Advanced forex trading strategies using technical and fundamental analysis: Dive into the thrilling world of high-level currency trading! Forget the beginner’s guide; this is where the real action is. We’ll unravel the secrets of mastering both technical indicators (think charting ninjas) and fundamental economic forces (the global economic pulse), showing you how to combine them for maximum profit potential.

Get ready to transform from a forex fledgling into a seasoned market maestro.

This journey will equip you with the advanced tools and strategies needed to navigate the complex forex market. We’ll explore sophisticated technical indicators, decipher macroeconomic news like a financial cryptographer, and learn to blend these seemingly disparate approaches into a powerful, cohesive trading strategy. Prepare for a deep dive into risk management, algorithmic trading, and the often-overlooked psychological aspects of consistent success in this high-stakes arena.

By the end, you’ll be armed with the knowledge to confidently tackle the forex market’s challenges and opportunities.

Introduction to Advanced Forex Trading

So, you’ve conquered the basics of forex trading – congratulations! You’ve learned about pips, spreads, and maybe even dabbled in a simple moving average. But the world of forex is a vast ocean, and you’ve only just dipped your toe in. Advanced forex trading takes you beyond the kiddie pool and into the exhilarating (and sometimes terrifying) deep end.

Prepare for bigger waves, stronger currents, and the potential for significantly larger rewards – and losses.Advanced forex trading strategies go beyond simple buy-low-sell-high tactics. It’s about mastering complex technical indicators, understanding nuanced fundamental analysis, and developing a robust trading psychology that can withstand market volatility. Beginner strategies often focus on simple chart patterns and basic indicators, relying heavily on short-term trades.

Advanced strategies, however, incorporate multiple timeframes, sophisticated risk management techniques, and a deeper understanding of global economic events. Think of it like this: beginners use a fishing rod, while advanced traders employ a whole fleet of high-tech fishing vessels equipped with sonar and GPS.

Risk Management in Advanced Forex Trading

Risk management is paramount in advanced forex trading, even more so than in beginner trading. The potential for larger profits also means the potential for larger losses. In advanced trading, where positions might be held for longer periods and leverage is often higher, a single bad trade can significantly impact your account. Effective risk management involves strategies like position sizing (carefully determining how much capital to allocate to each trade), stop-loss orders (automatically exiting a trade when it hits a predetermined loss level), and taking profits (locking in gains at specific price points).

For instance, a beginner might risk 2% of their account on a single trade, while an advanced trader might reduce this to 1% or even less, depending on the complexity and risk assessment of the trade. This meticulous approach helps to preserve capital and prevent devastating losses, ensuring longevity in the market. It’s not just about making money; it’s about staying in the game long enough to make the big wins.

Ignoring risk management in advanced trading is like sailing a yacht without a life vest – exciting, but potentially fatal.

Technical Analysis in Advanced Forex Trading

So, you’ve mastered the basics of candlestick patterns and maybe even dabbled in moving averages. Congratulations! You’re ready to ascend to the next level of forex trading, where the air is thinner, the views are spectacular, and the potential profits… well, let’s just say they’re significantly more exhilarating (and potentially devastating, so buckle up!). This section dives into the fascinating world of advanced technical analysis, where we’ll equip you with the tools to navigate the forex market with greater precision and confidence (or at least a slightly less shaky hand).Advanced technical analysis isn’t about finding the holy grail; it’s about refining your approach, stacking the odds in your favor, and minimizing risk.

Think of it as upgrading from a bicycle to a finely-tuned sports car – same destination, but the journey is far more exciting (and hopefully, faster).

Advanced Technical Indicators and Their Applications

Let’s explore some advanced indicators that go beyond the usual suspects. These aren’t your grandma’s moving averages; these are sophisticated tools requiring careful understanding and application. Misusing them can lead to disastrous results, so approach them with respect (and a healthy dose of caution).

| Indicator Name | Calculation | Use Case | Limitations |

|---|---|---|---|

| Average True Range (ATR) | Measures market volatility by calculating the average true range over a specified period. It’s based on the True Range (TR), which is the greatest of three values: the current high minus the current low, the absolute value of the current high minus the previous close, and the absolute value of the current low minus the previous close. | Determining stop-loss levels, position sizing, and identifying potential breakouts. A high ATR suggests high volatility, while a low ATR suggests low volatility. | Lagging indicator; doesn’t predict future volatility. Can be affected by outliers. |

| Relative Strength Index (RSI) | A momentum oscillator that measures the magnitude of recent price changes to evaluate overbought or oversold conditions in the price of a stock or other asset. Commonly calculated using a 14-period average. | Identifying potential reversals in price trends. Readings above 70 are generally considered overbought, while readings below 30 are considered oversold. | Can generate false signals, especially in sideways markets. The optimal period length can vary depending on the asset and timeframe. |

