What cryptocurrencies to buy now for long-term investment: Identifying promising cryptocurrencies with high growth potential – a question that echoes through the digital canyons of finance! Are you ready to ditch the dusty old piggy bank and ride the rollercoaster of cryptocurrency riches? Buckle up, buttercup, because this isn’t your grandma’s savings account. We’re diving headfirst into the wild world of digital assets, exploring the potential for astronomical gains (and, let’s be honest, the possibility of a spectacular crash).

We’ll navigate the turbulent waters of market trends, decipher the cryptic jargon, and ultimately help you pick the crypto gems that could make your future self very, very happy (or at least, not broke).

This guide will equip you with the knowledge to assess the cryptocurrency market, identify promising projects, manage risk, and develop a long-term investment strategy. We’ll delve into the technical aspects of different cryptocurrencies, comparing their scalability, security, and potential use cases. We’ll also discuss diversification strategies and the importance of understanding your own risk tolerance. Get ready to become a crypto connoisseur!

Understanding the Cryptocurrency Market

The cryptocurrency market is a wild, wild west – a rollercoaster of exhilarating highs and stomach-churning lows. One minute you’re riding the wave of a moon shot, the next you’re clinging on for dear life as the rug gets pulled out from under you. It’s a complex ecosystem driven by everything from Elon Musk’s tweets to global economic anxieties.

