual cryptocurrency holdings within the province is understandably elusive (due to privacy concerns, naturally!), we can paint a picture of the digital assets most likely found in Quebecker’s portfolios, based on general Canadian trends and available market data.

Think of it as a delicious poutine of crypto insights, served with a side of speculative sauce.

So, you’re tracking the top-performing cryptocurrencies in Quebec, eh? A lucrative pursuit, no doubt, but even the most seasoned crypto-trader needs a break. Fuel your brainpower (and your stomach) with some delicious, ethically sourced food from halal culinary before diving back into the volatile world of Bitcoin and Ethereum in Quebec. Remember, a well-fed trader is a happy trader!

Understanding the popularity of specific cryptocurrencies requires considering factors beyond just price fluctuations. Quebec’s bilingual nature, access to global financial news, and a relatively tech-savvy population all contribute to the unique investment landscape. Let’s dive into the crypto-cuisine of Quebec!

Top Cryptocurrencies in Quebec

While pinpointing exact Quebec-specific trading volumes is a challenge, we can extrapolate from broader Canadian trends and global market share. The following list represents likely popular choices, acknowledging that individual portfolios vary wildly.

- Bitcoin (BTC): The undisputed king remains a top choice for Quebec investors, mirroring global trends. Its established position, relative scarcity, and perceived store-of-value properties make it a cornerstone for many portfolios. While precise Quebec trading volume is unavailable, Bitcoin consistently holds a dominant market share globally, suggesting significant Quebec participation.

- Ethereum (ETH): Ethereum’s popularity stems from its role in decentralized finance (DeFi) and the burgeoning NFT market. Quebec’s relatively strong tech sector likely contributes to a higher-than-average interest in this platform for smart contracts and decentralized applications. Again, precise Quebec data is scarce, but Ethereum’s global market capitalization and trading volume suggest substantial Quebec involvement.

- Tether (USDT): A stablecoin pegged to the US dollar, Tether provides a haven for investors seeking to reduce volatility. Its use as a bridge currency between fiat and crypto markets makes it a popular choice for those navigating the ups and downs of the crypto world. Although specific Quebec data is unavailable, Tether’s global usage suggests significant adoption within the province for risk management strategies.

- Cardano (ADA): Cardano, known for its focus on sustainability and peer-reviewed research, may hold particular appeal in Quebec, a province known for its environmental consciousness. While lacking precise Quebec trading figures, its global presence indicates a segment of Quebec investors value its unique approach to blockchain technology.

Factors Influencing Cryptocurrency Investment Preferences in Quebec

Several factors contribute to the unique cryptocurrency investment landscape in Quebec. These factors go beyond simple price action and delve into the cultural and informational context.

- Bilingualism and Access to Information: Quebec’s bilingual nature (French and English) grants access to a broader range of information sources, both domestic and international. This access allows investors to research and analyze opportunities from diverse perspectives.

- Technological Savviness: Quebec possesses a relatively high level of technological literacy, fostering a more comfortable environment for navigating the complexities of cryptocurrency trading and investment.

- Proximity to the US Market: Quebec’s geographical proximity to the United States provides access to a larger and more developed cryptocurrency market, influencing trends and investment choices.

Investment Strategies and Risk Management: Top Performing Cryptocurrencies In Quebec

Navigating the wild world of cryptocurrency investment in Quebec requires a healthy dose of caution and a well-defined strategy. While the potential rewards are alluring (think escaping the clutches of the Canadian winter by retiring early to a sunny beach!), the risks are equally substantial. Let’s delve into the strategies and safeguards Quebec investors should consider.

So, you’re eyeing those top-performing cryptocurrencies in Quebec, eh? Smart move! But before you dive headfirst into the digital gold rush, remember to choose your exchange wisely. Understanding fees and security is crucial, which is why checking out the details on GDax cryptocurrency exchange: fees and security is a must. Then, armed with that knowledge, you can confidently conquer the Quebec crypto scene and maybe even retire to a maple syrup-filled chateau!

Common Investment Strategies Employed by Quebec Cryptocurrency Investors

Quebec investors, like their counterparts globally, employ a range of strategies, from the cautiously conservative to the daringly adventurous. Some favor dollar-cost averaging (DCA), steadily investing a fixed amount at regular intervals, regardless of price fluctuations. This strategy mitigates the risk of investing a lump sum at a market peak. Others might engage in more active trading, attempting to capitalize on short-term price movements.

A popular approach is to utilize technical analysis, studying charts and indicators to predict price trends. However, it’s crucial to remember that even the most sophisticated analysis isn’t a crystal ball.

