Which broker offers the lowest fees for day trading in Canada? – Which broker offers the lowest fees for day trading in Canada? That’s the million-dollar question (or maybe the million-dollar

-trade*!), isn’t it? Navigating the Canadian brokerage landscape for day traders can feel like traversing a minefield of commissions, platform fees, and hidden charges. Think of it as a financial obstacle course, but instead of physical hurdles, you’ve got confusing fee schedules and the ever-present threat of unexpectedly depleted accounts.

This guide will illuminate the path, revealing which brokers offer the most wallet-friendly options for your high-frequency trading adventures.

We’ll delve into the nitty-gritty of Canadian brokerage fees, comparing commissions, platform costs, and those sneaky inactivity charges that seem to appear out of nowhere. We’ll examine different fee structures, from commission-based models to the increasingly popular non-commission alternatives, and show you how trading volume significantly impacts your bottom line. Prepare for charts, tables, and enough financial jargon to make your head spin (in a good way, we promise!).

We’ll even uncover those hidden fees that brokers try to bury in the fine print – because transparency is key, even in the wild west of day trading.

Canadian Brokerage Landscape for Day Trading

Navigating the world of Canadian day trading brokers can feel like trying to find a loonie in a pile of toonies – a bit overwhelming, but with the right tools, totally doable. This section will illuminate the regulatory landscape, account types, and minimum account requirements, helping you avoid those pesky hidden fees and focus on maximizing your potential profits (or at least minimizing your losses!).The regulatory environment for day trading in Canada is overseen primarily by the Ontario Securities Commission (OSC) and other provincial securities commissions, all under the watchful eye of the Canadian Securities Administrators (CSA).

Think of them as the referees of the financial game, ensuring fair play and protecting investors from shady dealings. These regulatory bodies set the rules for brokers, requiring them to be registered and adhere to strict guidelines regarding client funds, trading practices, and disclosure of information. This means that while the thrill of day trading might be exciting, it’s also a regulated activity, and you’ll need to choose a broker who operates within these regulations.

Brokerage Account Types for Canadian Day Traders

Choosing the right brokerage account is crucial for day traders. The type of account you select will directly impact your trading capabilities, fees, and access to certain investment products. Different brokers offer varying account options tailored to different trading styles and risk tolerances.A common account type is the standard cash account. With this, you can only buy securities if you have sufficient funds available in your account.

Margin accounts, on the other hand, allow you to borrow money from your broker to amplify your trading power. This can lead to higher potential profits, but also significantly increases risk. Finally, some brokers offer specialized accounts designed for active traders, often providing access to advanced trading platforms and potentially lower commissions. The choice depends heavily on your trading strategy and risk tolerance.

It’s like choosing between a bicycle, a motorcycle, and a race car – each has its own advantages and disadvantages.

Typical Account Minimums for Canadian Day Trading Brokers

The minimum account balance required to open a day trading account varies considerably among Canadian brokers. While some may have relatively low minimums, others may require substantially larger initial investments. These minimums are often influenced by the broker’s services, trading platform capabilities, and the level of support they provide. For example, a broker offering advanced analytics and personalized support might require a higher minimum balance than one offering a more basic platform.

Think of it as the price of admission to a different level of the trading game. Some brokers may not explicitly state a minimum for account opening, but may have minimum requirements for margin accounts or access to certain features. It’s always best to check directly with the broker to confirm their specific requirements.

Fee Structures of Canadian Brokers

Navigating the world of Canadian day trading brokers can feel like traversing a minefield of fees. Understanding these costs is crucial to maximizing your profits, because even small differences in fees can significantly impact your bottom line, especially with the high volume of trades typical for day traders. Let’s dissect the fee structures to find the best fit for your trading style.

Canadian brokers typically charge fees in several ways. Commissions are the most obvious – a percentage or flat fee per trade. However, many also levy platform fees (for access to their trading software), inactivity fees (if your account sits dormant for too long), and data fees (for real-time market data). These seemingly small charges can add up quickly, particularly for active day traders.