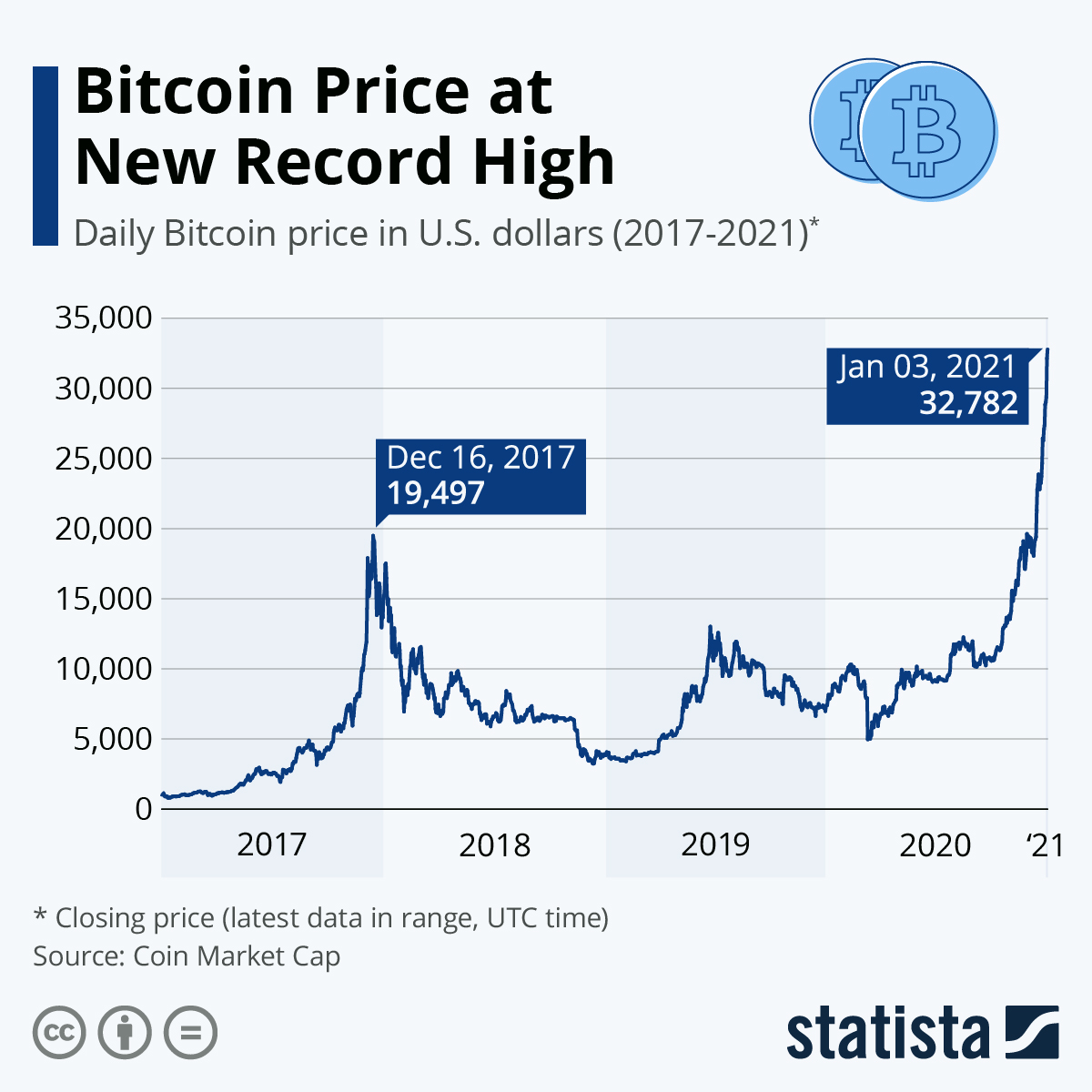

Understanding its nuances is crucial before diving in headfirst.The current state of the cryptocurrency market is, to put it mildly, volatile. We’ve seen periods of explosive growth followed by equally dramatic crashes. Influencing factors are legion: regulatory changes, technological advancements, macroeconomic conditions (inflation, interest rates), and of course, the ever-present speculator sentiment. Think of it as a giant game of Jenga, where one wrong move can topple the whole thing.

Risks Associated with Long-Term Cryptocurrency Investments

Investing in cryptocurrencies, even for the long term, carries significant risk. The market is notoriously unpredictable, and the value of your holdings can fluctuate wildly in short periods. Security breaches, regulatory crackdowns, and even the collapse of entire exchanges are all very real possibilities. Remember that past performance is not indicative of future results – a cryptocurrency that soared last year could be worthless tomorrow.

So, you’re thinking long-term crypto investments? Smart move! But before you dive headfirst into Dogecoin memes, remember you’ll need a solid platform to manage your digital assets. That’s where choosing the right app comes in – check out The best currency trading apps with advanced features to find your perfect match. Then, armed with the right tools, you can confidently research and select those promising cryptos with the potential to make you a crypto-king (or queen!).

Consider it a high-risk, high-reward proposition, and only invest what you can afford to lose completely. Think of it like betting on a particularly unpredictable horse race – exciting, but potentially very expensive.

Comparison of Cryptocurrency Market Capitalizations

Market capitalization, simply put, is the total value of a cryptocurrency. It’s calculated by multiplying the current price of a coin by its circulating supply (the number of coins currently in circulation). Cryptocurrencies with larger market caps are generally considered more established and less volatile, although this isn’t always the case. Smaller-cap cryptocurrencies, on the other hand, offer potentially higher growth but come with significantly more risk.

It’s like comparing a blue-chip stock to a penny stock – the blue chip is safer, but the penny stock could potentially offer much greater returns (or losses).

Top 10 Cryptocurrencies by Market Cap

The following table shows the top 10 cryptocurrencies by market capitalization (Note: Market cap and prices fluctuate constantly. This data is for illustrative purposes only and should not be considered financial advice. Always consult up-to-date information from reliable sources before making any investment decisions).

| Rank | Cryptocurrency | Price (USD) | Circulating Supply | Market Dominance (%) |

|---|---|---|---|---|

| 1 | Bitcoin (BTC) | (Current Price) | (Current Supply) | (Current Dominance) |

| 2 | Ethereum (ETH) | (Current Price) | (Current Supply) | (Current Dominance) |

| 3 | Tether (USDT) | (Current Price) | (Current Supply) | (Current Dominance) |

| 4 | Binance Coin (BNB) | (Current Price) | (Current Supply) | (Current Dominance) |

| 5 | XRP (XRP) | (Current Price) | (Current Supply) | (Current Dominance) |

| 6 | Solana (SOL) | (Current Price) | (Current Supply) | (Current Dominance) |

| 7 | Cardano (ADA) | (Current Price) | (Current Supply) | (Current Dominance) |

| 8 | Dogecoin (DOGE) | (Current Price) | (Current Supply) | (Current Dominance) |

| 9 | USD Coin (USDC) | (Current Price) | (Current Supply) | (Current Dominance) |

| 10 | Polkadot (DOT) | (Current Price) | (Current Supply) | (Current Dominance) |

Identifying Promising Cryptocurrencies

So, you’ve decided to dive into the wild, wild west of cryptocurrency – good on ya! But with thousands of options flashing before your eyes like a digital casino, choosing the right long-term investments can feel like navigating a minefield blindfolded. Fear not, intrepid investor! We’ve sifted through the digital dust to unearth three cryptocurrencies with serious potential for growth, based on current market trends and technological advancements.

