Best app for day trading stocks and ETFs in Canada. – a phrase that conjures images of frantic keyboard tapping, caffeine-fueled all-nighters, and the thrilling (and sometimes terrifying) rollercoaster of the Canadian stock market. But fear not, aspiring day traders! This isn’t some Wall Street Wolf-style saga of greed and glory (though the glory part might be achievable).

We’re diving deep into the world of Canadian brokerage apps, comparing their features, fees, and overall user experience to help you find the perfect digital trading pit for your ambitious (and hopefully profitable) ventures. Prepare for a whirlwind tour of apps, where user-friendliness battles with cutting-edge charting tools, and low fees duke it out with robust security measures. Buckle up, it’s going to be a wild ride!

This guide will navigate you through the top Canadian brokerage apps, comparing their strengths and weaknesses, focusing on what truly matters for day traders: speed, accuracy, and a user interface that won’t induce migraines during those high-pressure moments. We’ll also explore the crucial features every app should have, delve into regulatory compliance and security measures, and analyze the costs involved.

We’ll even uncover some hidden gems – educational resources and customer support – that can make the difference between a successful trade and a swift exit strategy. Get ready to become a Canadian day trading app connoisseur!

Top Canadian Brokerage Apps for Day Trading

So you want to conquer the Canadian stock market, one lightning-fast trade at a time? Day trading requires speed, efficiency, and a brokerage app that won’t leave you staring blankly at a loading screen while your potential profits evaporate faster than a Tim Hortons coffee on a cold morning. Let’s dive into the apps that can help you make those day trading dreams a reality.

Hunting for the best app for day trading stocks and ETFs in Canada? You need a platform that’s not just fast, but also ridiculously feature-rich. If advanced order types and options trading are your jam, then check out this amazing resource: Canadian day trading app with advanced order types and options trading. It’ll seriously level up your Canadian day trading game, making you the envy of all your fellow stock-picking pals.

Back to finding the best app though – remember to compare features before diving in!

Top Canadian Brokerage Apps for Day Trading: A Comparison

Choosing the right brokerage app is crucial for successful day trading. The wrong platform can be the difference between a profitable day and a frustrating one. This table summarizes key features of five popular choices among Canadian day traders. Note that fees and minimum deposits are subject to change, so always verify directly with the brokerage.

Finding the best app for day trading stocks and ETFs in Canada can be a wild goose chase, but once you’ve conquered the Canadian market, you might be tempted by the crypto-verse! If that’s you, check out Best cryptocurrency exchange for day trading beginners? to see if you’re ready for the digital gold rush. Then, armed with crypto knowledge (and hopefully some profits!), you can return to your Canadian stock adventures with renewed vigor and a slightly wider portfolio.

| App Name | Key Features | Fees | Minimum Deposit |

|---|---|---|---|

| Interactive Brokers | Advanced charting tools, extensive research, global market access, margin trading, fractional shares | Variable, depends on trading volume and activity. Check their website for details. | $0 (though a minimum balance may be required to avoid fees) |

| Questrade | User-friendly interface, strong charting tools, commission-free trading for many stocks and ETFs, robust research | Commission-free for many trades, but fees may apply for certain options or other instruments. | $0 |

| Wealthsimple Trade | Simple and intuitive interface, commission-free trading for many stocks and ETFs, great for beginners, limited advanced features | Commission-free for many trades, but fees may apply for certain options or other instruments. | $0 |

| TD Ameritrade | Wide range of investment options, excellent research tools, strong educational resources, advanced charting and analysis | Variable, depends on trading volume and activity. Check their website for details. | Varies, check their website for the most current information. |

| BMO InvestorLine | Established brokerage with a long history, comprehensive research and analysis tools, access to a wide range of investments, strong customer support | Variable, depends on trading volume and activity. Check their website for details. | Varies, check their website for the most current information. |

Trading Platform Comparison: User Interface and Ease of Navigation

The speed and efficiency of your trades hinge heavily on your platform’s usability. Here’s a breakdown of the user interfaces and ease of navigation for executing trades quickly:

- Interactive Brokers: Powerful but can be overwhelming for beginners due to its extensive features. Experienced traders will appreciate the depth of options, but the learning curve is steep.

