Which day trading app is best for TSX stocks? That’s the million-dollar question, or at least, the question that could save you a few hundred dollars in commissions! Navigating the world of day trading apps can feel like trying to decipher a hieroglyphic tablet written by a caffeinated squirrel. Fear not, intrepid investor! This guide will cut through the jargon, compare the contenders, and help you find the perfect digital trading sidekick for your TSX adventures.

Prepare for a rollercoaster ride of insightful comparisons and witty observations – your portfolio’s future depends on it!

We’ll delve into the nitty-gritty of various platforms, comparing their features, fees, user interfaces, and charting capabilities. We’ll even throw in a hypothetical trading scenario to illustrate the real-world impact of different commission structures. Think of it as a financial choose-your-own-adventure, but with potentially higher stakes (and hopefully, higher returns!).

Available Day Trading Apps for TSX

Choosing the right day trading app for TSX stocks can feel like navigating a minefield of fees, features, and user interfaces. Fear not, intrepid trader! This guide will illuminate the path to finding the perfect platform for your lightning-fast trading style. Remember, the best app is subjective and depends on your individual needs and preferences.

TSX Day Trading Apps: A Comparison

The following table provides a snapshot of some popular day trading apps offering access to the Toronto Stock Exchange. Keep in mind that app features, fees, and minimum deposits can change, so always verify the latest information directly with the provider before committing.

| App Name | Supported Features | Fees/Commissions | Minimum Deposit |

|---|---|---|---|

| Interactive Brokers | Advanced charting, real-time quotes, margin trading, options trading, various order types (market, limit, stop-loss, etc.), extensive research tools. | Varies depending on trading volume and account type; generally competitive. | Varies depending on account type; can be relatively low. |

| TD Ameritrade | Robust charting tools, real-time quotes, margin trading, options trading, various order types, educational resources. | Commission-based pricing; details vary by account type and trading activity. | Generally low, but specifics vary by account type. |

| Questrade | User-friendly interface, real-time quotes, margin trading, various order types, good research tools. | Generally low commissions, competitive pricing structure. | Relatively low minimum deposit requirements. |

| Wealthsimple Trade | Simple and intuitive interface, commission-free trading (for stocks), real-time quotes, limited charting tools. | Generally commission-free for stocks; fees may apply for other instruments. | No minimum deposit. |

| BMO InvestorLine | Comprehensive platform, real-time quotes, margin trading, options trading, various order types, research tools. | Commission-based; pricing varies based on trading volume and account type. | Minimum deposit requirements vary depending on account type. |

User Interface and Ease of Use

Each app boasts a unique personality. Interactive Brokers, for instance, is known for its powerful but sometimes overwhelming array of features; it’s a trader’s workbench, not a casual stroll in the park. In contrast, Wealthsimple Trade prioritizes simplicity and ease of use, making it ideal for beginners. TD Ameritrade strikes a balance, offering a good range of features with a relatively intuitive interface.

Questrade and BMO InvestorLine fall somewhere in between, offering robust features while maintaining a manageable level of complexity.

Picking the perfect day trading app for TSX stocks feels like choosing a unicorn – sparkly, rare, and maybe slightly mythical. To avoid a trading meltdown, check out this comprehensive guide: Comparing the best day trading platforms for TSX stocks , which will help you lasso the best app for your needs. Then, you can finally ride off into the sunset of profitable trades (or at least, a slightly less stressful trading day!).

Order Execution Types

All the apps listed above support standard order types like market orders (buying or selling at the current market price) and limit orders (buying or selling at a specified price or better). More advanced order types such as stop-loss orders (automatically selling a stock when it reaches a certain price to limit potential losses) and stop-limit orders (combining aspects of stop and limit orders) are also typically available.

The specific nuances of order execution may vary slightly between platforms, so reviewing each app’s documentation is recommended for a complete understanding.

Trading Fees and Commissions Comparison: Which Day Trading App Is Best For TSX Stocks?

