Which cryptocurrencies are the best to buy in Canada right now for long-term growth? That’s the million-dollar question (or, perhaps, the million-Bitcoin question!), and one that has Canadian investors scratching their heads and furiously refreshing their crypto charts. Navigating the wild west of cryptocurrency requires more than just a lucky hunch; it demands understanding the Canadian regulatory landscape, the inherent risks, and the potential rewards of various digital assets.

This deep dive will equip you with the knowledge to make informed decisions, turning your crypto dreams into a (hopefully) profitable reality.

We’ll explore the top-performing cryptocurrencies with promising long-term growth potential, focusing on their underlying technology, market performance, and risk profiles. We’ll also delve into diversification strategies tailored for the Canadian investor, considering factors like tax implications and regulatory uncertainties. Get ready to unleash your inner crypto-wizard!

Canadian Regulatory Landscape for Cryptocurrencies

Navigating the world of cryptocurrency in Canada requires a sturdy pair of regulatory boots. While the Canadian government is still figuring out how to best handle this rapidly evolving digital frontier, there’s a framework in place, albeit one that’s constantly evolving and sometimes feels like a game of digital whack-a-mole.

Current Regulatory Framework

Canada’s approach to cryptocurrency regulation is multifaceted, involving several federal and provincial agencies. The primary regulatory body is the Ontario Securities Commission (OSC), which oversees securities trading, including some cryptocurrencies deemed securities. Other agencies, like the Canada Revenue Agency (CRA) and the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC), play crucial roles in anti-money laundering and tax compliance related to cryptocurrency transactions.

Picking the perfect Canadian crypto for long-term gains? It’s a wild west out there, folks! Before you leap into the crypto-cauldron, though, remember to understand the potential pitfalls. Check out this insightful piece on Leverage trading crypto in Canada: risks and regulations to avoid becoming a crypto-casualty. Then, armed with knowledge (and maybe a lucky rabbit’s foot), you can return to your quest for crypto riches!

This distributed approach can lead to some regulatory overlap and inconsistencies, adding to the complexity for investors. The lack of a single, comprehensive national regulatory body for cryptocurrencies creates uncertainty and potential loopholes. This situation is, frankly, a bit of a regulatory Wild West, but the government is actively working to bring more clarity and order to the digital gold rush.

Tax Implications of Cryptocurrency Trading and Holding

Uncle Sam (or should we say, Aunt Canada?) wants his cut of your crypto gains. The CRA treats cryptocurrency as property, meaning capital gains taxes apply to profits from trading. If you hold cryptocurrency for longer than one year, the tax rate is lower than if you trade it more frequently. This means your crypto gains are added to your other income and taxed accordingly.

Accurate record-keeping is paramount; the CRA expects meticulous tracking of every transaction, including the date, the amount, and the fair market value at the time of the transaction. Failure to comply can lead to significant penalties. Think of it like this: meticulous record-keeping is your crypto shield against a tax audit ambush.

Risks Associated with Investing in Cryptocurrencies, Which cryptocurrencies are the best to buy in Canada right now for long-term growth?

Investing in cryptocurrencies carries inherent risks, amplified by the regulatory uncertainty in Canada. The volatile nature of the market is a major concern, with prices fluctuating wildly in short periods. Regulatory changes could impact the value of your investments, and the lack of consumer protection in this space leaves you vulnerable to scams and fraudulent activities. Furthermore, the decentralized nature of many cryptocurrencies makes it difficult to recover lost funds in case of theft or exchange failure.

Essentially, you’re riding a digital rollercoaster with a slightly unreliable safety harness.

