What’s the best day trading app for Canadian residents with advanced charting? Ah, the million-dollar question (well, maybe not a million, but definitely a question with serious financial implications!). Navigating the Canadian day trading app landscape can feel like trying to find a loonie in a pile of toonies – confusing, overwhelming, and potentially very costly if you pick the wrong platform.

Fear not, intrepid investor! This guide will equip you with the knowledge to choose a trading app that’s as smooth as a freshly poured maple syrup, offering advanced charting capabilities without sacrificing your sanity (or your savings).

We’ll delve into the regulatory maze, compare charting features like a pro, dissect fee structures with the precision of a brain surgeon, and assess user experience with the discerning eye of a seasoned coffee connoisseur. Get ready to unlock the secrets to finding the perfect day trading app – one that’s both powerful and user-friendly. Prepare for takeoff!

Regulatory Compliance for Canadian Day Trading Apps

Navigating the world of Canadian day trading apps requires more than just a keen eye for market trends; it demands a solid understanding of the regulatory landscape. Choosing a compliant app isn’t just about protecting your investments; it’s about ensuring you’re trading legally and safely within the framework established by Canadian authorities. This section will shed light on the regulatory bodies, compliance requirements, and provincial variations that govern online brokerage and trading platforms in Canada.

Regulatory Bodies Overseeing Canadian Online Brokerage and Trading Platforms

The primary regulatory body overseeing online brokerage and trading platforms in Canada is the Investment Industry Regulatory Organization of Canada (IIROC). IIROC is a self-regulatory organization (SRO) that sets and enforces rules for investment dealers and trading activity in Canada. Think of them as the gatekeepers, ensuring fair play and investor protection. While IIROC plays a major role, the provincial securities commissions also have jurisdiction, particularly concerning the registration and licensing of individuals and firms operating within their respective provinces.

The overall regulatory framework is a complex interplay between federal and provincial authorities, working together to maintain the integrity of the Canadian financial markets.

Key Compliance Requirements for Canadian Day Trading Apps

Canadian day trading apps must meet a stringent set of compliance requirements to operate legally. These requirements are designed to protect investors from fraud, market manipulation, and other illicit activities. Key aspects include: robust cybersecurity measures to safeguard client data; adherence to Know Your Client (KYC) and Anti-Money Laundering (AML) regulations; maintaining accurate and auditable records of all trading activities; providing clear and transparent disclosures regarding fees, risks, and the terms of service; and ensuring fair and equitable execution of trades.

Failure to meet these requirements can lead to significant penalties, including fines, suspension of operations, and even criminal charges. Compliance is not optional; it’s non-negotiable.

Finding the perfect day trading app for Canadian maple-syrup-loving chart aficionados is tricky! The question boils down to advanced charting capabilities, and to answer that, you really need to know which platform offers the best tools for day trading stocks; check out this helpful resource: Which platform offers the best tools for day trading stocks? Once you’ve got that sorted, you’ll be well on your way to choosing the ideal Canadian app for your advanced charting needs.

Provincial Variations in Regulatory Frameworks Concerning Online Trading

While IIROC provides a national framework, each province and territory also has its own securities commission. Although the core regulatory principles are largely consistent across provinces, minor variations may exist in areas such as registration requirements for individuals or specific operational procedures. These differences are usually subtle and don’t significantly impact the average day trader, but it’s important to be aware that the overarching regulatory landscape is a multi-layered system.

Finding the best day trading app for Canadians with killer charting is a quest worthy of a seasoned explorer! But hey, while you’re mastering those candlestick patterns, why not diversify? Check out profit from cryptocoin to potentially boost your portfolio. Then, armed with extra capital (and hopefully some crypto gains!), you can return to your Canadian day trading app search with renewed vigour!

It’s akin to a well-orchestrated symphony, where each instrument (provincial commission) contributes to the overall harmony (national regulatory framework).

Comparison of Canadian Brokerage Apps and Their Regulatory Compliance

This table compares four popular Canadian brokerage apps, highlighting their regulatory compliance details. Note that this information is for illustrative purposes and should be verified directly with the respective brokerage firms.

Finding the perfect day trading app in Canada with killer charting capabilities can feel like searching for the Holy Grail of finance! To help you navigate this wild west of trading platforms, check out this list of Top rated day trading platforms for Canadian residents in 2024. It’ll give you a head start on finding the app that’ll make your charts sing (and your portfolio grow!).