| MACD (Moving Average Convergence Divergence) | Calculates the difference between two exponential moving averages (EMAs), typically a 12-period EMA and a 26-period EMA. A signal line (a 9-period EMA of the MACD) is often added to identify potential buy/sell signals. | Identifying momentum changes, confirming trends, and spotting potential divergences between price and momentum. Crossovers of the MACD line and signal line can indicate buy or sell signals. | Can generate false signals, particularly in choppy markets. The sensitivity can be adjusted by changing the EMA periods. |

| Ichimoku Cloud | A complex indicator that incorporates multiple lines and areas to provide a comprehensive view of price, momentum, and support/resistance. It uses five lines: Tenkan-sen, Kijun-sen, Senkou Span A, Senkou Span B, and Chikou Span. | Identifying support and resistance levels, determining trend direction, and generating trading signals. The cloud itself acts as a dynamic support/resistance zone. | Can be difficult to interpret for beginners. The numerous lines can create visual clutter. It can lag behind price action. |

Chart Pattern Recognition Beyond Basic Candlestick Patterns

Basic candlestick patterns are a great starting point, but the truly advanced trader recognizes more complex patterns that often unfold over longer timeframes. Think of it as graduating from recognizing single words to understanding entire sentences and paragraphs in the language of the market. These patterns often involve combinations of candlestick patterns, trendlines, and support/resistance levels. For example, the “head and shoulders” pattern is a classic reversal pattern indicating a potential trend change.

Similarly, the “double top” and “double bottom” patterns can also provide valuable insights into potential price movements. Recognizing these advanced patterns requires significant experience and a keen eye for detail.

Combining Multiple Technical Indicators for Improved Accuracy

Using a single indicator is like navigating a vast ocean with only a compass – you might get there eventually, but the journey will be long and treacherous. Combining multiple indicators, however, is like adding a GPS, sonar, and a weather satellite to your arsenal. This significantly improves your accuracy and reduces the risk of false signals. For example, you might use the RSI to identify overbought/oversold conditions, the MACD to confirm trend direction, and the ATR to manage risk and position size.

The key is to choose indicators that provide complementary information and avoid creating conflicting signals. The art lies in understanding how these indicators interact and interpret the resulting picture. Remember, the goal is not to find perfect signals, but to improve the probability of successful trades.

Fundamental Analysis in Advanced Forex Trading

Forget mystical charts and tea leaf readings; fundamental analysis is where the rubber meets the road in forex trading. It’s about understanding the real-world forces that drive currency values, not just the wiggles on a screen. By analyzing economic data and political landscapes, you can gain a powerful edge, predicting market movements with significantly increased accuracy compared to relying solely on technical analysis.Fundamental analysis delves into the economic health and political stability of countries, providing a crucial context for interpreting price movements.

It’s like having a backstage pass to the global economy, allowing you to anticipate shifts before they impact the market. Ignoring fundamental analysis is like navigating a ship without a map – you might get lucky, but you’re far more likely to run aground.

Mastering advanced forex trading strategies using technical and fundamental analysis? Sounds thrilling, right? But before you risk your hard-earned cash, why not hone your skills first with a risk-free practice run? Check out this guide on Questrade demo account setup for practicing forex trading strategies to get started. Then, armed with experience, you can confidently conquer the world of advanced forex strategies, one profitable trade at a time!

