Downloadable PDF on mastering forex trading using ATS systems: Prepare to be amazed! Forget staring blankly at charts; this PDF unveils the secrets of automated trading systems (ATS), transforming you from a forex novice to a potential algorithmic whiz-kid. We’ll navigate the thrilling world of forex, demystifying ATS, comparing platforms, and even crafting your own trading strategy. Buckle up, because this isn’t your grandma’s investment guide!

This comprehensive guide dives deep into the world of automated forex trading, covering everything from the basics of forex and ATS to advanced strategies and risk management techniques. We’ll explore different ATS platforms, helping you choose the right one for your needs and skill level. We’ll also show you how to build, implement, and optimize your own ATS strategy, complete with real-world examples and case studies to illustrate success (and the occasional hilarious mishap!).

By the end, you’ll be ready to unleash your inner trading robot – responsibly, of course!

Introduction to Forex Trading and ATS Systems

So, you want to conquer the wild, wild west of forex trading? Prepare for a rollercoaster ride of exhilarating profits and stomach-churning losses (mostly exhilarating, we hope!). Forex, or foreign exchange, is basically the global marketplace where currencies are traded against each other. Think of it as a giant, 24/7 casino, but instead of chips, you’re betting with yen, euros, and dollars.

The goal? To buy low and sell high, just like your grandma taught you (except grandma probably didn’t trade currencies on margin).

Forex Trading Fundamentals

Forex trading involves speculating on the price movements of currency pairs, like EUR/USD (Euro against the US Dollar) or GBP/JPY (British Pound against the Japanese Yen). These prices fluctuate constantly based on a dizzying array of factors: economic news, political events, even the weather (seriously, sometimes!). You can profit by buying a currency pair when you think its price will rise and selling it when it does, or vice versa (short selling).

Leverage magnifies your potential profits (and losses!), allowing you to control larger positions than your account balance would normally permit. This is a double-edged sword, though, and proper risk management is absolutely crucial. Think of leverage as a rocket booster: it can send you to the moon, or crash you back to earth in a fiery ball of regret.

So you’ve downloaded our killer PDF on mastering forex trading using ATS systems – fantastic! Now, the next step is to actually trade, right? Learn how to fuel your newfound ATS expertise by opening a Questrade account – check out this guide: How to open a Questrade account for forex and currency trading. Then, get back to conquering the forex world with your newly acquired skills and that awesome PDF!

Advantages and Disadvantages of Automated Trading Systems (ATS)

Automated Trading Systems (ATS), also known as expert advisors (EAs) or forex robots, are software programs designed to execute trades automatically based on pre-programmed rules and algorithms. They’re like having a tireless, emotionless trader working for you 24/7.The advantages? No emotional trading (goodbye, impulsive decisions!), the ability to backtest strategies, and the freedom to pursue other activities while your bot diligently churns out profits (or, let’s be realistic, sometimes losses).The disadvantages?

You’re entrusting your money to a computer program, which is inherently risky. Unexpected market shifts can easily derail even the best-designed ATS. You also need a strong understanding of programming and forex trading to build or effectively use one. Plus, some unscrupulous vendors sell “miracle” ATS that are nothing more than glorified scams.

Types of ATS Software

ATS software comes in various flavors, each with its own strengths and weaknesses. Some are highly customizable, allowing you to tweak every parameter imaginable, while others offer a more “black box” approach, where the inner workings are less transparent. There are also cloud-based ATS, desktop-based ATS, and even mobile-based ATS. The choice depends on your technical expertise and trading style.