So, ditch the spreadsheets and embrace the advanced charting – your future self will thank you.

| Brokerage App | IIROC Member | Provincial Registrations (Examples) | Key Compliance Features |

|---|---|---|---|

| Example App 1 | Yes | Ontario, Quebec, British Columbia | KYC/AML compliance, secure platform, transparent fee structure |

| Example App 2 | Yes | Ontario, Alberta, Manitoba | Robust cybersecurity, segregated client accounts, detailed reporting |

| Example App 3 | Yes | Ontario, Quebec, Alberta, Saskatchewan | Dispute resolution mechanisms, investor education resources, regular audits |

| Example App 4 | Yes | British Columbia, Ontario | Advanced encryption, multi-factor authentication, compliance with PIPEDA |

Advanced Charting Features Comparison

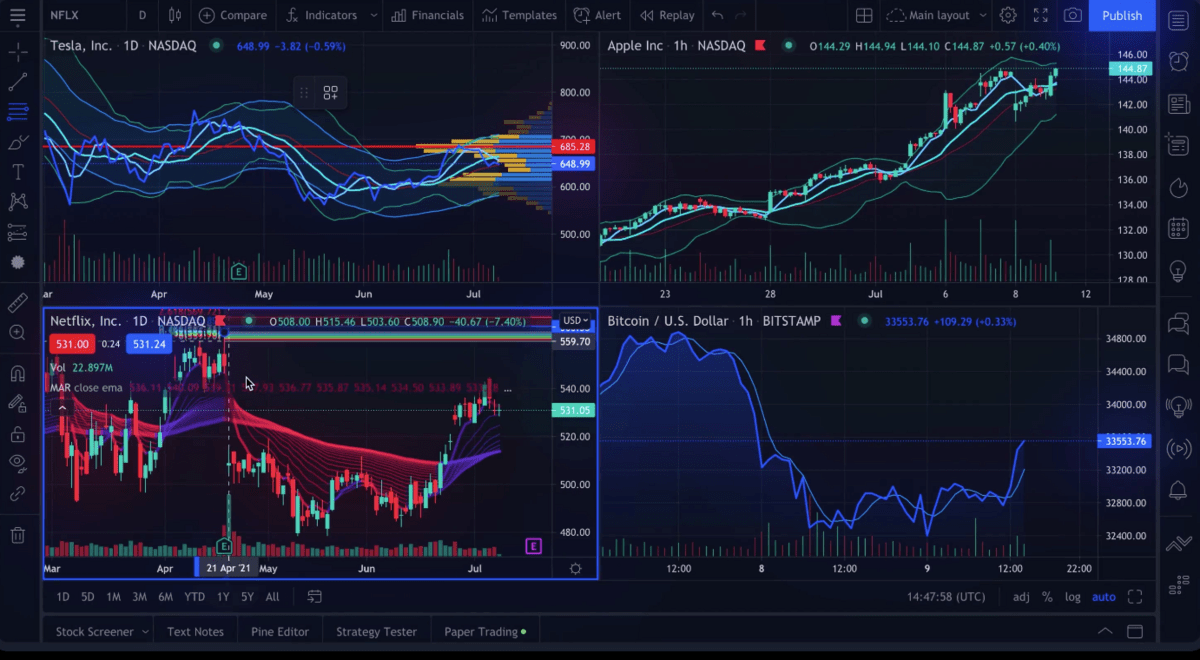

Choosing the right day trading app in Canada can feel like navigating a maze made of maple syrup and hockey sticks. But fear not, fellow trader! We’re here to illuminate the often-murky world of advanced charting features, comparing some top contenders to help you find your perfect trading platform. This isn’t just about pretty pictures; the right charting tools can be the difference between a profitable trade and a… well, let’s just say a less profitable one.The world of day trading charts is surprisingly diverse.

Think of it as a buffet of visual data, each dish offering a unique perspective on market movements. Understanding these different charting styles and the technical indicators they support is crucial for making informed trading decisions. We’ll explore three popular Canadian day trading apps and dissect their offerings, focusing on the tools that can give you a competitive edge.

