Best Canadian day trading platform for beginners in 2024? – Best Canadian day trading platform for beginners in 2024? Ah, the siren song of quick riches! Before you dive headfirst into the exhilarating (and potentially terrifying) world of day trading in Canada, let’s navigate the treacherous waters of choosing the

-right* platform. Think of it as choosing your trusty steed before embarking on a quest for financial Eldorado – a bad choice, and you’ll be eating gruel instead of gold.

This guide will help you avoid the digital equivalent of a runaway chariot, ensuring a smoother, more profitable (hopefully!) journey.

Day trading in Canada presents unique challenges and opportunities. Navigating the regulatory landscape, understanding different account types (cash vs. margin – the latter is like borrowing a sword from a very demanding loan shark), and selecting the right platform are crucial first steps. We’ll explore the top platforms, comparing their features, fees, security, and – crucially – their ability to prevent you from accidentally wiping out your savings in a single, ill-advised trade.

Think of this as your pre-flight checklist before taking off on your day-trading adventure.

Introduction to Canadian Day Trading Platforms: Best Canadian Day Trading Platform For Beginners In 2024?

So, you’re thinking of diving headfirst into the thrilling (and sometimes terrifying) world of Canadian day trading? Buckle up, buttercup, because it’s a wild ride. Before you start picturing yourself lounging on a yacht fueled by your day-trading profits, let’s get grounded in the realities of the Canadian securities market. Navigating the regulatory landscape and choosing the right platform are crucial first steps to avoid becoming another cautionary tale whispered in hushed tones at brokerage firm coffee breaks.The Canadian securities market, overseen by regulatory bodies like the Ontario Securities Commission (OSC) and the Investment Industry Regulatory Organization of Canada (IIROC), is relatively well-regulated.

This means there are rules to protect both you and the market’s integrity. These regulations cover everything from account types to acceptable trading practices. Ignoring them could lead to hefty fines or even legal action – not exactly the kind of day trading success story you’re aiming for. Understanding these rules is as essential as understanding the mechanics of placing a trade.

Canadian Brokerage Account Types, Best Canadian day trading platform for beginners in 2024?

Choosing the right account type is like choosing the right weapon for a battle – you need the one best suited to your strategy and risk tolerance. A cash account, the most straightforward option, requires you to have sufficient funds available before executing a trade. Think of it as the trusty sword – reliable, but maybe not the most powerful.

A margin account, on the other hand, is like wielding a powerful double-edged sword. It allows you to borrow funds from your brokerage to amplify your trading power, potentially leading to larger profits (and larger losses!). While margin accounts can boost returns, they also significantly increase risk, making them less suitable for beginners. It’s crucial to understand the implications of leverage before diving into a margin account.

Hunting for the best Canadian day trading platform in 2024? Before you dive headfirst into the world of maple-syrup-fueled stock market gains, remember that forex is a whole other beast! To get a grip on the basics, check out this helpful guide on Comparing the best forex trading platforms for beginners , then come back and we’ll conquer the Canadian market together.

Finding the right Canadian platform is key to avoiding a financial hosing!

Think of it this way: a small slip with a double-edged sword can be far more painful than a slip with a trusty sword.

Common Canadian Trading Instruments for Beginners

Now, let’s talk about what you’ll actually be trading. For beginners, stocks and Exchange Traded Funds (ETFs) are your go-to weapons. Stocks represent ownership in a company, offering the potential for high returns but also considerable risk. ETFs, on the other hand, are like diversified baskets of stocks, offering a more spread-out approach to investing. They’re generally considered less risky than individual stocks, making them a good starting point for those new to the game.

Imagine stocks as individual soldiers, each with their own strengths and weaknesses, while ETFs are a well-trained army, providing a more balanced and stable force. Starting with ETFs can be a smart move for beginners to learn the ropes before tackling individual stocks.