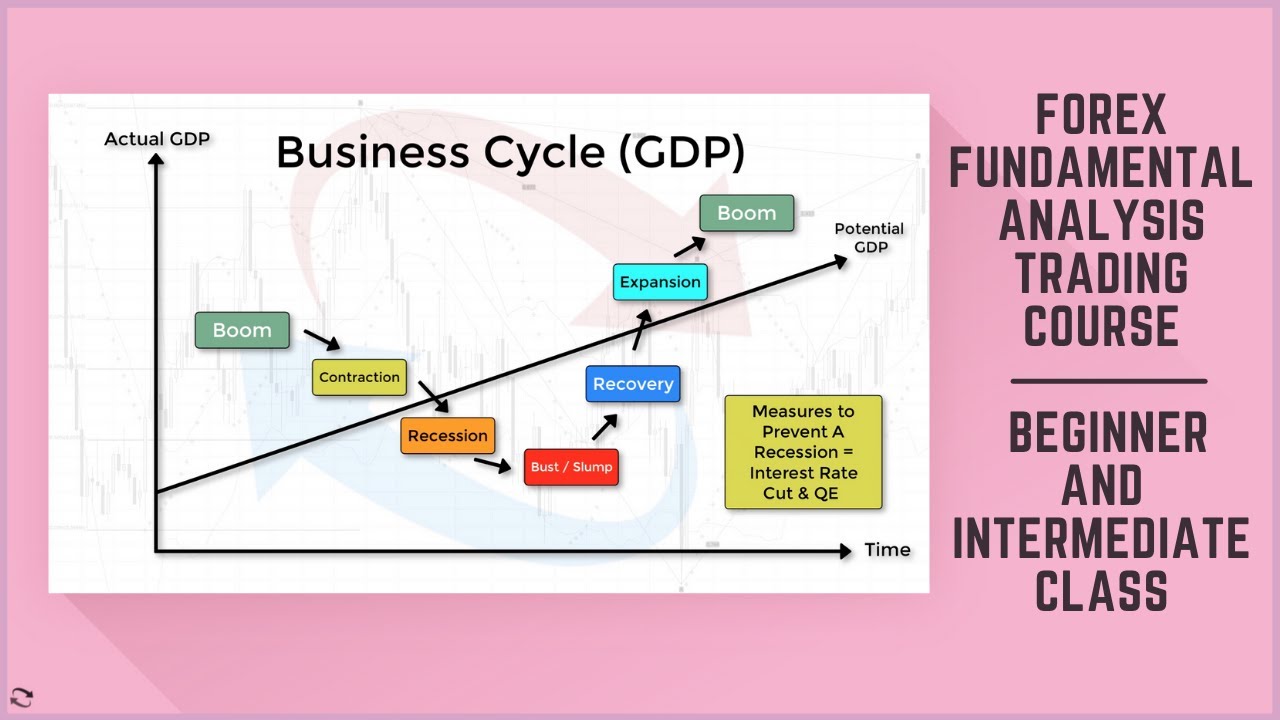

Macroeconomic Factors and Currency Pairs

Macroeconomic factors, the big picture stuff like inflation, interest rates, and GDP growth, are the heavyweight champions of currency movements. A country with a booming economy and high interest rates, for instance, will generally see its currency strengthen as investors flock to its assets. Conversely, a nation struggling with high inflation and slow growth will likely see its currency weaken.

Consider the relationship between the US dollar and the Euro. If the US Federal Reserve unexpectedly raises interest rates, the dollar will likely appreciate against the Euro, as investors seek higher returns. This isn’t always a straightforward correlation, though; other factors like geopolitical events and market sentiment can also significantly influence currency pairs. For example, during times of global uncertainty, investors often flock to the perceived safety of the US dollar, causing it to strengthen even if economic indicators aren’t overwhelmingly positive.

Key Economic Indicators and Their Influence

Several key economic indicators act as vital signals for forex traders. These are not mere numbers; they’re snapshots of a nation’s economic health, directly influencing currency values.

- Gross Domestic Product (GDP): GDP measures the total value of goods and services produced within a country. Strong GDP growth usually signals a healthy economy and a strengthening currency.

- Inflation Rate: Inflation, the rate at which prices rise, significantly impacts currency value. High inflation erodes purchasing power, making a currency less attractive to investors.

- Interest Rates: Central bank interest rate decisions are paramount. Higher interest rates attract foreign investment, strengthening the currency.

- Unemployment Rate: Low unemployment indicates a strong economy, positively influencing currency value.

- Trade Balance: A trade surplus (exporting more than importing) generally strengthens a currency, while a deficit weakens it.

Understanding the interplay of these indicators is crucial. For example, strong GDP growth coupled with low inflation is a highly positive signal for a currency, while high inflation and high unemployment suggest economic weakness and potential currency depreciation.

Interpreting Central Bank Statements and Their Implications

Central bank statements are akin to cryptic prophecies for forex traders. These statements, often released after interest rate decisions, can dramatically shift market sentiment and currency values. The key is to decipher the subtle nuances and implied future policy directions. A statement hinting at future interest rate hikes, even if no immediate change is announced, can cause a currency to appreciate as investors anticipate higher returns.

Conversely, a dovish statement suggesting a prolonged period of low interest rates may lead to a currency weakening.

“Don’t just read the words; read between the lines.”

Analyzing the language used is critical. Words like “gradual,” “measured,” or “patient” usually signal a cautious approach, while “robust,” “strong,” or “confident” indicate a more optimistic outlook. Furthermore, pay close attention to any revisions to the central bank’s economic forecasts. A downward revision to GDP growth, for instance, could trigger a sell-off in the corresponding currency. Remember, even seemingly minor shifts in language can send ripples through the forex market, underscoring the importance of meticulous analysis.

For instance, the subtle shift from “accommodative monetary policy” to “data dependent” can signal a significant change in the central bank’s stance and trigger significant market reactions.

Combining Technical and Fundamental Analysis

Forex trading, my friends, isn’t just about staring at charts until your eyes bleed (though that’s a significant part of it, let’s be honest). It’s about wielding the power of both technical and fundamental analysis – a dynamic duo that, when working in harmony, can transform you from a forex flounderer into a market maestro. Think of it as the ultimate trading power couple: technical analysis provides the precise timing, while fundamental analysis offers the strategic direction.The synergy between technical and fundamental analysis is nothing short of magical.

Technical analysis, with its charts, indicators, and patterns, helps identify optimal entry and exit points. It tells us

Mastering advanced forex trading strategies using technical and fundamental analysis requires mental fortitude, much like building serious muscle! You need the discipline to stick to your plan, and that requires strength – both mental and physical. So, before you dive into another complex chart, maybe check out some muscular strength exercises to bolster your resolve. Then, armed with both physical and analytical strength, conquer those currency markets!