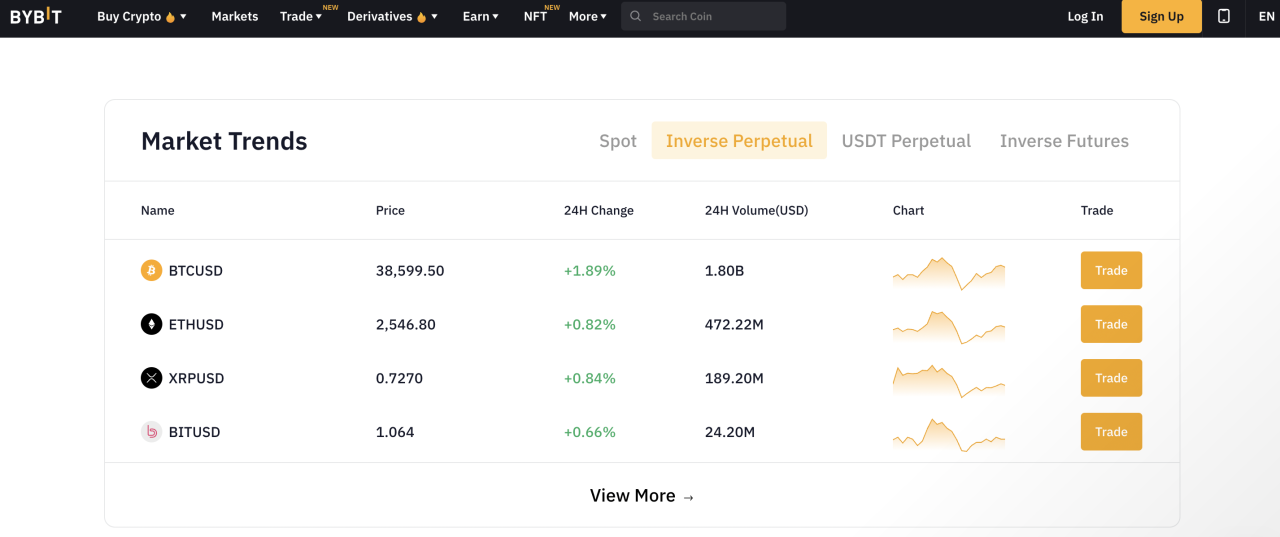

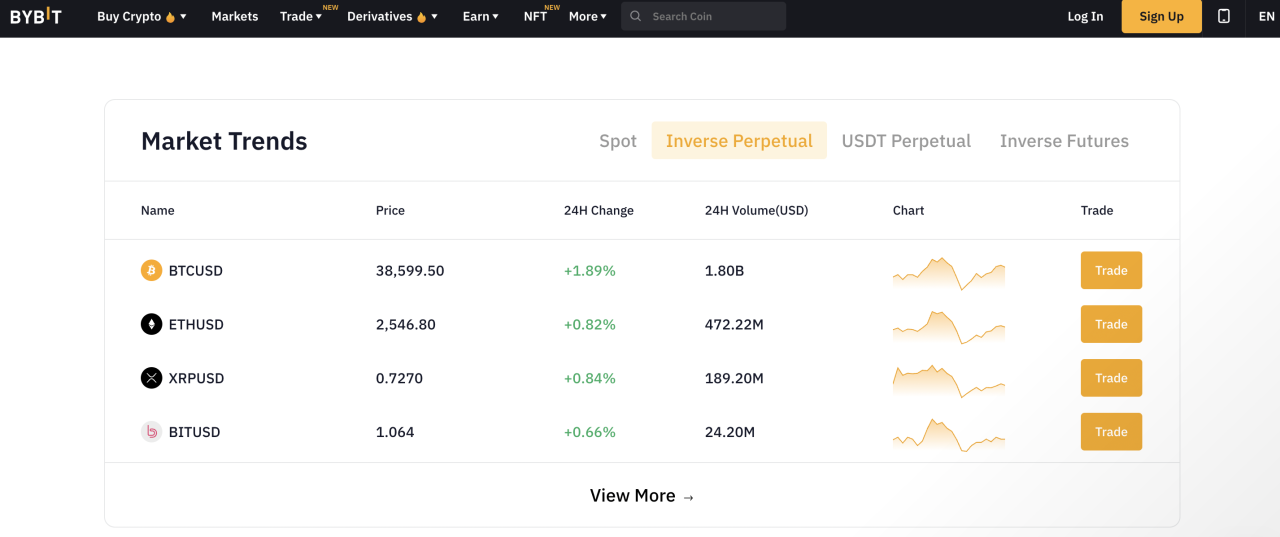

Comparison of Canadian Cryptocurrency Exchanges

Several cryptocurrency exchanges operate in Canada, each with its own set of fees, security measures, and features. Some popular choices include Kraken, Coinbase, and Binance. It’s crucial to compare these exchanges based on their security protocols (two-factor authentication, cold storage, etc.), transaction fees, available cryptocurrencies, and user interface before selecting one. Security is paramount; look for exchanges with robust security measures to protect your investments from hackers and other malicious actors.