Canadian Broker Fee Comparison

Below is a comparison of the fee structures of five major Canadian brokers. Remember that these fees can change, so always check the broker’s website for the most up-to-date information. This table provides a snapshot in time and should not be considered financial advice.

| Broker Name | Commission Structure | Other Fees | Minimum Account Requirements |

|---|---|---|---|

| Interactive Brokers | Variable, competitive commission rates depending on volume and account type; often very low for high-volume traders. | Potential platform fees depending on chosen platform; minimal other fees. | Varies depending on account type; can be relatively low. |

| TD Ameritrade | Generally higher commission rates compared to discount brokers like Interactive Brokers. | Platform fees may apply; potential inactivity fees. | Relatively high minimum account requirements. |

| Questrade | Competitive commission rates, often structured as a per-trade fee. | Minimal other fees; potentially data fees for advanced data packages. | Relatively low minimum account requirements. |

| Wealthsimple Trade | Generally offers commission-free trading for many stocks and ETFs. | No platform fees; no inactivity fees. | No minimum account requirements. |

| BMO InvestorLine | Commission structure varies; generally higher than discount brokers. | Platform fees may apply; potential inactivity fees. | Moderate minimum account requirements. |

Impact of Fee Structures on Day Traders

The impact of different fee structures varies dramatically depending on a day trader’s trading volume. A high-volume day trader executing hundreds of trades daily will find that even small differences in per-trade commissions can significantly eat into their profits. For example, a difference of just $0.01 per trade on 500 trades translates to a $5 difference. Over a month, this can become a substantial amount.

Conversely, a low-volume day trader might find that the overall fees are less significant compared to their trading gains or losses.

Brokers with commission-free trading, while seemingly attractive, may have other hidden fees or limitations that negate the apparent savings. Therefore, a comprehensive review of all fees is essential before selecting a broker. The “best” broker will depend entirely on the individual day trader’s specific needs and trading activity.

Impact of Trading Volume on Costs: Which Broker Offers The Lowest Fees For Day Trading In Canada?

Day trading, that thrilling rollercoaster of buying and selling stocks faster than a caffeinated squirrel, can be a wild ride, especially when it comes to fees. The more you trade, the more you pay – but thehow much* depends heavily on your chosen broker and their fee structure. Think of it as a choose-your-own-adventure where the ending (your bank balance) is heavily influenced by your trading volume.The relationship between trading volume and brokerage fees isn’t linear; it’s more like a mischievous gremlin riding a rollercoaster – sometimes it’s a gentle slope, sometimes it’s a heart-stopping plunge.

Let’s explore this with some hypothetical examples and see how different brokers handle high-volume versus low-volume trading.

Finding the cheapest Canadian day trading broker is a real nail-biter, almost as stressful as watching your favourite team’s penalty shootout! Need a break from the financial rollercoaster? Check out the latest football news for some much-needed distraction. Then, armed with fresh perspective, you can conquer the quest for those lowest fees and resume your day trading dominance.

Hypothetical Cost Comparison Across Brokers

Let’s imagine three Canadian brokers: Broker A, known for its low per-trade fees; Broker B, a mid-range option; and Broker C, a broker with higher per-trade fees but potentially lower minimum fees. We’ll compare the costs for a low-volume day trader (10 trades per month) and a high-volume day trader (100 trades per month). Assume each trade involves 100 shares of a stock priced at $50.Broker A charges $1 per trade.

Hunting for the cheapest day trading fees in Canada? It’s a jungle out there! To navigate this wild financial wilderness, you’ll need a map – and that’s where Comparison of the best day trading platforms available in Canada? comes in handy. This comparison helps you find the broker that’ll leave more of your hard-earned cash in your pocket, not lining their coffers.

So, ditch the guesswork and start saving!

Broker B charges $5 per trade plus a $10 monthly minimum. Broker C charges $10 per trade but has no minimum fees.For the low-volume trader:* Broker A: 10 trades$1/trade = $10

Broker B

$50 (trade fees) + $10 (minimum) = $60

-

Broker C

10 trades

- $10/trade = $100

For the high-volume trader:* Broker A: 100 trades$1/trade = $100

Broker B

$500 (trade fees) + $10 (minimum) = $510

So, you’re hunting for the cheapest Canadian day trading broker? Finding rock-bottom fees is a quest worthy of a seasoned adventurer! But if stocks aren’t your only game, and you’re itching to dive into the wild world of crypto, check out this guide for the Best crypto day trading platform with low fees and secure wallets? Then, armed with your newfound crypto knowledge, you can return to your Canadian stock broker search, a true master of the financial markets!

-

Broker C

100 trades

- $10/trade = $1000

As you can see, the difference in cost between brokers becomes significantly more pronounced as trading volume increases. Broker A’s low per-trade fee becomes increasingly advantageous with high-volume trading, while Broker C’s high per-trade fees quickly accumulate. Broker B’s minimum fee structure is less impactful for high-volume traders.

