Best day trading app for options trading in Canada? Ah, the siren song of quick profits! Navigating the Canadian options market can feel like trying to wrestle a moose in a blizzard – challenging, but potentially rewarding. This guide cuts through the icy winds of regulatory jargon and platform comparisons, helping you find the app that’s just right for your trading style, whether you’re a seasoned pro or a curious newbie.

Forget the endless scrolling and confusing comparisons; we’re here to help you find your perfect trading partner.

We’ll delve into the regulatory landscape (because, let’s face it, rules are important, even when dealing with potentially lucrative investments), explore the top trading platforms available to Canadians, and uncover the essential features that make an app truly outstanding. We’ll also discuss security, educational resources, and even throw in a hypothetical trading scenario to keep things exciting. Buckle up, buttercup, it’s going to be a wild ride!

Regulatory Landscape for Options Trading in Canada

Navigating the world of options trading in Canada requires a healthy dose of understanding regarding the regulatory framework. Think of it as a well-organized hockey game – there are rules, referees (regulators), and penalties for breaking those rules. Ignoring them can lead to a swift trip to the penalty box (or worse!). Let’s break down the key players and rules of this financial game.

Options trading, while potentially lucrative, isn’t a free-for-all. Several regulatory bodies ensure fair play and protect investors from unscrupulous practices. Understanding these regulations is crucial before diving headfirst into the exciting, yet sometimes treacherous, waters of options trading.

Regulatory Bodies Overseeing Options Trading in Canada

The primary regulatory body overseeing options trading in Canada is the Investment Industry Regulatory Organization of Canada (IIROC). IIROC acts as the self-regulatory organization (SRO) for investment dealers and their trading activities, including options trading. They establish rules, monitor compliance, and enforce penalties for violations. Think of them as the referees, ensuring a fair and orderly game.

The Ontario Securities Commission (OSC) and other provincial securities commissions also play a significant role, particularly in matters of investor protection and enforcement within their respective jurisdictions. These bodies work in tandem with IIROC to create a comprehensive regulatory environment.

Requirements for Canadian Residents to Trade Options

To trade options in Canada, you generally need to meet certain requirements. These often include demonstrating a sufficient level of investment knowledge and experience. This might involve passing a suitability test or having a proven track record of successful investing. Specific requirements can vary depending on the brokerage firm you choose and the complexity of the options strategies you employ.

Picking the best day trading app for options in Canada is like choosing the perfect hockey stick – it’s all about finding the right fit. But even with the best app, you need the right targets! Knowing which stocks to trade is crucial, so check out this guide on What are some profitable stocks for day trading in Canada?

before you dive in. Then, armed with knowledge and the right app, you’ll be scoring big in the Canadian stock market!

Many brokerages require a minimum account balance, and some may request documentation proving your financial capacity to handle the risks associated with options trading. It’s vital to fully understand these requirements before initiating any trades.

Comparison of Canadian and US Options Trading Regulations

| Regulatory Body | Requirements | Key Differences |

|---|---|---|

| IIROC (Canada), Provincial Securities Commissions | Suitability tests, minimum account balances, experience requirements, knowledge assessments may be required depending on brokerage and strategy complexity. | Generally stricter suitability requirements in Canada compared to the US, particularly for less experienced investors. The regulatory landscape in the US is more fragmented, with different exchanges and regulatory bodies having varying oversight. |

| SEC, FINRA (USA), various other self-regulatory organizations and exchanges | Vary widely depending on the brokerage and the complexity of the options strategies employed. May involve questionnaires, minimum account balance requirements. | US regulations tend to be more focused on disclosure and anti-fraud measures, while Canadian regulations often emphasize investor suitability and protection. |

Available Trading Platforms in Canada

Choosing the right platform for options trading in Canada can feel like navigating a minefield of jargon and fees. Fear not, intrepid trader! This section will illuminate the landscape of popular options trading platforms available to Canadian investors, helping you pick the perfect tool for your financial arsenal. We’ll delve into their features, compare their costs, and assess their user-friendliness – because let’s face it, a frustrating platform can turn even the most promising trade sour.

Finding the best day trading app for options trading in Canada? It’s a jungle out there, filled with more platforms than beavers in a Canadian forest! To navigate this wild west of trading, check out this handy guide on How to choose the best day trading platform for your needs. Then, armed with knowledge, you can conquer the Canadian options trading scene and maybe even buy a small island (or at least a really nice kayak).

