Questrade foreign exchange trading platform review and tutorial: Prepare for liftoff! Forget boring spreadsheets and yawn-inducing financial jargon. We’re about to embark on a thrilling adventure into the world of Questrade’s forex trading platform – a journey filled with charts that whisper secrets, fees that might surprise you (in a good way, hopefully!), and a mobile app that’s almost as addictive as your favorite social media feed.

Buckle up, buttercup, it’s going to be a wild ride!

This comprehensive guide dives deep into Questrade’s offerings, comparing it to industry giants like OANDA and TD Ameritrade. We’ll dissect the platform’s features, explore its trading tools, and even walk you through a sample trade step-by-step. We’ll uncover the secrets to navigating its interface, understanding its fee structure, and maximizing your trading potential. Think of us as your personal Sherpas, guiding you through the sometimes-treacherous terrain of foreign exchange trading.

Questrade Platform Overview

So, you’re thinking about dipping your toes into the exciting (and sometimes terrifying) world of foreign exchange trading? Questrade’s platform might just be your ticket to ride… or at least, a reasonably comfortable seat on the rollercoaster. Let’s take a look at what it offers. This isn’t your grandma’s knitting circle; this is the fast-paced, high-stakes world of currency trading, so buckle up!Questrade’s forex trading platform offers a surprisingly robust feature set, considering its generally user-friendly approach.

It’s not overloaded with bells and whistles that might confuse beginners, but it provides enough tools for seasoned traders to feel comfortable. Think of it as the Goldilocks of forex platforms – just right.

Account Types for Forex Trading

Questrade provides a straightforward selection of account types catering to different trading styles and experience levels. Essentially, you’ll find the usual suspects: a standard account for most traders, and potentially options for higher-volume traders seeking specific benefits like reduced commissions or access to advanced tools (check Questrade’s website for the most up-to-date offerings as these can change). The key difference lies in the commission structures and minimum deposit requirements, so choosing the right one depends entirely on your trading strategy and capital.

