Best day trading platform for both stocks and cryptocurrencies. – Best day trading platform for both stocks and cryptocurrencies? Ah, the holy grail of modern finance! Imagine, effortlessly flitting between the wild west of crypto and the established order of stocks, all from one sleek, user-friendly platform. This isn’t some get-rich-quick scheme whispered in smoky backrooms; it’s about finding the right tools to navigate the thrilling, often chaotic, world of day trading.

We’re diving deep into the features, fees, security, and overall user experience of top contenders, separating the digital wheat from the chaff (and maybe uncovering a few surprisingly delicious chaffs along the way).

This exploration will cover everything from intuitive interfaces and lightning-fast order execution to the crucial aspects of security and regulatory compliance. We’ll analyze fee structures, compare charting tools, and even delve into the often-overlooked world of mobile app functionality. Because let’s be honest, who wants to be chained to their desktop while the market’s moving faster than a caffeinated squirrel?

Platform Features Comparison

Choosing the right day trading platform is like picking the perfect superhero sidekick – you need someone reliable, powerful, and ideally, someone who doesn’t constantly spill their coffee all over your keyboard. This comparison dives into the strengths and weaknesses of several popular platforms, helping you find your perfect trading partner. Remember, the “best” platform is subjective and depends on your individual needs and trading style.

Platform Feature Comparison Table

This table summarizes key features of five popular day trading platforms. Remember, these features can change, so always check the platform’s website for the most up-to-date information. The ratings are subjective and based on a combination of user reviews and expert opinions.

| Platform Name | Stock Trading Features | Cryptocurrency Trading Features | Overall Rating |

|---|---|---|---|

| TradeStation | Advanced charting tools, excellent order routing, margin accounts, options trading, extensive research tools. | Limited cryptocurrency offerings; may require a separate account. | ★★★★☆ |

| Interactive Brokers | Global access to markets, low commissions, wide range of order types, sophisticated trading tools. | Offers a good selection of cryptocurrencies, integrated with stock trading platform. | ★★★★★ |

| Webull | Fractional shares, commission-free trading (with some limitations), user-friendly interface, educational resources. | Growing selection of cryptocurrencies, easy-to-use interface, commission structure varies. | ★★★☆☆ |

| TD Ameritrade | Robust research tools, educational resources, excellent customer support, various account types. | Limited cryptocurrency offerings, may require a separate account. | ★★★★☆ |

| Kraken | Limited stock trading options, mostly focused on cryptocurrency. | Wide range of cryptocurrencies, advanced charting tools, margin trading, staking options. | ★★★★☆ |

User Interface and Experience

Navigating a day trading platform should feel like driving a well-tuned sports car – smooth, responsive, and exhilarating (hopefully without the crashes!). TradeStation and Interactive Brokers, while offering powerful features, can have steeper learning curves. Webull, on the other hand, prioritizes a user-friendly interface, making it ideal for beginners. TD Ameritrade strikes a balance, offering a good blend of functionality and ease of use.

Kraken, being primarily a cryptocurrency exchange, has a slightly different interface optimized for digital asset trading. Order execution speed varies across platforms; Interactive Brokers and TradeStation are generally known for their speed and reliability.

Finding the best day trading platform for both stocks and cryptocurrencies can be a real rollercoaster, like trying to predict the next winning goal! Need a break from the market madness? Check out the latest football news for some much-needed excitement. Then, refocus: back to conquering those charts and maximizing your profits with the right trading platform – because even the best strikers need a solid game plan.

