Best cryptocurrency exchange for day trading beginners? Ah, the siren song of quick profits! Day trading crypto can feel like riding a rollercoaster built from pure adrenaline and volatile market whims. This guide isn’t promising riches beyond your wildest dreams (though, hey, stranger things have happened!), but it will arm you with the knowledge to navigate this thrilling, sometimes terrifying, world of digital assets.

We’ll explore the best exchanges for newbies, unravel the mysteries of charting tools, and even help you craft a trading plan that’s less “wild west” and more “smart and savvy.” Buckle up, buttercup, it’s going to be a wild ride!

From understanding the risks and rewards of day trading cryptocurrencies to comparing user interfaces of popular exchanges, we’ll cover the essentials. We’ll delve into the importance of security features, discuss different order types (market, limit, stop-loss), and provide examples of how to calculate the total cost of a trade, including fees. We’ll also explore the world of technical and fundamental analysis, shedding light on market depth and its significance for day traders.

Finally, we’ll point you toward helpful resources and community support to bolster your journey.

Understanding Day Trading and Cryptocurrency: Best Cryptocurrency Exchange For Day Trading Beginners?

Day trading cryptocurrencies is like riding a rollercoaster blindfolded – thrilling, potentially lucrative, and terrifying all at once. It’s a high-stakes game where fortunes can be made (or lost) in a matter of hours. This section will shed light on the inherent risks and rewards, the volatile nature of the crypto market, and the practical steps to get started.Cryptocurrency price volatility is influenced by a chaotic cocktail of factors, making it a wild ride for even seasoned traders.

Understanding these influences is crucial for survival.

So, you’re diving headfirst into the wild world of crypto day trading? Finding the best exchange for newbies is crucial, but before you leap, consider the fees! If you’re in Canada, figuring out which broker offers the lowest fees is equally important, and you can find that information here: Which broker offers the lowest fees for day trading in Canada?

Knowing your costs, whether in crypto or stocks, is the first step to avoiding a painful wallet-induced cry. Back to crypto – happy trading!

Risks and Rewards of Day Trading Cryptocurrencies

The potential rewards of day trading crypto are undeniably tempting. Imagine correctly predicting a price surge and multiplying your investment tenfold in a single day! However, the risks are equally substantial. The highly volatile nature of the crypto market means that losses can be just as dramatic as gains. A sudden market crash could wipe out your entire investment in minutes.

Furthermore, the decentralized and often unregulated nature of the cryptocurrency world leaves you vulnerable to scams, hacks, and platform failures. Successful day trading requires meticulous research, careful risk management, and nerves of steel. Consider the example of Bitcoin in 2021, which saw massive price swings, offering huge potential profits but also devastating losses for those who didn’t time the market correctly.

Factors Influencing Cryptocurrency Price Volatility

Several intertwined forces contribute to the dramatic price swings seen in the cryptocurrency market. News events, such as regulatory announcements or celebrity endorsements, can trigger significant price movements. Market sentiment, driven by social media hype and fear, plays a huge role. Technical factors, including trading volume and chart patterns, also influence price action. Finally, the relatively low liquidity of some cryptocurrencies compared to traditional markets amplifies price fluctuations.

Think of a small pond – a single large stone (a significant trade) creates a much bigger ripple than in a vast ocean (a highly liquid market).

Opening and Funding a Cryptocurrency Exchange Account

Navigating the world of cryptocurrency exchanges can feel like entering a digital labyrinth, but the process is straightforward once you understand the steps.

- Choose a reputable exchange: Research different exchanges, comparing fees, security features, and available cryptocurrencies. Consider factors like user reviews and regulatory compliance. Don’t just jump on the first flashy website you see!

- Create an account: Most exchanges require you to provide personal information, including your name, email address, and potentially proof of identity. Be prepared to complete a KYC (Know Your Customer) process.

- Secure your account: Enable two-factor authentication (2FA) immediately. This adds an extra layer of security, making it significantly harder for hackers to access your account. Think of it as adding a deadbolt to your digital front door.

- Fund your account: Most exchanges support bank transfers, credit/debit cards, and sometimes even cryptocurrency deposits. Choose the method that’s most convenient and cost-effective for you. Be mindful of potential fees associated with deposits.

- Start trading (carefully!): Once your account is funded, you can begin trading. Remember to start small, practice with demo accounts if available, and never invest more than you can afford to lose.