Comparison of Popular ATS Platforms

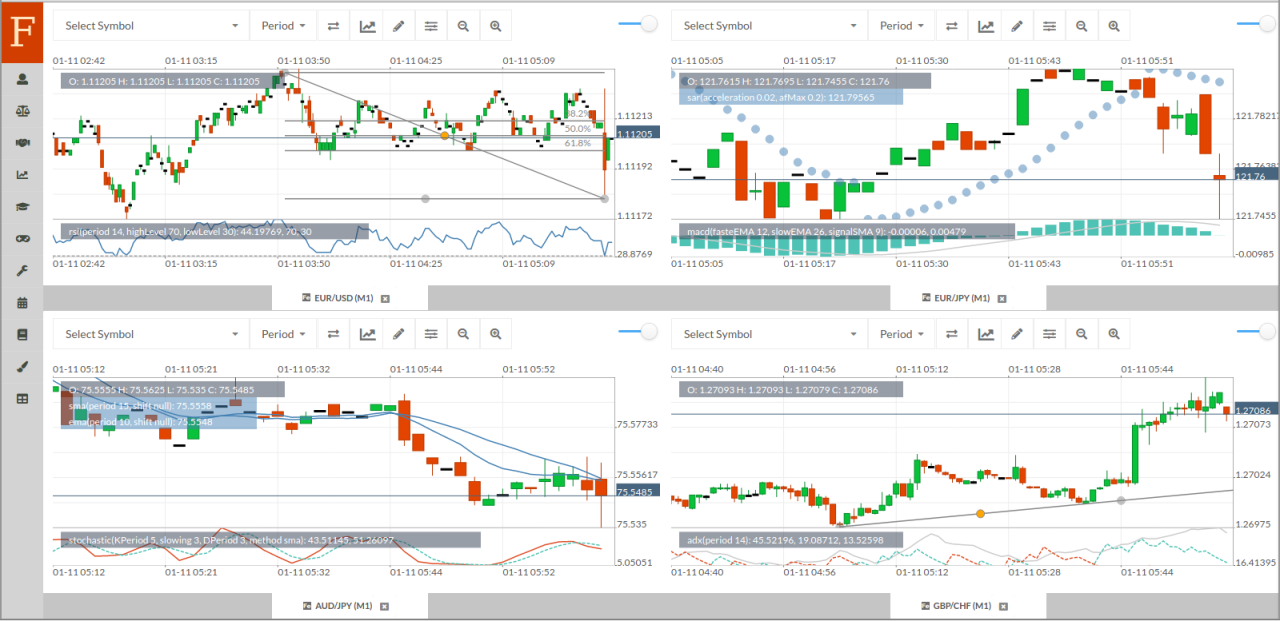

Choosing the right ATS is crucial, so here’s a comparison of three popular platforms (Note: features and costs can change, so always check the latest information on the provider’s website):

| Platform Name | Cost | Features | Ease of Use |

|---|---|---|---|

| MetaTrader 4 (MT4) | Generally free platform, but costs vary depending on brokers and add-ons | Extensive charting tools, automated trading capabilities (Expert Advisors), wide range of indicators, large community support | Beginner-friendly interface, large number of tutorials and resources available |

| MetaTrader 5 (MT5) | Generally free platform, but costs vary depending on brokers and add-ons | Enhanced features compared to MT4, including more advanced order types, economic calendar, improved charting, and more programming options. | Slightly steeper learning curve than MT4, but still relatively user-friendly with abundant resources. |

| cTrader | Generally free platform, but costs vary depending on brokers and add-ons | Focuses on speed and execution, offering advanced charting, algorithmic trading, and a sophisticated backtesting environment. | Modern and intuitive interface, though might be less user-friendly for complete beginners compared to MT4. |

Mastering Forex Trading Strategies with ATS

So, you’ve got your ATS humming along, ready to conquer the forex markets. But a finely tuned engine needs a skilled driver, and that driver is you, armed with the right strategies. Think of your ATS as a supercharged sports car – it’s capable of incredible speed and precision, but without a plan, you’ll just end up spinning your wheels (and losing money).

This section will equip you with the strategic know-how to harness your ATS’s power effectively.

Common Forex Trading Strategies Suitable for ATS Implementation

Many popular forex trading strategies lend themselves well to automation through ATS. These strategies often rely on clearly defined entry and exit signals, making them ideal candidates for algorithmic execution. The key is choosing strategies that are robust enough to handle market fluctuations and avoid over-optimization. Poorly designed strategies can lead to disastrous results, even with the most sophisticated ATS.