Charting and Analytical Tools

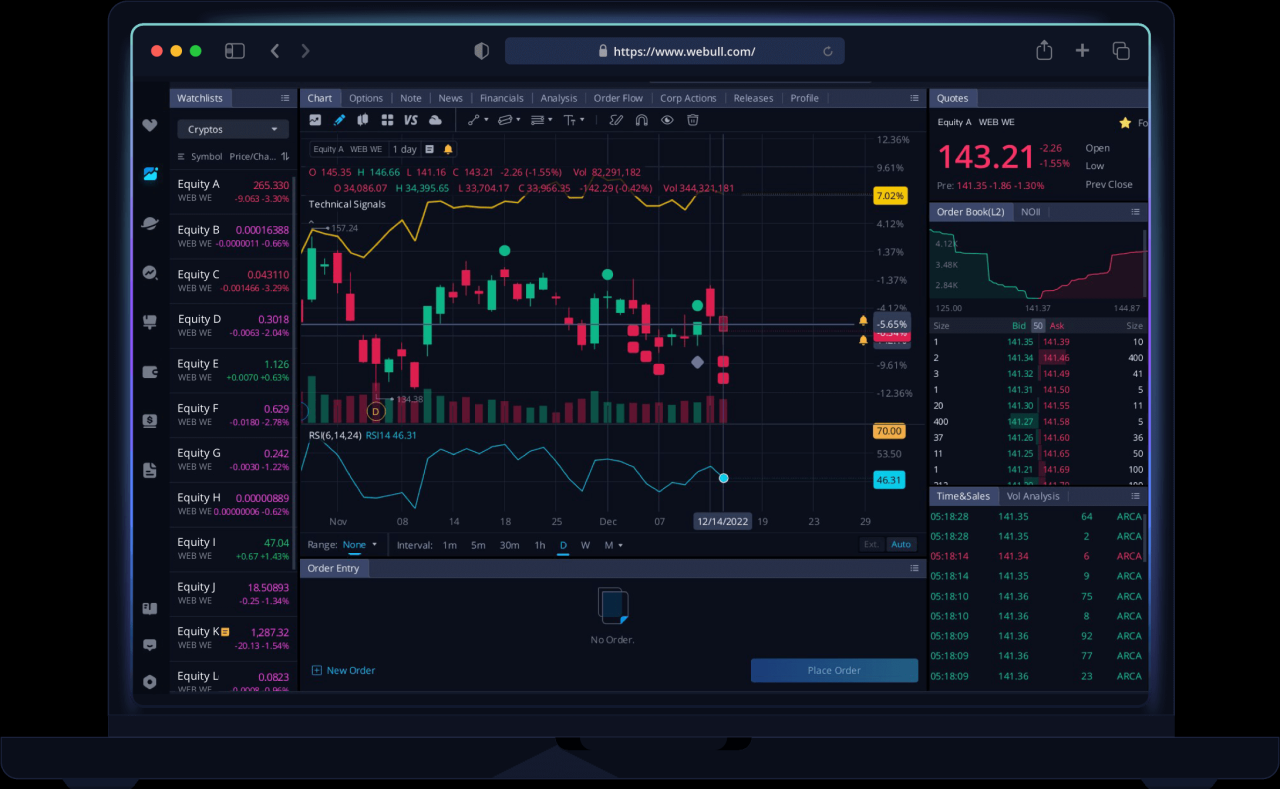

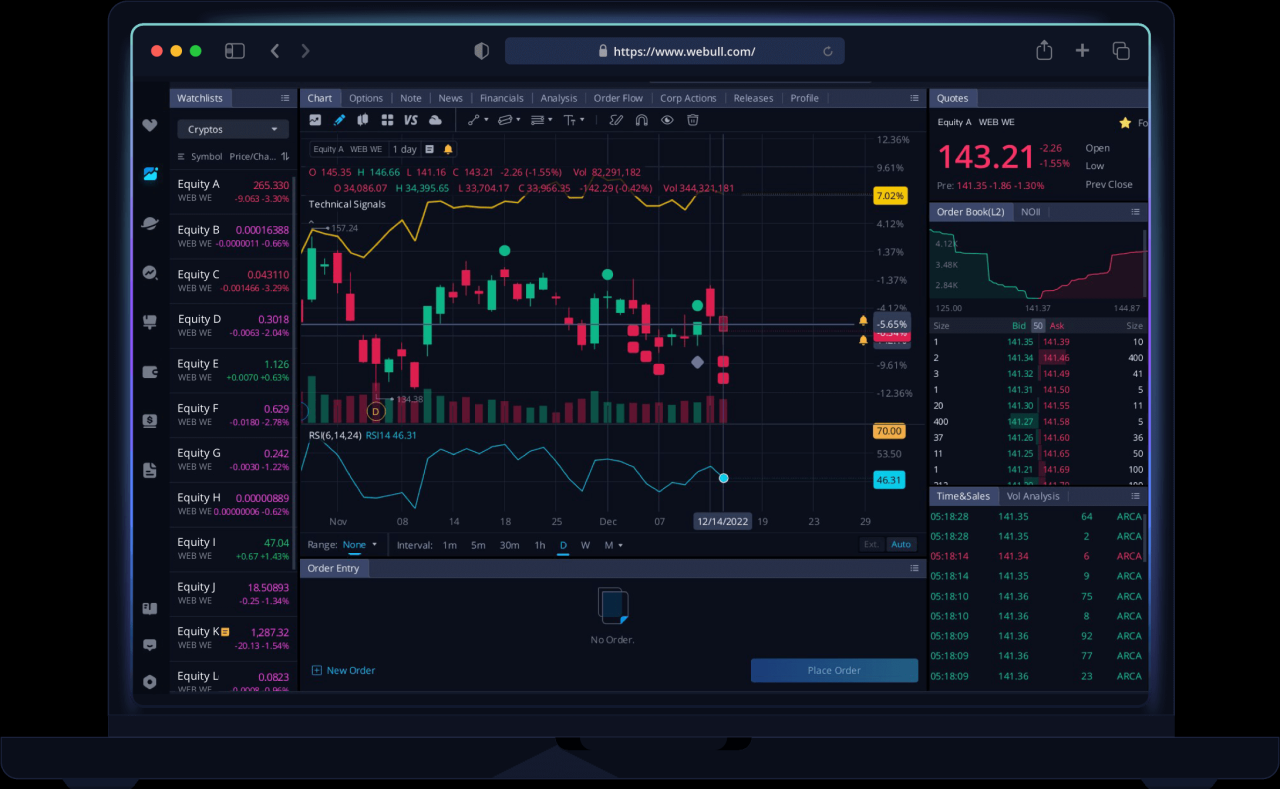

The charting and analytical tools are your X-ray vision into the market. TradeStation and Interactive Brokers are powerhouses in this area, offering a vast array of indicators, drawing tools, and customizable chart types for both stocks and cryptocurrencies (where available). Webull provides a solid, if less extensive, selection of tools, suitable for most day traders. TD Ameritrade offers a good balance of functionality and ease of use, while Kraken excels in charting tools specifically tailored for the cryptocurrency market.

The ability to overlay technical indicators and conduct backtesting is a key differentiator. For example, identifying a reliable head-and-shoulders pattern on a candlestick chart could be the difference between a profitable trade and a painful loss.

Fees and Commissions Analysis

Navigating the world of day trading fees can feel like traversing a minefield of hidden charges and confusing jargon. Understanding these costs is crucial, as even seemingly small fees can significantly impact your bottom line, especially with the high volume of trades typical of day trading. This section dissects the fee structures of various popular platforms for both stocks and cryptocurrencies, helping you choose the platform that best suits your trading style and budget.

Stock Trading Fees

The fees associated with stock trading vary significantly across platforms. Some platforms opt for a simple per-trade fee, while others employ a more complex tiered system based on trade volume or account size. Hidden fees, such as inactivity fees or data fees, can also significantly add to your expenses. It’s essential to thoroughly review each platform’s fee schedule before committing.

