What are the top performing Canadian crypto stocks to watch in 2024? This isn’t your grandpappy’s stock market; we’re diving headfirst into the wild, wild west of Canadian crypto – where fortunes are made (and lost) faster than you can say “blockchain.” Buckle up, buttercup, because we’re about to explore the exhilarating (and potentially terrifying) world of digital assets north of the border.

Prepare for a rollercoaster ride of market analysis, risk assessment, and enough jargon to make your head spin (in a good way, hopefully!).

We’ll be dissecting the key performance indicators that separate the wheat from the chaff (or, in this case, the Bitcoin from the… well, less-Bitcoin-like). We’ll unearth promising Canadian crypto companies, analyze market trends that could send your portfolio soaring (or plummeting), and even delve into some seriously specific stock examples. Think of this as your survival guide to navigating the sometimes-treacherous waters of Canadian crypto investing.

No guarantees, but we’ll arm you with enough information to make informed (and hopefully profitable) decisions.

Defining “Top Performing” Canadian Crypto Stocks

Picking the crème de la crème of Canadian crypto stocks requires more than just a lucky guess and a crystal ball (though those would be handy!). We need a robust methodology, a keen eye for detail, and perhaps a slightly caffeinated brain. Let’s dive into what truly defines a “top performer” in this exciting, albeit volatile, market.Defining “top performing” hinges on selecting the right Key Performance Indicators (KPIs).

These aren’t just arbitrary numbers; they’re the vital signs of a crypto stock’s health and potential. Simply put, we’re looking for stocks that show consistent growth and profitability, while also exhibiting resilience against market downturns.

Key Performance Indicators for Canadian Crypto Stocks

Several KPIs provide a comprehensive picture of a crypto stock’s performance. These indicators help us to understand not just the current state, but also the trajectory of the stock. Ignoring any one of these would be like judging a book by its cover – you’d miss the entire story.

So, you’re eyeing those top-performing Canadian crypto stocks for 2024? Smart move! But before you dive headfirst into the exhilarating world of digital assets, remember that securing your crypto is paramount. That’s where choosing the right wallet comes in – check out this guide on Choosing the right crypto wallet for Canadians for security and ease of use to avoid any unfortunate digital wallet mishaps.

Then, and only then, can you confidently tackle those lucrative Canadian crypto stocks!

- Return on Investment (ROI): This classic metric measures the profitability of an investment over a specific period. A higher ROI generally indicates better performance. For example, a stock with a 50% ROI over a year would be considered significantly better than one with a 5% ROI during the same period.

- Revenue Growth: Consistent and substantial revenue growth signals a healthy and expanding business. A company showing consistent year-over-year revenue increases suggests strong market demand and operational efficiency. For example, a company with 20% year-over-year revenue growth for the past three years is a strong contender.

- Market Capitalization: This reflects the total market value of a company’s outstanding shares. A higher market capitalization often suggests greater stability and investor confidence. A large market cap doesn’t guarantee success, but it usually implies a degree of established presence.

- Price-to-Earnings Ratio (P/E): This compares a company’s stock price to its earnings per share. A lower P/E ratio might suggest the stock is undervalued, while a high P/E ratio could indicate it’s overvalued. However, this metric should be considered in conjunction with other KPIs, as it can be misleading in rapidly growing sectors.

- Volatility: While high volatility can lead to significant gains, it also increases the risk of substantial losses. A lower volatility score indicates greater stability and reduced risk. For example, a stock with a beta of less than 1 is generally considered less volatile than the overall market.

Methodology for Ranking Crypto Stocks

Ranking crypto stocks requires a balanced approach. Simply focusing on one KPI is insufficient; it’s akin to navigating by only using a compass. We need a multi-faceted strategy. A weighted average approach, assigning different weights to each KPI based on its relative importance, provides a more holistic ranking system. For example, ROI might be weighted more heavily than volatility for investors focused on short-term gains, while the opposite might be true for long-term, risk-averse investors.