Several platforms cater to the Canadian options trading market, each boasting its own strengths and weaknesses. The best choice for you will depend on your experience level, trading style, and budget. Let’s examine some of the leading contenders.

Popular Options Trading Platforms in Canada

Here are five popular platforms offering options trading in Canada, along with a breakdown of their key features. Remember, the information below is for general knowledge and should not be considered financial advice. Always conduct your own thorough research before selecting a platform.

- Interactive Brokers (IBKR): Known for its powerful platform and wide range of options strategies, IBKR offers extensive charting tools, advanced order types (including complex options strategies), and a robust research platform. However, it might be overwhelming for beginners due to its complexity. Its commission fees are generally competitive, often lower for high-volume traders.

- TD Ameritrade: A popular choice for its user-friendly interface and comprehensive educational resources, TD Ameritrade provides a good balance between ease of use and advanced features. While it offers a solid selection of options strategies and charting tools, its commission fees might be slightly higher than some competitors for smaller trades.

- Questrade: Questrade is favoured for its low commission fees and straightforward platform. It’s a good option for beginners and those focused on cost-effectiveness. While it provides essential options trading tools and charting capabilities, it might lack the advanced features found in platforms like IBKR.

- Wealthsimple Trade: This platform stands out with its exceptionally user-friendly interface and commission-free trading. While its options trading features are more basic compared to others, it’s a great starting point for new investors wanting to learn about options trading without the pressure of high commissions. However, the limited advanced features might be a drawback for experienced traders.

- National Bank Direct Brokerage: As a Canadian institution, National Bank Direct Brokerage offers a localized experience with good customer support. It provides a solid selection of options strategies and charting tools, but its commission structure and mobile app functionality might not be as competitive as other options.

Platform Comparison Table

This table summarizes the key differences between the platforms discussed above. Note that commission fees and mobile app ratings can change, so always verify the latest information on the respective platform websites.

| Platform Name | Commission Fees | Key Features | Mobile App Rating (Illustrative – Check App Stores) |

|---|---|---|---|

| Interactive Brokers (IBKR) | Competitive, often lower for high volume | Advanced charting, complex order types, extensive research | 4.5 stars (example) |

| TD Ameritrade | Moderate | User-friendly interface, educational resources, solid options tools | 4 stars (example) |

| Questrade | Low | Simple interface, low-cost trading, essential options tools | 3.8 stars (example) |

| Wealthsimple Trade | Commission-free | Extremely user-friendly, basic options tools | 4.2 stars (example) |

| National Bank Direct Brokerage | Variable, check their website | Localized support, solid options tools | 3.5 stars (example) |

Key Features of a “Best” Options Trading App

Choosing the right options trading app in Canada can feel like navigating a minefield of fees, features, and frustrating user interfaces. But fear not, intrepid Canadian trader! A truly excellent app will be your trusty steed in the wild west of options trading, making the process smoother, faster, and (dare we say it?) even enjoyable.The following features are crucial for a seamless and successful options trading experience north of the border.

Think of them as the essential ingredients for your financial success recipe – leave any out, and your chances of a delicious profit plummet faster than a loonie in a Tim Hortons drive-thru.

Real-time Data and Charts

Real-time data is non-negotiable for options trading. Delays can mean the difference between a winning trade and a swift kick to your portfolio. A top-tier app provides live market data, including option chains, Greeks (delta, gamma, theta, vega – oh my!), and price movements, all updated with the speed of a caffeinated beaver. Imagine a dynamic, interactive chart that responds instantly to market fluctuations, allowing you to adjust your strategy in real-time, like a hockey player deftly dodging opponents.

Slow, lagging data is a recipe for disaster, akin to trying to build a snow fort during a blizzard – it’s just not going to happen.