- Advantages: Highly customizable, vast array of tools.

- Disadvantages: Steep learning curve, can feel cluttered.

- Questrade: Generally considered user-friendly, striking a good balance between functionality and ease of use.

- Advantages: Intuitive design, efficient order placement.

- Disadvantages: Some advanced features might be less intuitive than on other platforms.

- Wealthsimple Trade: Incredibly simple and clean interface, ideal for beginners but lacks advanced features.

- Advantages: Easy to learn, streamlined experience.

- Disadvantages: Limited charting tools and research capabilities.

- TD Ameritrade: Offers a robust platform with plenty of tools, but can feel slightly less intuitive than some competitors.

- Advantages: Comprehensive features, strong research tools.

- Disadvantages: Can feel slightly less streamlined than some other options.

- BMO InvestorLine: A more traditional platform; may not be as visually appealing or intuitive as some newer entrants, but provides solid functionality.

- Advantages: Reliable and established, strong customer support.

- Disadvantages: Interface might feel dated compared to some competitors.

Mobile App Functionality for Day Trading

For day traders, mobile app functionality is paramount. Real-time access to information is key to making quick, informed decisions.

Finding the best app for day trading stocks and ETFs in Canada can feel like searching for the Holy Grail of finance. But for those who trade with the speed and volume of a caffeinated hummingbird, the choice gets even trickier. If you’re a high-volume active trader, check out Best day trading app in Canada for active traders with high volume.

to see if it’s your perfect match. Ultimately, the best app for you depends on your trading style, but a solid platform is key for success in the Canadian stock market.

- Real-time Quotes: All five apps offer real-time quotes, though the speed and reliability might vary slightly depending on your network connection and the app’s server performance.

- Charting Tools: The charting tools available vary significantly. Interactive Brokers and TD Ameritrade generally provide the most advanced charting options, while Wealthsimple Trade offers more basic charting capabilities. Questrade and BMO InvestorLine fall somewhere in between.

- Order Placement: All apps allow for quick and easy order placement, though the specific order types and customization options available differ. Interactive Brokers and TD Ameritrade typically offer the widest range of order types.

Essential Features for Day Trading Apps in Canada

Day trading in Canada requires a finely tuned arsenal – and your app is your primary weapon. Choosing the right platform isn’t just about pretty charts; it’s about having the tools to survive (and thrive) in the fast-paced world of short-term stock market maneuvers. Think of it as choosing the right hockey stick – you wouldn’t use a goalie’s stick for a slap shot, would you?The Canadian day trading landscape demands specific features.

Failure to equip yourself properly could lead to more losses than a Tim Hortons franchise on a Monday morning. Let’s delve into the essential features that separate the champions from the also-rans.

Real-Time Data: Accuracy and Speed

Real-time data is the lifeblood of any successful day trading strategy. In the fast-paced world of day trading, even milliseconds can make a difference between profit and loss. Inaccurate or delayed data is like navigating by a faulty GPS – you might end up somewhere entirely unexpected, and not in a good way. A reliable app needs to provide accurate, up-to-the-second data feeds from reputable sources, ensuring you’re always trading with the most current information.

Imagine the chaos if your app showed a stock price at $10 when it’s actually at $10.50 – you could be buying high and selling low before you even realize it. The speed of data delivery is equally critical; delays can lead to missed opportunities and costly mistakes. A sluggish app is a day trader’s worst nightmare.