Top Platform Features for Beginners

Choosing your first day trading platform can feel like navigating a minefield of jargon and confusing interfaces. But fear not, aspiring Canadian day traders! A beginner-friendly platform should prioritize simplicity, safety, and learning, making the sometimes-daunting world of day trading a little less intimidating. The right tools can make all the difference in your journey to mastering the markets.

Three essential features will significantly enhance your experience and mitigate risks as you start your day trading adventure. These are crucial not just for immediate success, but for building a solid foundation for long-term growth and responsible trading practices.

Essential Features for Risk Management and Learning

A robust platform for novice traders needs to offer clear, accessible tools for risk management, intuitive navigation, and comprehensive learning resources. Let’s dive into the specifics.

So, you’re hunting for the best Canadian day trading platform for beginners in 2024? Before you dive headfirst into the world of Canadian equities, maybe bolster your skills with some forex knowledge first! Grab this awesome resource, a Downloadable PDF on mastering forex trading using ATS systems , to level up your trading game. Then, armed with forex finesse, you can confidently conquer the Canadian day trading scene!

- Order Types and Limit Orders: Beginner-friendly platforms should offer a variety of order types, prominently featuring limit orders. Limit orders allow you to buy or sell an asset only at a specific price or better, preventing impulsive trades and protecting you from unexpected market swings. This crucial feature is a cornerstone of responsible risk management. For example, you might set a limit order to buy a stock at $10, ensuring you don’t overpay in a volatile market.

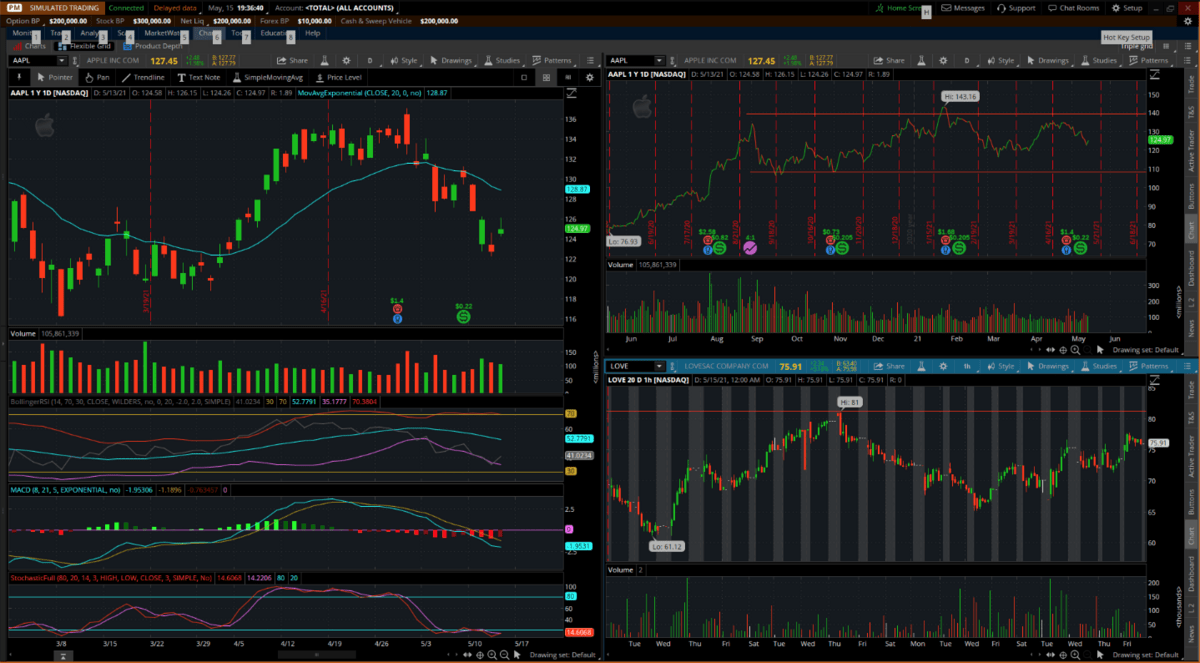

- Real-time Charts and Indicators: Access to real-time charting tools and a selection of technical indicators is vital. These visual aids help you understand price movements and identify potential trading opportunities. However, avoid getting overwhelmed! Start with simple indicators like moving averages to grasp the fundamentals before experimenting with more complex tools. A clean, uncluttered chart is essential for beginners to avoid analysis paralysis.