Finding the best day trading platform for both stocks and cryptocurrencies is a quest worthy of a seasoned adventurer! You need a platform that’s fast, reliable, and won’t bleed your profits dry with hefty fees. For Canadians seeking that sweet spot, check out this list of Reliable day trading platforms with low commissions in Canada. to ensure your hard-earned loonies aren’t disappearing faster than a bitcoin on a bull run.

Then, armed with this knowledge, you can conquer the world of day trading – one profitable trade at a time!

- Platform A: Charges a flat fee of $5 per trade, regardless of volume. No hidden fees.

- Platform B: Offers a tiered system. Trades under $1000 cost $7, while trades above $1000 cost $5. A $10 monthly inactivity fee applies if no trades are made.

- Platform C: Charges a percentage-based commission of 0.1% per trade, with a minimum fee of $2. No inactivity fees, but a $25 annual data fee.

Cryptocurrency Trading Fees

Cryptocurrency trading platforms often utilize a maker-taker fee structure, where fees vary depending on whether you are adding liquidity (maker) or taking liquidity (taker). This structure incentivizes users to add liquidity to the market. Beyond maker-taker fees, some platforms also charge withdrawal fees for transferring cryptocurrency to external wallets. The fees can fluctuate based on the cryptocurrency traded and the network congestion.

- Platform A: Maker fee: 0.1%, Taker fee: 0.2%. Withdrawal fees vary depending on the cryptocurrency.

- Platform B: Maker fee: 0.05%, Taker fee: 0.15%. A flat withdrawal fee of $1 is charged for all cryptocurrencies.

- Platform C: Maker fee: 0.0%, Taker fee: 0.25%. No withdrawal fees for Bitcoin, but other cryptocurrencies incur varying withdrawal fees.

Comparative Fee Analysis and Impact on Profitability, Best day trading platform for both stocks and cryptocurrencies.

Comparing fee structures across platforms reveals significant differences in cost. For example, a day trader executing 100 trades per day at an average of $1000 per trade would pay substantially more on Platform B’s tiered system compared to Platform A’s flat fee, even though the per-trade cost may seem comparable at times. The cumulative impact of these fees on profitability can be substantial.

Finding the best day trading platform for both stocks and cryptocurrencies is a quest worthy of a seasoned adventurer! But if your sights are set solely on the volatile world of digital assets, you’ll want to check out this guide on Which platform is best for day trading cryptocurrency in Canada? to avoid any digital disasters.

Then, armed with that knowledge, you can conquer the combined stock and crypto markets like a financial ninja!

A seemingly small difference in fees per trade can translate to thousands of dollars lost annually for active day traders. Therefore, meticulous analysis of fee structures is crucial for maximizing profitability.

Choosing the right platform can mean the difference between a profitable trading year and a significant loss. Even small savings on fees add up over time.

Security and Regulation: Best Day Trading Platform For Both Stocks And Cryptocurrencies.

Choosing a day trading platform involves more than just speed and low fees; your hard-earned money needs a fortress, not a flimsy shack! Security and regulatory compliance are paramount when entrusting your assets to a platform, and understanding the differences can save you from a digital mugging. This section delves into the security measures and regulatory frameworks of various platforms to help you make an informed decision.

Protecting your funds and personal information is a top priority for any reputable trading platform. This is achieved through a multi-layered approach combining robust technology and adherence to strict regulatory guidelines. Let’s explore the specifics.

Security Measures Implemented by Trading Platforms

A robust security posture involves a combination of technological safeguards and proactive security practices. These measures are designed to deter, detect, and respond to potential threats, protecting both user funds and sensitive data.

For example, many platforms utilize advanced encryption techniques like AES-256 to protect data both in transit and at rest. This encryption makes it incredibly difficult for unauthorized individuals to access your information, even if they were to gain access to the platform’s servers. Furthermore, multi-factor authentication (MFA) adds an extra layer of security, requiring more than just a password to access your account.