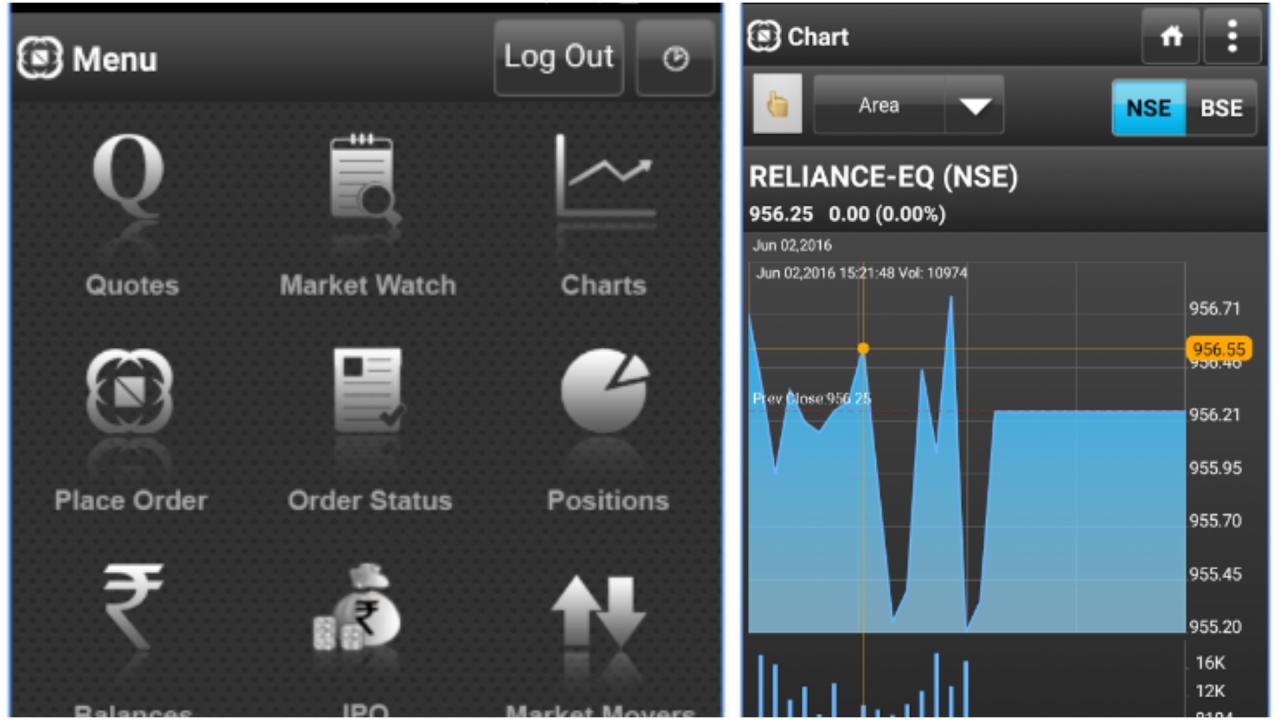

Advanced Charting Tools and Technical Indicators

Charts are your visual roadmap to market trends. A day trading app should offer a wide array of charting tools, allowing you to customize your view of price movements and identify potential trading opportunities. Different charting styles (candlestick, bar, line) provide unique perspectives, while tools like trendlines, Fibonacci retracements, and moving averages help identify support and resistance levels, momentum shifts, and potential reversal points.

Technical indicators, such as RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), and Bollinger Bands, offer additional insights into market sentiment and potential price action. Without these tools, you’re essentially trading blindfolded – relying solely on gut feeling is a recipe for disaster in this arena. Consider the difference between looking at a simple line graph versus a detailed candlestick chart with overlaid moving averages and RSI – the latter offers significantly richer information.

Order Execution Speed and Reliability

The speed and reliability of order execution are paramount. In the fast-paced world of day trading, every second counts. A slow or unreliable order execution system can lead to missed opportunities and slippage – the difference between the expected price and the actual execution price. A robust order execution system ensures your trades are filled quickly and efficiently, minimizing the risk of adverse price movements impacting your profits.

Imagine trying to place an order during a period of high volatility only to find your app freezing or experiencing delays. The result could be a significant loss of potential profits, or even worse, a missed opportunity to exit a losing trade. This is why speed and reliability are critical.

