How to choose the right day trading platform for your needs in Canada – How to choose the right day trading platform for your needs in Canada? Ah, the million-dollar question (or perhaps the million-dollar

-potential*, let’s be realistic!). Navigating the Canadian day trading landscape can feel like trying to predict the next hockey game winner – a thrilling, potentially lucrative, and occasionally bewildering experience. This guide cuts through the jargon and the hype, offering a humorous yet informative path to finding the perfect platform for your unique trading style, risk tolerance, and caffeine consumption habits (because let’s face it, day trading requires fuel!).

Prepare for a wild ride!

We’ll delve into the nitty-gritty of platform features, fees (those sneaky hidden ones, too!), regulatory compliance (because nobody wants a surprise visit from the Mounties), and the all-important research phase. We’ll also equip you with the knowledge to master demo accounts, conquer customer support, and ultimately, choose a platform that doesn’t just meet your needs, but actively

-excites* you.

Because let’s be honest, a little excitement is good for the soul (and the portfolio).

Understanding Your Trading Needs in Canada

Choosing the right day trading platform in Canada isn’t just about finding the shiniest app; it’s about finding the perfect tool for your unique trading style and financial goals. Think of it like choosing a hockey stick – a pro needs a different stick than a weekend warrior. Ignoring your individual needs will lead to frustration and, let’s be honest, potential losses.

Let’s dissect what makes you, you, as a Canadian day trader.

