What are the leverage limits for forex trading on Questrade in Canada? – What are the leverage limits for forex trading on Questrade in Canada? Ah, the million-dollar question (or perhaps the million-dollar

-loss*, if you’re not careful!). This isn’t your grandma’s knitting circle; we’re diving headfirst into the thrilling, slightly terrifying world of forex trading with Questrade, where leverage can be your best friend or your worst enemy. Think of it like this: leverage is the turbocharger for your trading engine – it can propel you to dizzying heights of profit, or send you careening into a ditch of debt faster than you can say “margin call!” So buckle up, buttercup, and let’s explore the wild, wild west of Questrade’s leverage limits.

We’ll dissect Questrade’s account types, their associated leverage limits, and the regulatory hurdles they must clear. We’ll uncover the factors influencing your personal leverage allowance – experience, account size, even which currency pair tickles your fancy. We’ll then navigate the Questrade platform itself, showing you exactly where to find (and adjust) those crucial leverage settings. Naturally, we’ll also discuss the inherent risks of high leverage, because even the most seasoned traders need a healthy dose of caution.

Finally, we’ll compare Questrade to its Canadian competitors, giving you the ammunition to make informed decisions about your trading future.

Questrade Account Types and Leverage Limits

So, you’re ready to dive headfirst into the thrilling world of forex trading with Questrade? Fantastic! But before you start imagining yourself sipping margaritas on a beach in the Bahamas (courtesy of your forex winnings, naturally), let’s talk about something equally important: leverage limits. Understanding these limits is crucial to managing risk and keeping your trading ambitions grounded in reality.

Think of it as your financial safety net – you wouldn’t jump off a cliff without one, would you?

Questrade Account Types and Their Associated Leverage, What are the leverage limits for forex trading on Questrade in Canada?

Questrade offers a few different account types, each with its own set of features and, importantly, leverage limits. The leverage you’re allowed depends on your account type and your trading experience. This isn’t a case of “the more, the merrier”; responsible trading means understanding and respecting these limits. Think of it like this: a higher leverage limit is like a powerful sports car – exhilarating, but requires more skill and caution to handle safely.

Leverage Limits Table

The following table summarizes the different Questrade account types, their minimum deposit requirements, and the maximum leverage permitted. Remember, these are subject to change, so always check Questrade’s official website for the most up-to-date information. Don’t rely on outdated information; you wouldn’t want your trading strategy to be based on yesterday’s news, would you?

| Account Type | Minimum Deposit | Maximum Leverage |

|---|---|---|

| Self-Directed Account | $0 | Up to 50:1 (depending on the instrument and your trading experience) |

| Margin Account | Variable, dependent on the broker’s requirements | Up to 50:1 (depending on the instrument and your trading experience) |

| RESP (Registered Education Savings Plan) | Variable, dependent on the broker’s requirements | Not typically used for Forex trading. |

| TFSA (Tax-Free Savings Account) | Variable, dependent on the broker’s requirements | Not typically used for Forex trading. |

Note: The leverage offered can vary depending on your trading experience and the specific currency pair you are trading. Always check Questrade’s platform for the most accurate information before executing a trade. Ignoring this could lead to a financial stumble, so remember to do your due diligence! Also, RESP and TFSA accounts are not typically used for leveraged forex trading due to the inherent risks involved.

Regulatory Compliance and Leverage Restrictions

Navigating the world of forex trading involves more than just chart patterns and technical indicators; it’s a carefully regulated landscape. In Canada, the rules of the game are set to protect investors and maintain market integrity. Let’s delve into how regulatory bodies shape the leverage limits you’ll encounter at Questrade.Questrade’s forex leverage limits aren’t plucked from thin air; they’re a direct result of stringent regulatory oversight.

The Investment Industry Regulatory Organization of Canada (IIROC), the primary self-regulatory organization for investment dealers, plays a pivotal role in setting the standards. They ensure that brokerage firms like Questrade operate within a framework designed to mitigate risk and protect clients from excessive leverage that could lead to substantial losses. This isn’t just about paperwork; it’s about ensuring a fair and stable trading environment for everyone.

IIROC’s Influence on Leverage Limits

IIROC’s influence on forex leverage is significant. They establish guidelines and regulations that dictate the maximum leverage ratios that brokerage firms can offer to their clients. These limits are regularly reviewed and updated to reflect changes in market conditions and risk assessments. The goal is to strike a balance between allowing traders the flexibility to leverage their positions and preventing excessive risk-taking that could destabilize the market or lead to devastating financial consequences for individual traders.