So, you’re eyeing those top-performing Canadian crypto stocks for 2024? Smart move! But before you dive headfirst into the exhilarating world of digital assets, remember to secure your trading platform. Navigating the Bitget Ontario registration and verification process is a crucial first step, ensuring your investments are safe and sound. Then, and only then, can you confidently return to your quest for the next big Canadian crypto winner!

Comparison of Ranking Systems and Their Limitations

Different ranking systems exist, each with its own strengths and weaknesses. Some systems may prioritize short-term gains, while others emphasize long-term growth potential. Some might focus solely on quantitative data, while others incorporate qualitative factors like management expertise and technological innovation. The limitations often stem from the inherent subjectivity in weighting KPIs and the inability to perfectly predict future market performance.

No system is foolproof; they are tools, not oracles.

Factors Influencing Performance of Canadian Crypto Stocks

The performance of Canadian crypto stocks is influenced by a multitude of factors, both internal and external. These factors interact in complex ways, making accurate prediction a challenging but fascinating pursuit.

- Regulatory Environment: Government regulations and policies significantly impact the crypto market. Changes in regulations can dramatically affect stock prices, sometimes overnight.

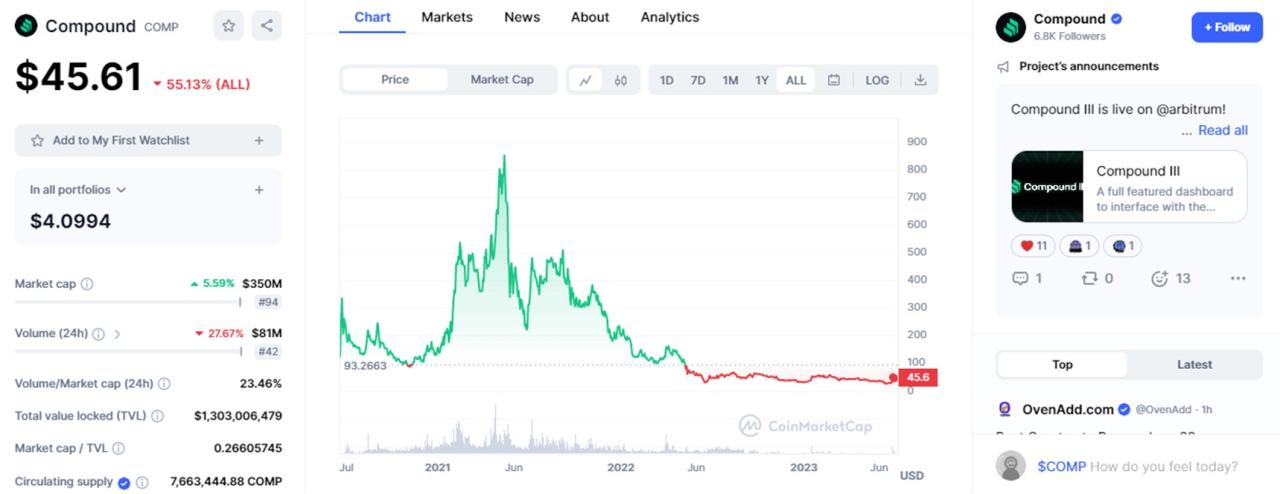

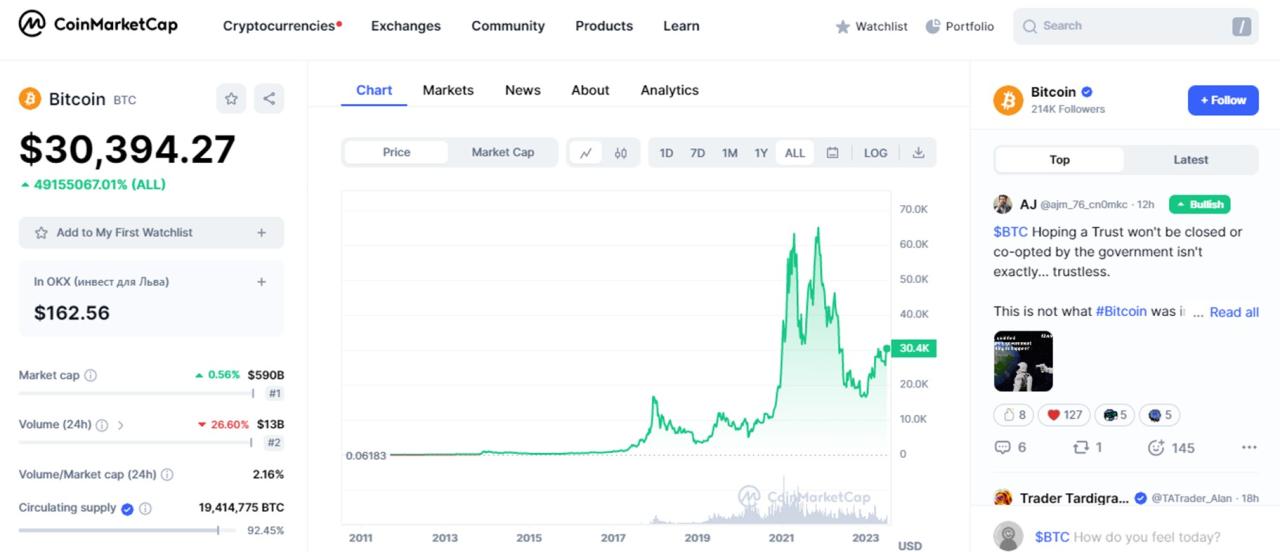

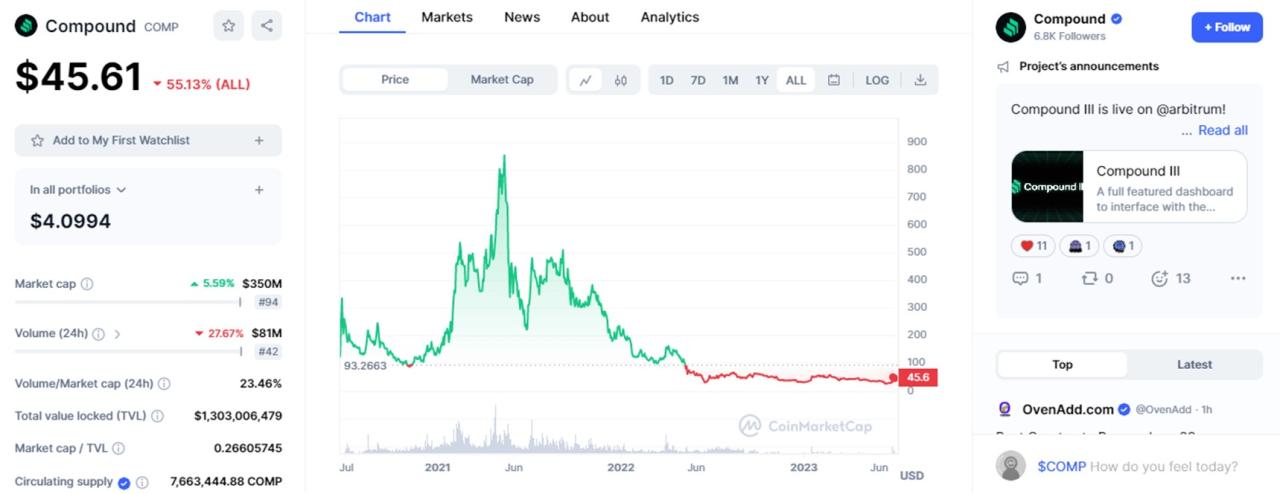

- Bitcoin and Cryptocurrency Market Trends: The overall performance of Bitcoin and other cryptocurrencies heavily influences the performance of crypto stocks. A bull market generally benefits crypto stocks, while a bear market can lead to significant losses.