Platform User Interface and Navigation

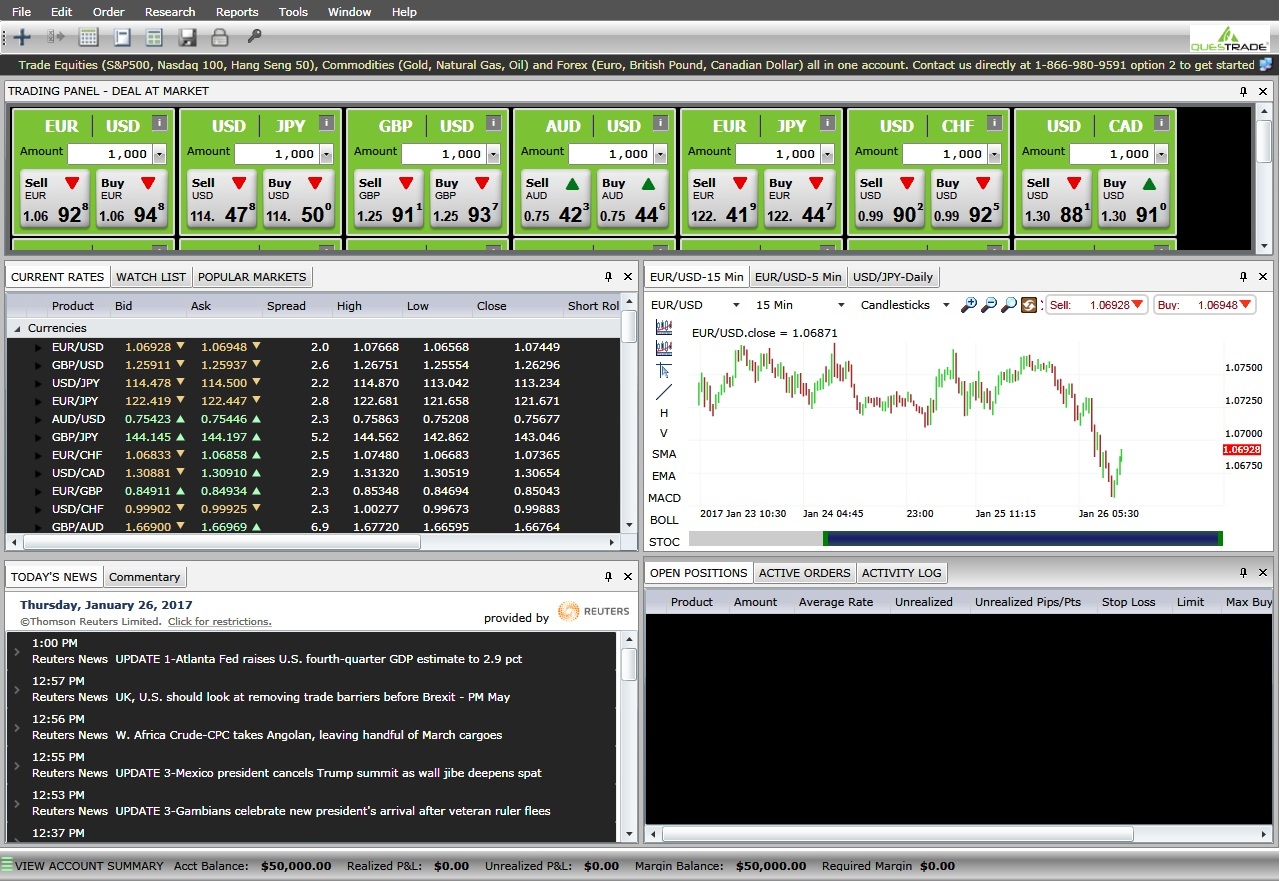

Navigating the Questrade platform is generally intuitive. The layout is clean and uncluttered, making it easy to find what you need without getting lost in a sea of confusing charts and graphs. The platform provides customizable dashboards, allowing you to tailor your view to focus on the information most relevant to your trading style. Finding specific tools or information is generally straightforward, although some advanced features might require a bit of exploration to master.

The learning curve is relatively gentle, however, even for newcomers to online trading platforms.

Ease of Use Comparison

| Platform | Ease of Navigation | Charting Tools | Order Execution Speed |

|---|---|---|---|

| Questrade | Beginner-friendly, intuitive layout | Adequate for most traders, customizable | Generally fast and reliable |

| OANDA | Slightly steeper learning curve, more advanced features | Excellent charting capabilities, highly customizable | Very fast, known for low latency |

| TD Ameritrade | User-friendly, comprehensive educational resources | Robust charting tools, many indicators available | Fast and reliable, comparable to Questrade |

Trading Tools and Resources

Let’s ditch the dusty textbooks and dive into the surprisingly robust toolkit Questrade offers forex traders. Forget wrestling with cryptic spreadsheets – Questrade’s platform is designed to empower you, not overwhelm you (unless you’re into that sort of thing, in which case, carry on!). We’ll explore the charting features, the technical indicators that whisper sweet secrets of future price movements, and the educational resources that’ll transform you from a forex newbie to a seasoned pro (or at least a slightly less clueless newbie).Questrade provides a comprehensive suite of charting tools designed to help you visualize market trends and make informed trading decisions.

These tools go beyond the basic line graphs your grandma might use to track her knitting progress. We’re talking interactive, customizable charts that can be tailored to your specific trading style and preferences. Think of it as your own personal crystal ball, but instead of predicting the future of your love life, it predicts the future of currency pairs.

Charting Tools

Questrade’s charting package boasts a variety of chart types, including candlestick charts (the classic, everyone’s favorite!), line charts (simple and elegant, perfect for spotting trends), bar charts (great for quick visual analysis), and area charts (useful for highlighting price ranges). You can customize the timeframe, from intraday tick charts to monthly or even yearly views, allowing you to analyze market movements on any scale.

Conquering the Questrade forex platform? It’s a battle of wits, requiring sharp focus and strategic planning – much like crafting the perfect workout routine. Need to build your trading muscles? Then you might also need to check out some muscular strength exercises for that extra boost of discipline and focus, which will help you dominate the charts.