User-Friendly Interface and Navigation

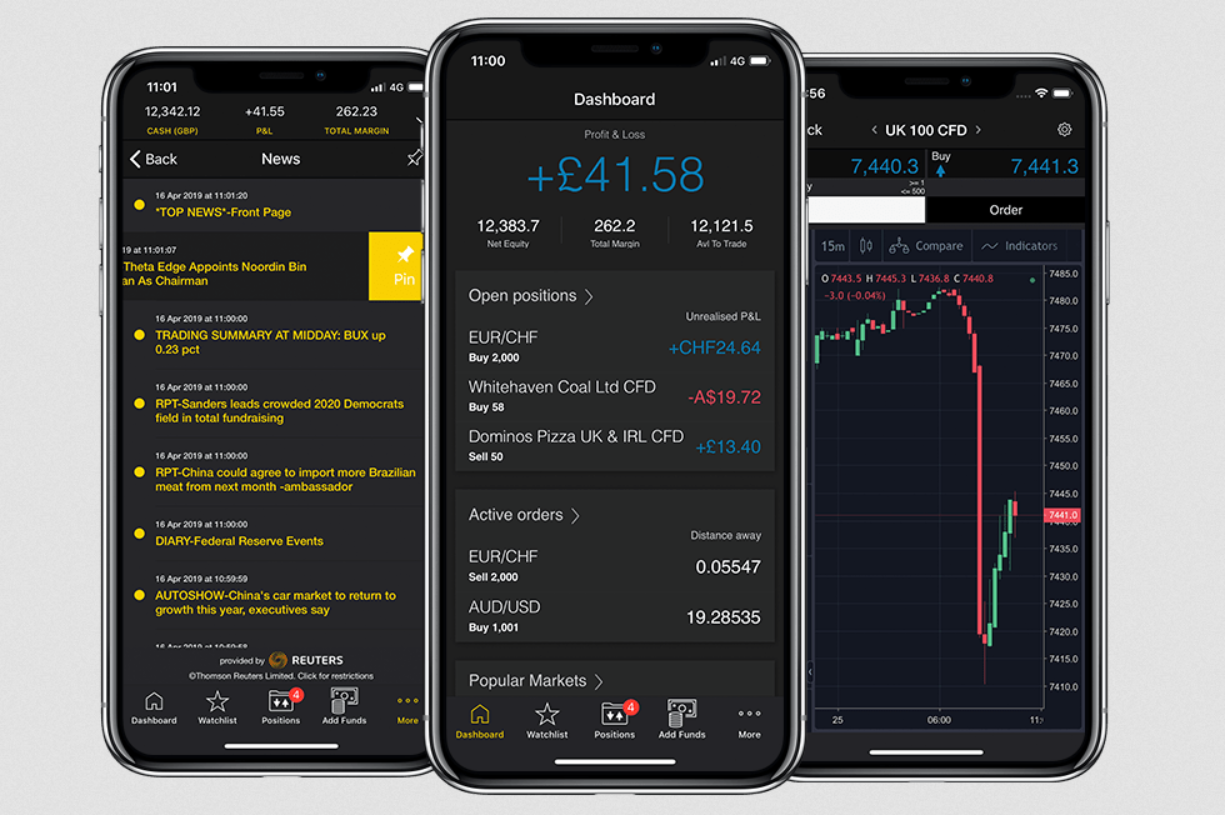

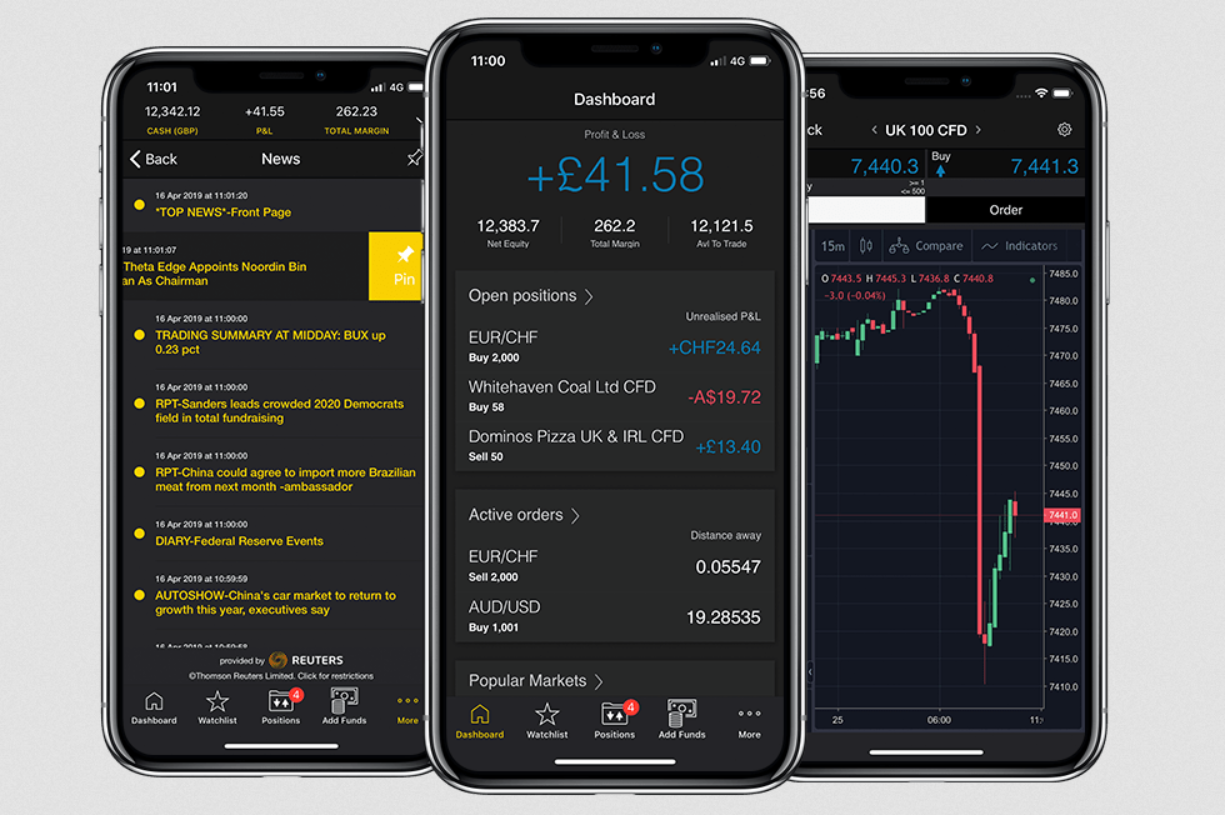

Even the most powerful trading tools are useless if they’re buried under a mountain of confusing menus and clunky navigation. The best options trading apps prioritize intuitive design. Think clean layouts, easily accessible tools, and a streamlined order placement process. The app should feel like a well-oiled machine, not a tangled mess of wires. Imagine a dashboard that presents all the essential information at a glance, with clear visual cues and logical groupings of functions.

The user experience should be so seamless, you’ll feel like you’re trading from the comfort of your favourite toque.

Advanced Order Types and Tools

Options trading isn’t just about buying and selling; it’s about sophisticated strategies. A superior app supports a wide range of order types, including limit orders, stop-loss orders, and more complex strategies like spreads and straddles. It should also provide tools for analyzing options chains, calculating potential profits and losses, and managing risk effectively. Think of it as having a full toolbox at your disposal, allowing you to craft intricate trading strategies with precision and confidence.

Hunting for the best day trading app for options trading in Canada? It’s a wild goose chase, let me tell you! But before we tackle those complex options, maybe you should master the basics first with a solid app for Canadian stocks. Check out this guide for the Best mobile app for day trading Canadian stocks. Then, and only then, are you ready to conquer the options world! So, back to the original question: finding that perfect options app in Canada is a quest worthy of a knight errant (with a very fast internet connection).

A limited selection of order types is like trying to build a house with only a hammer and a screwdriver – you’re severely limiting your potential.

Educational Resources and Support

Options trading can be complex, especially for beginners. A truly excellent app provides access to educational resources, including tutorials, articles, and webinars. Robust customer support is equally crucial, offering assistance via phone, email, or chat. Imagine a comprehensive learning center within the app itself, guiding you through the intricacies of options trading, and a responsive support team ready to answer your questions with patience and expertise.

This kind of support is like having a seasoned mentor in your corner, ready to provide guidance and support when needed.

Robust Security Measures

Protecting your hard-earned money is paramount. A reputable options trading app employs state-of-the-art security measures, including two-factor authentication, encryption, and regular security audits. This ensures your personal and financial information remains safe and secure. Think of it as a high-security vault protecting your investments, shielding them from cyber threats and unauthorized access. Compromised security is a nightmare scenario, like discovering a moose has decided your backyard is the perfect place for a nap.