- Technological Advancements: Innovations in blockchain technology and related fields can significantly impact the value of crypto stocks. A breakthrough innovation can propel a stock’s price, while a technological setback can cause a decline.

- Investor Sentiment: Market sentiment plays a crucial role in shaping stock prices. Positive news and investor confidence can drive prices up, while negative news or fear can lead to sell-offs.

- Company-Specific Factors: Internal factors such as management quality, financial health, and competitive landscape also play a crucial role in determining a company’s performance.

Identifying Promising Canadian Crypto Companies for 2024

Pinpointing the next big thing in the Canadian crypto scene is like trying to predict the next viral TikTok dance – a blend of educated guesswork, a dash of luck, and a healthy dose of caffeine. While no one has a crystal ball, we can examine publicly traded companies deeply involved in the crypto space and assess their potential for 2024.

Remember, investing in crypto is inherently risky, so do your own thorough research before diving in headfirst!

Several Canadian companies are making waves in the cryptocurrency industry, each with its unique approach and risk profile. Their success hinges on factors like regulatory changes, broader market trends, and, of course, the ever-volatile nature of cryptocurrency itself. Let’s delve into some key players.

Prominent Canadian Crypto Companies and Their Market Standing

The following table highlights some publicly traded Canadian companies with significant involvement in the cryptocurrency ecosystem. Note that market capitalization fluctuates constantly, so these figures are snapshots in time and should be independently verified.

| Company Name | Business Model | Key Technology/Focus | Approximate Market Cap (USD –

|

|---|---|---|---|

| [Company A – Replace with Actual Company Name] | [e.g., Bitcoin mining, blockchain technology development, crypto exchange] | [e.g., ASIC mining rigs, proprietary blockchain solutions, advanced trading algorithms] | [e.g., $XXX Million – This is a placeholder. Replace with actual data from a reliable source like Yahoo Finance or a similar platform.* ] |

| [Company B – Replace with Actual Company Name] | [e.g., Cryptocurrency investment, blockchain infrastructure development] | [e.g., Diversified portfolio management, high-performance computing infrastructure] | [e.g., $YYY Million -This is a placeholder. Replace with actual data from a reliable source like Yahoo Finance or a similar platform.* ] |

| [Company C – Replace with Actual Company Name] | [e.g., Cryptocurrency exchange platform, custody services] | [e.g., Secure wallet technology, robust trading platform, regulatory compliance] | [e.g., $ZZZ Million -This is a placeholder. Replace with actual data from a reliable source like Yahoo Finance or a similar platform.* ] |

| [Company D – Replace with Actual Company Name] | [e.g., Blockchain consulting, NFT marketplace] | [e.g., Smart contract development, NFT minting and verification] | [e.g., $WWW Million -This is a placeholder. Replace with actual data from a reliable source like Yahoo Finance or a similar platform.* ] |

Disclaimer: The information provided above is for illustrative purposes only and should not be considered financial advice. Always conduct thorough due diligence and consult with a financial professional before making any investment decisions.

Predicting the top Canadian crypto stocks for 2024 is like predicting the weather in Canada – wildly unpredictable! But if you’re looking to boost your portfolio, consider diversifying your approach; learn how to maximize your crypto gains by checking out this guide on How to stake crypto in Canada with high returns , then revisit those stock picks with a newfound appreciation for passive income.

Remember, even the most promising stocks need a smart strategy to truly shine!

Analyzing Market Trends and Predictions: What Are The Top Performing Canadian Crypto Stocks To Watch In 2024?

Predicting the future of Canadian crypto stocks in 2024 is like trying to predict the weather in Canada – wildly unpredictable, with potential for both sunshine and blizzards. Several factors will significantly influence their performance, creating a volatile but potentially rewarding landscape for investors willing to brave the storm.Market trends will be heavily influenced by the global crypto market’s overall health.

