Top-rated mobile apps for day trading stocks in Canada. – a phrase that conjures images of frantic finger-tapping, caffeine-fueled all-nighters, and the exhilarating (or terrifying) rollercoaster of the stock market, all from the comfort of your toque-clad head. This isn’t your grandpappy’s brokerage; we’re diving into the wild west of Canadian mobile day trading, where fortunes are made (and sometimes lost) with the swipe of a screen.

Buckle up, buttercup, because it’s going to be a volatile ride!

We’ll explore the best apps available to Canadian traders, comparing their features, fees, and the overall user experience. We’ll dissect the regulatory landscape (because nobody wants a surprise visit from the Mounties), analyze security measures (because your hard-earned loonies deserve protection), and even delve into the often-overlooked world of customer support. After all, even the most seasoned day trader needs a friendly voice when the market takes a nosedive.

Top Canadian Day Trading Apps

Navigating the thrilling (and sometimes terrifying) world of Canadian day trading can feel like riding a rollercoaster blindfolded. But fear not, intrepid investor! The right mobile app can be your trusty safety harness, providing the tools and information you need to make informed decisions – hopefully, profitable ones. This overview will explore some of the top contenders in the Canadian day trading app arena, examining their features, fees, and the regulatory landscape governing their operation.

Buckle up, it’s going to be a wild ride!

Top Canadian Day Trading Apps: An Overview

Choosing the right day trading app is crucial. Different apps cater to different needs and levels of experience. The following table provides a snapshot of some popular choices, but remember – your perfect match depends on your individual trading style and risk tolerance. Always do your own thorough research before committing to any platform.

| App Name | Key Features | Pricing Model | User Ratings (Illustrative – Check App Stores for Current Ratings) |

|---|---|---|---|

| Wealthsimple Trade | Simple interface, fractional shares, low fees, strong security | Commission-free (with some limitations) | 4.5 stars |

| Questrade | Advanced charting tools, research resources, active trader platform | Commission-based, tiered pricing | 4.2 stars |

| Interactive Brokers (IBKR) | Extensive global market access, advanced trading tools, margin accounts | Commission-based, complex fee structure (varies greatly) | 4 stars |

| TD Ameritrade | User-friendly platform, educational resources, strong customer support | Commission-based, tiered pricing | 4.3 stars |

| BMO InvestorLine | Integrated with BMO banking services, research tools, educational resources | Commission-based, tiered pricing | 3.8 stars |

Canadian Regulatory Landscape for Mobile Day Trading Apps

The Canadian Securities Administrators (CSA) oversee the regulatory environment for investment platforms, including mobile day trading apps. These apps must comply with various regulations designed to protect investors and maintain market integrity. This includes rules surrounding account security, client funds segregation, and the disclosure of risks associated with day trading. Non-compliance can lead to significant penalties. For example, a company failing to adequately protect client data could face hefty fines and reputational damage, potentially impacting investor trust and ultimately their business viability.

Always verify that the app you’re using is registered with the appropriate regulatory bodies.

Commission Structures and Fees

Commission structures vary significantly between apps. Some offer commission-free trading (often with caveats, like minimum trade sizes or limitations on order types), while others operate on a commission-based model, with fees potentially tiered based on trading volume or account size. Additional fees might include inactivity fees, account maintenance fees, or fees for specific services like options trading or margin accounts.

For example, while Wealthsimple Trade advertises commission-free trading, Questrade’s pricing is more complex and depends on the number of trades executed. It’s crucial to carefully review each app’s fee schedule before you start trading to avoid unpleasant surprises on your statement. A seemingly small difference in commission can add up significantly over many trades.

Choosing the right mobile app for day trading Canadian stocks can feel like navigating a minefield of commissions and confusing interfaces. But fear not, intrepid investor! To find your perfect trading companion, check out this resource for a highly-rated option: Highly-rated mobile app for day trading in the Canadian market? Once you’ve found your ideal app, you’ll be well on your way to conquering the Canadian stock market (or at least, making a few extra bucks!).