Day Trader Profiles and Platform Requirements

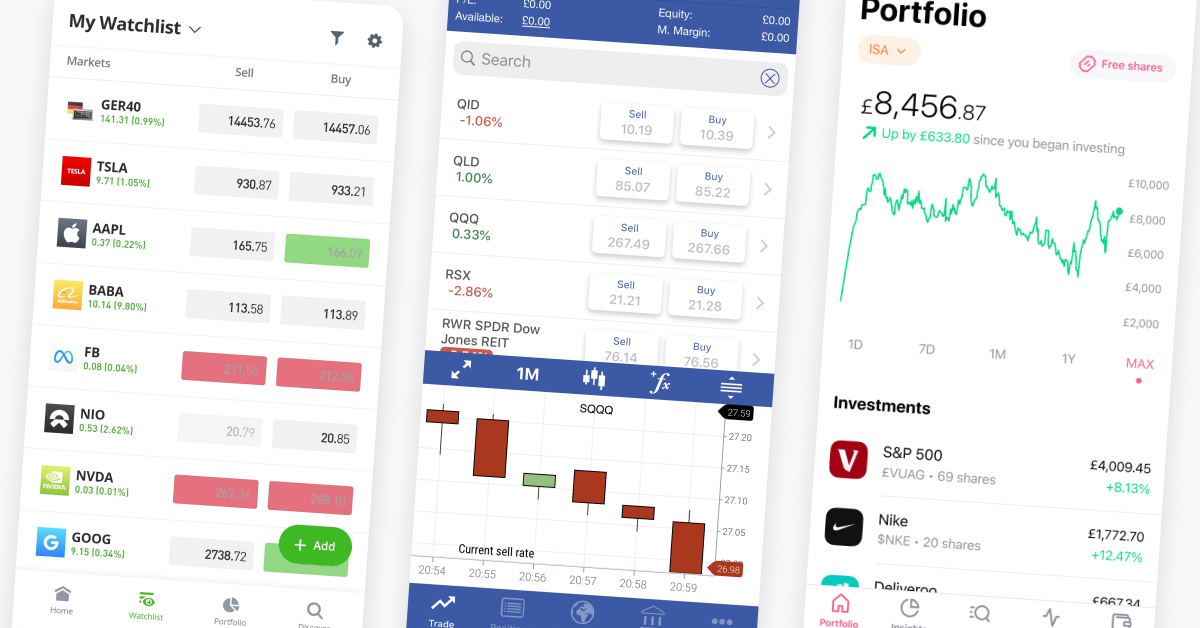

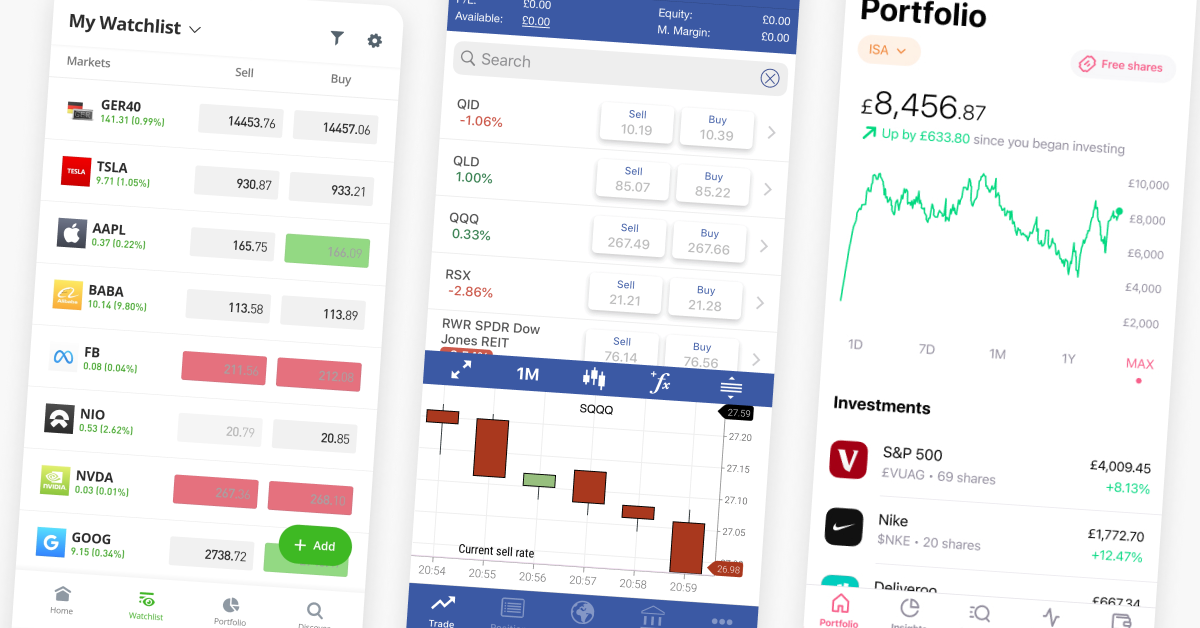

Different day traders have vastly different needs. The “scalper,” for instance, who aims for tiny profits on many trades throughout the day, needs a platform with lightning-fast execution speeds and real-time market data. Think of them as Formula 1 drivers; they need every millisecond to win. Conversely, the “swing trader,” who holds positions for hours or even days, might prioritize charting tools and technical analysis capabilities over raw speed.

They’re more like marathon runners – steady and strategic. The “momentum trader,” jumping on trending stocks, will need robust order types and maybe even social sentiment indicators. They are the sprinters, quick and decisive. The platform you choose should reflect your trading strategy.

Trading Style and Platform Selection

Your trading style dictates your platform needs. Scalping requires platforms with extremely low latency and advanced order types like market orders and limit orders. Swing trading, focusing on longer-term price movements, demands comprehensive charting packages, indicators, and perhaps even backtesting capabilities. A platform excellent for scalping might be utterly unsuitable for swing trading, and vice-versa. Ignoring this mismatch is like trying to play hockey with a baseball bat – it just won’t work.

Trading Capital and Risk Tolerance

Your available capital and risk tolerance are paramount. If you’re trading with a small account, you’ll need a platform with low commissions and perhaps even fractional share trading options. High-risk traders might favour platforms with margin trading capabilities (though proceed with caution!), while conservative traders will likely stick to cash accounts. Remember, your platform should support your risk management strategy, not undermine it.

A platform that encourages reckless behaviour isn’t your friend.

Assessing Individual Trading Needs Checklist

Before diving into platform comparisons, honestly assess your needs:

- Trading Style: Scalping, swing trading, momentum trading, etc.?

- Trading Frequency: How many trades do you plan to make daily/weekly?

- Trading Instruments: Stocks, options, futures, forex, cryptocurrencies?

- Technical Analysis Needs: Advanced charting, indicators, backtesting?

- Capital and Risk Tolerance: Account size, acceptable loss percentage per trade?

- Platform Features: Order types, real-time data, research tools, educational resources?

- Fees and Commissions: Brokerage fees, platform fees, data fees?

- Customer Support: Availability, responsiveness, methods of contact?

This checklist will help you narrow your search and choose a platform that truly aligns with your trading style and risk profile. Remember, the best platform is the one that empowers you to succeed, not one that overwhelms you.

Picking the perfect day trading platform in Canada can feel like choosing a unicorn – sparkly and rare! But before you saddle up, consider your forex strategy; understanding this is crucial, so check out this guide on How to choose the right forex broker in Canada based on my trading style to avoid any wild market rides.

Once you’ve tamed your forex beast, you can confidently choose a platform that complements your newfound expertise and makes day trading a breeze (or at least, less of a hurricane).