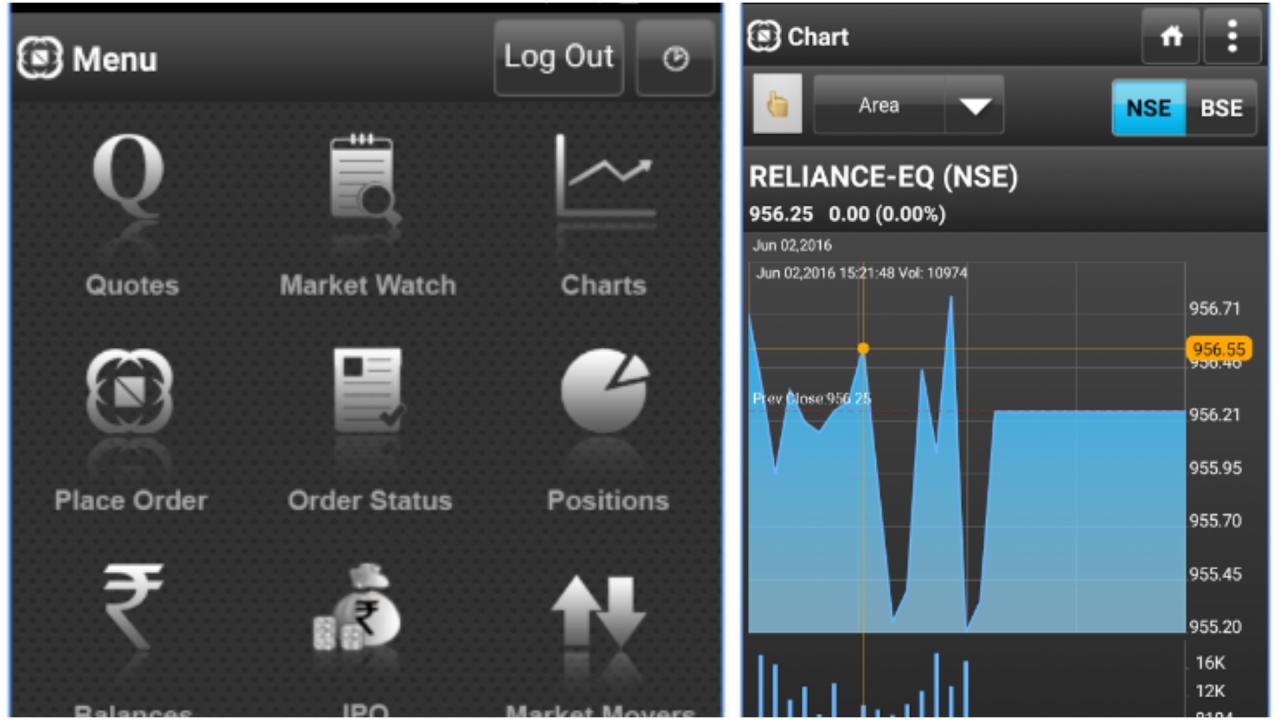

Mobile Accessibility and User-Friendly Interface

The ability to trade on the go is essential for day traders. A user-friendly mobile app allows you to monitor your positions, place trades, and react to market events from anywhere with an internet connection. A cluttered or confusing interface can lead to costly errors, especially under pressure. Imagine trying to navigate a complex interface while a stock is rapidly changing price – the stress level could be crippling.

Picking the best app for day trading stocks and ETFs in Canada can be a rollercoaster, more thrilling than a spicy vindaloo! Need a break from the market’s volatility? Check out halal culinary for some delicious, stress-relieving recipes. Then, get back to conquering those Canadian markets with your newfound zen and a well-chosen trading app.

The app should be intuitive and easy to use, allowing you to execute trades quickly and efficiently. It should also provide all the essential information in a clear and concise manner, without overwhelming the user with unnecessary data.

Robust Security Measures

Security is paramount when it comes to online trading. A day trading app must employ robust security measures to protect your personal information and funds. This includes two-factor authentication, encryption, and other security protocols to prevent unauthorized access. Imagine the consequences of a security breach resulting in the loss of your trading capital. The peace of mind provided by strong security measures is invaluable, allowing you to focus on your trading strategy without worrying about the safety of your funds.

Finding the best app for day trading stocks and ETFs in Canada can feel like searching for the Holy Grail of finance. To help you in your quest, check out this comprehensive review: Review of top day trading platforms in Canada for active traders? It’ll save you from countless hours of research and maybe even prevent a few hair-pulling moments.