Trading Volume and Total Fees Chart

The following chart illustrates the relationship between monthly trading volume and total fees for our three hypothetical brokers.[Chart Description: A line graph with “Monthly Trading Volume” on the x-axis (ranging from 0 to 100 trades) and “Total Fees ($)” on the y-axis (ranging from 0 to $1000). Three lines represent the three brokers: Broker A (a relatively flat, low line), Broker B (a line starting higher due to the minimum fee and increasing steadily), and Broker C (a steep, high line).

Data points would be plotted for each broker at various trading volumes (e.g., 10, 20, 50, 100 trades), reflecting the calculations above. The chart visually demonstrates how the cost difference between brokers widens with increased trading volume.]

Hidden Fees and Unexpected Charges

While per-trade fees are usually clearly stated, the devil is in the details. Beware of hidden fees that can sneak up on you like a ninja in a tutu. These could include:* Regulatory fees: These are unavoidable fees charged by regulatory bodies like the Investment Industry Regulatory Organization of Canada (IIROC).

Platform fees

Some brokers charge monthly or annual fees for access to their trading platforms or specific features.

Inactivity fees

If your account remains dormant for a period, some brokers might levy a fee.

Account maintenance fees

While less common for active day traders, these fees can apply to accounts with low balances.

Foreign exchange fees

Trading in US dollars or other currencies might incur conversion fees.It’s crucial to thoroughly review a broker’s fee schedule before opening an account to avoid any nasty surprises. Remember, the cheapest broker isn’t always the best; you need to balance cost with the quality of the platform, research tools, and customer service.

Non-Commission Brokerage Models in Canada

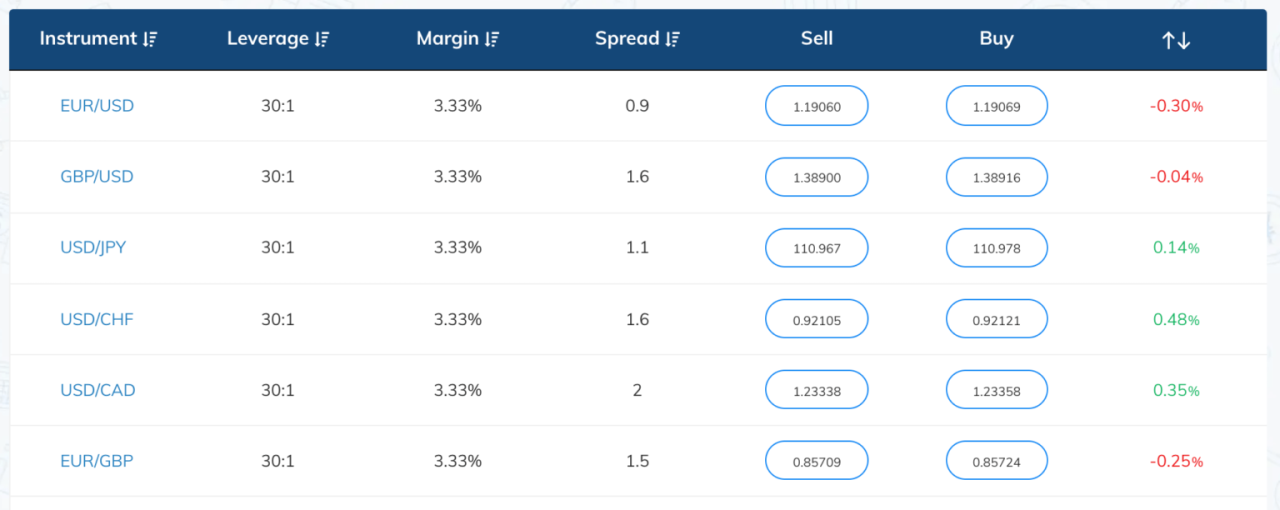

The Canadian brokerage landscape is evolving, with a growing number of brokers ditching the traditional commission-based model in favour of a seemingly more straightforward “no commission” approach. But don’t let the alluring “free” tag fool you – there’s always a catch, and understanding how these models work is crucial for savvy day traders.While the absence of explicit commissions sounds fantastic, these brokers recoup their costs through other means.

This often leads to a more opaque pricing structure than the clear-cut commission model, potentially making it trickier to calculate your actual trading costs. Let’s delve into the details.

Canadian Brokers Utilizing Non-Commission Models and Their Pricing Mechanisms

Several Canadian brokers have embraced the non-commission model. These brokers typically generate revenue through a combination of fees like margin interest, regulatory fees, and potentially wider spreads (the difference between the buy and sell price of a security). For example, some brokers might charge a small percentage of the trade value as a markup on the price of the security, cleverly disguised as “pricing adjustments.” This makes it challenging to directly compare them to commission-based brokers, demanding a careful analysis of your trading activity to determine the true cost.