- when* to trade. Fundamental analysis, on the other hand, focuses on the underlying economic factors influencing currency values. It tells us

- what* to trade and

- why*. Combining these two allows us to make informed decisions based on both short-term price movements and long-term economic trends. It’s like having a crystal ball (technical) that shows you the immediate future, and a map (fundamental) that guides you to the treasure.

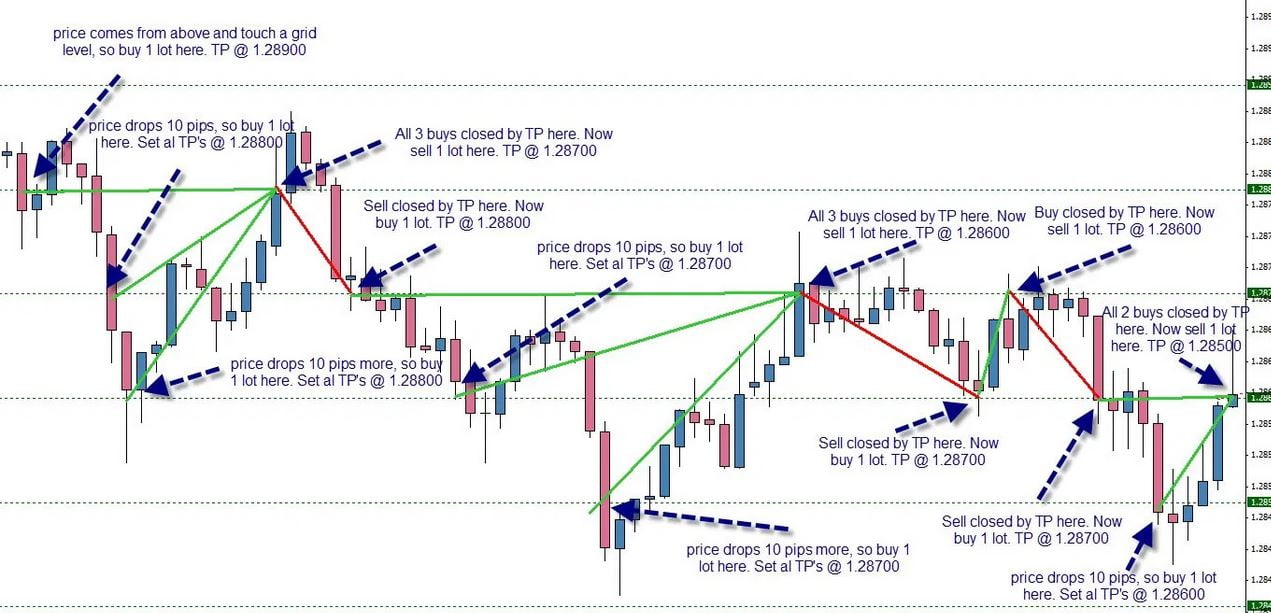

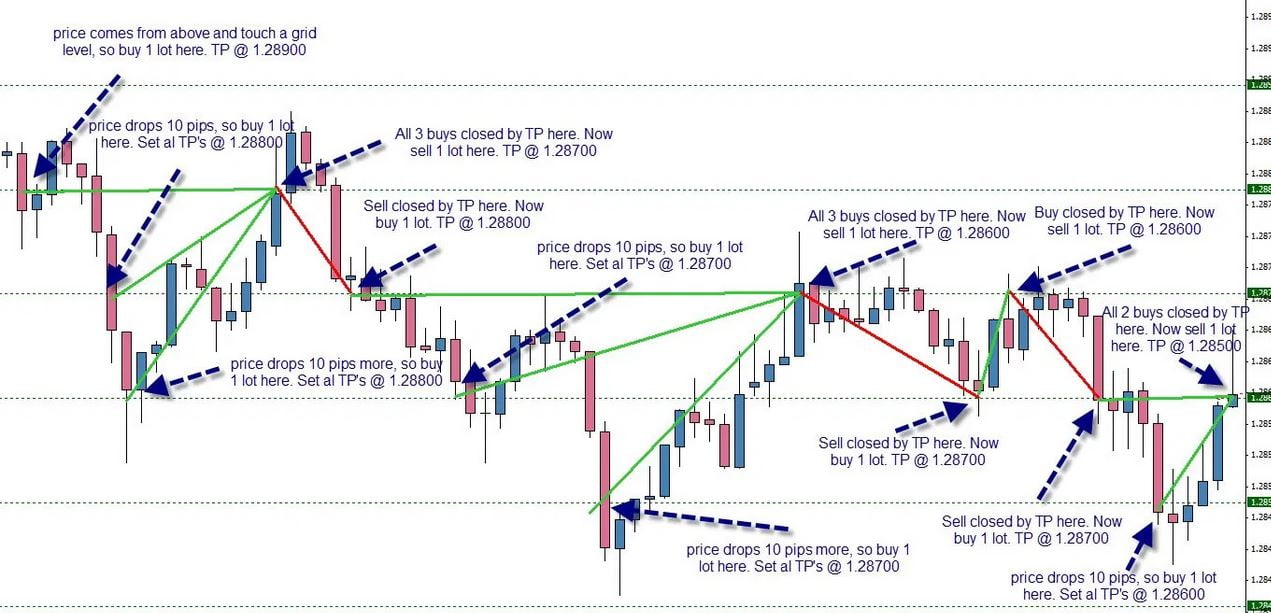

A Synergistic Trading Strategy

This strategy combines moving averages for technical analysis and economic indicators for fundamental analysis to identify high-probability trading opportunities. We’ll use a 50-day and 200-day moving average crossover as our technical signal, coupled with positive economic news as our fundamental confirmation.Specifically, we will look for a bullish crossover (50-day MA crossing above the 200-day MA) in a currency pair, ideally coinciding with positive economic data releases, such as a stronger-than-expected GDP report or a positive employment report for the target currency’s country.

A bearish crossover (50-day MA crossing below the 200-day MA), coupled with negative economic news, would signal a potential short opportunity.

Step-by-Step Guide to Combining Analysis

Before diving in, remember that this is a simplified example, and real-world trading involves much more nuance and risk management.

- Fundamental Screening: Begin by identifying currencies with positive economic outlooks. This might involve reviewing central bank statements, inflation reports, and other macroeconomic data. For example, if the US releases strong employment numbers, the USD might strengthen against other currencies.

- Technical Confirmation: Once you’ve identified a promising currency pair based on fundamentals, turn to technical analysis. Look for confirmation signals, such as a bullish crossover of moving averages or a breakout from a consolidation pattern. Imagine the USD/JPY pair showing a bullish crossover after a positive US jobs report – that’s a potential long opportunity.

- Risk Management: Always set stop-loss orders to limit potential losses. The amount should be determined by your risk tolerance and trading plan. For instance, you might set a stop-loss order at 1% below your entry price.

- Order Placement: Once both technical and fundamental signals align, place your trade. This involves entering a long or short position based on your analysis. In our USD/JPY example, you would enter a long position if you expect the USD to appreciate against the JPY.

- Monitoring and Adjustment: Continuously monitor your trade and adjust your strategy as needed. This might involve moving your stop-loss order or taking profits based on changing market conditions. For example, if the USD/JPY begins to trend downward despite positive fundamentals, you might consider closing your position to limit potential losses.