Predicting top Canadian crypto stocks for 2024 is like predicting the weather in Canada – wildly unpredictable! But before you dive in, choosing the right exchange is crucial. Understanding the fee structures and security measures is key, which is why comparing platforms like Crypto.com vs Coinbase: Fees, security, and features for Canada is a smart move. Only then can you confidently focus on those potentially lucrative Canadian crypto stocks!

A bull market will likely see Canadian crypto stocks soar, while a bear market could send them plummeting faster than a moose on roller skates. The price of Bitcoin, the crypto king, will remain a dominant force, influencing the valuations of all related companies. Furthermore, the adoption of blockchain technology beyond cryptocurrency, in areas like supply chain management and digital identity, will have a knock-on effect on the success of these stocks.

Regulatory Changes and Their Impact

Regulatory changes will undoubtedly play a pivotal role. Increased clarity and standardization in Canadian crypto regulations could boost investor confidence, attracting more capital and driving up stock prices. Conversely, overly restrictive or confusing regulations could stifle growth and lead to a decline. Think of it like this: clear rules are a well-lit highway for investment, while confusing rules are a treacherous, fog-laden backroad.

Predicting the top Canadian crypto stocks for 2024 is like predicting the Super Bowl winner – a wild guess with potentially huge rewards (or losses!). While analyzing market trends is crucial, sometimes you need a break and check out the latest football news for a dose of reality. Then, it’s back to the charts, hoping your crypto picks are touchdown-worthy investments in the new year.

The upcoming regulatory landscape will likely be a key determinant of whether 2024 is a year of crypto prosperity or a regulatory winter. For example, if Canada adopts a clear framework for stablecoins, we might see a surge in companies focusing on this segment. However, if regulations heavily restrict DeFi (Decentralized Finance) activities, then companies involved in that space could suffer.

Scenario Analysis: A Rollercoaster Ride

Let’s explore three possible scenarios for Canadian crypto stocks in 2024:

We will consider three hypothetical Canadian crypto companies: “MapleCoin,” focused on Bitcoin mining; “BeaverBlock,” specializing in blockchain technology solutions; and “CaribouCrypto,” operating a cryptocurrency exchange.

| Scenario | MapleCoin | BeaverBlock | CaribouCrypto |

|---|---|---|---|

| Bull Market (Bitcoin surges above $50,000): Increased demand for Bitcoin drives up MapleCoin’s profitability, boosting its stock price significantly. BeaverBlock benefits from increased demand for blockchain solutions. CaribouCrypto sees higher trading volumes and increased revenue. | Stock price increases by 150-200% | Stock price increases by 75-100% | Stock price increases by 50-75% |

| Bear Market (Bitcoin falls below $20,000): MapleCoin faces reduced profitability, impacting its stock price negatively. BeaverBlock’s growth slows down due to reduced investment in new technologies. CaribouCrypto experiences lower trading volumes and reduced revenue. | Stock price decreases by 50-75% | Stock price decreases by 25-50% | Stock price decreases by 10-25% |

| Neutral Market (Bitcoin fluctuates between $30,000-$40,000): Moderate growth for all three companies, with stock prices experiencing relatively minor fluctuations. Regulatory clarity plays a larger role in determining stock performance. | Stock price remains relatively stable, with minor gains or losses. | Stock price remains relatively stable, with minor gains or losses. | Stock price remains relatively stable, with minor gains or losses. |

Visual Representation of Potential Price Movements

Imagine three line graphs, one for each company. For the Bull Market scenario, the lines would sharply ascend, with MapleCoin showing the steepest incline, followed by BeaverBlock, and then CaribouCrypto. In the Bear Market scenario, the lines would plummet, again with MapleCoin experiencing the most dramatic drop, followed by BeaverBlock and then CaribouCrypto. The Neutral Market scenario would show relatively flat lines with minor fluctuations, indicating stable but less dramatic growth or decline.

The y-axis would represent the stock price, and the x-axis would represent time (throughout 2024). The visual would clearly demonstrate the varied impact of market conditions on each company’s stock performance.