So, you’re thinking long-term crypto investments, huh? Smart move! But first, you’ll need a solid platform, and figuring out the best one can be a minefield. That’s why checking out What’s the top-rated and most reliable platform for crypto trading in Canada? is crucial before you dive headfirst into Dogecoin-sized dreams. Once you’ve got your trading base covered, then we can talk about picking those potential moon-shot cryptos!

Buckle up, because this ride’s gonna be bumpy (but hopefully profitable!).Picking the right cryptocurrencies requires more than just throwing darts at a board (though thatcould* be fun). We’ve considered factors like market capitalization, technological innovation, adoption rate, and, of course, the ever-elusive potential for moon shots. Our choices represent diverse approaches to blockchain technology and cater to different investment strategies.

Remember, though, past performance is not indicative of future results – this isn’t financial advice, just informed speculation from a slightly caffeinated crypto enthusiast.

Ethereum (ETH)

Ethereum, the second-largest cryptocurrency by market capitalization, is more than just a currency; it’s a decentralized platform for running smart contracts and decentralized applications (dApps). Its technology, based on a proof-of-stake consensus mechanism, is constantly evolving, making it a robust and scalable ecosystem. This evolution, including the upcoming Shanghai upgrade, addresses previous scalability concerns and improves transaction speeds.

The unique features of Ethereum lie in its ability to host a vast array of decentralized applications, from DeFi platforms to NFTs and DAOs, driving continuous innovation and expanding its use cases. The security of Ethereum is further bolstered by its large and active community of developers and miners.

Cardano (ADA), What cryptocurrencies to buy now for long-term investment: Identifying promising cryptocurrencies with high growth potential

Cardano distinguishes itself through its rigorous, research-driven approach to blockchain development. Unlike some cryptocurrencies that prioritize speed over security, Cardano prioritizes a layered architecture and peer-reviewed scientific methodology. This meticulous approach ensures the platform’s long-term sustainability and resilience. Cardano’s unique features include its Ouroboros proof-of-stake consensus mechanism, which is known for its energy efficiency and security. The potential use cases for Cardano are broad, ranging from decentralized finance (DeFi) applications to supply chain management and identity verification systems.

Its commitment to scientific rigor positions it for sustained growth in the long term.

Solana (SOL)

Solana is a high-performance blockchain known for its blazing-fast transaction speeds and low fees. Its innovative hybrid consensus mechanism, combining proof-of-history and proof-of-stake, enables it to process thousands of transactions per second. This speed and efficiency are crucial for applications requiring high throughput, such as decentralized exchanges (DEXs) and gaming platforms. Solana’s unique features include its high scalability and its robust ecosystem of decentralized applications.

The potential use cases for Solana are vast, encompassing decentralized finance (DeFi), NFTs, and gaming, among others. Its focus on speed and efficiency makes it a compelling choice for developers building high-performance applications.

Scalability and Security Comparison

Comparing the scalability and security of these three cryptocurrencies reveals a fascinating interplay between speed, energy efficiency, and robustness. Ethereum, while improving, still faces scalability challenges compared to Solana’s high throughput. However, Ethereum’s established network and extensive security audits provide a higher level of trust. Cardano, with its focus on scientific rigor, prioritizes security and sustainability over raw speed, occupying a middle ground between the other two.

Each cryptocurrency has its own strengths and weaknesses, and the optimal choice depends on individual risk tolerance and investment goals. It’s a bit like choosing between a sports car (Solana), a luxury sedan (Ethereum), and a rugged off-road vehicle (Cardano) – each has its own unique advantages depending on the terrain.