The Importance of Risk Management When Using ATS

Risk management isn’t just a suggestion when using an ATS; it’s your financial lifeline. Unlike manual trading where emotional responses can influence decisions, an ATS will relentlessly execute your programmed strategy, regardless of market sentiment. This unwavering execution makes setting strict risk parameters crucial. Failure to do so can lead to rapid and significant losses. Think of it like this: a runaway train needs brakes, and your risk management is the brake system for your ATS.

So you want to conquer the forex world with our downloadable PDF on mastering forex trading using ATS systems? Excellent! But before you unleash your inner algorithmic trading guru, it’s wise to understand the legal landscape. Check out Quebec forex trading regulations and Questrade’s compliance to ensure you’re playing by the rules. Then, armed with knowledge and our killer PDF, you’ll be raking in those pips (legally, of course!).

Implement stop-loss orders, position sizing techniques, and diversification strategies to protect your capital. Consider a maximum drawdown limit, a percentage of your capital that you’re willing to lose before the system automatically halts trading.

Examples of Backtesting Strategies for ATS Optimization

Backtesting is the lifeblood of successful ATS development. It involves running your strategy against historical data to assess its performance. Imagine backtesting as a virtual test drive for your ATS, allowing you to identify potential flaws and optimize parameters before deploying it to live markets. For instance, you could backtest a moving average crossover strategy, adjusting the periods of the fast and slow moving averages to find the optimal combination for your chosen currency pair.

Another approach involves testing different risk management parameters, such as stop-loss levels and position sizes, to determine the settings that minimize losses while maximizing profits. Remember, thorough backtesting is not a guarantee of future success, but it significantly increases your chances.

A Hypothetical Trading Strategy Using an ATS

Let’s imagine a simple mean reversion strategy for the EUR/USD pair. Our ATS will monitor the 20-period moving average. When the price falls below the moving average by 1%, it signals a long entry, setting a stop-loss at 1.5% below the entry price. The take-profit order is set at 1% above the entry price. Conversely, when the price rises above the moving average by 1%, it signals a short entry, with a stop-loss at 1.5% above the entry price and a take-profit at 1% below the entry price.

This strategy is designed to capitalize on short-term price fluctuations around the moving average. Remember, this is a simplified example; real-world strategies would be far more complex and require rigorous backtesting and optimization. The success of this, or any, strategy depends heavily on accurate market analysis and well-defined risk parameters.

Building and Implementing Your ATS Strategy

So, you’ve conquered the theoretical aspects of forex trading and ATS systems. Now comes the fun part – building your own automated trading empire! Think of it less like building a robot overlord and more like crafting a highly caffeinated, meticulously organized squirrel who’s exceptionally good at spotting market trends. This section will guide you through the process, transforming your theoretical knowledge into a profit-generating machine (hopefully!).

Building a successful ATS strategy isn’t about throwing darts at a board and hoping for the best. It’s about a systematic approach, careful planning, and a healthy dose of patience. Remember, Rome wasn’t built in a day, and neither is a robust automated trading system.

Step-by-Step Guide to Building a Simple ATS Strategy

Let’s build a simple moving average crossover strategy. This classic strategy uses two moving averages – a fast one (e.g., 10-period) and a slow one (e.g., 20-period). When the fast moving average crosses above the slow moving average, it’s a buy signal. When the fast moving average crosses below the slow moving average, it’s a sell signal. Simple, elegant, and surprisingly effective (with proper risk management, of course!).

- Define Your Market: Choose a currency pair (e.g., EUR/USD). Consider volatility and trading volume.

- Select Your Indicators: We’re using two simple moving averages (SMA) – a 10-period SMA and a 20-period SMA. You can adjust these periods based on your risk tolerance and market analysis.

- Define Your Entry and Exit Rules: Buy when the 10-period SMA crosses above the 20-period SMA. Sell when the 10-period SMA crosses below the 20-period SMA.

- Determine Your Position Sizing: This is crucial for risk management. Never risk more than a small percentage of your trading capital on any single trade (e.g., 1-2%).

- Set Stop-Loss and Take-Profit Orders: Stop-loss orders limit your potential losses, while take-profit orders secure your profits. These should be set based on your risk tolerance and the market’s volatility.