Assessing Risk and Investment Strategies

Investing in Canadian crypto stocks can be a thrilling rollercoaster ride, promising potentially huge returns but also capable of stomach-churning drops. Think of it as a high-stakes game of financial poker – exciting, yes, but requiring a cool head and a well-thought-out strategy to avoid ending up with a busted flush. Understanding the risks and employing smart strategies is crucial for navigating this volatile landscape.The crypto market is notoriously unpredictable, influenced by factors ranging from regulatory changes and technological advancements to Elon Musk’s latest tweet.

Predicting top Canadian crypto stocks for 2024 is like predicting the weather in Canada – wildly unpredictable! But before you dive headfirst into the frosty world of digital assets, remember to choose your platform wisely. For a safe and legal landing, check out these Reliable crypto investment platforms regulated in Canada to help you navigate the icy terrain and potentially uncover those lucrative Canadian crypto gems.

So, buckle up, and may your portfolio flourish!

This inherent volatility means that even the most promising companies can experience significant price swings in short periods. Furthermore, the relative novelty of the crypto space introduces additional risks, including the potential for scams, security breaches, and unforeseen technological disruptions. The Canadian regulatory environment for crypto is still evolving, adding another layer of complexity and uncertainty for investors.

Key Risks Associated with Investing in Canadian Crypto Stocks, What are the top performing Canadian crypto stocks to watch in 2024?

Investing in crypto stocks carries inherent risks. Price volatility, as mentioned, is a major concern. A sudden market downturn could wipe out a significant portion of your investment in a matter of days. Regulatory uncertainty presents another significant challenge. Governments worldwide are still grappling with how to regulate cryptocurrencies, and changes in regulations could drastically impact the value of crypto stocks.

Finally, the risk of fraud and scams is ever-present in the crypto world. Thorough due diligence is essential to avoid falling victim to fraudulent schemes.

Investment Strategies for Mitigating Risks

Several strategies can help mitigate the risks associated with investing in Canadian crypto stocks. Diversification is paramount. Don’t put all your eggs in one basket – spread your investments across multiple companies and even asset classes to reduce the impact of any single investment’s poor performance. Dollar-cost averaging is another effective strategy. Instead of investing a lump sum, invest smaller amounts regularly over time.

This reduces the risk of investing a large sum at a market peak. Finally, setting stop-loss orders can help limit potential losses. A stop-loss order automatically sells your shares if the price falls below a predetermined level.

The Impact of Diversification on Portfolio Performance

Diversification is crucial for managing risk. Imagine an investor who put all their money into just one Canadian crypto company. If that company fails, the investor loses everything. However, an investor who diversifies across several companies and perhaps even includes traditional stocks or bonds in their portfolio significantly reduces their risk. If one investment underperforms, others might compensate, leading to a more stable overall portfolio performance.

For example, if one company’s stock drops 20%, but the rest of the portfolio experiences only minor fluctuations, the overall impact is much less severe than if the investor had only held that one stock.

The Importance of Due Diligence

Before investing in any crypto stock, thorough due diligence is essential. This involves researching the company’s business model, financial performance, management team, and competitive landscape. It’s also crucial to understand the technology behind the cryptocurrency and the regulatory environment in which the company operates. Consider researching news articles, financial reports, and analyst opinions to get a well-rounded picture. Don’t rely solely on promotional materials or social media hype.

Remember, thorough research can help you identify potentially risky investments and make informed decisions.

Exploring Specific Canadian Crypto Stock Examples

Picking Canadian crypto stocks is like choosing a flavour of poutine – there are a lot of options, some are surprisingly delicious, and others… well, let’s just say they might leave you wanting more gravy. This section dives into the profiles of a few Canadian companies navigating the wild world of cryptocurrency. Remember, past performance is

not* indicative of future results – this is the crypto equivalent of a rollercoaster, buckle up!