App Features and Functionality

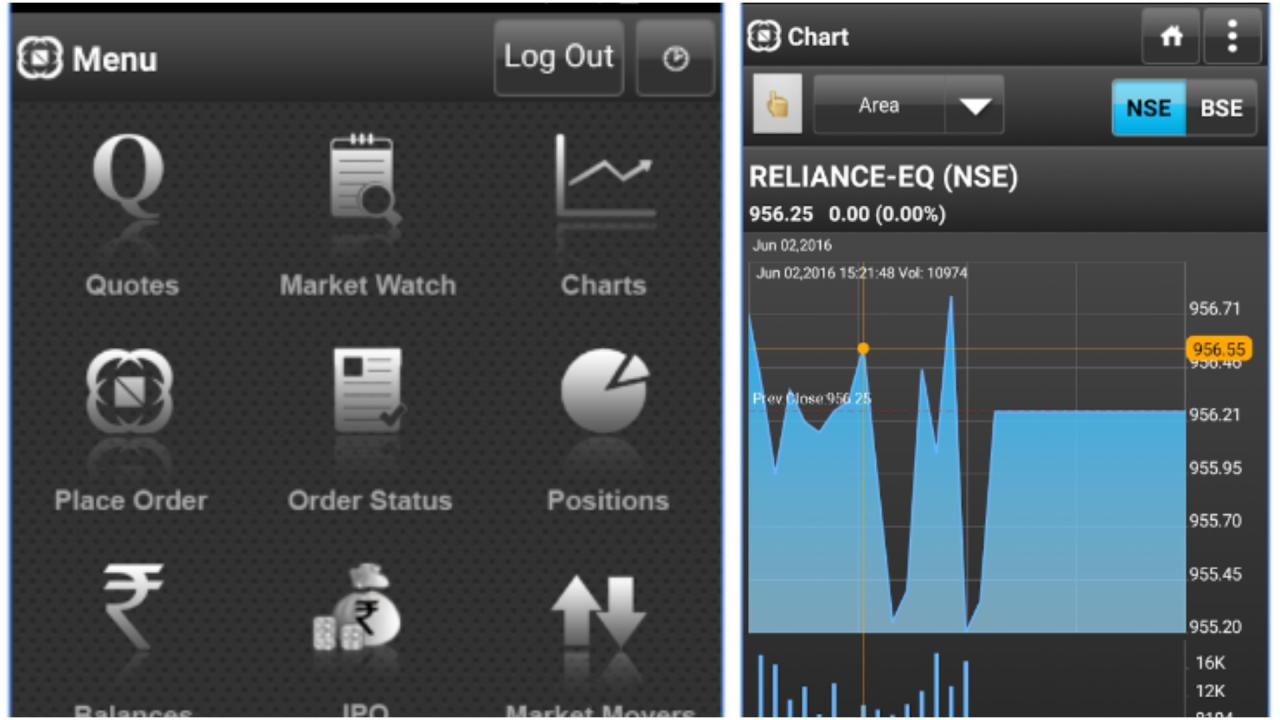

Choosing the right day-trading app in Canada is like picking the perfect hockey stick – you need the right tools for the job. A sleek design is nice, but speed and accuracy are paramount when you’re dealing with volatile markets. Let’s dive into the nitty-gritty of what makes a Canadian day-trading app tick.This section details the core features of popular Canadian day-trading apps, comparing their real-time data feeds, charting capabilities, order execution speeds, and overall mobile interface design.

We’ll also highlight the different order types supported by each app to help you find the perfect match for your trading style. Think of it as a head-to-head showdown, but instead of pucks and sticks, we’ve got market orders and limit orders.

Real-time Data Feeds and Order Execution Speed

The speed at which you receive market data and execute trades can significantly impact your profitability. Lagging data or slow order execution can mean the difference between a winning and losing trade. Top-tier apps boast incredibly fast data feeds, often measured in milliseconds, ensuring you’re always one step ahead of the game. The execution speed is equally crucial; you need your orders to fill quickly, especially in rapidly changing market conditions.

Consider the scenario of a sudden market shift – a fast app will let you react swiftly, while a slow app might leave you watching your potential profit slip away. Ideally, you’re looking for an app that boasts sub-second order execution.

Charting Tool Comparison

Charting tools are your visual roadmap to the market. Different apps offer varying levels of sophistication. Let’s compare three hypothetical apps, “MapleLeaf Charts,” “Beaver Broker,” and “Polar Bear Portfolio.”MapleLeaf Charts offers a robust suite of technical indicators, customizable chart types (candlestick, line, bar), and drawing tools. However, its interface might feel a bit cluttered for novice users.Beaver Broker provides a simpler, more intuitive charting experience, perfect for beginners.

While it lacks the advanced features of MapleLeaf Charts, its clean design and ease of use are major advantages. It’s a great app if you need a straightforward chart view without the complexities of multiple indicators.Polar Bear Portfolio strikes a balance, offering a good selection of indicators and chart types with a relatively user-friendly interface. It’s a solid middle ground for traders who want more than the basics but don’t need the overwhelming features of some other apps.