Fees and Commissions on Canadian Day Trading Platforms

Navigating the world of Canadian day trading platforms can feel like traversing a minefield of fees. Understanding these costs is crucial, as they can significantly impact your profitability. Ignoring them is like trying to win a marathon while carrying a hefty backpack full of bricks – you might start strong, but the weight will eventually slow you down.

Let’s dissect these often-hidden expenses to ensure you’re not leaving money on the table (or, worse, losing it!).

Canadian brokers employ various fee structures, making direct comparisons tricky. Some charge per trade, others offer subscription models, and some use a tiered system based on trading volume. Account minimums also vary widely, so be prepared to do your homework before committing to a platform. Remember, the cheapest option isn’t always the best – you need a platform that aligns with your trading style and risk tolerance.

Different Fee Models Employed by Canadian Brokers

Let’s examine the three main fee models prevalent in the Canadian day trading landscape. Understanding their nuances will help you make an informed decision that suits your trading habits and financial goals.

Per-Trade Commissions: This is the most straightforward model. You pay a fee for every trade you execute. The fee can be a fixed amount or a percentage of the trade value. This model is transparent but can become expensive for high-frequency traders.

Subscription Models: With a subscription model, you pay a recurring fee (monthly or annually) for access to the platform and its features. This often includes a certain number of commission-free trades. This can be advantageous for active traders who execute a high volume of trades. However, exceeding the included free trades can quickly negate the cost savings.

Tiered Fee Structures: These models offer different fee levels based on your trading volume or account balance. The more you trade, the lower your per-trade commission might become. This incentivizes higher trading activity, but be cautious; it’s easy to get caught up in the “volume game” and take on more risk than intended.

Comparison of Fee Structures Across Four Platforms

The following table provides a simplified comparison of fees for four hypothetical Canadian day trading platforms. Remember, these are examples and actual fees can change. Always check the broker’s website for the most up-to-date information.

| Platform Name | Commission per Trade | Inactivity Fees | Data Fees |

|---|---|---|---|

| TradeSwift | $5.99 + $0.01 per share | $10/month after 3 months of inactivity | Included |

| QuickTrade Pro | $7.95 flat fee | None | $15/month |

| NorthStar Investments | $4.99 per trade (Tiered: $3.99 for >100 trades/month) | $5/month after 6 months of inactivity | Included |

| MapleLeaf Brokerage | Subscription: $29.99/month (includes 50 free trades) | None | Included |

Hidden Costs Associated with Day Trading Platforms

Beyond the explicit fees, several hidden costs can significantly eat into your profits. These often overlooked expenses can catch unsuspecting traders off guard.

Picking the perfect Canadian day trading platform is like choosing a superhero sidekick – it’s gotta be a good fit! To help you navigate this crucial decision, consider checking out this insightful review of a popular contender: QuestTrade forex trading platform review and user experience. After reading that, you’ll be armed with more knowledge to make the best choice for your own trading style and risk tolerance in the exciting world of Canadian finance!

Regulatory Fees: These fees are levied by regulatory bodies and are usually passed on to the trader. They are not always clearly stated upfront.

Data Fees (beyond the table): Some platforms charge for real-time market data beyond a basic level. Advanced charting tools or specific data feeds can add considerable expense.

Picking the perfect day trading platform in Canada can feel like choosing a unicorn – sparkly and rare! But before you saddle up, consider your forex strategy; understanding this is crucial, so check out this guide on How to choose the right forex broker in Canada based on my trading style to avoid any wild market rides.

Once you’ve tamed your forex beast, you can confidently choose a platform that complements your newfound expertise and makes day trading a breeze (or at least, less of a hurricane).

Financing Costs: If you use margin trading (borrowing money to trade), interest charges can quickly accumulate, especially during periods of prolonged market downturns.

Platform Fees for specific features: Some platforms may charge extra for advanced order types, research tools, or educational resources. These can add up quickly if you’re utilizing these frequently.

Picking the perfect day trading platform in Canada can feel like choosing a unicorn – sparkly and rare! But before you saddle up, consider your forex strategy; understanding this is crucial, so check out this guide on How to choose the right forex broker in Canada based on my trading style to avoid any wild market rides.

Once you’ve tamed your forex beast, you can confidently choose a platform that complements your newfound expertise and makes day trading a breeze (or at least, less of a hurricane).

Withdrawal Fees: Be aware of any fees associated with transferring funds out of your trading account. While seemingly small, these fees can add up over time.