Risk Factors Associated with Investing in Cryptocurrencies in Quebec

The cryptocurrency market is notoriously volatile. Price swings can be dramatic and unpredictable, influenced by everything from regulatory announcements (think new Quebec legislation) to Elon Musk’s latest tweet. Market manipulation, hacks, and scams are ever-present threats. Furthermore, the regulatory landscape in Quebec, while evolving, remains relatively nascent, creating uncertainty for investors. Finally, the inherent complexity of blockchain technology and the decentralized nature of cryptocurrencies can make it difficult for investors to fully understand the risks they are taking.

Methods for Mitigating Risks

Risk mitigation is paramount. Diversification is key – don’t put all your digital eggs in one basket! Thorough research is essential before investing in any cryptocurrency. Only invest what you can afford to lose, and never chase quick riches. Consider using cold storage (offline wallets) to protect your assets from hacking. Staying informed about regulatory changes and market trends is also crucial.

Finally, consulting with a qualified financial advisor who understands the cryptocurrency market can provide invaluable guidance.

Comparison of Diversification Strategies for a Cryptocurrency Portfolio

Diversification strategies can range from simple to complex. A simple approach might involve investing in a few established cryptocurrencies like Bitcoin and Ethereum. A more sophisticated strategy could involve diversifying across different market capitalizations (large-cap, mid-cap, small-cap cryptocurrencies), asset classes (including stablecoins and DeFi tokens), and even geographic regions (exposure to projects originating from different countries). The optimal strategy depends on the investor’s risk tolerance and investment goals.

So, you’re curious about Quebec’s top-performing cryptos? Picking the right digital dough is crucial, and to make informed decisions, you’ll need the right tools. That’s where a solid coinvesting platform comes in – check out this killer comparison and review: Coinvesting platform comparison and review. Once you’ve got your platform sorted, you’ll be ready to conquer the Quebec crypto scene and maybe even find the next Bitcoin (but, you know, hopefully without the wild price swings!).

For instance, a portfolio heavily weighted towards newer, smaller-cap cryptocurrencies will be riskier than one focused on established, large-cap assets.

Hypothetical Investment Portfolio for a Risk-Averse Quebec Investor

For a risk-averse Quebec investor, a portfolio heavily weighted towards stablecoins (like USDC or USDT) and a small allocation to established cryptocurrencies like Bitcoin and Ethereum might be suitable. For example:

| Asset | Allocation |

|---|---|

| Stablecoins (USDC/USDT) | 70% |

| Bitcoin (BTC) | 20% |

| Ethereum (ETH) | 10% |

This portfolio prioritizes capital preservation over high-growth potential. Remember, even this relatively conservative approach carries inherent risks in the cryptocurrency market. This is just an example and should not be considered financial advice. Professional consultation is recommended.

Impact of Cryptocurrency on the Quebec Economy

The burgeoning world of cryptocurrency presents both exhilarating opportunities and potential pitfalls for Quebec’s economy. Its adoption could significantly reshape the province’s financial landscape, impacting everything from fintech startups to established businesses. Understanding these potential impacts is crucial for navigating this evolving technological frontier.

Economic Benefits and Drawbacks of Cryptocurrency Adoption

The potential benefits are multifaceted. Increased financial inclusion, facilitated by crypto’s accessibility, could empower underserved communities. Furthermore, the growth of blockchain technology, often intertwined with cryptocurrency, could create new jobs and attract foreign investment. However, the volatility inherent in cryptocurrency markets poses a significant risk. Sudden price swings could destabilize the economy, impacting investor confidence and potentially leading to financial losses for individuals and businesses.

The regulatory uncertainty surrounding crypto also presents a challenge, hindering its widespread adoption and potentially slowing economic growth. Quebec’s economy, like many others, needs to carefully weigh these potential benefits and drawbacks before fully embracing cryptocurrency.

Role of Cryptocurrency in the Growth of Fintech Companies

Cryptocurrency is a catalyst for innovation within Quebec’s fintech sector. Startups are leveraging blockchain technology to develop innovative financial products and services, attracting venture capital and fostering competition. The decentralized nature of cryptocurrency allows for the creation of more efficient and transparent financial systems, potentially disrupting traditional banking models. For example, a Quebec-based fintech company might use blockchain to streamline cross-border payments, reducing transaction fees and processing times.

So, you’re keen on Quebec’s top-performing cryptos? Smart move! But before you dive headfirst into Bitcoin’s chilly Canadian cousin, you’ll need a reliable exchange. That’s where finding the right platform matters – check out this list of Top Canadian crypto exchanges with low fees and high security. to avoid getting your digital coins frostbitten. Once you’ve secured your exchange, you can confidently conquer Quebec’s crypto scene!

This attracts international clients and strengthens Quebec’s position in the global fintech market. However, this growth needs careful monitoring to mitigate the risks associated with the volatile nature of cryptocurrencies.