Comparing Cryptocurrency Exchanges for Beginners

Choosing your first crypto exchange can feel like navigating a minefield of jargon and confusing interfaces. Fear not, aspiring day trader! This section will help you decipher the landscape and pick an exchange that’s right for your newbie status. We’ll compare some popular options, highlighting key features to look for, and explain the difference between centralized and decentralized exchanges.

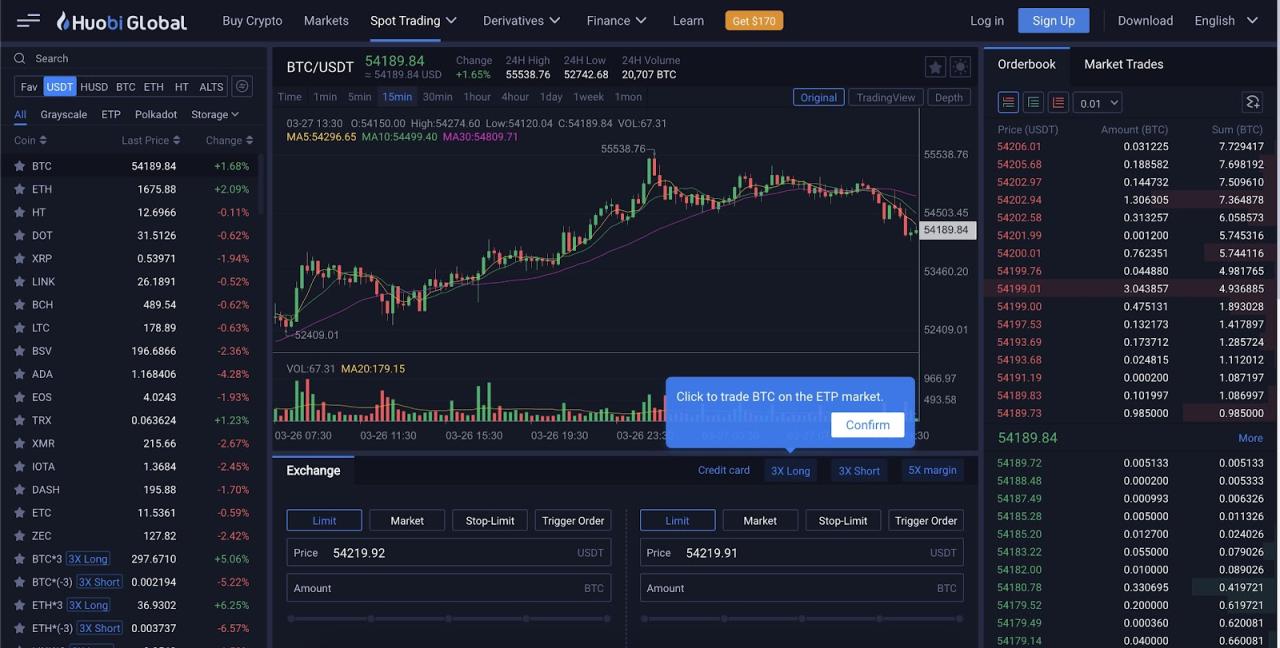

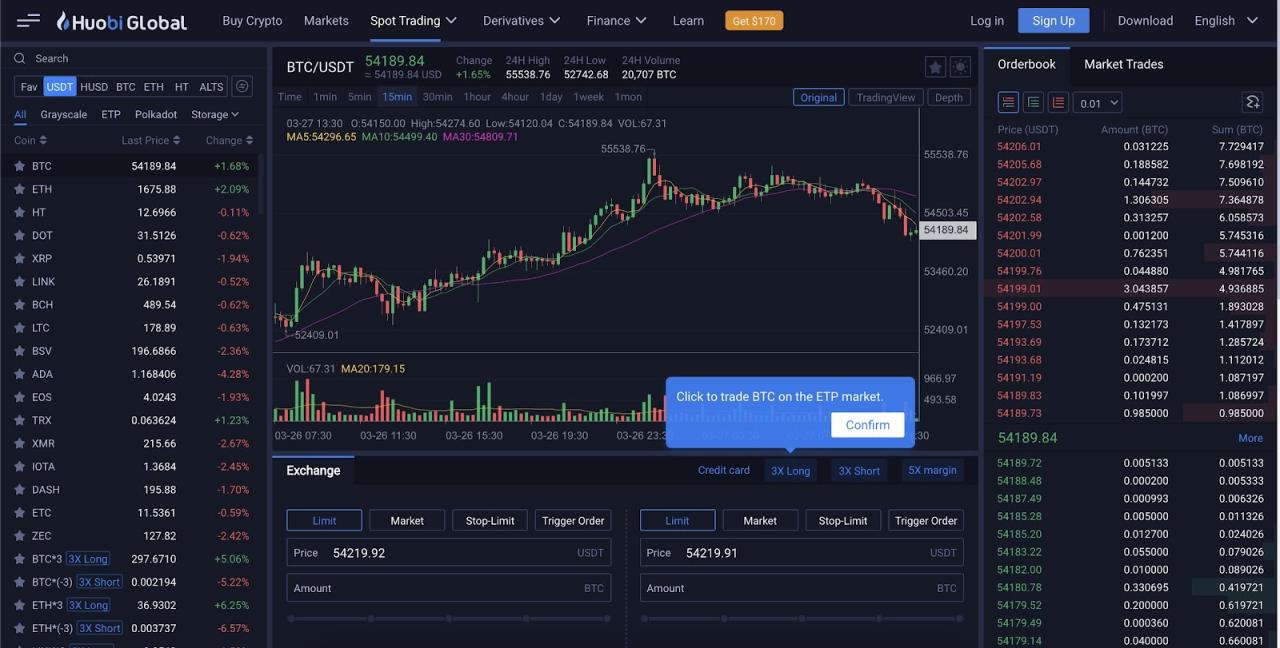

Cryptocurrency Exchange User Interface Comparison

The user interface (UI) is crucial, especially when you’re starting. A clunky, confusing UI can quickly turn a potentially profitable venture into a frustrating experience. Imagine trying to navigate a maze blindfolded while juggling flaming torches – not ideal for calm, rational trading decisions. Let’s compare the UIs of three popular exchanges: Coinbase, Kraken, and Binance.

| Exchange Name | Fees | Security Features | User-Friendliness |

|---|---|---|---|

| Coinbase | Generally higher fees, but simpler fee structure. | Robust security measures, including insurance and two-factor authentication (2FA). Known for its regulatory compliance. | Intuitive and beginner-friendly. Clean layout, easy navigation. Excellent for first-time users. |

| Kraken | Competitive fees, with various fee tiers depending on volume. | Strong security, including 2FA and various other security protocols. A more technically oriented platform. | More complex than Coinbase, with a steeper learning curve. Offers more advanced trading features. |

| Binance | Generally lower fees than Coinbase and Kraken, but a more complex fee structure. | Solid security, with 2FA and other features, but has faced security breaches in the past (though they’ve improved significantly). | Can be overwhelming for beginners due to its vast number of features and complex layout. Offers a wide range of cryptocurrencies. |

Key Features for Beginner Cryptocurrency Exchange Selection