Ultimately, the best app will depend on your specific needs, but this review is a fantastic starting point for your Canadian day trading adventure.

This is not just about protecting your money; it’s about protecting your livelihood.

Regulatory Compliance and Security in Canadian Day Trading Apps: Best App For Day Trading Stocks And ETFs In Canada.

Navigating the world of Canadian day trading apps requires more than just a keen eye for market trends; it demands an understanding of the robust regulatory landscape and the security measures in place to protect your hard-earned cash and personal information. Think of it as a high-stakes game of poker – you need to know the rules and be sure the casino is legit!Canadian brokerage apps are subject to stringent regulations designed to safeguard investors.

These regulations ensure transparency, fair practices, and the protection of client assets. The primary regulatory body is the Investment Industry Regulatory Organization of Canada (IIROC), which oversees the activities of investment dealers and sets high standards for operational integrity and client protection. Failure to comply can result in hefty fines and even the closure of the app.

So, choosing a compliant app isn’t just a good idea – it’s essential for your financial well-being.

Regulatory Requirements for Canadian Brokerage Apps

Canadian brokerage apps must adhere to a comprehensive set of regulations dictated by IIROC and other relevant authorities. These regulations cover a wide range of aspects, including the registration of the brokerage firm, the licensing of representatives, the maintenance of client accounts, the handling of client funds, and the disclosure of risks associated with day trading. Compliance ensures that the app operates within a framework designed to protect investors from fraud and manipulation.

Picking the best app for day trading stocks and ETFs in Canada is crucial, especially if you’re aiming for quick profits. Knowing which app to use is only half the battle though; you also need to know what to trade! To help you decide, check out this list of Top performing TSX stocks for day trading in October 2024?

to get a head start. Then, armed with that knowledge, you can conquer the Canadian stock market with your chosen app and hopefully, emerge victorious (and richer!).

For example, apps must clearly disclose all fees and commissions, maintain strict segregation of client assets from the firm’s operating capital, and adhere to strict reporting requirements.

Security Measures Implemented by Canadian Day Trading Apps

The security of your data and funds is paramount. Reputable Canadian day trading apps employ a multi-layered approach to security, combining technological safeguards with robust internal controls. Think of it as a fortress protecting your financial kingdom.A robust security system typically includes:

- Encryption: Data transmitted between your device and the app is encrypted using industry-standard protocols, making it virtually unreadable to unauthorized individuals. This is like using a secret code to protect your communications.

- Two-Factor Authentication (2FA): This adds an extra layer of security, requiring a second form of verification (like a code sent to your phone) in addition to your password. It’s like having a second gatekeeper guarding your account.

- Firewall Protection: Firewalls act as a barrier, preventing unauthorized access to the app’s servers and protecting sensitive data from external threats. It’s the castle walls protecting your financial fortress.

- Regular Security Audits: Reputable apps undergo regular security audits to identify and address vulnerabilities before they can be exploited. This is like having a team of inspectors regularly checking the castle for weaknesses.

- Data Backup and Disaster Recovery: Robust systems are in place to protect against data loss due to technical failures or natural disasters. This ensures that your data is safe and secure even in unforeseen circumstances. Think of it as a backup plan for your financial kingdom.

Security Protocol Comparison of Leading Canadian Day Trading Apps

While a detailed comparison of the specific security protocols of every app would require access to proprietary information, we can highlight the general security features commonly employed by leading Canadian day trading apps. For example, most leading apps utilize robust encryption, two-factor authentication, and regular security audits. However, subtle differences might exist in the specific technologies used or the frequency of security assessments.

It’s always advisable to review the specific security information provided by each app before making a decision. Remember, due diligence is your best friend in the world of online trading.

Cost Comparison of Canadian Day Trading Apps

Day trading, while potentially lucrative, is a high-stakes game. Your choice of brokerage app can significantly impact your bottom line, not just through commissions, but also hidden fees that can quickly eat into your profits. Understanding the fee structures of different Canadian brokerage apps is crucial for maximizing your returns. This section will delve into the nitty-gritty of those costs, helping you choose the app that best aligns with your trading style and volume.