So, you’re wrestling with Questrade’s forex leverage limits in Canada? It’s a jungle out there! To navigate this financial wilderness safely, you might want to consider the security of your trading platform; check out this guide on What are the safest and most secure day trading apps available? before you even think about those leverage limits.

After all, a secure app is the first step to smart leverage management with Questrade, or anywhere else!

Think of IIROC as the referee ensuring fair play in the forex arena. They set the rules, and Questrade, as a regulated brokerage, must adhere to them.

So, you’re wrestling with Questrade’s forex leverage limits in Canada? It’s a wild ride, let me tell you! But if you’re feeling adventurous and want to explore options, maybe check out the Best day trading app for options trading in Canada? to see if it’s a better fit for your risk appetite. Then, you can confidently return to the thrilling world of Questrade’s forex leverage restrictions, armed with newfound knowledge (or at least a slightly different headache).

Questrade’s Compliance Measures

Questrade’s commitment to compliance isn’t just a box to tick; it’s woven into the fabric of their operations. They maintain robust internal controls and systems to ensure they stay within IIROC’s leverage guidelines. This includes regular audits, rigorous risk management procedures, and ongoing training for their staff. They also provide clear and accessible information to their clients about leverage limits and the risks associated with leveraged trading.

So, you’re wrestling with Questrade’s forex leverage limits in Canada? It’s a jungle out there! Before you leap into the deep end, maybe try practicing your moves first. Check out Top rated day trading apps with paper trading accounts? to hone your skills. Then, armed with paper trading prowess, you can confidently tackle those Questrade leverage limits and conquer the forex world (or at least not lose your shirt).

Transparency is key to responsible trading, and Questrade strives to provide their clients with the tools and information they need to make informed decisions. Think of it as a multi-layered security system designed to protect both Questrade and its clients.

Recent Changes to Leverage Regulations

While specific recent changes require referencing official IIROC publications for precise details (as regulations can change frequently), it’s important to understand that the regulatory landscape is dynamic. IIROC regularly reviews and adjusts leverage limits based on market analysis and evolving risk profiles. These adjustments might involve lowering or raising leverage limits for certain instruments or client categories, reflecting a commitment to adapt to changing market conditions.

Staying informed about these changes through Questrade’s official communications and IIROC’s website is crucial for every forex trader. It’s like keeping your navigation system updated for the best and safest route through the financial markets.

Factors Influencing Leverage Limits

So, you’re ready to dive headfirst into the thrilling world of forex trading with Questrade, eh? But before you unleash your inner Warren Buffett (or your inner… well, let’s just say “enthusiastic trader”), it’s crucial to understand the often-mysterious world of leverage limits. These aren’t arbitrary numbers plucked from thin air; they’re carefully calculated based on a number of factors designed to protect both you and Questrade from the wild swings of the currency market.Questrade employs a multi-faceted approach to determine your individual leverage limits.

Think of it as a sophisticated algorithm that considers your trading history, your financial profile, and the general market conditions. It’s not a one-size-fits-all approach, and that’s a good thing! The goal is to provide you with appropriate leverage that aligns with your risk tolerance and experience. It’s like getting a custom-tailored suit for your trading adventures – except instead of fabric, it’s financial prudence.

Trading Experience and Account Size Impact on Leverage

Your trading experience plays a significant role in determining your leverage limit. A seasoned trader with a proven track record will generally be granted higher leverage than a newbie just starting out. This is because Questrade (and all responsible brokers) recognizes that experience correlates with a better understanding of risk management. Similarly, the size of your account acts as a safety net.

Larger accounts generally qualify for higher leverage because they have a larger buffer to absorb potential losses. Imagine it like this: a seasoned sailor with a large, sturdy ship (a substantial account) can handle rougher seas (higher leverage) than a novice in a tiny dinghy.

Leverage Limits Across Currency Pairs

Questrade’s leverage limits aren’t uniform across all currency pairs. The volatility of a specific currency pair is a major factor. Highly volatile pairs, such as those involving emerging market currencies, may have lower leverage limits compared to more stable pairs like EUR/USD. This is a safety precaution; higher volatility means a greater potential for rapid, substantial losses.