Hypothetical Options Trading App: “MapleLeaf Markets”

MapleLeaf Markets boasts a sleek, minimalist design with a predominantly red and white colour scheme (naturally!). The dashboard displays key information such as account balance, open positions, and market news in a clear, concise manner. Interactive charts are highly customizable, allowing users to add various indicators and drawing tools. Order placement is streamlined, with a simple, intuitive interface for selecting options contracts and specifying order parameters.

A built-in options strategy builder helps users construct complex trades, while a risk management tool calculates potential profits and losses. A comprehensive educational section offers tutorials, articles, and webinars on various options strategies, and customer support is available 24/7 via live chat, email, and phone.

Picking the best day trading app for options in Canada? It’s a tough call, like predicting the next winning touchdown! Need a break from the market’s rollercoaster? Check out the latest football news for a dose of exhilarating action. Then, get back to conquering those options trades – you’ve got this!

User Experience in MapleLeaf Markets

* Navigation: Intuitive menu structure and easily accessible tools. A search function allows users to quickly find specific features.

Order Placement

Streamlined process with clear order entry forms and real-time order status updates.

Account Management

Secure and user-friendly interface for managing account details, funding, and withdrawals. Detailed transaction history readily available.

Educational Resources

Comprehensive library of tutorials, articles, and webinars covering various options strategies and risk management techniques.

Customer Support

Prompt and helpful customer support available via live chat, email, and phone.

Factors Influencing App Selection: Best Day Trading App For Options Trading In Canada?

Choosing the perfect options trading app in Canada is like picking the perfect poutine – you need the right cheese curds (features), gravy (account type), and fries (trading style) to satisfy your cravings. The best app for you depends heavily on your individual circumstances and trading preferences. Let’s dive into the factors that will shape your decision.Selecting the right options trading app requires careful consideration of several key factors.

Ignoring these could lead to a trading experience that’s less than ideal, potentially costing you more than just a few fries.

Account Type Influences, Best day trading app for options trading in Canada?

The type of brokerage account you choose significantly impacts the app you’ll want to use. Margin accounts, allowing you to borrow money to amplify your trades, often require more sophisticated platforms with advanced risk management tools. Cash accounts, on the other hand, where you only trade with available funds, may benefit from simpler, more user-friendly interfaces. A complex platform might feel overwhelming if you’re simply trading with your savings.

Think of it like this: a Formula 1 race car is great if you know how to handle it, but it’s not ideal for a beginner driver.

Trading Experience and App Complexity

Your experience level is a crucial factor. A seasoned options trader might appreciate the granular control and advanced charting features offered by professional-grade platforms. These platforms often come with a steeper learning curve. However, a beginner might find such a platform intimidating and confusing. A simple, intuitive app with clear explanations and educational resources would be a much better fit for a newbie.

It’s like learning to cook: you wouldn’t start with a Michelin-star recipe if you’ve never used a whisk before.

Trading Style and App Features

Different trading styles require different tools. Scalpers, who execute trades rapidly, need platforms with incredibly fast execution speeds and real-time data feeds. They’d be frustrated by slow loading times or delayed information. Swing traders, who hold positions for longer periods, might prioritize charting tools and technical analysis features over blazing-fast execution. Imagine a marathon runner needing speed, versus a weightlifter needing strength – each requires different tools for success.

For example, an app with robust charting capabilities and backtesting features would be ideal for a swing trader, while an app with advanced order types and low latency is perfect for a scalper.

Security and Reliability Considerations

Choosing the right options trading app in Canada isn’t just about snazzy charts and intuitive interfaces; it’s about safeguarding your hard-earned cash. Security and reliability are paramount, and understanding the measures taken by different platforms is crucial before entrusting them with your investments. Think of it like choosing a bank – you wouldn’t just walk into any building and hand over your life savings, would you?Security measures implemented by reputable options trading apps in Canada prioritize the protection of user data and funds through a multi-layered approach.

This typically involves robust encryption protocols, stringent authentication procedures, and regular security audits to identify and address vulnerabilities before they can be exploited by malicious actors. The level of security offered can vary significantly between platforms, so careful comparison is essential.

Data Encryption and Two-Factor Authentication

Data encryption is the cornerstone of online security. Reputable options trading apps utilize robust encryption methods, such as AES-256, to scramble sensitive data like account details, transaction history, and personal information, making it unreadable to unauthorized individuals. Think of it as a secret code that only the app and your device can understand. Two-factor authentication (2FA) adds an extra layer of security by requiring a second verification method, such as a one-time code sent to your phone or email, in addition to your password.