Setting Up and Configuring an ATS Platform

Choosing the right platform is half the battle. Many platforms offer backtesting capabilities, allowing you to test your strategy on historical data before risking real money. Think of it as a test drive before buying the car.

The setup process will vary depending on your chosen platform, but generally involves:

- Account Setup: Create a demo account to test your strategy risk-free.

- Strategy Implementation: Most platforms allow you to code your strategy using a programming language (like MQL4 or Python) or use a visual interface to drag and drop indicators and set parameters.

- Backtesting: Thoroughly backtest your strategy on historical data to evaluate its performance. Look for consistent profitability and acceptable drawdown.

- Forward Testing (Optional): Before deploying your strategy with real money, consider forward testing it on a small account to see how it performs in live market conditions.

Monitoring and Adjusting Your ATS Strategy

Building an ATS isn’t a “set it and forget it” proposition. Constant monitoring and adjustments are essential for long-term success. Think of it as gardening – you need to water, weed, and fertilize your plants (your strategy) to ensure healthy growth.

So you want to conquer the forex world with ATS systems? Grab our downloadable PDF – it’s your secret weapon! But first, you’ll need a platform, right? Check out this awesome comparison of Canadian forex platforms for newbies, especially if you’re wondering about alternatives to Questrade: Best forex trading platforms for beginners in Canada, compared to Questrade. Then, armed with the best platform and our PDF, you’ll be trading like a pro in no time – maybe even faster than a caffeinated squirrel!

Regular monitoring should include:

- Performance Tracking: Regularly review your strategy’s performance metrics, such as win rate, average win/loss, and maximum drawdown.

- Market Condition Analysis: Analyze how your strategy performs under different market conditions (e.g., high volatility vs. low volatility).

- Parameter Optimization: Periodically adjust your strategy’s parameters (e.g., moving average periods) to optimize performance.

- Risk Management Review: Ensure your risk management settings are still appropriate for the current market conditions.

Checklist for Successful ATS Implementation

Before you unleash your automated trading bot upon the world, use this checklist to ensure you’ve covered all the bases:

- Clearly defined trading strategy with documented entry and exit rules.

- Thorough backtesting on historical data with satisfactory results.

- Robust risk management plan in place (position sizing, stop-loss, take-profit).

- Reliable and stable ATS platform chosen and configured.

- Monitoring system implemented to track performance and identify issues.

- Plan for regular strategy adjustments based on market conditions and performance data.

- Realistic expectations – understand that losses are inevitable, and consistent profitability takes time and effort.

Advanced Techniques for Forex Trading with ATS

Stepping beyond the basics of ATS trading, we now delve into the more sophisticated strategies and techniques that can significantly enhance your profitability and risk management. This section explores advanced order types, the strategic use of technical indicators, a comparison of programming languages suitable for ATS development, and finally, how to cleverly integrate fundamental analysis into your automated trading system.

So you’re ready to conquer the forex world with our killer downloadable PDF on mastering forex trading using ATS systems? Excellent! But before you dive headfirst into algorithmic trading, you’ll want to know your costs, right? That’s where understanding What are the Questrade forex trading fees and commissions? comes in handy. Knowing your fees helps maximize those sweet, sweet profits, ensuring your ATS system isn’t eaten alive by commissions before it even gets started.

Now, back to that PDF – let’s get you trading!

Prepare yourself for a journey into the exciting world of advanced forex trading!

Advanced Order Types and Their Applications in ATS, Downloadable PDF on mastering forex trading using ATS systems

Advanced order types offer a powerful way to fine-tune your trading strategy and manage risk more effectively. Instead of simple market orders, these orders allow for greater control over entry and exit points, minimizing slippage and maximizing potential profits. They are particularly useful within the context of an ATS, where precise execution is paramount.

- Stop-Limit Orders: These orders are placed at a specific price level, but only executed if the market price reaches that level and then moves beyond it in the desired direction. This helps to limit losses or secure profits while ensuring the order is not filled prematurely at an unfavorable price. For example, a trader might set a stop-limit order to sell a currency pair at 1.1000 if the price falls to 1.0990, thereby limiting potential losses.