Think of it as driving a sports car versus a minivan: the sports car (volatile pair) requires more caution and a less aggressive driving style (lower leverage) to stay safe. The minivan (stable pair) allows for a more relaxed approach (higher leverage). Questrade’s specific limits for each pair are readily available on their platform and should be reviewed before trading.

Accessing and Understanding Leverage Settings within Questrade Platform

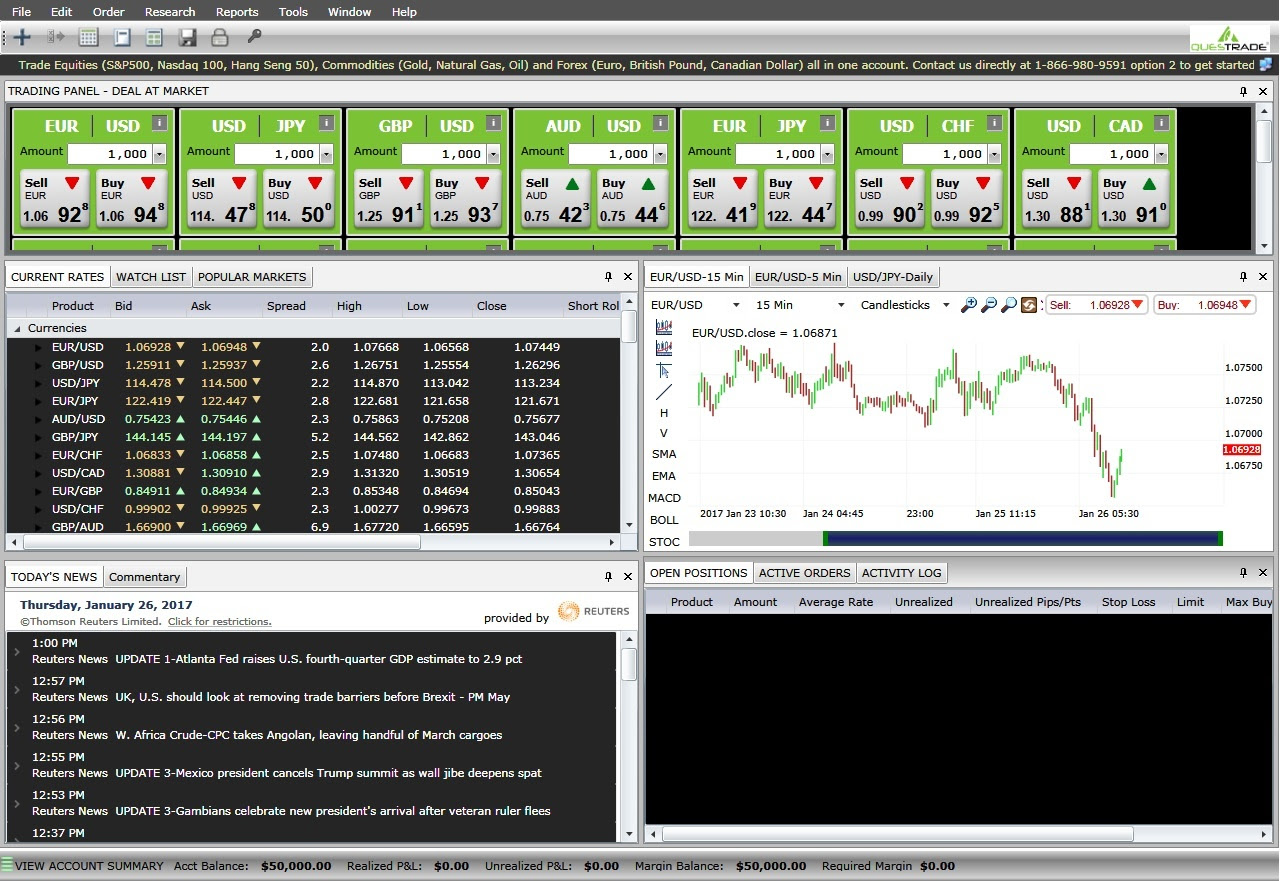

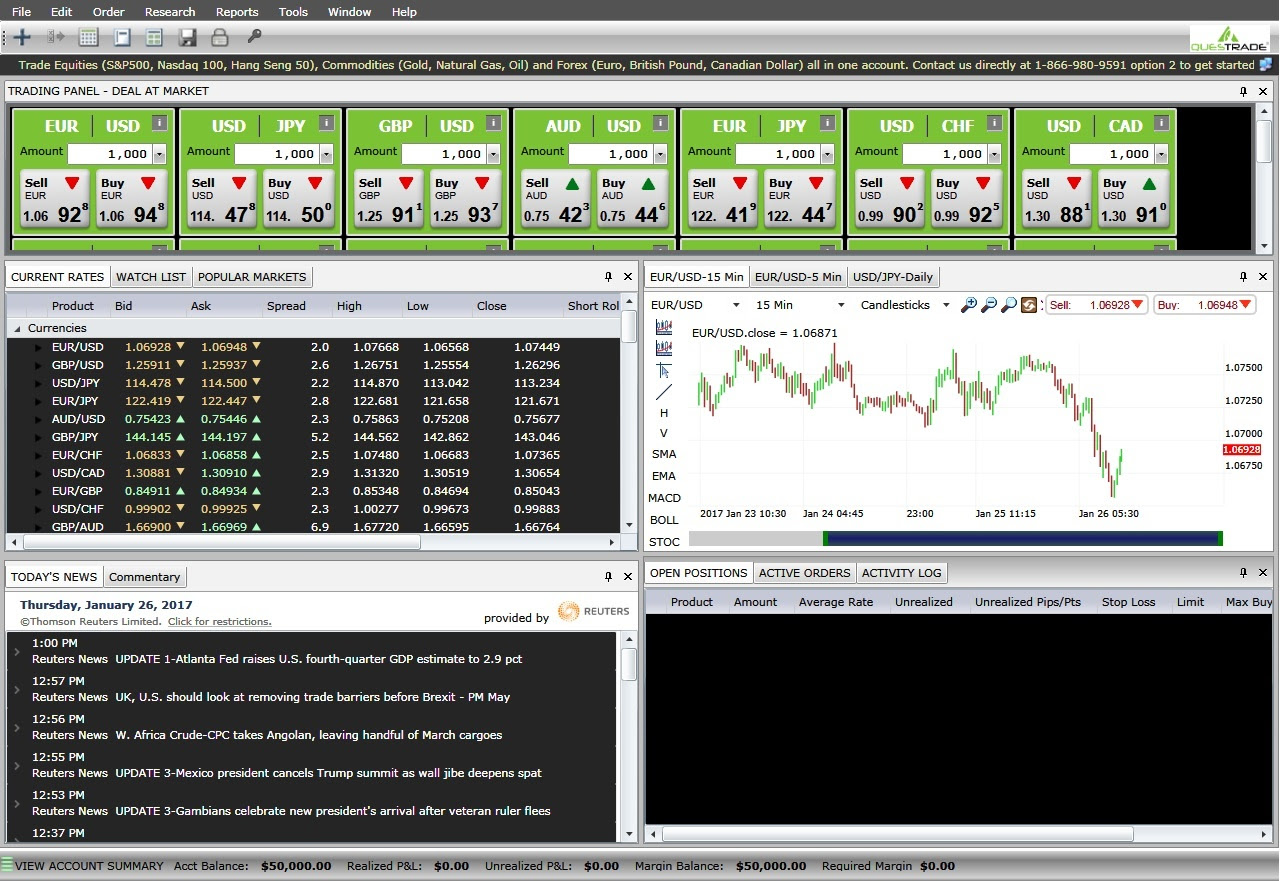

So, you’ve wrestled with the complexities of forex leverage limits and emerged victorious (or at least, less confused). Now, the final frontier: actually finding and adjusting those settings within the Questrade platform. Think of it as a treasure hunt, but instead of gold doubloons, you’re after the perfect leverage ratio for your next daring trade.Navigating the Questrade platform to locate and modify your leverage settings is surprisingly straightforward, even if the initial interface might seem like a labyrinth of financial wizardry.

Fear not, intrepid trader! This guide will illuminate the path.

Leverage Setting Location and Modification

Let’s embark on our quest to uncover the secrets of leverage modification within the Questrade trading platform. This step-by-step guide will lead you to the promised land of personalized leverage settings. Remember, always trade responsibly and within your risk tolerance.

- Log in to your Questrade account: This seems obvious, but it’s the crucial first step. Think of it as setting the stage for your trading masterpiece.