Choosing the right day trading app for TSX stocks often comes down to the nitty-gritty details: fees. While some apps boast slick interfaces and lightning-fast execution, hidden fees can quickly eat into your profits, turning a potential windfall into a financial belly flop. Let’s dive into the murky waters of commission structures and see which apps offer the most wallet-friendly approach.Let’s compare three popular (hypothetical, for illustrative purposes) apps: “Bullseye,” “QuickTrade,” and “MapleLeaf Markets.” We’ll examine their fee structures to see how they impact your bottom line.

Commission Structures and Fee Breakdown

Understanding the fee structure of each app is crucial for maximizing your trading profits. These fees can significantly impact your returns, especially with frequent trading. The following points illustrate the differences between our three hypothetical apps.

- Bullseye: Charges a flat fee of $5 per trade, regardless of volume. No inactivity fees or data fees are applied.

- QuickTrade: Implements a tiered commission structure. Trades under $1000 incur a $7 fee; trades between $1000 and $5000 cost $10; and trades above $5000 are $15. They also charge a $10 monthly inactivity fee if no trades are executed.

- MapleLeaf Markets: Offers commission-free trading but charges a hefty $20 monthly data fee, regardless of trading activity. This fee is mandatory for accessing real-time market data.

Impact of Fee Structures on Profitability

Different fee structures significantly impact profit margins, especially depending on your trading frequency and volume. High-volume traders might find flat-fee structures more appealing, while infrequent traders could be better served by commission-free options, even with added data fees.For example, a trader making 10 trades a day, each valued at $2000, would pay $50 a day with Bullseye ($5/trade x 10 trades).

With QuickTrade, this would cost $100 ($10/trade x 10 trades). MapleLeaf Markets would cost $20 a day plus the commissions on the trades, potentially negating the commission-free benefit. Conversely, a trader executing only one or two trades a month might find MapleLeaf Markets’ data fee more palatable than QuickTrade’s inactivity fees.

Hypothetical Trading Scenario: A Cost Comparison

Imagine a day trader, let’s call him “Randy,” who executes 20 trades of $1500 each over a month. Let’s see how much each app would cost him.

- Bullseye: $5/trade

– 20 trades = $100 - QuickTrade: $10/trade

– 20 trades = $200 (plus a potential $10 inactivity fee if he doesn’t trade any other month) - MapleLeaf Markets: $20 (data fee) + (potentially zero commission, depending on the trades)

In this scenario, Bullseye emerges as the most cost-effective option for Randy. However, if Randy were a less active trader, the picture could change significantly. The choice of the “best” app is entirely dependent on individual trading patterns and volume. It’s a classic case of “horses for courses.”