Finding the best day trading platform for both stocks and cryptocurrencies can feel like searching for the Holy Grail of finance! But before you embark on your quest for riches, consider your location; if you’re in Canada and new to this wild ride, checking out What are the best day trading platforms in Canada for beginners? is a smart move.

Then, armed with Canadian beginner knowledge, you can conquer the world of stocks and cryptos with confidence (and maybe even a unicorn or two!).

Think of it as a digital bouncer, making it much harder for hackers to get past the velvet rope. Robust firewall systems and intrusion detection systems constantly monitor for suspicious activity, acting as vigilant guards, ready to thwart any attempted breaches.

Regulatory Compliance and Licenses

The regulatory landscape for trading platforms varies considerably depending on the jurisdiction. Understanding a platform’s regulatory compliance is crucial for ensuring the safety of your investments. This section explores the regulatory bodies and licenses that platforms are required to obtain and maintain.

Compliance with regulations such as those set forth by the Securities and Exchange Commission (SEC) in the United States or the Financial Conduct Authority (FCA) in the United Kingdom demonstrates a commitment to transparency, accountability, and fair trading practices. Platforms adhering to these standards often undergo regular audits and inspections, ensuring ongoing compliance and adherence to best practices. The presence of these licenses and registrations acts as a seal of approval, providing users with an added layer of confidence in the platform’s trustworthiness.

Comparison of Security Features

A direct comparison of security features across different platforms highlights the nuances and variations in their security postures. This allows investors to make informed decisions based on their individual risk tolerance and security preferences.

| Platform | Two-Factor Authentication | Encryption | Fraud Prevention Measures | Regulatory Compliance |

|---|---|---|---|---|

| Platform A | Yes, multiple options available | AES-256 encryption | Real-time transaction monitoring, behavioral biometrics | SEC registered broker-dealer |

| Platform B | Yes, SMS and authenticator app | AES-256 encryption, SSL/TLS | Suspicious activity alerts, account lockout after multiple failed login attempts | FCA authorized and regulated |

| Platform C | Yes, but only SMS | AES-128 encryption | Basic fraud detection systems | Registered with a less stringent regulatory body |

Note: The above table is a hypothetical example and does not reflect the actual security features of any specific platform. Always verify the security measures directly with the platform before investing.

Trading Tools and Resources

Choosing the right platform hinges not just on fees, but on the arsenal of tools and resources available to help you navigate the sometimes-treacherous waters of stock and crypto trading. A platform that’s easy to use is great, but one that equips you with the right tools to make informed decisions is even better – think of it as the difference between a fishing rod and a fully-equipped charter boat.The availability of sophisticated order types, access to real-time market data, and robust educational resources can significantly impact your trading success.

Let’s dive into how different platforms stack up in this crucial area.

Finding the best day trading platform for both stocks and cryptos is a quest worthy of a seasoned adventurer! But before you conquer the digital markets, you need to know your terrain. To help you choose wisely, consider checking out this handy guide on What are the best stocks for day trading on the TSX in November 2024?

, which will give you a solid foundation for your stock picking prowess before you unleash your trading fury on any platform. Then, and only then, can you choose the best platform to execute your brilliant strategies!

Advanced Order Types

Advanced order types are your secret weapons in the trading world, allowing you to fine-tune your strategies and manage risk more effectively. Imagine them as specialized tools in a mechanic’s toolbox, each designed for a specific task. Stop-loss orders, for example, automatically sell your assets when they reach a predetermined price, limiting potential losses. Limit orders, on the other hand, let you buy or sell only when the price hits your specified target.

The best platforms offer a full suite of these, ensuring you have the right tool for every market condition, covering both stocks and cryptocurrencies seamlessly. Platforms that lack these features are like trying to build a house with only a hammer – you might get it done, but it’ll be a lot harder and less efficient.