- Navigate to the Trading Platform: Once logged in, locate the trading platform itself. This is usually prominently displayed, often with a button clearly labeled “Trade” or something similar. Think of this as finding the entrance to the trading arena.

- Locate the Account Settings: Within the trading platform, look for an area dedicated to account settings or preferences. This might be represented by a gear icon, a profile icon, or a menu option labelled “Settings.” Consider this your backstage pass to the inner workings of your account.

- Find the Leverage Settings: Within the account settings, search for a section specifically dealing with trading parameters or settings. This is where the leverage setting will typically reside. It might be called “Leverage,” “Margin,” or something similar. This is where the treasure is hidden!

- Adjust your Leverage: Once you’ve found the leverage setting, you should be able to adjust the multiplier according to your needs and Questrade’s permitted limits. Remember to double-check your selection before confirming. This is where you carefully choose your weapon for the financial battlefield.

- Save Changes: After making your adjustments, be sure to save your changes. This usually involves clicking a “Save,” “Apply,” or “OK” button. Think of this as sealing your fate (or your fortune!).

Visual Representation of Leverage Setting Location

Imagine the Questrade platform as a map.“`+———————————+| Questrade Trading Platform |+———————————+| [Trade] Button |+———————————+| Account Menu || (Gear Icon or Profile Icon) |+———————————+| Account Settings || > Trading Parameters || >> Leverage Setting || (Slider or Dropdown Menu) |+———————————+“`This text-based representation shows a simplified, hierarchical structure.

So, you’re wrestling with Questrade’s forex leverage limits in Canada? It’s a wild ride, let me tell you! While you’re figuring that out, maybe consider diversifying – check out how to profit from cryptocoin for a completely different beast altogether. Then, once you’ve conquered the crypto-jungle, you can return to the slightly less chaotic world of Questrade’s forex regulations.

Good luck!

The leverage setting is nested within the Account Settings, under Trading Parameters. The exact visual representation will vary slightly depending on the specific version of the Questrade platform you’re using, but the general structure should remain consistent.