Analyzing Cryptocurrency Projects

So, you’ve decided to dive into the wild, wild west of cryptocurrency investing. That’s great! But before you saddle up your digital bronco and ride off into the sunset, let’s make sure you’re not heading straight for a cactus. Analyzing a cryptocurrency project isn’t just about checking the price; it’s about digging deep to understand its potential for long-term growth.

Think of it as a thorough pre-purchase inspection, but for digital gold.This section provides a framework for evaluating the viability of a cryptocurrency project. We’ll cover crucial aspects like the team behind it, the underlying technology, market adoption, and essential metrics to gauge its health. We’ll also look at some real-world examples – both triumphant and tragic – to illustrate the importance of due diligence.

Framework for Evaluating Cryptocurrency Projects

A robust evaluation of a cryptocurrency project requires a multifaceted approach. We can structure this assessment using a three-legged stool analogy: Team, Technology, and Market Adoption. If any leg is weak, the whole stool – and your investment – is unstable.

- Team: Analyze the experience and reputation of the development team. Are they seasoned professionals with a proven track record? Is there transparency in their operations? A strong team inspires confidence and reduces the risk of scams or abandoned projects. Think of it as choosing a construction crew for your dream house; you want experienced builders, not amateurs.

- Technology: Assess the underlying technology of the cryptocurrency. Is it innovative and scalable? Does it solve a real-world problem or offer a unique advantage over existing solutions? A technologically superior cryptocurrency has a better chance of gaining widespread adoption. This is like evaluating the materials used in building your house – strong foundations and quality materials are essential.

So, you’re eyeing long-term crypto investments? Smart move! Picking the right coins is half the battle, but if you’re feeling adventurous, you might consider leveraging your trades – just be careful! Learn how to navigate the wild world of leveraged crypto trading in Canada by checking out this guide: How can I safely trade cryptocurrencies with leverage in Canada?

Remember, though, even with leverage, thorough research on promising cryptos like those with strong fundamentals and community support is key to long-term success.

- Market Adoption: Examine the level of market adoption. Is the cryptocurrency gaining traction among users and businesses? What is the trading volume and market capitalization? High adoption rates indicate a healthy and growing ecosystem. This is like considering the location of your dream house; a desirable neighborhood increases its value.

Predicting the next Bitcoin is tricky, like guessing which spice will make your next halal culinary masterpiece truly unforgettable. But serious long-term crypto investors need to do their research, looking for projects with solid tech and a passionate community – just like finding the perfect halal restaurant! So, buckle up, and let’s dive into the exciting (and potentially lucrative) world of crypto investing.

Metrics for Assessing Cryptocurrency Project Health

Understanding key metrics is crucial for evaluating a project’s health and viability. These metrics provide a quantitative assessment of the project’s progress and potential.

- Market Capitalization: The total value of all coins in circulation. A higher market cap generally suggests greater stability, but it’s not the sole indicator of success.

- Trading Volume: The amount of cryptocurrency traded within a specific period. High trading volume often indicates strong interest and liquidity.

- Developer Activity: The frequency of code commits and updates to the project’s source code. Consistent development signals ongoing improvement and maintenance.

- Community Engagement: The level of activity and participation within the cryptocurrency’s community (e.g., forums, social media). A strong and active community often contributes to the project’s long-term success.

Examples of Successful and Unsuccessful Cryptocurrency Projects

Let’s look at some real-world examples to illustrate the impact of the factors discussed above.Bitcoin, a pioneer in the space, benefited from a strong initial team, innovative technology (blockchain), and early adoption. Conversely, many lesser-known projects failed due to a lack of skilled developers, weak technology, or a lack of community support, leading to abandoned projects and investor losses.

One can compare this to the difference between a well-planned and executed construction project versus one riddled with errors and lacking proper oversight.

So, you’re thinking long-term crypto investments? Smart move! But first, you’ll need a reliable platform, and that’s where figuring out How can I download and use the Coinbase app for trading crypto in Canada? comes in handy. Once you’re set up, the world of potentially lucrative digital assets – from established players to exciting newcomers – awaits your savvy investment choices.

Happy HODLing!

Importance of Community Engagement and Developer Activity

A thriving community and active developers are crucial for a cryptocurrency’s long-term success. A strong community provides feedback, support, and advocacy, while active developers ensure the project remains secure, updated, and competitive. Think of it as the difference between a neighborhood watch program and an abandoned building; one fosters security and growth, the other invites decline.