Back to Questrade, remember, proper risk management is key to avoid a financial wipeout!

Zooming and panning are intuitive, and you can add various technical indicators directly onto the chart for a truly comprehensive analysis. Imagine the possibilities! You could even overlay your astrological chart (we don’t recommend basing trading decisions solely on this, though).

Technical Indicators

Technical indicators are the secret weapons of successful forex traders. Questrade offers a wide selection, allowing you to delve into the fascinating world of predictive analysis. Let’s look at a couple of examples:

- Relative Strength Index (RSI): This indicator measures the magnitude of recent price changes to evaluate overbought or oversold conditions in the market. An RSI above 70 often suggests an asset is overbought, potentially indicating a price reversal, while an RSI below 30 suggests it’s oversold, potentially indicating a price bounce. Think of it as a market mood ring – but for currencies.

- Moving Averages (MA): MAs smooth out price fluctuations, making it easier to identify trends. Different types of MAs exist, such as simple moving averages (SMA), exponential moving averages (EMA), and weighted moving averages (WMA), each with its own unique characteristics and sensitivity to recent price changes. They’re like a gentle hand guiding you through the choppy waters of the forex market.

Other indicators available include MACD (Moving Average Convergence Divergence), Bollinger Bands (for gauging volatility), and Stochastic Oscillators (another momentum indicator). Remember, though, indicators are just tools; they’re not magic spells that guarantee profit. Use them wisely in conjunction with your own analysis and risk management strategies.

Educational Resources

Questrade recognizes that forex trading can be complex, so they provide a range of resources to help traders of all skill levels.

- Glossary of Terms: A comprehensive glossary defining all those confusing forex terms that make your head spin. No more feeling lost in a sea of jargon!

- Educational Webinars and Articles: Questrade frequently hosts webinars and publishes articles covering various forex trading strategies, market analysis techniques, and risk management best practices. Think of it as your own personal forex sensei, guiding you on your trading journey.

- Practice Account: A risk-free environment to test your strategies and gain confidence before committing real money. It’s like a forex training ground where you can hone your skills without the fear of losing your hard-earned cash.

These resources are invaluable for both beginners taking their first tentative steps into the forex world and seasoned traders looking to refine their skills. Remember, continuous learning is key to success in forex trading. Don’t be afraid to explore and experiment!

So, you’re diving into the wild world of Questrade’s forex platform? Our Questrade foreign exchange trading platform review and tutorial will help you navigate those choppy waters, but remember, even the calmest seas can get stormy. Before you jump in headfirst, familiarize yourself with sound risk management – check out this essential guide on Responsible Forex trading practices and risk management techniques to avoid becoming a kraken’s snack.

Then, armed with knowledge, confidently return to conquering Questrade’s platform!

Order Execution and Fees

Let’s dive into the nitty-gritty of actuallydoing* forex trades on Questrade – the thrilling part where your money dances the tango with global markets (hopefully a tango, and not a tango-down!). We’ll cover how Questrade executes your orders and, just as importantly, how much they’ll charge you for the privilege.Questrade offers a range of order types to suit different trading styles and risk tolerances.

Understanding these order types is crucial for successful forex trading. The execution process itself is generally swift and efficient, but, as with any platform, occasional glitches can occur – think of it as the market experiencing a sudden case of the hiccups.

Order Types Available

Questrade provides the standard suite of order types you’d expect from a reputable forex broker. These include market orders (executed immediately at the best available price), limit orders (executed only when the price reaches a specified level), and stop orders (triggered when the price moves beyond a certain point, often used to limit losses or protect profits). More sophisticated traders might also appreciate the availability of stop-limit orders, which combine aspects of both stop and limit orders, offering a degree of price control even within a stop-loss scenario.

Think of them as your trading safety net with a bit of extra finesse.

Questrade’s Fee Structure

The cost of trading forex on Questrade, like most brokers, primarily revolves around spreads. Spreads represent the difference between the bid (the price at which you can sell) and the ask (the price at which you can buy) price of a currency pair. Questrade’s spreads vary depending on the currency pair and market conditions; they’re generally competitive, but it’s always wise to compare them to other brokers before committing.