Think of it as choosing a bank – you wouldn’t deposit your life savings into a bank with paper-thin security, would you? The same logic applies to choosing a cryptocurrency exchange.

Picking the perfect Canadian crypto for long-term gains is like choosing a winning lottery ticket (minus the whole “illegal gambling” thing). Before you dive in, though, you’ll want to check the fine print – specifically, the legal landscape of your chosen exchange. That’s where understanding Bitget availability and legality in Canada for crypto trading becomes crucial.

Only then can you confidently ponder those sweet, sweet long-term crypto profits!

Top Performing Cryptocurrencies (Long-Term Potential)

Picking the “best” cryptocurrencies is like trying to predict the next unicorn – exciting, potentially lucrative, and fraught with peril. Past performance is not indicative of future results, but examining cryptocurrencies with a history of strong performance and a compelling technological foundation can offer a glimpse into potential long-term growth. Remember, all cryptocurrency investments carry significant risk, and diversification is key.

Bitcoin (BTC)

Bitcoin, the OG cryptocurrency, needs little introduction. Its decentralized nature, secured by blockchain technology, and limited supply of 21 million coins have made it a store of value for many investors. The technology behind Bitcoin is a revolutionary public, permissionless blockchain that uses a proof-of-work consensus mechanism to validate transactions and secure the network. Its market capitalization consistently ranks it as the largest cryptocurrency, and its price history, while volatile, shows significant growth over the years.

However, its relatively slow transaction speeds and high energy consumption remain points of contention. Bitcoin’s risk profile is considered high due to its volatility, but its widespread adoption and established market position offer some degree of stability compared to newer cryptocurrencies. The circulating supply fluctuates slightly as miners continue to add new Bitcoin to the network, but it’s steadily approaching its maximum limit.

Ethereum (ETH)

Ethereum, often considered the “world computer,” expands on Bitcoin’s blockchain technology by enabling smart contracts and decentralized applications (dApps). This functionality has opened up a vast array of possibilities, from decentralized finance (DeFi) to non-fungible tokens (NFTs). Ethereum uses a proof-of-stake consensus mechanism (since the Merge in 2022), significantly reducing its energy consumption compared to Bitcoin’s proof-of-work. Ethereum’s market capitalization is substantial, placing it consistently among the top cryptocurrencies.

Its price history mirrors Bitcoin’s volatility, yet its broader utility and thriving ecosystem suggest strong long-term potential. The risk associated with Ethereum is still high due to market fluctuations, but its innovative technology and diverse use cases make it a compelling investment for many. The circulating supply is constantly increasing as new ETH is added to the network through staking rewards and transaction fees.

Solana (SOL)

Solana is a high-performance blockchain designed to handle a large volume of transactions with low latency. Its unique hybrid consensus mechanism combines proof-of-history and proof-of-stake, allowing for faster transaction speeds and lower fees than many other blockchains. Solana’s ecosystem is rapidly expanding, with a growing number of DeFi applications and NFTs. Its market capitalization is significantly smaller than Bitcoin and Ethereum, but its strong performance in the past has attracted significant attention.

Solana’s price history has shown periods of extreme volatility, reflecting its relatively young age and smaller market capitalization. The risk profile is therefore higher than established cryptocurrencies, but its potential for growth is also significant. The circulating supply of SOL is constantly evolving based on the network’s activity and staking rewards.

Cardano (ADA)

Cardano focuses on a research-driven approach to blockchain development. Its layered architecture separates the settlement layer (responsible for transaction processing) from the computation layer (supporting smart contracts), allowing for greater scalability and flexibility. Cardano utilizes a proof-of-stake consensus mechanism, emphasizing sustainability and energy efficiency. While its market capitalization is considerable, it’s smaller than Ethereum’s. Cardano’s price history exhibits volatility but has demonstrated periods of significant growth.