Beginners should prioritize simplicity, security, and ease of use. Think of it like learning to ride a bike – you don’t need a Formula 1 racing machine to start.A good exchange for beginners will have:

A clear and intuitive interface

Easy navigation is key to avoid costly mistakes.

Strong security measures

2FA, robust account protection, and a good reputation for security are non-negotiable.

Educational resources

Many exchanges offer tutorials, FAQs, and other resources to help beginners learn the ropes.

Good customer support

Having access to helpful support can be a lifesaver when things go wrong (and they sometimes will!).

A limited selection of cryptocurrencies

Focusing on a smaller number of well-established cryptocurrencies will reduce the complexity.

Centralized vs. Decentralized Exchanges: A Beginner’s Perspective

Centralized exchanges (CEXs) like Coinbase, Kraken, and Binance act as intermediaries, holding your funds. Decentralized exchanges (DEXs), on the other hand, don’t have a central authority. Think of CEXs as banks and DEXs as peer-to-peer transactions.For beginners, CEXs are generally recommended due to their ease of use and higher level of security (though security breaches can still occur).

DEXs often involve more technical knowledge and can be more complex to navigate. While DEXs offer greater autonomy and potentially better privacy, the added complexity makes them less suitable for beginners venturing into day trading. The learning curve is significantly steeper, and the risk of accidental errors is much higher.

Essential Tools and Features for Day Trading Beginners

Day trading cryptocurrencies can feel like navigating a rollercoaster blindfolded – thrilling, potentially lucrative, and utterly terrifying if you don’t have the right tools. Think of these tools as your safety harness and map; they’ll help you avoid the stomach-churning drops and find those exhilarating peaks. Without them, you’re basically gambling, and nobody wants that.Charting tools and technical analysis are your crystal balls (sort of).