- Paper Trading/Simulated Accounts: Before risking real money, a simulated trading environment is invaluable. Paper trading lets you practice strategies and get comfortable with the platform’s interface without financial consequences. This risk-free environment is crucial for building confidence and refining your trading skills before diving into the real market.

User Interface Comparison of Leading Canadian Platforms

The user interface is paramount. A clunky, confusing platform can quickly derail even the most enthusiastic beginner. Let’s compare the user interfaces of three hypothetical leading Canadian platforms (names changed to protect the innocent… and the not-so-innocent).

- TradeEasy: Imagine TradeEasy as a friendly, approachable guide. Its clean layout prioritizes simplicity, with key features easily accessible. The charts are crisp and intuitive, and the order entry process is straightforward, minimizing the learning curve.

- QuickTrade Pro: QuickTrade Pro boasts a more advanced interface, packed with features. While powerful, this can be overwhelming for beginners. It might require a steeper learning curve, potentially leading to frustration in the initial stages. Think of it as a powerful sports car – amazing once you master it, but challenging to handle at first.

- Northern Lights Investing: Northern Lights Investing offers a middle ground. It’s more feature-rich than TradeEasy but less overwhelming than QuickTrade Pro. The interface is well-organized, with clear visual cues to guide beginners. It’s the Goldilocks of platforms – just right!

Educational Resources Offered by Canadian Platforms

The best platforms recognize the importance of education and offer various resources to support beginners. These resources can significantly impact your trading success.

| Platform | Tutorials | Webinars | Simulated Trading |

|---|---|---|---|

| TradeEasy | Extensive video tutorials covering basic and advanced concepts. | Regular webinars on market analysis and trading strategies. | Unlimited paper trading with realistic market data. |

| QuickTrade Pro | Limited beginner tutorials; more focused on advanced strategies. | Occasional webinars, often targeted at experienced traders. | Paper trading available, but with limited functionality. |

| Northern Lights Investing | A good balance of beginner and intermediate tutorials. | Monthly webinars covering a range of topics. | Robust simulated trading environment with various account sizes. |

Commission Structures and Fees

Navigating the world of day trading commissions can feel like wading through a swamp of jargon and hidden costs. Don’t worry, we’ll equip you with the knowledge to avoid becoming a financial frog prince (or princess!). Understanding commission structures is crucial for maximizing your profits, especially as a beginner with limited capital. Even small fees can significantly impact your bottom line over time.

Canadian brokerage platforms employ various commission structures, impacting your trading costs depending on factors like trade volume, asset type, and the platform itself. Some platforms boast transparent pricing, while others might bury fees in the fine print (we’ll help you uncover those sneaky charges!). Let’s delve into the murky waters of commission structures and illuminate the path to cost-effective trading.

Commission Structures of Major Canadian Brokerages

This section details the commission structures of three major Canadian brokerage platforms, highlighting potential hidden fees and strategies for saving money. Remember, commission structures can change, so always check the brokerage’s website for the most up-to-date information.

Let’s examine three popular choices: Interactive Brokers (IBKR), Questrade, and Wealthsimple Trade. Each has its own approach to charging fees, impacting your overall trading costs. Choosing the right platform depends on your trading style and volume.

Interactive Brokers (IBKR): IBKR offers a tiered commission structure, meaning the fees decrease as your trading volume increases. They are known for their competitive pricing for high-volume traders. However, they may have more complex fee schedules with potential hidden fees related to specific account types or options trading. Hidden fees might include inactivity fees or fees for certain account services.