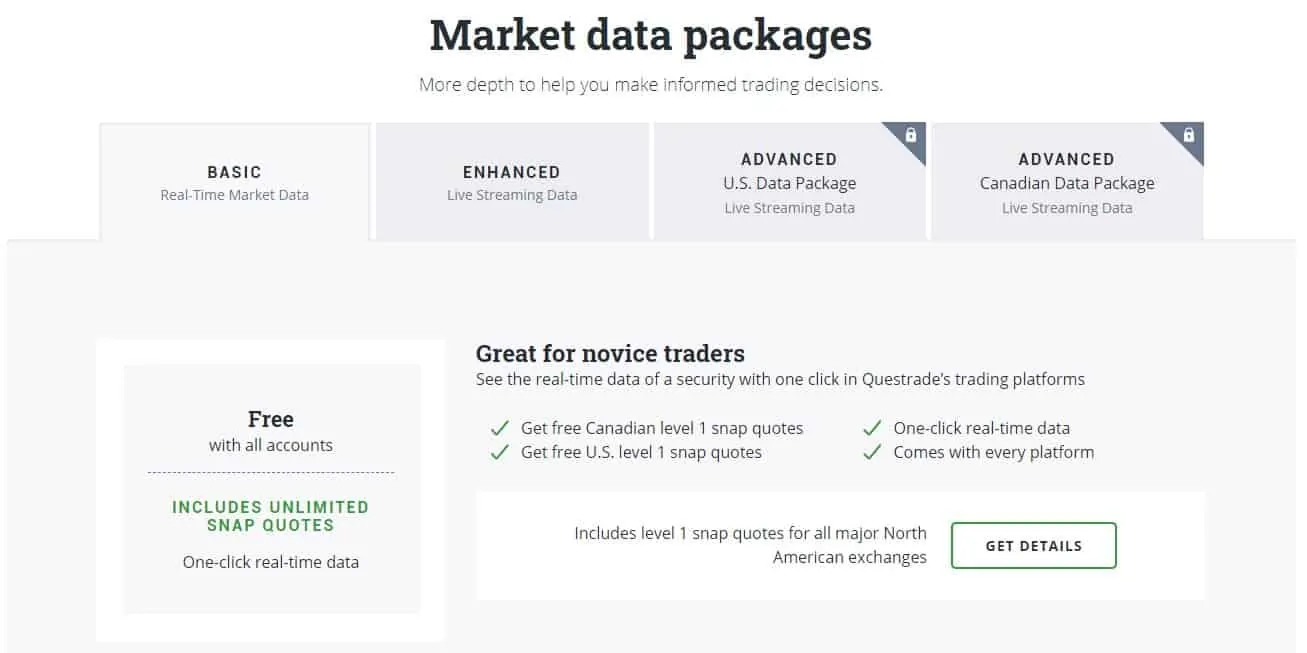

So, you’re wrestling with Questrade’s forex leverage limits in Canada – a truly thrilling game of financial high-wire walking! To make informed decisions, though, you’ll need up-to-the-second data, which is why knowing Which app provides real-time market data for day trading? is crucial. Back to Questrade: remember, those leverage limits exist for a reason – to prevent your account from vanishing faster than a magician’s rabbit.

Risks Associated with High Leverage in Forex Trading

High leverage in forex trading, while offering the potential for amplified profits, is a double-edged sword. It magnifies both gains and losses, meaning that even small market movements can result in substantial financial consequences. Understanding these risks is crucial before venturing into leveraged forex trading. Think of it like this: leverage is a powerful tool, but a powerful tool in the wrong hands can be incredibly dangerous.Leverage essentially allows you to control a larger position than your account balance would normally permit.

For instance, with a 50:1 leverage ratio, a $1,000 account can control a $50,000 trade. While this can lead to impressive returns on smaller price swings, it also means that even a small percentage move against your position can wipe out your entire account balance. The higher the leverage, the higher the risk.

Margin Calls and Account Liquidation

A margin call occurs when your account equity falls below the required margin level set by your broker, Questrade in this case. This means your open positions are at risk of being liquidated to cover losses. Imagine you’ve leveraged your $1,000 account 100:1 to trade a currency pair. A relatively small adverse price movement of just 1% could trigger a margin call, leading to your positions being closed automatically at a loss, potentially leaving you with nothing.

This rapid liquidation can happen without warning, emphasizing the urgency of risk management.

Significant Losses and Rapid Account Depletion

High leverage dramatically increases the potential for substantial losses. A seemingly small percentage move against your trade, amplified by leverage, can quickly lead to significant losses, potentially exceeding your initial investment. For example, a 5% adverse move on a $50,000 position (leveraged 50:1 from a $1,000 account) translates to a $2,500 loss – your entire account balance. This demonstrates the devastating impact high leverage can have, even on seemingly well-researched trades.

Emotional Trading and Poor Decision-Making

The fear of large losses associated with high leverage can often lead to impulsive and emotionally driven trading decisions. Traders may panic and close positions prematurely to cut losses, potentially missing out on potential recovery or even exacerbating losses by selling at the wrong time. Conversely, the thrill of quick profits might encourage overconfidence and excessive risk-taking, leading to larger, riskier trades that can backfire spectacularly.

So, you’re wondering about Questrade’s forex leverage limits in Canada? It’s a wild ride, let me tell you! Before you jump in headfirst, though, maybe check out some beginner-friendly day trading apps first – you can find some solid options by clicking here: What are the best day trading apps for beginners in Canada? Then, armed with that knowledge (and maybe a slightly less reckless approach), you can tackle those Questrade leverage limits with a bit more confidence.

Remember, responsible trading is key!

Strategies for Managing Risk When Trading with Leverage

Effective risk management is paramount when using leverage. This involves using appropriate position sizing, setting stop-loss orders, and diversifying your portfolio. Position sizing refers to determining the appropriate amount of capital to allocate to each trade, limiting potential losses to a manageable percentage of your overall account balance. Stop-loss orders automatically close a position when the price reaches a predetermined level, preventing further losses.

Diversification involves spreading your investments across multiple currency pairs or asset classes to mitigate risk. Never bet the farm on a single trade, no matter how confident you are. Treat trading as a marathon, not a sprint.

Margin Calls and Leverage Adjustments: What Are The Leverage Limits For Forex Trading On Questrade In Canada?

Let’s talk about the slightly less fun side of forex trading: margin calls. Think of it as your broker’s gentle (but firm) nudge reminding you that your trading account’s balance is getting a little too close to the danger zone. It’s not a pleasant experience, but understanding how it works can save you a lot of heartache (and money!).Margin calls with Questrade, like with most brokers, happen when your account equity falls below the required margin level for your open positions.