So, you’re eyeing those top-performing cryptocurrencies in Quebec, eh? Before you dive headfirst into the wild world of digital assets, maybe check out this helpful review first: Phemex Canada review: is it a good exchange for beginners? It might save you from some seriously hairy situations. Then, armed with knowledge, you can confidently conquer those Quebec crypto charts!

Challenges and Opportunities for Businesses in Quebec

Businesses in Quebec face both challenges and opportunities. The opportunity lies in integrating cryptocurrencies into their payment systems, potentially reaching a wider customer base, particularly those interested in decentralized finance (DeFi). However, businesses must also navigate the regulatory landscape and manage the risks associated with cryptocurrency volatility. For example, a Quebec retailer accepting Bitcoin payments might experience fluctuations in revenue depending on Bitcoin’s price.

Robust risk management strategies are essential to mitigate these risks. Furthermore, educating employees and customers about cryptocurrencies is crucial for successful adoption.

Potential Effects of Cryptocurrency Volatility on the Quebec Economy

The inherent volatility of cryptocurrencies presents a significant challenge. Sharp price fluctuations can impact investor confidence, potentially leading to capital flight and decreased investment in other sectors of the Quebec economy. This volatility can also affect the value of assets held by Quebec residents, potentially impacting their financial well-being. However, it’s important to note that the impact of this volatility can be mitigated through responsible investment strategies and effective regulation.

A well-regulated crypto market can help minimize the disruptive effects of volatility.

Illustrative Representation of Potential Economic Impact

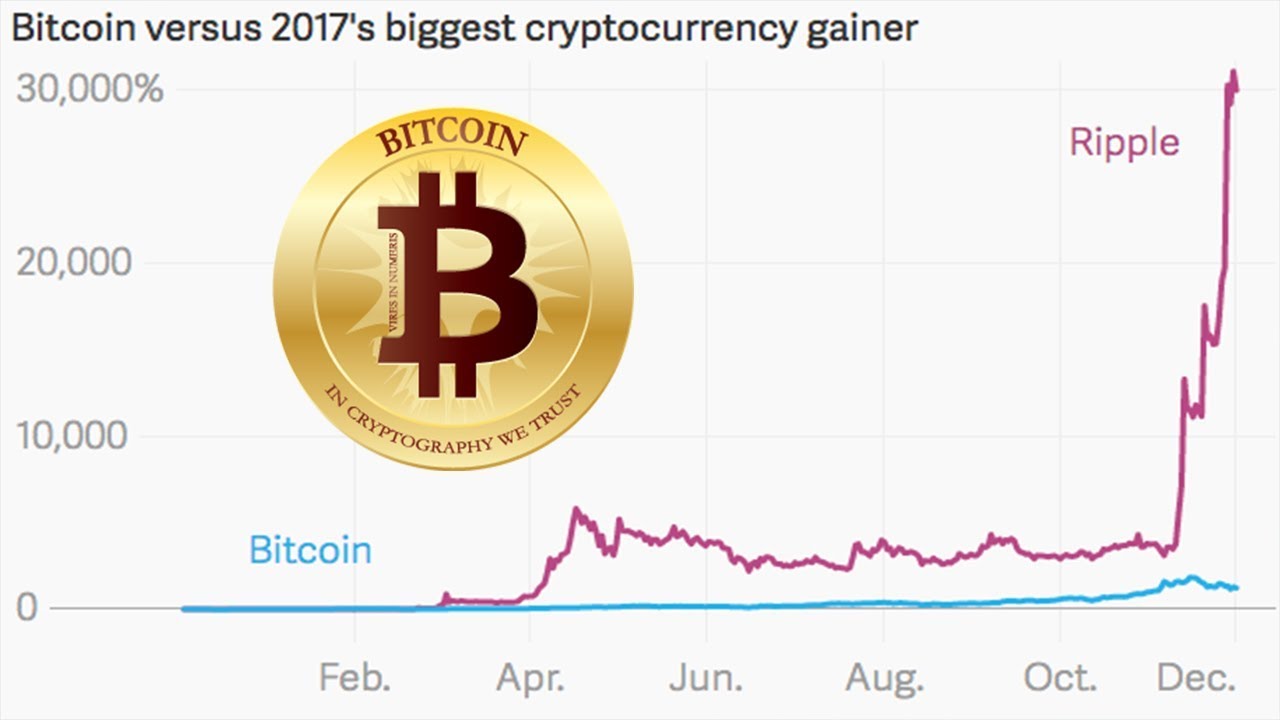

Imagine a graph depicting two lines: one representing the growth of the Quebec economy with limited cryptocurrency adoption, showing steady but moderate growth; and another line representing growth with significant cryptocurrency adoption, showcasing periods of rapid expansion interspersed with sharp declines reflecting market volatility. The latter line, while showing potentially higher peaks, also demonstrates significantly more pronounced troughs, illustrating the inherent risks and rewards of substantial crypto integration.