Remember, patience and discipline are key to success in forex trading. Don’t let emotions cloud your judgment.

Advanced Trading Strategies

So, you’ve mastered the basics of technical and fundamental analysis. Congratulations! You’re ready to ascend to the next level – the thrilling, sometimes terrifying, always exhilarating world of advanced forex trading strategies. Buckle up, buttercup, because it’s going to be a wild ride. We’ll explore some strategies that can make you a king (or queen!) of the currency markets, but remember, with great power comes great responsibility (and the potential for equally great losses).The choice of strategy heavily depends on your personality, risk tolerance, and available time.

Mastering advanced forex trading strategies, blending the mystical arts of technical and fundamental analysis, requires a keen eye for detail. But even the wisest guru needs to understand the often-overlooked impact of spreads on your bottom line; check out this Comprehensive guide to forex trading spreads and their impact on profits to avoid those sneaky spread-related surprises.

Then, armed with this knowledge, you can truly conquer the forex battlefield!

Some strategies demand constant vigilance, while others allow for a more relaxed approach. Understanding these nuances is key to success (and avoiding a financial meltdown).

Scalping

Scalping is like being a hyper-caffeinated hummingbird flitting from flower to flower. It involves making many small profits on tiny price movements over very short periods – typically seconds or minutes. Think of it as a high-frequency trading strategy on a smaller, individual scale. It requires lightning-fast reflexes, a rock-solid trading plan, and nerves of steel. The reward is the potential for rapid profit accumulation, but the risk is equally high.

One wrong move can wipe out your gains in a heartbeat. Scalpers need low spreads and access to fast execution speeds. This strategy isn’t for the faint of heart.

Swing Trading

Swing trading occupies a comfortable middle ground. It involves holding positions for a few days or weeks, capitalizing on intermediate-term price swings. It’s less stressful than scalping but demands more patience than day trading. Swing traders typically use technical indicators to identify potential entry and exit points. The risk is lower than scalping, and the potential rewards are moderate.

Mastering advanced forex trading strategies using technical and fundamental analysis is like learning a secret language of the markets. To truly decipher these cryptic messages, you need the right tools, and that’s where TradingView Canada charting platform for advanced forex technical analysis comes in handy. With its powerful charting features, you can unlock hidden patterns and make informed decisions, boosting your chances of forex success – or at least avoiding a hilarious financial meltdown.