Essentially, you’ve borrowed money to trade, and the value of your trades has dipped enough that your account no longer covers the potential losses. This is where the “margin” – the amount of your own money you’ve put up to secure the borrowed funds – becomes critical. If it gets too low, Questrade steps in to protect both you and themselves.

Questrade’s Margin Call Procedures

When a margin call occurs, Questrade will typically notify you via email and/or within your trading platform. The notification will clearly state the shortfall in your margin and the actions required to rectify the situation. These actions usually involve depositing more funds into your account to cover the margin deficit, or closing some of your open positions to reduce your exposure.

The time frame given to respond to a margin call varies but is usually quite short, giving you a limited window to act. Failing to respond appropriately can lead to Questrade automatically closing some or all of your positions to limit potential losses. This is done to protect your account from further losses. Imagine it as Questrade stepping in to prevent a catastrophic wipeout – they are looking out for your best interest, even if it’s a bit forceful.

Leverage Adjustments to Mitigate Risk

Questrade might also proactively adjust your leverage. Remember, leverage is a double-edged sword. While it magnifies potential profits, it also significantly amplifies potential losses. To reduce risk, Questrade may automatically lower your leverage on specific trades or across your entire account. This is a preventative measure designed to minimize the likelihood of a margin call occurring in the first place.

Think of it as Questrade tightening the reins a bit when things get a little too wild in the market. For example, if the market experiences a sudden and significant volatility spike, Questrade might automatically reduce your leverage to a safer level to prevent a margin call. This action is intended to protect both the trader and the brokerage firm from substantial losses.

It’s not a punishment; it’s a safety net.

Comparison with Other Canadian Brokers

Let’s dive into the wild world of Canadian forex leverage, where the limits can be as unpredictable as a Canadian winter! While Questrade offers its own unique set of leverage rules, it’s crucial to see how it stacks up against the competition. After all, finding the right broker is like finding the perfect pair of snowshoes – you need the right fit for your trading style and risk tolerance.Understanding the leverage differences between brokers is vital for traders.

Different leverage levels can significantly impact your potential profits and losses, influencing your trading strategies and overall risk management. A higher leverage might seem appealing, but it can quickly turn into a slippery slope if not handled carefully. Think of it like driving a Formula 1 car – exhilarating, but requires expert handling.

Leverage Limits Comparison Across Brokers

The following table compares the leverage limits offered by several major Canadian forex brokers. Remember, these limits can change, so always check the broker’s website for the most up-to-date information. It’s a bit like checking the weather forecast before heading out for a ski trip – you need the latest information to plan accordingly.

| Broker | Maximum Leverage (Typical for Major Pairs) | Notes |

|---|---|---|

| Questrade | Varies depending on instrument and trader experience; generally capped but may offer higher leverage for experienced traders. | Leverage limits are subject to change and individual assessment. |

| [Broker B Name] | [Maximum Leverage] | [Specific Notes, e.g., restrictions on certain currency pairs] |

| [Broker C Name] | [Maximum Leverage] | [Specific Notes, e.g., tiered leverage based on account size] |

| [Broker D Name] | [Maximum Leverage] | [Specific Notes, e.g., requirements for margin calls] |

*Note: The information provided above is for illustrative purposes only and may not reflect the current leverage offered by each broker. Always consult the individual broker’s website for the most accurate and up-to-date information.*

Key Differences in Leverage Policies

The differences in leverage policies across brokers can significantly affect a trader’s experience. For instance, one broker might offer higher leverage for experienced traders, while another might have stricter limits for all clients. This is like choosing between a powerful snowmobile and a gentle snowshoe – the right choice depends entirely on your skills and preferences. Some brokers might also offer different leverage levels based on the specific currency pair being traded, adding another layer of complexity.

This variation highlights the importance of carefully comparing brokers and understanding their specific leverage policies before opening an account. A seemingly small difference in leverage can dramatically alter the risk profile of a trade.

Outcome Summary

So, there you have it – a whirlwind tour of Questrade’s leverage limits. Remember, leverage is a double-edged sword: it can amplify your wins, but it can also magnify your losses. Understanding the rules of the game, knowing your limits, and employing sound risk management strategies are crucial for surviving (and thriving) in the forex arena. Don’t just jump in with both feet; tread carefully, learn the ropes, and always remember: forex trading isn’t a get-rich-quick scheme, it’s a marathon, not a sprint.

Now go forth and conquer (responsibly!).