The visual would highlight the need for a balanced approach, promoting innovation while mitigating the risks associated with volatility.

Resources and Information for Quebec Cryptocurrency Investors

Navigating the wild west of cryptocurrency can feel like riding a bucking bronco blindfolded. But fear not, Quebec crypto cowboys and cowgirls! Reliable information and resources are out there, helping you tame the digital beast and potentially ride off into a sunset of financial freedom (or at least avoid a spectacular crash landing). This section provides a roadmap to help you navigate the crypto landscape safely and smartly.

Making informed decisions in the cryptocurrency market requires access to credible information and a proactive approach to risk management. Understanding the resources available, recognizing potential scams, and performing thorough due diligence are crucial steps for any Quebec investor looking to participate in this dynamic market.

Reputable Resources for Quebec Cryptocurrency Investors, Top performing cryptocurrencies in Quebec

Finding trustworthy information is paramount. The internet is a vast ocean, and unfortunately, not all waters are safe for crypto navigation. Here are some reputable harbors to seek refuge in:

- The Autorité des marchés financiers (AMF): Quebec’s securities regulator provides valuable information on the regulatory landscape and warnings about potential scams. Their website is a must-visit for any serious crypto investor in the province.

- Investment Industry Regulatory Organization of Canada (IIROC): While not exclusively focused on crypto, IIROC regulates investment dealers and advisors in Canada, offering resources to help you identify registered professionals who can provide advice (though always remember to do your own research!).

- Government of Canada websites: The federal government offers general information on financial literacy and investing, some of which can be applied to the cryptocurrency context.

- Reputable international news sources: Publications like the Wall Street Journal, Bloomberg, and Reuters often provide in-depth analysis and reporting on cryptocurrency markets, though always be critical and cross-reference information.

Educational Programs and Workshops in Quebec

Learning about cryptocurrency doesn’t have to be a solo journey. Several avenues exist to enhance your knowledge and understanding of this complex asset class. While specific programs may fluctuate, actively seeking out educational opportunities is key.

- Universities and Colleges: Some Quebec universities and colleges might offer courses or workshops on finance and blockchain technology, which can provide a solid foundation for understanding cryptocurrencies. Check their course catalogs.

- Online Courses: Platforms like Coursera, edX, and Udemy offer a wide range of courses on blockchain technology, cryptocurrency investing, and related topics. These courses can provide a structured learning experience.

- Industry Events and Conferences: Keep an eye out for cryptocurrency conferences and workshops held in Quebec or online. These events can offer valuable insights from industry experts and networking opportunities.

- Community Groups and Meetups: Local cryptocurrency communities and meetups often organize educational sessions and discussions. These provide a chance to learn from others’ experiences.

Identifying and Avoiding Cryptocurrency Scams

The cryptocurrency world is unfortunately rife with scams. Knowing how to spot the red flags is crucial to protecting your hard-earned money. Think of it as learning to identify poisonous mushrooms in a forest – knowledge is your best defense.

- Unsolicited offers of high returns with minimal risk: If it sounds too good to be true, it probably is. Legitimate investments carry inherent risk.

- Pressure tactics: Legitimate investment opportunities won’t pressure you into making quick decisions. Take your time and do your research.

- Unregistered platforms or advisors: Always verify that the platform or advisor is registered with the appropriate regulatory bodies (like the AMF).

- Unrealistic promises: Be wary of guarantees of impossible returns or claims of “get-rich-quick” schemes.

- Requests for personal information: Legitimate platforms will not ask for sensitive information in unsolicited emails or messages.

The Importance of Due Diligence in Cryptocurrency Investment Decisions

Due diligence isn’t just a fancy term; it’s your shield against financial ruin. Thorough research is your best weapon in the crypto battlefield. Before investing, ask yourself these critical questions (or, rather, consider these critical points):

- Understand the project: Research the cryptocurrency’s whitepaper, team, and technology. What problem does it solve? Is the technology sound?

- Assess the market: Analyze the cryptocurrency’s market capitalization, trading volume, and price history. Is there real demand for the cryptocurrency?

- Diversify your portfolio: Don’t put all your eggs in one basket. Spread your investments across different cryptocurrencies to mitigate risk.

- Set a budget and stick to it: Determine how much you can afford to lose before investing. Cryptocurrency is highly volatile.

- Consult with a financial advisor: Consider seeking advice from a registered financial advisor who understands the complexities of cryptocurrency investments.

Ending Remarks

So, there you have it: a whirlwind tour of Quebec’s thrilling cryptocurrency market. From navigating the regulatory landscape to understanding the risks and rewards, we’ve covered the essentials for anyone looking to dip their toes (or maybe their whole body!) into the exciting world of digital assets in Quebec. Remember, investing in crypto is like ice skating – it can be exhilarating, but a little caution and planning can prevent a spectacular face-plant.

Happy investing!