Best forex trading signals for Canadian traders using Questrade: Think of your forex trading as a high-stakes game of poker, but instead of chips, you’re playing with loonies and toonies (and hopefully, winning big!). This guide is your cheat sheet to navigating the exciting – and sometimes terrifying – world of forex trading in Canada, specifically using Questrade’s platform.

We’ll unravel the mysteries of trading signals, help you avoid costly blunders (like accidentally betting your house on a single hand), and equip you with the knowledge to confidently trade your way to potential riches. Buckle up, buttercup, it’s going to be a wild ride!

We’ll delve into the specifics of Questrade’s platform, comparing it to other Canadian brokers, and explore various forex signal types – from the automated robots tirelessly crunching numbers to the insightful wisdom of human analysts. We’ll also cover crucial risk management strategies (because even the best poker players know when to fold), regulatory compliance (the rules of the game), and the tax implications of your forex wins (because Uncle Sam – or rather, the CRA – always wants their cut).

By the end, you’ll be equipped to make informed decisions and potentially turn your forex trading dreams into a profitable reality.

Questrade’s Forex Trading Platform Features Relevant to Canadian Traders

Questrade, a popular Canadian brokerage, offers a forex trading platform packed with features designed to appeal to the savvy Canadian trader. But does it truly deliver on its promises? Let’s delve into the specifics and see if it lives up to the hype. We’ll examine its platform features, compare its fees, and explore the educational resources available.

Questrade’s Forex Platform Features Beneficial to Canadian Traders

Questrade’s platform boasts several features beneficial to Canadian traders. For instance, its robust charting tools allow for in-depth technical analysis, crucial for navigating the often-volatile forex market. The platform also offers real-time quotes and market data, ensuring traders have access to the most up-to-date information to make informed decisions. Furthermore, its user-friendly interface, even for those new to forex, makes the platform accessible to a wide range of traders.

The ability to trade a diverse range of currency pairs, including those involving the Canadian dollar (CAD), is another significant advantage.

Comparison of Questrade’s Forex Trading Fees and Commissions with Other Major Canadian Brokers

Determining the most cost-effective broker requires a detailed comparison of fees. While Questrade generally offers competitive pricing, it’s crucial to compare its commission structure with other major Canadian brokers like Interactive Brokers and TD Direct Investing. For example, Questrade might have lower commissions on certain currency pairs but higher inactivity fees. Interactive Brokers, known for its advanced platform, may have higher commissions but offer more sophisticated trading tools.

TD Direct Investing, a more established player, may fall somewhere in between. It’s essential for Canadian traders to carefully weigh the cost of trading against the features and services offered by each platform to identify the best fit for their trading style and volume. A thorough review of fee schedules from each broker is strongly recommended.

Hunting for the best forex trading signals as a Canadian Questrade user? Before you dive headfirst into the wild world of currency trading, remember to hone your skills. Check out this handy guide: Can I use a practice account on Questrade to learn forex trading? to avoid becoming a statistic. Then, armed with practice account wisdom, you can confidently explore those top-notch forex signals and conquer the market (or at least, not lose your shirt!).

Educational Resources and Support Offered by Questrade for Forex Trading

Questrade provides a range of educational resources to support forex traders of all skill levels. These resources include webinars, tutorials, and market analysis reports. These resources help traders understand fundamental and technical analysis, risk management strategies, and other important aspects of successful forex trading. The availability of responsive customer support, accessible through various channels like phone, email, and online chat, is also a significant benefit.

Scoping out the best forex trading signals for Canadian Questrade users? Remember, savvy trading involves managing your currency too! Need to quickly swap some loonies for greenbacks? Check out this handy guide on How to convert 433 CAD to USD using Questrade’s forex services before diving into those lucrative signals. Then, armed with your USD and killer signals, you’ll be conquering the forex markets in no time!

However, the depth and comprehensiveness of these resources should be compared with offerings from other brokers before making a decision.