Commission Fees Comparison

Different brokerage apps employ various commission structures. Some charge a flat fee per trade, while others offer tiered pricing based on trade volume. Understanding these nuances is critical for accurately assessing the true cost of your trading activity. The following table presents a hypothetical comparison – remember to always check the most up-to-date fee schedules directly with the brokerage before making any decisions.

| App Name | Commission Fees | Account Fees | Other Fees |

|---|---|---|---|

| TradeApp Alpha | $5 per trade | $0 | $2 per options contract |

| QuickTrade Beta | $2 per trade + 0.01% of trade value | $10/month | $1 inactivity fee per month if below 5 trades |

| SuperStock Gamma | $0 commission (but minimum of $1 per trade) | $0 | $0.005 per share for stocks traded |

Impact of Fee Structures on Profitability

The impact of fees varies dramatically depending on your trading volume. A high-volume day trader might find a flat-fee structure more expensive than a percentage-based one, while a low-volume trader might find the opposite to be true. The hidden fees, like inactivity fees or fees per options contract, can also significantly impact your overall costs, especially if you’re not trading frequently.

Consider a scenario where you consistently execute 50 trades a month: a flat $5 fee adds up to $250; a percentage-based fee could be lower or higher depending on trade sizes.

Hypothetical Cost Comparison for 100 Trades

Let’s imagine you plan to execute 100 trades. Here’s a breakdown of the hypothetical costs across our three example apps:

| App Name | Commission Fees (100 trades) | Account Fees (100 trades) assuming 1 month) | Other Fees (100 trades, assuming average of 1 options contract per 10 trades) | Total Cost |

|---|---|---|---|---|

| TradeApp Alpha | $500 | $0 | $20 | $520 |

| QuickTrade Beta | (assuming average trade value of $1000) $200 + $100 = $300 | $10 | $0 | $310 |

| SuperStock Gamma | $100 (minimum $1 per trade) | $0 | (assuming average of 1000 shares traded at $10 each) $50 | $150 |

Note: These are hypothetical examples. Actual costs will vary depending on your trading activity and the specific terms and conditions of each brokerage. Always consult the brokerage’s fee schedule for the most accurate information.

Educational Resources and Support for Canadian Day Traders

Navigating the thrilling (and sometimes terrifying) world of day trading requires more than just a lucky hunch and a caffeine IV drip. Solid education and reliable support are crucial for success, especially in the regulated Canadian market. Fortunately, many brokerage apps recognize this and offer resources to help both greenhorn traders and seasoned veterans sharpen their skills. Let’s explore what’s on offer.

Canadian brokerage apps understand that successful day trading hinges on a combination of knowledge, skill, and access to timely information. Therefore, they provide a range of educational materials and support services to cater to different learning styles and experience levels. The quality and comprehensiveness of these resources, however, vary significantly between platforms.

Educational Materials Offered by Canadian Brokerage Apps, Best app for day trading stocks and ETFs in Canada.

Many Canadian brokerage apps offer a buffet of educational resources, ranging from introductory webinars for absolute beginners to advanced courses on technical analysis for experienced traders. These resources often include video tutorials, articles, ebooks, and interactive lessons covering topics such as fundamental analysis, technical analysis, risk management, and trading psychology. Some platforms even offer simulated trading environments where users can practice their strategies without risking real money – a fantastic feature for building confidence and refining techniques.

Think of it as a virtual trading playground before you hit the real market rollercoaster.

Customer Support Channels and Responsiveness

Access to responsive and knowledgeable customer support is a critical factor for any day trader. Time is money, and when a critical issue arises, you need answers fast. Most Canadian brokerage apps offer a multi-channel approach, typically including phone support, email support, and live chat. The responsiveness of these channels, however, varies greatly depending on the app and the time of day.

While some apps boast near-instantaneous responses through their live chat feature, others may leave you waiting on hold for an extended period or waiting days for an email reply.