- Trailing Stop Orders: These orders automatically adjust their stop-loss price as the market moves in your favor. This protects profits while allowing you to ride winning trades for longer. Imagine a trade that is steadily increasing in value. A trailing stop might adjust upward, ensuring your profits are locked in if the price suddenly reverses.

- OCO (One Cancels the Other) Orders: This type of order allows you to place two orders simultaneously, with the execution of one automatically canceling the other. This is useful for setting both a take-profit and a stop-loss order, ensuring only one order is filled regardless of market fluctuations.

Technical Indicators and Their Use in Conjunction with ATS

Technical indicators provide valuable insights into market trends and momentum, and their integration into an ATS can dramatically improve trading decisions. However, careful selection and combination are crucial. Over-reliance on indicators can lead to false signals and losses.

For instance, combining a moving average crossover with RSI (Relative Strength Index) can generate buy/sell signals based on both price trend and momentum. A crossover of a fast moving average above a slow moving average, coupled with an RSI reading above 70, might trigger a sell signal, suggesting overbought conditions.

Comparison of Programming Languages for ATS Development

The choice of programming language significantly impacts the development process, efficiency, and flexibility of your ATS. Each language offers its own strengths and weaknesses.

| Language | Strengths | Weaknesses |

|---|---|---|

| Python | Large community, extensive libraries (like Pandas and NumPy), relatively easy to learn. | Can be slower than compiled languages for computationally intensive tasks. |

| C++ | High performance, excellent for complex algorithms and high-frequency trading. | Steeper learning curve, more complex development process. |

| C# | Strong framework (.NET), good for integrating with other systems. | Performance might not match C++ for high-frequency trading. |

Incorporating Fundamental Analysis into an ATS Strategy

While ATS systems primarily rely on technical analysis, integrating fundamental analysis can add another layer of sophistication and improve long-term performance. This involves incorporating macroeconomic data, news events, and geopolitical factors into your trading strategy.

For example, an ATS could be programmed to adjust its trading parameters based on upcoming economic announcements like Non-Farm Payroll reports. A significant positive surprise could trigger increased buying pressure, while a negative surprise could lead to selling.

Risk Management and Money Management for ATS: Downloadable PDF On Mastering Forex Trading Using ATS Systems

Navigating the forex market with an Automated Trading System (ATS) can feel like riding a rollercoaster – thrilling, potentially lucrative, and occasionally terrifying. But unlike a rollercoaster, your financial well-being isn’t predetermined. Effective risk and money management is your safety harness, preventing a wild ride from becoming a catastrophic crash. This section will equip you with the strategies to keep your trading account healthy and your profits flowing.

Risk Management Techniques for Automated Trading

Automated trading systems, while offering efficiency, demand a robust risk management framework. Failing to implement such a framework is akin to sailing a ship without a rudder – you might initially seem to be making progress, but a storm will quickly reveal your vulnerability. Several techniques help mitigate potential losses.

Position Sizing in Automated Trading Systems

Position sizing is the art of determining the appropriate amount of capital to allocate to each trade. It’s not about how much you

- can* risk, but rather how much you

- should*. Incorrect position sizing is a frequent culprit behind blown accounts. A common method involves calculating the percentage of your account you’re willing to risk on any single trade. For instance, a 1% risk per trade means that if your stop-loss is hit, you’ll only lose 1% of your total trading capital. This ensures that even a string of losing trades won’t wipe out your account.

This approach transforms the emotional rollercoaster of trading into a more calculated and controlled experience.

Effective Money Management Strategies for Automated Trading

Money management strategies work hand-in-hand with risk management. They ensure you protect your capital while maximizing potential returns. A key aspect is diversifying your trades across different currency pairs and strategies. This reduces your dependence on any single market’s performance, much like a well-diversified investment portfolio reduces overall risk. Another strategy involves setting a maximum drawdown limit, a predetermined percentage loss beyond which you halt trading to re-evaluate your system and parameters.