Hunting for the cheapest day trading fees in Canada? It’s a jungle out there! But before you leap into the fray, figuring out the best platform is key, especially if you’re new to this wild world. Check out this guide for beginners: Best Canadian day trading platform for beginners in 2024? Once you’ve got your bearings, then you can really start comparing those all-important fees and find the broker that won’t break the bank (or your trading spirit!).

It’s like a magician’s trick – the commissions disappear, but the costs remain, sometimes in more subtle forms.

Effectiveness of Non-Commission vs. Commission-Based Models for Day Traders

The “best” model depends entirely on your trading style and volume. A high-volume day trader executing hundreds of trades daily might find a commission-based broker with low per-trade fees more cost-effective than a non-commission broker with hidden markups. Conversely, a less active day trader might find the simplicity and perceived “free” trades of a non-commission broker more appealing, even if the overall cost might be slightly higher due to hidden fees.

The key is to meticulously analyze your trading patterns and compare the projected costs under both models. Think of it as choosing between a fixed monthly gym membership versus a pay-per-visit system – both have their place depending on your frequency of use.

Potential Costs Associated with Non-Commission Brokers

The allure of “no commissions” can be misleading. Let’s examine some potential hidden costs:

- Margin Interest: If you use margin (borrowing money to trade), interest charges can significantly eat into your profits. Non-commission brokers often have competitive interest rates, but this is still a cost to factor in, particularly for active day traders who frequently leverage their positions. Remember, borrowed money always comes with a price.

- Regulatory Fees: These are unavoidable and are passed on to the trader by the broker, regardless of the pricing model. While seemingly small per trade, they accumulate over time, especially for high-frequency traders.

- Inactivity Fees: Some brokers may charge fees if your account remains inactive for a certain period. This is less of a concern for active day traders but something to keep in mind.

- Account Maintenance Fees: While less common, some brokers might charge a monthly or annual fee simply for maintaining your account.

- Data Fees: Access to real-time market data can incur additional costs, especially for advanced charting and analytics tools.

- Platform Fees: Some platforms may charge subscription fees for access to advanced trading tools or research capabilities. This is separate from the brokerage fees themselves.

Remember, the devil is in the details. Carefully read the fee schedule of any broker, regardless of whether they advertise “no commissions,” before opening an account. Don’t be charmed by the siren song of “free” – understanding the true cost is paramount for successful day trading.

Hunting for the cheapest day trading fees in Canada? It’s a jungle out there! Finding a balance between low costs and reliability is key, which is why you might want to check out this resource for active traders: Reliable and affordable day trading broker in Canada for active traders? Ultimately, the lowest fees depend on your trading volume and style, so do your homework before committing to any broker!

Advanced Trading Features and Their Costs

Day trading in Canada isn’t just about buying low and selling high; it’s about wielding the right tools to do it efficiently and, let’s be honest, with a touch of flair. Advanced trading features can be the difference between a profitable day and a day spent staring blankly at a chart wondering where your money went. But these powerful tools often come with a price tag, and understanding that cost is crucial.Let’s dive into the world of bells and whistles, exploring how these advanced features impact your bottom line.

We’ll compare the offerings of different brokers, because, let’s face it, not all brokers are created equal when it comes to equipping you for day-trading domination.

Advanced Trading Feature Costs

The cost of advanced trading features varies significantly between brokers. Some include basic levels of advanced tools in their standard fees, while others charge extra for access. These additional costs can quickly add up, especially for active day traders who rely heavily on these features. Factors influencing the price include the level of access (e.g., basic vs.

So, you’re hunting for the cheapest day trading fees in Canada? That’s a quest worthy of a seasoned adventurer! But even the most frugal trader needs a reliable app, and that’s where choosing the right one makes all the difference. Check out Recommended mobile app for day trading in Canada with real-time quotes? for some top picks.

Armed with that knowledge, you can then return to the thrilling hunt for the lowest brokerage fees – may the odds be ever in your favor!

professional-grade data), the type of feature (real-time data is generally more expensive than delayed data), and the volume of usage. Think of it like a buffet: a basic plate might get you by, but the all-you-can-eat option, while tempting, will cost you more.

Advanced Charting Tools Comparison, Which broker offers the lowest fees for day trading in Canada?