They help you predict – or at least make educated guesses – about price movements. Imagine trying to predict the weather without a barometer or weather forecast. Similarly, navigating the volatile crypto market without charts is a recipe for disaster. These tools visualize price trends, volume, and other crucial data points, allowing you to identify patterns and potential trading opportunities.

Charting Tools and Technical Analysis

Technical analysis uses charts and indicators to identify trading opportunities. Popular charting tools include TradingView, which offers a vast array of indicators and customizable chart types, and Binance’s integrated charting platform, which provides a convenient all-in-one solution for traders using their exchange. These tools allow you to plot moving averages (like the 50-day and 200-day moving averages, which smooth out price fluctuations and help identify trends), relative strength index (RSI) to gauge momentum and potential overbought or oversold conditions, and candlestick patterns (like hammers and dojis) that can signal potential price reversals.

By understanding these tools and their signals, you can make more informed trading decisions. For example, a bullish engulfing candlestick pattern might suggest a potential upward trend, prompting you to consider a long position. Conversely, a bearish engulfing pattern might indicate a potential downward trend, leading you to consider a short position or taking profits on existing long positions.

Order Types

Understanding different order types is crucial for executing your trades effectively and managing risk. Think of order types as your different communication methods with the exchange.

So, you’re a newbie day trader itching to dive into the crypto world? Choosing the right exchange is crucial, like picking the perfect surfboard before tackling a monster wave. To truly understand how to profit from this thrilling ride, check out profit from cryptocoin for some helpful tips. Then, armed with knowledge, you can confidently select the best cryptocurrency exchange for day trading beginners and ride those crypto waves to success!

- Market Orders: These are your “buy it now” orders. They execute immediately at the best available price. They are quick and efficient but may result in a less favorable price than desired, especially in volatile markets. Imagine you’re buying a limited-edition sneaker – a market order is like grabbing it as fast as possible, even if you might pay a slight premium.

- Limit Orders: These are your “buy it at this price or less” (or “sell it at this price or more”) orders. They only execute if the market price reaches your specified price. Limit orders help you control the price you pay or receive, offering better price certainty than market orders. Think of it as setting a price limit before you start shopping, ensuring you don’t overpay.

- Stop-Loss Orders: These are your safety nets. They automatically sell your asset if the price drops to a predetermined level, limiting your potential losses. Imagine setting a safety net below your climbing wall; if you fall, the net prevents you from hitting the ground.

Sample Trading Plan

A trading plan is your roadmap to success. It’s your personal guide to navigate the chaotic world of day trading. Without a plan, you’re essentially adrift at sea.

| Element | Details |

|---|---|

| Asset Selection | Focus on a few well-known cryptocurrencies (e.g., Bitcoin, Ethereum) to start. Avoid obscure coins until you have more experience. |

| Trading Strategy | Use technical analysis (e.g., moving averages, RSI) to identify potential entry and exit points. |

| Position Sizing | Never risk more than 1-2% of your trading capital on a single trade. |

| Risk Management | Always use stop-loss orders to limit potential losses. Set realistic profit targets and stick to them. |

| Record Keeping | Track your trades meticulously, including entry and exit prices, profits/losses, and reasons for each trade. |

Never invest more than you can afford to lose. Day trading is inherently risky.

Regulatory Considerations and Security Practices

Navigating the wild west of cryptocurrency day trading requires more than just chart-reading skills; it demands a healthy respect for the regulatory landscape and a fortress-like security strategy. Ignoring these aspects is like driving a Ferrari without brakes – exhilarating, but potentially catastrophic. This section will illuminate the crucial role of regulation and robust security practices in protecting your hard-earned digital assets.The world of cryptocurrency regulation is a constantly evolving landscape, a bit like a Jackson Pollock painting – vibrant, chaotic, and occasionally incomprehensible.

Different jurisdictions have different rules, and staying informed is paramount. While complete global harmonization remains a distant dream, several exchanges have taken significant steps to comply with regulations in major markets, offering a level of comfort for the cautious trader. Understanding these regulatory frameworks and choosing a compliant exchange is crucial for minimizing legal risks and building trust.