Hunting for the best day trading app for options in Canada? Finding the right platform is crucial, especially when dealing with the thrill (and potential heartbreak!) of options. But before you dive into apps, consider your brokerage – a solid foundation is key. Check out this guide on the Best Canadian stock brokerage for active day trading.

to make sure your chosen app integrates seamlessly. Then, armed with this knowledge, you can conquer the Canadian options market (or at least, give it a good try!).

This significantly reduces the risk of unauthorized access, even if your password is compromised. Imagine it as a double lock on your digital vault – even if someone gets past the first lock (your password), they still need the key to the second (your 2FA code).

Security Feature Comparison of Three Platforms

Let’s compare the security features of three hypothetical (but representative) Canadian options trading apps: “MapleTrade,” “BeaverBrokers,” and “CaribouCapital.” Note that specific features may vary and it is crucial to check the latest information directly with each platform.

Finding the best day trading app for options trading in Canada? It’s a wild west out there! But if you’re feeling adventurous and want to diversify beyond just options, check out the amazing options available on this platform for both stocks AND cryptocurrencies: Best day trading platform for both stocks and cryptocurrencies. Then, armed with that broader perspective, you can return to your Canadian options trading quest with a more informed, and hopefully, profitable approach!

| Feature | MapleTrade | BeaverBrokers | CaribouCapital |

|---|---|---|---|

| Data Encryption | AES-256 encryption for all data in transit and at rest | AES-256 encryption for data in transit; AES-128 for data at rest | Claims AES-256 encryption, but lacks detailed transparency |

| Two-Factor Authentication (2FA) | Offers 2FA via authenticator app, SMS, and email | Offers 2FA via authenticator app and email | Offers 2FA via SMS only |

| Regular Security Audits | Announces regular penetration testing and vulnerability assessments | Mentions security audits without specifying frequency or methodology | No public information on security audits |

As you can see, “MapleTrade” demonstrates a more comprehensive and transparent approach to security compared to the other two. “BeaverBrokers” provides decent security, but lacks the same level of detail. “CaribouCapital” falls short in terms of transparency and the range of 2FA options.

Assessing App Reliability and Trustworthiness

Assessing the reliability and trustworthiness of an options trading app involves a multifaceted approach. Look for platforms that are regulated by the appropriate Canadian authorities (like the Investment Industry Regulatory Organization of Canada – IIROC). Read independent reviews and user testimonials to gauge the experiences of other traders. Check for evidence of robust customer support channels, readily available contact information, and a clear dispute resolution process.

A reliable app will be transparent about its security practices and readily address any concerns you may have. Avoid apps with vague or unclear security policies, limited customer support, or overwhelmingly negative reviews. Remember, your peace of mind is as valuable as your investments.

Educational Resources and Support

Navigating the world of options trading can feel like trying to decipher ancient hieroglyphs – unless you have the right tools and knowledge. Luckily, many Canadian options trading apps go beyond simply providing a platform; they offer a surprising amount of educational support, ranging from beginner-friendly tutorials to advanced webinars. Choosing an app with robust educational resources can significantly impact your success and, more importantly, your sanity.Learning about options trading doesn’t have to be a painful experience.

Many platforms understand that throwing newbies into the deep end is a recipe for disaster (and potentially empty bank accounts). They provide various educational materials designed to build confidence and competence, helping you avoid costly mistakes. The quality and depth of these resources, however, vary significantly. Let’s delve into what’s on offer.

Types of Educational Materials Offered by Options Trading Apps

Different apps utilize various methods to educate their users. Some offer bite-sized tutorials perfect for quick learning sessions, while others provide in-depth webinars covering complex strategies. Many platforms also feature simulated trading environments, allowing you to practice without risking real capital. Think of it as a risk-free training ground where you can hone your skills before entering the real arena.

This is invaluable for understanding how options contracts behave in different market conditions. Some apps even incorporate interactive lessons or quizzes to reinforce learning and track your progress. It’s like having a personal options trading tutor at your fingertips.