This strategy is ideal for traders who can commit a few hours each day to monitoring the markets.

Position Trading

Position trading is the marathon runner of forex strategies. Traders hold positions for weeks, months, or even years, profiting from long-term trends. This strategy requires a deep understanding of fundamental analysis, as well as the patience of a saint. The risk is lower than scalping or swing trading, but the potential rewards are substantial. It’s suitable for traders with a high risk tolerance and a long-term investment horizon.

Think of it as planting a seed and patiently waiting for it to blossom into a magnificent money tree.

Risk and Reward Profiles

The risk and reward profiles of these strategies are inversely proportional. Scalping offers high potential rewards but also carries the highest risk. Swing trading offers a moderate risk-reward balance, while position trading presents the lowest risk with lower, but potentially more substantial, long-term rewards. It’s a bit like choosing between a high-stakes poker game, a friendly game of blackjack, and investing in a blue-chip stock.

Strategy Suitability for Different Trader Profiles

- Scalping: Suitable for traders with high risk tolerance, significant experience, and the ability to dedicate significant time to active trading. They need quick reflexes and access to advanced trading platforms.

- Swing Trading: Ideal for traders with moderate risk tolerance and the ability to dedicate a few hours each day to market monitoring. They require a good understanding of technical analysis and chart patterns.

- Position Trading: Best suited for traders with low risk tolerance, a long-term investment horizon, and a deep understanding of fundamental analysis. They need patience and discipline.

Remember, these are just guidelines. The best strategy for you will depend on your individual circumstances and trading style. Don’t be afraid to experiment (within reason, of course!), but always prioritize risk management above all else.

Risk Management and Money Management

In the thrilling world of forex trading, where fortunes can be made and lost in the blink of an eye, risk management isn’t just a suggestion – it’s your life raft in a stormy sea. A robust money management plan is your compass, guiding you through the choppy waters and ensuring you don’t capsize before reaching your destination.

Ignoring these crucial aspects is like sailing a paper boat in a hurricane; you might have a fun ride for a bit, but the outcome is rarely pretty.Understanding and implementing advanced risk management techniques is paramount to long-term success. It’s not about avoiding losses entirely (that’s impossible!), but about controlling them, limiting their impact, and ensuring your trading journey is sustainable.

This involves a strategic approach to position sizing and the unwavering use of stop-loss orders.

Mastering advanced forex trading strategies using technical and fundamental analysis is like learning a secret ninja code to financial freedom. But even the best ninja needs the right tools, which is why choosing the perfect platform matters. Check out this comparison: Comparing Questrade’s forex trading platform with Forex.com in Canada , to see which best suits your advanced strategies before you unleash your inner forex sensei and conquer the markets!

Position Sizing Strategies

Effective position sizing isn’t about throwing all your eggs into one basket; it’s about strategically distributing your risk across multiple trades. A common approach is to risk a fixed percentage of your trading capital on each trade, regardless of the potential reward. For instance, a trader might risk only 1% to 2% of their account balance on any single trade.

This ensures that even a series of losing trades won’t wipe out their entire capital. Another method involves calculating the position size based on the distance between the entry price and the stop-loss order. The smaller the distance, the larger the position size can be, but always within the pre-defined risk percentage. This method requires a careful assessment of the potential volatility of the currency pair being traded.

Stop-Loss Order Implementation, Advanced forex trading strategies using technical and fundamental analysis

Stop-loss orders are your safety net, automatically exiting a trade when it reaches a predetermined loss level. They prevent emotional decisions during market downturns, saving you from potentially catastrophic losses. It’s crucial to place stop-loss orders based on technical analysis, identifying key support levels or previous swing lows. Arbitrarily setting a stop-loss is akin to blindly throwing darts – it might hit the bullseye occasionally, but mostly it’ll miss.

Furthermore, consider using trailing stop-loss orders, which automatically adjust the stop-loss as the price moves in your favor, locking in profits while minimizing potential losses.

Developing a Robust Money Management Plan

A well-defined money management plan is the cornerstone of successful forex trading. It’s a detailed strategy outlining how much capital to allocate to trading, how to manage risk on each trade, and how to handle both wins and losses. This plan should incorporate position sizing techniques, stop-loss order placement, and a clear understanding of your risk tolerance. It’s also vital to include a plan for reinvesting profits and managing potential drawdowns (periods of consecutive losses).

Without a disciplined money management plan, even the most skilled trader can be swept away by the unpredictable nature of the forex market.

Hypothetical Trading Scenario and Risk Management Application

Let’s imagine a trader with a $10,000 account, employing a 1% risk management strategy. They identify a potential trading opportunity in the EUR/USD pair, aiming to buy at 1.1000 with a stop-loss at 1.0980. The risk per trade is therefore $100 ($10,000 x 1%). Using a standard lot size of 10,000 units, they calculate the appropriate position size to manage this risk.