The risk associated with Cardano is moderate to high, reflecting its relatively young age and ongoing development. Its circulating supply is also steadily increasing as new ADA is created through staking rewards.

Binance Coin (BNB)

Binance Coin is the native cryptocurrency of the Binance exchange, one of the world’s largest cryptocurrency exchanges. BNB’s utility extends beyond the Binance ecosystem; it’s used for trading fees, staking, and accessing various services within the Binance Smart Chain (BSC). Its market capitalization is substantial, and its price history reflects the growth of the Binance exchange and the broader cryptocurrency market.

BNB’s risk profile is moderate to high, as its value is closely tied to the success of the Binance exchange. The circulating supply is constantly evolving and subject to adjustments by the Binance team.

Diversification Strategies for Canadian Crypto Investors

Don’t put all your digital eggs in one basket! The cryptocurrency market is notoriously volatile, and while the potential for massive gains is enticing, so is the potential for equally massive losses. Diversification is your trusty steed in this wild west of finance, helping you navigate the ups and downs with a bit more grace (and hopefully, fewer tears).

Picking the perfect Canadian crypto for long-term gains? It’s a wild west out there, folks! But if you’re smart (and a little lucky), you can learn how to profit from cryptocoin and potentially ride that rocket to the moon. Of course, thorough research is key before you dive headfirst into any digital gold rush – remember, even the best-laid plans can go sideways in the cryptoverse!

This section explores how smart diversification can help Canadian crypto investors build a portfolio that’s both exciting and (relatively) safe.Diversification in cryptocurrency investing involves spreading your investments across different cryptocurrencies, reducing your exposure to the risk associated with any single asset’s price fluctuations. Imagine owning only Dogecoin and then Elon Musk tweets something… slightly cryptic. Yikes. Diversification helps cushion the blow of such events.

It’s about managing risk, not eliminating it entirely – remember, crypto is inherently risky.

Sample Diversified Cryptocurrency Portfolio

A well-diversified portfolio balances risk and reward. This example is for illustrative purposes only and shouldn’t be taken as financial advice. Always do your own thorough research before investing.

| Cryptocurrency | Allocation Percentage | Rationale | Risk Assessment |

|---|---|---|---|

| Bitcoin (BTC) | 40% | Established market leader, relatively stable compared to altcoins. Acts as a portfolio anchor. | Medium – Established but still volatile. |

| Ethereum (ETH) | 25% | Strong technology, large ecosystem, potential for long-term growth in decentralized finance (DeFi). | Medium-High – More volatile than Bitcoin but with significant growth potential. |

| Solana (SOL) | 15% | High transaction speeds and scalability, potential for significant gains but also higher risk. | High – Considered a high-growth, high-risk asset. |

| Cardano (ADA) | 10% | Focus on sustainability and research, potentially strong long-term growth. | Medium – Less volatile than Solana, but still subject to market fluctuations. |

| Stablecoins (e.g., USDC, USDT) | 10% | Provides stability and liquidity, useful for rebalancing the portfolio. | Low – Generally considered stable, but still subject to regulatory and counterparty risks. |

Benefits of Diversification in Mitigating Risk

Diversification isn’t just a fancy word; it’s a powerful tool for reducing the impact of losses. If one cryptocurrency underperforms, the others can potentially offset those losses. It’s like having a safety net – not foolproof, but definitely helpful during a market downturn. Think of it as spreading your bets across several horses in a race instead of putting all your money on one.

Importance of Personal Risk Tolerance

Your risk tolerance is as unique as your fingerprint. Some investors are comfortable with high-risk, high-reward strategies, while others prefer a more conservative approach. Before diving into crypto, honestly assess your risk tolerance. Are you okay with potentially losing a significant portion of your investment? If not, a more conservative, diversified portfolio with a higher allocation to stable assets is likely a better fit.

Picking the perfect cryptos for long-term Canadian gains? It’s a wild west out there! But before you lasso any Bitcoin, finding the right trading platform is key. That’s where checking out Best crypto trading app in Canada for beginners comes in handy. Once you’ve got your digital spurs on, you can start seriously considering which coins to bet on for that sweet, sweet future wealth.

Investing beyond your comfort level can lead to panic selling during market downturns, often resulting in bigger losses.