Reputable Regulated Cryptocurrency Exchanges

Choosing a regulated exchange significantly reduces the risk of scams and provides a degree of legal protection. However, “regulated” doesn’t automatically mean “safe,” so thorough due diligence remains essential. The level of regulation varies significantly by jurisdiction. For example, some exchanges may be registered with the Financial Conduct Authority (FCA) in the UK, while others might be subject to licensing requirements in the United States or Singapore.

It’s important to research the specific regulations applicable to your chosen exchange and the jurisdiction in which it operates. Examples of exchanges that operate under some form of regulatory oversight (the specifics vary greatly by location) include Coinbase, Kraken, and Binance (though Binance’s regulatory status is complex and varies by region). Always verify the regulatory status of any exchange before depositing funds.

Importance of Two-Factor Authentication and Other Security Measures

Imagine leaving your front door unlocked while you’re on vacation. That’s essentially what you’re doing if you don’t employ robust security measures on your cryptocurrency exchange account. Two-factor authentication (2FA) adds an extra layer of protection, requiring a second verification method (like a code from your phone or authenticator app) in addition to your password. Think of it as a double-locked door.

Beyond 2FA, consider using strong, unique passwords (avoiding easily guessable options like “password123”), enabling email notifications for account activity, and regularly reviewing your account statements for any unauthorized transactions. A strong password manager can significantly simplify this process. Regularly updating your software and avoiding suspicious links or emails are also crucial elements of a robust security strategy.

Risks of Scams and Phishing Attempts

The cryptocurrency world is unfortunately rife with scams and phishing attempts. These malicious actors often target unsuspecting beginners with promises of unrealistic returns or urgent requests for personal information. Phishing emails may appear legitimate, mimicking official exchange communications. Scammers might create fake websites that closely resemble real exchanges, luring users into entering their login credentials. Always verify the authenticity of any email or website before clicking links or entering sensitive information.

Be wary of unsolicited offers that seem too good to be true, as they often are. Educate yourself on common scam tactics, and report any suspicious activity to the appropriate authorities and the exchange itself. Remember, legitimate exchanges will never ask for your private keys or seed phrases.

Educational Resources and Community Support

Navigating the wild west of cryptocurrency day trading can feel like trying to tame a herd of caffeinated llamas. But fear not, aspiring crypto cowboys and cowgirls! Plenty of resources exist to help you learn the ropes and avoid becoming another casualty of the market’s volatility. This section explores those resources and the supportive communities that can make your day-trading journey less bumpy.

So, you’re diving headfirst into the wild world of crypto day trading? Finding the best exchange for beginners is crucial, and that means considering factors beyond just fees. But before you get lost in the Bitcoin jungle, you might want to check out the broader landscape – if you’re thinking about stocks and other assets, What’s the best all-around day trading platform available in Canada?

could offer valuable insights that translate to your crypto journey. Ultimately, the best crypto exchange for you depends on your specific needs and risk tolerance.

Remember, knowledge is power (and potentially, profit!).Learning to day trade crypto effectively requires a multifaceted approach. You need to grasp the technical aspects of trading, understand market analysis, and develop a solid risk management strategy. Fortunately, a wealth of educational resources are available, ranging from beginner-friendly tutorials to advanced courses taught by seasoned traders. Furthermore, active online communities provide a valuable platform for networking, sharing experiences, and learning from others.

So, you’re diving into the wild world of day trading? Picking the best crypto exchange for beginners is crucial, like choosing the right surfboard before tackling a tsunami. But before you get swept away by volatile cryptos, maybe consider a slightly calmer approach: check out the Top performing TSX stocks for day trading in October 2024? for a gentler introduction to the thrills (and spills!) of day trading.

Then, once you’ve mastered the stock market basics, you can confidently tackle the crypto kraken!

This combination of formal education and peer-to-peer learning is crucial for success in this dynamic market.

Online Educational Resources

Many platforms offer valuable resources for aspiring day traders. These range from free introductory materials to comprehensive paid courses. While the free resources provide a solid foundation, paid courses often offer more in-depth analysis and personalized guidance. Remember to always research the credibility of any source before investing time or money.

- Investopedia: Investopedia provides a plethora of articles and tutorials on various financial topics, including cryptocurrency trading. Their explanations are generally clear and concise, making them ideal for beginners.

- Coinbase Learn: Coinbase, a major cryptocurrency exchange, offers its own educational platform. It’s a good place to start learning about different cryptocurrencies and basic trading concepts.