So, you’re diving into our Questrade foreign exchange trading platform review and tutorial? Excellent! But if day trading gives you palpitations, consider a more relaxed approach with long-term investments. Check out Best FX funds for long-term investment and high returns for some potentially less stressful, high-yield options. Then, armed with this knowledge, you can return to mastering the Questrade platform with newfound financial zen.

Unlike some brokers, Questrade doesn’t charge commissions on forex trades, which can be a significant advantage, especially for high-volume traders. However, keep an eye out for any potential overnight financing charges (swap fees) if you hold positions open across trading days – these fees reflect the interest rate differential between the currencies involved. Think of them as a small overnight hotel charge for your currency holdings.

Fee Comparison Table

It’s always a good idea to shop around and compare fees. Below is a comparison of Questrade’s forex fees against two competitors (Note: Specific spreads and fees are subject to change and should be verified directly with the brokers).

| Broker | Spread (Example EUR/USD) | Commission | Overnight Financing Fees |

|---|---|---|---|

| Questrade | Variable, typically competitive | None | Variable, dependent on position size and currency pair |

| Competitor A (Example) | Variable, potentially higher than Questrade | Variable, possibly per trade | Variable |

| Competitor B (Example) | Fixed, potentially lower on certain pairs, higher on others | None | Variable |

Security and Regulation

Protecting your hard-earned cash in the wild west of online trading is paramount, and Questrade understands this better than a cowboy understands his trusty steed. They employ a multi-layered security approach designed to keep your account and funds safe from the digital bandits lurking in the shadows. Think of it as Fort Knox, but with slightly better Wi-Fi.Questrade operates under a strict regulatory framework, ensuring that your trading experience is not only secure but also adheres to the highest industry standards.

So you’re diving into the wild world of Questrade’s forex platform? Need a tutorial? You’re in luck! But before you conquer the Questrade interface, consider broadening your horizons. Check out this killer comparison of trading platforms, including a deep dive into A & O Trading – A & O Trading platform review and comparison with competitors – to see how it stacks up.

Then, armed with this knowledge, you can return to your Questrade adventure with newfound forex finesse!

This means they’re not just playing by the rules; they’re setting the example for others to follow. Let’s delve into the specifics of how Questrade safeguards your financial well-being.

Account Security Measures

Questrade utilizes a robust suite of security measures to protect user accounts. These include multi-factor authentication (MFA), which adds an extra layer of protection beyond just a password. Imagine it as a digital bouncer checking your ID before letting you into the exclusive club of your own investment account. They also employ advanced encryption technology to safeguard your personal and financial information during transmission and storage.

So, you’re diving into the Questrade foreign exchange trading platform review and tutorial? Excellent! But before you conquer the Questrade beast, consider sharpening your forex skills with this ultimate guide – Ultimate guide to successful Forex trading with Oasdom.com – then return to your Questrade journey armed with knowledge and maybe a slightly less panicked heart.

Happy trading!

This ensures that even if a digital pickpocket were to try their luck, they’d find themselves facing an impenetrable vault. Furthermore, Questrade continuously monitors accounts for suspicious activity, acting as your ever-vigilant security guard, ready to spring into action at the slightest hint of trouble. Regular security updates and patches further reinforce this defensive posture, ensuring that the platform remains resilient against emerging threats.

Regulatory Compliance

Questrade’s commitment to security extends beyond individual account protection. They are regulated by the Investment Industry Regulatory Organization of Canada (IIROC), a self-regulatory organization that oversees the activities of investment dealers and advisors in Canada. This means Questrade operates under a strict code of conduct, ensuring fair and ethical trading practices. IIROC’s oversight includes regular audits and inspections, ensuring Questrade maintains the highest standards of compliance.

In addition, Questrade is a member of the Canadian Investor Protection Fund (CIPF), providing an additional layer of protection for client assets in the unlikely event of a brokerage firm failure. Think of CIPF as a safety net, ensuring that your investments are protected even if the worst were to happen. This dual regulatory oversight provides investors with a significant level of confidence in Questrade’s commitment to security and transparency.