Comparison of Educational Resources Across Platforms

The availability and quality of educational resources significantly differentiate various options trading apps in Canada. While some offer a bare minimum, others provide comprehensive learning pathways, akin to a complete options trading MBA. This comparison focuses on three hypothetical platforms, illustrating the spectrum of educational offerings.

| Platform Name | Educational Resources | Quality Assessment |

|---|---|---|

| TradeSmart Pro | Basic tutorials, glossary of terms, FAQs. Limited webinar offerings. No simulated trading environment. | Beginner-friendly but lacks depth. Suitable for those already possessing some basic market knowledge. |

| OptionGalaxy | Comprehensive video tutorials, regular webinars on advanced strategies, interactive lessons, simulated trading environment with realistic market data. | Excellent resource for both beginners and experienced traders. The simulated trading environment is a particularly strong feature. |

| QuickTrade Options | Short video tutorials, a few webinars focusing on introductory concepts. No simulated trading environment. Limited interactive elements. | Adequate for very basic understanding, but lacks the depth and practice opportunities to truly master options trading. |

Illustrative Example

Let’s follow the intrepid journey of Brenda, a Canadian options trader with a penchant for maple syrup and meticulously planned trades. Brenda uses the fictional, but highly advanced, “MapleLeafTrader” app for all her options dealings. This app, we’ll imagine, boasts a sleek interface and powerful analytical tools.

Brenda’s Trade on MapleLeafTrader

Brenda, eyeing the recent surge in popularity of artisanal cheese curds, decides to speculate on the future price of “CurdCo,” a publicly traded cheese curd conglomerate. She believes the price will rise significantly in the next month. Using MapleLeafTrader’s advanced charting tools, she studies CurdCo’s stock price history, noticing a clear upward trend. The app’s intuitive interface displays a vibrant, interactive candlestick chart, complete with volume indicators, moving averages, and various technical analysis overlays that Brenda can customize with a few taps.

The chart, rendered in shades of creamy yellow and deep cheddar orange, is a visual feast for any data-loving cheese enthusiast.

Order Placement and Execution

Brenda decides to purchase a call option on CurdCo. She uses the app’s intuitive order entry form, which is clean and uncluttered. The form allows her to specify the strike price, expiration date, and number of contracts. The app provides real-time pricing and shows her the premium cost per contract. MapleLeafTrader also offers various order types, including market orders, limit orders, and stop-loss orders.

Brenda chooses a limit order, ensuring she doesn’t pay more than her target price. With a confident tap, she submits the order. The app instantly confirms the order and displays it in her open orders section. The order ticket, nestled neatly within the main interface, showcases the order details in crisp, easy-to-read font, against a background of subtly swirling cheese curd patterns.

Monitoring and Managing the Trade

The app’s watchlist feature, which Brenda has populated with CurdCo and other stocks, shows real-time price updates. Brenda also uses the app’s built-in news feed to stay abreast of any market-moving news about CurdCo. The account information display, a neatly organized panel on the right-hand side of the screen, displays her current portfolio value, available cash, and pending orders.

The display is designed with a calming palette of greens and browns, preventing eye strain even during hours of intense trading. As the price of CurdCo’s stock rises, Brenda watches her option’s value increase on the chart. The app provides real-time profit/loss calculations, keeping her informed of her potential gains. Should the price move against her, she can easily adjust her position using the app’s sophisticated order management tools.

App Visual Elements

The MapleLeafTrader app boasts a user-friendly interface. The main screen displays a customizable dashboard showing real-time stock quotes, charts, and news headlines. The charts are interactive and highly customizable, allowing users to add various technical indicators. The order ticket is straightforward, with clear fields for entering trade details. Account information, such as cash balance, open positions, and pending orders, is prominently displayed in a dedicated panel.

The overall color scheme is calming yet engaging, with subtle animations to enhance the user experience. The entire interface is designed for speed and efficiency, allowing Brenda to react quickly to changing market conditions. It is a visual testament to the power of combining sophisticated functionality with an intuitive and visually appealing design.

End of Discussion

So, there you have it! Finding the best day trading app for options in Canada isn’t about finding the

-one* perfect app, but finding the

-one* perfect app

-for you*. Consider your trading style, risk tolerance, and experience level when making your choice. Remember, thorough research and a dash of healthy skepticism are your best allies in this exciting – and sometimes chaotic – world of options trading.

Now go forth and conquer (the market, that is!).