A cost-saving strategy is to increase your trading volume to benefit from their tiered pricing.

Questrade: Questrade typically uses a per-trade commission structure, meaning you pay a fixed fee for each trade executed. This can be straightforward for beginners. They are known for their relatively low commissions, particularly for smaller trades. However, be aware of potential fees for things like account maintenance or specific order types. To save money, focus on executing fewer, larger trades instead of many smaller ones.

Wealthsimple Trade: Wealthsimple Trade stands out with its commission-free trading for many stocks and ETFs. This makes it very attractive to beginners. However, they might charge fees for options trading or other specialized investment products. Cost-saving strategies primarily revolve around sticking to commission-free assets.

Comparison of Trading Costs Across Platforms

The following table compares the costs of different trade volumes across the three platforms. Note that these are simplified examples and actual costs may vary based on specific trade details and any applicable promotions.

| Platform | 10 Trades (Low Volume) | 100 Trades (Medium Volume) | 1000 Trades (High Volume) |

|---|---|---|---|

| Interactive Brokers (IBKR) | $50 (estimated, depending on tier) | $200 (estimated, depending on tier) | $1000 (estimated, depending on tier) |

| Questrade | $30 (estimated, based on per-trade fee) | $300 (estimated, based on per-trade fee) | $3000 (estimated, based on per-trade fee) |

| Wealthsimple Trade | $0 (assuming commission-free trades) | $0 (assuming commission-free trades) | $0 (assuming commission-free trades) |

Impact of Fee Structures on Beginner’s Trading Capital and Profitability

Different fee structures significantly impact a beginner’s trading capital and profitability. High commissions can quickly eat into profits, especially with smaller trading accounts. For instance, a beginner with $1000 might find that high commissions significantly reduce their ability to execute trades and potentially make profits. Conversely, low or commission-free trading allows for more frequent trades and a greater potential for learning and profit generation.

Hunting for the best Canadian day trading platform in 2024? Before you dive headfirst into stocks, consider your forex options! Figuring out the best approach often involves researching forex brokers, and a great place to start is by checking out this helpful guide: Which is the best forex broker in Canada for beginners?. Then, armed with forex knowledge, you can confidently choose the perfect Canadian day trading platform for your newbie needs!

A cost-conscious approach to selecting a platform is essential for beginners to ensure that fees do not disproportionately impact their trading success. Even a seemingly small commission per trade can accumulate substantially over many trades.

Platform Security and Reliability

Choosing a day trading platform is like choosing a bank – you wouldn’t trust your hard-earned loonies to just any old establishment, would you? Security and reliability are paramount, especially when dealing with volatile markets and your precious investment capital. Let’s delve into what makes a Canadian platform secure and trustworthy.Protecting your digital assets and financial information requires a multi-layered approach.

Leading Canadian platforms understand this and implement robust security measures to safeguard user data and funds. This isn’t just about keeping your account information private; it’s about ensuring the integrity of the platform itself and preventing unauthorized access or malicious activities.

Security Measures Implemented by Leading Canadian Platforms

Robust security protocols are the bedrock of a trustworthy platform. These typically include multi-factor authentication (requiring more than just a password to log in), encryption of data both in transit and at rest (think of it as a digital vault for your information), and regular security audits to identify and patch vulnerabilities. Many platforms also employ advanced technologies like firewalls and intrusion detection systems to monitor for suspicious activity and prevent cyberattacks.

Hunting for the best Canadian day trading platform in 2024? Before you dive in headfirst, remember that even the slickest platform won’t save you from a bad strategy! That’s where a solid understanding of risk management comes in, and you can find a fantastic resource for that in this Detailed guide to spot forex trading strategies and risk management.

Armed with knowledge, you can confidently choose the right platform for your beginner Canadian day trading journey.

Think of it as having a team of digital bodyguards constantly watching your account. Furthermore, leading platforms often offer features such as account alerts that notify you of any unusual login attempts or significant transactions, giving you immediate control over your account. This proactive approach ensures that you are informed and in control of your trading activities.