Comparison of Questrade, Interactive Brokers, and TD Direct Investing Forex Platforms

| Feature | Questrade | Interactive Brokers | TD Direct Investing |

|---|---|---|---|

| Commission Structure | Competitive, varies by currency pair | Generally higher, but potentially lower for high-volume traders | Mid-range, competitive for moderate trading volume |

| Platform User-Friendliness | User-friendly interface | Steeper learning curve, more advanced features | Relatively user-friendly, suitable for beginners and experienced traders |

| Educational Resources | Webinars, tutorials, market analysis | Extensive educational resources and research tools | Good range of educational materials and support |

| Currency Pair Selection | Wide range, including CAD pairs | Very wide range of currency pairs | Broad selection, including major and minor pairs with CAD |

Types of Forex Trading Signals Available

Navigating the world of forex trading signals can feel like venturing into a jungle teeming with exotic (and sometimes dangerous!) creatures. But fear not, fellow Canadian Questrade users! Understanding the different types of signals available can help you tame this wild market and potentially boost your profits. Let’s break down the key signal categories and their respective strengths and weaknesses.

Forex trading signals essentially provide buy or sell recommendations for currency pairs. They aim to predict future price movements, saving you the time and effort of conducting your own technical and fundamental analysis. However, remember that no signal is foolproof, and they should always be considered as just one piece of your overall trading strategy.

Automated Forex Trading Signals

Automated signals are generated by algorithms and software, often based on complex mathematical models and technical indicators. These signals are delivered automatically, typically through a trading platform or a dedicated signal service. The advantage is their speed and consistency; they react instantly to market changes without emotional bias. However, relying solely on automated signals can be risky.

The algorithms may not always adapt to unexpected market shifts, and there’s a potential for them to be over-optimized or based on outdated data. Furthermore, the quality of automated signals varies dramatically depending on the sophistication of the underlying algorithm. A poorly designed system can lead to significant losses.

Manual Forex Trading Signals

Manual signals, on the other hand, are generated by human analysts who interpret market data and make trading decisions based on their experience and expertise. These signals often incorporate a blend of technical and fundamental analysis, potentially providing a more nuanced perspective than automated systems. The advantage here is the human element: the ability to consider qualitative factors, react to breaking news, and adjust to unpredictable market events.

However, manual signals are slower to deliver, can be influenced by human biases, and their consistency can vary depending on the analyst’s skill and experience.

Subscription-Based Forex Trading Signals

Many providers offer forex trading signals on a subscription basis. This typically involves paying a recurring fee for access to signals, often including additional resources like educational materials or market analysis reports. The advantages are the potential for higher-quality signals and access to expert analysis. The provider usually has a proven track record (hopefully!), and the subscription model incentivizes them to maintain a high level of accuracy.

However, the cost can be significant, and the quality of signals can still vary widely. It’s crucial to thoroughly research any provider before subscribing.

Reputable Forex Signal Providers for Canadian Traders

Choosing a reputable provider is paramount. While I cannot endorse specific companies, a thorough due diligence process should include checking reviews, verifying the provider’s regulatory compliance in Canada (important!), and examining their track record. Look for transparent reporting of signal performance, including win rates and average profits/losses. Avoid providers making unrealistic promises of guaranteed profits; those are usually red flags.

Criteria for Evaluating Forex Signal Providers

Choosing a reliable forex signal provider requires careful consideration. Here’s a checklist:

Before you hand over your hard-earned Canadian dollars, ensure the provider meets these critical criteria:

- Transparency: Does the provider openly share its trading strategy and performance history? Beware of those who are secretive.

- Track Record: Review their past performance data, looking for consistent profitability over a significant period. Be wary of short-term success stories; they can be misleading.

- Regulatory Compliance: Is the provider registered and regulated by a reputable financial authority in Canada or another trusted jurisdiction? This is essential for your protection.

- Customer Support: Does the provider offer responsive and helpful customer support? This is vital if you encounter problems or have questions.

- Realistic Expectations: Does the provider make unrealistic claims about guaranteed profits or exceptionally high returns? Avoid providers making such promises.

Regulatory Compliance and Risk Management for Canadian Forex Traders: Best Forex Trading Signals For Canadian Traders Using Questrade

Navigating the world of forex trading in Canada requires a keen understanding of the regulatory landscape and, perhaps even more importantly, a robust risk management strategy. While the thrill of potential profits is enticing, ignoring the rules and failing to protect your capital can quickly turn a promising venture into a financial disaster. This section will delve into the regulatory framework protecting Canadian forex traders and the essential risk management techniques necessary for success when using Questrade’s platform.The regulatory environment governing forex trading in Canada is primarily overseen by the Investment Industry Regulatory Organization of Canada (IIROC) and provincial securities commissions.