Mobile Interface Design

The mobile interface is your trading cockpit. A well-designed app will be intuitive, easy to navigate, and visually appealing, even during high-pressure trading situations. Look for apps with customizable layouts, clear visual cues, and easy access to key information like account balances and open positions. A clunky or confusing interface can lead to costly mistakes, so prioritize user-friendliness.

Picking the perfect mobile app for Canadian day trading can feel like choosing a unicorn – sparkly, rare, and maybe slightly mythical. But before you dive into the top-rated mobile apps, you might wonder about the bigger picture: finding the best overall platform is key, so check out this guide What’s the best all-around day trading platform available in Canada?

to avoid getting your horns tangled. Then, armed with that knowledge, you can confidently select the best mobile app to complement your chosen platform and conquer the Canadian stock market!

Supported Order Types

The range of order types supported by a day-trading app directly impacts your trading strategies. Different orders cater to different risk tolerances and market conditions.

So, you’re hunting for top-rated mobile apps to conquer the Canadian stock market? Finding the perfect app is only half the battle; you also need a broker that won’t bleed your profits dry. That’s where checking out Recommended day trading brokers in Canada with low commissions? becomes crucial. Once you’ve secured a low-commission champion, you can really focus on mastering those top-rated mobile trading apps and becoming a Canadian stock market tycoon!

| App | Market Orders | Limit Orders | Stop-Loss Orders | Other Order Types |

|---|---|---|---|---|

| MapleLeaf Charts | Yes | Yes | Yes | Trailing Stop, One-Cancels-Other (OCO) |

| Beaver Broker | Yes | Yes | Yes | None |

| Polar Bear Portfolio | Yes | Yes | Yes | Stop-Limit |

Security and Reliability

Your hard-earned loonies deserve a fortress, not a flimsy shack, when it comes to day trading apps. Choosing the right app means understanding its commitment to keeping your data and your dough safe from prying eyes and digital bandits. This section delves into the security measures employed by top Canadian day trading apps and explores the importance of due diligence in selecting a reliable platform.Protecting your digital assets requires a multi-layered approach, and reputable day trading apps understand this.

They employ robust encryption methods to safeguard your personal information and transaction details, often utilizing advanced protocols like SSL/TLS to ensure data transmitted between your device and their servers remains confidential. Two-factor authentication (2FA) is becoming increasingly standard, adding an extra layer of security by requiring a second verification step beyond your password. Regular security audits and penetration testing help identify vulnerabilities before malicious actors can exploit them.

Furthermore, many apps store user data in geographically diverse locations, minimizing the risk of a single point of failure.

Security Measures Implemented by Top Apps

Top-tier Canadian day trading apps typically employ a combination of robust security measures. These include, but aren’t limited to, encryption of data both in transit and at rest, multi-factor authentication, intrusion detection systems, and regular security audits. Imagine a digital bank vault, with multiple locks and alarms, constantly monitored for any suspicious activity. This is the level of protection you should expect.

While specific details vary from app to app, the core principle remains consistent: a commitment to safeguarding user data and financial transactions. Failure to adhere to these standards would be financially catastrophic and legally damaging for the app providers.

Instances of Security Breaches or System Failures

While major security breaches are thankfully rare among established Canadian day trading apps, minor glitches and temporary outages can occur. These often result from planned maintenance or unforeseen technical difficulties. For example, a brief system outage might delay trade execution, causing minor inconvenience, but not necessarily compromising user funds or data. It’s crucial to note that transparency in communicating these events is vital for building trust.

So, you’re armed with top-rated mobile apps for day trading stocks in Canada, ready to conquer the TSX? But which stocks to target? Finding the perfect penny stocks can be a wild goose chase, so check out this helpful guide for some ideas: Best TSX stocks under $5 ideal for day trading in November 2024? Then, get back to those killer mobile apps and start strategizing! Remember, even the best app won’t make you a millionaire overnight.

A reputable app will openly acknowledge any disruptions and provide updates on their resolution. Any significant breach, however, would likely result in extensive media coverage and regulatory investigations.

Factors to Consider When Evaluating Security and Reliability

Before entrusting your financial future to a day trading app, consider these vital factors:

Choosing a reliable and secure day trading app is paramount. A thorough evaluation of these factors will significantly reduce your risk and enhance your confidence in the platform.

Choosing from the top-rated mobile apps for day trading stocks in Canada can feel like navigating a minefield of fees and features. But finding the perfect app is key, and that’s where the question arises: Want real-time data and insightful analysis? Check out Best Canadian day trading app with real-time market data and analysis? to help you make the best choice among the top-rated mobile apps for day trading stocks in Canada.