Understanding the nuances of charting tools is paramount for any successful day trader. Different brokers offer varying levels of sophistication and customization in their charting packages. Here’s a comparison of three hypothetical brokers (names changed to protect the innocent, and possibly the slightly less innocent):

| Broker | Charting Tools | Cost | Notes |

|---|---|---|---|

| QuickTrade | Basic charting with limited indicators and drawing tools. Supports common chart types (candlestick, bar, line). | Included in standard commission fees. | Suitable for beginners, but lacks advanced features for sophisticated analysis. |

| ChartMasters | Extensive charting library with a wide array of technical indicators, drawing tools, and customizable layouts. Offers real-time data feeds as an add-on. | $25/month for basic package; $75/month for professional package with real-time data. | Powerful but expensive; the extra cost might be justified for high-volume traders. |

| DataWizards | Offers a robust charting platform with advanced features like customizable studies, backtesting capabilities, and multiple time frame analysis. | $50/month flat fee. | A good balance between features and cost; ideal for intermediate to advanced traders. |

Note: These are hypothetical examples. Actual costs and features will vary depending on the broker and the specific package chosen. Always check the broker’s website for the most up-to-date information.

Level II Market Data and Algorithmic Trading

Level II market data provides a detailed view of the order book, showing bid and ask prices from various market participants. This granular information can be invaluable for day traders, enabling them to identify potential trading opportunities and assess market depth. However, access to Level II data usually comes at a premium. Algorithmic trading, which involves using computer programs to execute trades automatically based on predefined rules, is another advanced feature that can be costly.

The cost of algorithmic trading software can vary widely depending on the complexity of the algorithms and the level of support provided by the broker. In addition to software costs, there might be fees associated with data feeds, execution, and maintenance. For example, a sophisticated algorithmic trading setup might cost hundreds or even thousands of dollars per month.

Account Minimums and Margin Requirements

Day trading in Canada requires navigating the sometimes-tricky waters of account minimums and margin requirements. Think of it as the financial equivalent of a rollercoaster: the thrill of potential profits is tempered by the stomach-churning possibility of losses, especially when leverage is involved. Understanding these requirements is crucial for avoiding unexpected fees and keeping your trading ambitions grounded in reality.Account minimums vary significantly between brokers, ranging from surprisingly low amounts to figures that would make a small-town mayor blush.

Some discount brokers might welcome you with open arms (and low minimums) while full-service brokers might require a substantial initial deposit to even get your foot in the door. These minimums act as a gatekeeper, determining who gets to play in the day-trading sandbox. For example, a discount broker might only demand $1,000 to open an account, while a full-service firm may insist on $25,000 or more.

This difference reflects the level of service and support offered.

Minimum Account Balances

The minimum account balance needed to open a day trading account in Canada is not standardized across all brokers. This minimum balance often influences the types of trading tools and services available to the trader. Higher minimum balances might unlock access to advanced trading platforms, research tools, and personalized financial advice. Conversely, lower minimum balances may limit access to such features.

A broker might require a higher minimum balance for day trading accounts specifically, reflecting the higher risk associated with this trading style.

Margin Requirements and Their Impact on Costs and Risk

Margin trading allows you to control a larger position than your account balance would normally allow, using borrowed funds from your broker. This is like getting a loan to buy more shares, amplifying both profits and losses. The margin requirement, typically expressed as a percentage (e.g., 50%), dictates how much of the position value you need to cover with your own funds.

The remaining portion is borrowed. However, this leverage is a double-edged sword. While it can magnify profits, it can also accelerate losses, potentially leading to margin calls—demands from your broker to deposit more funds to meet the margin requirement. Failure to meet a margin call can result in the forced liquidation of your positions, potentially leading to significant losses.

Margin Interest Calculation Example

Let’s say you have a $10,000 account and use 50% margin to buy $20,000 worth of stock. If your broker charges a 7% annual interest rate on margin loans, the daily interest charge would be approximately $0.38 ( ($20,000 – $10,000)0.07 / 365). This might seem insignificant, but over several days of holding the position, the accumulated interest can significantly eat into your profits, especially if your trades aren’t highly profitable.

If your trades only yielded a small profit or incurred a loss, the margin interest could completely negate any gains. For instance, if your trades yielded a $5 profit for the same period, the net profit after margin interest would be a loss of $0.38. A prolonged period of holding the position with minimal gains could result in a considerable loss due to accumulated margin interest.

Conclusive Thoughts

So, the quest to find the lowest-fee Canadian broker for day trading isn’t just about pinching pennies; it’s about maximizing your profit potential. Remember, the “best” broker depends entirely on your individual trading style and volume. A low-commission broker might be a steal for high-volume traders, while a non-commission broker could be more appealing for those with lower trading frequency.

Ultimately, careful research and a keen eye for hidden fees are your best weapons in this financial battle. Armed with this knowledge, you can confidently charge into the Canadian day trading arena, ready to conquer the market (and keep more of your hard-earned gains).