Think of it as a circuit breaker for your trading account.

Risk Management Techniques: Pros and Cons

| Technique | Pros | Cons | Example |

|---|---|---|---|

| Fixed Fractional Position Sizing | Simple, consistent risk, easy to implement in ATS. | Can be inflexible, may miss opportunities during periods of high volatility. | Always risk 1% of your account balance per trade. |

| Martingale System (Use with extreme caution!) | Potentially rapid recovery from losses (in theory). | High risk of catastrophic losses, requires significant capital, and is often unsustainable. | Double your position size after each loss. (Warning: This strategy is highly risky and generally not recommended.) |

| Kelly Criterion | Theoretically maximizes long-term growth. | Requires accurate win rate and average win/loss ratio estimations, complex calculation. | Uses a formula to calculate optimal position size based on statistical probabilities. |

| Trailing Stop-Loss | Locks in profits as the price moves favorably, minimizes losses. | Can lead to premature exits if the market reverses sharply, requires careful parameter setting. | Automatically adjusts the stop-loss order as the price increases, protecting profits. |

Case Studies of Successful ATS Strategies

Let’s ditch the theoretical and dive headfirst into the exhilarating (and sometimes terrifying) world of real-world ATS success stories. We’ll examine strategies that have not only survived but thrived, highlighting the triumphs, the near-misses, and the lessons learned along the way. Remember, even the most meticulously crafted ATS needs a bit of luck and a whole lot of adaptation.

Analyzing successful ATS strategies reveals a common thread: adaptability. The market is a capricious beast, and rigid strategies often crumble under its unpredictable weight. Successful traders understand this and incorporate flexibility into their systems, allowing them to adjust to changing market conditions. This isn’t about abandoning your strategy, but rather about intelligently modifying parameters and risk tolerances based on real-time data.

So you want to conquer the forex jungle using ATS systems? Our downloadable PDF on mastering this beast is your machete. But first, you’ll need a solid trading platform, and understanding its quirks is key; that’s where checking out Understanding Questrade’s forex trading platform features and tools. comes in handy. Armed with this knowledge, you’ll be ready to wield that PDF and dominate the forex markets!

Mean Reversion Strategy in the EUR/USD Pair

This case study focuses on a mean reversion strategy applied to the EUR/USD currency pair. The ATS utilized a combination of moving averages and Bollinger Bands to identify overbought and oversold conditions. The strategy aimed to capitalize on price reversals after significant deviations from the mean.

So you want to conquer the forex world with our downloadable PDF on mastering forex trading using ATS systems? Excellent! But before you unleash your inner algorithmic trading guru, it’s wise to understand the legal landscape. Check out Quebec forex trading regulations and Questrade’s compliance to ensure you’re playing by the rules. Then, armed with knowledge and our killer PDF, you’ll be raking in those pips (legally, of course!).

Implementation challenges included whipsaws during periods of high volatility. The initial parameters needed several adjustments to minimize false signals and optimize profit potential. The system initially struggled during news events, leading to losses. This prompted the addition of a news filter, dramatically improving performance. Key to success was the use of a trailing stop-loss order, securing profits while allowing for maximum price appreciation.

One particularly successful trade involved a short position entered when the EUR/USD pair reached the upper Bollinger Band during a period of relative market calm. The pair subsequently reversed, hitting the lower band within 24 hours, resulting in a 1.2% profit. The market conditions were characterized by low volatility and a clear trend reversal signal. Conversely, during a period of high volatility following a major economic announcement, the system generated a loss due to a whipsaw.

This loss highlighted the importance of the subsequently added news filter. The key factor in the success of this strategy was the combination of robust indicators, diligent parameter optimization, and the implementation of a dynamic risk management strategy.

Trend Following Strategy in Gold (XAU/USD)

This strategy focused on identifying and capitalizing on long-term trends in the gold market. The ATS used exponential moving averages of varying lengths to identify the primary trend direction.

Challenges included identifying the correct entry and exit points, as well as managing drawdowns during periods of trend reversals or consolidation. The initial version suffered from late entries and early exits, reducing profitability. This was addressed by modifying the moving average parameters and incorporating a momentum indicator to confirm trend strength. The key to success was the patient adherence to the trend-following approach, combined with a rigorous risk management framework.