Diversification and Risk Management

So, you’ve picked your potential crypto superstars – congratulations! But remember, even the most dazzling Bitcoin can be eclipsed by a sudden market downturn. This is where diversification and risk management step in, not as boring sidekicks, but as the dynamic duo ensuring your crypto journey doesn’t end in a spectacular crash landing. Think of it as building a crypto ark – you need a variety of animals (cryptocurrencies) to survive the inevitable flood (market correction).Diversification isn’t just about spreading your investments across different coins; it’s about strategically choosing assets with varying levels of risk and potential reward.

So you’re dreaming of crypto riches, eh? Picking the next Bitcoin is a fool’s errand (and a rich fool’s at that!), but smart long-term investing requires careful research. Before you dive in, though, you’ll want to minimize those pesky fees, so check out Which Canadian crypto exchange offers the absolute lowest trading fees? to make your hard-earned crypto go further.

Then, and only then, can you start seriously considering which promising cryptos to stake your future on!

Imagine trying to build a house using only one type of brick – it’s structurally weak and prone to collapse. Similarly, relying on a single cryptocurrency exposes you to immense risk. A well-diversified portfolio, on the other hand, resembles a sturdy building, capable of withstanding market tremors.

Strategies for Diversifying a Cryptocurrency Portfolio

Diversification involves spreading your investment across various cryptocurrencies, sectors (e.g., DeFi, NFTs, Metaverse), and market capitalizations (large-cap, mid-cap, small-cap). A common approach is to allocate a percentage of your portfolio to each category, adjusting these allocations based on your risk tolerance and market conditions. For example, a conservative investor might allocate 60% to established large-cap coins like Bitcoin and Ethereum, 30% to mid-cap altcoins with promising projects, and 10% to a selection of smaller, higher-risk projects.

A more aggressive investor might flip those percentages. The key is to find a balance that aligns with your comfort level.

Personal Risk Tolerance and Cryptocurrency Investment

Before diving headfirst into the crypto pool, honestly assess your risk tolerance. Are you a thrill-seeker comfortable with potentially losing some (or even all) of your investment for the chance of substantial gains? Or do you prefer a more cautious approach, prioritizing capital preservation over high-risk, high-reward opportunities? Your risk tolerance should dictate your investment strategy. Someone with a low risk tolerance might focus on established, less volatile cryptocurrencies, while a high-risk-tolerant investor might allocate a larger portion of their portfolio to newer, more volatile projects.

Remember, there’s no one-size-fits-all answer – your risk profile is unique.

Best Practices for Long-Term Cryptocurrency Risk Management

Long-term crypto investment requires a patient and disciplined approach. Regularly review your portfolio’s performance and rebalance it as needed to maintain your desired asset allocation. Don’t panic sell during market downturns; instead, consider it an opportunity to buy more at lower prices (dollar-cost averaging). Stay informed about market trends, technological advancements, and regulatory changes. Avoid investing more than you can afford to lose, and never invest money you need for essential expenses.

Treat crypto investments as long-term commitments, avoiding impulsive decisions driven by short-term market fluctuations. Finally, consider diversifying beyond cryptocurrencies into other asset classes, such as stocks or bonds, to further reduce overall portfolio risk.

Developing a Robust Cryptocurrency Investment Strategy

Planning is key to successful long-term crypto investment. Here’s a roadmap to building a robust strategy:

A well-defined strategy requires careful consideration of various factors to minimize risk and maximize potential returns. This involves a multi-step process that goes beyond simply selecting cryptocurrencies.

- Define your investment goals and timeframe: Are you aiming for long-term growth or short-term gains? How long are you willing to hold your investments?

- Assess your risk tolerance: How much risk are you comfortable taking? This will influence your asset allocation.

- Conduct thorough research: Investigate different cryptocurrencies, understanding their technology, team, and market potential.

- Diversify your portfolio: Spread your investments across multiple cryptocurrencies and asset classes.

- Develop a clear asset allocation strategy: Determine the percentage of your portfolio allocated to each cryptocurrency.