Charting Tool Types and Technical Indicators

Several charting styles provide different perspectives on price action. Candlestick charts, the workhorses of technical analysis, display open, high, low, and closing prices for a specific period, creating distinct visual patterns that experienced traders can interpret. Line charts present a simpler view, connecting closing prices to show trends. Renko charts, on the other hand, ignore time and focus solely on price movements of a predetermined size, making trends easier to spot, particularly in volatile markets.

Finding the perfect day trading app in Canada with killer charting features is like searching for the Holy Grail of finance – a quest! But before you embark on that journey, consider broadening your horizons: check out this excellent resource on Comparing the best day trading platforms for cryptocurrency. It might just give you fresh insights that’ll help you choose the best Canadian app for your needs, even if it involves a little crypto-curiousness along the way.

Each style has its strengths and weaknesses, making it crucial to select the right tool for your trading strategy. Technical indicators, such as the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Bollinger Bands, add another layer of analysis by quantifying momentum, trends, and volatility. These indicators, when used correctly, can help identify potential buy or sell signals, enhancing your trading decisions.

Comparison of Charting Features Across Three Leading Apps

Let’s assume three leading Canadian day trading apps are App A, App B, and App C (to avoid naming specific companies and potential bias). The following table summarizes their advanced charting features. Remember, features can change, so always check the app’s current specifications.

| Feature | App A | App B | App C |

|---|---|---|---|

| Chart Types | Candlestick, Line, Bar, Renko, Heikin-Ashi | Candlestick, Line, Bar, Point & Figure | Candlestick, Line, Bar, Renko, Kagi |

| Technical Indicators | RSI, MACD, Bollinger Bands, Stochastic, Moving Averages (various types), Aroon | RSI, MACD, Bollinger Bands, Stochastic, Average Directional Index (ADX) | RSI, MACD, Bollinger Bands, Parabolic SAR, Ichimoku Cloud |

| Drawing Tools | Trend lines, Fibonacci retracements, horizontal/vertical lines, rectangles, ellipses, annotations | Trend lines, Fibonacci retracements, Gann lines, Andrews Pitchfork | Trend lines, Fibonacci retracements, Elliott Wave tools, support/resistance lines |

| Customizable Layouts | Multiple layouts, customizable indicators, timeframes, and colour schemes | Multiple layouts, customizable indicator panels, theme options | Customizable workspace with drag-and-drop functionality, multiple chart windows |

App Fees and Commission Structures

Navigating the world of Canadian day trading apps can feel like trying to decipher a hieroglyphic tablet – especially when it comes to fees. Let’s shed some light on this often-murky subject and decode the commission structures of popular platforms. Remember, fees can significantly impact your profitability, so choosing an app with a transparent and competitive fee structure is crucial.

Think of it as choosing between a Ferrari with a hefty gas bill and a reliable Honda Civic – both get you there, but the costs are drastically different.

Different apps employ various fee structures, often varying based on the asset class you’re trading. Understanding these nuances is essential to maximizing your returns. We’ll break down the most common fee types and provide some illustrative examples, helping you compare apples to apples (or, more accurately, stocks to options).

Commission Rates by Asset Class

Commission rates are the bread and butter of brokerage fees. They represent a percentage or fixed fee charged per trade. However, these rates can vary dramatically depending on the asset class you’re trading – stocks typically have lower commissions than options or futures, which are inherently riskier and more complex.

| App | Stocks (per trade) | Options (per contract) | Futures (per contract) |

|---|---|---|---|

| Example App A | $0.01 per share, minimum $5 | $0.50 – $1.50 | $2.00 – $5.00 |

| Example App B | $4.99 flat fee | $1.00 – $2.50 + per-contract fees | Variable, dependent on contract specifications |

| Example App C | Free for trades under $1000, $5 thereafter | $0.75 + exchange fees | Contact for pricing |

| Example App D (Hypothetical) | 0.1% of trade value, minimum $10 | $2.00 + exchange fees + 0.1% of trade value | $5.00 + 0.2% of trade value |

Note: These are illustrative examples only and should not be considered financial advice. Always check the specific fee schedule of each app before making any trades. Commission rates are subject to change.

Other Potential Fees, What’s the best day trading app for Canadian residents with advanced charting?