Hunting for the best forex trading signals as a Canadian Questrade user? Before you jump in, you might want to ponder a crucial question: to Questrade or not to Questrade? Check out this comparison: Canadian Forex Limited vs Questrade: Which is better for forex trading? Knowing your platform is key to deciphering those elusive signals and making your loonie go further! So, choose wisely, eh?

Questrade, as a registered dealer, operates under this regulatory umbrella, providing a layer of protection for its clients. This means Questrade is subject to strict rules regarding client funds segregation, reporting requirements, and overall operational integrity. However, remember that regulation doesn’t eliminate risk; it simply aims to mitigate it and ensure fair practices. As a trader, you remain responsible for understanding and managing your own exposure.

So, you’re a Canadian trader conquering the forex markets with Questrade signals? Fantastic! But remember, even the sharpest minds need a strong body. Fuel your trading success with the best strength training program , building resilience to match your financial prowess. Then, armed with both mental and physical strength, return to those Questrade signals and dominate the forex game!

Regulatory Oversight and Client Protection

Canadian forex traders using Questrade benefit from the regulatory oversight provided by IIROC and provincial securities commissions. This framework mandates specific practices to protect investors, including the segregation of client funds from the brokerage’s operating capital. This means your money is held separately, reducing the risk of loss in case of Questrade’s financial difficulties. Furthermore, Questrade is required to adhere to strict reporting standards and undergo regular audits, providing an additional layer of transparency and accountability.

However, it’s crucial to remember that while regulation offers a safety net, it doesn’t guarantee profits or eliminate the inherent risks of forex trading.

Importance of Risk Management Strategies

Risk management isn’t just a good idea; it’s a necessity for survival in the forex market. Think of it as your financial life jacket – you might never need it, but when you do, you’ll be incredibly grateful to have it. Without a well-defined risk management plan, even the most accurate trading signals can lead to substantial losses.

Scoping out the best forex trading signals for Canadian Questrade users? Finding the right signals is only half the battle; first, you need a Questrade account! If you’re an international student, check out this handy guide on How to open a Questrade forex account for international students in Canada to get started. Then, armed with your account and killer signals, you’ll be conquering the forex markets in no time!

For Questrade users, this means implementing strategies that limit potential losses while allowing for calculated risk-taking. This includes understanding leverage, position sizing, and the crucial role of stop-loss orders.

Risk Management Techniques on Questrade’s Platform

Questrade’s platform offers tools that facilitate effective risk management. Stop-loss orders are paramount. These orders automatically close your position when the price reaches a predetermined level, limiting potential losses. For example, if you buy EUR/USD at 1.1000 and set a stop-loss at 1.0950, your position will automatically close if the price falls to that level, preventing further losses.

Position sizing is equally crucial. This involves determining the appropriate amount of capital to allocate to each trade, based on your risk tolerance and the potential volatility of the currency pair. A common approach is to risk no more than 1-2% of your trading capital on any single trade. Let’s say you have a $10,000 trading account and risk 1%; your maximum loss per trade should be $100.

Examples of Poor Risk Management Leading to Losses

Imagine a Canadian trader using Questrade, ignoring stop-loss orders and over-leveraging their account. They enter a trade with a significant amount of leverage, hoping for a quick, substantial profit. However, the market moves against them, and instead of using a stop-loss to limit losses, they hold onto the position, hoping for a reversal. The losses accumulate rapidly, quickly exceeding their initial capital and potentially leading to margin calls and account liquidation.

Another example could involve neglecting position sizing. A trader might invest a large percentage of their capital in a single high-risk trade, resulting in significant losses if the market moves unfavorably. These scenarios highlight the critical importance of adhering to a disciplined risk management plan.

Best Practices for Using Forex Trading Signals with Questrade

Harnessing the power of forex trading signals with Questrade can significantly boost your trading game, but only if you approach it strategically. Think of signals as helpful guides, not infallible oracles. Blindly following them is a recipe for disaster; intelligent integration into your overall trading plan is key to success. This section will equip you with the best practices to navigate the world of forex signals on Questrade’s platform, transforming potential pitfalls into profitable opportunities.Integrating Forex Trading Signals into a Comprehensive Trading StrategySuccessfully using forex signals requires more than just clicking “buy” or “sell.” It’s about weaving them into a broader trading strategy that considers your risk tolerance, financial goals, and market analysis.