Platform Demo Accounts and Trial Periods

Before you leap into the thrilling (and sometimes terrifying) world of Canadian day trading, think of a demo account as your personal, risk-free training ground. It’s like getting a test drive of a Ferrari before buying it – except instead of potential speeding tickets, you risk only virtual losses. This allows you to hone your skills and get acquainted with a platform’s quirks without jeopardizing your hard-earned loonies.Demo accounts are invaluable tools for aspiring day traders.

They provide a safe space to experiment with different strategies, familiarize yourself with the platform’s interface, and identify any potential pitfalls before committing real capital. Think of it as your personal, risk-free trading boot camp.

Understanding the Benefits of Demo Accounts

Using a demo account offers several key advantages. First and foremost, it eliminates the financial risk associated with live trading. You can practice trading without the fear of losing real money, allowing you to develop confidence and refine your strategies without the pressure of immediate financial consequences. Secondly, demo accounts provide a realistic simulation of the live trading environment.

You’ll get used to the platform’s layout, order execution speeds, and charting tools, preparing you for the real thing. Finally, it allows you to test different trading strategies without any monetary repercussions. This is crucial for developing a successful trading plan tailored to your risk tolerance and investment goals. Imagine trying out ten different strategies, all without the fear of a financial meltdown.

That’s the power of a demo account.

Effectively Utilizing a Demo Account

To maximize the benefits of a demo account, it’s crucial to approach it strategically. Don’t just randomly place trades; instead, focus on testing specific strategies and features. For example, you could backtest a particular indicator or refine your entry and exit points based on specific market conditions. Consider setting realistic goals for your demo trading, such as achieving a certain percentage gain or minimizing losses within a specified timeframe.

This will help you develop discipline and consistency, which are vital for successful day trading. Remember, the goal is not to make massive virtual profits, but to develop a robust trading plan and master the platform’s functionality.

Limitations of Demo Accounts, How to choose the right day trading platform for your needs in Canada

While demo accounts are incredibly beneficial, it’s important to acknowledge their limitations. The most significant difference is the emotional aspect. Trading with virtual money doesn’t replicate the psychological pressures of live trading, where real financial consequences are at stake. The thrill of victory and the agony of defeat are significantly muted in a demo environment. Also, market conditions in a demo account might not perfectly mirror live market dynamics, although most reputable platforms strive for accuracy.

Finally, demo accounts often don’t include the complexities of real-world issues such as slippage (the difference between the expected price and the actual execution price) or unexpected outages.

Opening and Utilizing a Demo Account: A Step-by-Step Guide

Opening a demo account is usually straightforward. Most platforms have a clear “Demo Account” or “Practice Account” option on their website. The process typically involves providing some basic information, such as your name and email address. Once you’ve registered, you’ll be granted access to a virtual trading account with a pre-loaded amount of virtual currency. From there, you can navigate the platform, explore its features, and begin practicing your trading strategies.

Remember to treat your demo account as if it were real money – this will help you develop the necessary discipline and mental fortitude for live trading. Many platforms even offer tutorials and educational resources to help you get started. Take advantage of these resources to familiarize yourself with the platform’s intricacies.

Customer Support and Educational Resources

Choosing a day trading platform in Canada is a big decision, akin to choosing a life partner (minus the potential for messy breakups… hopefully!). A crucial factor often overlooked is the quality of customer support and the availability of educational resources. After all, even the most seasoned trader occasionally needs a helping hand or a refresher course.The importance of readily available and responsive customer support cannot be overstated.

Picking the perfect day trading platform in Canada can feel like choosing a unicorn – sparkly and rare! But before you saddle up, consider your forex strategy; understanding this is crucial, so check out this guide on How to choose the right forex broker in Canada based on my trading style to avoid any wild market rides.

Once you’ve tamed your forex beast, you can confidently choose a platform that complements your newfound expertise and makes day trading a breeze (or at least, less of a hurricane).

Day trading is a fast-paced environment, and when things go wrong (and they will, at some point!), you need help, and you need it

now*. A platform with sluggish or unresponsive customer service can quickly turn a profitable trade into a frustrating loss. Think of it like this

Would you trust a surgeon who only responded to your panicked calls after lunch? Probably not.

Customer Support Channels

Different platforms offer various customer support channels, each with its own advantages and disadvantages. Phone support offers immediate interaction and the ability to explain complex issues verbally. However, hold times can be excruciating, and you might be stuck listening to elevator music longer than it takes to execute a trade. Email support is a more asynchronous method, allowing for detailed explanations but often resulting in slower response times.

Live chat offers a happy medium, providing relatively quick responses without the phone call anxiety. Ideally, a platform offers a robust combination of all three.