Real-Time Market Data and News Feeds

Real-time data is the lifeblood of successful trading. It’s the difference between reacting to yesterday’s news and capitalizing on today’s opportunities. Imagine trying to navigate a busy highway blindfolded – that’s what trading without real-time data feels like. The best platforms provide up-to-the-second information on price movements, volume, and other crucial market indicators. Furthermore, access to reliable news feeds, integrated directly into the platform, allows you to stay informed about events that could impact your investments.

Think of it as having a dedicated news team whispering updates directly into your ear, keeping you ahead of the curve. Delayed data, on the other hand, is like driving with a rearview mirror – you’re constantly looking in the past, not where you’re going.

Educational Resources and Customer Support

The importance of readily available educational resources and responsive customer support cannot be overstated, especially for newer traders. Think of it like learning to drive – you wouldn’t jump into a Formula 1 car without some lessons first. A good platform will provide tutorials, webinars, and other learning materials to help you build your trading skills. Exceptional customer support, available through multiple channels (phone, email, chat), ensures that you can get help when you need it.

A platform that lacks in these areas is like trying to assemble IKEA furniture without instructions – it might be possible, but it will likely be a frustrating experience.

- Platform A: Offers extensive video tutorials, webinars, and a comprehensive FAQ section. Customer support is available 24/7 via phone, email, and live chat.

- Platform B: Provides a basic help center with articles and FAQs. Customer support is available via email only, with limited hours.

- Platform C: Offers a blog with market analysis and trading tips, but lacks dedicated educational resources. Customer support is available through a ticketing system with slow response times.

Mobile App Functionality

Trading on the go is no longer a luxury; it’s a necessity for the modern, always-on investor. A clunky, frustrating mobile app can turn a potentially profitable trade into a hair-pulling ordeal. Let’s dive into how the leading platforms stack up in the mobile arena, because nobody wants to miss a winning trade because their app decided to take an unscheduled nap.The mobile app experience should seamlessly mirror the desktop platform’s functionality, offering a streamlined yet powerful trading environment.

Ideally, you should be able to execute trades, monitor your portfolio, and access real-time data with the same speed and efficiency as you would on your computer. However, the reality is often a bit more nuanced, with some apps excelling where others stumble. Let’s see who’s leading the mobile charge and who needs to hit the gym (the app development gym, that is).

Mobile App Feature Comparison

The following table compares the mobile app functionality of several popular platforms. Ease of use is rated on a scale of 1 to 5 stars, with 5 stars representing the smoothest, most intuitive experience. Remember, these ratings are subjective and based on general user feedback and reviews. Your personal experience may vary depending on your tech savviness and individual preferences.

Finding the best day trading platform for both stocks and cryptocurrencies is a quest worthy of a seasoned treasure hunter! But if you’re a Canadian eagle eyeing those lucrative markets, you’ll need the right tools. That’s where the question of Which Canadian brokerage offers the best day trading tools? becomes crucial. Once you’ve got your Canadian brokerage sorted, you’ll be well on your way to conquering the world of stocks and crypto trading, one lightning-fast trade at a time!

| Platform Name | Ease of Use Rating | Key Features | Notable Limitations |

|---|---|---|---|

| Platform A | ⭐⭐⭐⭐ | Intuitive interface, quick order placement, real-time charts, portfolio tracking, alerts, multiple account support. | Limited customization options for chart layouts, occasional lag during peak trading hours. |

| Platform B | ⭐⭐⭐ | Real-time data, order placement, basic charting tools, portfolio overview. | Clunky interface, slow loading times, limited order types, lack of advanced charting features. Navigating between screens can feel cumbersome. |

| Platform C | ⭐⭐⭐⭐½ | Excellent charting capabilities, customizable dashboards, advanced order types, robust security features, fingerprint login. Seamless integration with desktop platform. | Slightly steeper learning curve than some competitors, some users report occasional glitches with notifications. |

| Platform D | ⭐⭐⭐½ | User-friendly interface, fast order execution, good real-time data. | Limited charting tools, lacks advanced order types. The mobile app feels somewhat stripped down compared to the desktop version. |

Desktop vs. Mobile User Experience

While many platforms strive for parity between their desktop and mobile offerings, differences often exist. Desktop platforms generally boast more advanced charting tools, a wider array of order types, and more comprehensive analytical resources. Think of the desktop version as the heavyweight champion, while the mobile app is the agile contender. The mobile app often prioritizes speed and ease of execution for quick trades, sacrificing some of the depth and complexity of the desktop experience.