A successful trade saw the system initiate a long position in gold when a clear uptrend was established, as indicated by a series of higher highs and higher lows. The trade was closed after several weeks, resulting in a 4.5% profit. Market conditions were characterized by a strong bullish sentiment and sustained upward momentum. Conversely, a trade initiated during a period of sideways price action resulted in a small loss.

The success of this strategy stemmed from a combination of clear trend identification, appropriate position sizing, and effective risk management.

Legal and Regulatory Considerations for ATS

Navigating the world of automated trading systems (ATS) in forex requires more than just a keen eye for market trends and a knack for coding. It also demands a thorough understanding of the legal and regulatory landscape, a landscape that can be as volatile as the forex market itself. Ignoring these aspects can lead to hefty fines, legal battles, and even the complete shutdown of your trading operation.

So, buckle up, because we’re about to delve into the sometimes-dry but undeniably crucial world of forex trading regulations.The legal and regulatory frameworks governing automated forex trading vary significantly depending on your location. Each jurisdiction has its own set of rules and regulations designed to protect investors, maintain market integrity, and prevent fraud. These regulations often cover aspects like registration, licensing, reporting requirements, and the acceptable level of risk.

Failure to comply with these regulations can result in severe consequences, from financial penalties to criminal charges.

Jurisdictional Differences in Forex Regulations

Forex trading regulations are not a one-size-fits-all affair. For example, the United States has a robust regulatory framework overseen by bodies like the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA). These organizations set strict rules regarding the operation of ATS, including requirements for registration, compliance with anti-money laundering (AML) regulations, and the maintenance of detailed trading records.

In contrast, other jurisdictions may have less stringent regulations or a different approach altogether. Traders must therefore thoroughly research the specific regulations in their jurisdiction before deploying an ATS. Operating an ATS without proper registration or compliance could lead to significant penalties. A common example is the failure to report suspicious activity, which can attract hefty fines.

Similarly, neglecting to keep accurate records of trading activity can be problematic during audits.

Risk Management and Compliance

Effective risk management is not just a good idea; it’s a legal necessity in many jurisdictions. Regulations often mandate that traders implement robust risk management strategies to prevent excessive losses and protect their clients’ funds. This includes setting appropriate stop-loss orders, diversifying investments, and regularly monitoring trading activity. The failure to adhere to these risk management guidelines can lead to regulatory scrutiny and potential legal action.

For instance, a trader failing to implement stop-loss orders, resulting in significant client losses, could face legal challenges from affected clients.

Ethical Considerations and Responsible Use of ATS

Beyond legal compliance, ethical considerations play a crucial role in the responsible use of ATS. This includes ensuring transparency in trading strategies, avoiding manipulative practices, and acting with integrity in all interactions with clients and market participants. While an ATS can automate trading decisions, it doesn’t absolve the trader from ethical responsibilities. For example, employing strategies designed to artificially manipulate market prices or using insider information to gain an unfair advantage would be both unethical and potentially illegal.

Maintaining a clear audit trail of all trading activities is crucial for demonstrating ethical and responsible trading practices.

Data Security and Privacy

The use of ATS often involves the handling of sensitive personal and financial data. Therefore, robust data security measures are essential to protect this information from unauthorized access or breaches. Regulations such as GDPR (in Europe) and CCPA (in California) impose stringent requirements on data protection. Failure to comply with these regulations can lead to significant fines and reputational damage.

Implementing strong encryption protocols, secure data storage practices, and regular security audits are crucial for ensuring compliance and maintaining the trust of clients and regulators.

Final Review

So, there you have it – a journey into the fascinating world of automated forex trading. Armed with this downloadable PDF, you’re no longer just a spectator in the forex market; you’re a potential player, ready to harness the power of ATS. Remember, though, even robots need a good mechanic (that’s you!). Regular maintenance, careful monitoring, and a dash of common sense are crucial for success.

Happy trading (and may your profits be ever in your favor!)