Examples of Diversification Strategies

Several strategies exist for diversifying a crypto portfolio. A

- market-cap weighted* approach allocates investments proportionally to the market capitalization of each cryptocurrency (larger market cap means a larger allocation). An

- equal-weighted* approach assigns an equal percentage to each cryptocurrency in the portfolio, regardless of market cap. Other strategies might focus on diversification across different sectors within the crypto space (e.g., DeFi, NFTs, metaverse tokens). The best strategy depends on your individual goals and risk tolerance.

Fundamental Analysis of Selected Cryptocurrencies

Choosing the right cryptocurrencies for long-term investment requires a deep dive into their fundamentals. This isn’t about chasing the next moon shot; it’s about identifying projects with solid foundations and sustainable growth potential. Let’s examine Bitcoin, Ethereum, and Solana through this lens.

Bitcoin’s Fundamental Strengths

Bitcoin’s enduring appeal stems from its scarcity, robust network effect, and growing adoption. Its fixed supply of 21 million coins creates inherent scarcity, driving up value as demand increases. This scarcity is further amplified by the ever-increasing difficulty of mining new Bitcoins. The network effect is equally powerful; the more users Bitcoin has, the more secure and valuable it becomes.

Predicting the best cryptos for long-term Canadian growth is like predicting the weather in Vancouver – wildly unpredictable! But if you’re feeling adventurous, and want to potentially amplify your gains (or losses!), consider checking out the options for Open leverage crypto trading accounts in Canada before diving headfirst into Bitcoin or Ethereum. Remember though, high-risk, high-reward; choose wisely, my friend, for your future crypto portfolio!

This self-reinforcing cycle contributes significantly to Bitcoin’s dominance in the crypto market. Finally, Bitcoin’s adoption as a store of value, a hedge against inflation, and even a payment method in certain sectors continues to broaden, solidifying its position as a digital gold.

Picking the perfect crypto for long-term Canadian gains is like choosing a winning lottery ticket – pure luck and a dash of informed speculation! But to even play the game, you need a solid platform, and that’s where Kraken’s crypto trading platform for Canadian residents comes in handy. So, once you’ve got your Kraken account set up, the real question remains: which digital gold will make you a crypto king or queen?

Ethereum’s Smart Contract Ecosystem

Ethereum’s power lies not in its scarcity (it doesn’t have a fixed supply like Bitcoin) but in its innovative smart contract functionality. This allows for the creation of decentralized applications (dApps) and decentralized finance (DeFi) platforms, revolutionizing various sectors. The Ethereum Virtual Machine (EVM) provides a standardized platform for developers, fostering a thriving ecosystem. The success of DeFi protocols built on Ethereum, from lending and borrowing platforms to decentralized exchanges, demonstrates the power and potential of this technology.

However, Ethereum’s scalability challenges (high transaction fees and slow processing speeds) remain a significant hurdle to overcome. The ongoing transition to Ethereum 2.0 aims to address these issues, but the timeline remains uncertain.

Solana’s Unique Features and Potential

Solana distinguishes itself with its innovative consensus mechanism, which combines Proof-of-History (PoH) and Proof-of-Stake (PoS). This approach aims to achieve significantly higher transaction speeds and lower fees compared to Ethereum. Solana’s robust ecosystem also includes a growing number of dApps and DeFi projects, leveraging its speed and scalability. However, Solana has experienced network outages in the past, raising concerns about its reliability.

The centralized nature of some aspects of its validator network also raises questions about its true decentralization. Despite these challenges, Solana’s technology offers compelling advantages for certain applications, and its potential remains significant, albeit riskier than more established players.

Comparative Analysis: Bitcoin, Ethereum, and Solana

| Feature | Bitcoin | Ethereum | Solana |

|---|---|---|---|

| Scarcity | High (21 million max supply) | Low (no fixed supply) | Low (no fixed supply) |

| Network Effect | Extremely Strong | Very Strong | Growing rapidly |

| Technology | Simple, secure blockchain | Smart contract platform | High-throughput blockchain |

| Scalability | Limited | Improving (Ethereum 2.0) | High (but with past outages) |

| Risk | Relatively low (established) | Medium (established, but evolving) | High (relatively new, scalability concerns) |

| Potential | Long-term store of value | Innovation and DeFi hub | High-speed transactions and dApp development |

Each cryptocurrency offers a unique value proposition and carries different levels of risk. Bitcoin’s established position provides stability, Ethereum’s smart contract functionality drives innovation, and Solana’s speed and scalability aim for efficiency. The optimal choice depends on individual risk tolerance and investment goals. Diversification across these assets can help mitigate risk.