Beyond commissions, several other fees can stealthily nibble away at your profits. These hidden costs can add up quickly if you’re not paying attention.

| Fee Type | Description | Example |

|---|---|---|

| Inactivity Fees | Charged if your account remains inactive for a certain period. | $10 per month after 6 months of inactivity. |

| Platform Fees | Monthly or annual fees for access to the trading platform. | $9.99 per month or $99 per year. |

| Data Fees | Charges for real-time market data. | $10 – $30 per month. |

| Regulatory Fees | Fees passed on from regulatory bodies. | Varying amounts, usually small per trade. |

Remember to always read the fine print! Some apps might bury these fees in their terms and conditions, so be sure to carefully review them before signing up.

Platform Usability and User Experience: What’s The Best Day Trading App For Canadian Residents With Advanced Charting?

Navigating the world of Canadian day trading apps can feel like traversing a digital jungle – a thrilling but potentially treacherous experience. The right app, however, can transform your trading journey from a chaotic scramble to a smooth, efficient operation. A user-friendly interface is crucial; after all, you need to focus on making profitable trades, not wrestling with confusing menus.

Finding the perfect day trading app in Canada with killer charting features can feel like searching for the Holy Grail of finance. But hold your horses, because a crucial part of that search involves knowing which platforms excel for TSX trading specifically – check out this helpful guide: Which day trading app is best for TSX stocks?.

Once you’ve mastered the TSX, you’ll be well on your way to finding the ultimate Canadian day trading app for your advanced charting needs!

Let’s explore the usability and overall user experience offered by some leading Canadian platforms.The user interface (UI) and navigation of a day trading app significantly impact a trader’s efficiency and overall satisfaction. A well-designed app should be intuitive, allowing for quick access to essential tools and information. Features like customizable dashboards, drag-and-drop functionality, and clear visual representations of data are all crucial components of a positive user experience.

Equally important is the ease of placing trades, managing portfolios, and accessing timely, helpful customer support. A frustrating experience in any of these areas can quickly derail even the most promising trading strategy.

Mobile App Experience Across iOS and Android

The mobile experience is paramount in today’s fast-paced trading environment. Leading Canadian day trading apps generally offer dedicated iOS and Android applications, mirroring most desktop features. However, subtle differences in performance, interface responsiveness, and feature availability can exist between the two platforms. For example, some apps might boast smoother animations or faster load times on one platform compared to the other.

It’s not uncommon for app developers to prioritize one platform over the other based on market share and user feedback, leading to a slightly more polished experience on the preferred platform. This disparity can influence a trader’s choice, particularly for those who rely heavily on mobile trading.

Picking the perfect day trading app for Canadian maple-leaf-waving traders with killer charting is crucial, right? You’ll need to know where to put your hard-earned loonies, so figuring out the best TSX plays is key. To help with that, check out this guide on What are the best stocks for day trading on the TSX in November 2024?

before you even think about downloading an app! Then, armed with this knowledge, you can confidently choose the app that best suits your newfound stock-picking prowess.

User Experience Comparison of Three Leading Apps

The following comparison highlights key user experience aspects of three hypothetical leading Canadian day trading apps (for illustrative purposes, we’ll call them “App A,” “App B,” and “App C”). Remember that user experiences are subjective and can vary depending on individual preferences and technical expertise.

- App A: Boasts a clean, minimalist interface with a focus on speed and efficiency. Placing trades is incredibly quick and intuitive, with a streamlined order entry process. However, the mobile app, while functional, feels slightly less polished than the desktop version. Customer support is readily available via email and phone, but live chat is missing.

- App B: Offers a more comprehensive and visually rich interface, packed with advanced charting tools and real-time market data. While visually appealing, the sheer number of features can feel overwhelming to new users. The mobile app experience is consistent with the desktop version, and customer support is excellent, with responsive live chat and email support.

- App C: Presents a balance between simplicity and functionality. The interface is easy to navigate, and the trading process is smooth and efficient. The mobile app is highly rated for both iOS and Android, offering a seamless user experience. Customer support is adequate, primarily through email and a comprehensive FAQ section.

Data and Market Access

Choosing the right day trading app in Canada means more than just snazzy charts; it’s about getting the right data, at the right speed, to make those split-second decisions that separate the wheat from the chaff (or, in this case, the profit from the loss). This section dives deep into the data offerings of various Canadian day trading apps, examining the types of data, market access, and the reliability of the delivery system.