Imagine a skilled chef using a recipe – they adapt it based on available ingredients and their personal culinary style. Similarly, you should adapt signals to your own trading style. Don’t just follow a signal because it exists; assess its alignment with your current market outlook and risk management parameters. A signal suggesting a long position in EUR/USD might be perfect if your technical analysis confirms an upward trend, but disastrous if you anticipate a market correction.

Avoiding Common Pitfalls When Using Forex Trading Signals on Questrade

Ignoring the crucial role of risk management is a common mistake. Many traders, seduced by the promise of quick profits, over-leverage their accounts based on signals alone. Remember that even the best signals can fail. Always use appropriate stop-loss orders to limit potential losses. Another pitfall is neglecting to verify the source of the signals.

Not all signal providers are created equal; some are outright scams, while others simply lack the accuracy to be useful. Thoroughly research any provider before trusting their recommendations, paying close attention to their track record and methodology.

Backtesting Forex Trading Signals Before Live Trading on Questrade

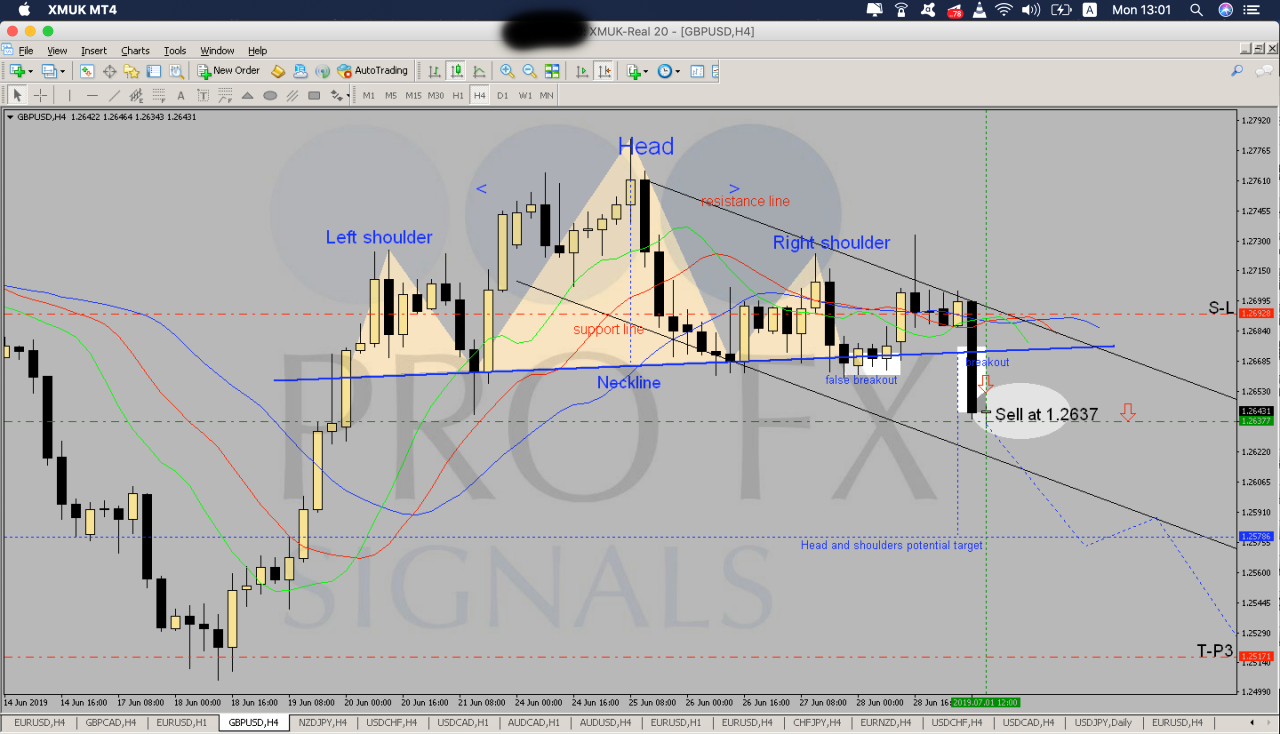

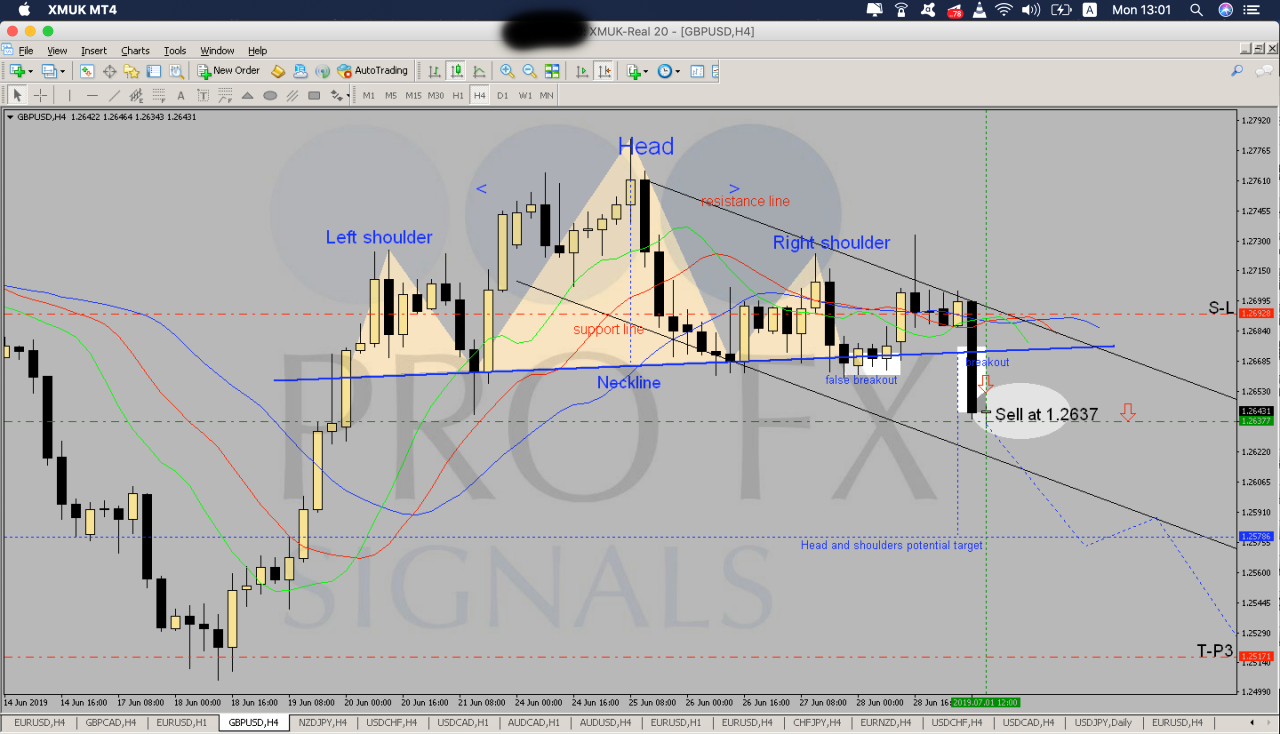

Before risking real capital, rigorously backtest your chosen signals. This involves using historical data to simulate how the signals would have performed in the past. Questrade’s platform offers charting tools that allow you to overlay signals onto historical price data. Imagine the chart displaying the EUR/USD exchange rate over the past year. You can then visually compare the signal’s buy/sell recommendations with the actual price movements to assess their accuracy and profitability.

While past performance isn’t a guarantee of future results, backtesting provides valuable insights into a signal’s reliability. Focus on consistent profitability over a significant period, not just a few lucky wins.

Step-by-Step Guide to Using Forex Trading Signals with Questrade

Let’s assume you’ve identified a reliable signal provider and backtested their signals successfully. Now, it’s time to integrate them into your Questrade trading.First, log into your Questrade account. The login screen, which you’ll see first, presents fields for your username and password, along with a “Forgot Password?” link and a secure connection indicator.Next, navigate to the trading platform.