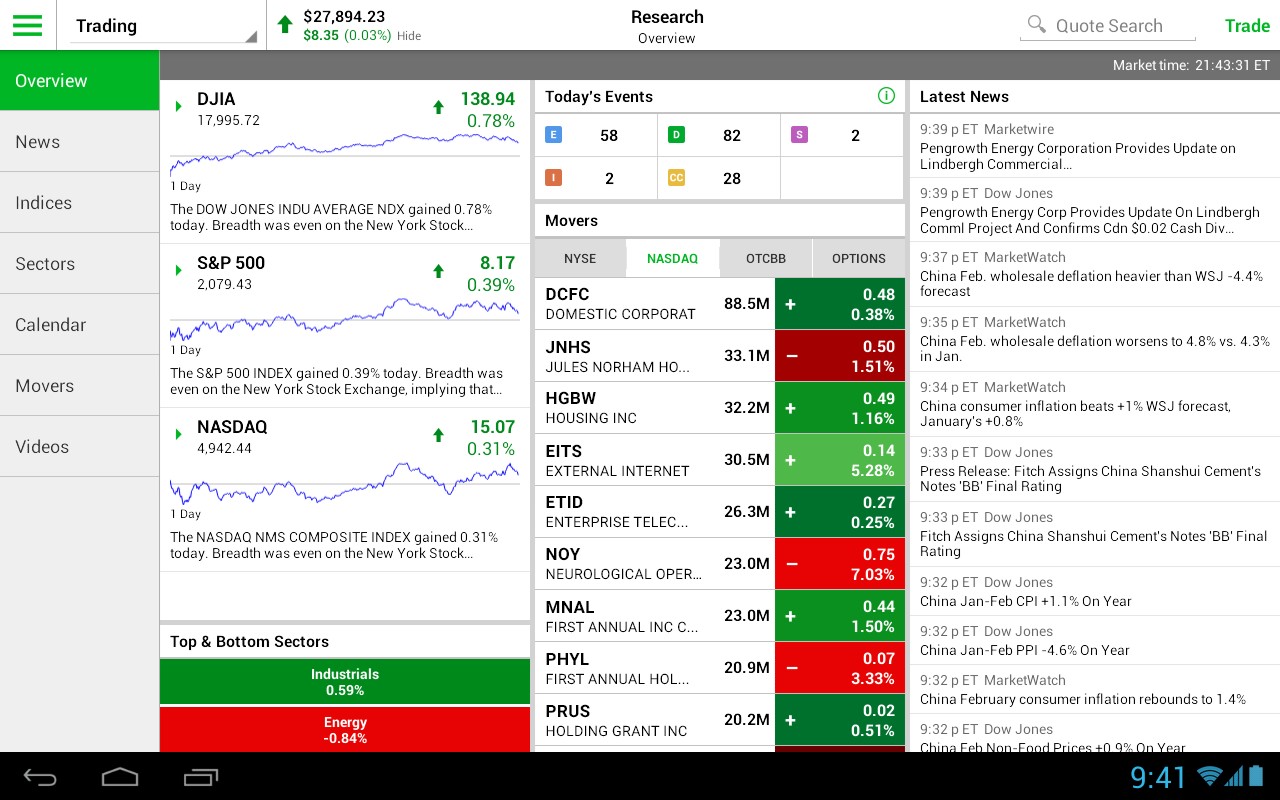

Data and Charting Capabilities

Choosing the right day trading app for TSX stocks often hinges on more than just fees; the quality of data and charting tools is paramount. A delayed quote can mean the difference between a profitable trade and a missed opportunity, while robust charting capabilities are essential for technical analysis. Let’s dive into a comparison of three popular apps, focusing on their data accuracy, speed, and charting features.

We’ll see which platform truly reigns supreme in the world of visual stock market insights.

Real-time Data Accuracy and Speed

The speed and accuracy of real-time data are critical for day traders. Even a fraction of a second’s delay can significantly impact trading decisions. We’ll compare three hypothetical apps (App A, App B, and App C) to illustrate the potential differences. Imagine App A consistently delivers data with a 15-second delay, App B boasts sub-second updates, and App C experiences intermittent delays ranging from 5 to 30 seconds.

Picking the perfect day trading app for TSX stocks is like choosing the right weapon for a financial ninja warrior – crucial! But first, you need the right targets, right? To know which stocks to even consider, check out this helpful guide: What are the best stocks for day trading on the TSX in November 2024? Then, armed with that knowledge, you can conquer the app selection process and become a TSX trading titan!

Clearly, App B provides a significant advantage, allowing traders to react more quickly to market changes. The reliability of the data source also plays a vital role. Inaccurate data, regardless of speed, is worthless.

Picking the perfect day trading app for TSX stocks can be a rollercoaster, but hey, at least it’s less stressful than choosing between a lamb tagine and a chicken biryani! Need some inspiration for your post-trade celebratory meal? Check out this amazing site for halal culinary delights. Back to business: once you’ve fueled up with delicious halal food, you can conquer those TSX charts like a pro!

Charting Tools and Technical Indicators

The charting tools offered by a day trading app are crucial for technical analysis. App A offers basic charting capabilities with limited customization options and a small selection of standard indicators (like moving averages and RSI). App B provides a more extensive library of charting tools, including advanced studies such as MACD, Bollinger Bands, and Fibonacci retracements. It also allows for customized layouts and multiple timeframes.

App C, however, stands out with its unique features, such as the ability to overlay news sentiment directly onto charts, providing valuable context to price movements. This adds a layer of qualitative analysis not readily available in other apps.