- Implement a rebalancing schedule: Regularly adjust your portfolio to maintain your target asset allocation.

- Set stop-loss orders: Limit potential losses by automatically selling if the price drops below a certain level.

- Stay informed and adapt: Continuously monitor market trends and adjust your strategy as needed.

- Document your investments: Keep accurate records of your transactions and portfolio performance.

- Consider tax implications: Understand the tax implications of your crypto investments in your jurisdiction.

Future Market Predictions (Qualitative): What Cryptocurrencies To Buy Now For Long-term Investment: Identifying Promising Cryptocurrencies With High Growth Potential

Predicting the future of cryptocurrency is like predicting the weather in a parallel universe – wildly unpredictable, yet strangely fascinating. While nobody has a crystal ball, we can examine potential scenarios based on current trends and technological advancements. Buckle up, because this ride might get bumpy.The cryptocurrency market’s future hinges on several interconnected factors. Government regulation, technological innovation, and mass adoption are key players in this high-stakes game.

Over the next five to ten years, we could see a range of outcomes, from explosive growth to a significant correction, or even something entirely unexpected.

Potential Market Scenarios and Their Impact

Several scenarios could unfold, each with its own impact on long-term investments. A bullish scenario involves widespread adoption, increased institutional investment, and the development of robust regulatory frameworks that foster innovation rather than stifle it. This could lead to exponential growth in cryptocurrency valuations, potentially dwarfing previous bull runs. Conversely, a bearish scenario might involve increased regulatory crackdowns, a major security breach impacting trust, or a prolonged period of economic uncertainty, leading to a significant market correction and potentially long-term stagnation for some cryptocurrencies.

A more moderate scenario could see steady, albeit less dramatic, growth, with certain cryptocurrencies consolidating their positions while others fall by the wayside.

Factors Impacting Cryptocurrency Prices

Several factors could significantly impact cryptocurrency prices. Government regulation, both supportive and restrictive, will play a crucial role. For example, clear regulatory frameworks in major economies could boost investor confidence, while overly restrictive regulations could stifle growth. Technological advancements, such as improvements in scalability and security, will also influence market sentiment. Furthermore, macroeconomic factors, such as inflation and economic downturns, can significantly affect investor behavior and cryptocurrency valuations, mirroring the impact on traditional markets.

Finally, widespread adoption by businesses and individuals is crucial for sustained growth. Imagine a world where crypto is as commonplace as credit cards; that’s a bullish scenario.

Technological Advancements Disrupting the Landscape

Technological advancements are constantly reshaping the cryptocurrency landscape. Layer-2 scaling solutions, designed to improve transaction speeds and reduce fees, could dramatically alter the usability and adoption of certain cryptocurrencies. Advances in privacy-enhancing technologies could also reshape the market, potentially leading to the rise of privacy coins with enhanced security features. The development of more energy-efficient consensus mechanisms could address environmental concerns surrounding some cryptocurrencies, fostering wider acceptance.

Furthermore, the integration of blockchain technology into various sectors, from supply chain management to decentralized finance (DeFi), could drive significant growth.

Hypothetical Scenario: A Significant Price Increase

Imagine a scenario where a cryptocurrency focused on sustainable energy solutions, let’s call it “EcoCoin,” experiences a dramatic price increase. This could be triggered by several factors. Firstly, a major global event highlighting the urgent need for sustainable energy solutions could drive increased investment in EcoCoin. Secondly, successful partnerships with major energy companies demonstrating the practical applications of EcoCoin’s technology could further boost its credibility and adoption.

Thirdly, positive regulatory developments specifically supporting green technologies could significantly impact investor sentiment and fuel price increases. The combination of these factors could lead to a substantial surge in EcoCoin’s value, attracting both retail and institutional investors.

Last Word

So, you’ve journeyed through the crypto jungle, armed with knowledge and a healthy dose of caution. Remember, the cryptocurrency market is a wild beast – unpredictable, exciting, and potentially incredibly lucrative. While we’ve highlighted some promising candidates, no one has a crystal ball (not even the most sophisticated AI). Thorough research, diversification, and a strong understanding of your own risk tolerance are your best allies in this thrilling adventure.

Happy investing – may your portfolio flourish like a digital rainforest!