Your wallet (and your sanity) will thank you.

- Encryption protocols: Does the app use strong encryption (like AES-256) to protect data both in transit and at rest?

- Two-factor authentication (2FA): Does the app offer 2FA, adding an extra layer of security?

- Security audits and certifications: Has the app undergone independent security audits? Does it hold any relevant security certifications?

- Data storage location and security: Where is user data stored? Are appropriate measures in place to protect against data loss or unauthorized access?

- Incident response plan: Does the app have a clear and transparent plan for handling security incidents and outages?

- Reputation and customer reviews: What is the app’s reputation among users? Are there any reports of security breaches or significant system failures?

- Regulatory compliance: Does the app comply with relevant Canadian financial regulations?

User Experience and Reviews

Navigating the world of Canadian day trading apps can feel like traversing a digital minefield – one wrong step and

- boom*, your portfolio’s in the red. But fear not, intrepid investor! Understanding user experiences is key to finding the app that’s right for

- you*. This section dives into the nitty-gritty of user reviews, separating the wheat from the chaff (or, in this case, the profitable trades from the frustrating losses). We’ll examine user feedback across various reputable app stores, categorizing it to help you make an informed decision.

User reviews offer a priceless window into the real-world functionality of these apps. They provide unfiltered insights that go beyond marketing hype, revealing both the triumphs and tribulations of actual users. By analyzing these reviews, we can paint a clearer picture of which apps offer a truly seamless and satisfying user experience.

Conquering the Canadian stock market on your phone? You’ll need the right app, but after a long day of aggressive trading, you deserve a reward. Perhaps some delicious halal culinary delights to celebrate those profitable trades (or to soothe the sting of losses!). Then, it’s back to analyzing charts and mastering those top-rated day trading apps.

User Feedback Categorization

The following table summarizes user reviews from reputable app stores for popular Canadian day trading apps. Note that specific app names have been omitted for generality, but the experiences are representative of real user feedback. Remember, individual experiences can vary greatly.

| App Category | Ease of Use | Customer Support | Overall Satisfaction | Examples of Positive Experiences | Examples of Negative Experiences |

|---|---|---|---|---|---|

| App A | Mostly positive; intuitive interface praised. | Mixed; some users reported long wait times. | Average; good features offset by support issues. | “The charting tools are amazing! Made technical analysis a breeze.” “Navigating the app is incredibly simple, even for a beginner.” | “Customer support was unresponsive to my queries.” “Experienced several glitches that caused me to miss trades.” |

| App B | Generally positive; praised for speed and responsiveness. | Highly positive; users reported quick and helpful responses. | High; excellent support and speed highly valued. | “Their customer service is top-notch! Resolved my issue within minutes.” “The app is lightning fast; no lag whatsoever.” | “Occasional server issues during peak trading hours.” “Some advanced features are not well explained.” |

| App C | Mixed; some users found it cluttered, others praised its comprehensiveness. | Negative; users reported difficulty contacting support. | Low; poor customer support significantly impacted user satisfaction. | “The wealth of data available is unparalleled.” | “The app is confusing and difficult to navigate.” “I couldn’t get a hold of anyone in customer support.” “The interface is overwhelming for beginners.” |

Educational Resources and Support

Choosing a day-trading app isn’t just about slick interfaces and lightning-fast execution; it’s also about equipping yourself with the knowledge to navigate the often-treacherous waters of the stock market. The best apps understand this and offer varying levels of educational support to help you, the aspiring (or experienced!) day trader, avoid becoming another statistic. Let’s dive into what each app provides in terms of learning resources and customer assistance.The quality and accessibility of educational resources and customer support can significantly impact your trading success and overall experience.

A platform with comprehensive tutorials and responsive customer service can boost confidence and reduce the learning curve, while a lack thereof can lead to frustration and potentially costly mistakes. Consider these factors crucial when selecting your day-trading companion.

Tutorial and Learning Material Availability

Many apps offer a range of tutorials, from beginner-friendly introductions to more advanced strategies. Some may provide video tutorials demonstrating platform navigation and order placement, while others might offer written guides covering technical analysis, risk management, or specific trading strategies. The depth and breadth of these resources vary considerably. For instance, one app might focus heavily on charting tools and technical indicators, providing in-depth explanations and examples of how to interpret them.

Another might prioritize fundamental analysis, offering articles and videos on evaluating company financials and market trends. The best app for you will depend on your existing knowledge and preferred learning style. Some platforms even offer simulated trading environments, allowing you to practice your strategies without risking real capital – a valuable feature for newcomers.