It’s like having two highly trained security guards watching over your assets – one from IIROC and one from CIPF – ensuring your investments are safe and sound.

Mobile App Functionality

Questrade’s mobile app aims to bring the power of their desktop platform to your pocket, but does it succeed in replicating the full experience? Let’s dive into the features, user experience, and any potential shortcomings. Think of it as a trading platform shrunk down to fit in your jeans pocket – sometimes delightfully compact, sometimes a little cramped.The Questrade mobile app offers a surprisingly robust selection of features, mirroring many aspects of its desktop counterpart.

While not a perfect one-to-one replication, the core functionalities are there, making it a viable option for traders who prefer the convenience of mobile trading. However, the user experience inevitably differs due to screen size limitations.

Feature Comparison: Desktop vs. Mobile

The desktop platform boasts a more extensive array of charting tools and advanced order types. For example, you might find more complex options strategies readily available on the desktop. The mobile app prioritizes ease of use, offering the most frequently used tools and features in a streamlined interface. Think of it as a carefully curated selection of your favorite tools, leaving the less frequently used ones in the toolbox at home.

This makes placing simple trades incredibly quick and intuitive on the mobile app, while more complex trades may require switching to the desktop platform.

User Experience: Placing Trades and Accessing Account Information

Placing trades on the Questrade mobile app is generally smooth and straightforward. The interface is intuitive, guiding users through the process with clear prompts and visual cues. Accessing account information is equally user-friendly, providing a consolidated view of your portfolio, balances, and recent activity. Finding specific details, such as transaction history or detailed account statements, is easy thanks to a well-organized menu structure.

However, the smaller screen size can make navigating through extensive data slightly more cumbersome than on the desktop platform. Imagine trying to read a dense financial report on a postage stamp – it’s doable, but not ideal.

Navigation and Interface Design

The app’s navigation is generally intuitive, with a clean and uncluttered interface. The use of color-coding and clear visual cues makes it easy to locate key information and functions. While some users might find the desktop platform’s more extensive menu options preferable, the mobile app’s streamlined approach minimizes distractions and allows for quick access to essential features. This is particularly beneficial for traders who need to make rapid decisions on the go.

Think of it as the difference between a sprawling, detailed map and a simple, direct route on a GPS app – both get you to your destination, but one is faster and easier to use.

So you’re diving into the wild world of Questrade’s forex platform? Our review and tutorial will help you navigate those treacherous waters, but remember, understanding regulation is key! Before you start trading, check out this crucial assessment of Ares Global Forex regulation and security measures assessment to ensure you’re playing it safe. Then, armed with knowledge, you can confidently return to mastering Questrade’s features and conquer the forex market!

Customer Support

Navigating the world of online trading can sometimes feel like traversing a particularly tricky maze – especially when things go sideways. Thankfully, even the most seasoned trader needs a helping hand occasionally, and that’s where robust customer support comes into play. Let’s see how Questrade stacks up in this crucial area.Questrade offers a multi-pronged approach to customer support, aiming to cater to different preferences and levels of urgency.

This isn’t your grandpappy’s brokerage; they’ve moved beyond the single phone line and embraced the digital age. Their goal is clear: to get you back to focusing on your investments, not wrestling with technical issues or unanswered queries.

Contact Channels

Questrade provides several avenues for contacting their support team. These options allow you to choose the method best suited to your situation and preferred communication style. Knowing your options empowers you to get the help you need efficiently.

- Phone Support: A traditional, yet still highly relevant, method for those who prefer a direct conversation. This is ideal for complex issues needing immediate attention.

- Email Support: A more asynchronous option, perfect for less urgent queries or situations where you need to gather information before contacting support. It allows for a detailed explanation of your problem.

- Online Chat: For quick questions or troubleshooting, the live chat function offers immediate assistance. This is a great option for resolving minor issues quickly and efficiently.

- Knowledge Base/FAQ: Before even reaching out, Questrade’s comprehensive FAQ section might hold the answer to your question. This self-service option can save you valuable time.