It’s important to remember that the Canadian crypto market is still relatively young and volatile. Investing in these companies carries significant risk, so only invest what you can afford to lose. Think of it as a high-stakes poker game – you might win big, or you might lose your chips. Let’s look at some players in the game.

Galaxy Digital Holdings Ltd. (GLXY)

Galaxy Digital is a major player in the Canadian crypto space, offering a diverse range of services including trading, investment management, and mining. They’ve seen some wild swings in their stock price, reflecting the volatility of the crypto market.

- Recent Performance: Galaxy Digital’s performance has been closely tied to the overall crypto market trends. Periods of market growth have seen significant gains, while downturns have led to substantial losses. Think of it like a seesaw – up one minute, down the next.

- Future Prospects: Galaxy Digital is aiming to expand its services and diversify its revenue streams. Their success will likely depend on their ability to navigate the regulatory landscape and capitalize on emerging opportunities in the crypto space. Success here means staying ahead of the curve and adapting quickly.

- Potential Challenges: Regulatory uncertainty and market volatility are major headwinds for Galaxy Digital. Competition from other established financial institutions is also a significant factor. It’s a crowded marketplace, so staying competitive is key.

- Key Financials: (Note: Specific financial data should be sourced from reputable financial websites like the company’s investor relations page or Bloomberg.) Investors should carefully review their financial statements for a complete picture.

- Strategic Initiatives: Expansion into new markets, development of innovative financial products, and strategic partnerships are key to their growth strategy.

Hut 8 Mining Corp. (HUT)

Hut 8 is a publicly traded Bitcoin mining company. Their performance is directly tied to the price of Bitcoin, making them a particularly volatile investment.

- Recent Performance: Hut 8’s stock price has mirrored the price of Bitcoin, experiencing significant gains during bull markets and substantial losses during bear markets. It’s a high-risk, high-reward situation.

- Future Prospects: The company’s future prospects depend heavily on the continued adoption of Bitcoin and the overall health of the cryptocurrency market. Efficiency in mining operations will also play a significant role.

- Potential Challenges: The energy costs associated with Bitcoin mining, the fluctuating price of Bitcoin, and competition from other mining companies are significant challenges. It’s a tough business, with thin margins.

- Key Financials: (Note: Specific financial data should be sourced from reputable financial websites like the company’s investor relations page or Bloomberg.) Analyzing their financials is crucial before investing.

- Strategic Initiatives: Expanding mining operations, increasing efficiency, and potentially diversifying into other cryptocurrencies are potential strategic initiatives.

Bitfarms Ltd. (BITF)

Bitfarms is another significant Bitcoin mining company operating in Canada. Similar to Hut 8, their fortunes are intrinsically linked to the price of Bitcoin.

- Recent Performance: Bitfarms’ stock price has closely tracked the price of Bitcoin, making it a very volatile investment. Think of it as a rollercoaster ride – exciting, but potentially stomach-churning.

- Future Prospects: The company’s future prospects depend largely on the price of Bitcoin and the overall health of the cryptocurrency market. Operational efficiency is key to profitability.

- Potential Challenges: Energy costs, competition from other mining companies, and the regulatory environment are all key challenges for Bitfarms.

- Key Financials: (Note: Specific financial data should be sourced from reputable financial websites like the company’s investor relations page or Bloomberg.) Reviewing their financials is vital to understand their financial health.

- Strategic Initiatives: Expansion of mining operations, technological advancements to improve efficiency, and exploration of new markets are potential strategic focuses.

Final Wrap-Up

So, there you have it: a whirlwind tour of the Canadian crypto stock market in 2024. While we’ve explored promising avenues and potential pitfalls, remember that investing in crypto is inherently risky. This isn’t financial advice (we’re writers, not wizards!), but a comprehensive overview to help you make your own informed choices. Do your due diligence, diversify your portfolio, and maybe, just maybe, you’ll strike it rich.

Or, at the very least, you’ll have a much better understanding of the exciting – and occasionally bewildering – world of Canadian crypto stocks. Happy investing (responsibly, of course!).