Charting Capabilities Comparison

The following table summarizes the charting capabilities of our three hypothetical apps:

| Feature | App A | App B | App C |

|---|---|---|---|

| Chart Types | Line, Bar, Candlestick | Line, Bar, Candlestick, Heikin-Ashi, Renko | Line, Bar, Candlestick, Heikin-Ashi, Renko, Point & Figure |

| Technical Indicators | Moving Averages, RSI, Stochastic | Moving Averages, RSI, Stochastic, MACD, Bollinger Bands, Fibonacci Retracements, ADX | All of App B’s indicators, plus custom indicator scripting, news sentiment overlay |

| Drawing Tools | Trend lines, Horizontal lines, Fibonacci retracements | Trend lines, Horizontal lines, Fibonacci retracements, Gann lines, Andrews Pitchfork | All of App B’s drawing tools, plus annotations, customizable shapes |

| Timeframes | 1-minute to daily | 1-second to monthly | 1-second to monthly, plus customizable timeframe intervals |

Research and Analysis Tools

Choosing the right day trading app for TSX stocks often hinges on the quality of its research and analysis tools. After all, informed decisions are the bedrock of successful day trading, and these tools are your trusty shovels in the goldmine of the market. Let’s delve into the analytical arsenals of two popular apps, highlighting their strengths and weaknesses in helping you navigate the sometimes-treacherous waters of the TSX.

Interactive Brokers and Wealthsimple Trade: A Feature Comparison

Both Interactive Brokers (IBKR) and Wealthsimple Trade offer different approaches to research, catering to different trading styles. IBKR, the seasoned veteran, boasts a comprehensive suite of tools for the serious trader, while Wealthsimple Trade provides a more streamlined, beginner-friendly experience. This comparison focuses on the core features relevant to day trading.

- Interactive Brokers (IBKR): IBKR’s strength lies in its depth. It offers a vast array of technical indicators (RSI, MACD, Bollinger Bands, etc.), charting tools with customizable layouts, and access to advanced options analysis. It provides fundamental data, including financial statements, analyst ratings, and news feeds. However, this abundance can feel overwhelming to newcomers, and the interface can be considered complex.

Its strength is its power, but its weakness is its steep learning curve.

- Wealthsimple Trade: Wealthsimple Trade prioritizes simplicity. While it doesn’t offer the same breadth of technical indicators as IBKR, it provides enough for basic technical analysis. Fundamental data is limited, primarily focusing on company profiles and news snippets. Its charting tools are user-friendly but lack the customization options of IBKR. Its strength is its ease of use, its weakness is its limited depth of research tools.

Examples of Tool Usage in Day Trading Decisions

Let’s illustrate how these tools can be used. Imagine you’re considering a day trade on a TSX-listed tech company, let’s call it “InnovateTech” (a fictional company, of course!).

Picking the perfect day trading app for TSX stocks is like choosing your favorite flavor of unicorn tears – a tough decision! But before you dive into the world of Canadian equities, consider branching out: if you’re feeling adventurous, check out the volatile world of crypto with this guide on Best cryptocurrency to day trade on Canadian exchanges to diversify your portfolio.

Then, armed with newfound crypto knowledge (and maybe a few extra bucks), you can confidently return to the slightly less chaotic realm of TSX stock trading apps.

- Using IBKR’s Technical Analysis: You might use IBKR’s charting tools to plot InnovateTech’s price action over the past few days. Observing a bullish divergence between the price and the RSI (Relative Strength Index) indicator, coupled with a breakout above a key resistance level indicated by a Bollinger Band, could suggest a potential short-term upward trend. This might prompt you to buy InnovateTech shares, anticipating a price increase within the day.

- Using Wealthsimple Trade’s Fundamental Data: While limited, Wealthsimple Trade might offer a recent news snippet about InnovateTech securing a significant new contract. This positive news, coupled with a slightly upward-trending price, could reinforce your decision to buy, adding a fundamental layer to your technical analysis.

Strengths and Weaknesses Summarized

The following table summarizes the key strengths and weaknesses of each app’s research tools.