By accurately calculating the pip value and the distance to the stop-loss, they determine the exact number of lots to buy, ensuring that a stop-loss hit at 1.0980 will result in a loss of approximately $100, and no more. This controlled risk approach protects their capital while allowing them to participate in potentially profitable trades. The scenario highlights the importance of precise calculations and adherence to the pre-defined risk percentage, irrespective of market sentiment or personal biases.

Algorithmic and Automated Trading

Forget manually clicking buy and sell buttons – algorithmic and automated forex trading, or algo-trading, is the future (or at least, a very exciting present). It’s all about letting computers do the heavy lifting, using pre-programmed rules and sophisticated algorithms to execute trades based on market conditions. Think of it as your own tireless, caffeine-fueled, never-sleeping forex ninja.Algo-trading relies on the power of computer programs to analyze market data, identify trading opportunities, and execute trades with speed and precision far exceeding human capabilities.

These systems operate based on predefined rules and parameters, eliminating emotional biases and impulsive decisions that often plague human traders. The core principle is to translate trading strategies into a set of instructions that a computer can understand and execute. This allows for consistent execution of a trading plan, regardless of market volatility or the trader’s emotional state.

Automated Trading System Benefits and Drawbacks

Automated trading systems offer several significant advantages. The most obvious is speed; algorithms can react to market changes far faster than any human. This speed advantage is crucial in fast-moving markets where milliseconds can mean the difference between profit and loss. Furthermore, algo-trading eliminates emotional biases. Fear and greed can cloud judgment, but a computer program remains objective, sticking to its pre-programmed strategy regardless of market sentiment.

Mastering advanced forex trading strategies, using both technical and fundamental analysis, requires serious dedication. But before you conquer the global markets, you might need to handle some currency conversion first – like figuring out how to swap your Canadian loonies for American eagles. Check out this handy guide on How to convert 433 CAD to USD using Questrade’s forex services to keep your trading funds flowing smoothly.

Then, armed with your freshly converted USD, you can return to charting those Fibonacci retracements and analyzing those economic indicators!

Consistency is another key benefit; an automated system will execute trades exactly as planned, day in and day out, without fatigue or wavering commitment. Finally, automated systems allow for diversification across multiple markets and strategies, maximizing potential returns while mitigating risk.However, automated systems are not without their downsides. The most significant risk is the potential for unforeseen errors in the code.

A bug in the algorithm could lead to significant losses. Furthermore, over-reliance on automated systems can lead to a lack of understanding of the underlying market dynamics. It’s crucial to remember that even the most sophisticated algorithms are only as good as the data and strategies they are based on. Market conditions change constantly, and a strategy that works well in one environment may fail in another.

Finally, the initial setup and maintenance of automated trading systems can be expensive and require specialized technical expertise.

Examples of Automated Trading Strategies

Several types of automated trading strategies exist, each with its unique approach and implementation.One common approach is trend-following, where the algorithm identifies and follows established market trends. This might involve using moving averages to determine the direction of the trend and placing trades accordingly. For example, a simple moving average crossover strategy could generate a buy signal when a short-term moving average crosses above a long-term moving average, and a sell signal when the opposite occurs.

The system would then automatically execute the trade based on this signal.Another popular strategy is mean reversion, which capitalizes on the tendency of prices to revert to their average. These systems identify when prices deviate significantly from their mean and place trades anticipating a return to the average. A common implementation might involve using Bollinger Bands; when prices touch the upper band, a sell signal is generated, and when they touch the lower band, a buy signal is generated.Finally, arbitrage strategies exploit price discrepancies between different markets.

Automated systems can monitor multiple exchanges simultaneously, identifying instances where the same asset is priced differently and executing trades to profit from the price difference. This requires extremely fast execution speeds and sophisticated algorithms to capitalize on these fleeting opportunities. Imagine a system constantly scanning multiple forex brokers, spotting a tiny price difference for the EUR/USD pair, and executing trades to profit from that discrepancy before the price equalizes.

That’s arbitrage in action.

Psychological Aspects of Advanced Forex Trading: Advanced Forex Trading Strategies Using Technical And Fundamental Analysis

The world of advanced forex trading isn’t just about charts and algorithms; it’s a battleground of the mind. Even the most skilled technical analyst can be undone by emotional turmoil and cognitive biases. Mastering the psychological aspects is as crucial as mastering the technical ones, if not more so, for achieving consistent profitability. Ignoring the mental game is like sailing a ship without a rudder – you might get lucky, but you’re far more likely to crash.The psychological challenges faced by advanced forex traders are numerous and often insidious.

They stem from the inherent uncertainty of the markets, the constant pressure of potential losses, and the allure of quick riches. This creates a fertile ground for emotional decision-making, leading to impulsive trades and a deviation from well-defined strategies. The pressure to outperform, coupled with the often-solitary nature of trading, can amplify these challenges.