This usually involves clicking on a prominent “Trade” or “Markets” button. The trading interface will display various market information and tools, including a customizable chart window.Now, locate the chart for your chosen currency pair. Imagine a typical candlestick chart with price data, volume indicators, and other technical studies. You can adjust the timeframe (e.g., 1-hour, daily, weekly) and add technical indicators as needed.Apply the forex signal.

Let’s say the signal recommends a buy order at 1.1000 for EUR/USD. You’ll use the order entry window, a pop-up box that appears when you click “Buy,” to specify the order details. Fields within the order window will allow you to input the currency pair, order type (market or limit), quantity, and stop-loss and take-profit levels.Finally, execute the trade.

Hunting for the best forex trading signals while using Questrade? You’re not alone! Choosing the right platform is crucial, so before you dive into those signals, check out this comparison: Comparing Questrade’s forex trading platform with Forex.com in Canada. This will help you decide if Questrade is the best platform for your winning forex signal strategy.

After confirming your order details, click “Submit Order” to place your trade. The order confirmation will appear on the platform, showing the trade’s details, including the order ID and execution price. Always review the confirmation before proceeding. Remember, consistent monitoring and disciplined risk management are crucial even after placing a trade based on a signal.

Tax Implications for Canadian Forex Traders

Navigating the Canadian tax system can feel like trying to decipher ancient hieroglyphs, especially when it comes to the seemingly mystical world of forex trading. But fear not, intrepid trader! Understanding the tax implications of your forex forays isn’t as daunting as it might initially appear. This section will illuminate the path to accurate reporting and, hopefully, minimize your tax burden.

Remember, this information is for general guidance only and you should always consult with a qualified tax professional for personalized advice.

Reporting Forex Trading Income and Expenses

Reporting your forex trading activities on your Canadian tax return involves carefully tracking all your transactions. This includes both profits and losses. Profits from forex trading are considered business income if trading is your primary source of income or if you conduct it on a large scale and with significant frequency. If it’s a more casual endeavor, it’s classified as capital gains.

The difference is significant; business income is taxed at your marginal tax rate, while capital gains are taxed at half your marginal rate. You’ll need to maintain detailed records of all trades, including the date, currency pairs traded, the amount of each trade, and any associated fees or commissions. This meticulous record-keeping is crucial for accurately calculating your income and expenses.

Questrade will usually provide statements that help in this process.

Comparison of Forex Trading Tax Treatment with Other Investments, Best forex trading signals for Canadian traders using Questrade

Let’s compare forex trading’s tax treatment with other investment income types in Canada. Interest income from savings accounts or bonds is taxed at your marginal rate. Dividends from Canadian corporations receive preferential tax treatment through the dividend tax credit. Capital gains from the sale of stocks or other assets are taxed at half your marginal rate, similar to casual forex trading.

However, forex trading involves unique complexities due to currency fluctuations and the frequency of transactions, which might lead to more significant tax implications compared to holding investments long-term.

Tax Scenarios and Implications

The following table illustrates different tax scenarios and their corresponding tax implications for Canadian forex traders using Questrade. Remember, these are simplified examples and don’t encompass all possible scenarios. Consult a tax professional for tailored advice.

| Scenario | Profit/Loss | Tax Treatment | Approximate Tax Rate (Example: 25% marginal rate) |

|---|---|---|---|

| Casual Forex Trading (Capital Gains) | $10,000 Profit | 50% of capital gains included in income | $1250 (25% of $5000) |

| Casual Forex Trading (Capital Gains) | $5,000 Loss | Can be used to offset capital gains | Reduces overall tax payable |

| Active Forex Trading (Business Income) | $20,000 Profit | Taxed at marginal rate | $5000 (25% of $20,000) |

| Active Forex Trading (Business Income) | $3,000 Loss | Can be carried forward to reduce future income | Reduces future tax payable |

Final Review

So, there you have it – your comprehensive guide to conquering the forex trading world as a Canadian Questrade user. Remember, trading involves inherent risk, so always approach it with a healthy dose of caution and a well-defined strategy. Don’t be afraid to learn, adapt, and refine your approach. Think of this as your forex trading toolbox – filled with the knowledge and tools to help you build your financial empire, one profitable trade at a time.

Happy trading!

1 thought on “Best forex trading signals for Canadian Questrade users”