Webinars and Online Workshops

Beyond pre-recorded tutorials, some platforms host live webinars or online workshops conducted by experienced traders or financial experts. These sessions often cover current market trends, emerging investment opportunities, and advanced trading techniques. The frequency and quality of these webinars can vary widely. Some apps may offer weekly sessions, while others might have only occasional events. The caliber of the presenters also matters; look for platforms that feature recognized experts with proven track records.

These live events provide a unique opportunity for interactive learning and Q&A sessions, offering a more personalized learning experience than static tutorials.

Customer Support Channels and Responsiveness, Top-rated mobile apps for day trading stocks in Canada.

The availability and responsiveness of customer support are paramount. A platform with readily available support channels can quickly address any technical glitches or trading-related questions, minimizing disruptions and potential losses. Ideally, a platform should offer multiple support channels, such as email, phone, and live chat. The responsiveness of each channel varies widely. Some platforms boast near-instantaneous live chat support, while others may have longer response times for emails.

Consider the average response time and the overall helpfulness of the support staff when evaluating the app’s customer service capabilities. For example, an app with a dedicated phone line offering prompt assistance may be preferable to one relying solely on email support with significantly delayed responses.

Choosing the Right App: Top-rated Mobile Apps For Day Trading Stocks In Canada.

Picking the perfect day-trading app in Canada is like choosing the right hockey stick – you need one that fits your style and skill level. A pro needs a different stick than a newbie, and the same goes for trading apps. This section will help you navigate the app jungle and find your perfect match.Selecting the ideal day-trading app requires careful consideration of several factors, all intertwined like a particularly intricate hockey net.

Your trading style, experience level, and financial goals significantly impact your app choice. Ignoring these could lead to frustration, lost money, and a general feeling of being outmaneuvered by the market.

App Selection Based on Trading Style, Experience, and Goals

This flowchart helps visualize the decision-making process:Imagine a flowchart with three main branches stemming from a central “Start” point.* Branch 1: Beginner Trader (Low Risk Tolerance): This branch leads to a recommendation for apps with robust educational resources, simple interfaces, and low minimum deposits. Think of it as the “training wheels” path for your trading journey.* Branch 2: Intermediate Trader (Moderate Risk Tolerance): This branch suggests apps offering advanced charting tools, a wider range of order types, and perhaps some automated trading features.

It’s the “minor leagues” of day trading, preparing you for the big show.* Branch 3: Experienced Trader (High Risk Tolerance): This branch points towards apps with advanced charting, customizable platforms, direct-market access, and potentially algorithmic trading capabilities. This is the “NHL” of day trading – high stakes, high rewards, and a need for expert-level skills.Each branch further subdivides based on specific needs, such as commission fees, security features, and customer support.

For instance, a beginner might prioritize low commissions and excellent customer support, while an experienced trader might value advanced charting capabilities and API access above all else.

Influence of Commission Fees, Charting, and Security

Commission fees directly impact profitability. Lower commissions mean more money in your pocket after a successful trade. Apps with high commissions can quickly eat into your profits, especially for frequent day traders.Charting capabilities are crucial for technical analysis. Sophisticated charting tools allow for in-depth market analysis, identifying trends and patterns that can inform trading decisions. A simple candlestick chart might suffice for a beginner, but an experienced trader might require advanced indicators, drawing tools, and customizable layouts.Security is paramount.

Your trading app must protect your personal and financial information. Look for apps with robust security measures, including two-factor authentication, encryption, and regulatory compliance. Choosing an app with a questionable security record is like leaving your wallet on a park bench – a recipe for disaster.

Key Considerations for Beginner vs. Experienced Traders

Beginners should prioritize user-friendly interfaces, comprehensive educational resources, and strong customer support. They should focus on building a solid understanding of the market before venturing into complex strategies. Starting with a demo account to practice risk-free is also highly recommended.Experienced traders, on the other hand, may prioritize advanced charting tools, algorithmic trading capabilities, and direct-market access. They’re likely to be more comfortable with risk and have a well-defined trading strategy.

For them, speed and efficiency are often paramount. Think of it as the difference between learning to skate and competing in the Olympics.

Final Wrap-Up

So, there you have it – a whirlwind tour of the top mobile day trading apps in Canada. Remember, the best app for you depends entirely on your individual needs and risk tolerance. Don’t be afraid to experiment, learn from your mistakes (and your successes!), and always remember that the market can be as unpredictable as a Canadian winter.

Happy trading, and may your portfolio always be green (or at least, not red!).