For instance, drawing complex trend lines or using advanced technical indicators might be easier on a larger desktop screen. However, a well-designed mobile app can still provide access to the core functionalities needed for effective trading on the go. The key is finding a balance between functionality and usability tailored to the smaller screen size and touch-based interaction.

Some platforms excel at this, while others clearly need some work.

Customer Support and Reviews

Navigating the often-turbulent waters of the stock and crypto markets requires a reliable life raft – and in this case, that life raft is excellent customer support. A responsive and helpful support team can be the difference between a smooth trading experience and a complete shipwreck. Let’s dive into the reviews and support channels offered by various platforms, examining how well they handle the inevitable bumps in the road.Customer support is a critical factor when choosing a trading platform.

A platform with poor customer support can leave you stranded when you need help the most, leading to frustration and potential financial losses. Conversely, a platform with excellent customer support can provide peace of mind and assist you in resolving issues quickly and efficiently. We’ll analyze both the quantitative (ratings and reviews) and qualitative (support channels and responsiveness) aspects of customer support for various platforms.

Customer Review Summary

To get a comprehensive picture, we’ve compiled a summary of customer reviews and ratings from various reputable sources, including Trustpilot, App Store reviews, and Google Play reviews. Bear in mind that individual experiences can vary widely, and these represent aggregated opinions.

- Platform A: Generally positive reviews, praising the platform’s intuitive interface and responsive customer support via email and live chat. However, some users reported longer wait times during peak hours. Average rating: 4.2 out of 5 stars.

- Platform B: Mixed reviews, with some users highlighting the platform’s extensive educational resources but criticizing the slow response times of their email support. Live chat support was generally praised for its quick responses. Average rating: 3.8 out of 5 stars.

- Platform C: Mostly negative reviews, citing difficulties contacting customer support and long resolution times for issues. Phone support was reported as unhelpful and often unavailable. Average rating: 2.9 out of 5 stars.

Customer Support Channels

The availability of various support channels is crucial for accessibility and convenience. Different users prefer different methods of contact, so a diverse range of options is essential.

- Platform A: Offers 24/7 live chat, email support, and a comprehensive FAQ section. Phone support is available during business hours.

- Platform B: Provides email support, live chat (limited hours), and a detailed knowledge base. Phone support is not available.

- Platform C: Primarily relies on email support, with a limited FAQ section. Phone support is advertised but rarely available, according to user reports.

Customer Support Responsiveness and Helpfulness

The speed and effectiveness of support are just as important as the availability of channels. A quick response is vital when dealing with urgent issues, such as account security breaches or technical glitches.

Platform A consistently demonstrates superior responsiveness across all channels, with live chat resolving most issues within minutes. Email support typically responds within 24 hours. Platform B’s live chat is helpful when available, but email responses can be slow, sometimes taking several days. Platform C’s support is consistently criticized for slow response times and unhelpful interactions, leaving users frustrated and unresolved issues.

Ultimate Conclusion

So, there you have it – a whirlwind tour through the best day trading platforms for both stocks and cryptocurrencies. While the “best” platform ultimately depends on your individual needs and trading style (and maybe your astrological sign, we’re not judging), we hope this guide has armed you with the knowledge to make an informed decision. Remember, responsible day trading is key – treat your financial endeavors with the same care you’d give your pet unicorn (or, you know, a less mythical, more financially stable pet).

Happy trading!