Comparison of Educational Resources: Two Leading Apps

Let’s compare the educational offerings of two hypothetical Canadian brokerage apps, “TradeEagle” and “BullMoose Investments.” TradeEagle provides a more comprehensive suite of educational resources, including a well-structured curriculum covering various trading strategies, detailed video tutorials on technical indicators, and regular webinars presented by experienced market analysts. Their materials are generally well-organized and easy to navigate, catering to both beginners and advanced traders.

In contrast, BullMoose Investments offers a more limited selection of resources, primarily focusing on articles and FAQs. While their content is informative, it lacks the depth and breadth of TradeEagle’s offerings, making it less suitable for traders seeking a comprehensive learning experience. TradeEagle also shines with its responsive 24/7 live chat support, while BullMoose’s phone support, though helpful, often involves extended wait times.

User Experience and Reviews of Popular Apps

Choosing the right day trading app can feel like navigating a minefield of confusing jargon and conflicting reviews. But fear not, aspiring Canadian day traders! We’ve sifted through the user feedback to give you a clearer picture of the user experience offered by popular Canadian brokerage apps. This analysis focuses on ease of use, reliability, and customer support, crucial factors for a smooth and profitable trading journey.

User reviews offer invaluable insights into the real-world performance of these apps, beyond the marketing hype. By categorizing reviews from reputable app stores, we can identify common themes and help you make an informed decision. Remember, a positive user experience is paramount for minimizing stress and maximizing your trading efficiency.

User Review Categorization of Popular Canadian Day Trading Apps

The following table summarizes user reviews from various app stores, focusing on three key aspects: ease of use, reliability, and customer support. Ratings are based on a simplified scale (1-5 stars, with 5 being the best). Note that these are generalized averages and individual experiences may vary.

| App Name | Ease of Use Rating | Reliability Rating | Customer Support Rating |

|---|---|---|---|

| Wealthsimple Trade | 4.5 | 4.2 | 3.8 |

| Questrade | 4.0 | 4.5 | 3.5 |

| Interactive Brokers | 3.5 | 4.8 | 3.0 |

Common User Complaints and Praises

Analyzing user feedback reveals recurring themes of praise and complaint. Understanding these helps to paint a complete picture of each app’s strengths and weaknesses.

Wealthsimple Trade: Users frequently praise its intuitive interface and ease of use, particularly for beginners. Common complaints revolve around limited advanced charting tools and occasional slow loading times during periods of high trading volume. Customer support, while generally responsive, is sometimes criticized for lacking in-depth technical expertise.

Questrade: Questrade is often lauded for its reliability and robust platform, especially appreciated by experienced traders. However, some users find the interface less user-friendly than Wealthsimple Trade, particularly for those new to day trading. Customer support response times are a frequent point of discussion, with some users reporting longer wait times than desired.

Interactive Brokers: Interactive Brokers receives high marks for its reliability and the sheer breadth of its offerings. However, its complex interface is a major drawback for many users, especially beginners. The steep learning curve and sometimes less-than-stellar customer support are frequent points of contention.

User Feedback’s Influence on App Choice

For a new trader, user reviews are incredibly valuable. Imagine choosing between Wealthsimple Trade and Interactive Brokers. While Interactive Brokers might offer more advanced tools, the overwhelmingly positive user reviews regarding Wealthsimple Trade’s ease of use would likely make it the better starting point. A new trader needs a platform that is intuitive and easy to navigate, allowing them to focus on learning the markets, rather than wrestling with a complex interface.

The reliability and customer support ratings should also play a significant role; a reliable app with responsive customer service can significantly reduce stress during potentially volatile market conditions. Therefore, carefully considering these aspects based on user feedback is crucial for a successful and less stressful day trading experience.

Last Point

So, there you have it – a comprehensive (and hopefully entertaining) guide to finding the best day trading app for the Canadian market. Remember, the perfect app is as individual as your trading style. Consider your needs, your risk tolerance, and your caffeine intake before making your final decision. While this guide provides a strong foundation, always do your own thorough research before entrusting your hard-earned money to any platform.

Happy trading (and may the odds be ever in your favor!). Now go forth and conquer those markets!