Responsiveness and Helpfulness

Experiences with Questrade’s customer support vary, as they do with any large organization. While many users report positive experiences with prompt and helpful responses, especially via phone and chat during peak hours, some have noted longer wait times during periods of high volume. The helpfulness of agents is generally praised, with many users highlighting the knowledge and patience demonstrated by the support staff.

However, the occasional less-than-stellar interaction is unfortunately not unheard of, reflecting the challenges inherent in providing consistently high-quality support across a large user base. One common observation is that the quality of support can sometimes depend on the specific agent you interact with, underscoring the importance of persistence if the first interaction isn’t satisfactory.

Illustrative Example: A Sample Trade

Let’s dive into a thrilling (and hopefully profitable!) example of executing a forex trade on the Questrade platform. We’ll navigate the process from order placement to the satisfying (or perhaps slightly less satisfying) moment of closing the position. Think of this as your virtual forex apprenticeship, complete with minimal risk and maximum learning.This example will walk you through a hypothetical trade, focusing on the visual and interactive aspects of the Questrade platform.

Remember, forex trading involves risk, and this is for illustrative purposes only. Don’t bet the farm on your first trade!

Order Placement: EUR/USD Long Position, Questrade foreign exchange trading platform review and tutorial

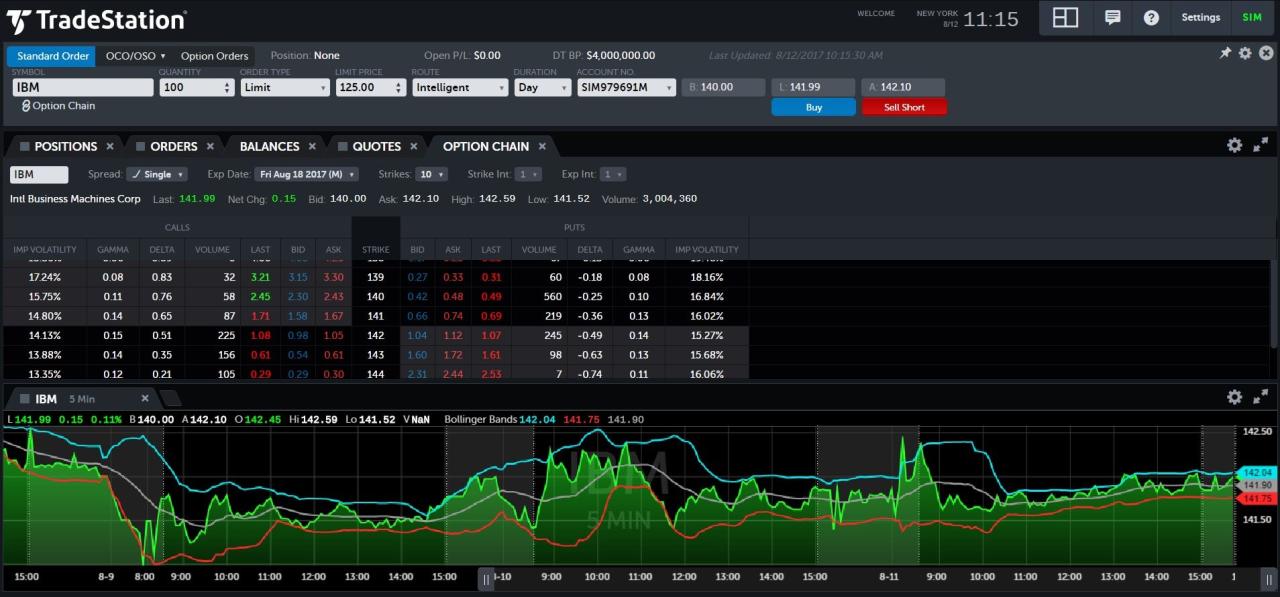

Before you even think about clicking that “Buy” button, you’ll need to decide on your trade parameters. Let’s say you’re bullish on the Euro and want to buy EUR/USD. You’ll see a clean interface displaying the current exchange rate, bid/ask prices, and charts. The charts themselves are highly customizable, allowing you to choose different timeframes, indicators, and overlays.