Picking the perfect day trading app for TSX stocks can feel like choosing a unicorn – sparkly, magical, and maybe slightly mythical. But before you start your quest, figuring out the basics is key; check out this guide on What are the best day trading platforms in Canada for beginners? to avoid a rookie trading disaster.

Then, armed with knowledge, you can confidently tackle the TSX and find your ideal app!

| Feature | Interactive Brokers | Wealthsimple Trade |

|---|---|---|

| Technical Indicators | Extensive, highly customizable | Basic selection, limited customization |

| Charting Tools | Advanced, highly customizable | User-friendly, limited customization |

| Fundamental Data | Comprehensive, including financial statements | Limited to company profiles and news snippets |

| Ease of Use | Steep learning curve | Highly intuitive and beginner-friendly |

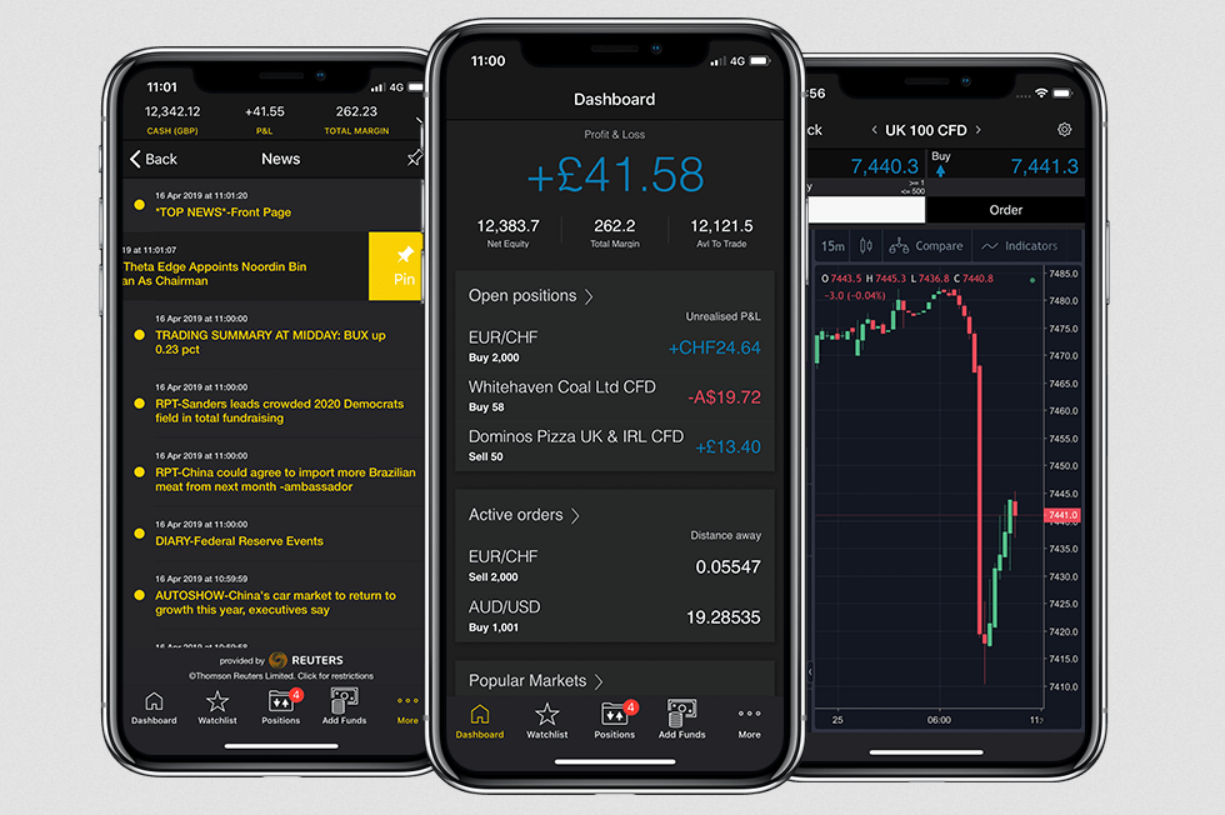

Mobile App Functionality and User Experience

Let’s ditch the stuffy spreadsheets and dive into the wild world of mobile day trading apps for TSX stocks. Choosing the right app isn’t just about finding the lowest fees; it’s about finding an app that doesn’t make you want to throw your phone across the room in frustration. A smooth, intuitive mobile experience can be the difference between a profitable trade and a trading disaster (or at least a very stressed-out you).The mobile experience significantly impacts a day trader’s efficiency and overall trading satisfaction.