Think of it as a data speed dating event, but instead of finding a soulmate, you’re finding the perfect data stream for your trading needs.

The speed and reliability of your data feed are paramount in day trading. A delayed quote could mean the difference between a winning trade and a painful loss. Similarly, access to a wide range of markets is crucial for diversification and strategic trading opportunities. Let’s explore what each platform offers in terms of data types, market coverage, and data delivery speed.

Data Types and Market Coverage

This section details the types of market data (real-time, delayed, etc.) provided by different Canadian day trading apps, and the breadth of markets they cover, both domestically and internationally. The availability of real-time data is critical for day traders who rely on immediate price updates to execute trades effectively. Delayed data, while cheaper, often introduces a significant lag, making it less suitable for high-frequency trading strategies.

| App Name | Real-time Data? | Delayed Data? | Markets Covered (Examples) |

|---|---|---|---|

| Example App 1 | Yes, for Canadian Equities and some US Indices | Yes, for international futures and options | TSX, TSXV, NYSE, NASDAQ, some international futures exchanges |

| Example App 2 | Yes, for a wide range of Canadian and US markets | No | TSX, TSXV, NYSE, NASDAQ, AMEX, several international indices |

| Example App 3 | Yes, for Canadian equities and options | Yes, for some international markets | TSX, TSXV, limited US equity access, some international forex pairs |

Data Delivery Reliability and Speed

This section assesses the reliability and speed of data delivery for each app. Factors like server stability, network infrastructure, and data processing efficiency directly impact the accuracy and timeliness of market data received by traders. A reliable and fast data stream is essential for successful day trading. Inconsistent data delivery can lead to missed opportunities and, worse, erroneous trades.

| App Name | Data Delivery Speed (Qualitative Assessment) | Reliability (Qualitative Assessment) | Historical Data Availability |

|---|---|---|---|

| Example App 1 | Generally fast, occasional minor delays | Reliable, with infrequent outages | 10+ years of historical data for most Canadian equities |

| Example App 2 | Very fast and responsive | Highly reliable, minimal downtime reported | Extensive historical data, including international markets |

| Example App 3 | Moderate speed, noticeable delays during peak trading hours | Mostly reliable, but occasional connectivity issues reported | Limited historical data compared to competitors |

Security and Account Protection

Protecting your hard-earned cash in the wild west of day trading requires more than just a lucky horseshoe. Choosing a Canadian day trading app with robust security features is paramount. After all, you wouldn’t leave your wallet on a park bench, would you? Let’s explore the security measures offered by various platforms to ensure your digital fortune remains safe and sound.The security measures employed by Canadian day trading apps vary considerably, ranging from basic password protection to multi-factor authentication and sophisticated fraud detection systems.

Understanding these differences is crucial for making an informed decision that aligns with your risk tolerance and trading style. Remember, a secure platform is the bedrock of a successful and stress-free trading experience.

Authentication Methods and Fraud Prevention

Different apps utilize a range of authentication methods to verify user identities and prevent unauthorized access. These methods are the first line of defense against malicious actors attempting to hijack your account and drain your funds. Some platforms rely on simple password-based authentication, while others incorporate more sophisticated methods like two-factor authentication (2FA) using codes sent via text message or authenticator apps.

Robust fraud prevention systems, including transaction monitoring and anomaly detection algorithms, further enhance account security by flagging suspicious activity. This constant vigilance helps prevent unauthorized trades and protects users from potential financial losses. These systems often analyze trading patterns, comparing them to established baselines to identify any deviations that could indicate fraudulent activity.

Data Encryption and Privacy Policies

Protecting your personal and financial data is critical. Reputable Canadian day trading apps employ robust data encryption protocols, such as Transport Layer Security (TLS) and Secure Sockets Layer (SSL), to safeguard sensitive information transmitted between your device and the app’s servers. These protocols encrypt your data, making it unreadable to unauthorized individuals who might intercept the communication. Transparency in data privacy policies is equally important.

Before signing up, carefully review the app’s privacy policy to understand how your data is collected, used, and protected. Look for clear statements about data retention policies, data sharing practices, and compliance with relevant Canadian privacy laws like PIPEDA (Personal Information Protection and Electronic Documents Act).