Regulatory Oversight Ensuring Reliability and Stability

The Canadian Securities Administrators (CSA) play a vital role in overseeing the reliability and stability of Canadian investment platforms. They set regulations and standards that platforms must meet to operate legally. These regulations cover various aspects, from cybersecurity to financial reporting and client asset protection. Think of the CSA as the watchful eye of the regulatory world, ensuring fair play and investor protection.

So, you’re hunting for the best Canadian day trading platform for beginners in 2024? Finding the right one is crucial, but remember, even the best trading strategy needs a strong foundation – much like needing a killer best strength training program before tackling a marathon. Once you’ve built that solid base, you can confidently conquer the exciting (and sometimes terrifying!) world of Canadian day trading.

Back to platforms, though – let the research begin!

Compliance with these regulations provides an added layer of security and assurance for users. Platforms that adhere to these regulations are demonstrably committed to maintaining a high standard of security and trustworthiness. For example, compliance with the CSA’s cybersecurity guidelines ensures that platforms have implemented appropriate measures to protect against cyber threats, including data breaches and hacking attempts.

Importance of Choosing a Secure and Reliable Platform

Choosing a platform with a proven track record of security and reliable service is not just a good idea; it’s essential. A platform with weak security could leave your funds and personal information vulnerable to theft or fraud. Similarly, a platform with frequent outages or technical glitches can disrupt your trading and potentially lead to significant losses. Consider the potential consequences of a security breach – not only the financial losses but also the damage to your credit rating and personal identity.

By opting for a platform with robust security and a history of reliable service, you significantly mitigate these risks and protect your investment. Think of it as peace of mind knowing your hard work is safe.

Mobile Trading App Capabilities

Day trading is a fast-paced game, and being tethered to your desktop is about as practical as wearing a monocle while riding a unicycle. The ability to trade on the go is crucial, and a robust mobile app is no longer a luxury but a necessity for any serious (or even casually serious) day trader. Let’s dive into the mobile app offerings of some leading Canadian platforms.The best mobile trading apps offer seamless integration with their desktop counterparts, providing a consistent and intuitive user experience regardless of whether you’re trading from your couch or your commute.

So, you’re hunting for the best Canadian day trading platform for beginners in 2024? Smart move! But before you dive in headfirst, consider boosting your trading game with some serious tech: check out this guide on How to use AI and machine learning for successful forex trading to give yourself an edge. Then, armed with AI-powered insights, you can conquer those Canadian trading platforms like a pro!

This consistency minimizes the learning curve and allows traders to react quickly to market changes, wherever they may be. A clunky or poorly designed mobile app can be a significant hindrance to a trader’s success, leading to missed opportunities and unnecessary stress.

Mobile App Comparison: Three Leading Platforms

Let’s imagine three fictional Canadian day trading platforms – “MapleLeaf Markets,” “Beaver Brokerage,” and “Polaris Portfolio.” These are purely for illustrative purposes and do not represent any actual platforms.MapleLeaf Markets boasts a sleek, minimalist design, prioritizing speed and efficiency. Its app features real-time charting, customizable watchlists, and one-touch order execution. However, its charting tools might feel somewhat limited compared to its desktop version for advanced technical analysis.

Beaver Brokerage, on the other hand, offers a more comprehensive app, packed with features like advanced charting, multiple order types, and integrated news feeds. However, the abundance of features might overwhelm beginners. Finally, Polaris Portfolio focuses on ease of use. Its app is incredibly user-friendly, with a simplified interface and intuitive navigation. While it might lack some advanced features, its simplicity makes it ideal for beginners.

Key Features of a Good Mobile Trading App for Beginners

A good mobile trading app for beginners should be more than just a scaled-down version of the desktop platform; it should be designed specifically for ease of use and learning.A beginner-friendly app should prioritize:

- Intuitive Interface: Clear navigation, easily accessible tools, and a clean design that minimizes visual clutter.