Educational Resources

A good day trading platform understands that continuous learning is key to success. They offer a variety of educational resources, such as webinars, tutorials, and even simulated trading environments. These resources can range from beginner-friendly introductions to advanced strategies, helping you hone your skills and adapt to market changes. Think of these resources as your personal trading sensei, guiding you on the path to enlightenment (and profit!).

A platform lacking in educational resources is like a chef who only provides you with the raw ingredients and expects you to magically conjure a Michelin-star meal.

Comparison of Platforms

| Platform Name | Customer Support Channels | Educational Resources | Response Time (Estimate) |

|---|---|---|---|

| Platform A | Phone, Email, Live Chat | Webinars, Tutorials, Simulated Trading | Phone: 10-30 minutes, Email: 24-48 hours, Chat: < 5 minutes |

| Platform B | Email, Live Chat | Tutorials, FAQs | Email: 12-24 hours, Chat: 5-15 minutes |

| Platform C | Phone, Email | Webinars (limited), FAQs | Phone: 30-60 minutes, Email: 48-72 hours |

| Platform D | Live Chat, Email | Webinars, Tutorials, Blog | Chat: <10 minutes, Email: 24 hours |

Choosing the Right Platform for Your Specific Needs: How To Choose The Right Day Trading Platform For Your Needs In Canada

Finding the perfect day trading platform in Canada is like finding the perfect pair of shoes – you need the right fit for your feet (or trading style, in this case). One size doesn’t fit all, and choosing the wrong platform can lead to more frustration than profits. This section will help you match your trading personality with the ideal platform features.Choosing a platform that aligns with your trading strategy is crucial for success.

A platform overloaded with features you’ll never use is just as detrimental as one lacking essential tools. Consider your preferred trading style, the markets you frequent, and your technical proficiency when making your decision.

Platform Features and Trading Styles

Matching your trading style to a platform’s features is key. For instance, a scalper – someone making many trades in short periods – needs a platform with lightning-fast execution speeds and advanced charting tools, while a swing trader, holding positions for longer periods, might prioritize in-depth fundamental analysis features.

- Scalping: Platforms offering fractional-second execution speeds, advanced charting packages (think multiple timeframes and indicators readily available), and low latency are essential. Think platforms known for their speed and reliability in executing high-volume trades. A platform with a clunky interface would be a nightmare for this style.

- Swing Trading: A swing trader benefits from robust charting tools, fundamental data (news feeds, earnings reports), and perhaps even backtesting capabilities to refine their strategies. Speed isn’t as paramount as it is for scalpers, but reliability and access to comprehensive market information are critical.

- Day Trading (General): A platform with a balance of speed, charting tools, and order types is needed. The ability to easily manage multiple positions simultaneously and access real-time market data is vital. The platform should be user-friendly enough to allow quick decision-making.

Examples of Platforms for Different Strategies

Let’s illustrate with some hypothetical examples (note: specific platform recommendations should always be based on your individual research and due diligence).Imagine “Speedy Gonzales Trading,” a platform boasting unparalleled execution speeds and a sleek, minimalist interface perfect for scalpers. Conversely, “Chartastic Analytics,” a platform with extensive charting capabilities and integrated fundamental data, would be better suited for swing traders.

A more general day trader might prefer “Balanced Brokerage,” a platform offering a good mix of speed, charting, and order types.

Decision-Making Flowchart for Platform Selection

To guide your decision, consider this simplified flowchart:

| Question | Answer | Platform Type |

|---|---|---|

| What’s your primary trading style? | Scalping (very short-term trades) | High-speed, low-latency platform with advanced charting |

| What’s your primary trading style? | Swing Trading (holding positions for days or weeks) | Platform with strong charting, fundamental data, and backtesting tools |

| What’s your primary trading style? | Day Trading (general) | Balanced platform with good speed, charting, and order types |

| What are your technical skills? | Beginner | User-friendly platform with good educational resources |

| What are your technical skills? | Advanced | Platform with advanced charting and customizable features |

| What’s your budget? | Limited | Platform with low commissions and fees |

| What’s your budget? | Unlimited | Platform with advanced features and premium support |

Remember, this is a simplified guide. Thorough research and testing are essential before committing to any platform. Don’t be afraid to try demo accounts!

Conclusion

So, there you have it – your comprehensive guide to conquering the Canadian day trading platform jungle. Remember, the perfect platform isn’t a mythical creature; it’s a carefully chosen tool that empowers your trading strategy. By understanding your needs, researching diligently, and utilizing the tips and tricks Artikeld above, you’ll be well-equipped to navigate the exciting world of Canadian day trading.

Now go forth, and may your trades be ever in your favour! (But always remember to diversify, okay?)