You might choose a candlestick chart with moving averages for a classic technical analysis view. After selecting your currency pair, you’ll input your order details: the amount of EUR you want to buy (this is often expressed in lots, which represent a standardized number of units), your stop-loss order (to limit potential losses), and your take-profit order (to secure profits when the price moves in your favor).

The order ticket itself is clearly laid out, with fields for each parameter clearly labeled and easy to understand. Once everything is entered, a final confirmation screen appears before your order is sent to the market. This allows for a last-minute sanity check.

Monitoring the Trade

After placing your order, the Questrade platform provides real-time updates on your position’s performance. You’ll see your open trades listed clearly, with the current exchange rate, profit/loss, and the initial order details. The platform also offers various tools to monitor market movements, including live charts that dynamically update with every tick. These charts are interactive; you can zoom in, zoom out, and use various technical indicators to analyze the price action.

You’ll be able to watch your trade’s performance unfold before your very eyes, with the profit/loss figures updating constantly.

Closing the Position

When you’re ready to close your position (either to lock in profits or cut losses), you’ll simply select the trade from your open positions list. The platform will present you with a straightforward option to close the trade at the current market price. This process is as simple as clicking a button. Upon closing, your profit or loss will be calculated and reflected in your account balance.

You’ll receive a confirmation message detailing the transaction and its impact on your account. The platform keeps a comprehensive history of all your trades, allowing you to review past performance at any time. You’ll see detailed records of your entries, exits, profits, and losses, which can be invaluable for analyzing your trading strategy.

Comparison with Competitors

Choosing a forex trading platform is like choosing a superhero – you want one with the right powers (features), a reasonable price tag (fees), and a personality you can actually stand (user experience). Let’s pit Questrade against some heavyweight contenders to see how it stacks up. This comparison focuses on key aspects relevant to the average trader.

We’ll be comparing Questrade to two popular alternatives: Interactive Brokers (IBKR) and OANDA. While each platform offers its own unique strengths, understanding their differences is crucial for selecting the best fit for your trading style and needs. Remember, the “best” platform is subjective and depends on individual priorities.

Platform Feature Comparison

Here’s a table summarizing the key features of each platform. Note that feature availability can change, so always check the provider’s website for the most up-to-date information. This comparison aims to give you a general overview.

| Feature | Questrade | Interactive Brokers (IBKR) | OANDA |

|---|---|---|---|

| Trading Platforms | Proprietary web and mobile platforms; relatively user-friendly interface. | Trader Workstation (TWS) – powerful but steep learning curve; Client Portal – more user-friendly. | User-friendly web and mobile platforms; known for its intuitive design. |

| Instrument Variety | Offers a good selection of currency pairs. | Extremely wide range of instruments, including forex, stocks, options, futures, and more. | Focuses primarily on forex, offering a broad selection of currency pairs. |

| Advanced Order Types | Offers a standard selection of order types. | Provides a very extensive range of advanced order types. | Offers a solid selection of advanced order types. |

| Research and Analysis Tools | Provides basic charting and market data. | Offers extensive research tools and market data. | Provides good charting and market analysis tools. |

Fee Structure Comparison

Fees can significantly impact profitability. This section compares the fee structures of the three platforms, focusing on forex trading.

It’s crucial to remember that fees can vary based on factors such as trading volume, account type, and specific instruments. Always consult the most current fee schedules provided by each brokerage.

User Experience Comparison

The user experience is subjective, but we can highlight some key differences. Questrade generally provides a user-friendly experience, particularly for beginners. IBKR’s TWS is powerful but has a steeper learning curve. OANDA strikes a balance between functionality and ease of use.

Concluding Remarks: Questrade Foreign Exchange Trading Platform Review And Tutorial

So, there you have it – a whirlwind tour of Questrade’s forex trading platform! From its intuitive interface to its robust security measures, Questrade offers a compelling option for both seasoned traders and newcomers alike. While no platform is perfect, Questrade’s strengths lie in its user-friendly design, competitive fees, and a surprisingly helpful customer support team (at least, in our experience!).

Remember to always do your own research and choose a platform that best suits your individual trading style and risk tolerance. Happy trading!