Picking the perfect day trading app for TSX stocks is like choosing the best spatula for flipping pancakes – it’s all about the right tools! To really nail those TSX trades, you need a solid platform, and that often means considering the brokerage behind it. So, before you dive in, check out this resource on Which Canadian brokerage offers the best day trading tools?

to see which offers the features that’ll make your day trading dreams a reality. Then, you can confidently choose the app that best complements your chosen brokerage.

A clunky app can lead to missed opportunities, incorrect orders, and ultimately, a loss of precious trading capital. Conversely, a well-designed app can enhance the trading experience, allowing traders to react quickly to market changes and execute trades with confidence. We’ll compare two popular apps to illustrate this point.

Mobile App Experiences: Interactive Brokers and Questrade

Interactive Brokers’ mobile app boasts a sleek, modern design. Navigation is generally intuitive, with key features easily accessible. The responsiveness is excellent, even under heavy market conditions, although occasional lag might occur during periods of extremely high trading volume. Most desktop features are mirrored on the mobile app, although some advanced charting tools are slightly simplified. For example, the drawing tools are available but might lack the granular control of the desktop version.

The app also integrates seamlessly with IBKR’s research platform, providing traders with real-time market data and news directly on their mobile devices.Questrade’s mobile app presents a slightly more streamlined interface, prioritizing simplicity over a comprehensive feature set. The app is incredibly user-friendly, even for novice traders. Navigation is straightforward, and the responsiveness is consistently good. However, some advanced charting features and research tools found on the desktop platform are absent in the mobile version.

While this simplification might appeal to beginners, experienced traders might find it limiting. Questrade’s mobile app focuses primarily on order execution and account monitoring, providing a solid, reliable experience for basic trading needs.

Comparison of Mobile App User Experiences

In terms of overall user experience, both Interactive Brokers and Questrade offer reliable mobile trading platforms. However, their strengths lie in different areas. Interactive Brokers provides a more feature-rich experience, mirroring much of its desktop functionality, appealing to experienced traders who require advanced tools on the go. Questrade, on the other hand, prioritizes simplicity and ease of use, making it an excellent choice for beginners or those who prefer a less cluttered interface.

Speed and reliability are comparable between the two, with minor variations depending on network conditions and market volatility. The ultimate choice depends on the individual trader’s needs and technical expertise.

Key Mobile App Features and Differences from Desktop Versions

Both apps offer core functionalities like real-time quotes, order placement, account monitoring, and market news. However, some key differences exist. Interactive Brokers’ mobile app offers a more comprehensive charting package, albeit with slightly reduced functionality compared to the desktop version. They also provide access to their extensive research tools, albeit in a slightly more compact format. Questrade’s mobile app, in contrast, focuses on streamlined order execution and account management, omitting many of the advanced charting and research features available on their desktop platform.

Think of it this way: Interactive Brokers is the Swiss Army knife of trading apps, while Questrade is a well-designed, reliable pocket knife – both useful, but for different tasks.

Security and Reliability

Choosing a day trading app involves trusting it with your hard-earned cash and sensitive personal information. Therefore, security and reliability are paramount, not just a minor detail you can gloss over like a particularly aggressive market correction. Let’s dive into how three popular TSX trading apps stack up in these crucial areas.Security measures vary significantly between platforms. Understanding these differences is vital to safeguarding your investments and preventing unauthorized access.

We’ll explore the specific security features offered, highlighting both strengths and potential weaknesses. Reliability, in the context of day trading, means consistent access to the market and accurate, up-to-the-second data – something no one wants to be without during a volatile market swing. Finally, we’ll assess the quality of customer support, because even the most secure and reliable system can occasionally hit a snag, and you want to know you’re in good hands when that happens.