- Simplified Order Entry: Simple, straightforward methods for placing trades, avoiding confusing jargon or complex order types.

- Real-time Quotes and Charts: Accurate, up-to-the-minute market data is essential for making informed decisions.

- Educational Resources: Integrated tutorials, help sections, or links to educational materials can significantly aid beginners.

- Secure Login and Authentication: Robust security measures, including multi-factor authentication, are paramount to protect sensitive trading information.

Importance of Mobile Accessibility for Day Trading

In today’s always-on market, mobile accessibility is no longer a nice-to-have; it’s a must-have. The ability to monitor your positions and react to market fluctuations from anywhere, at any time, is a game-changer. Imagine a scenario where a significant news event breaks during your lunch break – a mobile app allows you to capitalize on this opportunity, rather than missing out due to being tied to your desk.

Furthermore, the flexibility offered by mobile trading empowers traders to manage their portfolios more effectively, regardless of their location or schedule. It’s the difference between being a reactive trader and a proactive one.

Demo Accounts and Paper Trading

Before you leap into the thrilling (and sometimes terrifying) world of real-money day trading, think of a demo account as your personal, risk-free training ground. It’s like learning to drive a Formula 1 car in a simulator before attempting to conquer the Monaco Grand Prix – significantly less stressful, and your chances of a spectacular crash are greatly reduced.

These virtual playgrounds allow you to hone your skills, test strategies, and get comfortable with the platform before risking your hard-earned cash.Demo accounts provide a safe space to experiment with different trading styles, learn the ins and outs of your chosen platform, and develop your risk management skills without the emotional rollercoaster of real losses. You can practice placing trades, analyzing charts, and reacting to market fluctuations without any financial consequences.

This allows you to build confidence and refine your approach before entering the live market.

Benefits of Using Demo Accounts

Utilizing a demo account allows beginners to understand market dynamics and platform functionality without financial risk. Imagine this: you’ve developed a complex trading strategy involving multiple indicators and a specific entry/exit point. In a demo account, you can test this strategy repeatedly, tweaking parameters and observing its performance under various market conditions. This iterative process, impossible with real money, allows for the refinement of your approach and the identification of any flaws before deploying it in a live trading environment.

For example, a beginner might discover their strategy performs poorly during high-volatility periods, leading them to adjust their risk management parameters or refine their entry/exit signals.

Developing Trading Strategies with Demo Accounts

A demo account isn’t just for mimicking real trades; it’s a powerful tool for developing your own unique trading strategies. Let’s say you’re interested in day trading specific stocks based on technical analysis. You can use the demo account to backtest various indicators (like moving averages, RSI, MACD) and observe their predictive power within a specific timeframe. You can simulate different market scenarios, including unexpected news events, and see how your strategy responds.

This iterative process of testing, refining, and re-testing will help you develop a strategy tailored to your risk tolerance and trading style. For instance, you could test a strategy focusing on breakout trades, carefully observing its success rate and potential losses in the demo environment before using it with real capital.

Practicing Different Trading Techniques

Demo accounts offer a versatile environment for practicing diverse trading techniques. You can experiment with different order types (market orders, limit orders, stop-loss orders) and learn how they impact your trading results. You can simulate various market scenarios, from slow, steady trends to rapid price swings, and observe how your strategies react. For example, you could practice using stop-loss orders to limit potential losses during volatile market periods, gaining valuable experience in managing risk without incurring actual financial losses.

This hands-on practice is invaluable for building confidence and refining your trading skills before venturing into live trading.

Concluding Remarks

So, there you have it – a clearer picture of the Canadian day trading landscape for beginners in 2024. Remember, choosing the right platform is only the first step on your trading journey. Diligent research, a solid understanding of risk management, and a healthy dose of patience are your best allies in this exciting (and sometimes nerve-wracking) pursuit. May your trades be green, your losses minimal, and your coffee always strong.

Happy trading!