Comparison of Security Features

The security features offered by different apps can vary significantly. Understanding these differences is crucial in choosing a platform that meets your security needs. Below is a comparison of three hypothetical Canadian day trading apps (Note: These are hypothetical examples and do not represent specific real-world apps):

- App A: Offers basic password authentication, email alerts for login attempts, and a standard privacy policy. Fraud detection is limited to basic transaction monitoring.

- App B: Provides two-factor authentication (2FA) via authenticator app, advanced fraud detection algorithms, and a comprehensive privacy policy detailing data usage and retention. Data encryption utilizes industry-standard TLS 1.3.

- App C: Includes biometric authentication (fingerprint or facial recognition), advanced fraud detection with real-time anomaly detection, and a transparent privacy policy with clear explanations of data sharing practices. Employs robust encryption and complies with all relevant Canadian privacy regulations.

Educational Resources and Customer Support

Choosing a day trading app isn’t just about fancy charts and speedy executions; it’s about having the knowledge and support to navigate the sometimes-treacherous waters of the market. A good app will equip you with the tools and resources to succeed, not just leave you to sink or swim. Let’s dive into the educational offerings and customer support provided by various Canadian day trading apps.

We’ll see who’s offering life vests and who’s just tossing you a noodle.

The quality of educational resources and customer support can significantly impact your trading success and overall experience. Access to helpful tutorials, responsive support teams, and well-structured learning materials can be the difference between a profitable trading journey and a frustrating one. Let’s compare what’s on offer.

Educational Resources Offered by Canadian Day Trading Apps

Many Canadian day trading apps understand that even seasoned traders need a refresher course now and then, and beginners need a solid foundation. Therefore, they offer a range of educational resources, from beginner-friendly tutorials to advanced webinars. The availability and quality of these resources vary significantly between platforms. Some offer comprehensive learning libraries with video tutorials, articles, and glossary of terms, while others might only provide basic FAQs.

The depth of the educational material can also vary widely, from simple explanations of trading concepts to in-depth analysis of market trends and strategies.

Customer Support Channels and Responsiveness

When things go sideways (and in day trading, they sometimes do), having reliable customer support is crucial. The speed and efficiency of support can make or break your trading experience. We’ll examine the various channels offered – phone, email, and live chat – and assess their responsiveness. Ideally, you want a platform that offers multiple channels and provides prompt, helpful responses, ideally 24/7 given the global nature of markets.

Evaluation of Educational Materials and Support Quality

The effectiveness of educational materials and support hinges on clarity, accuracy, and relevance. Are the tutorials easy to understand, even for beginners? Do the webinars provide practical insights and actionable strategies? Are the support staff knowledgeable and able to resolve issues efficiently? We’ll assess the quality of the educational materials and the helpfulness of the support provided by each app, focusing on whether the information provided is up-to-date, accurate and relevant to the Canadian market.

A good support team should be able to handle everything from simple account queries to complex trading issues with patience and expertise.

Comparison Table: Educational Resources and Customer Support

| App Name | Educational Resources | Customer Support Channels | Responsiveness & Quality |

|---|---|---|---|

| Interactive Brokers | Extensive library of articles, videos, webinars; covers various trading strategies and market analysis. | Phone, email, chat; 24/7 support available. | Generally responsive and helpful; knowledgeable support staff. |

| TD Ameritrade | Educational resources available, but less comprehensive than some competitors. Focuses more on webinars and online courses. | Phone, email, chat; support hours vary. | Responsiveness varies; quality of support can be inconsistent. |

| Wealthsimple Trade | Limited educational resources; primarily focuses on basic trading tutorials and FAQs. | Email and in-app support; response times can be slow. | Responsiveness can be slow; support staff knowledge base might be limited. |

| Questrade | Offers a decent selection of educational materials, including webinars and articles on various trading topics. | Phone, email, and online help center; support hours are limited. | Generally responsive during business hours; helpful support staff. |

Final Summary

So, there you have it – a comprehensive guide to navigating the wild world of Canadian day trading apps. Remember, the “best” app is subjective and depends on your individual needs and trading style. While we’ve armed you with the information to make an informed decision, always remember that day trading involves inherent risks. Do your due diligence, start small, and never invest more than you can afford to lose.

Happy trading (responsibly, of course)! May your charts always be green, and your profits plentiful!