Emotional Management Strategies

Effective emotional management is paramount. Advanced traders employ various strategies to stay grounded amidst market volatility. This includes maintaining a detailed trading journal to track not only trades but also emotional states during different market conditions. Identifying triggers for emotional responses – such as a sudden market downturn or a string of losing trades – is key to developing coping mechanisms.

Regular exercise, meditation, and sufficient sleep are also crucial for maintaining emotional equilibrium and avoiding burnout. These practices help to create a more stable mental state, allowing for clearer, more rational decision-making.

Avoiding Cognitive Biases

Cognitive biases are systematic errors in thinking that can significantly impact trading performance. Confirmation bias, for instance, is the tendency to favor information that confirms pre-existing beliefs, leading to ignoring contradictory evidence. Overconfidence bias can lead to excessive risk-taking and ignoring stop-loss orders. The gambler’s fallacy, the belief that past events influence future independent events, can lead to irrational trading decisions.

Advanced traders actively work to identify and mitigate these biases through rigorous self-reflection, seeking diverse perspectives, and employing systematic risk management techniques. For example, using pre-determined risk parameters and sticking to a trading plan helps to avoid impulsive decisions fueled by overconfidence or fear.

Maintaining Trading Discipline

Discipline is the cornerstone of successful advanced forex trading. It involves sticking to a pre-defined trading plan, regardless of market fluctuations or emotional impulses. This means resisting the urge to deviate from the strategy based on gut feelings or short-term market noise. Regularly reviewing and refining the trading plan, based on performance analysis and market changes, is crucial for maintaining discipline.

It also means setting realistic goals, avoiding unrealistic expectations of overnight wealth, and accepting losses as part of the learning process. The ability to stick to a well-defined plan, even when faced with adversity, is a hallmark of a truly disciplined and successful advanced trader. This involves developing a strong mental fortitude that can withstand the inevitable setbacks and emotional roller-coaster inherent in the forex market.

Backtesting and Optimization of Strategies

So, you’ve concocted a brilliant forex trading strategy, a masterpiece of technical and fundamental analysis, a symphony of buy and sell signals. But before you unleash it upon the volatile world of currency markets and risk your hard-earned cash, you need to put it through its paces. Enter backtesting, the rigorous training regime for your trading strategy. Think of it as the boot camp before deployment.Backtesting involves simulating your strategy on historical forex data to see how it would have performed in the past.

It’s like a time machine for your trading plan, allowing you to test its mettle without risking real money. This process helps you identify strengths, weaknesses, and areas for improvement before you start trading live. Imagine trying to launch a rocket without first running simulations – it’s a recipe for disaster!

Backtesting Process

The backtesting process typically involves several steps. First, you’ll need to gather historical forex data, which is readily available from various brokers and data providers. This data should include price information (open, high, low, close), as well as any other relevant indicators you used in your strategy. Next, you’ll need to program your strategy, either manually (for simpler strategies) or using a specialized backtesting software or platform.

Many platforms offer automated backtesting features, making this process significantly easier. The software will then run your strategy against the historical data, generating a performance report that includes metrics like profitability, maximum drawdown, and win rate. Finally, you analyze the results to assess your strategy’s effectiveness. Imagine a meticulous scientist meticulously documenting every experiment.

Optimization Methods

Once you have the results of your backtesting, you can start the optimization process. This is where you fine-tune your strategy’s parameters to improve its performance. This might involve adjusting entry and exit points, tweaking indicator settings, or altering risk management parameters. For example, you might discover that your strategy performs better with a tighter stop-loss order or a different moving average period.

Optimization should be approached systematically, avoiding over-optimization which can lead to poor performance in live trading. Think of it as carefully adjusting the knobs and dials of a finely tuned machine. One small tweak can make a big difference, but too many adjustments can lead to chaos.

Limitations of Backtesting and Forward Testing

It’s crucial to remember that backtesting is not a foolproof method. Historical data doesn’t perfectly predict future market behavior. Market conditions change constantly, influenced by economic events, geopolitical shifts, and even the collective psychology of traders. Backtesting can only tell you how your strategy

- would have* performed in the past, not how it

- will* perform in the future. Therefore, forward testing, where you test your optimized strategy on a small amount of real money, is essential before deploying it fully. Think of it as a final exam before graduation – it’s a crucial step to prove your strategy can handle the pressures of the real world. Over-reliance on backtesting without forward testing is like relying solely on practice exams to predict your performance on the actual exam; the real deal is often very different.

Summary

So, you’ve journeyed through the exhilarating (and sometimes nerve-wracking!) world of advanced forex trading strategies. You’ve learned to harness the power of both technical and fundamental analysis, wielding them like a financial Jedi master. Remember, mastering the forex market is a marathon, not a sprint – consistent learning, disciplined execution, and robust risk management are your keys to long-term success.

Now go forth and conquer the currency markets, one profitable trade at a time! May your pips always be green (or whatever color signifies profit in your chosen currency pair!).