Factors Influencing Long-Term Cryptocurrency Growth

Predicting the future of cryptocurrencies is like trying to predict the next viral TikTok dance – wildly unpredictable, yet strangely compelling. However, several key factors significantly influence their long-term trajectory, creating a complex tapestry woven from global economics, technological innovation, and the ever-shifting sands of public opinion. Understanding these factors is crucial for navigating the crypto landscape.Macroeconomic factors exert a powerful gravitational pull on the cryptocurrency market.

For instance, periods of high inflation often see investors flock to cryptocurrencies as a potential hedge against inflation, boosting demand. Conversely, tightening monetary policies by central banks, like raising interest rates, can cool down the market as investors seek safer, higher-yield alternatives. The overall health of the global economy – recessions, geopolitical instability, and major financial events – also play a crucial role, often influencing investor risk appetite and impacting cryptocurrency prices.

Think of the 2022 crypto winter, heavily influenced by rising interest rates and general economic uncertainty.

Macroeconomic Influences on Cryptocurrency Growth

Global economic conditions, such as inflation rates, interest rate adjustments by central banks, and the overall health of the global economy (recessions, geopolitical tensions), significantly impact cryptocurrency valuations. High inflation may drive investors towards cryptocurrencies as a hedge, while rising interest rates may divert investments to higher-yield alternatives. The 2008 financial crisis, for example, laid the groundwork for Bitcoin’s creation, highlighting the potential for cryptocurrencies to offer an alternative financial system.

Similarly, the current inflationary environment has seen renewed interest in cryptocurrencies as a store of value, though this interest is often tempered by economic uncertainty.

Technological Advancements and Cryptocurrency Adoption

Technological innovation is the lifeblood of the cryptocurrency ecosystem. Improvements in blockchain technology, such as enhanced scalability solutions (like sharding and layer-2 solutions), increased transaction speeds, and the development of more user-friendly interfaces, all contribute to wider adoption. The emergence of decentralized finance (DeFi) and non-fungible tokens (NFTs) further expands the utility and appeal of cryptocurrencies, attracting new investors and driving growth.

Imagine a future where everyday transactions seamlessly integrate with blockchain technology – this technological evolution is a major driver of long-term growth.

Regulatory Changes and Cryptocurrency Prospects

Regulatory frameworks play a pivotal role in shaping the cryptocurrency landscape. Clear and consistent regulations can foster trust and legitimacy, attracting institutional investors and encouraging mainstream adoption. Conversely, overly restrictive or unclear regulations can stifle innovation and limit growth. The contrasting regulatory approaches in different countries illustrate this point: some nations actively embrace cryptocurrencies, while others maintain a cautious, even hostile stance.

The ongoing debate around crypto regulation globally directly impacts investor confidence and market stability. Consider the contrasting regulatory approaches of Singapore and China, highlighting the impact of government policies on cryptocurrency markets.

Public Perception and Media Influence on Cryptocurrency Investment

Public perception, heavily influenced by media coverage, can significantly impact cryptocurrency investment decisions. Positive media portrayals, emphasizing the potential benefits and technological advancements, can boost investor confidence and drive market growth. Conversely, negative news, highlighting scams, security breaches, or regulatory crackdowns, can trigger sell-offs and erode investor trust. The “FOMO” (fear of missing out) and “FUD” (fear, uncertainty, and doubt) cycles illustrate the powerful influence of media narratives and public sentiment on cryptocurrency markets.

The dramatic price swings of Bitcoin, often triggered by major news events or social media trends, exemplify this influence.

Risk Management for Long-Term Cryptocurrency Holdings: Which Cryptocurrencies Are The Best To Buy In Canada Right Now For Long-term Growth?