- YouTube Channels: Numerous YouTube channels dedicated to cryptocurrency trading offer both free and paid content. Be sure to vet the creators carefully; look for those with a proven track record and a focus on responsible trading practices.

- TradingView: TradingView is a popular platform for charting and technical analysis. While not strictly educational, its extensive charting tools and community features make it a valuable learning resource.

Utilizing Simulated Trading Environments

Before risking real money, practice your trading skills using a simulated trading environment. Most cryptocurrency exchanges offer a “paper trading” or “demo account” feature. This lets you execute trades with virtual funds, allowing you to test strategies and get comfortable with the platform’s interface without the fear of financial loss.Let’s say you’re using a demo account on a fictional exchange called “CryptoGalaxy.” You’d log in, navigate to the simulated trading section, and select the cryptocurrency you want to trade, for example, Bitcoin (BTC).

You’d then place a buy order at a specific price, say $28,000. Once the order is filled (in the simulation), you would own virtual BTC. Later, you might place a sell order at $28,500. The platform would then calculate your virtual profit, showing you the outcome of your trade without impacting your actual funds. This allows you to practice order types, timing, and risk management without any financial consequences.

Hypothetical Successful Day Trade

Imagine you’ve been following Bitcoin’s price action and notice a bullish pattern forming. You believe the price is likely to increase in the short term. Using your CryptoGalaxy demo account, you place a buy order for 0.1 BTC at $29,000. After an hour, the price rises to $29,300. You then place a sell order for your 0.1 BTC at this higher price.

Your profit (in virtual currency) would be ($29,300 – $29,000)0.1 BTC = $30. This successful trade demonstrates the potential of day trading, but it’s crucial to remember that this is a simplified example and real-world trading involves significant risk. The key steps were identifying a potential opportunity, placing well-timed orders, and managing risk by defining a target price and potentially a stop-loss order.

Fees and Transaction Costs

Day trading, especially in the volatile world of crypto, can be a thrilling rollercoaster. But before you strap yourself in, you need to understand the hidden costs that can quickly turn a potential profit into a frustrating loss. These fees, often seemingly small, can significantly impact your bottom line, so let’s dive into the nitty-gritty of exchange fees.

Transaction fees are the silent assassins of day trading profits. They’re the sneaky little charges that eat away at your gains, sometimes even turning a profitable trade into a losing one. Understanding these fees is crucial for successful day trading, allowing you to choose the right exchange and optimize your trading strategy to minimize their impact. Ignoring them is like leaving your wallet open on a busy street – you’re practically inviting trouble!

So, you’re diving headfirst into the wild world of crypto day trading? Picking the right exchange is half the battle! But before you even think about Binance or Coinbase, you need to master the art of spotting those fleeting profit opportunities. That’s where knowing which indicators are key comes in – check out this awesome guide Which indicators are best for identifying short-term day trading opportunities?

to get a head start. Once you’ve got the indicator game down, then we can talk about the best beginner-friendly exchange for you!

Exchange Fee Structures, Best cryptocurrency exchange for day trading beginners?

Different cryptocurrency exchanges employ various fee structures. It’s vital to compare these structures carefully before committing to any platform. The fees can vary based on several factors, including the trading volume, the type of cryptocurrency, and even the payment method used. Below is a comparison of fee structures from four popular (but hypothetical, for illustrative purposes) exchanges.

| Exchange | Trading Fee (Maker/Taker) | Withdrawal Fee (BTC) | Deposit Fee |

|---|---|---|---|

| CryptoFlash | 0.1% / 0.15% | 0.0005 BTC | Free |

| CoinGalaxy | 0.05% / 0.1% | 0.0002 BTC | 0.001 BTC |

| BitComet | 0.2% / 0.25% | 0.001 BTC | Free |

| CryptoNova | Variable (0.02% – 0.2%) | 0.0008 BTC | Free |

Note: These are hypothetical examples. Actual fees vary and should be checked directly on the exchange’s website. “Maker” fees apply when you add liquidity to the order book, while “Taker” fees apply when you remove liquidity.

Impact of Transaction Fees on Profitability

Let’s illustrate how transaction fees can significantly impact your profits. Imagine you buy 1 BTC at $30,000 and sell it at $30,100. That’s a $100 profit, right? Not quite. If your exchange charges a 0.1% trading fee on both the buy and sell orders, that’s a $6 fee ($30,000

– 0.001 + $30,100

– 0.001 = $6).