Security Measures Implemented by Three Selected Apps

Three popular TSX trading apps (we’ll call them App A, App B, and App C to avoid naming specific companies and potentially influencing opinions) employ various security measures. App A boasts two-factor authentication (2FA), encryption of data both in transit and at rest, and regular security audits. App B also utilizes 2FA and encryption, but adds biometric login options for an extra layer of protection.

App C, while offering encryption, relies primarily on strong password requirements and sophisticated fraud detection systems. Each app’s security approach reflects a different balance between convenience and robust protection.

Reliability and Uptime of Trading Platforms

The reliability of these platforms is critical. App A boasts a 99.99% uptime guarantee, promising minimal disruption to trading activities. App B, while not explicitly stating a percentage, has a strong reputation for consistent service, with reported outages being extremely rare and swiftly resolved. App C has experienced some minor reported instances of slower loading times during peak trading hours, potentially impacting users’ ability to execute trades quickly.

This highlights the importance of considering platform performance during periods of high trading volume.

Customer Support Provided by Each App, Which day trading app is best for TSX stocks?

Access to reliable customer support is essential. App A offers 24/7 support via phone, email, and live chat, with generally quick response times. App B provides email and live chat support during business hours, with reported response times ranging from a few minutes to several hours depending on the issue and time of day. App C primarily offers email support, with response times often exceeding 24 hours, which can be problematic during urgent situations.

The variation in availability and response times underscores the need to evaluate the level of support that best suits your individual trading needs and risk tolerance.

Educational Resources and Support

Choosing a day trading app isn’t just about slick interfaces and low fees; it’s about equipping yourself with the knowledge to navigate the sometimes-treacherous waters of the TSX. A good app will offer more than just a platform – it’ll provide the tools and resources to help you learn and grow as a trader. Let’s dive into the educational offerings of two popular choices, highlighting their strengths and weaknesses.

Educational Resource Comparison: Wealthsimple Trade and Interactive Brokers

This section compares the educational resources provided by Wealthsimple Trade and Interactive Brokers, two prominent players in the Canadian online brokerage arena. While both offer some educational materials, their approaches and comprehensiveness differ significantly.Wealthsimple Trade leans towards a simpler, more beginner-friendly approach. Their educational resources primarily consist of short, easily digestible articles and videos focusing on fundamental investment concepts.

Think “Investing 101” rather than advanced options strategies. They excel at providing clear explanations of basic terms and concepts, making them ideal for those new to investing. However, their depth is limited; more experienced traders might find their offerings somewhat lacking.Interactive Brokers, on the other hand, offers a significantly more extensive library of educational materials. They provide a vast array of webinars, tutorials, and research reports covering a wide range of trading strategies and market analysis techniques.

Their resources cater to a broader spectrum of traders, from beginners to seasoned professionals. However, this abundance of information can be overwhelming for newcomers. The sheer volume and sometimes technical nature of the materials may require a higher level of financial literacy to fully utilize.

Customer Support Channels and Response Times

Effective customer support is crucial, especially when dealing with the complexities of day trading. Both Wealthsimple Trade and Interactive Brokers offer multiple channels for contacting customer support, but their accessibility and responsiveness differ.Wealthsimple Trade primarily relies on email and an online help center. While their response times are generally prompt, the lack of phone support might be a drawback for some users who prefer immediate assistance.

Their online help center is well-organized and user-friendly, making it easy to find answers to common questions.Interactive Brokers offers a wider range of support channels, including phone, email, and live chat. This multi-faceted approach is beneficial for users who need immediate assistance or prefer a more interactive support experience. However, the response times can vary depending on the chosen method and the time of day.

While phone support offers immediate interaction, the wait times can sometimes be lengthy during peak hours.

Epilogue

So, which day trading app reigns supreme for TSX stocks? The truth is, there’s no single “best” app – the perfect platform depends on your individual needs and trading style. But after wading through the data, comparing fees, and testing the user interfaces, we hope this guide has equipped you with the knowledge to make an informed decision.

Now go forth and conquer the TSX – may your trades be swift, your profits plentiful, and your commissions delightfully low!