Investing in cryptocurrencies can feel like riding a rollercoaster – exhilarating highs followed by stomach-churning lows. While the potential for massive returns is alluring, it’s crucial to remember that the crypto market is notoriously volatile and unpredictable. Successfully navigating this landscape requires a robust risk management strategy, a plan that goes beyond simply hoping for the best. This section will Artikel key strategies for protecting your investment and ensuring a smoother, less anxiety-inducing journey to your financial goals.Successful long-term cryptocurrency investment hinges on a realistic understanding of both potential gains and inevitable risks.

Ignoring the latter can lead to significant losses, transforming a potentially lucrative venture into a financially devastating experience. A well-defined risk management plan, therefore, is not a mere suggestion; it’s an absolute necessity.

Setting Realistic Investment Goals and Managing Expectations

Establishing clear, achievable goals is paramount. Instead of dreaming of overnight riches, focus on a realistic timeline and potential returns. For example, rather than aiming to double your investment within a month, consider a more moderate goal, such as a 20% annual return over five years. This approach allows for market fluctuations and prevents impulsive decisions driven by unrealistic expectations.

Remember, consistent, steady growth is often more sustainable than chasing short-term gains. Consider diversifying your portfolio across different asset classes to further mitigate risk. This way, a downturn in one area won’t necessarily sink your entire investment.

Strategies for Mitigating Risks Associated with Volatility and Market Manipulation

Cryptocurrency markets are susceptible to dramatic price swings, often fueled by news events, social media trends, and even outright manipulation. Diversification is your best friend here. Don’t put all your eggs in one basket. Spread your investments across several cryptocurrencies with varying market caps and functionalities. Dollar-cost averaging (DCA) is another powerful tool.

Instead of investing a lump sum, spread your investment over time, buying regularly regardless of price fluctuations. This strategy reduces the impact of buying high and helps to average out the cost of your holdings. Finally, staying informed about market trends and news is vital. Understanding the factors influencing price movements can help you make more informed decisions and avoid panic selling during market downturns.

Consider following reputable news sources and analysts, but always critically evaluate the information you receive.

Methods for Securing Cryptocurrency Holdings

Security is paramount in the crypto world. Losing your private keys means losing your cryptocurrency, and recovering it is virtually impossible. Hardware wallets, physical devices designed to store your private keys offline, offer the highest level of security. They are immune to online hacking attempts, a significant advantage over software wallets or exchanges. When choosing an exchange, prioritize reputable platforms with a strong security track record and robust security measures like two-factor authentication (2FA).

Never share your private keys with anyone, and be wary of phishing scams. Regularly back up your hardware wallets and keep your recovery phrases in a secure location, separate from the device itself. Treat your private keys like the combination to your safe deposit box – extremely valuable and needing the utmost protection.

Potential Risks and Mitigation Strategies

Understanding the risks is half the battle. Here’s a breakdown of common risks and how to mitigate them:

- Risk: Volatility and Market Crashes. Mitigation: Diversification, Dollar-Cost Averaging, Long-Term Investment Horizon.

- Risk: Hacking and Theft. Mitigation: Hardware Wallets, Secure Exchanges, Strong Passwords, Two-Factor Authentication.

- Risk: Regulatory Uncertainty. Mitigation: Stay informed about regulatory changes in your jurisdiction (Canada, in this case), consider geographically diversified investments.

- Risk: Scams and Phishing. Mitigation: Only use reputable exchanges and wallets, be cautious of unsolicited offers, verify websites and email addresses.

- Risk: Loss of Private Keys. Mitigation: Secure storage of recovery phrases, multiple backups, hardware wallets.

- Risk: Inflation and devaluation of cryptocurrencies. Mitigation: Diversification, regular portfolio rebalancing, consideration of inflation-hedging strategies.

Conclusive Thoughts

So, which cryptocurrencies are the best to buy in Canada right now? The answer, my friend, is not a simple one-size-fits-all. It depends on your risk tolerance, investment goals, and understanding of the market. Remember, diversification is key, thorough research is paramount, and even the most promising cryptocurrencies carry inherent risks. By carefully considering the factors discussed – from Canadian regulations to fundamental analysis – you can build a portfolio that aligns with your financial aspirations.

Happy investing (responsibly, of course!)