Your actual profit is now just $94. On a single trade, this might seem insignificant, but imagine accumulating these fees over numerous trades throughout the day – it adds up quickly!

Calculating Total Trade Cost

Calculating the total cost of a trade involves considering all applicable fees. Here’s a simple example:

Total Trade Cost = (Purchase Price

- (1 + Purchase Fee)) + (Withdrawal Fee)

- (Sale Price

- (1 – Sale Fee))

Let’s say you buy 0.5 BTC at $30,000 per BTC with a 0.1% purchase fee, and then sell it at $30,200 with a 0.1% sale fee, incurring a $0.0005 BTC withdrawal fee. The calculation would be:

(($30,000

– 0.5)

– 1.001) + ($0.0005 BTC

– $30,000)

-(($30,200

– 0.5)

– 0.999) = $15,015 + $15 – $15,084.995 = -$54.995

In this scenario, even with a seemingly profitable trade, the accumulated fees result in a small net loss. This highlights the importance of meticulous fee consideration in your day trading strategies.

Cryptocurrency Market Analysis for Beginners

So, you’re ready to dive into the wild world of day trading crypto? Fantastic! But before you throw your hard-earned cash into the digital ring, let’s talk about understanding the market. Think of it like this: you wouldn’t try to win a chess match without knowing how the pieces move, right? Market analysis is your crypto chess strategy.Predicting price movements in the crypto market is like trying to predict the weather in a hurricane – exciting, but wildly unpredictable.

However, by combining fundamental and technical analysis, you can significantly improve your odds. This isn’t about guaranteeing riches (nobody can do that!), but rather about making informed decisions based on data, not gut feelings.

Fundamental Analysis in Cryptocurrency

Fundamental analysis focuses on the underlying value of a cryptocurrency. This involves examining factors like the technology behind the coin (is it innovative? scalable?), the team developing it (are they competent and trustworthy?), the adoption rate (how many people are using it?), and overall market sentiment (is everyone suddenly bullish or bearish?). For example, a positive announcement about a major company adopting a specific cryptocurrency could drive its price up, while news of a security breach could send it plummeting.

Consider Bitcoin: its established network, widespread adoption, and limited supply contribute to its relatively high value compared to newer, less-established projects.

Technical Analysis in Cryptocurrency

Technical analysis, on the other hand, focuses on chart patterns and historical price data to predict future price movements. It’s all about identifying trends, support and resistance levels, and using indicators to gauge momentum and potential reversals. Think of it as reading the tea leaves, but with graphs and algorithms instead of mystical herbs. For instance, identifying a “head and shoulders” pattern on a price chart could suggest an upcoming price drop, while a breakout above a significant resistance level might signal a bullish trend.

Many tools and platforms provide various technical indicators, such as moving averages, relative strength index (RSI), and MACD, to assist in this analysis.

Cryptocurrency Market Orders

Understanding different order types is crucial for executing your trading strategy effectively. A simple “market order” buys or sells at the best available price immediately, which is great for speed but might not get you the best price. A “limit order,” on the other hand, lets you specify the price at which you want to buy or sell.

This gives you more control but carries the risk that your order might not be filled if the price doesn’t reach your target. “Stop-loss orders” automatically sell your cryptocurrency if the price drops below a certain level, limiting potential losses. Finally, “stop-limit orders” combine the features of stop-loss and limit orders, offering a more sophisticated approach to risk management.

Market Depth and its Significance

Market depth refers to the number of buy and sell orders at various price levels. A high market depth indicates strong liquidity, meaning you can buy or sell large amounts of cryptocurrency without significantly impacting the price. Conversely, low market depth can lead to significant price slippage (the difference between the expected price and the actual execution price) especially during high-volume trading.

Day traders should always consider market depth before placing large orders to avoid unexpected price movements. For example, if you’re trying to sell a large quantity of a less-liquid altcoin, you might experience a significant price drop as you sell, leading to lower profits than anticipated.

Concluding Remarks

So, you’ve braved the wild world of day trading cryptocurrencies for beginners. You’ve learned about the best exchanges, mastered the art of charting (well, maybe not mastered, but you’re on your way!), and even developed a rudimentary trading plan. Remember, the crypto market is a rollercoaster, not a gentle stroll in the park. But armed with knowledge, a dash of caution, and maybe a stiff drink after a particularly thrilling (or terrifying) day, you’re ready to take on the digital frontier.

Now go forth and conquer (responsibly, of course!).